In 2021, all employers are faced with major changes to their current reporting practices.

If until this moment they reported on pension contributions to the Pension Fund, on contributions in case of temporary disability and injuries - to the Social Insurance Fund, and on accrued and paid taxes - to the Federal Tax Service, now all powers to administer contributions have been transferred to the Tax Inspectorate (except for contributions "for injuries"). In connection with this, Order No. ММВ-7-11/551 of the Federal Tax Service of 2016 approved a unified reporting form RSV-1. Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

According to the new rules, all employers, regardless of their form of ownership, rent it out: these can be either individual entrepreneurs with employees or legal entities.

Procedure for payment of benefits

According to the rules in force today, sick leave and maternity benefits are paid in one of two ways:

- At the expense of the employer with subsequent reimbursement. This method is used in all regions, with the exception of participants in the FSS pilot project (point 2).

- Directly from the fund. We are talking about the “Direct Payments” project, which is carried out in some regions of Russia (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

Everything said below applies only to payers of insurance funds from point No. 1.

At the end of the month, the policyholder determines the amounts:

- accrued insurance premiums;

- benefits paid.

If more contributions are accrued than benefits paid, the difference is transferred to the Social Insurance Fund. If on the contrary, that is, the difference between contributions and benefits turns out to be a minus sign, then it is counted against future payments or returned from the Fund to the policyholder.

Exceptions to this procedure are provided only for benefits for the first 3 days of sick leave.

Conditions for filling out reports

RSV-1 reporting is required to be submitted to the Tax Inspectorate by all legal entities and individuals who use hired labor in their work and are payers of insurance premiums. The form and reporting procedure for RSV-1 were approved by Order of the Federal Tax Service of 2021 No. ММВ-7-11/ [email protected]

Part of the benefits for temporary disability on sick leave is paid by the employer from his own funds, the other part is compensated by the Social Insurance Fund.

If the amount of accrued benefits turns out to be less than the amount of benefits paid, then the employer has the right to receive compensation to his current account. In this case, the receipt of such compensation must be reflected in the RSV-1 reporting form.

Thus, the conditions for filling out RSV-1 reporting are as follows: the employer has the status of a legal entity or individual entrepreneur, he employs employees under an employment contract, or he engages persons for certain operations under a civil contract, he is a payer of insurance premiums.

How benefits are reflected in the RSV

When filling out the DAM form, benefits should be reflected in Appendix 2 to Section 1 :

- line 080 reflects the amount of compensation received by the policyholder from the Fund;

- on line 090 - the difference between the amount of benefits paid to insured persons and the amount of accrued contributions.

The Tax Service explained exactly how the amount of contributions is reflected in line 090 in a letter dated 08/23/17 No. BS-4-11 / [email protected] The calculation is made using the following formula (indicators are taken from the corresponding lines of Appendix 2 to Section 1):

Amount in line 090 = Line 060 - Line 070 + Line 080

The result is interpreted as follows:

- If it is positive , it means that the policyholder has a debt. In the column “Total from the beginning of the billing period” of line 090 the calculated value is indicated, and in the column “Characteristic” - 1.

- If the result is negative , then the Fund is in debt. In the column “Total since the beginning of the billing period” the value without the “-” sign , and in the column “Sign” - 2.

How to confirm earnings received from another employer

Benefits are calculated based on the employee’s average daily earnings.

The calculation period for paying sick leave is two calendar years preceding the year of temporary disability. If an employee has worked in other companies over the previous two years, then to determine the average earnings, he must provide a certificate from his previous place of work about the income received during that period.

The form of the certificate of the amount of earnings and the procedure for issuing it are established by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n. Information about earnings indicated in the certificate can be checked by making a request to the Federal Social Insurance Fund of Russia.

The certificate must contain information about the amount of earnings for which insurance premiums were calculated, the number of days of temporary disability, maternity leave and child care leave, as well as periods during which the employee retained his average earnings, but no contributions were accrued to him. This data is necessary for calculating “maternity” and “children” benefits, since these days are excluded from the calculation period.

The employer is obliged to issue it to the employee on the day of dismissal or upon a written request from the resigned employee.

Example.

How to calculate and record temporary disability benefits An employee of Alpha LLC, Sidorov, was sick from April 22 to April 30, 2021 and submitted a sick leave certificate to the accounting department. Sidorov’s total insurance experience is three years, of which he has been working at Alpha LLC since January 1, 2018. Before that, he worked only at Delta LLC. The calculation period for calculating and paying benefits for temporary disability of an employee includes the two previous years - 2021 and 2021. The amount of payments for which insurance premiums were calculated for OSS last year by Alpha LLC (Sidorov’s current employer) includes:

- salary in the amount of 190,000 rubles;

- bonus for production performance – 10,000 rubles.

Sidorov did not provide a certificate of payments for the period of work at Delta LLC for 2021.

Thus, the accountant of Alpha LLC can take into account only the money that Sidorov received at his last place of work, that is, at Alpha LLC. 200,000 rubles is less than the limit of 815,000 rubles. In 2021, the income limit is set at 815,000 rubles. To calculate benefits, this amount is used in 2019 (together with the maximum amount established for 2021 - 755,000 rubles).

200,000 rubles is less than the minimum two-year salary in the amount of 270,720 rubles. (RUB 11,280 × 24 months), calculated from the amount of the minimum wage in force at the time of the insured event. This means that benefits should be calculated based on the minimum.

Sidorov is entitled to a benefit in the amount of 60% of average earnings. The amount of daily allowance due to Sidorov will be equal to 222.51 rubles. (RUB 270,720: 730 days × 60%).

Sidorov was sick for 9 calendar days. The company will pay for three days. It will be 667.53 rubles. (RUB 222.51 × 3 days). The remaining 6 days will be paid for and reimbursed by the fund: 1335.06 rubles. (RUB 222.51 × 6 days).

Alpha's accountant will make the following entries:

DEBIT 69 SUB-ACCOUNT “PAYMENTS WITH FSS” CREDIT 70

RUB 1,335.06 – benefits were accrued at the expense of the Social Insurance Fund;

DEBIT 20 CREDIT 70

RUB 667.53 – benefits are accrued at the expense of the company;

DEBIT 70 CREDIT 68 SUB-ACCOUNT “PIT SETTLEMENTS”

260 rub. ((RUB 667.53 + RUB 1,335.06) × 13%) – personal income tax is withheld from the benefit amount;

DEBIT 70 CREDIT 50

RUB 1,742.59 (1335.06 + 667.53 – 260) – benefits paid.

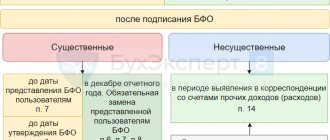

Discrepancies

As a result, it turns out that line 090 reflects a balance that does not correspond to the accounting data. Because of this, accountants have doubts about whether they filled out the above DAM lines correctly.

In fact, a discrepancy does not mean there is an error at all. It arises due to the specifics of the DAM form - it does not contain cells in which the incoming and outgoing balances should be reflected. Therefore, the amount by which benefits paid in 2021 exceed the amount of contributions is not reflected in the DAM for the 1st quarter of 2021. Accordingly, if in the 1st quarter a refund was received from the Social Insurance Fund, then from the calculation it will not be clear that it compensates for the difference between benefits and contributions for the previous year.

Let's explain with an example. In 2021, the positive difference between benefits paid and assessed contributions amounted to 25 thousand rubles. It is reflected like this:

- In the DAM for 2021, line 090 of Appendix 2 to Section 1 indicates the amount of 25 thousand rubles with attribute 2.

- In accounting, in the debit of account 69, the subaccount “Social Insurance Settlements” at the end of the year there remains a balance of 25 thousand rubles.

In the 1st quarter of 2021, the company did not charge contributions or pay benefits, but received compensation for last year’s expenses from the Social Insurance Fund in the amount of 25 thousand rubles. The reflection is like this:

- In the DAM for the 1st quarter of 2021: on line 080 of Appendix 2 to Section 1 - the amount is 25 thousand rubles;

- on line 090 of Appendix 2 to Section 1 - the amount is 25 thousand rubles with sign 1.

Conclusions: according to accounting data, there is a zero balance, and the DAM form indicates that the policyholder owes 25 thousand rubles. However, all data is correct.

How to fill out the RSV form correctly

The RSV-1 calculation contains information that is the basis for the calculation and payment of insurance premiums from the 1st quarter of 2017. One of the sections of the report is devoted to insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity.

It consists of a title page and three sections indicating contributions for pension, medical and social insurance of employees, as well as personalized information.

In the RSV-1 form, it is necessary to fill out only those sections in which the employer has something to transfer. For example, if an employer does not have contributions with additional tariffs, then he does not fill it out and submit it to the inspectorate.

After the employer submits a report on contributions to the Federal Tax Service, the inspectorate transmits it to the territorial division of the Social Insurance Fund (Appendix 2-4 to Section 1 with information on accrued contributions and benefits). Therefore, the employer should take into account that the figures calculated for contributions and those transferred to the Social Insurance Fund to receive compensation must be the same.

How to check

If you have doubts about the correctness of filling out the DAM, it is recommended to reconcile the calculations with the budget . This is the most reliable method that will give a 100% guarantee that there will be no errors.

You can also check the balance of social insurance settlements using a calculation certificate (Appendix 1 to the letter of the Federal Social Insurance Fund of Russia dated December 7, 2016 No. 02-09-11/04-03-27029). Such a certificate, along with other documents, is submitted to the Fund by those policyholders who want to receive compensation.

The document contains fields that reflect the debts owed by the policyholder and the Fund at the beginning and end of the reporting period. Thus, the mentioned calculation certificate reflects the real state of settlements with the Social Insurance Fund.

In conclusion, let us mention that when checking, inspectors are not guided by the contents of line 090 of Appendix 2 to Section 1. The document from which they receive data on mutual settlements is the Budget Payment Card . Reconciliation of the policyholder is carried out precisely on the basis of this card, and not at all according to data from the DAM.

How to fill out the register for the Social Insurance Fund

The procedure for payments for the period from June 1 to June 11 has not changed compared to previous payments for April and May. Employers submit registers for employees to the Social Insurance Fund, and the fund issues benefits and pays them from its own funds.

Employers do not need to withhold personal income tax from this payment. The FSS will do this as a tax agent.

When filling out registers for the Social Insurance Fund, the following features must be taken into account:

- the reason for disability is indicated as 03 (quarantine);

- date of issue of sick leave - 2020-04-06, 2020-04-20, 2020-05-12 and 2020-06-01;

- periods of incapacity for work - from 2020-04-06 to 2020-04-19, from 2020-04-20 to 2020-04-30, from 2020-05-12 to 2020-05-29, from 2020-06-01 to 2020 -06-11;

- start work - 2020-04-20, 2020-05-01, 2020-05-30, 2020-06-12.

Please note how to indicate the sick leave number in the register:

- For June 1–11 — 999030000000

- For May 12–29 — 999020000000

- For April 20–30 — 999010000000

- For April 6–19 — 999000000000

The benefit is calculated according to general rules. With more than 8 years of experience, days of incapacity for work are paid at 100%. For the calculation, earnings for two years are taken, but it is limited to the average monthly earnings of 69,961.65 rubles in 2021.

An employee who violates quarantine will have to return the benefit.

How to fill out the DAM for the first quarter of 2021: read the explanations of the Federal Tax Service

To reimburse expenses for social benefits , you first need to understand the amount of such benefits and the desired option for compensating the expenses incurred. There can be two options:

- offset of incurred social expenses against upcoming accruals for insurance premiums for temporary disability;

- refund from social insurance of expenses incurred upon application.

However, it is not possible to offset benefits against contributions if the policyholder is a participant in the Social Insurance Fund pilot project.

In addition, you should understand for which year benefits are reimbursed. If we are talking about expenses incurred before the end of 2021, then the procedure for interaction with government agencies will be different.

To keep records of benefits, use our Simplified 24/7 . It prepares documents and HR reports in one click. Take a trial access to the program for 30 days. Consultation on all accounting issues is available to users 24 hours a day, 7 days a week.

In 2021, compensation is directly provided by Social Insurance (FSS). The algorithm of actions depends on when the positive balance appeared on your 69 account.

If the overpayment occurred on January 1, 2021, then an application for a refund is submitted to Social Insurance. For this purpose, an application is used in Form 23-FSS of the Russian Federation, approved by Order No. 49 dated February 17, 2015.

Social insurance may order an inspection at this stage. Upon completion of the audit, confirmed data on the overpayment is transferred to the tax authorities, who in turn transfer money from the budget.

In this case, the refund will be made by the Social Insurance Fund itself.

When filling out the ERSV report, you can pay attention to line 001 of Appendix No. 2 of the reporting form. This line implies an indication of which method is used to reimburse social security expenses - direct payments or an offset system.

Most policyholders use an offset system. Direct payments can only be used by those legal entities or entrepreneurs that are registered in the regions where the FSS pilot project operates. In this case, benefits are paid directly to employees based on documents submitted by the employer to Social Security.

In 2021, the list of participants in the Social Insurance pilot project includes 33 regions of Russia.

Since with direct payments, accrued insurance premiums cannot be reduced by the amount of benefits paid, they are not reflected in the ERSV report.

This section contains personal data of the insured persons, so it must be filled out for each such person. The section consists of several subsections.

Subsection 3.1 should reflect your full name, date of birth, gender, INN and SNILS codes, country code 643 (for Russia), document code (Appendix No. 6 to the Procedure) and its details. When filling out the calculation for the period for the first time, column 010 is crossed out.

Subsection 3.2 is for pension contributions. Its first part 3.2.1 reflects payments. You must indicate the amounts for the last three months of the reporting (calculation) period. In this subsection we fill in the lines:

- 130 – category code of the insured person from Appendix No. 7 to the Procedure (do not forget about the new codes, which are mentioned at the beginning of the article);

- 140 – total amount of payment to the employee;

- 150 – base for contributions;

- 160 – including paid under GPC;

- 170 – amount of contributions (base x tariff).

Contributions for SMEs should be calculated according to two tariffs: basic tariffs are applied to payments within the minimum wage, and preferential tariffs are applied to payments above the minimum wage. Accordingly, if the payment in the company exceeds the minimum, there will be 2 subsections 3.2.1 for each insured person. The first is filled in regarding payments up to the minimum wage. The amount of 12,130 rubles is prescribed, the amount of contributions is 2,688.6 rubles (this is 22% of the minimum wage), and the code “NR” is also entered.

The second time, subsection 3.2.1 should be completed in relation to payments above the minimum wage and use the code “MS”. A 10% contribution rate will apply to this portion. If the payment is not more than the minimum, then there will be only one subsection 3.2.1.

Let's give an example for filling out the DAM for the 4th quarter of 2021. Let the employee’s salary be 65,000 rubles per month. In this case, we will fill out the subsection separately for the amount of 12,130 (22% contribution rate) and for the amount of 65,000 - 12,130 = 52,870 (10% rate).

When calculating contributions at an additional tariff, you must fill out subsection 3.2.2.

This application calculates pension and medical contributions. It is filled out in terms of tariffs, so SMEs create two attachments 1. The first time in column 001 you need to indicate the tariff code “01”, which means the basic tariff applied to payment within the minimum wage. The second time Appendix 1 is filled out regarding part of the payments above the minimum wage with code “20”.

Subsection 1.1 reflects the number of insured persons, including those from whose payments deductions are made. Payment amounts should be reflected on a cumulative basis from the beginning of the billing period, as well as for the last 3 months separately.

For example, the company employs only a director who receives a salary of 65,000 rubles per month. For 2021, he was paid 780,000 rubles. The basic tariff base will be:

- for January-March – 65,000 * 3 = 195,000 rubles;

- payment within the minimum wage for April-December – 12,130 * 9 = 109,170 rubles;

- the base at the 22% tariff is equal to 195,000 + 109,170 = 304,170 rubles.

Thus, the amount of contributions at the 22% tariff will be 66,917.4 rubles.

Payments to the manager for April-December exceeding the minimum wage are taxed at a 10% rate: (65,000 – 12,130) * 9 = 475,830 rubles. The amount of contributions at the 10% tariff will be 47,583 rubles.

Further, in subsection 1.1 you should indicate: the amounts of payments that are not subject to contributions, the amounts that are subject to deduction, the calculated base and the amount of contributions from it (separately from the base within the limit and above).

Medical contributions are calculated according to the same principle - subsection 1.2 of Appendix 1 is intended for them. More detailed calculations can be seen in the sample of filling out the DAM for the 4th quarter of 2021.