In what cases do you need a certificate of average earnings?

The main role of this document is that a certificate of average earnings for determining unemployment benefits is the main source of information when calculating unemployment benefits.

The benefit is available only to those citizens who have registered with the employment center and are actively looking for a new job.

Registration with employment authorities can occur without providing this certificate from the previous employer. It is not a mandatory document in this case.

However, persons who have recently terminated their contracts should understand that unemployment benefits will in this case be calculated based on the minimum amount.

A certificate of average earnings allows you to significantly increase the amount of such benefits.

This possibility is provided for by the provisions of regulations. Important: if an employee was dismissed on the initiative of the administration as a measure of bringing to administrative responsibility, then the amount of benefits will be at the minimum level, even when the relevant certificate of average earnings was provided to the employment authorities.

When is the certificate issued?

At the time of dismissal, the administration should not issue a certificate of average earnings for the employment center if the resigning employee has not received a request for its release. This is due to the fact that it is not included in the mandatory list of forms issued to the employee upon dismissal.

However, management has such an obligation when an employee submits an application for the issuance of this document. If the request is received, then the certificate must be completed and issued on the last day of work upon dismissal.

For citizens who terminated their employment contracts and did not send requests for the issuance of this form at the time of dismissal, it is possible to contact their former employer after dismissal.

Attention: the administration of a business entity must issue this document within three days from the date of receipt of an application for a certificate from a former employee. This must be done if a significant period of time has passed since the termination of the employment relationship.

Sample certificate of income in free form 2021

Information about your income may be requested by many authorities. These could be banks if you want to take out a loan there, or government agencies that pay subsidies or other benefits. Sometimes such paper is required to obtain a work visa. So it is not surprising that a sample income certificate is one of the most common reference documents for a certain number of residents.

Types of certificates

A sample free-form income certificate does not have a clearly regulated wording; the content depends on the place of submission:

- To the bank to apply for a loan. In this case, the employee needs to contact his employer with a request to issue Form 2-NDFL; this is what financial institutions often require.

- For the labor exchange. If an employee has been laid off at his company, is temporarily looking for vacancies, and therefore has decided to join the labor exchange, for official registration he will need to provide information about his earnings over the last three months (the average value is calculated). It is based on this document that the social security authorities will determine the amount of unemployment payments.

- If the employee quit of his own free will, then along with the work book he will also be given a certificate in form 182n, which will be needed for the next employment.

- If a citizen intends to apply for a subsidy for housing and communal services, then the certificate must contain data on wages for the last 6 months, and also be marked “Provided at the place of request.”

- In addition, information about your profit may be requested in other places, if this does not violate the confidentiality policy, for example, in the Federal Tax Service of Russia, then the document indicates exactly the information that is directly requested.

Who should issue an income certificate?

An institution can issue such an official document to any of its employees. To do this, you need to contact the accounting department with the appropriate request (as a rule, verbal wording is sufficient, a written statement is not required). The employer is obliged to fulfill your request within three working days. The original document must be certified by the head of the enterprise or his authorized representative. Such a person may well be the chief accountant; his signature is also mandatory in any case.

Structure and design rules

There is no standardized template for the certificate, which is why it is called “free form”, but there is still a list of elements that will definitely be presented.

— details of the issuing organization; The full name of the campaign must be written down (LLC, CJSC, etc., you can also indicate the TIN and KPP)

- owner details

- average monthly salary

— total income for a certain period (mostly 3 or 6 months), most often displayed in table form.

As for the owner’s details, they also consist of several parts. It goes without saying that the full name (full name) and passport details must be indicated. After this, the nuances of the employee’s labor relationship with the company are clarified: the fact of his employment is confirmed, the position and date of conclusion of the employment agreement are named.

Possible mistakes

Errors in such documents are very rare. But it also happens when obviously false data is provided. For example, when a person has income in addition to wages, the sample income certificate for social security may not “go through”, because tax authorities regularly carry out audits. Or when a certificate is provided by an individual entrepreneur, then the entrepreneur must deduct VAT, personal income tax, income tax, insurance premiums, etc., that is, indicate “net” income.

Forms for downloading:

If you still have any questions on this topic, we suggest you download and familiarize yourself with the specific document templates:

For what period is information provided (for how many months)

The provisions of the regulations establish that a certificate of average earnings must be issued for three full months of the employee’s work that preceded his dismissal. Therefore, this calculation does not apply to the standard method of determining the average salary of an employee.

That is, if a person terminated his employment agreement on September 21, then upon receiving a request from him, the employer must prepare a certificate for the period - June, July, August.

It should be taken into account that the following times should be removed from the billing period:

- The period of paid leave provided by law while the employee retains his job.

- The length of time the employee was on sick leave.

- Periods of downtime in work when they were the fault of employers.

- Vacation periods at your own expense.

- Periods of caring for children when employees retain their place of work and are paid.

- The time of the strike, if the employee did not take part in it, but because of this event he could not carry out his work activities.

- Another period when the employee did not work, but he was paid full or partial wages.

- Periods when the employee was granted time off.

Attention: Sometimes, a situation arises when an employee does not have accrued wages for the payroll period in question, as well as days of work. Then, the certificate can be completed for the previous full three months before these three months.

That is, if an employee terminated the contract on September 21, he has been on sick leave since June, then March, April, May can be taken as the billing period.

certificate for the employment center 2018

Certificate of average earnings to the employment center sample for 2021

Currently, there are two forms of this certificate, and the use of each is equivalent. The first form is a form that was adopted by the Ministry of Labor in 2021. Currently, this form continues to operate without changes. Consider filling it out. There are no official instructions for the certificate.

Sample of filling out the form according to the Ministry of Labor

In the upper right corner there is a place for the company stamp. Next to it you need to write down the TIN and main OKVED codes. The latter is entered only in numbers, without decoding.

In the field “Issued by gr.” You must indicate your full name. the citizen for whom this document is drawn up. Next, in the “From” and “To” fields, you need to enter the dates in the interval between which he carried out work in the company. On the next line, write the full name of the organization or full name. entrepreneur.

The next step is for the accountant to calculate the average earnings for the previous 3 months and record the result of this calculation in the certificate. This must be done first in numbers, then in words.

After this, you need to write down in numbers the number of weeks during which he worked over the previous 12 months.

The next step is several fields where you need to record the number of hours per day, as well as the number of days per week during which the employee performed full-time and short-time duties.

Attention: in the case where the employee did not work the whole day, it is necessary to indicate the article from the Labor Code on the basis of which the short schedule was established for him.

In the next block of the column, you need to indicate the periods during the previous 12 months when the employee’s salary was not calculated. This includes downtime, leave without pay, sick leave, etc. Entries are made according to the principle: days of the beginning and end of the period, name of the period.

In the “Certificate issued on the basis” field, you need to list the details of the documents from which information was obtained to fill out the certificate.

After drawing up, the document is signed by the manager and the chief accountant, and they must also provide a transcript of the signature; the date of completion and contact telephone number are indicated below.

If any of the columns is not filled in, a dash must be placed in it.

Attention: in addition to the main form of the certificate, each of the subjects has the right to develop and implement its own version of the document. At the same time, government agencies in the regions usually ask to provide them with a certificate using the internal form, and not the federal one.

An example of filling out a certificate for Moscow

As a rule, local certificates are simpler and include fewer required fields. Using an example, let's look at how to fill out a certificate for Moscow.

It is advisable to issue the certificate on letterhead, where all the required details are indicated in the header. If this is not possible, then you need to put a company stamp in the upper left corner and write down the TIN code next to it.

In the next field “Gr. Issued.” You must indicate your full name. the person for whom the certificate is being filled out. Then, in the following fields “From” and “To” the dates between which he worked in the company are entered.

On the next line, write the full name of the company or full name. entrepreneur.

Next, you need to indicate the OKVED activity code - only a digital code is used without text decoding.

The following periods include the number of days and hours when he performed labor duties under full or short working hours. If an employee worked part-time, then it is necessary to indicate the article from the Labor Code on the basis of which such a schedule was assigned to the employee.

At the next step, the accountant needs to calculate the employee’s average earnings for the previous 3 months and indicate it in the certificate in numbers and words.

If during the previous 12 months the employee had periods without accrual of wages - for example, he was on sick leave or on leave without pay, then for each such case you need to enter the start and end days, as well as the name of the period.

In the “Certificate issued on the basis” field, details of the primary documents on the basis of which the accountant filled out this certificate are recorded.

After providing all the information, the document must be signed by the manager and chief accountant and their signatures deciphered. If there is a seal, its imprint is affixed to the certificate. Below you need to write down the contact phone number and the date when the document was drawn up.

Certificate of average earnings: new recommended form

Only in May of this year, the Russian Ministry of Labor published letter No. 16-5/B-5 dated January 10, 2019, in which it announced the update of the recommended form on average earnings for the last three months at the last place of work.

A certificate of average earnings to determine the amount of unemployment benefits is issued to the dismissed employee to receive unemployment benefits from the employment service at his place of residence.

Now in the new certificate form there is no need to list the periods when the employee did not receive wages (due to unpaid leave, sick leave, downtime, absenteeism, etc.).

Basically, the composition of the certificate remained unchanged. As before, it should contain the following information:

- about the company in which the citizen worked;

- about the individual to whom the certificate was issued;

- about the period of work in the company;

- about working conditions (full or part-time, indicating the number of working hours);

- about the average salary for the last three months;

- on the grounds for issuing a certificate (personal accounts, payment documents);

- about the director and chief (senior) accountant of the organization.

Please note that the new certificate form is recommended. The employer can draw up a certificate in any form.

Also, specialists from the Ministry of Labor clarify that if the employer has drawn up a certificate in any form and it contains all the information that is needed to determine the amount and timing of payment of unemployment benefits, then the employment service does not have the right to refuse to accept the certificate.

Unemployment benefits for 2021

Let us remind you that for 2021 the minimum and maximum amounts of unemployment benefits have been increased. A special maximum is established for citizens of pre-retirement age (Resolution of the Government of the Russian Federation of November 15, 2018 No. 1375).

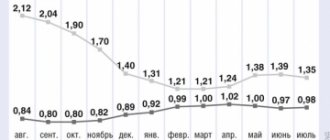

According to Article 30 of the Federal Law of April 19, 1991 No. 1032-1 “On Employment in the Russian Federation”, the amount of benefits in the first year will be from average earnings:

- in the first three months – 75%;

- in the next four months – 60%;

- in the remaining five months - 45%.

However, whatever the result of the calculation, the amount of unemployment benefits cannot exceed the maximum amount (Article 33 of the Federal Law of April 19, 1991 No. 1032-1). This is why it is installed.

From January 1, 2021, the unemployment benefit amounts are:

- minimum – 1,500 rubles;

- maximum – 8,000 rubles.

For citizens of pre-retirement age who have less than 5 years of work left before retirement, the maximum unemployment benefit will be 11,280 rubles.

Calculation of average earnings

To calculate an employee’s remuneration based on average earnings, they are guided by the general calculation procedure (Article 139 of the Labor Code of the Russian Federation) and the specifics of calculation (approved by the Government of the Russian Federation in Resolution No. 922 dated December 24, 2007).

To calculate average earnings, you need to determine:

- billing period;

- number of working days in the billing period;

- the amount of payments that the employee received in the pay period.

Let's briefly look at each of these periods.

How to determine the billing period

The billing period is the 12 calendar months preceding the period during which the employee retains his average salary.

In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

Companies can refuse the generally established billing period of 12 months and establish a different billing period (Article 139 of the Labor Code of the Russian Federation). The billing period can be six months, three months, etc. It must be taken into account that the situation of employees cannot be worsened in comparison with that established by law.

How to determine the number of days in a billing period

Once the billing period has been determined, to calculate average earnings it is necessary to calculate the number of working days in this period. The procedure for calculating the number of days in a pay period depends on whether the employee worked all the days included in the pay period or not.

If the employee has worked the pay period completely, you need to determine the number of working days in the pay period according to the calendar of a five-day work week. When determining the number of working days, holidays and weekends are not taken into account.

The pay period may not be fully worked by the employee. Thus, the calculation period does not include days on which:

- the employee received temporary disability benefits or maternity benefits;

- an employee raising a disabled child was provided with additional paid days off;

- the employee was on leave without pay;

- the employee was released from work with full or partial retention of wages;

- the employee did not work due to downtime (for example, due to the suspension of the organization or workshop);

- the employee did not participate in the strike, but due to it was not able to perform his work.

Accordingly, periods for which payments were calculated based on average earnings are excluded from the calculation period, with the exception of breaks for feeding a child.

If the billing period has not been fully worked out, then it is necessary to calculate the number of working days worked in the billing period according to the calendar of a five-day working week.

How to determine the amount of payments for the billing period

Once you have determined the pay period, you need to determine the amount of payments to the employee for this period.

The procedure for calculating average wages is established by Article 139 of the Labor Code of the Russian Federation and the Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

When calculating average earnings, you should, in particular, take into account:

- wages accrued to employees at tariff rates, official salaries, piece rates, as a percentage of revenue from sales of products (performance of work, provision of services);

- wages paid in non-monetary form;

- Commission remuneration;

- bonuses and additional payments (for class, qualification category, length of service, combination of professions, etc.);

- the final calculated salary of the previous year, regardless of the time of accrual;

- compensation payments related to working hours and working conditions (determined by regional regulation, additional payments for work in hazardous and difficult working conditions, at night, in multi-shift work, on weekends and holidays and overtime);

- bonuses and rewards (provided for by the remuneration system);

- other payments applied by the employer, etc.

It should be especially noted that funds issued to employees not as remuneration for labor (dividends on shares, interest on deposits, insurance payments, financial assistance, loans, etc.) are not taken into account when calculating average earnings.