Who is required to submit a report?

Reporting forms for property fiscal collection are provided by organizations recognized as taxpayers in accordance with Chapter 30 of the Tax Code of the Russian Federation. Today, payers are recognized as organizations that have movable and immovable property on their balance sheet as part of fixed assets.

Please note that this chapter has been amended. Starting from 01/01/2019, the object of taxation of the property fiscal tax is only real estate. Movable fixed assets (transport, equipment, inventory) are exempt from property tax collection.

Before July 15: pay the tax indicated in the declaration

The data you provided in the declaration is processed until the end of June. After this, the tax authorities determine the amount to be paid. It can be seen in your personal account on the website of the Federal Tax Service or the portal of government services of the Russian Federation gosuslugi.ru. Unlike property tax, the tax office will not send notifications about the deadlines and amount of payment for the 3-NDFL declaration. You will have to pay this tax yourself. This can be done at Sberbank branches and on the government services portal. A receipt for payment can be prepared on the tax website.

If you do not meet the deadline, you will be considered a debtor and you will be charged a penalty. In the future, if there is no payment for a long time, we may talk about collecting the debt in court.

Which form to use

The tax return is submitted based on the results of the tax period. The tax period for property fiscal payment is a year. Therefore, the answer to the question of how often you need to submit a corporate property tax return is once a year, annually.

The report form was approved by Federal Tax Service order No. ММВ-7-21/ [email protected] 14, 2019, as amended by Federal Tax Service order No. KCh-7-21/ [email protected] 2020. Reporting on it is provided starting from March 14, 2021.

Read more: “Property tax declaration: step-by-step instructions and sample filling.”

Section 4 on movable property

A new section 4 has been included in the new corporate property tax declaration. It must be filled out for movable property that the company or its separate division, which has a separate balance sheet, accounts for as fixed assets.

The requirement to complete the new section applies to taxpayers:

- Russian organizations;

- foreign organizations operating in the Russian Federation through permanent missions.

Movable property is shown in Section 4 of the corporate property tax declaration at an average annual value other than zero, broken down by the constituent entities of the Russian Federation in whose territory the company owns movable property.

Read in the berator “Practical Encyclopedia of an Accountant”

Section 4 of the corporate property tax declaration

If the company does not have movable property, section 4 is not completed. But the declaration must be submitted in full: the title page and all five sections - 1, 2, 2.1, 3 and 4.

An exception is only for foreign companies whose real estate does not relate to activities through permanent establishments. They submit a declaration consisting of:

- title page;

- section 1;

- section 3.

What other reporting does the taxpayer submit?

Article 379 of the Tax Code of the Russian Federation establishes not only the tax period - a year, but also the reporting period - a quarter.

The following are recognized as reporting periods:

- 1 quarter;

- half year;

- 9 months.

Previously, in addition to annual reporting, the taxpayer organization was obliged to provide the Federal Tax Service Inspectorate with a quarterly advance calculation of property tax. From 2021, quarterly reporting has been cancelled. Based on the results of the reporting quarters, advance payments are made if they are established by regional legislation. But you don't need to submit a calculation.

New tax return for property tax

Organizations will submit property tax returns for 2021 using a new form. The new declaration form was approved by order of the Federal Tax Service of Russia dated August 14, 2019 No. SA-7-21/ [email protected]

The update of the declaration is due to the amendments to Article 386 of the Tax Code of the Russian Federation that have entered into force (Federal Law No. 63-FZ dated April 15, 2019). One of the main innovations concerns tax calculations for advance payments.

From 2021, the obligation of organizations to submit advance calculations for property tax is canceled. There will no longer be a need to submit calculations based on the results of the first quarter, six months and nine months of the calendar year.

At the same time, organizations will continue to calculate and pay advances on property taxes on a quarterly basis. The deadlines for payment of advance payments are set at the regional level. In this case, information about advances paid will no longer be indicated in advance calculations, but in the tax return itself.

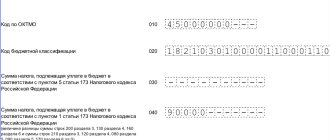

In this regard, section 1 of the updated declaration form was supplemented with new lines (lines 021, 023, 025 and 027). In these lines it will be necessary to indicate information about the calculated amount of tax payable to the budget for the tax period, as well as about the calculated amounts of advance payments for it.

The amount of tax payable to the budget at the end of the year will also be determined as the difference between the amount of tax calculated for the tax period and the amount of advance payments paid for the year.

In turn, lines containing information on the amounts of advance tax payments calculated for the reporting periods were excluded from sections 2 and 3 of the declaration.

Report submission deadlines in 2021

Article 386 of the Tax Code of the Russian Federation stipulates the deadline for filing the annual property tax return. If the day the report is submitted falls on a weekend or non-working holiday, then the last day of submission is postponed to the first next working day.

| Report | Reporting period | Submission deadline |

| Declaration | Year | No later than March 30 of the following year |

In 2021, the deadline for submitting a tax return for corporate property tax is:

- for 2021 - 03/30/2021;

- for 2021 - 03/30/2022.

Reporting period for property tax: nuances

In general, the establishment of a reporting period depends on the method of calculating property tax:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- When determining tax based on the book average value of property, the reporting periods are:

- 1st quarter;

- half year;

- 9 months.

- If the tax is calculated based on the cadastral value of the property, then the reporting periods are the 1st, 2nd and 3rd quarters.

The average annual value of property is established on the basis of the company's accounting documents. The cadastral is determined by Rosreestr and requested through established channels in the department.

In 2021, the advance payment was submitted to the Federal Tax Service 3 times:

- until May 2 - for the 1st quarter (for both methods of calculating tax);

- until July 31 - for the six months (at the average value of assets) or the 2nd quarter (at the cadastral price);

- until October 30 - for 9 months (average price), 3rd quarter (cadastral price).

These reporting periods are essentially quite similar, but the difference between them predetermines differences in the methods of tax calculation.

What are the consequences of late submission of reporting forms?

If an organization does not comply with the deadlines for submitting a property tax return in 2021 for legal entities, then it faces liability in accordance with Articles 119 and 119.1 of the Tax Code of the Russian Federation in the form of a fine:

- 200 rub. — for failure to comply with the electronic reporting form;

- 5% of the unpaid amount of the calculated payment to the budget based on unprovided reporting, but not less than 1000 rubles. and no more than 30% of the specified amount.

In addition, if a tax return is not submitted, the Federal Tax Service has the right to block transactions on the company’s bank accounts until the report is submitted to the inspectorate (clause 3 of Article 76 of the Tax Code of the Russian Federation). Blocking occurs if the delay is more than 10 days.

Legal documents

- Article 372 of the Tax Code of the Russian Federation. General provisions

- Order of the Federal Tax Service of Russia dated March 31, 2017 N ММВ-7-21/ [email protected]

- Article 379 of the Tax Code of the Russian Federation. Taxable period. Reporting period

- Article 386 of the Tax Code of the Russian Federation. Tax return

- Article 119 of the Tax Code of the Russian Federation. Failure to submit a tax return (calculation of the financial result of an investment partnership, calculation of insurance premiums)

- Article 119.1 of the Tax Code of the Russian Federation. Violation of the established method of submitting a tax return (calculation)

- Article 76 of the Tax Code of the Russian Federation. Suspension of transactions on bank accounts, as well as electronic money transfers of organizations and individual entrepreneurs

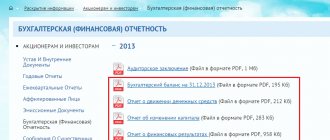

Unified property tax return

In accordance with Art. 386 of the Tax Code of the Russian Federation, tax returns for property tax must be submitted to each tax office at the location of real estate owned by the organization.

Starting in 2021, an exception will apply to this rule. Thus, organizations receive the legal right to submit a single property tax return to one of the tax inspectorates. We are talking about those organizations that are registered with several tax authorities at the same time at the location of the real estate objects they own in the territory of one subject of the Russian Federation.

Previously, in practice, the possibility of providing a single tax return already existed. The Ministry of Finance allowed organizations to submit centralized reporting on property tax to a tax office of their choice (letter of the Ministry of Finance dated November 19, 2018 No. 03-05-04-01/83286). However, this right was not regulated at the legislative level, and the procedure for submitting centralized reporting had to be coordinated with the regional department of the Federal Tax Service of Russia.

Now the right to submit a single tax return is expressly stated in the law (clause 1.1 of Article 386 of the Tax Code of the Russian Federation). In accordance with the new rules, organizations registered with several inspectorates within one region have the right to submit a single property tax return to one of the specified inspectorates of their choice.

However, this rule applies only to organizations whose property tax base is determined as the average annual value of real estate. In other words, the property of organizations should be taxed exactly at market value. It will not be possible to submit a single declaration in relation to property taxed at cadastral value.

It will not be possible to submit a single declaration in cases where the law of the subject of the Russian Federation in which the organization is registered for taxation establishes standards for deductions from property tax to local budgets (clause 20, article 1 of Federal Law dated April 15, 2019 No. 63-FZ ). In other words, the tax paid by the organization must go in full to the budget of the constituent entity of the Russian Federation, and not be distributed between the budgets of municipalities.

Also, a mandatory condition for the transition to centralized submission of property tax reports is notification of the tax authority about such a transition.

Who is required to report income taxes?

A 3-NDFL income declaration is submitted in cases where an individual:

- Pays tax independently, without involving the employer in this process;

- Plans to partially or fully reimburse the amount of previously paid tax or receive a deduction.

In the first case, 3-NDFL must be submitted within a strictly established time frame. In the second case, no such specific deadlines have been established.

The obligation to file a declaration lies with the following categories of persons:

- Business entities that are on the OSN - the general taxation system;

- Citizens who are considered residents of the Russian Federation, but receive income outside its borders;

- Persons who received income as a result of transactions on the sale of property that they owned.

The list is not complete; there are other cases in which individuals are required to report income to the state represented by the Federal Tax Service.

Where and when to file 3-NDFL in 2021?

The completed form is submitted to the territorial tax authority at the place of registration. The place of residence at the time of filing the declaration is taken into account. It is on this principle that the Federal Tax Service keeps records of payers.

The exception is non-residents of the Russian Federation, as well as the sale of real estate. For example, in the latter case, the declaration is submitted at the place of registration of this property.

Before the introduction of quarantine-related measures, the deadline for filing a declaration was limited to the last day of April (but not earlier than January 1, i.e. after the end of the reporting period - the calendar year). In this case, the tax had to be paid no later than July 15.

The exception is foreign citizens whose stay and activities in the Russian Federation are ending and they leave it for good. In this case, they need to submit a declaration no later than 30 days before departure.

Government Decree No. 409 dated April 2, 2021, due to quarantine, introduced adjustments to the deadline for filing the declaration - until July 30. But the deadline for paying taxes remains the same. In addition, the act canceled the traditional Open House events.

Some changes in both form and content

The above order changed not only the form for filing 3-NDFL, but also the procedure for filling it out, namely:

- We made a division into accounting for income received outside the Russian Federation and specified it;

- We entered clarifying data regarding both telephone numbers and adjustments to the declaration itself;

- They provided for the division of costs separately for treatment and the purchase of medicines, which are used in determining the social tax deduction.

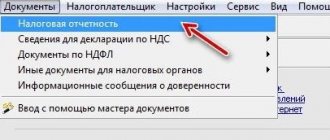

The declaration is completed in the following ways:

- The printed or issued form must be filled out by hand;

- Using office equipment and free software from the tax service.

3-NDFL is filled out both at the territorial tax authority and through the official website of the Federal Tax Service. You can do this for free.

The advantage of this software is that some indicators are calculated automatically. This significantly simplifies filling out the document and reduces the risk of making an error, for which you can subsequently receive a fine and penalty.