Sometimes not only large corporations, but also small businesses have to send employees on business trips. And, of course, the expenses for travel and accommodation of an employee seconded in the interests of the company to another city or even to another country are paid by the employer. Unfortunately, for organizations using a simplified taxation system with a rate of 6%, such costs will not provide any benefits when calculating the single tax. If we are talking about a “simplification” with the object “income minus expenses,” then, like companies on OSNO, they can take such expenses into account when determining the tax base.

General provisions on business trips

What categories of employees does the employer have the right to send on business trips?

The organization has the right to send on business trips only employees who have an employment relationship with the employer (including part-time workers, foreign workers), with the exception of certain categories of citizens, namely:

- pregnant women (Part 1 of Article 259 of the Labor Code of the Russian Federation);

- employees during the period of validity of the apprenticeship contract, with the exception of cases when the business trip is related to apprenticeship (Part 3 of Article 203 of the Labor Code of the Russian Federation);

- workers who have not reached 18 years of age, with the exception of creative workers and athletes;

- disabled people, if this contradicts their individual rehabilitation program;

- candidates registered to participate in elections;

- citizens who work on the basis of civil contracts;

- employees of other organizations (for example, who perform work or provide services under an outsourcing agreement);

- certain categories of workers, if they have not given written consent to a business trip (or if they have given such consent, but business trips are prohibited for them by a medical certificate).

Confirmation: Art. 166 , part 2 art. 287 , part 8 art. 11 of the Labor Code of the Russian Federation, clause 2 of the Regulations , approved. By Decree of the Government of the Russian Federation No. 749 of October 13, 2008, letter of the Ministry of Finance of Russia No. 03-03-04/1/844 of December 19, 2006.

Should an organization obtain the written consent of an employee to send him on a business trip?

The organization must obtain written consent if the following are sent on a business trip: – women who have children under three years of age; – mothers (fathers) raising children under five years of age without a spouse; – employees who have disabled children; – workers who care for sick family members (if there is a medical certificate).

At the same time, such employees can be sent on a business trip (with their written consent) only if this is not prohibited for them in accordance with a medical certificate.

When receiving written consent for a business trip, the employee must be notified in writing that he has the right to refuse the business trip. Therefore, in this case, it is advisable to draw up a single document that will combine both notification of the opportunity to refuse a business trip and the opportunity to give consent. Such a document may be a notification about sending an employee on a business trip (see the form “Notification about sending on a business trip an employee who has the right to refuse it”).

What guarantees are provided to a posted worker?

An employee who is sent on a business trip is provided with the guarantees provided for by labor legislation, namely: – preservation of his place of work (position); – maintaining average earnings while on a business trip; – reimbursement of expenses associated with a business trip (travel expenses, rental housing, daily allowance, etc.).

These guarantees also apply to part-time workers (both internal and external). In this case, the part-time worker’s average earnings for the time he is on a business trip need to be kept only by the employer who sent him on a business trip. If an employee is sent on a business trip at the same time both at his main place of work and part-time, the average earnings must be maintained by both employers. Reimbursement for business trip expenses in this case is distributed between employers by agreement between them.

For how long does an organization have the right to send an employee on a business trip around Russia?

The employer determines this period independently, taking into account the volume, complexity and other features of the official assignment.

The period for which the employee is sent on a business trip must be indicated in the travel documents, which are signed by the manager (or the person authorized by him for this purpose). Namely: – in the order to send the employee on a business trip; – on a travel certificate; - on a job assignment.

The maximum period for which an employee can stay on a business trip in Russia is not established by law. The exception is foreign workers. With regard to them, determining the maximum period of stay on a business trip has its own characteristics (clause 6 of Article 13 of Federal Law No. 115-FZ of July 25, 2002, annex to Order of the Ministry of Health and Social Development of Russia No. 564n of July 28, 2010).

Confirmation: clause 4 of the Regulations , approved. By Decree of the Government of the Russian Federation No. 749 of October 13, 2008, letter of the Ministry of Finance of Russia No. 03-03-06/1/304 of April 28, 2010.

Are you going on a business trip? We talk about the rules, guarantees and compensations

Business trips will also be affected by changes in the new edition of the Labor Code of the Republic of Belarus, which will come into force on January 28, 2021.

According to the Labor Code of the Republic of Belarus, a business trip is considered to be a trip by an employee, by order of the employer, for a certain period of time to another location to perform an official assignment outside the place of his permanent work. This form of work has its own rules, and the employee performing it has certain guarantees and the right to compensation for expenses.

Changes provided for by the new edition of the Labor Code

Change #1

It will affect the form of the travel certificate. In particular, what it should look like will now be decided by the employers of each specific organization. Previously, the Ministry of Finance of the Republic of Belarus was responsible for the form of travel certificates.

Change #2

This change will be the introduction of compensation for departure on a business trip and arrival from it on an employee’s day off.

Currently, posted workers are also provided with compensation, but only if they are sent on a business trip to perform work on their day off. And if an employee is forced to go on a business trip on a day off, but on this day does not perform the assigned work (is on the road), then he does not receive any compensation or additional guarantees, except for payment of travel expenses (daily allowance). For such a day, his average earnings are not retained, and the non-working time spent is not compensated in any way.

According to the new Labor Code, if the employer obliges the employee to go on a business trip or return from it on his day off, then, if desired, the employee will be able to rest on another unpaid day. You can use this right only in the month when the business trip took place, or on any day of the next month.

The employer is obliged to provide the specified compensation only if the employee expresses a desire. The deadline for provision has also been established - no later than the month following the month in which the employee was on a business trip.

Change #3

The third amendment to the new Labor Code will lift the ban on sending women with children under 3 years of age on business trips. Now the norm prevents such workers from going on business trips even with their consent, as well as traveling outside their hometown for advanced training, seminars and other events.

Women who have children under the age of 14 (disabled children under 18) still have the opportunity to be sent on business trips with their written consent. This opportunity will remain with them.

But pregnant women will still not be sent on business trips.

Now women on social leave to care for a child, and whose work involves frequent business trips, will be able to go to work if they wish until the child reaches the age of 3 years.

Business trips within the country and abroad

The Labor Code prescribes the general procedure for sending on a business trip and returning from it, and also defines the procedure for reimbursement of expenses, provision of guarantees and compensation.

According to the rules, before sending an employee on a business trip, the employer is obliged to issue an appropriate order (instruction, resolution). In addition, at least 1 day before departure, the employee must be issued a travel certificate. If not just one employee, but a whole group is going on a business trip, then you can issue one travel certificate for everyone. But only if everyone goes to the same place and for the same period.

If an employee is sent on a business trip based on an invitation (from a government agency, an international organization, an organization), in an order (instruction, resolution), the employer must indicate the conditions for sending the employee in accordance with the invitation received, taking into account the obligations of the receiving party.

Once the basic documents are ready, the employer is obliged to give the posted worker an advance and/or transfer money to his bank account (in Belarusian rubles and/or foreign currency) to reimburse the following expenses:

– for travel to and from the business trip;

– for renting residential premises;

– for accommodation outside the place of residence (daily allowance);

– for other expenses incurred by the employee with the permission of the employer.

If the employee of his own free will decides to stay at the place of business trip or arrive there in advance, the employer will reimburse the costs of renting living quarters and daily allowance only for the official days of the business trip.

After returning from a business trip, the employee must provide the employer with a report on the expenditure of the advance and, if necessary, return the unused amount of money. The final payment to the posted employee must be made no later than 30 calendar days (from the date of submission of the report on the use of the advance payment).

In addition, the Labor Code stipulates: if an employee gets sick while on a business trip, he must be reimbursed for the costs of renting accommodation (except for cases when the posted worker is undergoing hospital treatment), for travel to and from the place of business trip, and also be paid daily allowance for the entire time, until, for health reasons, he was unable to begin his official assignment or return from a business trip. In this case, the temporary disability of the posted employee must be documented.

Travel expenses

By law, posted workers are reimbursed for the following travel expenses to and from the place of business travel:

– expenses for travel by rail, air, water, and road transport;

– expenses for transporting baggage in the event of fulfilling an official assignment to carry it in excess of the free baggage allowance for a travel document (ticket) for the type of transport followed by a business traveler;

– the cost of booking, commission fees, use of a set of bedding, as well as service included in the price of the travel document (ticket).

When traveling abroad the following is paid:

– travel by transport used by the employee on a business trip. It is noteworthy that officials who are members of the Council of Ministers of the Republic of Belarus can use any tariffs (business class on an airplane, a sleeping car on railway transport, 1st class cabins on water transport and other luxury tariffs). Other posted workers can travel at any fare, with the exception of business class;

– travel (including transfer, taxi) to a station, airport or pier, as well as from a station, airport or pier to the place of departure, destination and transfers on internal lines of railway, air, water, and road transport.

The Labor Code specifies the case when the employer will reimburse travel expenses using a business class fare.

Thus, if the conditions of a business trip have changed, including the timing and location of the business trip, sometimes an employee is forced to purchase travel tickets abroad at business class rates (to follow a changed route or return to the place of permanent work earlier or later than the originally established date). In such cases, the employer's permission to purchase business class tickets is not required.

If the employee purchased travel tickets at his own expense, he must provide supporting documents. In the absence of such, the employer has the right to reimburse for travel only 0.1 basic units in each direction.

If an employee spends on transportation expenses within the location of a business trip, then such expenses are paid from the daily allowance and are not subject to reimbursement. At the same time, the employer reimburses the costs of a taxi or renting a car abroad (based on supporting documents). Previously, this possibility was not provided.

Daily allowance

Within the Republic of Belarus, daily allowance per person is 9 rubles per day. If the receiving party bears the costs associated with providing the posted worker with food and transportation within the location of the business trip, the sending party pays per diem only for the time spent en route.

It is also determined that when an employee is sent on a business trip abroad for one day, reimbursement of daily allowance depends on the country to which he is sent.

When an employee is sent on business to several foreign countries on the same day, the employer determines the amount of daily allowance based on the largest amount of daily allowance reimbursement established for one of these foreign countries. In this case, the day of departure (departure) is considered the day of departure (departure) of passenger transport with which the employee is sent on a business trip from the Republic of Belarus, and the day of arrival is the day of arrival of the specified transport in the Republic of Belarus according to travel documents (tickets). When transport departs before 24 o'clock inclusive, the current day is considered the day of departure (departure), and from 0 o'clock and later - the next day.

For employees sent on a business trip by road, the day of departure (departure) and the day of arrival will be considered the days of crossing the State Border of the Republic of Belarus, which will be determined by the mark in the document for departure from the Republic of Belarus and/or entry into the Republic of Belarus. In addition, it is determined that during travel through the territory of the Republic of Belarus before the day of departure (departure) from the country or after the day of arrival in the country, daily allowances are paid at domestic rates.

Renting residential premises and other expenses

In the Republic of Belarus, the following amounts of expenses for renting residential premises are established:

– in regional centers and the city of Minsk – 50 rubles per day;

– in regional centers – 25 rubles per day;

– in other settlements – 20 rubles per day.

As for the costs of renting residential premises abroad, the required amount is determined individually and is not fixed.

The posted worker is also reimbursed for the following expenses:

– on registration and issuance of visas, including payment for services related to the reception and processing of documents for visas;

– on payment of the mandatory fee (duty) collected from citizens at airports; – insurance against accidents and illnesses while traveling abroad;

– on motor transport insurance and civil liability of the carrier.

If the business trip is canceled for reasons beyond the control of the posted employee, the cost of obtaining visas, including payment for services related to the reception and processing of documents for visas, hotel reservations, the cost of the tariff established by the carrier when returning purchased travel documents (tickets) ) are reimbursed in full - based on supporting documents.

Victoria Yakimova, official website of the Federation of Trade Unions of Belarus

Business trip arrangements

Now let's figure out how an employee's trip is documented.

Like any action or decision within an organization, especially if it is related to personnel, a business trip requires the preparation of a very specific list of documents. Is it necessary to issue a memo when sending an employee on a business trip?

There is no need to formalize, except in cases where such an obligation is provided for in the employer’s internal documents (in particular, in the accounting policies) and (or) in the employer’s local regulations (for example, in the Regulations on business trips).

The form of the memo, the procedure and cases for filling it out are not provided for by law. Therefore, the organization independently decides for itself whether it needs to be formalized when sending an employee on a business trip or not. The decision on the need to draw up a memo should be enshrined in the organization’s accounting policies for accounting purposes and (or) in the employer’s local regulations (for example, in the Regulations on Business Travel). Confirmation: Art. 8 of Federal Law No. 402-FZ of December 6, 2011 , part 2 of Art. 5 , part 1 art. 8 of the Labor Code of the Russian Federation.

In addition, the grounds and purposes for sending an employee on a business trip are indicated in the order (instruction) of the manager on sending the employee on a business trip and in the official assignment.

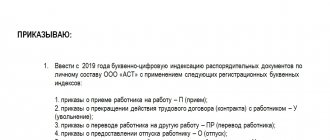

The use of unified forms of personnel documentation approved by the State Statistics Committee of Russia is not mandatory (taking into account a number of features). That is, the employer has the right to independently develop the forms of primary accounting documents that he will use. At the same time, the legislation does not prohibit the continued use of established forms of unified primary documents. In any case, the forms used must contain all the required details listed in Part 2 of Art. 9 of Federal Law No. 402-FZ of December 6, 2011

Depending on which forms the employer decides to use, he can either determine his own procedure for filling them out, or be guided by the instructions that apply to the unified forms developed by the State Statistics Committee of Russia (if it approves them for use). In particular, an order to send an employee on a business trip can be issued using Form No. T-9 or Form No. T-9a (applied when sending two or more employees on a business trip at the same time), and a service assignment - using Form No. T-10a and follow the instructions for their application and completion (Instructions for the application and completion of forms for recording labor and its payment (No. T-9, No. T-9a, No. T-10a), approved by Resolution of the State Statistics Committee of Russia No. 1 of January 5, 2004). This document will serve as confirmation of the period spent on a business trip. It indicates the dates of arrival and departure, which the employee must mark directly at the company where the employer sent him. However, this requirement only applies to business trips within Russia.

What is meant by an official assignment when sending an employee on a business trip?

This is understood as an assignment to a posted worker to perform certain work (perform certain actions) within the framework of his labor function, stipulated by the employment contract and job description given by the employer. For example, conduct negotiations, conclude an agreement, set up equipment operation, conduct interviews, etc. Confirmation: Part 1 of Art. 166 , Art. 60 of the Labor Code of the Russian Federation.

The official assignment to the posted employee must be clear and comprehensive. It needs to be formulated in the job assignment.

In particular, when using the unified form of official assignment in form No. T-10a, lines in column 11 of this document are specially provided for formulating an official assignment for a posted employee. Upon returning from a business trip, opposite the official assignment, the employee must write a short report on its implementation.

Confirmation: Instructions for the use and completion of forms for recording labor and its payment (No. T-10a) , approved. Resolution of the State Statistics Committee of Russia No. 1 of January 5, 2004

How to fill out an order to send an employee on a business trip?

It must be filled out in the order established for filling out the form, which is approved for these purposes in the accounting policies of the organization. When an employee is sent on a business trip, a corresponding order is drawn up. In particular, when using a unified form of an order to send an employee on a business trip (forms No. T-9, No. T-9a), its columns are filled out in accordance with the Instructions for the use and completion of forms for recording labor and its payment (No. T-9, No. T-9a), approved. Resolution of the State Statistics Committee of Russia No. 1 of January 5, 2004

In the title part of the order in a unified form it is necessary to provide: – the name of the organization that sends the employee (workers) on a business trip; – number and date of document preparation.

In the main part of the order in a unified form, you must indicate: - last name, first name, patronymic and personnel number of the employee (workers) whom the organization sends on a business trip; – the structural unit in which the employee (employees) works; – position (specialty, profession) of the employee (workers); – destination of the business trip (country, city, name of organization); – start and end dates of the business trip; – duration of the business trip and its purpose; – source of financing expenses associated with the business trip (indicated if necessary); – details of the document that is the basis for drawing up the order (for example, an official assignment).

This document is filled out by an employee of the personnel service (personnel department, personnel department). It is signed by: – the employee(s) who is sent on a business trip; – the head of the organization (the person authorized by him for this purpose).

What form should I use to prepare a travel certificate?

The use of unified forms of personnel documentation approved by the State Statistics Committee of Russia is not mandatory (taking into account a number of features). That is, the employer has the right to independently develop the forms of primary accounting documents that he will use, including a travel certificate. At the same time, the legislation does not prohibit the continued use of established forms of unified primary documents. In any case, the forms used must contain all the required details listed in Part 2 of Art. 9 of Federal Law No. 402-FZ of December 6, 2011

Depending on which forms the employer decides to use, he can either determine his own procedure for filling them out, or be guided by the instructions in force in relation to the unified forms developed by the State Statistics Committee of Russia (if it approves them for use).

If the employer decides to use the forms developed by the State Statistics Committee of Russia, he must draw up a travel certificate according to form No. T-10 (see Sample). The columns of the unified form No. T-10 are filled out in accordance with the Instructions for the use and completion of forms for recording labor and its payment (No. T-10), approved. Resolution of the State Statistics Committee of Russia No. 1 of January 5, 2004

All of the above documents are important for personnel records. From a tax accounting point of view, to confirm business trip expenses, the only fundamental thing is the presence of a travel certificate. In case of his absence, that is, when crossing the border, notes about this in the international passport will be confirmation of the fact of the trip. In addition, in order to be able to take into account travel payments when calculating the tax base, it is necessary that the employee, within 3 days after returning, draw up an advance report listing all his expenses, as well as attaching all documents confirming payment for travel, accommodation and other monetary expenses within the framework of his business trips.

FEES

6. Bring minimal clothing

I used to take too many things with me, worry about the weather, and fuss with toiletries and shoe shine kits. Then I realized that 70% of what I carry with me, I don’t even take out of my suitcase.

How to determine a reasonable minimum?

- Number of trousers = number of days on a business trip/2

- Number of shirts = number of pants + 2

- Plus a jacket.

- One of the shirts must be white.

The main rule is that the trousers match the shirts. The jacket will most likely be worn once or twice, so it is enough if it is combined with a couple of outfits. If you have a super formal meeting, bring a suit and tie. The suit will fly in a separate case. I put everything else in my bag.

7. Fly with travel bags

If your business trip is no more than five days, leave your suitcases at home. Firstly, you save time because you do not have to wait for your luggage upon arrival and check in for your flight at a separate counter for people without luggage. Secondly... you save time!

8. Identify what you will feel uncomfortable without

The most comfortable state will allow you to fully concentrate on work tasks. It can be anything - from headphones and perfume to talismans. I am calm if I have with me: phone, laptop, power bank, notepad, hand cream, hair and beard styling product, perfume.

9. Roll your clothes rather than fold them.

This leaves fewer creases and takes up less space in your bag.

10. It’s normal to arrive at the airport an hour before departure.

I never arrive very early at the airport. From experience, an hour is enough at any airport. My favorite is Sheremetyevo, most of all I don’t like flying from Domodedovo.

Allowable travel expenses

What documents can be used to confirm the entertainment expenses incurred?

This can be confirmed by documents that justify one or another type of travel expenses: travel expenses, accommodation, per diem.

The legislation does not define a specific list of supporting documents that an organization can use to justify travel expenses for employees.

Opinion of the Ministry of Finance of Russia and the Federal Tax Service of Russia: documents confirming an employee’s travel expenses for travel and rental premises may be:

– advance report approved by the head of the organization;

– travel certificate;

– documents evidencing the employee’s travel expenses (including documents evidencing expenses for the purchase of an electronic travel ticket), rental of living quarters, etc. (attached to the advance report). At the same time, the presence of documents such as an official assignment and an order to send an employee on a business trip is not necessary to confirm expenses for profit tax purposes. Confirmation: letters of the Ministry of Finance of Russia No. 03-03-06/1/764 dated November 19, 2009, No. 03-03-05/169 dated September 14, 2009, Federal Tax Service of Russia No. MN-22-3/890 dated November 25 2009

Due to the fact that a travel certificate is issued only for business trips within Russia and to the CIS countries, when sending an employee on a business trip to other countries, copies of the pages of the international passport with marks on crossing the border must be available (clause , Regulations, approved by Government Decree RF No. 749 of October 13, 2008).

Important! For one-day business trips, a travel certificate may also be missing.

To justify expenses in the form of daily allowances, documents are required that are drawn up when sending an employee on a business trip (in particular, a travel certificate for a long business trip in Russia and the CIS countries). Additionally, you do not need to present various checks and receipts. Confirmation: letters of the Ministry of Finance of Russia No. 03-03-06/1/741 dated November 11, 2011 , No. 03-03-06/1/206 dated April 1, 2010 , No. 03-03-06/1/770 dated November 24, 2009

What form should I use to prepare an advance report when an employee returns from a business trip?

The advance report is the primary document with the help of which an employee (including those sent on a business trip) confirms the expenses incurred by him on issued accountable funds (Part 1, Article 9 of Federal Law No. 402-FZ of December 6, 2011, p. 26 Regulations, approved by Decree of the Government of the Russian Federation No. 749 of October 13, 2008).

An advance report must be drawn up in the form approved in the organization’s accounting policies for accounting purposes. The organization has the right to draw up this document according to the unified form No. AO-1, approved. Resolution of the State Statistics Committee of Russia No. 55 of August 1, 2001. You can also develop an advance report form yourself (including using a standard form as a basis).

In any case, the primary documents used by the organization must contain all the mandatory details listed in Part 2 of Art. 9 of Federal Law No. 402-FZ of December 6, 2011

However, let's get back to business trips. The Labor Code provides a strict list of articles under which a posted worker can claim compensation.

These are travel expenses, rental accommodation and daily allowance. Payment for meals is not made separately. It is assumed that these expenses are included in the daily allowance. In addition to these expenses, the company, by internal regulatory document, can approve a list of additional costs that are compensated to employees. This could be, for example, communication services, the Internet, taxis. One way or another, the principle of economic feasibility must be observed, that is, a person on a business trip must make such expenses only to carry out an official assignment.

So, what expenses should be reimbursed to an employee sent on a business trip?

You need to compensate for expenses associated with a business trip. In particular, these include: – travel expenses; – expenses for renting housing; – daily allowance; – other expenses that the employee incurred with the consent of the employer.

The specific amounts, as well as the procedure for reimbursement of travel expenses, must be fixed in the collective agreement (another local regulatory act, for example, the Regulations on Business Travel).

Confirmation: Art. 168 of the Labor Code of the Russian Federation .

Labor legislation does not establish the obligation to pay expenses associated with business trips to all employees in the same amount. The amount of compensation is determined based on the financial capabilities of the organization. The employing organization has the right, by its local regulations, to provide for a differentiated amount of these expenses for employees occupying different positions (for example, different amounts of expenses for the head of the organization and his deputies, heads of structural divisions, and other employees).

Confirmation: letter of the Ministry of Labor of Russia No. 14-2-291 dated February 14, 2013 , paragraph 3 of Rostrud letter No. 164-6-1 dated March 4, 2013.

To determine the amount of advance payment to an employee for the entire duration of a business trip, it is necessary to take into account its duration, which can be established on the basis of travel documents. For example, an organization can calculate the amount of daily allowance based on a travel certificate.

Confirmation: clause 11 of the Regulations , approved. By Decree of the Government of the Russian Federation No. 749 of October 13, 2008, letter of the Ministry of Finance of Russia No. 03-03-06/1/741 of November 11, 2011.

However, in any case, the specific amount of the advance payment for a business trip (taking into account the specified features) is determined in a general manner by the head of the organization (clause 4.4 of the Regulations on the procedure for conducting cash transactions).

Principles of tax accounting for business trips

All approved expenses, as already mentioned, are accepted in the presence of supporting documents when calculating income tax on the general taxation system (subclause 12, clause 1, article 264 of the Tax Code of the Russian Federation) and the single tax under the “income-expenditure” simplified tax system (subclause 13 Clause 1 of Article 346.16 of the Tax Code of the Russian Federation).

The principle of accounting for such expenses is the same for both, with the exception of one point. General operating organizations reflect costs according to the date of the approved advance report in all cases, regardless of the source of their payment. Organizations using the simplified tax system do the same if business trip expenses were paid from the advance payment issued to the employee. If the traveler paid part of the expenses or even all of them from his own money, then the “simplified” employer will be able to reflect them in tax accounting only upon payment of compensation. It is also necessary to remember that travel expenses accepted for taxation can only be made for full-time employees working in the company on the basis of an employment agreement. Expenses for business trips of persons with whom a civil law contract has been concluded are not included. Compensation for the cost of travel for them, if necessary, should be included in the terms of the contract.

Types of expenses: daily allowance

The daily allowance paid to an employee is essentially the amount with which he will satisfy his personal needs while on a business trip. Its size should be the same for all employees. Payments may differ only according to the geography of travel, for example, for business trips within the Russian Federation one amount, for abroad - another.

When calculating income tax or a single “simplified” tax, expenses for daily allowance payments are accepted in any amount. The only condition is that their specific dimensions must be recorded in the organization order. Also, regardless of the size, this type of travel allowance is not subject to pension, medical and social contributions.

But from the point of view of taxation of these payments with personal income tax, things are worse. The personal income tax-free amount of daily allowance is established in paragraph 3 of Article 217 of the Tax Code, and these figures are not at all large: 700 rubles per day in Russia and 2,500 rubles for foreign countries. Anything paid in excess of these standards must be taxed at a rate of 13% and deducted from the employee’s salary.

Plane, train, taxi

The cost of travel for an employee to the place of business trip from the point of view of its accounting for the “profitable” tax does not matter. The main thing, as already mentioned, is the availability of supporting documents. Previously, the ticket itself was recognized as such, and in the case of air travel, also the boarding pass. With the growing popularity of electronic tickets, it has become difficult to provide their “live” equivalent to the accounting department, since many carrier companies simply do not issue them. However, no particular problem should arise in this regard. Railway travel can be confirmed with a control coupon of an electronic ticket, in other words, an extract received electronically when ordering a ticket via the Internet. This, in particular, is stated in the recently published letter of the Ministry of Finance of Russia dated April 12, 2013 No. 03-03-07/12256.

A similar itinerary/receipt form generated by an automated information system for registration of air transportation is also suitable if the employee travels by plane on a business trip. True, as in the days of paper tickets, he will have to attach to such a printout a boarding pass confirming his flight on the route specified in the electronic ticket (letter of the Ministry of Finance of Russia dated April 19, 2013 No. 03-03-07/13501).

In addition to the cost of travel itself, expenses for tax purposes include compulsory personal insurance for passengers on transport, fees for issuing travel documents and issuing bedding on trains. All other transport fees reduce the tax base only if they are directly included in the ticket price (letter of the Ministry of Finance of Russia dated July 24, 2008 No. 03-03-06/2/93).

The cost of a ticket is not an employee's income, regardless of the method of payment. Both in a situation where an enterprise organizes travel, and if an employee buys a ticket himself, and the employer subsequently reimburses him for what he spent, this amount is not subject to personal income tax or insurance contributions.

Does the organization have the right to take into account the employee’s expenses for a taxi to the airport from which he is departing on a business trip?

Has the right to be taken into account as part of other expenses associated with production and (or) sales, subject to certain conditions.

When calculating income tax as part of other expenses associated with production and (or) sales, the organization has the right to take into account business travel costs. In particular, these include travel expenses to and from the business trip. At the same time, tax legislation does not contain any reservations or restrictions on the type of transport that an employee can use to get to the place of business trip and back. Confirmation: pp. 12 clause 1 art. 264 of the Tax Code of the Russian Federation.

In addition, the obligation to reimburse the employee for any expenses associated with a business trip, if they were made with the permission and knowledge of the organization, is enshrined in labor legislation (part 1 of article 168 of the Labor Code of the Russian Federation, paragraph 1 of clause 11 of the Regulations, approved by Government Resolution RF No. 749 of October 13, 2008). An employee's expenses for a taxi to the airport are related to the costs of travel to and from the business trip. The procedure and amount of reimbursement of such expenses are determined by a collective agreement or internal documents of the organization (Part 2 of Article 168 of the Labor Code of the Russian Federation).

Conclusion: the organization has the right to take into account the employee’s expenses for a taxi to the airport from which he is departing on a business trip as expenses when calculating income tax.

At the same time, any expenses for the purpose of calculating income tax are taken into account only if they are economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation).

The need to call a taxi can be justified, for example: – by the absence of direct routes from the employee’s departure point to the airport; – a break in the operation of public transport in case of late (early) departure on a business trip.

You can document expenses by: – an order for the provision of a vehicle for the transportation of passengers and luggage; – a receipt for payment for the use of a passenger taxi or cash register checks; – a memo in which the employee will justify the reason for calling a taxi and indicate the route; – internal regulations of the organization (for example, Regulations on business trips).

Confirmation: letters of the Ministry of Finance of Russia No. 03-03-06/1/621 dated October 4, 2011 , No. 03-03-06/2/162 dated August 27, 2009 , No. 03-03-06/1/505 dated July 31, 2009

So, the organization has the right to compensate the posted employee and take into account the costs of taxi travel to the airport and back in its taxes. This is, in particular, stated in the letter from the financial department.

Living expenses

Similarly, payment for an employee’s accommodation on a business trip is not subject to all “salary taxes”. By the way, such a personal income tax benefit applies not only to those trips when a company employee goes on a business trip, representing the commercial interests of the employing organization, but also when he goes, for example, for an internship in order to improve his own qualifications. This is stated in the letter of the Ministry of Finance of Russia dated April 12, 2013 No. 03-04-06/12417.

To confirm living expenses on a “profitable” basis, you will need primary documents issued in the name of the employing organization by the hotel. According to Decree of the Government of the Russian Federation of May 6, 2008 No. 359, this can be a strict reporting form developed by the hotel itself. This BSO must necessarily contain such details as the name of the document, its number and series, as well as the date of preparation and payment, name, legal address and TIN of the organization that issued it, name and cost of the service, position and surname, first name and patronymic of the person responsible for the preparation of the form, its signature and the seal of the organization.

Most hotels have cash register equipment, so instead of BSO, the seconded employee can justify the fact of paying for the room with a cash receipt. In addition, hotels must issue documents confirming the very fact of providing accommodation services, as well as, if they are a VAT payer, an invoice.

When reflecting living expenses, it should be borne in mind that the provided documents should not include amounts for organizing meals for the employee, which, we remind you, is paid from the daily allowance.

There are two options: either the employee will agree with the hotel representatives so that the cost of breakfast is included in the cost of accommodation, and there are no references to meals at a local restaurant in the document at all, or the accountant will have to “pack” the allocated amounts into the stipulated daily allowance, deducting them from subsequent payments .

Other business trip expenses

Does an organization have the right to include as expenses the costs of paying for a business dinner with partners held in a restaurant during a business trip?

When calculating income tax, an organization may take into account, as part of other expenses associated with production and (or) sales, the representation expenses specified in clause 2 of Art. 264 of the Tax Code of the Russian Federation (clause 22, clause 1, article 264 of the Tax Code of the Russian Federation). These include, in particular, costs associated with holding official meetings, receptions (including breakfasts, lunches or other similar events), servicing representatives of other organizations participating in negotiations in order to establish and (or) maintain mutual cooperation , as well as officials of the taxpayer organization participating in the negotiations. Moreover, the ability to take into account these costs does not depend on the location of such events.

Conclusion: the costs of paying for a business dinner with partners held in a restaurant during a business (production) business trip should be recognized when calculating income tax in the manner prescribed for accounting for entertainment expenses.

At the same time, entertainment expenses for the purpose of calculating income tax are taken into account only if they are economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Confirmation: letters of the Ministry of Finance of Russia No. 03-03-06/2/11897 dated April 10, 2013 , No. 03-03-06/1/675 dated November 1, 2010 , No. 03-03-06/1/759 dated November 16, 2009

ARRIVAL

11. Immediately upon arrival, reconfirm all work meetings

This will allow you not to waste time and quickly adjust your plans for the coming day. In general, during one-day or two-day business trips, you need to do everything as quickly as possible in order to have time to solve more work problems. Short business trips are dangerous because there is always not enough time.

12. Upon arrival at the hotel, immediately give the maid all your clothes for ironing

Usually this service is inexpensive, but it saves time and makes you feel comfortable and confident. This is why I stopped ironing clothes at home the night before a business trip.

13. Book a taxi in advance

I always check with the meeting party which taxi is best to get around and what is the average reasonable price from the airport to the city center.

Happy business trips!

Related materials: