Object of taxation

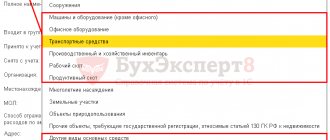

Construction projects that have not yet been put into operation are considered to be construction in progress. Objects in this category include:

- Mothballed construction site.

- At the suspension stage.

- Completely stopped.

- A finished object undergoing safety testing and compliance with technical parameters.

Chapters 30-32 of the Tax Code of the Russian Federation determine the taxation procedure for such objects. The law clearly establishes the requirement to pay property taxes on unfinished construction.

The main nuances of its payment are established by local authorities, since this tax relates to regional fees.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Consultations on accounting and taxation » Property tax » Is acquired real estate subject to property tax if it is not put into operation?

The enterprise (OSNO) acquired real estate and land as a separate division in 2018; these objects are accounted for on account 08, because the facilities have not been put into operation. The operation of these facilities is not yet planned because In 2021, construction of a new warehouse began on the site of the acquired land plot, and the acquired old warehouses may be demolished.

Question

Are purchased real estate that is not put into operation subject to property tax?

Expert's answer

The object of taxation is real estate recorded in accordance with the established rules for maintaining accounting records on the balance sheet as fixed assets, unless otherwise provided by Art. Art. 378, 378.1 and 378.2 of the Tax Code of the Russian Federation (Article 374 of the Tax Code of the Russian Federation).

So, in particular, according to clause 4 of PBU 6/01, an object of real estate is accepted by an organization for accounting as fixed assets if the following conditions are simultaneously met:

a) the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization;

b) the object is intended to be used for a long time, that is, a period of more than 12 months or a normal operating cycle if it exceeds 12 months;

c) the organization does not intend the subsequent resale of this object;

d) the object is capable of bringing economic benefits (income) to the organization in the future (for commercial organizations).

The clarifications of the Ministry of Finance of Russia note that an asset is accepted by an organization for accounting as fixed assets while simultaneously meeting the conditions established by clause 4 of PBU 6/01, that is, when the object is brought into a state suitable for use in activities, regardless of its entry into operation (Letters dated 04/18/2007 N 03-05-06-01/33, dated 06/08/2012 N 03-05-05-01/31).

{Question: Is a fixed asset that has not been put into operation subject to corporate property tax? (Expert consultation, Ministry of Finance of Russia, 2019) {ConsultantPlus}}

The property is, in principle, ready for use, but not in the capacity in which the organization intends to use it. If such property is not included in fixed assets and, therefore, in the object of taxation, the tax authorities will most likely assess additional tax. However, the organization has a chance to defend its point of view in court.

For example, the Federal Antimonopoly Service of the Ural District, in Resolution No. F09-2938/09-S2 dated 06/09/2009, indicated that in order to be registered as a fixed asset, an object must be suitable for use for certain purposes. In particular, the court recognized that the hangar is subject to property tax not from the moment of its installation, but only after it is brought into a state in which it is suitable for use as a warehouse for finished products (for which it was planned to be built).

Property that is unsuitable for use cannot be included in fixed assets and is not subject to tax (Resolution of the Federal Antimonopoly Service of the North-Western District dated April 1, 2013 N A56-34010/2012). Moreover, if disputes arise with tax authorities, the organization will need evidence that the property is unfit for use. They may be:

— acts on the commissioning of equipment, according to which it is unsuitable for use and does not participate in the organization’s activities (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated December 1, 2009 N A22-356/2009/5-48);

— unsuccessful results of test runs of equipment (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated November 7, 2007 N A29-9610/2006A);

- acts of regulatory authorities, which identified deficiencies in property, issued orders to eliminate them (Resolutions of the Federal Antimonopoly Service of the Ural District dated 02/16/2011 N F09-404/11-S3, FAS Moscow District dated 03/11/2010 N KA-A40/1845-10, FAS Volga District dated June 17, 2008 N A65-26068/07 (left in force by the Determination of the Supreme Arbitration Court of the Russian Federation dated November 18, 2008 N 12833/08));

- documents confirming the introduction of property into temporary operation during the period of capital work at the site, during which its normal operation is not yet possible (Letter of the Ministry of Finance of Russia dated May 29, 2006 N 03-06-01-04/107, Resolutions of the Federal Antimonopoly Service of the North-Western District dated 04/09/2013 N A26-7054/2012, FAS of the West Siberian District dated 02/14/2012 N A81-2327/2011, FAS Volga District dated 03/22/2011 N A72-15321/2009). The use of a part of the property that is not its structural element and is separable without causing harm to it also does not indicate that the fixed asset is ready for use (Resolution of the Federal Antimonopoly Service of the Ural District dated April 11, 2011 N F09-1836/11-C3).

Tax Guide. Practical guide to corporate property tax {ConsultantPlus}

At the same time, there is judicial practice according to which an object can be accepted for accounting as fixed assets if actual operation is carried out (for example, Resolution of the Federal Antimonopoly Service of the West Siberian District dated August 22, 2012 in case No. A81-888 /2011).

The Constitutional Court of the Russian Federation in its Determination dated December 14, 2004 N 451-O indicated that within the meaning of paragraph 1 of Art. 38 and art. 374 of the Tax Code of the Russian Federation, the object of taxation for the property tax of organizations are elements of the separate property of a legal entity, taken into account on its balance sheet as fixed assets, that is, such assets of the organization that form the economic basis of its business activities.

Therefore, if real estate is not put into operation in the prescribed manner, but is actually being operated, that is, the object meets the conditions for accepting it for accounting as fixed assets, such property is subject to corporate property tax.

A similar position is set out in the Letter of the Ministry of Finance of Russia dated 09/06/2006 N 03-06-01-02/35 (sent by the Letter of the Federal Tax Service of Russia dated 11/10/2006 N MM-6-21/ [email protected] ) and the Decision of the Supreme Arbitration Court of the Russian Federation dated 10/17/2007 N 8464/07 on the refusal to satisfy the application for invalidation of the specified Letter of the Ministry of Finance of Russia (sent by Letter of the Federal Tax Service of Russia N MM-6-21 / [email protected] ), as well as in the Letter of the Ministry of Finance of Russia dated 02.09.2014 N 03-03-06 /1/43913

{Question: Is a fixed asset that has not been put into operation subject to corporate property tax? (Expert consultation, Ministry of Finance of Russia, 2019) {ConsultantPlus}}

According to accounting rules, real estate, which will then be taken into account as fixed assets, is accounted for in account 08 “Investments in non-current assets”. While the object is listed on this account, it does not fall into the property tax base. But you need to be prepared for claims from the tax inspectorate.

If real estate is not put into operation in the prescribed manner, but is actually in use, that is, the object meets the conditions for accepting it for accounting as fixed assets, such property is subject to corporate property tax.

The explanation was given by the accountant-consultant of LLC NTVP “Kedr-Consultant” Natalya Borisovna Petrova in September 2018.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE ().

This consultation has passed quality control:

Reviewer: Selezneva Irina Akhmatyasavievna, Associate Professor of the Department of Accounting, Finance and Auditing, Izhevsk State Agricultural Academy

Legal basis of tax

Article 408 of the Tax Code states that property tax is calculated by the tax service. Its employees send notifications about the need to pay taxes to property owners at the end of the tax period. The notice indicates the payment amount.

In addition to Article 406, some aspects of property taxation are regulated by Articles 52, 401, 402, 403, 406 and 407 of the Tax Code of the Russian Federation.

Calculation of property tax on unfinished construction projects

In a situation where property rights have already been registered for unfinished construction, it is necessary to pay property tax in full. Its calculation may vary depending on the region. In particular, in some regions of the Russian Federation, the tax is calculated based on the cadastral value of the property.

The only way to avoid paying tax in this case is not to register ownership of the property until construction is completely completed.

Why are people in no hurry to register their property?

The majority of our fellow citizens live with faith in the state, but the presence of documents does not yet confirm ownership. Moreover, there is one erroneous rumor circulating around this issue, allegedly you can add your property to the Unified State Register of Real Estate at your own request, but this law was relevant in the early 90s, after the collapse of the USSR. Now the procedure for registration, ownership and assessment of taxes has changed. A law has already been adopted that if property is not registered in the Unified State Register, then it is removed from the cadastral register.

It is immediately worth recalling that on January 1, 2021, developed by the Ministry of Economic Development of the Russian Federation comes into force It will introduce significant amendments to the Land Code of the Russian Federation. It says: “If a personal land plot has not been surveyed, then from January 1, 2021 you will not be able to dispose of it.” What does the concept of “no land surveying have been carried out” mean? This implies that the plot was registered under the dacha amnesty.

Here the question immediately arises: if the plot is included in the Unified State Register, why cannot the owner dispose of it ?

The concept of “dispose of” includes: transfer by inheritance, sell, etc. In order to manage the site in full, it is necessary to call a specialist who can carry out land surveying.

Land surveying work is carried out at the expense of the owner, this can cause many difficulties for land owners

However, there are other pitfalls here. There is such a thing as “cadastral errors”. After the land survey, the citizen needs to register with the cadastral register, which he may be denied due to the borders of his plot crossing the borders of his neighbor.

It is impossible to enter such data on a public cadastral map , and the imposition of boundaries can only be challenged in court. We have repeatedly witnessed how innocent people, due to a cadastral error, were forced by a court decision to pay 150 thousand rubles or more for a forensic examination.

We often receive comments from summer residents that it is at their expense that the state wants to replenish the country’s budget, without commensurating this with their capabilities. Raids are now being actively carried out on dacha plots, inspectors are looking for violators who became such through no fault of their own. Incorrect measurements by surveyors result in land owners occupying their neighbor's land - officially called "land grabbing".

How to apply for a tax exemption for an unfinished construction project?

Despite the fact that in some cases property tax can indeed be paid at a preferential rate, this does not apply to unfinished properties.

The tax on unfinished construction in all constituent entities of the Russian Federation must be paid in full. Therefore, you can receive the benefit only after completion of construction and registration of the building as a full-fledged real estate object.

It is also worth checking the lists of preferential tax payments with the local administration. Sometimes unfinished objects can also end up there. Lists of benefits for different regions can be found on the website of the Federal Tax Service.

Tax rate

The tax rate may vary in different regions. Certain restrictions are imposed by Article 406 of the Tax Code of the Russian Federation. In particular, according to it, the regional rate cannot exceed the minimum by more than three times. By the way, in most regions the tax rate on unfinished construction is 0.1%, and in Moscow it is 0.3% of the cadastral value of the property.

For individuals, when calculating on the basis of cadastral value, the marginal tax rates are determined by Article 406 of the Tax Code of the Russian Federation:

- 0.1% for residential buildings.

- 2% for administrative, retail facilities and facilities worth more than 300 thousand rubles.

- 0.5% for other objects.

Legal entities do not have to pay tax on unfinished objects at all, since these objects are not used in their commercial activities. The tax will need to be paid only after the facility is put into operation.

Dear readers! We cover standard methods for solving legal problems, but your case may be unique. We will help you find a solution to your problem for free

— simply call our legal consultant at:

+7 (495) 128-73-40 (Moscow)

+7 (812) 603-71-55 (Saint Petersburg)

8 (800) 302-33-75 (free call within Russia)

It's fast and free ! You can also quickly get an answer through the consultant form on the website.

Common mistakes

Error No. 1: An unfinished building is not listed on the enterprise’s balance sheet as a fixed asset, property tax in respect of it is not transferred to the budget, but it is regularly used in the production process.

Comment : This cannot be done; similar cases have already been considered by the court, and the decision was made in favor of the tax inspectorate. You must either register the structure and pay tax on it, or refuse to use it until the official start of use in the company’s work.

Error No. 2: An attempt to apply benefits in relation to a building, the cost of which, according to the cadastral valuation, exceeded three hundred million rubles.

Comment : Property benefits for unfinished buildings do not apply to buildings worth more than three hundred million and to premises used in the course of business activities.

Error No. 3: Filling out an application to the tax office for a property tax benefit later than November 1 of the year for which the tax should already be assessed.

Comment : You must leave an application at the Federal Tax Service office and provide documents proving your rights to the benefit no later than November 1 of the reporting period, since the Federal Tax Service calculates the amount of tax and sends notifications to individuals 30 days before the payment deadline (for individuals this is December 1), otherwise take advantage of The benefit will only be available starting next year.

Calculation of tax amount

Tax authorities determine the cadastral value of an unfinished property at the end of the year, and based on this data, they charge tax according to the regional rate. Therefore, the calculation procedure is general, but the tax may differ in different regions.

In the case of shared ownership of a construction project, each owner must pay tax on his share. Accordingly, the debts of one of the shareholders do not concern other owners and cannot be transferred to them.

If the property has been owned by the taxpayer for less than a year, then special rules for calculating property tax apply to it. In this case, the annual tax is divided into 12 months, and then multiplied by the number of months during which the payer is the owner of the unfinished property. Thus, the tax will be less than the annual one.

It is important to take into account that Article 23 of the Tax Code of the Russian Federation obliges the owner of the property to report to the tax office about all objects that he owns and for which tax notifications are not received. But if notifications do not arrive because the owner has the right to tax benefits, then there is no need to report such buildings to the tax office.

Results

For legal entities, unfinished construction projects are not subject to property tax.

For individuals, unfinished construction may be subject to tax if in the region of its location the tax base for the tax is calculated from the cadastral value, it is owned by the individual and its cadastral value is known.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of property tax under the NZS

Despite the fact that this is a type of property tax, this fee has the following features:

- It is calculated for each region separately, which means it may differ.

- It is calculated according to the cadastral value, although previously it was calculated according to the inventory value.

Also, the tax amount for unfinished construction is always less than for completed and commissioned objects.

Cadastral value of NZS objects

The cadastral value is determined on the basis of the state cadastral valuation. For both finished buildings and unfinished ones, the cadastral value is usually less than the market value. In rare cases, the opposite happens, but this is possible for objects that have already been put into operation, which have increased in price due to the development of infrastructure around them or for other reasons. For unfinished construction, the cadastral value is always lower than the market value.

The Federal Tax Service clarified the specifics of taxation of unfinished construction

In those regions where the tax on unfinished construction is calculated based on the cadastral value, it cannot exceed 0.3% of the cost (for a house) and 0.5% (for other construction projects). In this case, the owner of an unfinished property cannot claim property tax benefits other than those established in the given municipality.

If the inventory value is used to calculate the tax, then no tax is charged at all on unfinished objects (in accordance with the order of the Ministry of Construction of the Russian Federation No. 87 of 1992).

Tax benefits for unfinished buildings

Benefits for this type of property are not approved by federal legislation; everything depends on regional regulations. For property tax, it is possible to apply for a benefit if a citizen has legal grounds for doing so, however, benefits cannot be applied to particularly expensive objects (from three hundred million rubles). For all other unfinished buildings, the benefit is assigned to only one object of each type upon completion of an application to the Federal Tax Service and presentation of the relevant documents. You should contact the tax service before November 1 of the reporting year.

It will also not be possible to apply for a benefit for unfinished buildings owned by individual entrepreneurs, unless the individual entrepreneur can prove to the Federal Tax Service that he is not yet able to use them in the production process due to incomplete construction. But if the tax authorities suspect that the real estate, even if unfinished, is somehow useful in the operation of the enterprise, a tax will be assessed.