Are there any special features?

Often, organizations erect various buildings and structures for their own use, and not for sale or to third-party investors. For example, a company is building an office building for itself (a warehouse, a production base for the production of building materials, etc.) both with the involvement of contractors and with its own resources. For the construction of the facility, special machinery and equipment is purchased. Let’s assume that the tax accounting policy calculates depreciation using the straight-line method and provides for the use of a depreciation bonus. How to take into account the costs of “auxiliary” fixed assets involved in the creation of “capital” fixed assets? Are there any peculiarities in calculating depreciation in such a situation? Questions arise due to the fact that a specific list of costs included in the initial cost of a fixed asset is not established by regulation (neither in accounting nor in tax legislation).

Contract construction

If the developer is constructing by contract, the cost of the construction project is formed by the debit of account 08-3 “Construction of fixed assets” at the expense of work performed by contractors and the developer’s own costs for organizing construction.

Make the following entries in accounting:

Debit 08-3 Credit 60 – costs for the construction of the facility for work performed by contractors are written off;

Debit 19 Credit 60 – VAT claimed by contractors is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – VAT submitted by contractors is accepted for deduction;

Debit 08-3 Credit 26(20) – the developer’s own costs associated with organizing the construction of the facility are written off.

If the developer engages a technical customer to partially or fully perform its functions, then its services are reflected as part of capital investments.

In accounting, reflect this with the following entries:

Debit 08-3 Credit 60 – costs for the construction of an object for the services of a technical customer are written off;

Debit 19 Credit 60 – VAT presented by the technical customer is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – VAT submitted by the technical customer is accepted for deduction.

Situation: how can a developer reflect in accounting and take into account the receipt of temporary buildings and structures when calculating income tax? The developer constructs the main facility for himself using a contract method.

Include temporary title buildings and structures that meet certain criteria as part of fixed assets. Costs for objects that do not meet these requirements, as well as costs for non-title buildings, increase the initial cost of the main construction project.

To understand the nuances of accounting, it is important to understand what temporary structures are erected during construction. There are two types of such objects:

- Temporary title buildings and structures (VTZS). Such temporary buildings are used for the needs of the entire construction site. The list of auxiliary buildings is determined in advance in the title list (hence the name). Such temporary structures include electrical substations, technical warehouses, boiler rooms, access roads to the construction site (except roads), dormitories for workers, etc.

- Temporary non-title buildings and structures (TNS). These temporary buildings are used in certain construction areas. The composition of non-title structures is determined by the contractor based on emerging needs. This includes, for example, scaffolding, stepladders, electrical, water, and gas distribution.

In what order to register and take into account VTZS

As already mentioned, temporary title buildings and structures that meet certain requirements are taken into account as separate objects as part of fixed assets. When ready, such facilities must be put into operation directly during the construction process. This is done by special working commissions. In this case, an act is drawn up, for example, in the OS-1a form. This procedure follows from paragraph 1.6 of the Construction Norms and Rules SNIP 3.01.04-87, approved by Decree of the USSR State Construction Committee dated April 21, 1987 No. 84, and paragraph 3.1.8 of the Regulations approved by letter of the Ministry of Finance of Russia dated December 30, 1993 No. 160.

The specified rule on the inclusion of VTZS in the OS is valid only to the extent that does not contradict the Law of December 6, 2011 No. 402-FZ and PBU 6/01. Therefore, it is necessary to take into account the restrictions established by the latest regulatory documents. In particular, one of the main criteria will be the useful life of more than 12 months and the cost of the title structure more than 40,000 rubles. And if the working commission often sets the SPI equal to or less than the duration of construction, then with the cost it’s not so simple.

To determine the cost of a temporary title building, actual expenses for it are collected separately from other construction expenses on account 08 “Investments in non-current assets.” To do this, you can open a special sub-account, for example, “Construction of VTZS”.

To determine the estimated cost of VTZS, use one of the following methods:

- make calculations based on the construction organization project based on the title list;

- set aside a percentage of the estimated cost of all construction, repair, and installation work based on established standards.

This is established by paragraph 4.84 of the Methodology, approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1.

The chosen method for calculating the estimated cost of VTZS does not affect the procedure for determining the initial cost of temporary construction. To do this, you need documents confirming the actual costs of constructing the VTZS. Such a document will be an act of acceptance of work performed (for example, in the KS-2 form). In it, the contractor must indicate the cost of work performed and costs of materials. It is compiled on the basis of a log of work performed (form KS-6a). Use these documents when determining the initial cost of the VTZS.

When the VTZS object is ready and meets the established criteria, include it in fixed assets. Remember, if you have documents confirming the actual costs of the developer for the construction of the VTZ, it is not accepted into accounting as part of fixed assets, disputes with tax inspectors cannot be avoided. And the courts support the demands of tax inspectors (see, for example, the decision of the Thirteenth Arbitration Court of Appeal dated March 28, 2011 No. A56-49550/2010).

Starting next month, start depreciating such an object.

Here's what wiring you'll need to do. When forming the initial cost of the VTZS, reflect the actual costs of its construction as follows:

Debit 08 subaccount “Construction of VTZS” Credit 60 (76) – reflects the cost of contract work on the construction of VTZS.

When commissioning an object that meets the criteria of a fixed asset:

Debit 01 Credit 08 subaccount “Construction of VTZS” - reflects the initial cost of VTZS included in the OS.

When calculating depreciation:

Debit 08 subaccount “Construction of the main construction project” (91-2) Credit 02 – depreciation of the VTZS involved in construction has been accrued.

What to do if the VTZS does not meet the OS criteria? Include the costs of constructing such an object directly into the initial cost of the object being built:

Debit 08 subaccount “Construction of the main construction project” Credit 08 subaccount “Construction of the VTZS” - reflects the initial cost of the VTZS included in the OS.

All this follows from the Instructions for the chart of accounts (accounts 01, 02, 08, 60, 76, 91), paragraphs 4 and 17 of PBU 6/01.

If it is impossible to determine the actual cost of VTZS from documents from the contractor

In this case, a possible solution would be to set the initial cost based on what was planned in the design and estimate documentation. This document is an integral part of the contract; any changes in the cost of construction are agreed upon and endorsed by the parties either by changes in the estimate or by additional agreements (Articles 743 and 744 of the Civil Code of the Russian Federation). Therefore, design and estimate documentation can be used as a sufficient basis for determining the initial cost.

What if, after accounting for VTZS as part of fixed assets, the estimated cost has changed? In this case, assign the amount of the increase to the cost of the main construction project. After all, firstly, such an increase will no longer be associated with the VTZS put into operation. And secondly, there is no reason to overestimate VTZS - fixed assets, both in accounting and tax accounting. This follows from paragraph 14 of PBU 6/01 and paragraph 2 of Article 257 of the Tax Code of the Russian Federation.

Advice: to avoid uncertainty with the initial cost of VTZS, correctly formulate the contractor’s obligations in the contract.

The fact is that the developer does not have the right to simply request additional documents from the contractor confirming the actual costs of constructing the VTZS. After all, they are calculated based on established standards from the remaining construction work actually completed. This is confirmed by the letter of the Ministry of Regional Development of Russia dated October 20, 2009 No. 34541-IP/08. However, despite the chosen calculation method, it is still necessary to receive VTZS. This is done in the manner established in the contract. Which the department also points out.

Therefore, write down the contractor’s obligation to submit the necessary documents on the actual costs of constructing the VTZS. For example, the following phrase can be added to the contract: “...For completed construction of temporary title buildings and structures, the contractor is obliged to submit a separate act in the KS-2 form and documents confirming the actual cost of materials and work performed...”.

Only such measures will make it possible to form the initial cost of VTZ without problems. Other decisions to determine the initial cost may cause a dispute with property tax and income tax inspectors. And you will have to defend your position in court.

In what order to take into account VNSS

The costs of temporary non-title buildings and structures are taken into account by the contractor. For the developer-customer, it is only important to include the actual costs indicated in the acceptance certificate for the work performed in the initial cost of the main construction project.

When receiving the act, make the following entry:

Debit 08 subaccount “Construction of the main construction project” Credit 60 (76) – the cost of the construction project is reflected as part of investments in the main construction project.

All this follows from the Instructions for the chart of accounts (accounts 08, 60, 76).

How is the OS created?

In fact, there are two possible ways to organize the OS creation process:

- create an object on your own;

- involve contractors and third-party resources in the process - accounting for the contract method of construction.

In both cases, the accountant’s task is to correctly take into account all expenses and reflect the accepted object correctly at its original cost.

To organize correct accounting of a created, constructed, erected object, it is necessary to correctly determine the costs incurred, make sure that the created property is really a fixed asset, and determine how VAT on expenses will be taken into account. Accounting depends on the method of creating an asset - business or contract. Postings and paperwork will be slightly different.

Accounting when creating in an economic way

The economic method assumes that the company will engage in construction, creating an OS facility on its own, without receiving the help of contract companies.

Acceptance of independently created or constructed fixed assets for accounting is carried out at a cost called the initial one.

Components of the initial cost of an OS when manufactured independently:

- cost indicator of the materials used, spare parts, components (MP) without added tax;

- salary of the company’s own personnel involved in the creation of the OS object;

- insurance contributions for employee salaries;

- depreciation of equipment used in the process;

- VAT on inventories, which cannot be accepted for reimbursement, for example, due to the lack of an invoice.

The sum of all these costs forms the initial cost of an economically created fixed asset, at which it must be accepted for accounting.

Step-by-step instruction

The organization decided to build an additional warehouse to store finished products on its own.

In the second quarter, construction work was carried out using economic methods. The costs of building the warehouse were:

- material costs - 250,000 rubles;

- wages - 80,000 rubles;

- insurance premiums - 24,160 rubles.

On July 2, construction was completed and the warehouse was put into operation.

On July 10, an extract from the Unified State Register of Real Estate was received regarding the registration of ownership of the property.

Let's look at the step-by-step instructions for creating an example: PDF

Accounting in construction for a contractor

Keeping records of construction activities of organizations is enshrined in PBU 9/99, PBU 10/99, PBU 2/94, PBU for investment accounting. All costs in a construction company are subject to division into the elements mentioned above.

To reflect construction costs in accounting, accounting account 20 “Main production” is used. The debit of account 20 reflects the following expenses:

- for materials with simultaneous reflection of costs on the credit of account 10 “Material inventories”;

- for the salary of construction company personnel under loan 70 “Payroll calculations”;

- for settlements with suppliers on account credit 60.

When receiving step-by-step acceptance, you should use account 46 “Completed stages of work in progress”, forming the posting Dt 46 Kt 90 - the work in progress is reflected.

Through inventory accounting

So, let’s say the customer buys the necessary materials and checks in at his warehouse.

Now he needs to display the transfer of valuables to the Contractor, which means he needs to create a warehouse for this, which you will call “Contractor”.

The transfer of materials itself will be formalized through a special document called “Transfer of Goods.”

The only disadvantage of this method is that documents are not issued in printed M-15 form and if you need it, you will have to create it manually. When your counterparty reports on where and how much material he used, you will need to collect all the costs in the “Request Invoice” document.

If your counterparty still has some unspent valuables, then they need to be processed back to your warehouse through a document called “Transfer of Goods.”

This method is quite good for those who do not want to do manual adjustments, but most often they use the second method, which we will write about below.

Documenting

After examining the object, the commission must give an opinion on the possibility of its use. To do this, you need to draw up a primary document, which must contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. Such a document may be an act in form No. OS-1a or in form No. OS-1.

Apply the act in form No. OS-1a during the construction of buildings (structures). Draw it up at the time the object is included in the fixed assets (at the time its value is reflected in account 01 “Fixed assets” or 03 “Income-generating investments in tangible assets”) (paragraph 2 of the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7). Draw up an act based on primary accounting documents confirming the expenses incurred. Do not fill out the details of the donating organization, which are provided at the beginning of the act, as well as the sections “Information on the condition of the fixed asset object on the date of transfer” and “Passed over”.

In the act in form No. OS-1a, indicate:

- number and date of its compilation;

- full name of the fixed asset;

- place of acceptance of the fixed asset;

- factory and assigned inventory numbers of the fixed asset;

- depreciation group number and useful life of the fixed asset;

- information about the content of precious metals and stones;

- other characteristics of the fixed asset (total area, number of floors, etc.).

In addition, put a note on the conclusion of the acceptance committee (for example, the entry “Can be used”). The executed act is approved by the head of the organization.

When producing other fixed assets (except buildings and structures) on your own, use the form of act No. OS-1. When filling it out, apply the same rules as when drawing up form No. OS-1a.

This procedure follows from the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Simultaneously with drawing up the act in form No. OS-1a (OS-1), fill out the inventory card in form No. OS-6a (OS-6) in one copy. Draw up an inventory card on the basis of the act and primary documents. In the future, enter into the card information about all changes that affect the accounting of fixed assets (revaluation, modernization, internal movement, disposal). Reflect this information on the basis of primary documents (for example, on the basis of the acceptance certificate for modernized fixed assets in form No. OS-3).

This procedure is provided for by the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Attention: the absence (failure to submit) primary documents for accounting for fixed assets is an offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation), for which tax and administrative liability is provided.

VAT deductible during construction

VAT amounts presented in connection with the acquisition of project documentation can be deducted without waiting for the start of construction work. The fact is that the development of design documentation and the implementation of construction work are independent operations carried out on the basis of separate contracts (Resolution of the AS MO dated 04.04.2016 N F05-3313/2016 in case N A40-43152/15).

In addition, the condition that the purchase must be intended for use in transactions subject to VAT does not mean that the use of the deduction is possible only after the actual use of the purchase in taxable activities begins. Therefore, the taxpayer’s task is to confirm the potential possibility of using project documentation to carry out VAT-taxable transactions (Resolution of the AS of the Moscow Region of December 4, 2017 N F05-17613/2017 in case N A41-12864/2017). The tax authorities, in their official explanations, do not themselves challenge the right to deduction in the period in which services or work are accepted for accounting on account 08 (Letter of the Federal Tax Service of Russia dated January 20, 2016 N SD-4-3 / [email protected] ). But if the object is not used in taxable activities in the future, the deduction of input VAT will be in question.

There is no such basis for VAT restoration as writing off an unfinished facility. Nevertheless, in practice, tax authorities insist on restoring the “input” VAT on a written-off (unfinished) facility (letter of the Ministry of Finance of Russia dated 02/07/2008 N 03-03-06/1/86). The argument is still the same: these objects will not be used in future transactions subject to VAT.

Most arbitration disputes work out in favor of taxpayers.

Thus, in one of the disputes, the reasons for writing off fixed assets and a fixed assets asset were physical wear and tear, damage and obsolescence of equipment, as well as the impossibility of using it. The grounds for writing off an asset are confirmed by properly executed primary documents in accordance with the accounting policies adopted by the company. As the judges noted, Art. 170 of the Tax Code of the Russian Federation does not provide for the restoration of VAT previously accepted for deduction in cases of write-off of equipment and facilities of the Tax Service due to physical and moral wear and tear (Resolution of the AS of the West Siberian District dated March 15, 2016 N A67-8553/2014).

Get expert advice

according to your situation and get expert advice.

Ask a Question

Ask a Question

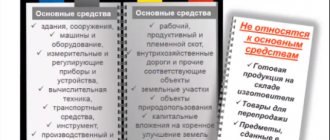

What applies to fixed assets

Fixed assets include an asset, that is, the property of an organization, for which four conditions are met:

- The object is intended for use in production, performing work or providing services; for management needs, or for rental.

- The item is intended to be used for a period exceeding 12 months (or the normal operating cycle if it exceeds 12 months).

- Subsequent resale of the property is not expected.

- The facility is capable of bringing economic benefits in the future.

Examples of fixed assets: buildings and structures, working and power machines, equipment, computers, vehicles, tools, household equipment, breeding livestock, perennial plantings, etc.

In addition, fixed assets include land, water, subsoil and other natural resources, as well as capital investments in leased property and for radical land improvement.

Maintain tax and accounting records of fixed assets according to the new rules

When can an object be capitalized?

Conditions for including created property in the OS:

- Long service life - over 12 months.

- Making a profit from use - the object must participate in economic activity to obtain benefits.

- No intention to sell the asset in the next year.

If these three conditions are not met, the manufacturing object is not accepted as part of fixed assets, but is included as inventory.

Important! If we are talking about construction, then the constructed real estate before the state registration of rights to it is accounted for in an independent subaccount 01 of account.

Initial cost

Fixed assets constructed on an economic basis are accepted for accounting at their original cost (clause 7 of PBU 6/01). Include in the initial cost all costs directly related to the manufacture of the object (clause 8 of PBU 6/01, clause 5.1.1 of the Regulations approved by the Ministry of Finance of Russia dated December 30, 1993 No. 160). For example, expenses for paying salaries to employees involved in production, for the purchase of building materials, for the maintenance of construction machines, etc. A detailed list of expenses that form the initial cost of constructed (manufactured) fixed assets is given in the table.

When forming the initial cost of an object, take into account expenses based on:

- primary accounting documents (requests, invoices, pay slips, etc.);

- any other documents confirming the costs incurred (customs declarations, business travel orders, etc.).

For registration, accept documents that contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. For more information on preparing primary documents, see How to manage document flow in accounting.

During the operation of a fixed asset, its initial cost does not change. Therefore, if any costs associated with the creation (manufacturing) of an object are incurred by the organization after it is included in fixed assets, do not change the initial cost. And consider the costs as part of current expenses. The exceptions are cases of completion (retrofitting), reconstruction, modernization, partial liquidation and revaluation of fixed assets. This procedure follows from paragraph 14 of PBU 6/01.

Situation: is it possible in accounting to include the salaries of administrative and management personnel in the initial cost of a fixed asset constructed on an economic basis? The organization does not conduct any activities.

Yes, you can.

General business expenses are included in the initial cost of a fixed asset only if they are directly related to the creation of the object. This is stated in paragraph 8 of PBU 6/01 and paragraph 5.1.1 of the Regulations approved by the Ministry of Finance of Russia dated December 30, 1993 No. 160. If the organization does not conduct other activities, then during construction the administrative and managerial personnel perform functions related to its provision. Consequently, under these conditions, the costs of maintaining administrative and managerial personnel can be included in the initial cost of the facility being created. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated March 2, 2006 No. 03-03-04/1/178.

Accounting: creation in a self-employed way

In accounting, all costs associated with the construction of an object using economic means are reflected in account 08-3 “Construction of fixed assets”. In this case, make the following entries:

Debit 08-3 Credit 10 (23, 25, 26, 60, 70, 76...) - reflects the costs associated with creating an object and bringing it to a state suitable for use;

Debit 19 Credit 60 (76) – VAT is reflected on costs associated with creating an object and bringing it to a state suitable for use.

Often, an organization uses property produced for sale for its own needs. If you plan to include former products in fixed assets, then first create its value on account 08. At the same time, make the following entry:

Debit of account 08 Credit of account 43 – the cost of the created property is taken into account as part of investments in non-current assets.

We note that although such posting is not provided for in the Instructions for the chart of accounts, it is correct. After all, the Instruction does not regulate accounting and has no advantages over PBU (paragraphs 1, 2 of the preamble to the Instructions for the chart of accounts, letter of the Ministry of Finance of Russia dated March 15, 2001 No. 16-00-13/05).

There is no need to reverse or correct this entry. The fact that the property was initially taken into account in account 43 is not a mistake. At that time, it was intended to be used as part of the MPZ (clause 2 of PBU 5/01).

The procedure for forming the initial cost of a fixed asset and its evaluation is prescribed in PBU 6/01, which is mandatory for use. Therefore, first include the value of the property that you decide to use as a fixed asset as part of investments in non-current assets. This follows from paragraphs 7–12 of PBU 6/01 and paragraph 8 of paragraph 2 of PBU 22/2010.

As soon as the object meets certain criteria, include it in fixed assets in the general manner.

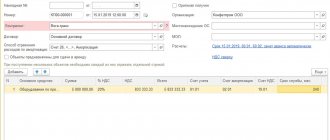

Construction period – three years

In accounting policy, for tax and accounting purposes, depreciation is calculated using the straight-line method. Tax accounting provides for the use of a depreciation bonus (for special equipment in the amount of 30%). For an excavator, its amount is 300,000 rubles. (RUB 1,000,000 × 30%).

The accountant of Monolit CJSC made the following entries in the accounting:

DEBIT 08 subaccount “Purchase of fixed assets”

CREDIT 60

– 1,000,000 rub. – purchased an excavator;

DEBIT 19 CREDIT 60

– 180,000 rub. – VAT allocated;

DEBIT 68 subaccount “VAT calculations”

CREDIT 19

– 180,000 rub. – VAT is accepted for deduction on the cost of the excavator;

DEBIT 01 subaccount “Fixed assets in operation”

CREDIT 08 subaccount “Purchase of fixed assets”

– 1,000,000 rub. – the excavator is included in the fixed assets put into operation; DEBIT 08 subaccount “Construction of fixed assets”

CREDIT 02

– 16,393.44 rubles. (RUB 1,000,000: 61 months) – depreciation has been accrued for the excavator, the amount of depreciation is included in the initial cost of the building (monthly during the construction period).

In tax accounting, the company applied a depreciation bonus in the amount of 300,000 rubles. and reflected it as part of indirect expenses of the current period, thereby saving 60,000 rubles on income tax. Since the specified amount (300,000 rubles) was not included in the expenses of the current period in the accounting records, the accountant made the following entry:

DEBIT 68 subaccount “Calculations for income tax”

CREDIT 77

– 60,000 rub. (RUB 300,000 × 20%) – deferred tax liability is reflected.

In tax accounting, depreciation of special equipment also participates in the formation of the initial cost of the building - depreciable property. But the amount of monthly depreciation of the excavator will be 11,475.41 rubles. ((RUB 1,000,000 – RUB 300,000) : 61 months).

Upon completion of construction (after three years), the accounting records will take into account the depreciation of the excavator in the amount of 590,163.84 rubles in the initial cost of the building. (RUB 16,393.44 × 36 months). In tax accounting - only 413,114.76 rubles. (RUB 11,475.41 × 36 months). At the same time, no entries for writing off the deferred tax liability to the debit of account 77 “Deferred tax liabilities” are made during the construction period, since the accrual of depreciation of special equipment neither in accounting nor in tax accounting does not affect the financial result (is not reflected in expenses).

After the building was built and put into operation, Monolit CJSC established its useful life at 361 months (tenth depreciation group) and began to depreciate, that is, write off the costs of its construction through depreciation. At the same time, with the start of depreciation of the building, expenses (in the form of depreciation of the formed initial cost of the building) begin to include the costs of purchasing an excavator.

The difference between the depreciation amounts in accounting and tax accounting that arose during construction amounted to RUB 177,049.08. (590,163.84 – 413,114.76). In the previously reflected deferred tax liability (RUB 60,000), this part will amount to RUB 35,409.82. (RUB 177,049.08 × 20%). This amount will be written off over the useful life of the building:

DEBIT 77

CREDIT 68 subaccount “Calculations for income tax”

– 98.09 rub. (RUB 35,409.82: 361 months) – the deferred tax liability was written off in the form of the difference between the accounting and tax amounts of depreciation of the excavator accrued during the construction of the building.

The second part of the deferred tax liability for depreciation of the excavator in the amount of RUB 24,590.18. (60,000 – 35,409.82) will be written off during further operation of the excavator (in the company’s production activities) during the remaining 25 months (61 – 36) of its useful life:

DEBIT 77

CREDIT 68 subaccount “Calculations for income tax”

– 983.61 rub. (RUB 24,590.18: 25 months) – the deferred tax liability was written off in the form of the difference between the accounting and tax amounts of depreciation of the excavator during its further operation (outside the construction of the company’s office building).

Thus, the deferred tax liability formed upon the acquisition of special equipment (excavator) will be fully repaid: partly during the operation of the constructed building, and partly during the further operation of the equipment.

Important to remember

According to financiers, the depreciation bonus on purchased construction machinery and equipment relates to the expenses of the reporting period and does not increase the initial cost of the building under construction.

The article was published in the journal “Accounting in Construction” No. 8, August 2013.

Paperwork

Accounting for incurred costs and recording of transactions is carried out using the following documents :

- invoices for receipt and transfer of goods;

- accounting information;

- invoice – in relation to tax on construction work, subject to accounting as part of the cost of a fixed asset due to the full application of the latter in non-VAT-taxable activities;

- payslips.

Postings

Account 08 is used to collect all expenses . All cost amounts are collected in the debit of this accounting account; upon completion of the creation of the object, the total value of the recorded costs is transferred to account 01 , where the object will be accounted for until it is disposed of from the organization or written off.

When collecting costs for the construction or creation of an object, account 08 corresponds with various accounts, depending on the type of expense.

List of corresponding accounts:

- 10 – to account for inventories invested in the manufacture of an object;

- 02 – to account for depreciation charges if depreciable equipment is involved in construction or manufacturing;

- 70 – to account for the remuneration of employees of the enterprise engaged in the creation of fixed assets;

- 69 – to account for insurance contributions accrued for employee benefits.

As a result of production, the total indicator of all expenses is transferred in one transaction from credit 08 to debit 01. Thus, the created object is accounted for as a fixed asset at its original cost.

A summary table with accounting entries for the construction (creation) of an operating system using an economic method using one’s own resources is given below.

Postings for the economic method:

| Business transaction | Debit | Credit |

| The cost of inventories allocated for the construction (manufacturing) of fixed assets is taken into account (excluding tax) | 08 | 10 |

| Expenses for paying staff are taken into account | 08 | 70 |

| Reflects the costs of compulsory labor insurance for personnel | 08 | 69 |

| Depreciation on equipment used in creation is taken into account | 08 | 02 |

| VAT on SMP is shown in the cost of an object intended entirely for non-taxable activities | 08 | 19 |

| The constructed (created, manufactured) object is capitalized as a fixed asset | 01 | 08 |

Accounting for other methods of acquiring fixed assets:

- contribution to the management company in the form of a contribution from the founder;

- free receipt;

- purchase.

Manufacturing example

Example conditions:

The company purchased computer components for RUB 448,400. (VAT including RUB 68,400).

From these components, 7 computers were assembled on our own without the involvement of third parties, while all components were involved in the assembly.

All computers were capitalized as fixed assets on the balance sheet of the enterprise.

The cost of wages for workers involved in the manufacture of computers amounted to 75,000 rubles, the total amount of insurance contributions was 22,500 rubles.

The assembly of computers from components does not relate to construction and installation work, and therefore this operation is not subject to VAT, and accordingly, in this example there is no need to account for VAT.

Example accounting entries:

| Sum | Operation | Debit | Credit |

| 380000 | Computer components supplied to the parish | 10 | 60 |

| 68400 | VAT allocated on supplier invoice | 19 | 60 |

| 68400 | VAT is accepted for deduction | 68 | 19 |

| 448400 | Transferred non-cash payment to the supplier for components | 60 | 51 |

| 380000 | All components were transferred for computer assembly | 08 | 10 |

| 75000 | Reflects the calculation of salaries for personnel engaged in the manufacture of computers | 08 | 70 |

| 22500 | The accrual of insurance coverage is reflected | 08 | 69 |

| 477500 (380000 + 75000 + 22500) | 7 computers accepted for registration | 01 | 08 |

Example of building construction

Example conditions:

The company built an office building for itself using its own resources.

Expenses:

- materials – 1,180,000 (180,000 – tax included);

- builders' salary – 300,000;

- wage contributions for builders – 90,000;

- depreciation of construction equipment – 150,000.

Example accounting entries:

| Sum | Operation | Debit | Credit |

| 1000000 | Construction materials were delivered to the parish | 10 | 60 |

| 180000 | VAT allocated on supplier invoice | 19 | 60 |

| 180000 | Tax accepted for deduction | 68 | 19 |

| 1180000 | Transferred non-cash payment to the supplier for construction materials | 60 | 51 |

| 1000000 | All materials were transferred to construction | 08.3 | 10 |

| 300000 | Reflects the calculation of salaries for personnel involved in construction | 08.3 | 70 |

| 90000 | The accrual of insurance coverage is reflected | 08.3 | 69 |

| 150000 | Accrued depreciation on equipment is taken into account | 08.3 | 02 |

| 1540000 (1000000 + 300000 + 90000 + 150000) | The office is included in fixed assets | 01 | 08.3 |

| 277200 (1000000 + 300000 + 90000 + 150000) * 18% | VAT accrued on SMP for own needs | 19 | 68 |

| 277200 | VAT is accepted for deduction, since the constructed office is planned to be used in taxable activities | 68 | 19 |

simplified tax system

Organizations using the simplified system are required to keep accounting records, including fixed assets, in full (Part 1, Article 2 of Law No. 402-FZ of December 6, 2011). At the same time, in order not to lose the right to apply the simplification, the organization must control the residual value of fixed assets, which cannot exceed 100,000,000 rubles. (Subclause 16, Clause 3, Article 346.12 of the Tax Code of the Russian Federation).

For information on the features of accounting for fixed assets built (manufactured) using economic methods, when simplified, see How to take into account the receipt of fixed assets and intangible assets using the simplified tax system.

Situation: is it possible to take into account when calculating the single tax the costs of constructing a fixed asset built on an economic basis? The organization applies a simplification and pays a single tax on the difference between income and expenses.

Yes, you can.

The right to take into account the costs of constructing a fixed asset is in no way connected with the method of construction or manufacture of fixed assets (subclause 1, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Therefore, the organization has the right to take into account in expenses when calculating the single tax the costs of constructing a fixed asset using economic methods.

Accounting: creation by contractor

In the process of creating a fixed asset on an economic basis, an organization can attract contractors to perform individual works. Also take into account the cost of their services when forming the initial cost of the fixed asset being created (clause 8 of PBU 6/01). Make the following wiring:

Debit 08-3 Credit 60 (76) – reflects the cost of contract work for the construction of a fixed asset;

Debit 19 Credit 60 (76) – reflects VAT presented by the contractor.

For information on the specifics of accounting for fixed assets manufactured by contract, see How to reflect the construction of fixed assets by contract in accounting.

Revaluation of fixed assets

Conducting a revaluation is a right, not an obligation of the organization. In other words, the company may refuse revaluation. If the corresponding decision is made, then the operating system will have to be revalued annually as of December 31. Revaluation is carried out in relation to all fixed assets included in the group of homogeneous objects.

As a result of revaluation, the value of an object can either be reduced (depreciation) or increased (revaluation). The changed cost is called replacement cost.

The accountant reflects the results of the markdown on account 91 “Other income and expenses.”

The postings will be as follows:

DEBIT 91 CREDIT 01 - reflects the amount of depreciation of the object DEBIT 02 CREDIT 91 - reflects the amount of depreciation adjustment made based on the results of the depreciation.

If in subsequent periods the same object is again revalued by the same amount, then the amount of the revaluation must be shown on the credit of account 91.

The accountant credits the results of the revaluation to additional capital and reflects it on the credit of account 83.

The postings will be as follows:

DEBIT 01 CREDIT 83 - reflects the amount of revaluation of the object DEBIT 83 CREDIT 02 - reflects the amount of depreciation adjustment as a result of revaluation.

If in subsequent periods the same object is marked down, then the amount of the markdown must be attributed to the reduction of additional capital and reflected in the debit of account 83. The markdown, which in magnitude exceeds the initial revaluation, must be partially written off as a decrease in additional capital, and the remaining amount must be reflected in the debit of the account 91.

For fixed assets that are revalued annually, the amount of depreciation is calculated based on replacement cost, not original cost.

Accounting: acceptance for accounting and commissioning

Reflect the cost of accepted finished objects on account 01 “Fixed Assets” or account 03 “Income Investments in Material Assets”, to which open the sub-accounts “Fixed Assets in Warehouse (In Stock)” and “Fixed Assets in Operation”. If the time of registration of a fixed asset and its commissioning coincides, make the following entry:

Debit 01 (03) subaccount “Fixed asset in operation” Credit 08-3 – the fixed asset created by self-employed was accepted for accounting and put into operation at its original cost.

If the moments of registering a fixed asset and its putting into operation do not coincide, make the following posting:

Debit 01 (03) subaccount “Fixed asset in warehouse (in stock)” Credit 08-3 – the created object is taken into account as part of fixed assets at its original cost.

This procedure is provided for in paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and the Instructions for the chart of accounts.