Sick leave is a document that allows you to receive paid leave due to temporary loss of ability to work. Reliable for injuries sustained while performing work duties, illnesses, or caring for a relative. The bulletin is filled out by employees of medical organizations that have the appropriate license to operate.

Funds are accrued by the employer and the Social Insurance Fund. Payment is calculated based on the certificate of incapacity for work by the company's accountants.

Step-by-step description of the calculation

Taking into account all the changes in 2021 that were made to the legislation, it is possible to describe step by step how the calculation occurs.

Stage 1.

A certificate of incapacity for work is accepted from the applicant. Whether the document is filled out correctly and whether it is original is something that the accounting department must first check before accepting it. It depends on this whether the employer will be reimbursed for the amounts spent on sick leave for its employee. Such compensation is handled by the FSS body - the Social Insurance Fund. The original sick leave certificate must be printed on a certain paper that has watermarks on it. Also, such paper should contain fibers of different colors: its center, as a rule, has a light tint compared to the edges, and the fields in which entries should be made are a different shade of yellow. You can find out in detail what the real form looks like on the FSS website, and there you can also find out all the information about those forms that were stolen.

After checking the form itself, you need to check its design. All entries made in it must have a printed font or must be written in gel ink exclusively in black.

A certificate of incapacity for work can be of several types:

- Primary.

- Duplicate.

- Continuation.

Each of these types has its own personal mark. On the primary sheet, this particular type should be ticked, on the sheet, which is a continuation of the previous one, there should be a record of the number of the previous sick leave, and on the duplicate sheet, as you might guess, there should be a “duplicate” tick.

After this, you should proceed to directly checking the information indicated on the sheet. You need to carefully check the employee’s initials, the day he was born and the dates on which he suffered from any illness. It is worth understanding that a sheet indicating an illness that lasted no more than 15 days should not be signed by the chairman of the VC.

The data has been verified, now you should pay attention to the available seals. They must be blue and have the signatures of the doctors who issued the document. The next check is the discharge date. The employee must begin his duties the next day after the end of his illness. If the sick leave is extended, an annex is added to the certificate of incapacity for work, on which the code “31” is written, or another if further treatment is planned.

All of the above steps are very important. Very often you can encounter quite controversial situations in which doubts arise about the authenticity of the certificate of incapacity for work and the correctness of its execution. If such a situation occurs, then there is always the opportunity to contact the fund and consult with specialists who will confirm or refute doubts.

After the disability card has been checked for all of the above points, the accountant has every right to register it and, in the next 10 days, directly calculate benefits. Once this happens, it must be paid on your very first paycheck.

Stage 2.

Calculation of sick leave benefits. First of all, it is necessary to determine the calculation period, and it, as a rule, is equal to two years that were before the current period in which the employee went on sick leave. After this, you need to calculate the amount of earnings an employee receives for one average day. For this, amounts are taken for two years, but it is precisely those that are subject to contributions that are divided into 730 days of the calculation period. The resulting result must be compared with the existing limit, that is, with an amount that cannot be exceeded in order to receive compensation from the Social Insurance Fund in the future. Back in 2021, such a limit for one working day was 1632 rubles and 88k, but already in 2021 it amounted to 1772 rubles and 60k. Such amounts are obtained by adding all insurance deposit limits in the years in which the billing period is carried out and dividing by 730 days. To calculate material support in the current 2021, calculations are taken for the past two years—2019 and 2020. The limit in 2021 was 718 thousand rubles, and in 2020—755 thousand rubles.

So, based on these amounts, let’s calculate the highest income for one average day:

- (718 000 + 755 000):730=2017,81.

It follows that in 2021 the average daily income cannot exceed the amount of 2021.81 thousand rubles. So, the average wage value has been calculated. The next step will be to determine the length of insurance coverage, since it directly affects the amount of benefits that will be accrued. If the employee had already been working at his job for 6 months at the time he was sick, then the calculation of his sick leave will be calculated based on the minimum wage (Minimum Wage). From the first day of 2021 it is 9489 rubles. But, if an employee has been working at work for more than 6 months and up to five years, then sick leave will be paid taking into account 60% of the average salary, and if the work experience is between 5 and 8 years, then sick leave will be 80% of the average salary . If the patient has been working at his job for over 8 years, then his sick leave will be paid at 100% of the average salary. It should be remembered that the accrual of length of service begins from the first day of work until the employee goes on sick leave. After calculating the amount that is accrued for one working day and taking into account the length of service, it is necessary to multiply it by the days on which the employee was sick. For this, a special calculation formula is used.

It looks like this:

- Earnings for one average day = (salary for 24 months that were before the employee’s illness (calculation limits must be taken into account) / 730 days.

- Subsidy for one working day = (Earnings for one average day) * (Insurance period—100.80 or 60%).

- Final amount = (Benefit for one working day) * (Dates on which the employee was sick).

Stage 3.

Payment of benefits. It is the employer who must pay the benefit, except in cases where the employee lives in the region related to the pilot project (the Social Insurance Fund is responsible for the payment). Knowing the final benefit amount, the employer subtracts 13% from it to pay taxes and adds the rest to the salary.

Registration of sick leave in 2018

Sick leave is issued on a special form, which you can see in the photo below.

It’s worth saying right away that not every medical organization has the right to issue sick leave. Only accredited medical institutes have this right. For example, neither emergency doctors, nor medical personnel in blood transfusion centers, nor employees of emergency departments of clinics and hospitals HAVE THE RIGHT TO ISSUE SICK LEAVES.

Example of a sick leave form

What is needed to apply for sick leave?

For registration you only need a passport.

Deadlines for filing sick leave.

The sick leave certificate indicates exactly the date it was filled out, so that, at the request of the patient, this date can correspond to either the date of admission to the hospital or the end date of the sick leave. If you are admitted to the hospital after the end of the working day, be sure to ask your doctor to fill out a sick leave sheet with the date of the next day. Since you will not receive wages for the day you have already worked.

It is important that sick leave CANNOT BE ISSUED FOR PAST PERIODS.

Obtaining sick leave abroad?

If you get sick outside the country, for example, during a business trip, then you must obtain the appropriate supporting documents in the country where you are located. Upon your return, you can simply legalize them and submit them to a medical institution at your place of residence, where a special commission will receive it.

Sick leave during vacation time?

In 2021, everything will remain the same in this matter. That is, if you get sick while on vacation, having received sick leave, you will be able to extend your paid vacation for the entire period of sick leave.

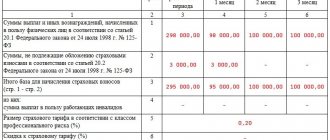

Visual calculation of illness sample in 2021

In August 2021, a sales specialist provided an extract to the accounting department stating that she was sick. In total, she was absent from work for health reasons for 9 days. Her experience is 6 years.

The actual income of a sales specialist in 2021 was 400 thousand rubles, in 2021 - 480 thousand rubles. It turns out that the billing period will be equal to the amount of 880 thousand rubles. We compare the received amount with the possible earnings limit, which is 1,473,000 rubles. It turns out that the salary of a sales specialist is not higher than the limit.

Now let’s calculate the sales specialist’s allowance for the day:

- (400 thousand rubles +480 thousand rubles): 730*80%. =964.38 rub.

Why 80%? As already mentioned in the article, exactly 80% is taken, since the experience of a sales specialist ranges from five to eight years.

The sales specialist was on sick leave for 9 days.

It turns out that it is necessary to calculate the benefit for these days:

- RUB 964.38 (salary for one day) * 9 (number of days on sick leave) = 8679.42 rubles.

This is how sick leave is calculated. It is worth noting that as soon as the calculation has taken place, in the first three days it is the employer himself who pays for it, and in the following days the Social Insurance Fund. But there are also exceptions. These include maternity benefits in 2021, abbreviated as BiR, and child care benefits. Payments of these types of benefits are made only by the Social Insurance Fund. In order to understand in detail, you should focus on these benefits, since they are calculated somewhat differently.

Results

The accrual of sick leave in 2021 has not undergone significant changes: the accountant needs, as before, to know the employee’s SDZ, length of service, and number of sick days. However, there are nuances in paying sick leave to an employee who was injured at work or to a woman who was recently on maternity leave.

For information on calculating sick leave after maternity leave, read the article “How to calculate sick leave after maternity leave?”

Find out how to pay sick leave for a domestic injury here. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

BiR and sick leave

One hundred and forty days is the time that is considered to be the entire maternity leave. Of these, 70 days are the period of time before childbirth, and the rest are the time after childbirth. If the birth was difficult, then the employee is given an additional sick leave, which indicates that she cannot work for another 16 days. And if the pregnancy is considered multiple, the benefit already includes 194 days. The period for calculation is taken over the previous two years, as is the case with a regular benefit. This is the only similarity between them. Then the differences begin. First, the billing period is not divided into the usual 730 days. There may be more of them - for example, 731, if the year for which the calculation is taking place has 366 days, or 732 days - if the years for the previous period were high.

Well, secondly, from this number, exceptional periods are subtracted, which include:

- Disease.

- Maternity leave.

- Parental leave.

- A period of time during which an employee does not work, but nevertheless receives payments that are not subject to contributions.

There is also a third difference: the billing period can be replaced by one or two years, but only if the employee was on maternity leave at that time or was taking care of a child whose age was 1.5-3 years. To replace it, it is allowed to take another year that has already passed. The main condition for such a replacement is that the benefit must be greater than it would have been if the replacement of periods had not occurred. If a situation arises where it is necessary to change the payroll period, then the employee is required to write a statement in which she must indicate which years she wants to change.

Sick leave in 2018

Each of us has at least once encountered, or will still encounter, the need to take sick leave.

According to labor law, sick leave is a certain basis for receiving assistance associated with temporary loss of ability to work due to health problems.

Sick leave in 2018

As you know, in 2021 an electronic sick leave certificate was introduced. That is, the employer fills out a sick leave certificate online, which removes unnecessary paperwork.

In 2021 , sick leave can also be filled out electronically. To fill out sick leave online, you will need to fill out a special electronic form in the system and, of course, have it certified with the electronic signatures of the employer and the person taking the sick leave.

Examples of how the B&R benefit is calculated

Let’s say that Maria’s subordinate is going to go on maternity leave in October 2021. To calculate her average daily earnings, the employer took information for the past years 2021 and 2021. Maria has received a stable salary for the last two years, which was equal to 33 thousand rubles. During her entire work experience, she was on sick leave only once and it lasted one calendar month. As a result, she was paid only 21 thousand rubles for sick leave.

If we calculate, based on the available information, what salary Maria earns per day, we get the following amount:

- SZ= (33000×23+21000):731-30=1112.70 rub.

That is, to the total salary for the 23 months that Maria had already worked, they added the benefit that she received when she was on sick leave, and divided everything into the days of both years (one high-income year was also taken into account), and in They took away the 30 days she spent on sick leave. The resulting amount is subsequently multiplied by as many days as Maria will be on maternity leave.

As it turned out, Maria will have only one child, the pregnancy is going well and no complications are expected.

Therefore, she is entitled to 140 days of vacation, from which we can calculate what the amount of her maternity benefit will be:

- DP=1112.70×140=155778 rub.

Filling out sick leave 2018

Filling out sick leave by a doctor in 2021

Correctly filling out a sick leave form is very important. First of all, this is important for the doctor who prescribes sick leave and for the accountant of the enterprise where the patient works. But it doesn’t hurt the employees themselves to see a sample of filling out sick leave so that they know what to pay attention to in order to avoid correcting mistakes.

How to fill out sick leave correctly in 2021

Basic rules for filling out sick leave in 2021:

- Filled out in Russian

- Printed capital letters

- Black ink

- Starting from the very first cell in the graph

- You cannot go beyond the boundaries of cells

- The sick leave form can be filled out with a gel pen (BUT NOT a BALLPOINT pen), or printed on a computer.

- Medical corrections when filling out a sick leave certificate are not allowed.

- The diagnosis or reason for sick leave is not indicated. Instead, a special code is entered, where: 01 – illness, 02 – worker injury, 03 – quarantine. This is done to maintain anonymity and inviolability of medical confidentiality.

Our users often write about errors when filling out sick leave sheets, so, the team of the medical portal 47 medportal . ru , strongly advises you to use these rules and check that sick leave is filled out correctly.

Filling out sick leave by an employer in 2021

It is important for any employer to understand that if he accepts sick leave filled out with medical errors, then the Social Insurance Fund has the right to refuse compensation to such an employer.

Here are a few basic rules for filling out sick leave for 2018:

- The name of the institution can be indicated either in full or in abbreviated form. That is, if the name of the institution does not fit into 29 cells, then you simply interrupt the name, but in no case go beyond the cells.

- The employer must fill out the “Start date” column if the employment contract was terminated or cancelled.

- You can find a sick leave calculator on the Social Insurance Fund website at the following link (https://portal.fss.ru/fss/sicklist/guest).

Child care and sick leave

All employees whose children are sick also have the right to purchase financial support. And the fact of who the employee is for the child—aunt, uncle, mother, grandmother—is not at all important. In principle, calculating sick leave for child care is no different from the usual calculation of benefits, but there is only one difference - the time of sick leave during which the employee will be paid benefits.

A few facts are worth highlighting here:

- If the child being cared for has not yet exceeded the age of 7 years, then the employee will be paid benefits for the entire period of sick leave, but it should not last more than 2 months for the entire year. It is acceptable to be on sick leave for 90 days, but only if the child has serious illnesses. If the child is treated at home, then the employee is paid 100% of the benefit only in the first 10 days, but on all subsequent days, the benefit will be only 50% of the due payment. If the child is treated in a hospital clinic, the benefit will be paid to the maximum and throughout the entire duration of treatment.

- If the child being cared for is between 7 and 15 years of age, the benefit is paid for 15 days at a time, but not more than 45 days for the entire year.

Insurance period for sick leave

What is the insurance period for sick leave in 2018 ? This is the period during which an employee of the enterprise was insured in the event of temporary disability caused by illness, injury, quarantine, etc.

The insurance period for sick leave in 2021 includes the following periods:

- When a person worked under an employment contract in an institution

- Periods of work in government positions

- Insurance experience obtained in other types of service (this could be an individual business, for example).

- Service in the army and law enforcement agencies is also included in the insurance period for sick leave for 2021.

See also: All necessary vaccinations for 2018

Payment procedure

The prescription of the Law “On Compulsory Social Insurance”, which has No. 255-F3, states that when caring for a child at home, the employee is entitled to the following benefits:

- Within 10 days, payment is made based on the employee’s length of service. At the same time, the total length of service is taken into account, and not the score earned with the current employer.

Taking into account the length of service, the amount of payments is:

- 100% payment - for over 8 years of experience;

- 80% payment - for less than 8 years of experience, but more than 5;

- 60% payment - for less than 5 years of experience;

- On all subsequent days, payment is made in the amount of 50%, based on the average salary.

IMPORTANT !!! If an employee’s child was treated in a hospital (with full hospitalization), then payment of benefits will be carried out based on the requirements of the law, and it does not matter at all how many days the sick leave lasted.

Example:

You can calculate sick leave taken to care for a child using the formula:

- SD=SM/KM*KN.

Let's decipher all the abbreviations: SD - average salary per day, SM - average salary per month, KM - how many days in a calendar month, KN - how many days the sick leave lasted.

Let's use the formula as an example:

Employee Ivan was on sick leave, necessary to take care of the child for 15 days. His experience totals 6 years, and the average salary is 20 thousand rubles.

It turns out that in the first 10 days of sick leave, Ivan will be paid a benefit in the amount of 6,666 rubles, and for the next 5 days he will receive 3,333 rubles. And if you count the entire sick leave, then Ivan will receive 9,999 rubles for it.

In what case may child care and previous sick leave not be paid?

An employee who goes on sick leave to care for a child may not always hope to receive appropriate benefits. So, for example, if the sick leave falls at the time when the employee went on his allotted vacation, then the benefit will not be paid. No payments are received from the Social Insurance Fund, since the law does not specify paying for such sick leave.

Also, sick leave for caring for a child who is over 15 years old will also not be paid if the employee is absent from work for more than 3 days.

Sick leave will not be paid to an employee who is caring for a child but is not a relative. So, for example, a child’s stepfather, who is not his official guardian according to documents, who applied to his employer to receive benefits, will not receive payments. And here the fact will not be taken into account whether he lives with the child or not, and how many years he has been replacing his father.

How is sick leave paid?

Many may think that sick leave for employees is paid by the employer, but this is only partially true. In fact, the scheme for calculating sick leave for 2021 is as follows:

- If the employee stays for more than 3 days , the sick leave is paid by the employer

- If an employee is sick for more than 3 days , sick leave is paid by the Social Insurance Fund, so don’t worry and don’t ruin yourself, but use sick leave as a small vacation.

Scheme for issuing sick leave