KKM check from the point of view of the law

A cash receipt is an accounting document obtained using cash register equipment. It is intended to confirm the fact of purchase and sale made when paying in cash. A check allows you to record the amount that passed through the cash register during the reporting period.

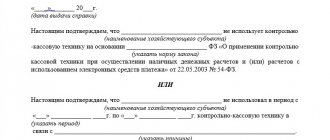

If such a document is not punched or there is no cash register, a violation of consumer rights occurs, for which liability is provided. Therefore, when conducting inspections, special attention is paid to checks.

What needs to be done to check

Use your smartphone to control your purchases:

- Install the Cash Receipt Checker app on your phone. You can verify a document without registering, but to scan you will have to create your own account. To do this, enter your phone number, wait for the code sent via SMS, and enter it. In doing so, you gain access.

- Log in to the program, select “Receive an extract” from the menu. Make sure all export documents are available. This is indicated by a green icon and the inscription “Receipt received”. If the phrase “Receipt is correct” is displayed, this means that the sample is correct. To receive it, you need to open and click “Get Receipt”.

What is a check for?

The check and all the information contained in it are necessary for maintaining accounting and tax reporting by individual entrepreneurs and legal entities. Also, with its help, ordinary consumers of goods and services can achieve justice in resolving conflict situations related to the protection of their interests.

In the work of organizations or individual entrepreneurs

When preparing an advance report, a specialist from the accounting department is required to indicate a unique check value and date . This category of reporting contains all the necessary information about funds allocated for:

- providing a responsible person during the business trip;

- purchase of inventory items for the company;

- acquisition of fuel resource.

All papers attached to the expense report must be readable and reflect exclusively real data on the costs of a legal entity or individual entrepreneur . All checks must be issued in the prescribed manner to avoid problems with the tax office.

General customers/service users

A check for ordinary citizens is, first of all, confirmation of the fact of a transaction, regardless of its characteristics: whether it is dinner in a restaurant, a purchase in a hypermarket, replenishing a balance or paying bills.

If there is a need to return the goods, it is this document that is needed to carry out the actions prescribed by the regulations. To do this, you will have to contact representatives of the retail outlet or the organization where the service was provided. You need to have your passport with you.

It is important to remember the key condition: replacing a product that meets the quality criteria is only permissible within two weeks from the date of its purchase.

It is not uncommon when a check may be needed when tracking postal items. If a parcel is lost, you can find it using its individual number. The receipt is also required as evidence when participating in legal proceedings.

Confirmation of the fact of making purchases, paying fines, alimony - all this will help avoid unjustified prosecution.

Electronic copies

Federal Law 54 requires that the cash register user must provide a receipt to the buyer on paper or electronically.

The first option is familiar to us, since we receive a report printed on tape, where all the necessary information is contained in a state storage device.

The second version – the software is installed and recorded in the memory of the storage device. Sent to the cell phone or E-mail of the buyer of the product. A check is issued:

- During purchase and sale through online stores.

- Before punching a paper check, the client asks to send it to his smartphone or email.

- If a person at one time refused to accept the receipt, and then he needed it for reporting.

It is important to know that if you requested an electronic form, and the cash register is not equipped with such a function, the seller is obliged to provide it to you in any case. To do this, he contacts the accounting department, where a specialist uses his computer to log into his personal account on the OFD platform. Next, it will download it and send it to you by email. If the company fails to provide such a service, it faces a huge fine. For legal entities this is an amount from 20,000 to 40,000 rubles. An individual entrepreneur will pay a penalty in the amount of a quarter or half of the cost of the price of the goods being sold.

How are fiscal data deciphered in a check?

The meaning of most details is intuitive to the buyer, but the part related to fiscal data requires explanation. Let's take a closer look at some of the details of a cash receipt and their meaning.

Let us recall that fiscal data, according to Federal Law-54, is information about the payments of the seller and the buyer, stored in the fiscal memory and transmitted via online cash register to the Federal Tax Service, as well as information about the cash register equipment servicing these calculations:

- RN KKT - registration number of cash register equipment. It is assigned upon registration with the Federal Tax Service.

- ZN KKT - serial number of cash register equipment. This detail is entered at the equipment setup stage.

- FN No. - number of the fiscal drive (factory). It is entered into the settings before the cash register starts operating. Displayed automatically.

- FD No. - number of the fiscal receipt in order. It is assigned by the cash register automatically.

- FP, FPD - a fiscal sign of a document. It is affixed on the basis of the registration data of the trading organization in the Federal Tax Service: TIN, registration date, reg. CCP number, serial number of CCP; TIN OFD (fiscal data operator), in addition - the serial number of the FD.

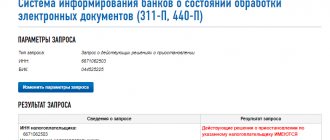

- OFD website address, website address for checking the FPD, website address of the Federal Tax Service. At this address, the legality of the trade transaction is checked, which is recorded through the fiscal data operator, i.e. the check is checked. As a rule, the website of the tax service is indicated here.

- QR is a two-dimensional code. Designed to verify encoded check details, quickly read by image processing devices configured accordingly. The Federal Tax Service has developed a special program that works with a QR code.

We suggest you familiarize yourself with How to see whether a person has been convicted or not.

For an electronic check, the following are required:

- FDF version number - there are currently two versions of the fiscal data format in use: 1.05 and 1.1.

- FFD code is the code of the fiscal document form. For a check this is number 3, for a corrective cash receipt it is 31.

All fiscal documents (cash receipt, shift opening report, etc.) are created at the cash register according to a specific format - the fiscal data format (FFD). Today, there are two approved formats: 1.05 and 1.1 (until 2021, format 1.0 was also used). The higher the format, the more opportunities there are to indicate various calculation options on cash receipts. For example, starting from FFD 1.05, sales on credit, advance offset, agency fees, etc. can be reflected in receipts.

To generate a cash receipt in a certain format, it is necessary that this format is supported by the cash register itself, the fiscal drive (FN), and the cash register software (software).

Where to look for the check number on a cash register receipt

A check issued in accordance with legal regulations contains the following data:

- name of company;

- taxpayer identification number;

- designation of a cash register assigned during the production process;

- ordinal combination (the need to clarify this number is determined by Decree of the Government of the Russian Federation No. 745);

- date of transaction with clarification of time parameters;

- transaction cost.

In addition to the positions already provided in accordance with articles of Federal Law No. 54, new ones have been added:

- the taxation system used;

- contact information of the organization: telephone number or email address;

- sign and form of calculation;

- VAT for each product/service;

- QR code that can be used to verify the authenticity of a document.

Organizations using the simplified tax system are exempt from VAT, so it is not necessary to reflect these values in their checks.

There is no generally accepted sample of a payment receipt: in each individual company or individual entrepreneur it is formed taking into account the preferences of the organization itself. However, in any case, it is necessary to reflect in the document all the information required by law.

Features of creating a check form depend on a number of factors:

- year of production of the KKM;

- a plant acting as an equipment manufacturer;

- model of equipment;

- company policy, its field of activity.

It is not uncommon for a number to be quite difficult to find. To get an answer, you can contact the institution staff. But if this is not possible, then you can find the information yourself:

- It is worth looking for the following positions in the content: transaction number, check, transaction or symbols No. and #.

- In most cases, the numbers are indicated next to the date of the transaction or a row higher, directly with the cashier’s personal information.

- It is important not to confuse the receipt number with the machine code. It’s easy to distinguish them: the second position is always preceded by the abbreviation “KKM”.

- An airplane or train ticket is itself a payment document. In this situation, the ticket number is the check number. With its help you can find out all the information about your upcoming trip.

- Obtaining information from the electronic version is somewhat complicated, since the number changes its location. In this case, it is located next to the holder’s passport details and request ID.

The presence of all the necessary information in a cash receipt gives it legal force, which allows you to use the document to confirm the fact of transactions. Therefore, if organizations fail to comply with the prescribed standards, the validity of the receipt may be challenged. As a result, new problems arise with defending one’s position.

The check and all the information contained in it are necessary for maintaining accounting and tax reporting by individual entrepreneurs and legal entities. Also, with its help, ordinary consumers of goods and services can achieve justice in resolving conflict situations related to the protection of their interests.

When preparing an advance report, a specialist from the accounting department is required to indicate a unique check value and date. This category of reporting contains all the necessary information about funds allocated for:

- providing a responsible person during the business trip;

- purchase of inventory items for the company;

- acquisition of fuel resource.

All papers attached to the expense report must be readable and reflect exclusively real data on the costs of a legal entity or individual entrepreneur. All checks must be issued in the prescribed manner to avoid problems with the tax office.

A check for ordinary citizens is, first of all, confirmation of the fact of a transaction, regardless of its characteristics: whether it is dinner in a restaurant, a purchase in a hypermarket, replenishing a balance or paying bills.

If there is a need to return the goods, it is this document that is needed to carry out the actions prescribed by the regulations. To do this, you will have to contact representatives of the retail outlet or the organization where the service was provided. You need to have your passport with you.

It is important to remember the key condition: replacing a product that meets the quality criteria is only permissible within two weeks from the date of its purchase.

It is not uncommon when a check may be needed when tracking postal items. If a parcel is lost, you can find it using its individual number. The receipt is also required as evidence when participating in legal proceedings.

Confirmation of the fact of making purchases, paying fines, alimony - all this will help avoid unjustified prosecution.

You can perform the replacement procedure without a receipt - using its unique number. All information about completed operations is stored in the cash register database, so difficulties with returns are almost completely eliminated.

According to the Law of the Russian Federation “On the Protection of Consumer Rights,” no legal entity can refuse to provide a client with a new payment receipt if it has been lost. Therefore, if the request is not satisfied, you can exercise the right to contact law enforcement agencies.

We invite you to read: Placement in a psychiatric hospital by court decision

During the conversation, you will need to notify the specialist about the nuances of payment. So, be sure to indicate the amount and product - this will speed up the search process. After receiving the document details, to prepare it in paper form, you need to contact the branch of the company responsible for servicing a specific terminal (usually banks).

Cash registers with built-in receipt printer for rent:

MTS Cash register 5” Ready for labeling

Best price

Hit

- Battery: 3.7V/5200 mAh

- Brand: MTS Kassa

- In standby mode, the cash register works: up to 30 days

- Weight: 500 g

900 rub.

Buy in 1 click Read more

MTS Cash register 7” Ready for labeling

- Battery: 7.4V/2500 mAh

- Brand: MTS Kassa

- Weight: 765 g

- Warranty: 12 months

900 rub.

Buy in 1 click Read more

MTS Cash register 12” Ready for labeling

- Brand: MTS Kassa

- Weight: 2.1 kg

- Interfaces: Wi-Fi, Bluetooth, 3G (optional), RS232C, USB (Type-A), LAN, RJ12 (cash drawer)

- Number of characters per line: 48 characters

900 rub.

Buy in 1 click Read more

MTS Cash desk 5” + acquiring Ready for labeling

- Battery: 3.7V/5000 mAh

- Brand: MTS Kassa

- Weight: 600 gr

- Built-in photo scanner: 1D/2D

900 rub.

Buy in 1 click Read more

Any cash transaction must be accompanied by the issuance of a cash register receipt.

This document is important for both sellers and buyers, and most often the question arises: where can I look for the check number? For consumers, this information may be needed when returning goods or in the event of a legal dispute.

For sellers, the absence of a number on a receipt can result in liability under Article 14.5 of the Code of Administrative Offenses of the Russian Federation and considerable fines (up to 10,000 rubles).

Where can I find the cash receipt number (document number for the shift)?

Starting in 2021, due to the introduction of online cash registers, new details have appeared on the cash register receipt, and the form of the receipt itself has become much more convenient.

However, the cash register receipt number can still help both in a legal dispute and in resolving a conflict with inspectors. The cash receipt reflects numerous data from which almost everything can be said about the transaction.

The cash receipt number (document number for the shift) is located under the address of the corresponding outlet.

Since from July 1, 2018, most retail outlets are required to use online cash register systems, which must be able to generate “electronic” checks and send them online to the tax authorities, additional details have become mandatory. Now the check is drawn up in two formats at once - traditional and electronic, but both must contain the same data.

The main innovation on the cash register receipt is the QR code. Having scanned it, a conscious consumer armed with a smartphone can instantly determine whether the seller is breaking the law by supplying tax authorities with incorrect, fake data on cash payments.

The new procedure for using cash registers will allow consumers of goods and services to be involved in civil control by checking the legality of a cash register receipt. - Ministry of Finance of Russia.

Moreover, an electronic check is a full-fledged alternative to a paper one. The smartphone screen displays all information about the purchase, down to the shift number and even the seller’s tax regime. If the buyer needs to receive an electronic version of the cash register receipt, then the seller should be informed about this. Then a note about this will appear on the receipt.

Businessmen should also remember that the cash receipt will have to indicate all product items purchased under this transaction, with a clear link to all-Russian classifiers (OKPD 2, OK 034-2014).

For some taxpayers (individual entrepreneurs on PSN, UTII and simplified tax system), this will become mandatory only from February 1, 2021, unless they sell alcohol and other excisable goods.

Both will have to study product positions.

There are a lot of details on a cash receipt, and the number is only one of them. But it’s cheaper to set up the display of all positions once than to pay administrative fines every time.

What is a QR code

This Quick Response coding was originally created for the automotive industry in Japan. Represents a trademark for two-dimensional or matrix strokes. The optical mark on the product shows all the information and is read by the machine. For productive data storage, four special modes are used, such as: digital, alphabetic, paired and kaji.

The advantages of the QR code compared to the standard UPC have made it possible to go beyond the automotive industry and gain popularity in other areas of the national economy. New extensions have been added to the fast reading capabilities, helping:

- track products;

- identify objects;

- view a specific time;

- manage documentation;

- organize general marketing (production and sales of products based on the study of the economic market).

The device is very easy to use. It consists of dark-colored squares that are concentrated on a mesh surface of a white background. Using photography equipment such as a camera, these squares are read and processed using non-binary Reed Solomon cyclic codes. Their main task is to scan and recognize the image. Next, data is extracted from the pattern. Such features of the device help in the work of trade, in the logistics field and in all industries.

Functions of cash receipts

In addition to the information and fiscal burden placed on the form, another purpose of the paper medium for trading transactions is known. A check can be an excellent advertising tool. Reputable business structures in the form of large supermarkets are especially successful in this. The receipt often contains information about promotions, seasonal discounts and sales.

This practice does not contradict the requirements of the tax office if all the required information about the sale and purchase is present in the document. Often the consumer himself needs to prove certain expenses. For example, many organizations will not accept an expense report without a receipt. Unfortunately, sometimes you have to prove your case through court, during which an inconspicuous but very important cash document can again come in handy.

The majority of customers believe that it is impossible to return a purchase without a receipt. But legislation in the field of consumer protection is on the side of the latter. The product can be returned even if the buyer does not have a receipt. The only condition is the need to provide strong evidence that the subject of the dispute was purchased from this trading company. It's even better when there are witnesses. Thus, the loss of a fiscal form does not lead to the loss of the opportunity to return a low-quality product.

Penalties

Those who are obliged to print checks face a fine if they do not have the nomenclature:

- from 1500 to 3000 rub. for officials;

- from 5000 to 10000 rub. for organizations.

A fiscal document without nomenclature is essentially invalid, so the transaction is considered terminated.

Thus, in addition to problems with the Tax Inspectorate, a conflict situation arises with the buyer, which will have to be resolved.

Responsibility for violations in the work with control equipment

An important property when deciphering a check as a necessary fiscal document is the fact that it has been punched. If the form is not registered, the businessman violates the rights of the buyer, as well as his obligations to comply with payment discipline. The law provides for the imposition of a fine on an unscrupulous entrepreneur. Its amount ranges from 3 thousand to 4 thousand rubles. A document that, when decrypted by the cash register, has not been registered and does not comply with the rules established by law, is also equivalent to a blank check.

Every merchant should understand that falsifying cash forms is a violation of the law and entails administrative and even criminal liability. Modern technology can determine the authenticity of a document when decoding. Cash registers allow you to issue copies because they are equipped with a storage device. A duplicate check has the same value as the original.

Only a trained salesperson who knows how to read a receipt and also knows what to do in certain cases can be involved in performing duties at the cash register. Any breach of the form is recorded by the cash register system and becomes the basis for recording the amount at the cash desk, which is the taxable base. Control systems have now become a common subject in business environments.

In addition to fiscal functions, they allow you to determine the success of the sale of goods by different groups, determine the time most visited by customers and, based on this, formulate a business strategy.

“Where can I look for the check number?”

is a common question among buyers who have made a purchase. Information about the check number is also necessary for individual entrepreneurs (legal entities) to maintain accounting records. The check number is a mandatory detail; without a number, the check may be considered invalid.

Sources:

- https://buhguru.com/buhgalteria/kassa/nomer-cheka.html

- https://ZnayDelo.ru/biznes/registraciya/nomer-cheka.html

- https://sobercar.ru/posmotret-nomer-cheka-cheke/

- https://alians-uk.ru/decoding-of-the-cashiers-check-where-is-the-check-number-in-the-cash-receipt.html