It is no secret that one of the central arguments when switching to electronic documents is convenient and fast work with the Federal Tax Service. But interaction with the tax office is not limited to the submission of documents: there are on-site inspections, consultations, and much more. Synerdocs specialists and I have encountered many situations where, without a call or an official letter to the regional tax office, it was impossible to resolve even the simplest issue with the format of a document or its medium. As a result, we have accumulated quite a lot of interesting letters and responses (check out our correspondence with the Federal Tax Service on the website) and, finally, we have begun to understand how deeply the transition to electronic documents is changing the approach to work of users and Federal Tax Service specialists.

We prepare documents

If you received a request electronically and want to send documents via TKS, you need to accept it and send an acceptance receipt. It will be loaded into the IFTS system and will serve as a notification that the request has been received. Check out the list of required documents. Some of them may have been compiled on paper - they will need to be scanned, some - in electronic form. In the latter case, pay attention to the format in which the documents were compiled. If in xml formats approved by the Federal Tax Service, then they can be attached to the inventory immediately. Otherwise, the documents will have to be printed, certified and scanned again, or converted into the required tif or jpg formats using appropriate software. Please note that, according to the inventory format, a limited list of documents can currently be submitted using the TKS, which is indicated in the Appendix to the Order of the Federal Tax Service of Russia dated June 29, 2012 No. ММВ-7-6/ [ email protected] All other documents will have to be sent by mail.

If the request was initially sent on paper, then it will not be possible to submit documents under the TKS due to the impossibility of creating an inventory of documents. The fact is that the xml format of the inventory presupposes the presence of a so-called identifier of the document file for which the inventory is generated (i.e., requirements). This identifier is not on the paper request, and without it the inventory will not be loaded into the inspection system.

Form your answer

In the request, go to the "Reply" tab and select:

- “Upload documents” - to send the requested documents electronically.

- “I’ll send everything on paper!” - if the documents are sent by registered mail.

- “Write a letter” - if it is impossible to submit documents on time and you want to extend it.

Attention!

In response to a request, you cannot send only a letter, otherwise the Federal Tax Service may impose a fine. The answer must be formalized.

We create an inventory

Next, you need to create an inventory, collect and attach all documents to it. This can be done either independently (for example, in an accounting system) or in the tax reporting system in which the request was received. It is more convenient to work in the reporting system in the sense that all inventory details related to the requirement, signature and number of documents sent will be filled in automatically. These are the details on which it depends whether the package of documents will be loaded into the inspection acceptance complex. In this case, it will be possible to send the package immediately without unloading and searching for ways to send it via TKS.

Let us give an example of the procedure for preparing and submitting documents in the Kontur-Extern tax reporting system. To fill out the inventory details, you need to indicate the document form code for the KND (1165034) and the identity of the person who signed the document - the head of the organization (3) or its representative (4).

Complete the requirement

Multiple submissions can be sent per request. Therefore, even after receiving a receipt, the document will remain in the “Requirements” section.

If you have submitted all documents and no longer plan to work on the claim, click Mark Complete. The document status will change to .

The requirement has been completed.

Attaching documents

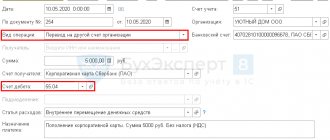

All that remains is to attach the documents. Documents in the form of xml files can be downloaded from the EDI system or from an electronic archive. From the details you will need to indicate the code or name of the document, the code of the document form according to the KND and the serial number in the request. To attach scanned images of paper (or electronic in any format) documents, you will have to fill in more data: which data depends on the type of document. For invoices, this includes, for example, the date and document number, details of the parties to the transaction, the amount including VAT and VAT.

After all the documents are attached to the inventory, the package of documents must be signed with an electronic signature certificate of the system user and sent to the tax office. If the package was compiled correctly, then it will be loaded through the GPR acceptance complex and will end up in the EDI of the Federal Tax Service, where the documents will already be reviewed by an inspector. Otherwise, the user in the system will receive a notification of refusal with a list of rejected documents. They will need to be corrected, attached to the inventory and sent again to the tax office.

Submission of electronic documents during an on-site tax audit

It’s worth noting right away that today there are no special regulations that regulate the procedure for conducting on-site tax audits (ATI) in organizations with electronic document management. Therefore, taxpayers should focus on legal acts that are used for paper document flow. According to the letter of the Federal Tax Service dated July 25, 2013 No. AS-4-2/ [email protected] “On recommendations for conducting on-site tax audits,” document verification involves:

- visual examination of the document to ensure that all necessary details are present;

- assessment of the correctness of calculations and all total indicators in primary documents, accounting registers and reporting forms;

- legal verification of documents for compliance with legal norms;

- checking the accuracy of the information provided about business transactions performed.

If the organization has electronic or mixed document flow, then the tax inspector must be provided with software and hardware to conduct the tax audit procedure.

What does it mean? During the VNP, the taxpayer should provide the inspector with a computer on which, first of all, document viewing tools should be installed. To view informal documents in .DOC(X), .XLS, .PDF, .JPG, .TIFF formats, quite familiar and common programs are used. But, for example, electronic invoices are in .XML format, how can I view them?

The taxpayer can show documents directly in the information or accounting system with which he directly works.

Another option is to save the XML document in .PDF format, but this does not allow you to verify the electronic signature. In this case, you can provide an XML file with an electronic signature and directly in PDF. This will allow you to check the electronic signature, the compliance of the document with the Federal Tax Service formats, the presence of the necessary details and the correctness of the calculations. And finally, you can show the documents in the EDF operator’s system. But the first and last options are fraught with the fact that the inspector may gain access to other documents.

In addition, a cryptographic information protection tool (CIPF) and a tool for viewing electronic signature information must be installed on the computer or laptop provided to the inspector. This may be specialized software, a taxpayer information or accounting system, or an EDF operator system, including a web client.

Case Study

Interdistrict Inspectorate of the Federal Tax Service of the Rostov Region No. 6152, through the system of the special operator SKB Kontur, sent an electronic request to the taxpayer to submit invoices that were issued on paper. At the same time, the inspection expressed a desire to receive these documents in the form of scanned images via the Internet. The taxpayer scanned the documents, created an inventory in the special operator’s system and sent the entire package to the inspectorate. The package was successfully loaded into the electronic data exchange system of the Federal Tax Service, after which the documents were checked by the inspector and entered into the inspection database.

“The technology for submitting documents in electronic form has been working in all INFS of Russia since November 2012,” says Tamara Mokeeva. “Tax inspectors are increasingly taking the initiative to accept documents via the Internet, both electronic and paper.”

“When submitting documents on paper, copies of documents are certified. In this case, a copy of each document must be certified, and not the firmware of these documents. Electronic documents are objectively easier to process and store, and automated recording of requirements fulfillment reduces the risk of missing submission deadlines. Shipping costs are reduced. The Federal Tax Service is considering expanding the list of documents that can be submitted under the TKS. The active participation of taxpayers in EDI will speed up this area of work,” says Tatyana Vasilenko, head of the department for working with taxpayers of the interdistrict Federal Tax Service No. 6152.

What free electronic services are there for interacting with tax authorities?

Among the services for sending electronic documents to the tax office are:

Tax officials provide many other free services to taxpayers. They do not allow you to interact with tax authorities on the exchange of electronic documents, but they help solve other important practical tasks (for example, “Check yourself and your counterparty,” “Online appointment for an inspection,” “Find out about a complaint” and others).

Prepare documents regarding the change of individual entrepreneur data

Important!

From November 25, 2020, the application form P24001 for registering changes in information about individual entrepreneurs in the Unified State Register of Individual Entrepreneurs and the requirements for its completion have changed. If you prepare an application using the old form, the tax office will not accept it. Our free service will help you prepare documents according to the new sample.

Application form P24001 for changing information about individual entrepreneurs

Application form P24001 - Create an application

- Generate an application automatically Enter your data in the form, download the already completed application P24001 and all other documents to make changes to the information about the individual entrepreneur in the Unified State Register of Individual Entrepreneurs. Create an application

- XLS, 384 KB

- PDF, 1.2 MB

An application for changes to information about an individual entrepreneur in form P24001 must be submitted to the inspectorate, regardless of the nature of the changes. Prepare an application and sign it in the presence of a competent employee (inspectorate, MFC, notary office). Do not staple or stitch the application.

If you need original documents about making changes to the individual entrepreneur in the Unified State Register of Individual Entrepreneurs, please mark this on the last page of the application.

Unified State Register of Legal Entities: general information

The Unified State Register of Legal Entities (USRLE) is a database containing information about all companies operating in Russia.

Information about individuals is not included in it, but it is quite possible to find the details of non-profit organizations or peasant farms. In accordance with paragraph 1 of Art. 5 of the Federal Law “On State Registration...” dated 08.08.2001 No. 129, information about the company stored in the register includes:

- its name;

- date of state registration;

- location address;

- reorganization and liquidation procedures carried out in relation to the enterprise;

- changes made to the company’s constituent documents and other sources of information;

- data of founders and managers;

- types of economic activities carried out by the enterprise;

- in the event that a company is undergoing bankruptcy proceedings, the stage at which it is located.

During its operation, an enterprise can correct information previously entered into the register. For example, the company may change its director or one of its participants may decide to sell its share to a third party. Such changes must be promptly registered with the tax office, since the relevance of the information contained in the register is important not only for government agencies, but also for counterparties working with the enterprise.

There is no need to pay the fee again

Previously, if the tax office made a decision to refuse registration, then, regardless of the reason for the refusal, re-submission of documents required re-payment of the state fee.

But from October 1, 2021, if registration is refused due to an error, those wishing to register their business have another chance. Within three months from the date of the decision to refuse, you can resubmit the documents without paying the state fee again. Moreover, documents that were previously submitted to the tax authority and did not contain errors do not need to be submitted again. It is necessary to submit only those documents in which an error was made or missing documents. The right to make adjustments to an already submitted package of documents is granted only once. The second time you will not be able to avoid paying the state duty again.

Receive documents on amendments to the Unified State Register of Individual Entrepreneurs

Within 5 days after receiving the application, the Federal Tax Service must consider your application. Based on the results of the review, either changes are made to the Unified State Register of Individual Entrepreneurs (and then you receive a Unified State Register of Individual Entrepreneurs with new data), or the inspectorate issues you a written reasoned refusal to state registration of changes.

Regardless of the method of submitting documents, the result of consideration of your application should be sent to the email specified in application P24001. If you want to receive documents on changes in paper form, make a note about this on the last page of form No. P24001.

You can track the progress of your application until you receive the result in a special section of the Federal Tax Service online service.

Grounds for applying to the Federal Tax Service

The reasons for applying for individuals and legal entities are different.

Individuals often contact the Federal Tax Service on the following issues:

- Receipt of paper confirming the absence of debts.

- Opening your own business.

- Obtaining information about existing bank accounts.

- Obtaining an individual taxpayer number.

- Resolving issues related to citizenship.

- Filing a complaint.

- Request for personal income tax certificate 2 and registration of tax deduction.

Legal entities receive the following services:

- Approval of the procedure for submitting reports.

- Legal registration faces.

- Filing a complaint.

- Taxation of foreign organizations.

These are not all the services provided by the tax office.

Possible problems

If a citizen wants to register with the tax office online through State Services, then difficulties may arise only when creating his own account. This is due to the fact that in addition to providing personal data, you must confirm your account. This can be done in several ways:

- Using an electronic digital signature.

- Send a letter by Russian Post.

- Use online banking.

- Contact the MFC.

Some people do not have the opportunity to quickly use the above methods, although they need to register with the tax office online now.

A citizen may be refused registration. This occurs in cases where an error was made when specifying the required information or the user entered false information. The solution to the problem is to re-submit the application, indicating reliable data.