Procedure for withholding accountable money

Funds that are issued to the employee as accountable funds are withheld from the salary in case of non-return by the employee. To do this, an order is issued to withhold accountable funds in free form. Such an order must be issued within a certain period, namely, no later than one month from the end date of the period that was set for the employee to report. These funds can only be recovered if the employee does not dispute either their amount or the basis. In this regard, it is necessary to obtain the written consent of the employee, in which he confirms that he is not against deductions. If there is no such consent, funds can only be recovered through the court (137 Labor Code of the Russian Federation).

Important! The amount of deductions from an employee’s monthly salary should not exceed 20%.

Supporting documents must be attached to the costs.

If the employee still has a debt, then the organization’s main counterargument is the ability to collect it. But if a company has already accepted an unconfirmed advance report from an employee and written off his debt, it should operate with the reality of costs. For example, the results of work, services or purchased goods. If the company paid the debt to the counterparty through an accountant, it is necessary to present acts of reconciliation with this counterparty.

In one of the legal proceedings, the organization accepted goods without documents for accounting. The employees attached to the advance reports acts of the working commission, certificates and reports, as well as orders from the director of the company for each of the accountable persons. The company considered that the individual accounted for the money. But the tax authorities did not agree with this, included these amounts in the income of employees and imposed contributions on it. The court sided with the company. He pointed out that the tax authorities did not provide evidence that the society received materials, goods, works and services free of charge. Consequently, the company paid for them, and the accountable money cannot be considered income of individuals (Resolution of the Autonomous District of the Ural District dated November 11, 2015 No. F09-7999/15). However, so far this is only one case in favor of the company, so it is not a fact that the tax authorities will also lose next time.

Deadline for return of accountable money

The legislation does not establish a deadline for issuing accountable funds; the employer must do this independently. This period is indicated in the employee’s application for the release of money for reporting. No later than three days after the established deadline, the employee must account for the funds received. If we are talking about money given to an employee on a business trip, then the report must be submitted within three days from the date of return from the business trip (Government Decree No. 749 of October 13, 2008).

If, when issuing accountable money, no deadline was set for providing an advance report, then the employee is obliged to provide it on the day the money is issued. However, it is better to ensure that such situations do not arise and there are no claims from the inspection authorities, to set a deadline for the report or return of funds.

Important! The size of the report and the period for which it is issued is determined by the employer. The employee must report on the funds issued no later than 3 days from the end of this period.

If an employee does not return unspent funds on time, this is a violation of cash discipline. But there is no liability for such a violation.

How to reflect an unreturned report in accounting

The accountant must return the unspent money within the period for which it was issued to him. If he did not do this, he will have to recognize them as unreturned.

Such means include:

- money for which an advance report has not been submitted or has been submitted but not reasonably accepted by the manager;

- the balance of funds has not been deposited at the cash desk, despite the fact that the advance report has been submitted.

We reflect these amounts in accounting based on the accounting certificate by posting Dt 94 Kt 71 .

Useful information from ConsultantPlus

So that the inspectors have no doubt that the money was taken on account and not misappropriated by the employee, we recommend establishing rules in the organization with clear deadlines for submitting a report on the amounts spent. Moreover, such reports must be accompanied by supporting primary documents (read more...).

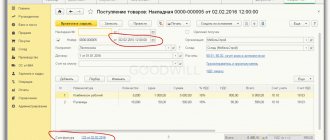

Hold example

To the accountant of LLC "Continent" Petrova O.P. On February 1, 2021, an advance payment of 4,000 rubles was issued for the purchase of stationery for the accounting department for a period of 25 days. Petrova purchased stationery for only 2,500 rubles, for which she compiled an advance report, to which she attached supporting documents: a cash receipt and a sales receipt. Petrova did not return the remaining amount of accountable money - 1,500 rubles (4,000 - 2,500) on time, but wrote an application to recover this amount from her wages for February 2018.

Petrova’s salary for February is 35,000 rubles. The employee does not have children, so she is not required to provide a personal income tax deduction.

The maximum amount of deductions from wages per month is 20%:

35,000 x 20% = 7,000 rubles.

The amount that needs to be withheld from Petrova is less than 20% of the salary, so we can withhold it in full.

The postings will be as follows:

| Business transaction | D | TO | Amount, rubles |

| Funds issued for reporting are reflected as a shortage | 94 | 71 | 1 500,00 |

| Petrova's salary was accrued | 44 | 70 | 35 000,00 |

| Personal income tax was withheld from Petrova’s salary (35,000 x 13%) | 70 | 68 | 4 550,00 |

| An accountable amount was withheld from Petrova | 70 | 94 | 1 500,00 |

| Petrova's salary was transferred | 70 | 51 | 28 950,00 |

Errors in advance reports may result in additional charges

In one of the cases, the court found that the tax authorities were right, since the primary documents that the company attached to the expense report did not contain the position, surname, first name and patronymic of the person who signed them. The sales receipts did not contain the names of the goods, but only general phrases: “household expenses” or “office supplies.” There were also no dates for drawing up the documents, the columns “quantity” and “price of goods” were not filled in, there was no seller’s signature. In this case, the accountable amounts can be considered the employee’s income. This is what the Supreme Court of the Russian Federation considered in its ruling dated 03/09/16 No. 302-KG16-450. The AC of the North Caucasus District came to the same conclusion in its resolution dated May 23, 2016 No. F08-2743/2016.

In another case, the director of the company received 4.7 million rubles on account, and confirmed the expenses with contracts with individuals. They were interrogated, it turned out that the individuals had never sold materials to the company and did not receive any money from it other than salaries. In addition, the goods that were specified in the sales contracts were neither written off nor leftover materials. The court sided with the tax authorities and supported additional assessments (resolution of the Federal Antimonopoly Service of the East Siberian District dated January 24, 2014 No. A19-2278/2013).

Another example is that employees attached checks from organizations that did not have registered cash registers to the advance report. As a result, controllers included the accountable money in the income of individuals. The court supported them (resolution of the Administrative Court of the North Caucasus District dated July 7, 2015 No. F08-3967/2015).

When can you write off accountable amounts?

Accountable amounts can only be written off due to the expiration of the statute of limitations (ST). To do this, use the following procedure:

- Set the date from which the ID period is counted. It begins to be maintained from the day that follows the deadline for returning the report (191 of the Civil Code of the Russian Federation). For example, the employee had to return the unspent account by February 10; accordingly, from February 11 I begin counting the ID period. ;

- 3 years are counted from the beginning of the ID period. The term of ID is 3 years (196 Civil Code of the Russian Federation). The deadline for this particular case is not established by law, so the deadline for the ID is accepted. But it is necessary to take into account such circumstances that may cause the interruption of the ID. In this case, the ID countdown begins again.

Cash payments

Russian civil legislation does not limit the circulation of money. Any organization or individual has the opportunity to use funds for their needs. The only condition is the legality of such use. The right to spend money does not depend on its form. These regulations are provided for in Chapter 6 of the Civil Code of Russia.

The Central Bank of Russia, in paragraph 1 of its Directives dated October 7, 2013 No. 3073-U, directly noted that cash payments are made without restrictions between citizens who are not individual entrepreneurs. In the case of settlements between companies or entrepreneurs, some features established by the Bank of Russia should be taken into account.

Domestic companies and entrepreneurs do not have the right to spend cash from the cash register. Exceptions that allow the use of cash are directly listed in clause 2 of the Directive of the Central Bank of Russia dated October 7, 2013 No. 3073-U. Acceptable cases of spending such amounts include:

Companies and entrepreneurs cannot use cash for other purposes.

All cash transactions, the parties to which are enterprises and individual entrepreneurs, must be made taking into account the maximum allowable amounts. The Central Bank of Russia has established that the cash payment limit for one transaction cannot exceed 100,000 rubles.

If a participant in cash transactions is a citizen who is not registered as an individual entrepreneur, then the maximum payment amount is not taken into account. The limit does not apply in the case of the issuance of money in 2021 against a report from the cash register or payment of wages. This rule is enshrined in paragraphs 5 and 6 of the Directives of the Central Bank of the Russian Federation dated 10/07/2013 No. 3073-U.

What to do if the director does not account for the accountable money

Until recently, it was believed that it was necessary to withhold personal income tax on unreturned accountable amounts. But nowadays things are different. If the employee does not report, then the money cannot be recognized as his property; this debt will remain with him. It is necessary to withhold personal income tax and calculate insurance premiums only if the employee’s debt is forgiven. In this case, the employee receives income, and the company receives a loss. Therefore, with any employee, even with

director, it is worth agreeing to provide a report on advances issued. But if the company does not write off the debt and does not withhold it from the employee, then it can only be written off after the expiration of the ID period, which is 3 years (

It is better to issue money for a long term. It's safer

The company has the right to set a separate deadline for each accountable amount. This needs to be fixed in an order or memo. You can prescribe a single reporting deadline for everyone or fix different deadlines depending on the level of the position or the purpose of the money. For example, an accountant has three months to buy rare parts and report on these expenses. The deadline for the report on the purchase of household needs is three working days.

However, the above orders must be created in advance. In one of the cases, the company set a period of 24 months for reporting on funds. But she lost the trial because she presented an order for such a long term during the trial. During the audit of the company, the tax authorities did not see him. The judges considered the company’s actions to be an evasion of additional charges, and therefore did not take the order into account (resolution of the Third AAS dated September 28, 2015 No. 03AP-4126/2015).

Cash limit

The Central Bank of the Russian Federation issued Instructions dated March 11, 2014 No. 3210-U, which approved the procedure for conducting cash transactions. This document is mandatory for companies that use cash in their activities.

From the content of these instructions of the Central Bank it follows that the cash in the company’s cash desk at the end of the day cannot exceed the limit. This indicator is developed and established by the enterprise independently. The limit is calculated using the formulas attached to Instructions dated March 11, 2014 No. 3210-U, and taking into account the actual performance of the company.

All cash in excess of the limit must be deposited at the bank. This requirement is mandatory. Its violation may be grounds for imposing an administrative fine on the company.

It is important to note that entrepreneurs are exempt from the obligation to set a limit.

What liability does an employee with arrears face in the case of accountable funds?

The practice of tax inspectors often tells us that if you have given accountable funds to an employee who has a debt, the following measures may be applied to you:

- Calculation of income tax (NDFL) and insurance premiums.

- Funds issued also remain accountable and must be returned in good faith.

- Recording violations of cash transactions with a fine of up to 5,000 rubles for officials and up to 50,000 for legal entities.

Free consultation

8 800 511-39-66Ask a question

Registration of cash transactions

To carry out cash transactions, companies must organize a cash desk and appoint responsible employees. It is these employees who are responsible for the correct management of the cash register and registration of cash transactions.

When conducting cash transactions, companies are required to prepare cash documents. Such documents are an incoming cash order and an outgoing cash order. The forms of these forms are approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88. The Ministry of Finance of Russia in Information No. PZ-10/2012 emphasized that the PKO and RKO forms are mandatory for use.

When registering cash flow through the cash register, you should remember that the cash flow order is used when issuing money. A cash receipt order is used when funds are received.

Cash documents are signed by the cashier and the accounting employee, and are also recorded in the register of cash documents.

It should be remembered that cash documents must be drawn up without errors. If orders are issued in paper form, then corrections or additions cannot be made to their content. To eliminate errors, you should reprint the corresponding document and make the necessary entries in it.

Expenditure cash order forms are used when issuing wages, cash for reporting, and other cases of registering the expenditure of cash.

A prerequisite for the correct execution of cash transactions is maintaining a cash book. The form of such a document is approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88.

All cash transactions must be recorded in the cash book maintained by the cashier. Complete information is entered into form No. KO-4 in accordance with the receipt and expenditure orders. Any discrepancies are unacceptable.

At the end of the working day, the cash balance is indicated in the cash book, which is certified by the cashier’s handwritten signature.

It must be emphasized that all of the above forms should be used by companies in the case of transactions with monetary documents. A prerequisite for registration of such a movement is the affixing of the o.