If the tax burden and the share of VAT deductions do not correspond to the established norm, this will attract increased attention from tax authorities. First, they will send a demand to explain the low performance. If the request is ignored, the controllers will fine the company 5 thousand rubles. Next, the company will begin to be studied by the pre-audit analysis department. He will calculate the organization’s indicators and draw a conclusion where and how much, in his opinion, it did not pay extra. If the above-mentioned department, based on its report, considers that the taxpayer falls far short of the calculated amounts, he faces an on-site tax audit.

To avoid such situations, it is worth understanding:

- where do tax authorities get the desired indicators;

- is it possible to somehow reduce these indicators or explain the reason why the company does not reach them;

- in which cases the company has the right not to explain deviations from the standards.

Explanation of the low tax burden in construction

The amount of taxes transferred by the organization for the year is 5 million rubles. It does not include personal income tax, since its actual payers are employees.

There is also no need to take into account fines and penalties. The inspectorate refused to refund the tax to Exporttrade LLC, accusing it of incorrect execution of documents, lack of economic meaning of transactions, and also of dishonesty. We divide taxes by revenue (line 010 of the Profit and Loss Statement) - 76 million.

rubles Then the tax burden for 2007 is equal to 5 percent (3.8 million rubles: 76 million rubles x 100%). If at the end of 2008 this level is lower, then the likelihood of an audit increases. In addition, the reason for reducing the load is a change in contracts.

It is legal when the change has business purposes, not just tax ones. This is what the Plenum of the Supreme Arbitration Court of the Russian Federation decided (clause 4 of the Resolution of October 12, 2006).

N 53). However, it is often not a decree for inspectors. Excerpt from the profit and loss report of Real LLC thousand.

rub. Indicator For the reporting period For the same period of the previous year Name Code The criterion under consideration (as opposed to the tax burden) is also applicable for those working in different fields of activity.

Explanation of the reasons for the low tax burden

However, the Federal Tax Service prepares materials on the average tax burden and profitability of the economy by industry, which makes it possible for enterprises and organizations to compare the profits received and taxes paid to the budget with general indicators for the Russian Federation.

Income and expenses for the main types of business must be disclosed in Form N 2. Or at least in accounting. In addition to protection, the company should test the arguments of the tax authorities. They often make mistakes (in particular, increasing the cost of input VAT) or take the indicator that is beneficial to them. Disputes also arise in the assessment of the following criterion proposed by the authors of the Concept.

In letters requiring an explanation of the reasons for reducing the tax burden, inspectors direct organizations to:

- clarification of data on the calculation of tax liabilities

- explanation of discrepancies with industry indicators

- changing the OKVED code in case of discrepancy with the type of activity carried out by the company. However, the Federal Tax Service prepares materials on the average tax burden and profitability of the economy by industry, which allows enterprises and organizations to compare the profits received and taxes paid to the budget with generalized indicators for the Russian Federation. In letters requiring an explanation of the reasons for reducing the tax burden, inspectors direct organizations to:

- clarification of data on the calculation of tax liabilities

- explanation of discrepancies with industry indicators

- changing the OKVED code in case of inconsistency with the type of activity carried out by the company • And the last reason may be the implementation of investments allocated for the development of trade, production and other activities.

Tax burden by type of economic activity in 2021

Otherwise, a fine of 200 rubles is possible (Art.

In this case, you will need to prepare a calculation proving the low tax burden.

126 of the Tax Code of the Russian Federation). In addition, secrecy will arouse suspicion among inspectors; they may begin a pre-inspection analysis for an on-site inspection. If the organization is small, then after a letter with clarification they will most likely be left behind. If the taxpayer is large and important to the inspectorate, then it will conduct an analysis. Then it will become clear which claims the company must respond to. It is worth describing the reasons in detail if the company risks getting involved in an offsite meeting.

Tell us why the indicators were formed, provide calculations and plans for solving the situation.

Questions about workload and profitability are not dangerous. Because of them, 90% of colleagues never updated their reporting.

The company is not required to strive for national averages. Tell the tax authorities why you have such indicators, and the auditors will withdraw your claims. The risk of an on-site inspection is low.

How to prevent a tax audit: main risk areas

No. Thus, according to 2007 data, the safe level of tax burden in wholesale and retail trade was considered to be 3.9%, in construction - 15.9%, in the production of machinery and equipment - 17.2%, and in the fuel and energy industry and altogether 60.2%.

Those wishing to plan the amount of the deduction must take into account that the moment of exercising the right to deduct VAT refers to the period when such a right arose in accordance with the established deduction procedure, and is not automatically transferred. In addition to the company's performance, relationships with counterparties are also at risk. All of the listed documents contain the same signs of unreliability of the counterparty: The establishment of a counterparty company at the so-called mass registration address is also considered suspicious

We recommend reading: How to find out who owns the land by address

How to explain the low tax burden?

First of all, I will explain why the tax inspector is asking for an explanation of the low tax burden.

In fact, a request for an explanation of a low tax burden is a type of tax commission.

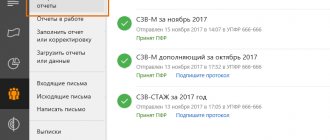

They are carried out on the basis of Letter of the Federal Tax Service of Russia dated July 17, 2013 N AS-4-2/12722

“On the work of tax authorities’ commissions on the legalization of the tax base”

1 .

Check the correctness of the calculation of the tax burden. Explanation of the low tax burden. A low tax burden in itself cannot entail any sanctions. This is only a factor in attracting the attention of tax authorities to you. The maximum they can do is come to you with an on-site tax audit.

The low tax burden can be explained by: A decrease in sales volumes (compared to previous years); Increasing purchase prices for raw materials; Increasing the level of wages; Increased administrative costs, etc. The organization carrying out construction activities (construction contractor) received a requirement to explain the reasons for the low tax burden. The tax burden in the Construction industry for the year, according to the Federal Tax Service of the Russian Federation (industry average) is 10.9%.

The taxpayer's tax burden for the year was 7.3%. Explanation of the low tax burden The lower level of tax burden of the LLC, in comparison with the industry average, is explained by a decrease in its income and an increase in expenses, which occurred due to the following circumstances: - The LLC participated in a tender for the construction of a non-residential building at the address: ____. As a result of the tender, the LLC did not receive the right to conclude a contract for construction and installation work on this facility.

— The LLC participated in a tender for the renovation of a non-residential building at the address: ____. As a result of the tender, the LLC did not receive the right to conclude a contract for work on this facility.

— in the calendar year, the following amounts of bad receivables for payment for work performed were written off: 12 million — receivables from Lavochka LLC under the contract ______; 7 million rubles - receivables of Pechnik LLC under the agreement ______; — in the calendar year, the organization invested funds in the amount of 15 million.

rubles for the purchase of construction equipment.

The amount of accrued depreciation for the year amounted to 2 million.

rubles General Director of Contractor LLC _________ Builder M.I. 1) The document (Letter of the Federal Tax Service of Russia dated July 17, 2013 N AS-4-2/12722) was canceled by Letter of the Federal Tax Service of Russia dated March 21, 2021 N ED-4-15/ “On the Commission for the Legalization of the Tax Base,” but the commissions in practice continue work.

Tax burden is a value that shows the level of tax burden of the taxpayer.

Make sure that the VAT deduction percentage is calculated correctly

VAT has two standards for the safe percentage of deductions. The Federal Tax Service of Russia secured one by order dated May 30, 2007 No. MM-3-06/ [email protected] (clause 3 of the Publicly Available Criteria for Self-Assessment of Risks for Taxpayers). The tax authorities cited the same figure in letter No. AS-4-2/12722 dated July 17, 2013, which explains how to calculate the share of deductions. The Federal Tax Service of Russia publishes the second indicators on the website by region and country as a whole.

In practice, it is safer for companies to focus on the first norm. Now it is 89 percent. For example, if there are many exporters in the region, they will charge VAT at a rate of 0 percent, and will accept deductions at a rate of 10 and 18 percent. Such reimbursement amounts will correct data from companies that do not export, resulting in deduction shares that exceed 100 percent. However, any other companies in this region should not hope that they can avoid paying VAT to the budget, paying it off with deductions. Or rather, you can not pay, but in this case you should expect tax officials to conduct an on-site inspection.

How to calculate the share of deductions is indicated in the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12722. The Federal Tax Service draws attention to the fact that when calculating the ratio of VAT deductions to the calculated tax, it is not necessary to take into account the “net”. Namely, deductions for:

- advances;

- construction and installation work;

- tax agents.

It happens that tax authorities deviate from their own rules. Advances, for example, can give a significant imbalance, since tax authorities will take into account the amount twice: as an advance and as sales in the next period. To avoid such a situation, when receiving requests from the inspectorate, it is advisable to recalculate their share of the deduction. If the company identifies an error, when responding, it can present its calculation and refer to the explanations of the Federal Tax Service.

Increased attention from tax authorities can be avoided if you keep your own statistics by period and avoid dangerously exceeding the share of deductions.

Low tax burden

Tax authorities may be interested in the activities of a taxpayer if his tax burden is lower than the average burden for the relevant type of economic activity (clause 1 of the Publicly Available Risk Assessment Criteria).

Appendix No. 3 to the Order provides indicators of the tax burden per taxpayer for the main types of economic activity.

The taxpayer must compare his data on the tax burden with these indicators. Currently, this Appendix contains load indicators for 2006 - 2013. In accordance with paragraph 6 of the Order, tax authorities must update this data annually and post it on the official website of the Federal Tax Service of Russia (https://www.nalog.ru).

See a sample explanation to the tax authority regarding the reduction of the taxpayer’s tax burden. In this regard, in our opinion, it is illogical to use this criterion in relation to taxpayers who use exclusively UTII, since their tax burden is not related to the revenue received, but depends on the amount of income imputed to them. In our opinion, taxes paid by the tax agent should not be taken into account when calculating the tax burden.

After all, tax agents do not pay tax at their own expense, but withhold it from the taxpayer’s income (clause

1 tbsp. 24 of the Tax Code of the Russian Federation). Clause 1 of the Publicly Available Risk Assessment Criteria does not disclose for what period the tax burden should be determined. However, the tax authorities provided calculations for the calendar year. Therefore, when calculating your tax burden, it is also advisable for you to use the ratio of the taxes you paid and the revenue (turnover) for the year as a whole. — accrued amounts of taxes, fees, penalties and tax sanctions.

They are entered on the basis of declarations submitted by the taxpayer, decisions based on the results of tax audits, decisions of a higher tax authority, judicial acts, etc.; - the amount of taxes, fees, penalties and fines that the taxpayer transferred to the budget; — the difference between received and accrued payments.

We recommend reading: Zavgorodny Vasily Mikhailovich Lieutenant General

When does the Federal Tax Service have the right to require documents and which ones?

The Federal Tax Service may request explanations and documents confirming the correctness of calculation and timely payment (withholding and transfer) of taxes.

The right to request documents is given to the Federal Tax Service by Article 93 of the Tax Code of the Russian Federation. Cases when the tax authority is authorized to request documents within the chamber chamber are regulated by paragraph 8 of Article 88 of the Tax Code.

The Constitutional Court of the Russian Federation at one time indicated to tax authorities that the Tax Code is based on the inadmissibility of causing unlawful harm during tax control.

Tax control should not turn from a tax policy tool into a tool for suppressing economic independence and initiative, as well as excessively limiting freedom of enterprise and property rights. This, in turn, does not comply with the Constitution of the Russian Federation.

The Supreme Court of the Russian Federation, in its Determinations No. 301-KG18-20421 dated March 14, 2019 and No. 309-ES19-21200 dated February 28, 2020, indicated that the convenience of tax administration cannot serve as a basis for limiting the rights of taxpayers.

The fact that the rights of the Federal Tax Service regarding the requested information are limited is also stated in the Resolution of the RF Armed Forces dated July 09, 2014 No. 46-AD14-15. In the letter of the Federal Tax Service dated September 13, 2012 No. AS-4-2/15309, the tax authorities themselves agreed that they do not have the right to request additional information and documents from the taxpayer, unless otherwise provided for in Article 88 of the Tax Code of the Russian Federation.

Despite the decisions of the Supreme Courts, the Ministry of Finance has repeatedly emphasized in its letters that tax inspectors within the chamber have the right to demand not only documents that are the basis for the calculation and payment of taxes, but also other documents outside of the audit. For example, letter of the Ministry of Finance dated 02/09/2021 No. 03-02-11/8341.

Jurisprudence on this issue varies greatly. In earlier cases, courts sided with taxpayers. The cases of the latter indicate the opposite.

Although, there are recent court decisions in support of the taxpayer, in which judges agree that the requirements of the Federal Tax Service go beyond the norms of the Tax Code of the Russian Federation: AS SZO dated January 18, 2021 No. F07-15509/2020; Resolution of the AS UO dated June 22, 2020 No. F09-1131/20.

Thus, in the decision of the Federal Antimonopoly Service of the Moscow Region dated February 13, 2014 No. F05-43/14, the judges decided that other documents containing information about the indicators of the organization’s economic activities that can be used by inspectors when conducting an inspection of a given payer must be submitted when requested by the inspectorate.

Previously on the topic:

What documents does the Federal Tax Service have no right to demand during a VAT filing with a refund?

The court found out which documents the Federal Tax Service does not need for a desk audit

How to explain to the Federal Tax Service the reasons for the low tax burden

After filing a tax return, it is checked by specialists. The information contained in the document may raise questions.

In particular, the low tax burden is suspicious. If the tax authorities have any questions, you will have to provide explanations.

An explanatory note can only be requested during an on-site and desk inspection. To provide explanations, the payer must know what the tax burden is. This is the ratio of taxes paid to the profit recorded in the documents.

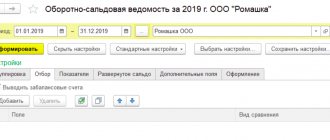

The size of the burden is determined by this formula: Amount of taxes for the year / indicator from line 2110 “Revenue of the annual report” * 100% The amount of taxes is determined based on the information in the tax return. What load is considered low? To determine the adequacy of the indicator, the obtained value is compared with industry averages.

The income tax burden can also be determined using this formula: Calculated amount of income tax (line 180 of sheet 02 of the declaration for the year) / Amount of revenue and non-operating income (line 010 and 0120 of sheet 02 of the declaration) * 100% A load of 1% is considered low for trading companies and 3% for entities with other areas of activity. Recommendations for drawing up an explanatory note: It is recommended to send an explanatory note within 5 days to the tax office’s request to provide a note. Otherwise, you will have to face verification.

A reduced load may also arise because errors were made in the declaration. In this case, you need to send updated information.

Let's look at common errors and their codes: An updated declaration is a table that contains credentials and details. In the lines with these registers, it is necessary to explain previously made distortions.

The document specifies all areas of the company’s activities. Each sheet must contain details of the legal entity.

Some sheets require certification in the form of a signature from a representative of the organization.

Reasons for low tax burden - explanation

For example, an organization conducts construction activities. For 2016, the total percentage of the tax burden (TB) was 7%, and the industry average was set at 10.9%. The deviation is 3.9%, most likely the tax authorities will ask for an explanation. If you do not provide an explanation, the risks of scheduling on-site activities increase “manifold”, so it is recommended not to ignore the inspection requirements and draw up a written justification.

Before you start drawing up explanations, check the level of your fiscal burden yourself. To do this, specify the OKVED code, calculate the total amount of taxes for the year, taking into account personal income tax, and calculate the specific percentage of personal income in relation to annual income. When comparing data on individual taxes and payments, study the indicators from Appendix No. 2 to the Order, which indicates the criteria for assessing the low load in terms of deductions for VAT, personnel wages, unified agricultural tax, simplified tax system, UTII, personal income tax on business income, profitability of activities, etc. .

Low tax burden explanation sample

Reasons for the low tax burden The tax burden is tied to revenue: the more revenue, the more taxes you need to pay.

“In response to your request for clarification regarding _____ No.____, we report the following: _____”

. The content of the answer is formed depending on the essence of the question presented.

- Losses reflected in the declaration.

- The tax burden on it is low: for legal entities in the production sector - less than 3%, for trading companies - less than 1%.

For VAT, two indicators are considered together: This can happen if calculations were made on the basis of previously issued advance invoices. Code 3 indicates a discrepancy between section 10 (invoices issued) and 11 (invoices received).

This may happen if the declaration contains information about the intermediary operations of the taxpayer.

Code 4 is kind of universal.

We hope to finalize the law on microenterprises, which will reduce the burden on this business entity in terms of reporting, fines, and other parameters.

“We hope that the policy of the state, as well as the tax authorities, will be aimed at supporting enterprises”

- take this to a psychiatrist. knp said: 04/21/2021 01:51 pm Don’t waste time unsubscribing.

No one will read your letter.

That is, there must be the required minimum according to the Tax Code of the Russian Federation. You have the right to reflect the remaining expenses as indirect.

2. Accounts payable.

If it was written off, then the posting was D XXX K 91.01, i.e. income. On what basis was this income not reflected in NU?

If you did not write off the creditor, then explain what the BO reflected and for what reason this data is not in the OU.

What does the concept of “tax burden” mean?

The term “tax burden” is mentioned in such an important document of the Federal Tax Service as order No. MM-3-06 / [email protected] dated May 30, 2007. It regulates the principles of on-site control activities, including criteria for selecting enterprises for inspection. Based on the norms of the Order, each taxpayer can independently assess the risk of an audit. The list of criteria is given in subsection 4 of the Order. At the same time, in this list, the insufficient tax burden (below the industry average) is in first place.

The tax burden is determined by type of OKVED and denotes the percentage ratio of taxes paid and income received as a result of business activities. The indicators are calculated by tax authorities for the year using a special method. The data is given in Appendix No. 3 to the Order. If, when analyzing the financial indicators of an enterprise, minimization of tax liabilities is revealed, significant deviations from the average statistical data are found, employees of the Federal Tax Service may decide on the need to conduct an on-site audit. But first, the taxpayer is sent a request to provide explanations. How to competently justify the reasons for a low tax burden?