Home / Uncategorized / Filling out 3 Personal Income Tax What is an Investment or Purchase and Sale Agreement

If an apartment was purchased in a new building during the construction stage, according to the DDU, then the acquisition method is set to “investment” in the program or “equity agreement” in the taxpayer’s personal account. At the same time, for the first time you will be able to fill out a 3-NDFL declaration for the next calendar year after signing the acceptance certificate.

If an apartment or house was purchased on the secondary market using a policy, then the date from which you can claim a deduction when purchasing a home is the date the property is registered and an extract from the Unified State Register is issued (or a certificate of ownership if the apartment is registered before 2021). Everything here is logical and intuitive: the method of acquisition in 3-NDFL is a purchase and sale agreement.

Date of registration of ownership of the apartment in 3 personal income tax

This is due to the entry into force of the order amending the VAT reporting form. The Government of the Russian Federation has approved a list of non-food products, for the sale of which at retail markets, fairs, exhibition complexes and other trading areas, organizations and individual entrepreneurs are required to use cash register equipment.

- construction and finishing materials (for apartments and rooms only finishing materials);

- purchase of housing (cost of housing under contract);

- development of design and estimate documentation;

- payment for construction and finishing services;

- connection to networks or creation of autonomous sources of electricity, water, gas supply and sewerage (only for a residential building).

- housing costs;

- expenses for: purchasing housing (cost of housing under contract);

- construction and finishing materials (for apartments and rooms only finishing materials);

- payment for construction and finishing services;

- development of design and estimate documentation;

- connection to networks or creation of autonomous sources of electricity, water, gas supply and sewerage (only for a residential building).

Date of registration of ownership of the apartment in 3 personal income tax

The deduction can be obtained not only for educational expenses at state universities, but also at commercial educational institutions (if they have a license): kindergartens and schools; centers for additional adult education (driving schools, foreign language courses, etc.); centers for additional education for children (music schools, sports clubs, etc.).

When filling out, you must indicate the date of registration, which is listed in the certificate of ownership of the apartment (line 060), the certificate of share in the right to living space (line 090), and also indicate the first year of tax deduction. In addition, in paragraph 1.11 the amount of 2 million rubles is entered if the apartment cost 2,000,000 rubles or more, or the exact amount of the price of the apartment at a lower cost of housing. If housing was purchased under a mortgage lending program, you must indicate the interest rate in clause 1.12.

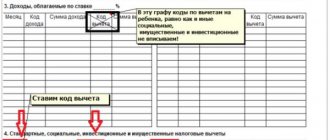

Investment deduction for personal income tax for investors

IMPORTANT! If securities are purchased but not sold (even if their value has increased), then the difference in price is not recorded, so no income arises for tax purposes. If the securities are sold at a loss, then there is no income either. In these cases, we are not talking about an investment deduction.

There is only one criterion that allows you to make an unambiguous choice. If an individual does not have income subject to personal income tax (this could be pensioners; mothers on maternity leave; individual entrepreneurs using special regimes; persons receiving a low white salary), then only a deduction for transactions accounted for on an IIS is suitable for him. After all, the deduction for depositing funds returns the tax paid on other income of an individual that has nothing to do with investing.

Date of registration of ownership of the apartment in 3 personal income tax

When you sell an apartment, house, land plot, etc., as well as shares in them, the income received is subject to personal income tax at a rate of 13% (clause 5, clause 1, article 208. clause 1, article 224 of the Tax Code of the Russian Federation). However, the law provides certain benefits that are related to the period of ownership of real estate. The following rules will help you determine how long the property will remain in your ownership. The period of ownership of real estate is determined from the date of state registration of your ownership of this property or share in it.

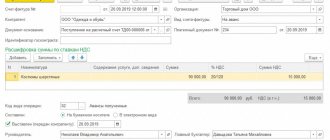

(Line 260 of sheet I from 3-NDFL with the last submitted 3-NDFL). Let's help Ivanov I.I. fill out the declaration. Go to the official website of the Federal Tax Service https://www.nalog.ru Select the “Individuals” section Find the “Software” section, select “Declarations” Select the year for which you are filing a declaration, then select “Installation program. EXE extension"

This is interesting: A Veteran Bought an Apartment in Soskve and Moved, Will the Benefits Continue as a Labor Veteran

How to pay taxes correctly - learn how to fill out 3 personal income taxes and submit information to the Federal Tax Service

- Art. 119 of the Tax Code of the Russian Federation regulates sanctions for failure to submit a tax return.

- If it is proven that you deliberately evaded paying taxes, fines increase to 20-40%. This is discussed in more detail in Art. 122 Tax Code of the Russian Federation .

- It is also not in your interests to delay time, clause 4 of Art. 75 of the Tax Code of the Russian Federation regulates the amount of penalties accrued for each day of delay. It is tied to the refinancing rate of the Central Bank of the Russian Federation. At the time of preparation of the material, it is 7.75%, which means that the fine will increase by 7.75/300 = 0.0258% per day.

The current version of this software can be downloaded for free on the tax website , use only the latest version. The good thing about the program for filling out 3 personal income taxes is that you can save intermediate results and then return to working with the data. When filling out online (via the Federal Tax Service website), there is no such option and everything must be done in one go.

Date of registration of ownership of the apartment

Electronic versions of declarations have become very relevant today. In fact, you find a current sample document and fill it out online. You indicate all the necessary data, and you can use step-by-step instructions. After which, you indicate all the numbers, and the calculations will be made automatically, since the program is equipped with the necessary calculation algorithm. Everything is quite simple.

Every person who decides to purchase their own home tries to find out how long it takes to register ownership of an apartment. First you need to understand that this is a legal procedure that involves documentary confirmation of the fact of transfer of rights to real estate from one person to another.

General terms

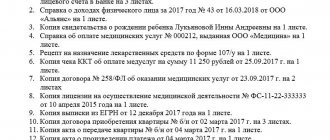

- Passport and TIN;

- Certificate of income in form 2-NDFL (issued by the employer at the end of each year);

- Real estate purchase agreement and payment documents;

- Transfer and acceptance certificate or certificate of ownership (extract from the Unified State Register of Real Estate);

- Mortgage agreement and documents on interest paid.

Preparatory stage

Having filled in the housing data, we return to the general tab. If the deduction is requested for several objects, we repeat all the steps starting from step 1. In any case, its total amount will not exceed 2,000,000 rubles, even if the apartments were more expensive.

Tax deductions for the sale of property are provided only by the tax office of residence. Receiving such a deduction from the employer is not provided for by law. You also need to apply there to reduce the income from the sale of property by the amount of expenses for its acquisition. This procedure is provided for in Article 220 and paragraph 2 of Article 229 of the Tax Code of the Russian Federation.

Answer: Taxpayers filing a tax return in Form 3-NDFL fill out sheet “L” of the declaration “Calculation of property tax deduction for amounts spent on new construction or acquisition on the territory of the Russian Federation of a residential building, apartment, room or share of shares) in them” (approved by order of the Ministry of Finance of Russia dated December 31, 2008 N 153n). To fill out the specified declaration sheet, the following provisions of the Tax Code of the Russian Federation should be taken into account. Clause 3 of Art. 210 of the Tax Code of the Russian Federation establishes that for income for which a tax rate of 13% is provided, the tax base is determined as the monetary expression of such income subject to taxation, reduced by the amount of tax deductions provided for in Art. 218-221 Tax Code of the Russian Federation. A property tax deduction is provided to a taxpayer by reducing the amount of income taxed at a rate of 13% by the amount of expenses associated with the purchase of housing (subject to the restrictions established by law). In accordance with paragraphs. 2 p. 1 art. 220 of the Tax Code of the Russian Federation, when determining the size of the tax base, the taxpayer has the right to receive a property tax deduction, in particular, in the amount spent by him on the acquisition of a residential building, apartment or share(s) in them in the territory of the Russian Federation, in the amount of actual expenses incurred. At the same time, the total amount of the tax deduction established by paragraphs. 2 p. 1 art. 220 of the Tax Code of the Russian Federation, for legal relations that arose in 2008, cannot exceed 2,000,000 rubles, excluding amounts aimed at repaying interest on targeted loans (credits) received from credit and other organizations of the Russian Federation and actually spent by the taxpayer on new construction or purchasing an apartment in the Russian Federation. As a general rule, the specified property tax deduction is provided to the taxpayer on the basis of a written application, as well as payment documents drawn up in the prescribed manner and confirming the fact of payment of funds by the taxpayer for expenses incurred (receipts for receipt orders, bank statements on the transfer of funds from the buyer’s account to the account of seller, sales and cash receipts, acts on the purchase of materials from individuals indicating the address and passport details of the seller and other documents). If the apartment is purchased as a common joint property, in accordance with the provisions of paragraphs. 2 p. 1 art. 220 of the Tax Code of the Russian Federation, the amount of property tax deduction is distributed among co-owners in accordance with their written application. Taking this into account, taxpayers who have acquired property in common joint ownership must agree among themselves on the ratio in proportion to which the amount of the property tax deduction will be distributed between them. It should be borne in mind that the Ministry of Finance of Russia explains that if housing is purchased into the ownership of several persons, the property tax deduction is not doubled, but is distributed among its owners in the prescribed manner (letter of the Ministry of Finance of Russia dated 06/05/2009 N 03-04-05 -01/436). Thus, in addition to the general list of documents established by law, in order to receive a deduction, you need to submit an application to the tax authorities, in which you should indicate the ratio in which the owners decided to distribute the deduction. For example, co-owners of property can agree on a decision to distribute the property tax deduction among themselves in the ratio of 50% and 50%. Any other ratio is possible. In a letter dated June 25, 2009 No. 3-5-04/888, the Federal Tax Service explained that a special case of such a distribution could be the application by co-owners of a residential property of deduction amounts for its purchase in the amounts of, respectively, 2 million rubles and 0 rubles. At the same time, in the opinion of the tax authorities, regardless of the amount of the deduction specified in the above-mentioned application, the co-owner of such an object, who has not personally applied for a property tax deduction for the costs of purchasing housing, cannot be considered to have exercised his right to a deduction in the sense of the provisions of paragraph 20 pp. 2 p. 1 art. 220 Tax Code of the Russian Federation. Let us recall that, according to this paragraph, the repeated provision to the taxpayer of the property tax deduction provided for in paragraphs. 2 p. 1 art. 220 of the Tax Code of the Russian Federation is not allowed. Thus, when submitting an application to the tax authorities for a property tax deduction in connection with the purchase of an apartment and a personal income tax declaration, the owners of common property independently distribute the amount of the deduction established by law by submitting a written application. In accordance with clause 25.2 of the Procedure for filling out the tax return form for personal income tax (approved by order of the Ministry of Finance of Russia dated December 31, 2008 N 153n), subclause 1.7 of sheet L reflects the amount of expenses actually incurred by the taxpayer for new construction or acquisition of a residential building, apartment, rooms or shares (shares) in the specified property (excluding amounts aimed at repaying interest on targeted loans (credits) received from credit and other organizations of the Russian Federation), but not more than 2,000,000 rubles. When acquiring the specified property into common joint ownership, this indicator is indicated in the amount of expenses actually incurred, but not more than the amount of the property tax deduction calculated in accordance with the written application of the taxpayers. In other words, the total amount of the deduction in the case under consideration will not exceed the actual costs of purchasing the apartment, that is, 1,800,000 rubles. The distribution of this amount will depend on the joint decision of the co-owners. When distributing the deduction, for example, in equal shares in subclause 1.7 of sheet L, each taxpayer indicates an amount of 900,000 rubles.

You may be interested in:: Dental benefits for combat veterans

The date of registration of property rights for 3 personal income tax is considered

At the same time, until the buyer acquires ownership of the apartment, his transfer of funds to the seller to pay for the cost of the acquired real estate should be considered as receiving an advance.

If we submit it to the employer, then from the date of filing the application, the accounting department ceases to withhold income tax until the amount of tax withheld exceeds the amount of the calculated deduction. But along with the application, you must bring a notification confirming the right to a property deduction from the tax office.

- number of the Federal Tax Service branch you are applying to;

- first name, patronymic, last name;

- home address;

- Taxpayer INN;

- the year or years (but not more than three) for which you want to receive a deduction;

- address of the property taken under the mortgage;

- date, signature;

- calculated data.

Where can I get them?

Getting a tax refund for purchasing an apartment with a mortgage is quite simple. The main thing is to collect all the documents, and the trip to the tax office will be short-lived. Before you go, you need to prepare and collect the entire package of papers, make photocopies of the required ones and file them in the proper form.

- in paper form, that is, in person or by mail. Then it is recommended to install the specified program on your computer, fill out a declaration in it, print it and send it along with copies of all necessary documents by a valuable letter with an inventory,

- in electronic form. This is done through the online service “Taxpayer Personal Account”, where information is entered into the declaration directly, then scanned documents are uploaded there, and then all this is sent to the Federal Tax Service.

How to find out the date of registration of ownership of an apartment

The most common type of civil transaction is a real estate purchase and sale agreement. This type of agreement may provide for the payment of tax if the transaction is subject to a number of restrictions of the Tax Code of the Russian Federation, and then it is important to determine the date/day of registration of ownership of the apartment in 3-NDFL.

The moment the ownership right arises is the day of death of the actual owner of the property or the date of probate of the will. Both individuals and legal entities are required to enter into the right of inheritance within 6 months from the date of proclamation of the will/death and during this period undergo state registration of property rights. If this procedure is not completed within six months, entering into a proprietary relationship becomes possible only through legal proceedings.

Sale of an apartment (house) in 2021: tax in different situations and examples of 3-NDFL

In this case, it is easier to understand who does not need to declare a real estate sale transaction. Such lucky ones include those who owned the object of sale for a sufficient period of time, allowing them not to count or pay taxes at all.

If an apartment or house in which the shares belonged to different owners is sold to a new buyer as a single object of ownership under one contract, then both the proceeds from the transaction and the deduction are subject to distribution in proportion to the former shares.

Registration of ownership of an apartment

Currently, the subject of the title is legally incorrect. As of 03/01/2013, the registration of the apartment purchase and sale agreement was canceled, but part of the previous registration was retained - registration of the transfer of ownership. Due to changes in legislation, the content of contracts for the sale and purchase of apartments has also changed. We do not recommend taking samples from the Internet.

1. Collect the necessary package of documents (it’s better to ask a specialist, the packages are different in each case). The validity periods of documents are also different in different cases. For example, to conclude and register a purchase and sale agreement in notarial form, you must have a fresh cadastral passport and a 10-day extract from the Unified State Register; for a contract in simple written form, you can use an old technical passport

How to reflect investment deduction for personal income tax in 3 personal income taxes

An investment deduction is one of the forms of state support for a citizen. In gratitude for the fact that an individual helps develop the country’s economy and invests his own funds in its various sectors, the legislator allows the return of part of the funds spent . Investment deduction for individuals is regulated by Article 219.1 of the Tax Code of the Russian Federation.

- The person who invests the funds must have Russian citizenship and make a contribution specifically to the Russian economy. Otherwise, there can be no talk of any deduction

- A citizen can have only one investment account, which must function for at least three years

- Such an account must be replenished annually, but not by more than 1 million rubles. As proof of the contribution of money, the investor must have in hand a document confirming payment

- To apply for a deduction, a citizen must receive official income and transfer personal income tax from its amount

You may like => Chief Engineer May Not Be Financially Responsible

Date of registration of ownership of a residential building apartment room ddu

- acceptance of an application for state registration of rights;

- legal examination of submitted documents,

- checking their authenticity, the legality of the transaction,

- identification or exclusion of circumstances that impede the registration of ownership rights to a given property;

- entering the necessary information into the Unified State Register of Real Estate (USRN);

- issuance of documents with a registration inscription on a contract or other title deed (in the future, if necessary, the owner can receive an extract from the Unified State Register of Real Estate for his property, which is issued when applying to Rosreestr or the MFC from the beginning of 2021).

- If the owner of one share in an apartment inherits another share as a result of the death of the owner, the period of ownership of the apartment is calculated from the date of initial registration of ownership of the share in the apartment (Letter of the Ministry of Finance of Russia dated October 24, 2013 No. 03-04-05/45015). Example: as a result of privatization carried out in February 2010, the apartment was registered as shared ownership of the grandmother and grandson, ½ share each.

Tax return for the sale of an apartment - filling out and submitting

– drawing up a report when selling an apartment that is in shared ownership, for example, between husband and wife. Both spouses must report to the tax office about the profits received. If their existing shares of real estate were unequal, the property deduction when calculating the tax will be applied in proportion to the shares sold.

- An opportunity to save personal time on going to the department and waiting in line.

- The fact of filing is documented and cannot be disputed or rejected. If necessary, an official notice is sent to the taxpayer.

- Allows you to submit papers in a timely manner, even without being at the moment at the place of registration.

There are clear deadlines for filing a tax return that must not be missed. So, to pay the tax there is also a time period for which the money must be paid. You must do this before June 15 of the year you filed your return. Late arrivals will also result in an increase in tax.

After you have filled out the declaration, you must submit it to the tax office at your place of official registration. You can do this yourself or have someone else do it. Please note that in the latter case, in order for someone to represent you at the tax office, you need to issue a power of attorney certified by a notary. There are several ways to deliver documents to the office; you have the right to choose any one that seems convenient and most suitable to you.

Date of Registration of Ownership of the Apartment Where to View For 3 Personal Income Tax

EGRN, and not the right confirming document, as was previously the case. The certificate of state registration of rights is a conditionally reliable document, since when changes were made to the real estate register, the law did not oblige the Certificate to be changed. -Why? -Answer in the article: Certificate of state registration of property rights is a conditionally reliable document. The most reliable document about the existence of registered rights to real estate is a recent extract from the Unified State Register of Real Estate. Therefore, the extract from the Unified State Register of Real Estate does not contain data on the previously issued Certificate of State Registration of Rights.

- Certificate of state registration of property Certificate of state registration of property rights Certificate number of state registration of property rights

- Cancellation of a certificate of state registration of property rights

- Obtain a certificate of state registration of property rights

- Form of Certificate of State Registration of Property Rights

- Lack of certificate - lack of ownership

Deduction amount

4. When acquiring property into common joint ownership (marriage certificate; written statement (agreement) on the agreement of the parties involved in the transaction on the distribution of the amount of the property tax deduction between the spouses).

Where to begin?

Click the “Next” button to move on to the fifth step of filling out the declaration, in which we indicate data about the property. If real estate data is listed in your taxpayer account, then some of the fields will be automatically filled in.

17.1 art. 217 of the Tax Code are not subject to personal income tax taxation of income received by individuals who are tax residents of the Russian Federation for the corresponding tax period from the sale, in particular, of apartments, rooms and shares in the specified property that were owned by the taxpayer for three years or more. This is clause 1.12 of the sheet. "I" tax return.

Date of registration of ownership of the apartment

This Certificate is issued by local branches of the Federal Registration Service when registering (more precisely, during state registration) a citizen’s ownership of a specific property. In everyday life, this paper is called the Certificate of Ownership of the apartment or “Title”, since this document contains basic (title) information about the apartment. Object of law (i.e.

Our lawyers provide legal services for state registration of rights to residential and non-residential premises (registration of an apartment, house or other property). And if problems arise with registration, we will help you solve them in court. The right of ownership and other real rights to residential premises, namely their emergence, limitation, transfer and termination of ownership, are subject to state registration. The right of ownership refers to property rights.

Filling out 3 Personal Income Tax What is an Investment or Purchase and Sale Agreement

4. Getting a tax deduction will become easier. In Russia, in 2021 it will be easier to obtain a tax deduction when purchasing an apartment, house or land plot. According to the new rules, individuals will be able to reimburse personal income tax with one application only - without drawing up a 3-NDFL declaration. In addition to significantly reducing the list of required documents, a simplified desk audit will shorten the time frame for obtaining a tax deduction. Now just checking the submitted documents with the Federal Tax Service takes three months, another 30 days will be required to transfer funds to the account. According to the new rules, a desk audit will take 30 days from the date of filing an application for a tax deduction, and money will be transferred to the account within 15 days after its completion.

3. Real estate will not be subject to increased personal income tax. Last year, Russia adopted a progressive personal income tax rate—income over 5 million rubles. from January 1, 2021 are taxed at a rate of 15%. This may have affected many property owners, but it was decided not to apply the progressive scale to one-time or irregular income, including income from the sale of real estate. Therefore, personal income tax remains the same - 13%.

Where to see the number of the certificate of registration of ownership

Here actions in relation to real estate are recorded, relates to a title document and has the appearance of a valuable form, which has its own number and all kinds of security signs. This was done to establish its uniqueness and prevent all kinds of attempts at deception.

It is also worth considering that the registry provides us with information with a delay of approximately fourteen days, as a result of which this should be taken into account during the transaction, since during this period the apartment could have already been sold to someone else.

Method of acquisition: investment or purchase and sale agreement

By purchasing a bill of exchange, the buyer of an apartment under construction signs an agreement to purchase from the developer (promissory note) a security in the amount of the cost of the apartment. At the same time, the preliminary agreement stipulates that payment for the future transaction is possible by repaying the bill.

You may be interested in:: How to Appoint a Non-Member of the Association as Chairman of the Association

Those persons claiming real estate in a new building will no longer share responsibility for the provision of services by the construction company. Therefore, they have every right to demand the performance of services already accepted, and those indicated in the agreement of obligations. As for the service provider, he also acquires broad powers.

Any logos other than VTB logos, if any are shown in the materials of the Investor School, are used solely for informational purposes and are not intended to mislead clients about the nature and specifics of the services provided by VTB, or to obtain additional benefits through the use of such logos, as well as promoting goods or services of the copyright holders of such logos, or damaging their business reputation.

Nothing in the information or materials presented in the Investor School constitutes or should be construed as individual investment recommendations and/or VTB’s intention to provide the services of an investment advisor, except on the basis of agreements concluded between the investment advisor and clients. VTB cannot guarantee that the financial instruments, products and services described in the materials of the Investor School are suitable for all persons who have read such materials and/or correspond to their investment profile. Financial instruments mentioned in information materials may also be intended exclusively for qualified investors. VTB is not responsible for financial or other consequences that may arise as a result of your decisions regarding financial instruments, products and services presented in information materials.

Date of registration of ownership of the apartment

The apartment purchase and sale agreement stipulates that ownership passes to the buyer after final payment. At the time of registration of this agreement with the registration chamber, the seller has owned the property for less than three years. At the time of final settlement with the seller, the three-year period will expire. How will the date of sale of the apartment be determined? Is it possible to consider income received from its sale as not subject to taxation in accordance with paragraph.

The period of ownership of property by the taxpayer is the period of its continuous ownership until sale (Letter of the Ministry of Finance dated November 20, 2012 No. 03-04-05/9-1324). If everything is clear at the end of the period, then at the beginning not everything is so clear. In different situations, the beginning of the period may be different.

How to fill out 3-NDFL to receive an investment deduction

A personal income tax deduction provides an opportunity to reduce taxes. Chapter 23 of the Tax Code of the Russian Federation provides for 5 types of deductions for personal income tax. The possibility of their use depends on various factors. For example, everyone can receive a standard social deduction, while a property deduction can be received by those citizens who buy or sell property. An investment deduction is applied when receiving income from transactions with securities or from income on an individual investment account (hereinafter referred to as IIA) and on operations on it.

- Provided at the end of the contract for maintaining an IIS, if the period of holding the account is at least three years.

- The use of a deduction is possible only if during the entire period of maintaining the account no deduction was used for the amount of funds deposited into the IIS.

- The deduction can be obtained both by submitting a tax return and when calculating and withholding tax by a tax agent.