Statistics confirm that the fight against “fly-by-night” companies is bearing fruit, for example, income tax collection in 2016 compared to 2015 increased by 8.5 percent, and VAT compared to the same period – by 6.6 percent.

In the fight for positive dynamics in tax collection, Federal Tax Service inspectors are helped by the ASK VAT 2 software package. The complex finds tax gaps by identifying unscrupulous companies in the supply chain of goods in the country from the importer, manufacturer to the final consumer, exporter. Thus, the problem of checking their counterparties for integrity is becoming increasingly pressing for businesses. Despite the fact that there is still no legislative provision for the rules for exercising due diligence and caution when choosing business partners, this is the responsibility that regulatory authorities primarily refer to when making claims regarding the validity of tax benefits.

Checking the integrity of the counterparty is possible through the use of a set of measures that are aimed at ensuring that the taxpayer can be convinced of the integrity of his partner. The inspected company must be an active organization that can fulfill its obligations under the contract (Resolution of the Supreme Arbitration Court of the Russian Federation dated April 20, 2010 No. 18162/09; letter of the Federal Tax Service dated January 23, 2013 No. AS-4-2 / [email protected] ).

Entering into an agreement with a fly-by-night company is risky

Two categories of risks can be distinguished—the consequences of concluding a transaction with such an organization. The first category is associated with the counterparty's failure to fulfill contractual obligations. If he does not have production and financial resources, then there is a high probability that he will not only be unable to complete the work or provide the service, but will also not return the prepayment.

The second category is tax risks associated with the possibility of withdrawal of VAT deductions and income tax expenses, or refusal of VAT refund and related sanctions. This situation may arise if the counterparty does not pay taxes, and the tax office and the court conclude that the transaction was not real, all transactions took place only “on paper”, and the partner of such counterparty did not exercise due diligence.

In the service you can see the degree of reliability of the counterparty

It is much more convenient to choose a reliable supplier or assess the tax risks of interaction with a potential partner using the counterparty verification service. Firstly, it allows you to quickly get all the information in one place. Secondly, it does some of the work for you and shows some data in a “processed” form. For example, the Rusprofile service uses a specially developed system for analyzing organizations based on the facts of their activities. The “Reliability” section is one of the convenient tools for checking. First of all, for the following reasons:

- The result of assessing the company’s reliability is immediately visible in the counterparty’s card.

- You can use detailed analysis for in-depth verification.

- The service provides recommendations to further confirm the company’s reliability.

All this will make it possible to make sure that the counterparty does not have any signs of a “fly-by-night company” or to learn in detail about the existing risks.

Rusprofile accumulates information about Russian organizations from various sources: from the Unified State Register of Legal Entities and special registers of the Federal Tax Service to files of court cases and registers of licensing authorities. Thanks to this, a huge database is created for all organizations. The service impartially evaluates more than 50 facts about each company and shows the degree of reliability of the counterparty: low, medium or high. Information about this is immediately displayed in the company card. This option can be especially useful at the stage of getting to know a company, at the first stage of choosing a business partner, as well as during an express check of a large number of counterparties.

A mark of average and low reliability in itself is not a reason to refuse to enter into a transaction. It only means that closer attention needs to be paid to the verification and is a reason to clarify and analyze additional information. If, based on the results of a deeper check, the company’s dubious status is confirmed, it is better to refuse cooperation. It works like this.

For example, a mark indicating that the address is unreliable reduces the status of the company and requires attention in terms of checking the actual address and personal acquaintance with the management. But when making a decision, you need to consider the context. The assessment of this fact varies depending on various factors, in particular:

- what is located at this address: office 20 sq. m in an abandoned building or a floor in a prestigious business center;

- whether there was a business meeting in this office and this address is real - or all negotiations are conducted on another territory or only through correspondence, and the real address of the counterparty is unknown.

The situation is the same with the “mass” of a leader: he may be a “nominee”, or maybe a businessman who actually has a stake in a large number of organizations, including those with investment purposes.

Ways to find information about a counterparty

Today, several areas of studying the reliability of partners are used:

- recommendations from those who have already dealt with them and whom you trust is the least reliable way, because “Trust, but verify”;

- contacting specialists, for example, a detective agency;

- studying the counterparty’s documentation and making independent decisions;

- comparison of the information provided with open data on the Internet.

Almost comprehensive information about a potential partner can be obtained online. For this, there are both special services and data on official resources.

The assigned status depends on the result of the analyzed facts

For a deeper check of the counterparty, it is better to use a detailed analysis of risk factors. This will allow you to see what risk factors influenced the status and find out their content. In the “Reliability” section of the service, all facts about the company are divided into 3 types: negative, requiring attention and positive.

Negative facts:

- Enforcement proceedings are ongoing against the company for significant amounts;

- the company is in the process of liquidation or has been liquidated;

- in relation to the founders, managers or address of the company there are marks on mass distribution;

- financial stability, profitability, debt-to-equity ratio and other financial indicators are negative

Positive facts:

- in the registers with data on “mass” and disqualified persons there is no information about the address, director or founders of the company;

- the company was founded more than 3 years ago;

- there is data on payments to the Pension Fund, Compulsory Medical Insurance Fund or Social Insurance Fund of the Russian Federation;

- financial indicators indicate the stable position of the organization.

Facts to pay attention to:

- there has been a change of manager or address in the company over the past year;

- the share in the authorized capital is in trust or inheritance;

- the company is included in the SME register and belongs to the category of small business or micro-enterprise.

These are just a few examples. The service database contains more than 50 such facts.

A detailed rating helps to identify risk areas and clearly shows all the facts, distributing them into categories, and provides individual comments regarding the organization being audited. This allows you to see a fairly complete picture of the company’s activities and create a “portrait” of it.

Of course, the rating and depth of verification will have different meanings depending on the situation: a lot depends on the type of transaction and its amount. For ordinary transactions involving small amounts, as a rule, an express conclusion will be sufficient: checking the company’s reliability status with an emphasis on the powers of the manager and signatory and a cursory study of all risk factors. The main thing is that the transaction itself is real and not fictitious. For larger transactions, you will need to pay special attention to additional information obtaining and collecting documents on negative facts that require attention. The admissibility of such a differentiated approach was recently confirmed by the Supreme Court of the Russian Federation in its Ruling dated May 14, 2020 in case No. A42-7695/2017.

What should a dossier on a counterparty contain?

What information about the partner will confirm his trustworthiness? You need to truthfully answer the following questions about a potential counterparty:

- How financially sound is the partner organization today?? It is necessary to clarify:

- presence of debts, loans;

- unpaid fines and penalties;

- possible participation in liquidation or bankruptcy proceedings, etc.

- What is known about the company's management? It happens that some founders are officially disqualified or barred by court from holding their position. An alarm bell if the manager has many small companies under his wing, especially if some of them are on the verge of bankruptcy.

- Does the company have the right to carry out this activity? It is important to check permits and licenses for those types of activities that require them, and the reflection of this possibility in the statutory documents.

- How long has the organization been in operation? The youth of a company does not mean that it is unreliable, but a solid period of time is more significant evidence in its favor.

- Is it located where it is registered? A discrepancy between the legal and actual addresses is not always sedition. But you should check whether the registered address is a mass one (for more than 10 organizations), used specifically for “one-day” organizations, and whether it is even possible to conduct business in the premises located at the designated address.

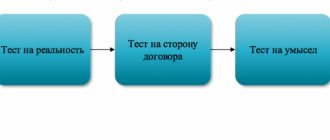

Step-by-step instructions for checking a counterparty

FOR YOUR INFORMATION! A complete list of points indicating the possible unreliability of the counterparty is given in Appendix No. 2 to Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/333 and letter of the Ministry of Finance of the Russian Federation dated December 17, 2014 No. 03-02-07/1/ 65228.

Recommendations for additional verification

The Rusprofile service provides recommendations for safe cooperation with companies. They help to minimize both tax risks and the likelihood of non-fulfillment of contractual obligations by the counterparty.

The content and extent of advice varies depending on the results of the analysis of the facts and the company's rating. This may be a minimum of actions - for example, requesting copies of some documents and checking the credentials of the manager and signatory. Or maybe a detailed list of steps: personally visit the office, meet with the manager, check the availability of resources, check reviews about the company on the Internet, etc.

Please note: the information in the service is updated continuously. Therefore, the rating of an organization, facts about it and recommendations may differ in different periods of time. They change following changes that occur in the company and the appearance of new information in state registers. To minimize risks, you need to check the reliability before each transaction. However, it is easier and more convenient to subscribe to organizational monitoring in order to learn about important changes in a timely manner.

Using the “Reliability” section, you can also check your own company. This will let you know how others see your organization and what needs to be improved to improve your trustworthiness rating. For example, appeal against decisions to include “mass” addresses or managers in the register if such marks appeared without reason.

In addition, a company’s rating can be increased by connecting to the “Rusprofile.Business” service: companies whose representatives have registered on the portal receive additional reliability points. It also allows you to manage your organization's page, in particular, specify contact information, add a logo, download current accounting reports, licenses, certificates, presentations and reviews. Such organizations receive about on their page.

NOTE

The rating and reliability statuses represent the opinion of the Rusprofile service based on the analysis of open public data on the facts of the organization’s economic activities using a scoring model.

This assessment is not a statement of fact, does not provide any warranties or representations to third parties, and does not constitute a recommendation for business or other decisions. Maria Bazyuk, Ph.D., editor-in-chief of Rusprofile.ru

Other articles

Potential losses

In the activities of most companies, there are risks of non-receipt of payment from counterparties, which entails a long negotiation process, hanging accounts receivable and costs of litigation, after which it may turn out that the debtor has nothing to pay. Such situations, in addition to the costs of servicing them, entail the withdrawal of funds from the company’s turnover and, as a result, direct losses.

Assessing the solvency of the counterparty, even if it was recommended for cooperation by trusted persons, can promptly draw attention to risks and prevent losses.