An interim report is a regular report in Form 4-FSS; it is filled out when the commercial insurer has made all insurance payments in large quantities. For example, the policyholder paid several sick leaves or paid maternity leave to the fund. The total amount of contributions paid must not exceed the amount to be reimbursed.

If the amount is greater, then the money can be returned back from the fund ahead of schedule, without waiting for the reporting period. All expenses incurred during the reporting quarter are reimbursed on a regular quarter basis. In this case, an interim report is not needed.

It turns out that an interim report is drawn up when the employer pays amounts greater than what was paid to employees during the period of incapacity.

In this article we will look at an example of an interim report to the Social Insurance Fund and how to fill it out.

Deadlines for submitting form 4-FSS

Companies submit Form 4-FSS to the branch of the FSS of the Russian Federation at the place of their registration within the following deadlines:

- no later than the 25th day of the month following the reporting period, if reporting is sent electronically;

- no later than the 20th day of the month following the reporting period, if it is submitted in paper form.

Thus, you must submit the calculation in form 4-FSS for 2021 no later than:

- January 20, 2021, if the policyholder reports on paper;

- January 27, 2021 (including weekends), if the policyholder submits reports electronically.

Let us remind you that policyholders whose average number of employees exceeds 25 people send Form 4-FSS to social insurance in electronic form. Policyholders with this indicator of 25 people or less can submit the form on paper.

Structure of the reporting form

Let us remind you that from 01/01/2017, the administration of the main part of insurance premiums passed to the tax inspectorates, therefore the current structure of the 4-FSS report differs from the version that was in effect previously. Unnecessary fields have been removed from it and new columns have been added.

Also see "".

The procedure for filling out 4-FSS in force in 2021 indicates that the form of this report consists of the following sections:

- title page;

- Tables No. 1, 2 and 5 are required to be completed by all policyholders without exception;

- Tables No. 1.1, 3 and 4 are prepared for individual categories of employers for whom the conditions specified in the instructions are met.

Also see “Required sheets of Form 4-FSS”.

To avoid mistakes when preparing the calculation, we recommend that you study our sample filling in advance.

Is there a program for filling out 4-FSS in 2021? Yes, such a service is offered by the Social Insurance Fund itself. It can be used on its official website using this link, completely free of charge.

Well-known TCS operators provide similar opportunities. Working with them will protect you from formal errors and inconsistencies in the entered data.

Procedure for filling out form 4-FSS

Form 4-FSS and the procedure for filling it out were approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381.

All policyholders must submit to the fund a title page, tables 1, 2, 5. The remaining tables do not need to be filled out or submitted if there are no indicators.

When filling out the title page, you should first of all pay attention to the “Subordination Code” indicator. Here you need to indicate the 5-digit code assigned to the policyholder, which indicates the territorial body of the fund in which the policyholder is currently registered.

In the “Average number of employees” field, you should indicate the average number of employees for 2021. This indicator is calculated in accordance with Rosstat Order No. 772 dated November 22, 2017.

In the field “Number of working disabled people” you need to reflect the number of such workers as of December 31, 2019

TABLE: “Structure of Form 4-FSS”

| Table | How to fill |

| 1 | Here you need to calculate the base for calculating accident insurance premiums on an accrual basis from the beginning of the billing period and for each of the last three months of the reporting period. Determine the size of the insurance rate taking into account the discount or surcharge |

| 1.1 | The table is filled out by insurers sending their workers temporarily under an agreement on the provision of labor for workers (personnel) in the cases and on the conditions established by the Labor Code of the Russian Federation |

| 2 | The table should reflect the following information according to accounting data: - in line 1 - debt on contributions for accident insurance at the beginning of the billing period. This information must correspond to the information about the insured's debt at the end of the previous billing period specified in the form for such period; - in lines 2 and 16 - the amounts of contributions for accident insurance accrued from the beginning of the billing period and paid; - in line 12 - the debt of the territorial body of the FSS of the Russian Federation to the policyholder at the beginning of the billing period. These data must correspond to information on the debt of the territorial body of the fund at the end of the previous billing period, given in the form for such a period; - in line 15 - expenses incurred for accident insurance since the beginning of the year; - in line 19 - debt on contributions for accident insurance at the end of the reporting (calculation) period, including arrears - on line 20; — line 1.1 reflects the amount of debt of the reorganized insurer and (or) the deregistered separate division to the Federal Social Insurance Fund of the Russian Federation; — line 14.1 indicates information about the debt of the Federal Social Insurance Fund of the Russian Federation to the reorganized policyholder and (or) to the deregistered separate division. These lines are filled in by insurers-successors and organizations that included such separate divisions. Other lines contain the rest of the available data. |

| 3 | The insurer's expenses for compulsory social insurance against accidents at work and occupational diseases are reflected. In addition, this table includes data on expenses incurred by the insurer to finance preventive measures to reduce industrial injuries and occupational diseases |

| 4 | Data is reflected based on reports of industrial accidents and cases of occupational diseases at the enterprise |

| 5 | This table must reflect the following information: — on the total number of jobs subject to a special assessment of working conditions, and on the results of the special assessment. And if the validity period of the workplace certification results has not expired, then - information based on this certification; — on mandatory preliminary and periodic medical examinations of employees. Indicate all data as of 01/01/2019; special assessments and medical examinations carried out during 2021 do not need to be reflected. In 4-FSS for the first quarter, half year, 9 months and year, table 5 will be the same |

An example of filling out interim reporting in the Social Insurance Fund

“Take from accruals.”

This means that the tax is first calculated for each employee and then added up; 2.3.2. “Calculate from the base in the report.” The program takes the base from Table 3 of the Social Insurance Fund form and multiplies it by 2.9%;

Information on insurance premiums and their movement, necessary for the FSS to reimburse the amounts to the employer, is obtained from the calculation certificate. Details of the list of information included in the calculation certificate are defined in the Order. The calculation certificate form has not been approved at the legislative level. Employers independently develop a form for submission to the institution, subject to indicating the data required for reimbursement. The document must contain information about the amounts:

- Social Insurance Fund debts to the employer at the beginning and end of the period.

- Accrued, additionally accrued, paid and spent insurance premiums by the employer, including the amounts of the last 3 months.

- Refunded, offset and not accepted for offset funds.

- Written off amounts of debt of the employer (policyholder).

If it is necessary to monitor the accuracy of the data, the FSS may request information from the Federal Tax Service.

Sample of filling out the calculation according to Form 4-FSS for 2019

Situation

Rassvet LLC is registered in Moscow. The company employs 5 people. All employees are citizens of the Russian Federation. During 2021, their numbers did not change.

For 2021, employees received wages, which are subject to contributions for injuries in the amount of 1,200,000 rubles, including:

- For October 2021 - 100,000 rubles

- For November 2021 - 100,000 rubles

- For December 2021 - 100,000 rubles

The company applies a rate for accident insurance premiums of 0.2 percent.

Discounts and surcharges to the insurance rate are not established.

The amount of accident insurance premiums accrued for 2021 amounted to 2,400 rubles. Including:

- For October 2021 - 200 rubles

- For November 2021 - 200 rubles

- For December 2021 - 200 rubles

At the end of 2021, a debt amounted to 200 rubles. This is due to the fact that the due date for payment of contributions for December is January 15, 2021.

There were no industrial accidents in the organization in 2021.

Instructions for filling out an interim report

If it happened that you paid amounts to social networks. fear is much higher than the accrued single tariff, you should apply for compensation and draw up an interim report.

- First of all, the necessary package of documents is collected. They must confirm the right to receive compensation, all statements, all transfers (payment documents) must be collected.

- Then a statement is written to the social fund with a request to return the overpaid money. Sometimes insurers require proof of the validity of receiving compensation. All payment documents must be available.

- After everything is collected, you need to start filling out the report (interim). Filling out begins with the title page (the first sheet of the report). In the Reporting period field in the second pair of cells, the current period is indicated.

- Next, enter all information about the organization (TIN, KPP, ORGN, etc.). The last name, first name and patronymic of the merchant must be indicated. This data must correspond to the documentation when registering a commercial structure.

- Then the first section is completed. It consists of several tables into which data on insurance premiums paid for the quarter is entered. When filling out interim reporting, you need to enter the months in which payments were made.

- Information about the number of employees is entered (the average number is taken). The number of registered women is indicated in a separate line.

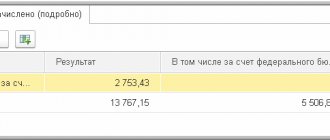

- In Table 2 of Section 1, you need to enter information about the amount accrued according to the single tariff in social networks. fear. and indicate how much was actually paid. When filling out the interim statement, you should pay attention to lines 12, 13, 14. These lines indicate the amount that the social worker owes. fund to the employer. If insurers have already paid compensation, then in line 6 you need to indicate the amount of compensation.

All other data is entered as in the usual 4-FSS statement, which is submitted quarterly.

Fine for violating the deadline for submitting Form 4-FSS

The fine for violating the deadlines for submitting 4-FSS is provided for by Federal Law No. 125-FZ of July 24, 1998. So, if the policyholder does not report to the fund on time, then he faces a fine of 5 percent of the amount of injury premiums accrued for payment for each full or partial month of delay. The maximum fine is 30 percent of the calculated amount of contributions, the minimum is 1 thousand rubles.

For failure to comply with the method of submitting the form electronically, a sanction has also been established - 200 rubles.

In addition, there is administrative liability for violating the deadline for submitting the form: the official can be fined in the amount of 300 to 500 rubles (Part 2 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

What information is included in the sections of the reporting form?

Let's look at the contents of the document columns that are required to be filled out by all hiring companies:

Title

The procedure for filling out 4-FSS in 2021 begins with this section. It contains information about the policyholder:

- name according to the constituent documentation;

- TIN and checkpoint;

- location;

- activity code;

- registration number in the FSS;

- subordination code.

Here they indicate for which quarter of which year the data is presented and who the recipient is. The title deed is certified by the director of the company/private entrepreneur or an authorized representative (in this case, the power of attorney number is written down).

For more information, see “Rules for filling out the title page of Form 4-FSS.”

Table No. 1

The current procedure for filling out 4-FSS for 2021 assumes that the base from which insurance premiums are calculated is calculated here. The accountant’s task is to correctly indicate what is subject to taxation and what is not. Indicate the value of the current tariff, taking into account surcharges and discounts provided by the Social Insurance Fund.

For more information, see “How to fill out Table 1 of Form 4-FSS.”

Table No. 2

This is a direct calculation of the amount of contributions that need to be transferred. The accountant writes down the amount of the existing debt and the amount of liabilities accrued for the current quarter.

For more information, see “Rules for filling out Table 2 of Form 4-FSS.”

Table No. 5

A few words about how to fill out 4-FSS in 2021 in this part: you need to indicate in tabular form the results of a special assessment of working conditions, on which the insurance rate depends.

For more information about this, see “Filling out Table 5 of Form 4-FSS.”