The activities of any organization are reflected in accounting. Accounting (financial) reporting is the main source of information for both internal users (business owners, management, employee associations, etc.) and external users (government agencies, investors, partners, etc.). That is, decisions will be made on the basis of the annual report, development prospects can be judged and current events occurring in the business can be adjusted.

What does an annual financial report consist of?

The composition of the annual financial statements is regulated by Art. 14 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

The annual financial statements consist of a balance sheet, a statement of financial results and appendices thereto.

To applications according to paragraphs. 2, 4 Orders of the Ministry of Finance dated July 2, 2010 No. 66n include:

- Statement of changes in equity;

- Cash flow statement;

- Report on the intended use of funds (for non-profit organizations);

- other applications (explanations).

The forms of annual financial statements are approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. Moreover, both for “ordinary” organizations and for organizations that have the right to use simplified methods of accounting, including simplified accounting (financial) reporting.

When do financial statements need to be submitted?

Accounting statements are provided within three months after the end of the reporting period.

If the reporting is subject to a mandatory audit, the auditor's report is presented in electronic format along with the reporting (or within 10 working days after the date of its signing by the auditors). The deadline for submission is December 31 of the year following the reporting year.

Updated financial statements can be submitted no later than 10 working days from the day following the day of correction or the day of approval of the annual statements. LLCs provide reporting within 10 working days after April 30, JSC - 10 working days after June 30.

According to 247-FZ of July 26, 2021, if changes are made to the statements, they are taken into account in the financial statements of the next period (Federal Law of July 26, 2021 No. 247-FZ).

Simplified accounting reporting

For some organizations, the law provides for the right to use simplified methods of accounting, as well as to prepare simplified financial statements. In paragraph 4 of Art. 6 of the Law “On Accounting” No. 402-FZ lists the following entities:

- organizations classified as small in terms of business volume;

- non-profit structures created in accordance with the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ;

- participants of the Skolkovo project, subject to the Law “On Innovation dated September 28, 2010 No. 244-FZ.

Small businesses include organizations with an average number of employees of up to 100 people and an income not exceeding 800 million rubles. There are also restrictions on the share of participation in the authorized capital of such organizations. You can find out whether your organization is a small or medium-sized business by using the special service of the Federal Tax Service.

For small enterprises, Order No. 66n contains special concessions. In mandatory forms, you can indicate aggregated indicators, combined by groups. These forms are:

- balance;

- income statement;

- report on the intended use of funds.

Those who have the right to simplify reporting have the opportunity to choose whether to use the forms given in the order or develop them themselves.

The importance of indicators when preparing financial statements

Accounting statements must reflect the real situation that exists in a particular organization. In order for the picture to be complete, it is necessary to include in the documentation certain indicators that will give an understanding of the real situation and allow making forecasts and eliminating mistakes made earlier.

It is very important to take an inventory of the assets and liabilities that the organization has. In this case, a detailed analysis is done and information is collected about the funds that are in the organization’s account, about debt, if any, about funds, reserves and shares.

It is also necessary to analyze and enter into the documentation all information about business transactions performed, cash accruals and write-offs. This data should be stored in the company's internal documents. In order to quickly obtain information, the company’s accountant needs to fill out internal documentation in a timely manner and correctly draw up reports and schedules. If the accountant did not do this, the restoration of documentation and information must be entrusted to an outsourcing company, whose specialists have repeatedly performed similar tasks.

Our company provides complete and high-quality accounting support, which includes services for the preparation and restoration of financial statements, and more.

To draw up competent financial statements, it is necessary to reconcile intra-organizational calculations (often mutual settlements occur between departments and divisions, it is important that all of them are justified and verified).

In addition, you need to pay attention to accounts receivable and payable, and if any exist, make a reconciliation. It is also necessary to include in the documentation information about the expenditure of profits received, internal balances, balances of separate divisions, conduct an audit, and enter the final indicators for all parameters into the final reporting.

A lot will depend on the results obtained, in particular, the emergence of further plans for the development of the organization, taking into account the analysis.

What changes in 2021 when preparing the annual report?

From January 1, 2021, in connection with the entry into force of the Federal Law of November 28, 2018 No. 444-FZ “On Amendments to the Federal Law “On Accounting,” the obligation to submit financial statements to Rosstat has been canceled, since the functions of forming and maintaining state information resource for financial statements are assigned to the Federal Tax Service of Russia.

Starting from 2021, all categories of taxpayers will be required to submit annual financial statements for 2021 only in electronic form through electronic document management operators. All financial statements are posted in the public domain on the website nalog.ru in a state information resource containing data on the annual financial statements of organizations.

One of the main criteria for annual financial statements is their reliability. In some cases, the law provides for a mandatory audit of such reporting.

On January 1, 2021, changes to paragraph 1 of Art. 5 of the Federal Law of December 30, 2008 No. 307-FZ “On Auditing Activities”. This paragraph lists cases in which organizations must conduct a mandatory audit of accounting (financial) statements.

In accordance with the changes, a mandatory audit of accounting (financial) statements must be carried out by organizations that meet at least one of the following conditions:

- income received from business activities for the year immediately preceding the reporting year is more than 800 million rubles (income is determined in the manner established by the Tax Code);

- the amount of assets on the balance sheet as of the end of the year immediately preceding the reporting year is more than 400 million rubles.

Let us recall that before the amendments were made, organizations whose revenue exceeded 400 million rubles for the year preceding the reporting year, or the amount of balance sheet assets at the end of the previous reporting year exceeded 60 million rubles, were subject to mandatory audit.

Accounting statements are submitted no later than three months after the end of the reporting year, that is, March 31 (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation).

Formation of accounting policy 2021, FSBU 5/2019 “Inventories” and FSBU 25/2018 “Lease Accounting”, VAT and profit - free webinar from Kontur.Skola. Organize your accounting according to the rules.

Report to statistics

Most companies do not need to submit accounting reports to Rosstat. But there are exceptions.

The obligation to submit annual accounting (financial) statements to statistical authorities is reserved for two groups of subjects.

The first is those whose reports contain information classified as state secrets in accordance with the legislation of the Russian Federation.

The second exception is those against whom foreign states have introduced restrictive measures (Part 7, Article 18, Clauses 5, 6, Part 4, Article 18 of the Accounting Law). Their lists are compiled by the Government.

Administrative responsibility

In accordance with Art. 15.11 of the Code of Administrative Offenses of the Russian Federation for gross violation of accounting requirements, including accounting (financial) reporting, tax authorities have the right to bring officials of organizations to administrative liability.

A gross violation of accounting requirements, including accounting (financial) reporting, means:

- understatement of taxes and fees by at least 10 percent due to distortion of accounting data;

- distortion of any indicator of accounting (financial) statements expressed in monetary terms by at least 10 percent;

- registration of a fact of economic life that has not taken place or an imaginary or feigned object of accounting in the accounting registers;

- maintaining accounting accounts outside the applicable accounting registers;

- preparation of accounting (financial) statements not based on data contained in accounting registers ;

- the economic entity lacks primary accounting documents , and (or) accounting registers, and (or) accounting (financial) statements, and (or) an audit report on the accounting (financial) statements (if the audit of the accounting (financial) statements is mandatory) during the established storage periods for such documents.

In accordance with paragraph 1 of Article 15.11 of the Code of Administrative Offenses, a gross violation of accounting requirements, including accounting (financial) reporting, entails the imposition of an administrative fine on officials in the amount of five thousand to ten thousand rubles.

Repeated commission of this administrative offense shall entail the imposition of an administrative fine on officials in the amount of ten thousand to twenty thousand rubles or disqualification for a period of one to two years.

What is "GIR BO"?

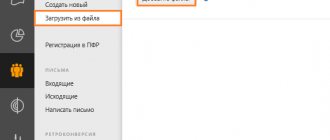

The abbreviation GIR BO stands for “State Information Resource of Accounting Reports.” GIR BO is an online service for financial statements of organizations, as well as audit reports on these statements.

As a general rule, all organizations are required to submit a copy of their financial statements to their tax office.

Who is exempt from this?

- State enterprises

- Bank of Russia

- Religious organizations

- Organizations submitting financial statements to the Bank of Russia

- Organizations whose financial statements contain information related to state secrets

Reorganized and liquidated companies do not send their latest financial statements to the State Investment Inspectorate.

Note!

From May 2021, GIR BO will be available to all users. Thanks to the service, you can obtain free information about the financial statements of any organization. It will also be possible to receive a copy of the reporting signed with an electronic signature of the Federal Tax Service of Russia.

How should financial statements be presented for 2021?

Changes have been made to the reporting procedure due to the introduction of GIR BO.

Accounting reports need to be submitted only to the tax office

Starting from reporting for 2021, you no longer need to submit your balance sheet separately to the tax office and separately to statistics. In accordance with the order of the Federal Tax Service of Russia No. dated November 13, 2021, a mandatory copy of the balance sheet must be submitted only to the Federal Tax Service.

Only small businesses will be able to provide paper reporting

For 2021, only small businesses will be able to report on paper. They are allowed to submit financial statements on paper or via the Internet at their choice.

Organizations that are not small businesses are required to submit reports for 2021 electronically. Electronic reporting formats were approved by Order of the Federal Tax Service of Russia dated November 13, 2021 No. ММВ-7-1/ [email protected]

Important to consider!

Already next year, starting with reporting for 2021, even small businesses will be prohibited from submitting reports on paper. There will be only one delivery format left - electronic via the Internet.

Electronic balance is equal to paper balance

As of reporting for 2021, the electronic balance is equal to the balance drawn up and signed on paper. Now the head of the company can sign a balance sheet printed on paper, or certify an electronic balance sheet with an electronic signature.

Previously, it was believed that the company's balance sheet was drawn up only after the manager signed it on paper. The accounting department was required to keep a paper copy of the balance sheet with the signature of the director (Federal Law of November 28, 2021 No. 444-FZ).

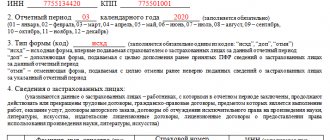

Who is allowed to submit paper 2-NDFL for 2021?

2-NDFL certificates for 2021 can be submitted in paper form only by those employers whose number of employees is up to 10 people inclusive. The Federal Tax Service of Russia mentions this in letter dated December 9, 2021 No. BS-4-11/ [email protected]

Federal Law No. 325-FZ of September 29, 2021 amended the Tax Code. According to the changes, the minimum number of employees at which personal income tax reporting and calculations of insurance premiums must be submitted to the Federal Tax Service in electronic form has been reduced from 25 to 10 people. This means that fewer organizations and individual entrepreneurs will be able to report for 2021 on paper.

Please note that it is also necessary to prepare a register for 2-NDFL certificates.

Can I use old VAT document formats in 2021?

From January 1, 2021, the use of outdated invoice and universal transfer document formats is prohibited.

Let us remind you that there are two types of electronic formats of invoice and universal transfer document (UDD). New formats were approved by order of the Federal Tax Service of Russia dated December 19, 2021 No. ММВ-7-15/ [email protected] Outdated - by order of the Federal Tax Service of Russia dated March 24, 2016 No. ММВ-7-15/ [email protected] Until the end of 2021, obsolete formats was allowed to be used along with new ones.

From January 1, 2021, this cannot be done. Sellers of goods, works and services can only use those formats of VAT documents that are approved by Order No. ММВ-7-15 dated December 19, 2021/ [email protected]

The new formats take into account the VAT rate of 20%. In addition, additional indicators have been introduced into the invoice form: “code of the type of goods in accordance with the unified Commodity Nomenclature of Foreign Economic Activity of the EAEU” and “identifier of the government contract, agreement (agreement) (if any).”

OKVED code: why is it needed?

Tax representatives use the OKVED code in calculating industry average tax burden, average wages, etc. Rosstat uses OKVED for statistical observations.

The financial statements indicate the actual OKVED code. It must correspond to the type of activity that the organization actually engaged in during the reporting year. If the actual OKVED code differs from the OKVED codes specified in the Unified State Register of Legal Entities, the organization must send an application to the inspectorate to make changes to the register.