PBU 3/2006

Registered with the Ministry of Justice of the Russian Federation on January 17, 2007 N 8788

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION ORDER dated November 27, 2006 N 154n ON APPROVAL OF THE ACCOUNTING REGULATIONS “ACCOUNTING FOR ASSETS AND LIABILITIES, THE VALUE OF WHICH IS EXPRESSED IN FOREIGN CURRENCY” PBU 3/2006

(as amended by Orders of the Ministry of Finance of the Russian Federation dated December 25, 2007 N 147n, dated October 25, 2010 N 132n, dated December 24, 2010 N 186n)

In order to improve legal regulation in the field of accounting and financial reporting and in accordance with the Regulations on the Ministry of Finance of the Russian Federation, approved by Decree of the Government of the Russian Federation of June 30, 2004 N 329 (Collection of Legislation of the Russian Federation, 2004, N 31, Art. 3258; N 49, Art. 4908; 2005, N 23, Art. 2270; N 52, Art. 5755; 2006, N 32, Art. 3569; N 47, 4900), I order:1. Approve the attached Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006).

2. Establish that this Order comes into force from the 2007 financial statements.

3. Establish that organizations that are legal entities under the legislation of the Russian Federation (with the exception of credit organizations and budgetary institutions) carry out in their accounting records as of January 1, 2007, recalculation into rubles of the value of funds in settlements expressed in foreign currency (including borrowed obligations) with legal entities and individuals, subject to payment based on the terms of contracts (regardless of the terms of their conclusion) in rubles.

Recalculation is carried out in the manner established by paragraphs 5 and 8 of the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006), and the amounts of increase or decrease in the value of these funds in calculations resulting from the recalculation are credited to the account accounting for retained earnings (uncovered losses).

Minister A.L. KUDRIN Appendix to the Order of the Ministry of Finance of the Russian Federation dated November 27, 2006 N 154n

ACCOUNTING REGULATIONS “ACCOUNTING FOR ASSETS AND LIABILITIES, THE VALUE OF WHICH IS EXPRESSED IN FOREIGN CURRENCY” PBU 3/2006

(as amended by Orders of the Ministry of Finance of the Russian Federation dated December 25, 2007 N 147n, dated October 25, 2010 N 132n, dated December 24, 2010 N 186n)

I. General provisions

1. This Regulation establishes the specifics of the formation in accounting and financial statements of information on assets and liabilities, the value of which is expressed in foreign currency, including those payable in rubles, by organizations that are legal entities under the legislation of the Russian Federation (with the exception of credit organizations and state (municipal) institutions). (as amended by Order of the Ministry of Finance of the Russian Federation dated October 25, 2010 N 132n)

2. This Regulation does not apply:

- when recalculating financial statements compiled in rubles into foreign currencies in cases where such recalculations are required by constituent documents, when concluding loan agreements with foreign legal entities, etc.;

- when including data from the financial statements of subsidiaries (dependent) companies located outside the Russian Federation in the consolidated financial statements prepared by the parent organization.

3. For the purposes of these Regulations, the concepts below mean the following:

- activities outside the Russian Federation - activities carried out by an organization that is a legal entity under the laws of the Russian Federation, outside the Russian Federation through a representative office or branch;

- date of transaction in foreign currency - the day the organization has the right, in accordance with the legislation of the Russian Federation or an agreement, to accept for accounting the assets and liabilities that are the result of this transaction;

- exchange rate difference - the difference between the ruble valuation of an asset or liability, the value of which is expressed in a foreign currency, on the date of fulfillment of payment obligations or the reporting date of a given reporting period, and the ruble valuation of the same asset or liability on the date of its acceptance for accounting in the reporting period or reporting date of the previous reporting period.

II. Conversion of the value of assets and liabilities expressed in foreign currency into rubles

4. The value of assets and liabilities (currency notes in the organization’s cash register, funds in bank accounts (bank deposits), cash and payment documents, financial investments, funds in settlements, including for borrowed obligations, with legal entities and individuals, investments in non-current assets ( fixed assets, intangible assets, etc.), inventories, as well as other assets and liabilities of the organization), expressed in foreign currency, are subject to conversion into rubles for reflection in accounting and financial statements.

5. Conversion of the value of an asset or liability expressed in foreign currency into rubles is carried out at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation.

If, for the recalculation of the value of an asset or liability expressed in foreign currency and payable in rubles, a different rate is established by law or by agreement of the parties, then the recalculation is made at such rate.

6. For accounting purposes, the specified conversion into rubles is made at the rate valid on the date of the transaction in foreign currency. The dates of individual transactions in foreign currency for accounting purposes are given in the appendix to these Regulations.

If there is an insignificant change in the official exchange rate of a foreign currency to the ruble, established by the Central Bank of the Russian Federation, conversion into rubles associated with the performance of a large number of similar transactions in such foreign currency can be carried out at the average rate calculated for a month or a shorter period. (paragraph introduced by Order of the Ministry of Finance of the Russian Federation dated December 25, 2007 N 147n)

7. Recalculation of the value of banknotes at the organization’s cash desk, funds in bank accounts (bank deposits), monetary and payment documents, securities (except for shares), funds in settlements, including for borrowed obligations with legal entities and individuals (except for funds received and issued advances and prepayments, deposits), expressed in foreign currency, in rubles must be made on the date of the transaction in foreign currency, as well as on the reporting date.

Recalculation of the value of banknotes at the organization's cash desk and funds in bank accounts (bank deposits), expressed in foreign currency, can also be carried out as the exchange rate changes.

(clause 7 as amended by Order of the Ministry of Finance of the Russian Federation dated December 25, 2007 N 147n)

8. To prepare financial statements, the value of the assets and liabilities listed in paragraph 7 of these Regulations is recalculated into rubles at the rate in effect on the reporting date.

9. For the preparation of financial statements, the value of investments in non-current assets (fixed assets, intangible assets, etc.), inventories and other assets not listed in paragraph 7 of these Regulations, as well as funds received and issued advances and prepayments, deposits are accepted in the assessment in rubles at the rate in effect on the date of the transaction in foreign currency, as a result of which the specified assets and liabilities are accepted for accounting.

Assets and expenses that were paid by the organization in advance or for the payment of which the organization transferred an advance or deposit are recognized in the accounting records of this organization, assessed in rubles at the rate in effect on the date of conversion into rubles of the funds issued in advance, deposit, prepayment (in part attributable to the advance, deposit, prepayment).

The income of an organization, subject to the receipt of an advance, deposit, prepayment, is recognized in the accounting records of this organization in rubles at the rate in effect on the date of conversion into rubles of the received advance, deposit, prepayment (in the part attributable to the advance, deposit, prepayment ).

(clause 9 as amended by Order of the Ministry of Finance of the Russian Federation dated December 25, 2007 N 147n)

10. Recalculation of the value of investments in non-current assets, assets listed in paragraph 9 of these Regulations, as well as funds received and issued advances, prepayments, deposits after their acceptance for accounting due to changes in the exchange rate is not carried out. (clause 10 as amended by Order of the Ministry of Finance of the Russian Federation dated December 25, 2007 N 147n)

III. Accounting for exchange rate differences

11. Accounting and financial statements reflect exchange rate differences arising from:

- operations for full or partial repayment of receivables or payables denominated in foreign currency, if the exchange rate on the date of fulfillment of payment obligations differed from the rate on the date of acceptance of these receivables or payables for accounting in the reporting period or from the rate on the reporting date in which these receivables or payables were restated last time;

- operations to recalculate the value of assets and liabilities listed in paragraph 7 of these Regulations.

12. Exchange rate differences are reflected in accounting and financial statements in the reporting period to which the date of fulfillment of payment obligations relates or for which the financial statements were compiled.

13. Exchange differences are subject to credit to the financial results of the organization as other income or other expenses (except for the cases provided for in paragraphs 14 and 19 of these Regulations or other regulatory legal acts on accounting). (as amended by Orders of the Ministry of Finance of the Russian Federation dated December 25, 2007 N 147n, dated December 24, 2010 N 186n)

14. Exchange rate differences associated with settlements with founders on deposits, including in the authorized (share) capital of an organization, are subject to credit to the additional capital of this organization.

IV. Accounting for assets and liabilities used by an organization to conduct activities outside the Russian Federation

15. To prepare financial statements, the value of assets and liabilities expressed in foreign currency, used by the organization to conduct activities outside the Russian Federation, is subject to conversion into rubles.

The specified conversion into rubles is carried out at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, except for the cases listed in paragraph 18 of these Regulations.

16. Conversion of the value of assets and liabilities expressed in foreign currency, listed in paragraph 7 of these Regulations and used by the organization to conduct activities outside the Russian Federation, into rubles is carried out at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, effective for the reporting period. date.

17. Conversion of the value of assets and liabilities expressed in foreign currency, listed in paragraph 9 of these Regulations and used by the organization to conduct activities outside the Russian Federation, into rubles is carried out at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, on the date of the transaction transactions in foreign currency, as a result of which these assets and liabilities were accepted for accounting.

Recalculation of the value of assets and liabilities listed in paragraph 9 of these Regulations, made in accordance with the legislation or rules of a foreign state - the place where the organization conducts its activities outside the Russian Federation, is carried out at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, effective on the date of the said recount.

18. Recalculation of income and expenses expressed in foreign currency that form financial results from the organization’s activities outside the Russian Federation into rubles is carried out using the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, in effect on the corresponding date of the transaction in a foreign currency. currency, or using the average exchange rate calculated as a result of dividing the sum of the products of the official exchange rates of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, and the days of their validity in the reporting period by the number of days in the reporting period.

19. The difference arising as a result of the recalculation of the value of the assets and liabilities of the organization, expressed in foreign currency, used to conduct activities outside the Russian Federation, into rubles, is reflected in the accounting of the reporting period for which the organization’s financial statements are prepared.

The specified difference is subject to crediting to the additional capital of the organization. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 24, 2010 N 186n)

When an organization ceases its activities outside the Russian Federation (in whole or in part), part of the additional capital corresponding to the amount of exchange rate differences related to the discontinued activities is added to the financial result of the organization as other income or other expenses. (paragraph introduced by Order of the Ministry of Finance of the Russian Federation dated December 24, 2010 N 186n)

V. The procedure for generating accounting and reporting information on transactions in foreign currency

20. Entries in accounting registers for accounts of assets and liabilities, the value of which is expressed in foreign currency, are made by an organization operating both on the territory of the Russian Federation and abroad, in rubles.

The specified entries for assets and liabilities listed in paragraph 7 of these Regulations are simultaneously made in the currency of settlements and payments.

Accounting statements are prepared in rubles.

In cases where the legislation or rules of the country where the organization conducts its activities outside the Russian Federation require the preparation of financial statements in a different currency, then the financial statements are also prepared in this foreign currency.

21. Exchange differences are reflected in accounting separately from other types of income and expenses of the organization, including financial results from transactions with foreign currency.

22. The financial statements disclose:

- the amount of exchange rate differences arising from transactions of recalculation of the value of assets and liabilities expressed in foreign currency, subject to payment in foreign currency;

- the amount of exchange rate differences resulting from transactions of recalculation of the value of assets and liabilities expressed in foreign currency, payable in rubles;

- the amount of exchange rate differences credited to accounting accounts other than the account of the financial results of the organization;

- the official exchange rate of foreign currency to the ruble, established by the Central Bank of the Russian Federation, as of the reporting date. If, for the recalculation of the value of assets or liabilities expressed in foreign currency and payable in rubles, a different rate is established by law or by agreement of the parties, then such rate is disclosed in the financial statements.

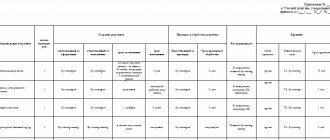

Appendix to the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006), approved by Order of the Ministry of Finance of the Russian Federation dated November 27, 2006 N 154n

List of dates for individual transactions in foreign currency

| Transaction in foreign currency | The date of the transaction in foreign currency is considered |

| Transactions on bank accounts (bank deposits) in foreign currency | The date of receipt of funds to the bank account (bank deposit) of the organization in foreign currency or their debiting from the bank account (bank deposit) of the organization in foreign currency |

| Cash transactions with foreign currency | The date of receipt of foreign currency, monetary documents in foreign currency at the organization’s cash desk or their issuance from the organization’s cash desk |

| Income of the organization in foreign currency | Date of recognition of the organization's income in foreign currency |

| Organizational expenses in foreign currency, including: | Date of recognition of the organization's expenses in foreign currency |

| import of inventories | date of recognition of expenses for the acquisition of inventories |

| import services | date of recognition of expenses for the service |

| expenses related to business trips and business trips outside the territory of the Russian Federation | date of approval of the advance report |

| Investments of an organization in foreign currency in non-current assets (fixed assets, intangible assets, etc.) | Date of recognition of costs forming the cost of non-current assets |

I. General provisions

1. This Regulation establishes the specifics of the formation in accounting and financial statements of information on assets and liabilities, the value of which is expressed in foreign currency, including those payable in rubles, by organizations that are legal entities under the legislation of the Russian Federation (with the exception of credit organizations and budgetary institutions).

2. This Regulation does not apply:

- when recalculating financial statements compiled in rubles into foreign currencies in cases where such recalculations are required by constituent documents, when concluding loan agreements with foreign legal entities, etc.;

- when including data from the financial statements of subsidiaries (dependent) companies located outside the Russian Federation in the consolidated financial statements prepared by the parent organization.

3. For the purposes of these Regulations, the concepts below mean the following:

- activities outside the Russian Federation - activities carried out by an organization that is a legal entity under the laws of the Russian Federation, outside the Russian Federation through a representative office or branch;

- date of transaction in foreign currency - the day the organization has the right, in accordance with the legislation of the Russian Federation or an agreement, to accept for accounting the assets and liabilities that are the result of this transaction;

- exchange rate difference - the difference between the ruble valuation of an asset or liability, the value of which is expressed in a foreign currency, on the date of fulfillment of payment obligations or the reporting date of a given reporting period, and the ruble valuation of the same asset or liability on the date of its acceptance for accounting in the reporting period or reporting date of the previous reporting period.

III. Accounting for exchange rate differences

11. accounting and financial statements reflect exchange rate differences arising from:

- operations for full or partial repayment of receivables or payables denominated in foreign currency, if the exchange rate on the date of fulfillment of payment obligations differed from the rate on the date of acceptance of these receivables or payables for accounting in the reporting period or from the rate on the reporting date in which these receivables or payables were restated last time;

- operations to recalculate the value of assets and liabilities listed in paragraph 7 of these Regulations.

12. Exchange rate differences are reflected in accounting and financial statements in the reporting period to which the date of fulfillment of payment obligations relates or for which the financial statements were compiled.

13. Exchange differences are subject to credit to the financial results of the organization as other income or other expenses (except for the cases provided for in paragraph 14 of these Regulations or other regulatory legal acts on accounting). (as amended by Order of the Ministry of Finance of the Russian Federation dated December 25, 2007 No. 147n)

14. Exchange rate differences associated with settlements with founders on deposits, including in the authorized (share) capital of an organization, are subject to credit to the additional capital of this organization.

V. The procedure for generating accounting and reporting information on transactions in foreign currency

20. Entries in accounting registers for accounts of assets and liabilities, the value of which is expressed in foreign currency, are made by an organization operating both on the territory of the Russian Federation and abroad, in rubles. The specified entries for assets and liabilities listed in paragraph 7 of these Regulations are simultaneously made in the currency of settlements and payments. Accounting statements are prepared in rubles. In cases where the legislation or rules of the country where the organization conducts its activities outside the Russian Federation require the preparation of financial statements in a different currency, then the financial statements are also prepared in this foreign currency.

21. Exchange differences are reflected in accounting separately from other types of income and expenses of the organization, including financial results from transactions with foreign currency.

22. The financial statements disclose:

- the amount of exchange rate differences arising from transactions of recalculation of the value of assets and liabilities expressed in foreign currency, subject to payment in foreign currency;

- the amount of exchange rate differences resulting from transactions of recalculation of the value of assets and liabilities expressed in foreign currency, payable in rubles;

- the amount of exchange rate differences credited to accounting accounts other than the account of the financial results of the organization; the official exchange rate of foreign currency to the ruble, established by the Central Bank of the Russian Federation, as of the reporting date. If, for the recalculation of the value of assets or liabilities expressed in foreign currency and payable in rubles, a different rate is established by law or by agreement of the parties, then such rate is disclosed in the financial statements.

Appendix to the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006), approved by Order of the Ministry of Finance of the Russian Federation dated November 27, 2006 No. 154n

List of dates for individual transactions in foreign currency

| Transaction in foreign currency | The date of the transaction in foreign currency is considered |

| Transactions on bank accounts (bank deposits) in foreign currency | The date of receipt of funds to the bank account (bank deposit) of the organization in foreign currency or their debiting from the bank account (bank deposit) of the organization in foreign currency |

| Cash transactions with foreign currency | The date of receipt of foreign currency, monetary documents in foreign currency at the organization’s cash desk or their issuance from the organization’s cash desk |

| Income of the organization in foreign currency | Date of recognition of the organization's income in foreign currency |

| Organizational expenses in foreign currency | Date of recognition of the organization's expenses in foreign currency |

| including: | |

| import of inventories | date of recognition of expenses for the acquisition of inventories |

| import services | date of recognition of expenses for the service |

| expenses related to business trips and business trips outside the territory of the Russian Federation | date of approval of the advance report |

| Investments of an organization in foreign currency in non-current assets (fixed assets, intangible assets, etc.) | Date of recognition of costs forming the cost of non-current assets |