Staffing table for 2021: sample filling

- structure, staffing and number of employees;

- list of structural divisions (if any);

- names of positions, specialties, professions indicating qualifications, information on the number of staff units and official salaries (see, for example, the decision of the Ussuriysky District Court of Primorsky Krai dated November 20, 2017 in case No. 2-5392/2017).

Other sanctions are possible for the absence or failure to provide the “staffing” at the request of the controllers.

For example, tax authorities can issue a fine of 200 rubles. on the basis of Article 126 of the Tax Code of the Russian Federation, if the organization or individual entrepreneur does not present this document. In addition, there will be additional tax charges due to the fact that certain expenses or amounts of insurance premiums turn out to be unconfirmed. It is necessary to issue an order or instruction from the employer to approve the staffing table. This order is drawn up in any form. It should have made it clear what kind of staffing schedule is being adopted and from what date it will be put into effect. In this regard, it is advisable to formalize the approved staffing table as an appendix to the order.

The staffing table is an important document that every employer (organization or individual entrepreneur) should have. The lack of staff can result not only in fines for violation of labor laws, but also in problems during tax and other audits. Read our article about how to create, approve or change the staffing schedule in 2021.

The period during which changes must be made to the staffing table in connection with changes in the company structure has not been established. However, you must remember that on the basis of this document, information is indicated in employment contracts and work books. Therefore, the updated staffing table must be entered in advance, that is, before the dates for drawing up an employment contract or making an entry in the work book.

Answer: According to the Letter of Rostrud dated April 27, 2011 No. 1111-6-1, it is impossible. This may result in fines for violating labor laws. If you need to indicate a different salary, you can use the inclusion of incentive or compensation bonuses in the HR for one of the employees. You can also change job titles, for example: “manager” to “senior manager”, but each should have its own job description.

The first thing to do is indicate the name of the company. It must match the one written on the registration certificate. If the “name” contains Latin letters or words, then this should be indicated. If the registration document contains a short and full name, then any of them can be entered into the ShR.

1. From July 1, 2021, the following positions at Aphrodite LLC will be reduced: - programmer, 2 pcs. units; — web designer, 1 pc. units. 2. HR manager Nikolaeva E.A. notify the employees of Aphrodite LLC about the upcoming termination of the employment contract with them due to the reduction of individual staff positions and offer them the vacant positions available in the organization. 3. HR manager Nikolaeva E.A. together with legal assistant Romanova A.P. by July 1, 2021, formalize the procedure for reducing individual staff positions in the manner established by labor legislation. 4. HR manager Nikolaeva E.A. by July 1, 2021, draw up a new staffing table for Aphrodite LLC.

Column 1. Here you need to enter the name of the structural unit. These include workshops, departments, and branches. It is more convenient to indicate divisions in a document in a hierarchical order. For example, first of all, indicate the administration, legal department, accounting, personnel department, that is, those departments that deal with general management. Next are the departments that carry out the main tasks of the enterprise, for example, production, sales department, etc. Units performing auxiliary or service tasks are listed last. For example, these are warehouses, the supply department.

If a company introduces a new staffing unit, then in this case the staffing table itself should be changed. For this purpose, the manager also issues an order to introduce a new position. The procedure begins with drawing up a memo on the introduction of a new staff position to the employer. It is compiled by the head of the department where a new staff unit is needed. The note must provide all the justifications for this decision, and must also include statistical information confirming the feasibility of the changes, and a job description for the future employee.

Why prepare a staffing table in an organization, since the names of specific employees are not included in it? The essence of this document is control over the structure of the enterprise, the number of employees and the size of the salary fund. To know which positions are occupied by specific employees (indicating their full names), a staffing table is maintained, which is formed for a local branch or for the entire structure of the enterprise.

The staffing table, or shtatka, is a necessary internal regulatory act that determines the composition of the organization’s employees, indicating their positions and salaries. Before filling out the staffing table, it is necessary to have a clear understanding of the sequence of production processes and the number of divisions of the organization. For this purpose, the structure of the organization is first developed, which gives an idea of the composition and relationship of the internal links of the enterprise: workshops, sections, departments, bureaus, laboratories and other divisions that make up a single economic entity. The structure does not indicate the number of staff positions and the amount of salary; there is a staff for this.

- list of structural units in the order of their subordination;

- names of positions taking into account subordination within a department, workshop, etc. (for example, chief accountant, deputy chief accountant, leading accountant, accountant);

- information about qualifications (for example, category 2 metrology engineer, category 5 milling operator, etc.);

- information about the number of bets;

- salary, hourly rate in accordance with the current remuneration system;

- types and amounts of surcharges and allowances.

Staffing table

- It describes the structure of the company, departments, divisions. By looking into it, you can immediately get an idea of the system of divisions of the company.

- It contains information about the total number of employees in the entire company, in each division, and about how many staff units there are for each position.

- Provides information about what wage system was adopted by the personnel of each department, workshop, etc.

- Sets the amounts of allowances for staff.

- Using this paper, you can easily track the number of vacant positions.

We recommend reading: Maternity Capital Guarantee

How to approve the company's staffing table

Answer: According to Letter of Rostrud dated April 27, 2021 No. 1111-6-1, it is impossible. This may result in fines for violating labor laws. If you need to indicate a different salary, you can use the inclusion of incentive or compensation bonuses in the HR for one of the employees. You can also change job titles, for example: “manager” to “senior manager”, but each should have its own job description.

The document is necessary for individual entrepreneurs and organizations of all forms of ownership that have hired employees. It is not drawn up only in cases where the organization has one manager, people work under civil contracts, or an individual entrepreneur independently carries out its activities without involving employees.

Top 8 mistakes when drawing up staffing schedules

- Correctly: when indicating salaries in the staffing table for positions of the same name, the salary amounts should be determined to be the same. The so-called above-tariff part of wages (bonuses, additional payments and other payments) may be different for different workers, including depending on qualifications, complexity of work, quantity and quality of work (Letter of Rostrud dated 04/27/2011 No. 1111-6-1) .

If employees assigned positions with the same titles have different job responsibilities and include additional responsibilities and workload, then this can serve as proof for the employer that the different salaries are set reasonably.

- How correct . The staffing table is an organizational and administrative document that clearly gives an idea of what positions and professions the employer is in need of.

- If “outside the state,” then we are only talking about concluding a GPC agreement.

Example: in a subject, the minimum wage is 12,130 rubles. If in column 5 “Tariff rate (salary), etc., rub.” indicate a salary of 10,000 rubles, but at the same time in column 7 of the staffing table - an allowance of 3,000 rubles, then in total it is clear that the employee’s salary is not lower than the minimum amount. This situation is legitimate. Otherwise, there may be claims from regulatory authorities.

Example : the head of a branch is given the right to personally approve the staffing table due to the fact that the branch carries out all the functions of a legal entity. In order to avoid claims from regulatory authorities, it is necessary to indicate in the “Name of organization” column of the staffing table the name of the parent organization, and not the branch. In this case, the name of the branch must be reflected in the “Structural division” column.

Is staffing required for individual entrepreneurs in 2021?

It is allowed to independently develop the document form, but most often it is recommended to use the approved T-3 form. It is not dogmatic and can be supplemented as necessary by commercial entities to reflect all the information required in the document.

Importance of the document

Is staffing required for individual entrepreneurs? It is desirable, because if an entrepreneur employs 2 or more people, then he will need to enter into an employment contract with them, which will indicate qualification requirements and salary.

An employment contract concluded in Russia in 2021 is distinguished by the following features: The employee occupies a specific position and works permanently. He submits to the manager and carries out his orders, takes into account the requirements of the work schedule and work schedule.

We recommend reading: 120-oz your home if you are over 35 years old refused

The employer and employee can agree to include in the contract other clauses that could be related to the specifics of the enterprise’s activities. Procedure for registering a part-time employee Document Comment Application In the employment application, the applicant indicates the name of the company, personal information of the employer (full name), his initials, registration address, a request for employment in a specific unit for a specific position on a part-time basis.

How to draw up a part-time employment contract correctly

In column 5 “Tariff rate (salary), etc.” The staffing table indicates the full salary (full rate), without taking into account the regional coefficient. When hiring a new employee, there is no need to redo the staffing table if it initially contains the positions (number of positions) of the required employees. If you hire employees, but there is no staffing table corresponding positions, then you need to either issue a new staffing table or make changes to the old one. Changes to the staffing table can be made at any time when there is a need for it. Frequency and periodicity

Part-time, working hours: five-day work week with two days off (Saturday, Sunday), 4 hours a day. Payment is proportional to the time worked based on the salary specified in this order.

What are the staffing rates and what are their differences depending on the form of remuneration?

The desire to reduce the number of papers in an enterprise should not affect documents vital to the organization. Therefore, a personnel officer or accountant who has received a task from management to draw up a staffing table needs to understand that this is a safety net, first of all, for the company, and not a waste of time. When starting to draw up a new local act of an enterprise, many are faced with problems in reflecting salaries, rates and additional payments for individual positions.

The concept of “rates” most often refers to the salary for a full working month (usually for a 40-hour work week). It is not always so. In column 5 of the standard T-3 form, which the enterprise can modify at its discretion or even replace with its own form, it is necessary to reflect the amount of payment for each specific specialist, in accordance with the wage regulations or the collective agreement.

As a result, in the staffing table in the “Number of staffing units” section there may be not only whole numbers, but also fractions. Each whole unit means that the enterprise requires that the duties in this specialty be performed full time during the entire work week.

The staffing table is a list of specialist rates required for the company at the moment , with fixation of the main provisions for remuneration of hired persons. It includes absolutely all positions for which it is planned to hire workers on various conditions (full-time, part-time, internal, full-time and part-time).

- for those who must work standard hours per month (for example, 8 hours a day, 5 days a week) - the full salary for one staff unit per month in monetary terms;

- for piecework payment - the amount of remuneration for performing a certain amount of work;

In situations where the staffing table is filled out in the form provided by the employer, he himself determines the procedure for recording employees in it, working part-time or generally during a part-time or part-time work week. That is, it is permissible to use separate columns or even sections of the staffing table to record such categories of employees, as well as indicating the salary specifically taking into account part-time work for the categories of employees in question.

First of all, it is necessary to understand that the very fact of working part-time must be reflected in the employment contract with the employee. But the procedure for filling out the staffing table will differ, depending on how exactly this document is maintained at the enterprise. In general, two different approaches can be distinguished here:

The question of how to reflect 0.5 pay rates in the staffing table - that is, part-time employment of an employee - is extremely relevant for many modern Russian employers and HR specialists. Despite the apparent complexity of this issue, part-time positions in the staffing table are reflected in most cases in the same way as the position of an employee working on the principle of full-time employment. A sample staffing table for 0.5 staff can help you draw up documentation correctly.

Part-time work is now a fairly common solution for many workers and employers. For example, when there is no need for a full-time specialist, or when a position can easily be filled by an external or internal part-time worker, this is the approach that is used. You can read more about how part-time work is ensured in a separate article. Next, we will consider the specific features of drawing up personnel documentation when employing part-time workers.

The staffing table is a depersonalized document. That is, it indicates specific positions, regardless of which employee actually occupies them.

- In accordance with these principles, each part-time position is indicated in the staffing table as a full-time position.

- In the column “Number of staff units” a fractional value is indicated if the position involves the employment of only one part-time employee.

- The “Salary” column must indicate the total salary in the same amount as it would be if working full time.

This site is not a mass media outlet. As a printed media outlet, the HR Directory magazine is registered by the Federal Service for Supervision of Communications, Information Technologies and Mass Media (Roskomnadzor), registration certificate PI No. FS77-64204 dated 12/31/2015

Well, for an individual entrepreneur, this work is performed by a personnel officer, an accountant (if there are any on staff), or directly by the entrepreneur himself. Changing the staffing table, increasing salaries As is known, the Labor Code does not allow changes in workers' wages downwards (except for the situations specified in Article 74

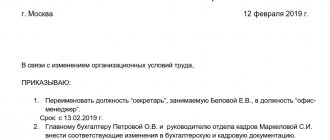

Limited Liability Company "Stroitel" ORDER No. 2-ShR dated January 21, 2015 On introducing changes to the content of the staffing table No. ShR-1, approved by Order No. 1 dated April 1, 2014. In connection with the change in the scope of work performed, I ORDER: To make the following changes to the content of the staffing table No. ШР-2: 1.

The length of the working week is indicated, and specific time frames for the working day are given, as well as time for rest and food; The salary (or rate) is indicated for the full rate, as reflected in the staffing table, and a note is made that the employee is paid in proportion to the time worked.

If a full-time employee has piecework wages and the amount of the monthly payment cannot be determined in advance, the phrase “Piecework wages” is entered in the column. We draw attention to the amount of salaries, tariff rates for the same names and qualifications of professions and positions.

How to reflect in the staffing table 0

- The staffing table is a depersonalized document. That is, it indicates specific positions, regardless of which employee actually occupies them.

- In accordance with these principles, each part-time position is indicated in the staffing table as a full-time position.

- In the column “Number of staff units” a fractional value is indicated if the position involves the employment of only one part-time employee.

- The “Salary” column must indicate the total salary in the same amount as it would be if working full time.

How to reflect 0.5 rates in the staffing table - general principles

First of all, it is necessary to understand that the very fact of working part-time must be reflected in the employment contract with the employee. But the procedure for filling out the staffing table will differ, depending on how exactly this document is maintained at the enterprise. In general, two different approaches can be distinguished here:

We recommend reading: How they now compensate Chernobyl survivors for rent

Familiarization with the staffing table of employees is carried out only if this obligation of the employer is secured by a collective agreement, agreement, or local regulatory act (letter of Rostrud dated May 15, 2021 No. PG/4653-6-1).

When reducing staff or numbers, or changing salaries, changes are also made to the staffing table, but it must be taken into account that the date of entry into force of the changes cannot occur earlier than 2 months after the issuance of the order. This is due to the fact that employees must be notified 2 months in advance about the upcoming layoff (Part 2 of Article 180 of the Labor Code of the Russian Federation) or about upcoming changes in the terms of employment contracts.

How to fill out a staffing table: sample and example

Column 3 of the staffing table contains the name of the position, specialty, profession, which are indicated in the nominative case without abbreviations. The name of the position or profession is assigned by the employer, if the work is not associated with difficult working conditions and the provision of benefits, otherwise, when indicating the position in the staffing table, you need to be guided by:

If a woman on maternity leave wants to return to work before the child reaches the age of 3 years, she must be hired, even if her position is deleted from the staffing table.

- salaries were increased for all employees of one division or company without exception, then calculate the increase factor and increase earnings by it when calculating vacation pay;

- Since salaries were increased for individual employees, there is no need to calculate the increase factor and index the average earnings to it to calculate vacation pay.

Only a vacant position can be deleted from the staffing table

We are conducting an audit of a company where there is an order to change the staffing table due to the introduction of several new positions and an increase in salaries for old positions. How to correctly calculate vacation pay - taking into account the employee’s average earnings, increased by an increase factor, or not?

- at the request of a pregnant woman at any stage of pregnancy;

- at the request of an employee who is forced to care for a sick family member (medical documents are provided as evidence);

- at the request of the mother, father, legal representative of a child under 14 years of age or minor children with disabilities.

Accountant's Directory

To avoid questions from inspection bodies and employee complaints of discrimination, do not set different salaries for the same position (Article 2 of the Labor Code of the Russian Federation). If you want to pay a part-time worker a higher salary, enter categories by position into the staffing table or set a salary bonus.

The contents of the order must comply with the terms of the contract. This is stated in Part 1 of Article 68 of the Labor Code of the Russian Federation. For persons with whom the organization will enter into civil contracts (contracts, paid services, etc.), admission orders are not needed. Labor legislation does not apply to them (Article 11 of the Labor Code of the Russian Federation).

That is, the staffing table can initially establish the work of a part-time worker by indicating not “1”, but “0.5” for this position. Details in the materials of the Personnel System: As a general rule, in the staffing table it is necessary to indicate all staff units (including part-time ones), regardless of who they will be occupied subsequently: part-time workers or main part-time employees. The main employee can also receive half the rate, for example, in the case of combining professions (positions) (Part 2 of Article 60.2 of the Labor Code of the Russian Federation).

Any company has a certain official composition, fixed by a special document, which, as is known, is called the staffing table. By making adjustments to it, management manages the company, debugging the remuneration system and optimizing the organizational structure.

Life is beautiful!)) qKadr Russian Federation, Moscow #3 August 27, 2013, 10:27 I want to draw the moderator’s attention to this message because: A notification is being sent... “You’re not fat, I’m telling you!” Take two chairs and sit down with us!” Mamawka Russia, Taganrog #4 August 27, 2013, 10:28 Write the number of staff units as 0.5, Tariff rate (salary), etc. for example 5000 rubles. (rate) Total, 2500 rubles (0.5 of the rate). This is if there are no allowances. Form T-3 is available on the internet. I want to draw the moderator's attention to this message because: A notification is being sent...

What are the staffing rates and what are their differences depending on the form of remuneration?

The desire to reduce the number of papers in an enterprise should not affect documents vital to the organization. Therefore, a personnel officer or accountant who has received a task from management to draw up a staffing table needs to understand that this is a safety net, first of all, for the company, and not a waste of time. When starting to draw up a new local act of an enterprise, many are faced with problems in reflecting salaries, rates and additional payments for individual positions.

As a result, in the staffing table in the “Number of staffing units” section there may be not only whole numbers, but also fractions. Each whole unit means that the enterprise requires that the duties in this specialty be performed full time during the entire work week.

The staffing table is a list of specialist rates required for the company at the moment , with fixation of the main provisions for remuneration of hired persons. It includes absolutely all positions for which it is planned to hire workers on various conditions (full-time, part-time, internal, full-time and part-time).

The concept of “rates” most often refers to the salary for a full working month (usually for a 40-hour work week). It is not always so. In column 5 of the standard T-3 form, which the enterprise can modify at its discretion or even replace with its own form, it is necessary to reflect the amount of payment for each specific specialist, in accordance with the wage regulations or the collective agreement.

- with the exclusion of vacancies due to organizational changes in the company’s work;

- introducing new staffing positions if business expansion is necessary;

- reduction of staffing units associated with a reduction in numbers or staff;

- changes in salaries;

- renaming departments, names of structural units, etc.

It is advisable to develop and formalize a staffing table at the very beginning of the company’s activities. But if you forgot to approve the schedule, this can be done at any time during the existence of the business and approved again at least every month. Or make the necessary changes to an existing one on the basis of a special order.

When defining professions and positions, you cannot take their names, as they say, “out of thin air.” You should adhere to the names contained in qualification reference books or approved professional standards. Moreover, in some cases this is mandatory: Article 57 of the Labor Code of the Russian Federation stipulates that if any positions, specialties or professions are related to the provision of compensation and benefits or the presence of contraindications, then their names must strictly coincide with the names and requirements from regulatory documents , i.e. professional standards and reference books. Similar requirements apply to specialists who have early retirement benefits. In this case, you should be guided by lists 1 and 2 of industries, works, professions and indicators that give the right to preferential pension provision (Resolution of the USSR Cabinet of Ministers of January 26, 1991 No. 10 and Resolution of the USSR Council of Ministers of August 22, 1956 No. 1173). If these requirements are neglected, then an employee whose work record book actually indicates a fictitious profession will have problems when applying for a pension. And entries in the labor record are made only in accordance with the staffing table and the employment order.

The document is drawn up by any official of the organization to whom such powers are delegated (manager, accountant, human resources specialist). When drawing it up, be sure to rely on labor legislation and internal regulations of the company, for example:

Another difficulty arises when the SR form indicates not a profession or position, but a specific type of work. This issue is not regulated by law, but in practice, employers are often forced to indicate the type of work in order to avoid problems when confirming a reduction in staff or number of employees. This is necessary when there are such positions in the organization. In this case, use the Procedure for using unified forms of primary accounting documentation, approved by Decree of the State Statistics Committee of Russia dated March 24, 1999 No. 20. This document states that the management of the organization has the right to issue an order (instruction) and indicate all additional details to be entered in Form T -3. If the organization uses only types of work and the number of employees is small, the ShR is allowed not to be compiled.

What will happen if you do not draw up this document? It may be required during a tax or labor audit. And if the employer does not provide it, this may be regarded as a violation of labor law. It is punishable under Article 5.27 of the Code of Administrative Offenses with the following fines :

All data is indicated without abbreviations, in accordance with the names in the structure of the enterprise. If there is no separate structure, then the columns are filled in alphabetically or in descending order of the number of employees in the departments. The codes of structural units must also correspond to the structure of the organization. If it is absent, codes are assigned in accordance with the order in which the divisions are located in the table.

1. Approve staffing schedule No. 3-ShR dated December 30, 2021 in the amount of 35 staff units and a monthly wage fund in the amount of 1,238,000 (one million two hundred thirty-eight thousand) rubles. 2. Introduce document No. 3-ШР dated December 30, 2021 into operation from January 1, 2021. 3. Control over the implementation of this order is entrusted to the HR manager Nikolaeva E.A.

The staffing table (SHR or in common parlance - “shtatka”) contains a list of structural units, the names of positions, specialties, professions indicating qualifications, as well as information on the number of positions (Decree of the State Statistics Committee of January 5, 2004 No. 1). The same resolution also approved the unified form No. T-3, which is installed in all personnel accounting software products and, as a rule, is used by organizations and entrepreneurs.

For the document in question, there is a T-3 form , approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1. However, the legislation does not establish strict rules for the formation of this document. According to letters of Rostrud dated 01/09/2013 No. 2-TZ, dated 01/23/2013 No. PG/409-6-1, dated 05/15/2021 No. PG/4653-6-1, commercial organizations and entrepreneurs-employers You are not required to use Form T-3. If necessary, you can supplement it with lines and columns or develop your own form based on it. But it is impossible to remove any details from the approved form (Resolution of the State Statistics Committee of Russia dated March 24, 1999 No. 20).

Transfer of a part-time employee: how to register

Employment of employees at 0.5 wages is not prohibited by labor legislation. At the same time, it is important for the employer to take into account a number of mandatory restrictions and correctly document this procedure. In our material you will find the necessary tips for this personnel situation, learn how to calculate the salary and duration of vacation for an employee transferred to part-time.

Average earnings are calculated according to the general rule - the average daily earnings are used, calculated by dividing the amount of wages actually accrued for days worked in the billing period (including bonuses and remunerations) by the number of days actually worked during this period.

Example. The salary of the accountant of Progress LLC Tomilina N. E. is 32,000 rubles. From July 2021, at her personal request, expressed in the application, the employee was transferred to part-time work at 0.5 times the rate. From this moment on, her monthly salary will be: 32,000 rubles. x 4 hours /8 o'clock = 16,000 rubles or 32,000 rubles. x 0.5 bet = 16,000 rub.

- establishes categories of employees for whom the employer cannot refuse a request for transfer to part-time (Part 2 of Article 93 of the Labor Code of the Russian Federation);

- stipulates the conditions and circumstances of the legal transfer of employees to part-time work at the initiative of the employer (Article 74 of the Labor Code of the Russian Federation).

There is one exception in relation to employees transferred at a personal request to 0.5 rates and belonging to the category of employees who cannot be denied this. The period of their work in part-time mode is limited to the period of preferential circumstances (Part 2 of Article 93 of the Labor Code of the Russian Federation).

- Overall change. It is assigned a new registration number and ratified by order (instruction).

- Selective change. Should be registered in an order or instruction. This method is possible if the adjustments are not significant.

Labor legislation does not contain a direct requirement for commercial sector employers to draw up a staffing table. However, despite this, it is better to draw up a “staff”. After all, the staffing table contains complete information about the organization’s human resources and the monthly wage fund (Article 57 of the Labor Code of the Russian Federation, section 1 of the instructions, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1).

In the column “Number of staff units” the number of employees who must be hired for this position is entered. If it also provides for the admission of part-time workers, then their number is written in a fractional expression corresponding to the size of the paid rate - for example, 0.5.

If the organization has hired employees, then the staffing table must be drawn up and approved in accordance with all the rules. In this article we tell you which form should be used for the staffing table, how to fill out each section and how to make changes.

A staffing unit is understood as a job unit established by the staffing table of an enterprise. According to Article 284 of the Labor Code, a part-time worker can work no more than 16 hours a week. If your company pays day on the 1st or 2nd, you will have to pay the April salary early on April 28th.