It is the responsibility of all employers who are policyholders to fill out and submit the DAM form to government agencies. The document has a certain structure. You must enter information into the form taking into account a number of rules. Many employers have a number of questions when filling out the form. For example, not everyone knows whether dismissed employees should be displayed in the DAM. To answer this question, you need to refer to the current regulatory documents governing this area.

Is it necessary to show in the DAM employees who were laid off in the last quarter or half of the year?

RSV stands for calculation of insurance premiums. Employers must complete this form regularly and submit it to government agencies. Many managers are interested in whether to include dismissed employees in the DAM.

The answer to this question can be found in letter of the Federal Tax Service No. BS-4-11/4859 dated March 17, 2021. This document states that the third section indicates all insured persons in whose favor payments or other benefits were made in the reporting quarter, half-year or year. Information about employees who were dismissed in the previous period is also provided.

For example, if during the reporting quarter the company’s accounting department awarded a bonus to an employee with whom the employment relationship ceased in an earlier period, then information about him must be reflected in the DAM. The fact that the civil law or employment contract with this employee was terminated does not matter.

If the employee was dismissed in the previous reporting period, and after that no payments were made in his favor by the company’s management, then there is no need to include such an employee in the third section of the DAM. For example, the employment relationship with a subordinate was terminated in January. Until the end of six months there were no payments in his favor. Information about such an employee will not be displayed in the half-year report.

Filling out the DAM form for dismissed employees

If during the reporting quarter payments were accrued to individuals, including those who were dismissed or those whose employment was terminated in the previous quarter, then information about them is included in section 3 of the calculation of insurance premiums.

The form for calculating insurance premiums on the DAM and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] (hereinafter referred to as the Order).

The tax period for insurance premiums is a calendar year. Reporting periods – I quarter, I half of the year, 9 months. The calculation is submitted no later than the 30th day of the month following the billing (reporting) period, taking into account the rule for postponing the date if it coincides with weekends or holidays (clause 7 of Article 431 of the Tax Code of the Russian Federation).

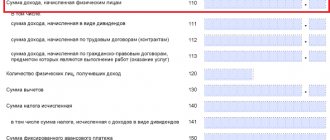

Section 3 is intended to reflect the personal data of insured persons in the DAM calculation. Data on income paid to an individual and pension contributions accrued on it is indicated in subsection 3.2 in relation to the months of the last quarter of the tax period - the reporting period for which the calculation is provided (clause 22.1 of the appendix No. 2 to the Order).

Subsection 3.2 of Section 3 also includes data from employees who were dismissed in the previous quarter, but to whom payments were accrued in the reporting quarter. Officials have pointed this out more than once.

The general procedure for completing the DAM calculation provides that throughout the tax period (year), data is entered into interim reporting on an accrual basis. Therefore, dismissed employees also fall into the DAM. Data on such employees must be included until the end of their separation year.

If there were no payments in their favor in the reporting quarter, subsection 3.2 for them is no longer filled out. Section 3 will contain only information that allows you to identify this person - subsection 3.1. And payments that were accrued to those who resigned during the year should be included in subsection 1.1 of Appendix 1 to Section 1 along the lines “Total from the beginning of the billing period.”

As for filling out the SZV-M form, we recommend that in order to decide whether to include information in the report, we proceed from the following: what type of contract was concluded - labor or civil law for the performance of work; whether the contract was valid in the reporting month.

If the contract was in force, then information about the insured person must be included in the SZV-M report.

The fact of accrual and payment of remuneration and calculation of insurance premiums under this agreement does not matter.

Tax expert B.L. Swain

PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT

Complete information about accounting rules and taxes for an accountant. Only a specific algorithm of actions, practical examples and expert advice. Nothing extra. Always up-to-date information.

Connect berator

Where and when should I submit the report?

Previously, company managers submitted reports on insurance premiums for full-time employees to extra-budgetary funds, that is, to the Social Insurance Fund and Pension Fund. 2017 brought certain changes. Starting from 2021, the RSV must be submitted to the Federal Tax Service.

It is this organization that monitors the payment of insurance premiums. Employers should send reports to the tax office at their place of registration.

As for the timing, employers must submit the DAM to the Federal Tax Service quarterly by the 30th day of the month following the end of the reporting period, that is, at the end of January, April, July and October.

It should be taken into account that if the 30th falls on a weekend or holiday, then the deadline for submitting the form to the Federal Tax Service is postponed, according to the rules established by the Tax Code, to the next working day.

For late submission of reports, the employer faces a fine. Its amount depends on whether insurance premiums were paid on time.

DAM: should former employees be included in the calculation?

If during the reporting quarter payments were accrued to individuals, including those who were fired or whose employment was terminated in the previous quarter, then information about them is included in section 3 of the calculation of insurance premiums.

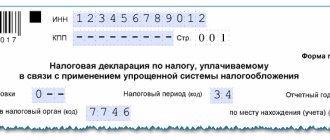

The form for calculating insurance premiums on the DAM and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] (hereinafter referred to as the Order).

The tax period for insurance premiums is a calendar year. Reporting periods – I quarter, I half of the year, 9 months. The calculation is submitted no later than the 30th day of the month following the billing (reporting) period, taking into account the rule for postponing the date if it coincides with weekends or holidays (clause 7 of Article 431 of the Tax Code of the Russian Federation).

How to reflect personal information in the RSV

Section 3 is intended to reflect the personal data of insured persons in the DAM calculation.

Data on income paid to an individual and pension contributions accrued on them are indicated in subsection 3.2 in relation to the months of the last quarter of the tax period - the reporting period for which the calculation is provided (clause 22.1 of Appendix No. 2 to the Order).

Subsection 3.2 of Section 3 also includes data from employees who were dismissed in the previous quarter, but to whom payments were accrued in the reporting quarter. Officials have pointed this out more than once.

Is it necessary to show in section 3 former employees who were not accrued any payments after their dismissal?

Let's answer this question based on the following.

The general procedure for completing the DAM calculation provides that throughout the tax period (year), data is entered into interim reporting on an accrual basis.

Therefore, dismissed employees also fall into the DAM. Data on such employees must be included until the end of their separation year.

If there were no payments in their favor in the reporting quarter, subsection 3.2 for them is no longer filled out. Section 3 will contain only information that allows you to identify this person - subsection 3.1.

And payments that were accrued to those who resigned during the year should be included in subsection 1.1 of Appendix 1 to Section 1 along the lines “Total from the beginning of the billing period.”

For SZV-M, the fact that the contract is valid is important

As for filling out the monthly form SZV-M, we recommend that in deciding whether to include information in the report, proceed from the following:

- what type of contract was concluded - labor or civil law for the performance of work (provision of services);

- whether the contract was valid in the reporting month.

If the contract was in force, then information about the insured person must be included in the SZV-M report. The fact of accrual and payment of remuneration and calculation of insurance premiums under this agreement does not matter.

Document structure

The RSV form has a certain structure.

At first glance, the document seems very voluminous. But the policyholder does not need to fill out all sections. The document consists of the following parts:

- Title page;

- section No. 1. Summary data on insurance premiums is provided;

- section No. 2. To be completed for heads of peasant farms;

- section No. 3. This is personalized information about each employee.

Sections have subsections and applications.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

How to fill it out correctly?

The DAM is drawn up in accordance with the form approved by order of the Federal Tax Service of Russia No. ММВ-7-11 / [email protected] dated October 10, 2021. The same document also contains the procedure for filling out the form.

Instructions for entering information into the RSV form:

- The title page must be completed by all policyholders. Information about the employer is indicated (TIN of the organization, KPP (for legal entities), organizational and legal form, OKVED-2, contact phone number), document correction number, reporting period code, calendar year, number of pages of the document. In the second part of the title page, information about the official who signs the form is entered. Indicate full name, personal signature, date of filling out the DAM;

- The first section is completed. This displays information about insurance premiums that the employer calculates from the salaries of his subordinates. The budget classification code is indicated;

- The third section is completed. Personalized information is provided separately for each employee. The employee’s TIN, SNILS, citizenship, gender, date of birth, series and passport number are indicated. A note is made as to whether the subordinate is insured or not. Completing section 3 for resigned employees has some features. Information is not entered into subsection 3.2 if no accruals were made for the reporting period. In this case, only information is provided that allows the identification of employees with whom the employment contract was terminated.

When filling out the document, you should adhere to the following rules:

- number the pages by putting “001”, “002”, “003”, etc. in the corresponding cells;

- text fields should be filled in from left to right in block letters;

- write decimal fractions in two genders;

- At the end of each page put a date and signature.

Should the dismissed person be included in section 3 of the ERSV?

Hello! Opinions on this issue are divided. The letter specified in the request contains: a) the first phrase: “Taking into account the above, section 3 of the calculation is filled out by the payer for all insured persons in whose favor payments and other remunerations were accrued in the reporting period, including those dismissed in the previous reporting period " It turns out that we must include in the report those fired, but for whom there are accruals in the reporting period. b) phrase two: “In accordance with clause 22.1 of the procedure, section 3 of the calculation is filled out by payers for all insured persons for the last three months of the billing (reporting) period, including in whose favor payments and other remunerations were accrued during the reporting period.” The same letter provides a link to the definition of an insured person: “Article 7 of the Federal Law of December 15, 2001 N 167-FZ “On Compulsory Pension Insurance in the Russian Federation” determines that insured persons are persons who are covered by compulsory pension insurance in accordance with this Federal Law, including those working under an employment contract or under a civil law contract, the subject of which is the performance of work and the provision of services.” It turns out that the filling must be for all insured persons for the last three months . Employees dismissed in the last quarter no longer work for the organization under an employment contract and are not insured persons of the organization. c) phrase three: “According to clause 22.2 of the procedure, if the personalized information about the insured persons does not contain data on the amount of payments and other remunerations accrued in favor of an individual for the last three months of the reporting (calculation) period, subsection 3.2 of section 3 of the calculation is not filled out.” . Already selected insured persons may not have accruals. For example, this could be an employee on long-term leave without pay. He is our employee, which means he is an insured person, and he has no accruals in the reporting period. A link to the ITS for the algorithm for filling out the report, according to which those fired without accruals are not included in the report - https://its.1c.ru/db/strahrep#content:34765:zup30 But the letter is also interpreted differently. The Chief Accountant proposes to include those dismissed in the report (https://www.1gl.ru/#/document/11/17547/bssPhr720/?of=copy-72beb03a82), although it is written below that it is not necessary to include the dismissed in section 3. The Russian tax courier on the ITS website - https://its.1c.ru/db/buhmag#content:20950:hdoc writes that it is safer to include in Section 3 all employees from the beginning of the year, incl. fired because the report is submitted for six months (see Rule 4. Include resigned employees in the DAM).

What opinion to adhere to and argue or not with the tax office is up to you to decide.

Is it necessary to hand over a certificate to a dismissed employee?

Upon dismissal, the employee is given an extract from the RSV form.

The obligation to provide the employee with personalized accounting information is established by the fourth paragraph of Article No. 11 of Federal Law No. 27 of April 1, 1996. A certificate from the DAM is a document confirming the receipt of wages and the accrual of contributions. Information in the statement is entered only for the employee with whom the employment contract was terminated. The certificate is issued on the day of actual dismissal along with other documents for the employee. According to Article No. 151 of the Civil Code of Russia, a subordinate has the right to file a lawsuit against the employer for refusing to issue the RSV form, as well as to demand financial compensation.

It should be noted that the employer must provide an extract from the DAM to any full-time employee who has applied for such a document. The certificate should be prepared by the accounting department of the enterprise within 5 calendar days after receiving a request from a subordinate.