What are the costs from an accounting point of view?

If you focus on Art. 318 and 319 of the Tax Code of the Russian Federation, the law divides all expenses into two types. Moreover, it is legally correct to call expenses “costs.”

Indirect costs

This is money that cannot be directly counted in the cost of a specific product; it forms the cost of several products at once. But without these expenses, the business will not be able to produce the product. Typically, this category includes payments for rent and housing and communal services, expenses for marketing, advertising, secretariat, and accounting.

Direct costs

These are the costs that form the cost of a particular product. For example, this includes raw materials, semi-finished products, components and other production supplies. Direct costs also include wages and social benefits that are directly involved in production, and depreciation of equipment.

Direct costs also include payment for work performed by contractors - if they directly affect the cost of the product. So, if you order packaging for products, then these are direct costs. If a contractor is involved in servicing computers and repairing other equipment in your office, then these are rather indirect costs, because they affect the entire process as a whole.

Convenient service for dividing expenses into direct and indirect

Try it

You yourself must determine which expenses are classified as direct and which as indirect. If in your accounting policy you did not classify costs as direct, then they will be classified as indirect.

Non-operating expenses

There is a third type of costs - non-operating costs. They do not form the cost of production, either for a specific product or as a whole, and generally have no direct connection with production and sales.

For example, non-operating expenses are usually called the costs of servicing a loan, expenses for legal fees, and penalties. A detailed list is contained in Art. 265 Tax Code of the Russian Federation.

Reducing the list of direct expenses

How free can an organization be in determining the list of specific types of direct expenses?

There is a point of view according to which the taxpayer has every right to determine the list of direct costs as he sees fit. For example, focusing on obtaining the greatest commercial benefit. In a number of cases, official authorities and courts also adhere to a similar position (resolution of the Federal Antimonopoly Service of the North-Western District dated October 4, 2011 No. A56-55568/2010).

Important! Attribution of costs to direct or indirect must always be justified (letter of the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3/2952) and cannot, moreover, contradict the provisions of the Tax Code of the Russian Federation (determination of the Supreme Arbitration Court of the Russian Federation dated May 13, 2010 No. VAS-5306/ 10).

It is much easier to narrow down the list of direct costs for those companies that produce relatively few types of products, and quite simply if we are talking about only 1 type of product. In this case, almost any non-production costs can be considered indirect, for example those associated with rent or salaries of personnel not involved in the process of producing goods.

Note that the policy of reducing the list of direct costs cannot always be considered as bringing economic benefits. This can be traced in 2 aspects:

- Firstly, the company can produce goods with strong seasonal demand, such as ice cream or soft drinks. In this case, it may be more profitable for the company to reduce the tax base precisely during the period of less intense sales - at the expense of amounts that are not included in the tax reduction in the warm season.

- Secondly, the amount of amounts available for use to reduce the tax base is not always adequate to the tax and reputational risks that may arise from certain manipulations with the determination of direct and indirect expenses. It may simply be more profitable for a company to take advantage of the tax reduction a little later than to spend money on a legal confrontation with the Federal Tax Service and subsequently restore its image in the market.

Other types of costs for financial accounting

For financial accounting, expenses are divided into two more types.

- Constant - they are not directly related to the volume of production. If output is increased or decreased, fixed costs will not change. For example, an accountant’s salary will not change if you start producing not 100, but 200 cakes per month. So it's a constant waste.

- Variables - depend on the quantity of products produced or sold and change proportionally. For example, if you increase the production of cakes from 100 to 200 per month, then the amount of spending on sugar also increases.

Cost types can be combined. Typically, direct costs affect the cost price, so they are classified as variables. For example, the cost of semi-finished products: the more we produce, the more we spend, so this is a direct variable category.

There are exceptions - for example, advertising costs are not directly reflected in the cost of production and are indirect costs. But with the help of web analytics, we can calculate how much advertising money is needed to sell one unit of product - for example, using retargeting. If we want to sell more, we will have to increase the budget. Therefore, it is an indirect variable expense.

Check where the money is going so you can make the right management decisions

Fixed and variable costs are usually used for financial accounting and business planning - these are conventional concepts; the law does not regulate or oblige you to track them. Direct and indirect are needed for accounting; they are based on other criteria. If you determine income and expenses on an accrual basis, then they need to be tracked and determined, this is a legal requirement.

Who should handle the cost sharing?

According to Art. 318 of the Tax Code of the Russian Federation, all legal entities on OSNO that operate on the accrual basis must divide costs into direct and indirect. Indirect costs are distributed across all types of products. To do this, choose a base, which can be variable costs.

In accounting and tax accounting, the accrual method is understood as a method where income is taken into account at the time of documentary confirmation of the transaction. There is also the cash method - income is taken into account at the moment the money is received at the cash desk. The cash method is usually used by organizations using the simplified tax system, as it is simpler and helps to avoid cash gaps.

If you are on OSNO and the average revenue excluding VAT in each of the previous four quarters is no more than 1 million rubles, you have the right to keep tax records using the cash method. Exceptions are specified in Art. 273 of the Tax Code of the Russian Federation: despite compliance with the revenue requirement, the cash method cannot be used by banks, consumer credit cooperatives and microfinance organizations, companies extracting carbon raw materials and companies owned by foreign organizations.

Direct and indirect expenses in the income tax return

In Appendix No. 2 to sheet 02 of the income tax return, the following should be separately reflected:

- direct costs associated with the sale of goods, works, services (line 010);

- direct expenses for trade operations (line 020), including the cost of purchased goods sold (line 030);

- indirect expenses (total on line 040) with breakdown for some types of expenses.

Direct costs in the production of products, performance of work, provision of services

According to paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, for profit tax purposes, production and sales expenses incurred during the reporting (tax) period are divided into direct and indirect.

Direct expenses are those expenses that at the end of each month are distributed between sold goods (works, services) and unsold goods (works performed, services not accepted by customers). In addition, direct costs are subject to distribution between finished products (completed work) and work in progress (unfinished work).

The taxpayer independently determines in the tax accounting policy the list of direct expenses associated with the production of goods (performance of work, provision of services). This is directly stated in Article 318 of the Tax Code of the Russian Federation. Here is an approximate list of expenses that can be classified as direct expenses:

— costs of raw materials and supplies, components and semi-finished products;

— expenses for remuneration of key production personnel and mandatory social contributions from this remuneration (insurance contributions);

— depreciation.

The letter of the Federal Tax Service of Russia dated February 24, 2010 No. KE-4-3/ [email protected] states that the mechanism for allocating production and sales costs must contain economically feasible indicators determined by the technological process. In this case, the taxpayer has the right, for tax purposes, to classify individual costs associated with the production of goods (work, services) as indirect costs only if there is no real possibility of classifying these costs as direct costs. The Federal Tax Service in its letter refers to law enforcement practice, in particular, to the Determination of the Supreme Arbitration Court of the Russian Federation dated May 13, 2010 No. VAS-5306/10. The specified letter is posted on the official website of the tax department www.nalog.ru in the section /Explanations of the Federal Tax Service, mandatory for use by tax authorities/.

Indirect expenses are all other expenses for production and sales that are fully included in the expenses of the reporting (tax) period in which they were incurred.

Peculiarities of recognition of direct expenses when providing services

Clause 2 of Art. 318 of the Tax Code of the Russian Federation establishes that a taxpayer providing services has the right to attribute the amount of direct expenses incurred in the reporting (tax) period in full to the reduction of income from production and sales of the reporting (tax) period without distribution to the balances of work in progress.

In order to exercise the right to write off direct expenses in full in the current reporting (tax) period, this right must be secured in the tax accounting policy .

Note! Clause 1 of Art. 318 of the Tax Code of the Russian Federation does not provide for a special procedure for taxpayers providing services in terms of determining the list of direct expenses. This means that in any case this list must be approved in the tax accounting policy . And, accordingly, the taxpayer must fill out line 010 of Appendix No. 2 to Sheet 02 of the income tax return.

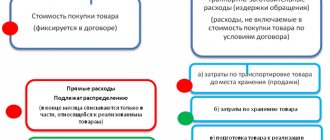

Direct trading expenses

Trading operations are operations involving the resale of purchased goods. The procedure for accounting for expenses on trade operations is regulated by Article 320 of the Tax Code of the Russian Federation.

Direct trading expenses include:

— the cost of purchasing goods at the price established by the terms of the contract;

— transportation costs for the delivery of goods from suppliers (sellers) to the organization (taxpayer) carrying out trade operations.

Trade organizations are given the right to independently determine the composition of the cost of purchased goods. For example, an organization can immediately take into account in the cost of purchased goods transportation costs for the delivery of these goods, insurance costs, and other costs directly related to the purchase of a specific batch of goods. In this case, it makes sense to apply a unified approach to the formation of the cost of purchased goods in accounting and tax accounting.

The organization must reflect the procedure for forming the cost of purchased goods in its tax accounting policy . However, this procedure can be changed no earlier than after 2 years.

If the taxpayer decides not to include transport costs in the cost of purchased goods, then at the end of each month he must distribute transport costs for the delivery of goods between goods sold in the reporting (tax) period and unsold goods (remaining goods in warehouses and stores). The procedure for such distribution is established by Article 320 of the Tax Code of the Russian Federation:

TP = Tn + Tm – Tk , where

TR – transportation expenses subject to write-off in the current month;

Tn – transportation costs not written off at the beginning of the month;

Тм – transport costs for the current month (presented by carriers and suppliers);

Tk – transport costs attributable to the balance of goods at the end of the month (not written off at the end of the month).

Tk = CURRENT x SP , where

Current – balance of goods at the end of the month (unsold goods);

SP – average percentage of transportation costs.

SP = (Tn + Tm)/ (TR + Current) , where

TR – goods sold during the month.

Note! Write-off of the cost of goods sold (inclusion in the expenses of the current reporting tax period) is carried out using one of the methods (clause 3 of Article 268 of the Tax Code of the Russian Federation):

— at the cost of the first in time of acquisition (FIFO),

— at the cost of the most recent acquisition (LIFO),

- at average cost,

- at the cost of a unit of goods.

The chosen method must be fixed in the tax accounting policy .

Let's sum it up

So, the procedure for reflecting direct expenses in the income tax return directly depends on the chosen methods and methods of tax accounting.

The tax accounting policy should:

1. Establish a list of direct expenses (Article 318);

2. Determine the procedure for distributing direct costs for work in progress (WIP) and finished products manufactured in the current month (work performed, services rendered). The specified procedure cannot be changed within 2 years (clause 1 of Article 319);

3. For a taxpayer providing services: to secure the right to attribute the amount of direct expenses in full to the reduction of income of the reporting (tax) period without distribution (clause 2 of Article 318);

4. For trading operations:

a) determine the procedure for forming the cost of purchasing goods. This order cannot be changed within 2 years (Article 320);

b) determine the method for writing off the cost of goods sold as expenses (clause 3 of Article 268).

How to maintain direct and indirect costs in tax accounting

In accounting, the division into indirect and direct costs is important for the formation of cost. Do not forget that indirect costs cannot be attributed directly to the cost of one product. Instead, choose a reasonable allocation basis and add a note to that effect in your accounting policy.

In tax accounting, costs are also divided into indirect and direct, but for different purposes - they affect the reduction of the tax base. It is important to consider at what point specific costs affect the cost of production.

- Indirect expenses reduce the tax base in the same reporting period in which they arise.

- Direct expenses are charged to the current tax period only after you have sold the products to which they were charged. No implementation - no reduction. For example, if a product is in a warehouse, then the direct costs of its production are not deducted from income.

Please note: the amount of taxable profit will decrease if the organization's indirect costs exceed direct ones, and costs will be taken into account earlier. Therefore, you need to carefully monitor the rationale for your decisions: if you underestimate direct expenses or incorrectly account for them, the tax office may perceive this as a way to evade taxes.

List of direct expenses from the point of view of the Tax Code of the Russian Federation and the Ministry of Finance

In accordance with paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, for the purpose of calculating the tax base, a taxpayer can take into account expenses of 2 types: direct and indirect. The legislator refers to the first:

- material costs associated with the purchase of raw materials or materials that are involved in production or provision of services and are the basis of the production process (clause 1 of Article 318, subclause 1, 4 of clause 1 of Article 254 of the Tax Code of the Russian Federation);

- salaries of employees who are directly involved in the production of goods or provision of services;

- contributions to state funds accrued on salaries;

- depreciation on fixed assets that are used in the production of goods or provision of services.

The Tax Code of the Russian Federation classifies other expenses, except non-operating ones, as indirect.

The Russian Ministry of Finance recommends that taxpayers include in the structure of direct expenses the costs that form the cost of production and reflect them in the prescribed manner in accounting. The department outlined this position in Letter No. 03-03-06/1/247 dated May 14, 2012. In accounting, the costs that form the cost are most often reflected in accounts such as 20, 23 and 25. At the same time, the debit indicators of accounts 23 and 25 are, as a rule, transferred monthly to account 20.

At the same time, the legislator establishes that the taxpayer can independently record in his accounting policy a list of expenses related to direct ones for tax purposes (clause 2 of Article 318 of the Tax Code of the Russian Federation).

The fact is that direct expenses can be used to reduce the tax base only after the product or service produced by the company is sold, while indirect expenses can be used to optimize taxation in the same month in which they were made.

Important! The list of the above types of costs is not closed - they may be supplemented by other expenses. At the same time, expanding this list is in the interests of tax specialists rather than taxpayers. Most firms still strive to minimize the current payment burden and therefore try to classify as much of the cost as possible as indirect.

Thus, the key question in determining the list of direct costs that worries many businesses is the following: what are the legal ways to narrow the range of relevant costs as much as possible? Let's consider how a company can approach its resolution.

How to write off expenses

To avoid confusion, try to minimize differences in accounting and tax accounting. Reflect and justify all expenses in documents, otherwise you will have to prove your position to the tax inspectorate.

Write off direct expenses in the same period in which you sold the products, even if the buyer has a deferred payment until the next reporting periods. Do not write off expenses for finished products in warehouses. Do not distribute indirect expenses in tax accounting. They are written off at a time, in the same period in which you produced them. At the same time, reduce your taxable income.

To bring accounting data closer together, try to balance the amount of cost in accounting with direct costs in tax accounting.

Distribution of direct expenses. How to take into account “unfinished work”

What expenses need to be distributed?

| The list of direct expenses is in Article 318 of the Tax Code |

In order to calculate taxable profit, each accountant needs to divide all the company's expenses into direct and indirect.

Direct costs reduce profits only partially, indirect costs completely. Recently the list of these expenses has changed. Now direct costs include: - for the purchase of raw materials and supplies for production; — for the purchase of components; — for the purchase of semi-finished products; — for the salaries of production workers (including the unified social tax from their salaries); — for depreciation of production fixed assets. All other costs are indirect. Only the amount of direct expenses that relates to products sold reduces profit. To calculate this amount, you need to distribute direct costs between: - “unfinished” (that is, products that are unfinished); — products in stock; - products shipped but not sold to customers (for example, if the products were transferred to an intermediary for sale).

The easiest way is to determine the total amount of direct expenses. To do this, they need to be folded. The calculation of direct expenses that relate to “work in progress” depends on the type of activity of your company.

Depending on the type of activity, the Tax Code divides all firms into three groups: - those performing work or providing services; — processing raw materials; - conducting other activities.

The first group includes companies that perform work or provide services. These are construction, transport, consulting, auditing firms, consumer service enterprises, etc. The second group includes enterprises that use one or another raw material as the basis for finished products: oil refiners, metallurgists, woodworkers, etc. Who does what? then by others (other activities) - in the third group. For example, it produces radio equipment, instruments, cars, etc.

| The new procedure for the distribution of direct expenses is effective from January 1, 2002 |

Calculation of “work in progress”

Performance of work (provision of services)

If your company is included in the first group, then calculate the expenses that relate to “work in progress” as follows:

Total direct expenses for the month

x

Volume of unfinished work (services) at the end of the month

+

Volume of completed work (services) not accepted at the end of the month

:

Volume of work (services) performed per month

=

Amount of direct expenses that relates to “work in progress”

You only need to determine that the amount of direct expenses that relates to “work in progress”. The remaining amount of expenses reduces profit. The fact is that you do not have finished products in the warehouse and finished products shipped to customers. Calculate the amount of expenses that reduce profit as follows:

Amount of direct expenses per month

—

Amount of direct expenses that relates to “work in progress”

=

Amount of direct expenses that reduces profit

Example 1.

CJSC “Aktiv” transports cargo. In August, the total volume of transport traffic amounted to 500,000 t/km. Of these, transport services of 40,000 t/km were not accepted by customers. Direct costs for August - 200,000 rubles. “Unfinished projects” include direct expenses in the amount of 16,000 rubles. (RUB 200,000 x 40,000 t/km: 500,000 t/km). The Aktiva accountant can reduce the profit for August by 184,000 rubles.0).

Raw material processing

As the code says, if you process raw materials, you need to allocate direct costs “to work-in-process balances as a share of those balances in the feedstock (in quantitative terms), less process losses.” How to calculate this share and determine the amount of expenses that relates to “work in progress”? First of all, find out how much raw material went into production and how much was spent on “work in progress”. Take this data from primary documents on the movement of raw materials (for example, limit cards). Calculate the amount of direct expenses that relates to “work in progress” as follows:

Amount of direct expenses per month

x

Amount of raw materials spent on “work in progress”

:

Amount of raw materials transferred to production per month

-

Technological losses

=

Amount of direct costs that relate to “work in progress”

Example 2.

LLC “Passive” processes timber. In August, 4,000 cubic meters were released into production. m of forest. Of these, 1200 cubic meters. m was spent on the production of boards that did not undergo all the necessary processing (that is, “unfinished”). Technological losses of forest amounted to 65 cubic meters. m. The amount of direct costs for August is 8,000,000 rubles. “Unfinished” includes direct expenses in the amount of RUB 2,439,644. (RUB 8,000,000 x 1,200 cubic meters: (4,000 cubic meters - 65 cubic meters)).

Other activities

If your company belongs to the third group, you need to calculate direct costs related to “work in progress”, “in proportion to the share of direct costs in the planned (standard, estimated) cost of production.” Do this using the formula:

Amount of direct expenses per month

x

The amount of direct costs in the planned cost of finished products

:

Planned cost of finished products

=

The amount of direct costs that relates to “work in progress”

Example 3.

LLC “Reserve” produces radios.

The planned cost of one radio receiver is 2000 rubles/piece, including: — direct costs—1600 rubles/piece; — indirect costs — 400 rubles/piece. Direct expenses of the company for August - 1,500,000 rubles. Based on the amount of unfinished products, direct costs in the amount of 1,200,000 rubles are allocated to “work in progress”. (1,500,000 x 1600: 2000). Calculation of the cost of finished products in the warehouse

| Forms of primary documents for accounting of finished products were approved by Decree of the State Statistics Committee of August 9, 1999 No. 66 |

To determine this indicator, find out the total number of products produced per month and the quantity transferred to the warehouse.

Take all this data from primary documents on the movement of finished products (for example, a log of product receipts). First, calculate the amount of direct costs that relate to the products shipped. It needs to be done like this: The amount of direct costs that relates to finished products

—

Direct costs for “work in progress”

x

Total quantity of finished goods shipped to customers

:

Total quantity of finished goods

=

Direct costs for shipped products

Then calculate the direct costs that relate to the balance of finished goods in the warehouse. Do this using the formula:

The balance of direct expenses for finished products in the warehouse at the beginning of the month + Total amount of direct expenses - Direct expenses for “work in progress” - Direct expenses for shipped products = Direct expenses for finished products in the warehouse

Example 4.

CJSC Aktiv produces furniture.

1000 tables were made in August. Of these, 550 tables were shipped to customers. The balance of direct expenses that relate to finished products in the warehouse at the beginning of August is 360,000 rubles. The amount of direct expenses for August is RUB 4,500,000. Expenses that are classified as “unfinished” - 600,000 rubles. The amount of direct expenses that relates to shipped products will be: (RUB 4,500,000 - RUB 600,000) x 550 pcs. : 1000 pcs. = 2,145,000 rub. The amount of direct costs for finished products in the warehouse at the end of August will be:

360,000 rubles.

+ 4,500,000 rub. — 600,000 rub. — 2,145,000 rub. = 2,115,000 rub. Calculation of the cost of shipped but not sold products

Direct costs are allocated to shipped products only in two cases:

| The procedure for the distribution of direct expenses is contained in Article 319 of the Tax Code |

- if the ownership of the product has not been transferred to the buyer;

- if the products are transferred for sale under an intermediary agreement. It is impossible to understand from the text of the code how such expenses should be calculated. Therefore, we propose our own algorithm. It is closest to the code. First, determine the amount of direct expenses that will need to be distributed. Do it this way: Total amount of direct expenses - Expenses on “work in progress” - Direct expenses on finished goods in the warehouse = Amount of direct expenses that must be distributed

Secondly, calculate the amount of direct costs that relate to products shipped but not sold to customers using the formula:

Quantity of products shipped but not sold: Total quantity of products shipped x Amount of direct costs to be distributed = Direct costs for products shipped but not sold

Then, to the amount received, add the balance of direct costs for shipped but not sold products at the beginning of the month.

Example 5.

Let's use the data from the previous example.

Let’s assume that Aktiv has handed over 150 tables for sale. The balance of direct costs for shipped but not sold products at the beginning of August is 180,000 rubles. Direct costs for products in the warehouse (excluding balances at the beginning of the month) - RUB 1,755,000. The amount of direct expenses that must be distributed will be: RUB 4,500,000.

— 600,000 rub. — 1,755,000 rub.) = 2,145,000 rub. The amount of direct costs for shipped but not sold products will be:

150 pcs.

: 550 pcs. x 2,145,000 rub. = 585,000 rub. The total amount of direct costs for shipped but not sold products at the end of August will be:

180,000 rubles.

+ 585,000 rub. = 765,000 rub. M. ZHARKOVA, leading specialist of the income tax department of the Ministry of Finance The material was published in the 8th issue of the magazine “Practical Accounting”