How does an overpayment of income tax occur?

Overpayment of income tax occurs for organizations in the following cases:

- The organization pays monthly advance payments. The income tax accrued based on the results of the quarter during which these payments were made turned out to be less than the amount of advance payments. Or, based on the results of the quarter, the organization received not a profit, but a loss.

Read more about advance payments in the material “Advance payments for income tax: who pays and how to calculate?” .

- The organization submitted an updated profit declaration for the previous period with a reduction in the amount of tax accrued for payment or with the replacement of profit by loss.

Read about the specifics of creating an updated declaration in the article “Updated declaration: what does an accountant need to know?” .

- The organization made a technical error when paying taxes and transferred to the budget an amount exceeding the amount accrued according to the declaration.

Situation three: the fact of overpayment is due to a court decision

Another category of refund disputes consists of cases where excessive payment of taxes is confirmed by court decisions.

This applies to a situation where an accountant found an error in the taxable base, filed an updated declaration, but inspectors conducted a desk audit and did not confirm the reduction in the base. The company then challenged the verification decision in arbitration and won the dispute. However, more than three years have passed since the tax was transferred, and the return of the overpayment has become possible only through legal proceedings. Here the arbitrators unanimously come to the conclusion that the three years to file a claim should be counted from the date on which the verdict annulling the “camera chamber” decision came into force (see, for example, the resolution of the Federal Antimonopoly Service of the Moscow District dated July 6, 2011 No. F05-5670/11 ).

A contested decision on an on-site inspection can also serve as a reason for recognizing an overpayment. There is an example where an organization won both in the first and appellate instances. But while the litigation was going on, the three-year period from the date of overpayment was missed. However, the Federal Antimonopoly Service of the Moscow District confirmed the right to a refund, considering that the accountant learned about the excessive payment on the day when the decision on the appeal came into force (resolution dated 08/09/11 No. F05-7508/11).

General rules for offset and refund of overpayments

The following points are common to the offset and refund of overpayments for income tax:

- Offset and refund can be made within a period of no more than 3 years from the date of the overpayment (clause 7 of article 78 of the Tax Code of the Russian Federation).

- For overpayments resulting from filing a declaration, offset and refund will be possible only after 3 months allotted to the tax authorities to verify the declaration (clause 2 of Article 88 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 21, 2017 No. 03-04-05/ 9949).

- Offset and return are carried out on the basis of an application submitted to the Federal Tax Service in the approved form (clauses 4 and 6 of Article 78 of the Tax Code of the Russian Federation). The application can be sent electronically or submitted to the Federal Tax Service on paper. In the latter case, it is made in 2 copies.

Application forms for refund and offset of overpayments of taxes can be downloaded from our website: “Form and sample application for tax offset” and.

Find out how to fill out an application for a refund of overpaid taxes using KND form 1150058 in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

- Before submitting an application for a credit or refund, an organization must check the amount of the existing overpayment with the data of the tax authorities. It is not necessary to do a reconciliation for this. It is enough to request a certificate from the Federal Tax Service about the status of settlements with the budget and make sure that the overpayment amounts match. This must be done due to the fact that tax authorities have the right to independently offset the overpayment to pay off arrears on other taxes (clause 5 of Article 78 of the Tax Code of the Russian Federation).

For information on the procedure for conducting an inventory of payments, see the article “Inventory of receivables and payables.”

- The decision to carry out such an offset (or to refuse it) must be sent to the organization in writing within 5 working days from the date of its adoption (clause 9 of Article 78 of the Tax Code of the Russian Federation).

Situation two: excessive payment is caused by distortions of the tax base

Another common reason for overpaying tax is incorrect determination of the taxable base. The sequence of events here is as follows. As soon as the accountant discovers an overstatement of the base, he submits an updated declaration. Inspectors, in turn, conduct a desk audit and reflect the overpayment in the budget settlement card. If more than three years have passed since the date of transfer of money, the taxpayer must apply to the court for a refund.

Such disputes generally end in victory for organizations and individual entrepreneurs. Although tax authorities are convinced that the moment when the accountant learned about the overpayment is the date of transfer of funds, judges take a different position. They agree with the taxpayer that the identification of an error can be judged by the date of the “clarification”, and it is from this date that three years must be counted for going to court (see, for example, the resolution of the Federal Antimonopoly Service of the Central District dated January 18, 2011 No. F10-5928/2010).

It happens that a taxpayer has the right to a benefit, but does not know about it. Then he receives the relevant information and applies the benefit retroactively. In this case, the starting point for calculating the three-year period, according to the judges, is the day of receipt of information about the benefit. This was the case with an institution that received a letter from local authorities. The letter stated that some transactions carried out by the institution were exempt from taxation. The judges came to the conclusion that the tax must be refunded, despite the fact that it was transferred more than three years ago (Resolution of the Federal Antimonopoly Service of the Ural District dated March 10, 2011 No. F09-376/11-S2).

Sometimes there are court decisions that are negative for taxpayers. One company first submitted “clarifications” to the Federal Tax Service, and two years later - an application for a refund, which the tax authorities refused. The FAS of the East Siberian District did not recognize the organization’s right to return the overpayment, because from the judges’ point of view, three years should be calculated not from the date of filing the application, but from the date of filing the updated declaration (resolution dated 06/09/11 No. A58-7281/10).

How to offset an overpayment for income tax

The option of offsetting the existing overpayment is more preferable for both tax authorities and organizations. This operation has a shorter execution time than a refund and does not entail the actual transfer of funds.

Income tax, regardless of which budget it is transferred to, is a federal tax (Article 13 of the Tax Code of the Russian Federation). From 10/01/2020, when crediting and refunding, the type of tax does not matter: federal, regional or local. Any tax can be offset against any tax, regardless of the budget for its crediting. See here for details.

Let us recall that until September 30, 2020, overpayments of income tax could only be offset against budget payments of the same level (clause 1 of Article 78 of the Tax Code of the Russian Federation), namely:

- future payments for the same tax;

- other federal tax (for example, VAT or personal income tax);

- penalties for taxes of the same level;

- tax penalties of the same level.

To learn about the possibility of offsetting an overpayment of income tax against a fine for currency violations, read the article “Overpayment of tax: can it be offset against a fine for currency violations?”

The text of the application for offset of overpayment of income tax must indicate the amount that is planned to be offset, the budget classification codes (BCC) of taxes (penalties, fines) between which the offset should be made, as well as OKTMO, IFTS codes and tax period codes.

The decision to carry out an offset is made by the tax authorities within 10 working days (clause 4 of article 78 of the Tax Code of the Russian Federation). The date of offset will be the date of the decision. Therefore, if the offset date is important for the tax payment deadline to which the overpayment amount will be transferred, this circumstance must be kept in mind.

After the organization receives a decision on offset, an accounting entry is made on the date of offset, reflecting the transfer of the offset amount to the debit of account 68 (sub-account for accounting for tax calculations, to which the overpayment amount was transferred) from the credit of account 68 (sub-account for accounting for income tax calculations, to in which the overpayment took place).

Situation four: the overpayment is caused by the fact that the taxpayer did not claim VAT for deduction

There are special cases where the excess payment occurred due to an unreported VAT deduction. Subsequently, the accountant submits an updated declaration, where he lately indicates the deduction and sets the tax for reimbursement. But inspectors conduct a desk inspection and refuse compensation, citing paragraph 2 of Article 173 of the Tax Code of the Russian Federation. It states that no refund is available if the return is filed more than three years after the end of the relevant tax period.

In this case, companies and individual entrepreneurs have only one choice - to seek compensation through the court. In this case, the general statute of limitations applies, equal to three years from the date when the taxpayer learned or should have learned about the violation of his right to compensation (Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 18, 2007 No. 65).

The judges believe that the violation of the right became known when the decision was made on the desk audit and the refusal to refund the VAT. If three years have not passed from the date of such a decision, the inspection is obliged to transfer the money (resolutions of the Federal Antimonopoly Service of the North-Western District dated 01/18/11 No. F07-14164/2010 and dated 08/03/11 No. F07-6258/11).

How to return an overpayment of income tax

The text of the application for the return of an overpayment must indicate the details of the current account to which the organization requests to return the amount of the existing overpayment.

The decision on a refund is made by the tax authorities in the same way as for offset, within 10 working days (clause 8 of Article 78 of the Tax Code of the Russian Federation). Moreover, if at the time the decision is made, the organization has arrears in payments to the budget of the same level, then such debt will first be repaid from the amount of the existing overpayment (clause 6 of Article 78 of the Tax Code of the Russian Federation). The decision of the tax authority will reflect the fact of offset of the existing debt. The remaining overpayment amount will be refunded.

The actual refund of funds is carried out by the Federal Treasury on the basis of instructions from the tax authority. The total return period should not exceed one month from the date of filing the application for return (Clause 6, Article 78 of the Tax Code of the Russian Federation).

The organization will take into account the fact of the return of funds on the date of receipt of funds by posting to the debit of account 51 from the credit of account 68 (sub-account for accounting for income tax calculations in which the overpayment took place). The offset carried out by the tax authority when making a decision on the return will be reflected in the entries in the same way as when offset on the initiative of the organization.

ConsultantPlus experts explained the nuances of refunding overpayments or crediting income taxes. Study the material by getting trial access to the K+ system for free.

Why difficulties arise

Everything would be simple and understandable if it were possible to easily determine the moment when the taxpayer knew or should have known about the overpayment. But there is no guidance in this regard in the law, and in practice disagreements arise between inspectors and accountants. Representatives of the Federal Tax Service claim that this moment came more than three years ago, so the right to return has been lost. Organizations and individual entrepreneurs claim that three years have not yet expired and insist on a refund.

Judges put points in disputes. Moreover, the outcome of the case and the arguments that played a decisive role largely depend on the characteristics of each situation. Let's see what conclusions referees most often come to in the most common situations.

Results

If you have discovered an overpayment of tax, then to offset it or return it to your current account, you just need to write a corresponding application. It should be taken into account that the refund procedure is longer compared to tax offset.

For more information on tax refunds and offsets, see the section “Tax refunds in 2021 - 2021 (application and procedure).”

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to identify

Before you begin filling out an application for a refund or tax credit, you need to determine whether this treasured amount exists or is it just an accounting error in the records. So, how to identify the overpaid amount in taxes.

Step No. 1. Check your accounting.

Of course, first of all it is necessary to check the correctness of registration of transactions in the organization’s accounting records. It is quite possible that the error crept not in the payment order, but in the way the accountant compiled the posting. Particular attention should be paid to the procedure for registering transactions in specialized accounting programs.

Check what? Accounting accounts and analytics on them (KBK, subaccount, KOSGU, type of payment, etc.). Re-grading by BCC or type of transaction (fine, tax, fine) are the most common errors in accounting programs.

After checking, be sure to create a balance sheet and an account card for the period you are interested in. This is necessary to check whether the errors are fixed or not.

Step No. 2. Check with the bank.

If no accounting errors are found, check your bank statements. Are the transactions posted correctly in accounting, and did the bank execute payment orders correctly?

In the bank statement, you can verify the tax recipient, KBK and other payment details; it is against these indicators that you can verify the accounting data. Correct any errors found in your accounting. If the bank makes a mistake, contact your local branch to resolve the problem. It is worth noting that banking errors are isolated cases.

Step No. 3. Reconciliation with the Federal Tax Service on taxes and contributions.

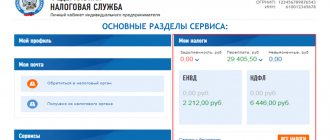

So, if internal control and reconciliation with the banking organization did not produce results, then you should contact the Federal Tax Service. To do this, just contact the nearest territorial inspection office. If the institution exchanges documentation with the Federal Tax Service via secure Internet channels, then you can request an extract in electronic format. You can also obtain information in your personal account on the official website of the Federal Tax Service. For more details, see the material “Instructions: how to check tax arrears.”

Based on the results of reconciliation with the Federal Tax Service, we determine the overpaid amount for taxes. Now we decide what to choose: offset or issue a tax refund.