Why do you need PKO - concept

The organization receives money by transferring it to a current account (non-cash payment) or to the cash desk in cash. It is necessary to register banknotes at the cash desk in accordance with the Procedure for Conducting Operations by issuing a cash receipt order.

Individual entrepreneurs conducting business activities under the simplified taxation system may not use this form of document.

Why is PKO needed?

The cash order monitors the cash position and is an important document reflecting the necessary information in the accounting department.

The detachable part of the order is a receipt provided to buyers and counterparties, confirming the transfer of funds.

Read about registering an expense cash order here.

Options for receiving money to the cash register:

- receipt of funds from the current account;

- funds from customers;

- return of borrowed funds;

- contribution from the founder to the authorized capital of the company.

Accepting cash at the cash desk without issuing a receipt order is not permitted and is regarded as a violation of cash discipline, punishable by a fine.

Is it necessary to issue a check for a cash receipt order?

Retention period for cash receipt order

The time period allocated for keeping PKO in storage, as for any other primary accounting documentation and payment documents, is based on the order of the Ministry of Culture of the Russian Federation and is 5 years after the end of the reporting year. Moreover, the organization must take responsibility for the proper retention of records during this period.

Important! When an organization is liquidated, the retention period remains unchanged. Even if the actual legal entity no longer exists, papers cannot be destroyed. To do this, the liquidation commission transfers the documents to the state archive, where they will be stored until a certain period.

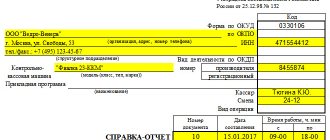

This is what a PKO sample should look like

A cash receipt order is an important document when a company receives money. It must be filled out without errors or blots. Today, the Internet provides many opportunities that allow you to apply for a PCO online through special services.

What form can I use to fill out?

For the posting of cash, the State Statistics Committee of Russia approved a special form (KO-1) dated August 18, 1998.

What does the KO-1 form look like (according to OKUD 0310001)? The form contains the cash receipt order itself and a receipt for it, which is a tear-off coupon.

Procedure and rules of registration

The receipt order may be drawn up in handwriting or using technical means intended for data processing (personal computer, software)

Form KO-1 is drawn up by an accountant in a single copy, signed by the chief accountant or an employee vested with similar powers.

You should pay attention to the numbering of forms: it should not be interrupted throughout the entire calendar year. This requirement is often neglected by entrepreneurs.

Most employers are familiar with the obligation to prepare receipts, but the specifics of their preparation are not known to everyone.

The point that is often ignored is that on the day the KO-1 is issued, the money must arrive at the cash desk, otherwise the order is not considered valid.

In practice, situations arise when a receipt order is issued first, and the funds are deposited into the cash register after some time, or vice versa - the money appears first, and the necessary papers are drawn up later.

It is prohibited to make changes or amendments to the document; if they occur, the document must be drawn up again.

How to correctly fill out the details of the unified form KO-1?

It should be noted that a cash receipt order includes 2 components: an order and a receipt.

Registration is carried out in a general copy, the receipt is handed over to the citizen who transferred the cash.

To accurately fill out the approved order form, you should enter data sequentially, one after another, starting from the top line.

The first block should begin with an introductory line, where the full name of the enterprise, structural unit and its code is recorded in accordance with the statutory documentation.

If the latter is missing, then a dash is placed in the line. Information about the OKPO code is also entered in accordance with the information of the State Statistics Committee.

In the line “Document number” a serial number is entered based on the register of cash documentation, the numbering of which begins from the beginning of the year.

When entering the date of compilation, the writing sequence must be observed: day, month, year. Arabic numerals are used for filling, with a “zero” placed before the single digit. The fixed date must correspond to the receipt of money.

The second block is the main one and includes information about financial receipts to the company’s cash desk.

Information about cash accounting and its amount is presented in the columns:

- “debit” - enter the number of the accounting account on the debit of which funds are received (as a rule, 50 is indicated - “Cash”), the cell is not required to be filled in and can be left empty;

- “credit” - enter the code of the department where the cash is received (if it is absent, a dash is placed) and the number of the corresponding account reflecting the receipt of cash at the cash desk (71 - return of accountable amounts, 51 - withdrawal of an amount from a credit institution, 90 - revenue, 62 - receipts from customers, 73 - other settlements with employees, 75 - contributions to the authorized capital).

- “Analytical accounting code” is filled in if the enterprise has approved codes for analytics;

- “amount” - indicates the amount of money received (in numbers);

- “targeted purpose code” - used only by non-profit institutions where targeted funding is implied.

Individual entrepreneurs can leave columns with data on loans blank.

Below the table is the last name, first name and patronymic of the person from whom the cash was received, as well as the reasons for its transfer.

What to write in the bottom? The basis can include the return of unspent funds, payment under the contract, retail revenue, payment of invoices.

Next, the amount deposited into the cash register is written down again, but using a letter designation.

Whole numbers are written with capital letters, fractions after the decimal point are written in numbers, and currency is written without abbreviations.

If after writing the amount there is an empty space left in the column intended for writing it, then you need to fill it with a dash. This will protect against the possibility of order falsification.

It is also necessary to indicate whether VAT is allocated or not (the tax rate is written down in numbers, or there is a note about exemption from it).

The data of the attached primary papers (advance report) is indicated as an attachment; copies of them are attached to the form.

How to fill out a receipt?

Having filled out the receipt order, you can begin to enter information into the receipt - a tear-off coupon for the PKO. All information is recorded in the same way as an order.

After the cash arrives at the cash register, the cashier tears off the receipt along the cut line and hands it to the person who deposited the money. The order itself remains with the cashier.

A corresponding note is made in the cash book (KO-4) about accepted cash.

After checking all the details, the cashier accepts the funds and enters them according to the cash register, if this is the company’s income.

Who is authorized to sign?

Form KO-1 is prepared by:

- Chief Accountant;

- accountant or cashier specified by the company's administrative document;

- director of the organization (if the company does not have an accountant on staff).

The PKO must contain the signatures of the chief accountant and accountant or the manager and the cashier.

If the immediate manager of the enterprise is involved in conducting cash transactions, all documentation is signed by him personally.

How to put a seal correctly?

The seal impression must be placed on the o located on the receipt.

The current regulations do not provide for the possibility of simultaneously putting an imprint on the receipt and on the order.

Download a free blank form and a completed sample in Word and Excel format

cash receipt order KO-1 form according to OKUD 0310001 – in word, excel format.

filling out the application for making a contribution to the authorized capital - sample.

registration for receiving cash from the bank - excel.

Example for receiving money from a buyer - excel.

Sample PKO for making a contribution:

Sample PQR for receiving cash from the bank:

Sample PKO for receiving money from the buyer:

Stamping

The imprint should be located on the o part of the form and capture the receipt. The legislation does not provide special rules for affixing a seal. In practice, it is customary to place 60% of it on the main part, and 40% on the receipt. Some recommendations are given in Resolution of the State Statistics Committee No. 88 of August 18, 1998. The legislation also does not establish a specific list of details that must be placed on the operator’s seal. It is advisable to include in the stamp information that was previously considered mandatory:

- Name of the enterprise (full and in Russian), organizational and legal type.

- Location.

- Registration number.

Important points

The cashier issues funds exclusively to the person whose information is indicated in the order. The latter presents a document confirming his identity. If the issuance is made by power of attorney, it is necessary to check the compliance of the full name. recipient, given in the order, information about the person represented. A document confirming the authority of the actual recipient is attached to the payment form. If several payments will be made under the power of attorney or in different organizations, a copy is attached to the order. The original must remain with the operator who made the last issue.

Contents of the document

The “Base” field indicates the operation performed. For example, this could be “refund of overexpenditure according to report No. 123 dated March 2, 2017.” In the “Attachment” field, primary and other documents are indicated. At the same time, their numbers and dates of compilation are given. Applications can be applications for the issuance of funds, invoices, and so on. Rules for registration f. KO-2 are provided for in the Methodological Recommendations approved by Goskomstat Resolution No. 88. It is not allowed to make any corrections to the expenditure order. The document is also signed by the chief accountant, manager or other person authorized by him. Entrepreneurs who keep records of costs and income or physical indicators, according to tax legislation, may not issue expense vouchers.

Operator actions

When issuing funds for expense orders, the cashier must check:

- Availability of required signatures and their compliance with the samples.

- Equality of amounts indicated in words and numbers.

- Availability of documents provided in the form.

- Compliance with full name in the order information provided by the recipient.

After this, the operator prepares the required amount and hands over the payment document to the person receiving it. In the order, the recipient must indicate the number of rubles (in words) and kopecks (in numbers). The person also signs and dates it. The operator must count the prepared money. In this case, the recipient must see how the cashier does this. The subject who accepted the funds also recalculates them under the supervision of the operator. If this is not done, the recipient subsequently cannot make a claim to the cashier for the amount issued. After this, the operator must sign the payment document.

Responsibility for violating the rules

Measures provided for by law are applied to enterprises that do not comply with instructions for conducting cash transactions. Liability is established by various regulations. Among them is Presidential Decree No. 840 of July 25, 2003. Chapter 15 of the Code of Administrative Offenses provides for Article 15.1. It fixes penalties for violating the rules of working with cash and the procedure for carrying out cash transactions. In case of exceeding the amounts intended for settlements with counterparties, non-receipt (partial or full) of received funds, non-compliance with instructions for storing free money in excess of limits, an administrative fine is provided: 40-50 minimum wages - for officials, 400-500 minimum wages - for organizations.