Rules for filling out the form

On the inspection websites and at the stands in the department there are samples of filling out an individual’s application for registration with the tax authority, the basic requirements for filling out the form:

- the text is entered in your own hand in block letters in blue or black ink or printed on a computer;

- if filled out with one’s own hand, put dashes in empty cells;

- corrections are not allowed.

We offer instructions on how to fill out an application for a TIN step by step.

Step 1. Fill out page 1:

- At the top of the page, indicate your Taxpayer Identification Number (if available).

- Next is the tax authority code. Find out by calling the inspectorate or on the Federal Tax Service website.

- Enter your details in the nominative case, as in an identity document.

- Please note your citizenship information and country code. For a stateless person, enter code 999.

- Indicate information about the submitter and telephone number for contact using “8” and without brackets.

Step 2. Fill out page 2.

- Fill out the line at the top by hand - enter your full name.

- Enter the details of your identity document (fill in the four digits of the series separated by a space after the first two).

- Next, fill out the data from the document exactly as indicated in the document (with all punctuation marks, in the same case).

- Place the date and signature at the bottom of the page.

Step 3. Fill out page 3:

- Fill out your full name at the top of the page by hand.

- Indicate information about your place of residence or stay (the type and name of the settlement, elements of the planning structure, road network, buildings and premises within the building are entered by hand).

- Sign and date at the bottom of the page.

Previously, there was a special sample for filling out an application for a TIN when changing a surname; from 10/01/2020 it is no longer necessary to submit it; the Federal Tax Service independently receives information through the Unified State Register of Civil Registry Office.

ConsultantPlus experts discussed how a foreign citizen can obtain a TIN. Use these instructions for free.

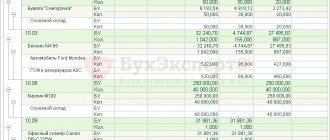

Sample filling 2-2-Accounting

The application must be completed on 3 pages. At the top of the first page, the TIN is indicated in accordance with the document confirming registration with the tax authority. In the “tax authority code” field, you must indicate the code of the tax office to which the application is being submitted.

Next, in the main part of the form, you must enter the surname of the individual in the first line, fill in the first name and then the patronymic in the next line. The data in the application in form 2-2-Accounting must be entered as indicated in the identification documents.

Form 2-2-Accounting must be filled out by hand, in blue or black ink, or can be filled out using special software. Symbols must be entered into the cells in large block letters, legible handwriting, one character per cell.

Next, the page is divided into 2 parts, the right part is filled out by the tax inspector, the left part is filled out either by the individual submitting the 2-2-Accounting application, or by his representative, depending on this, the corresponding figure is entered (5 - if the accuracy of the information is confirmed by the individual himself, 6 – if his representative). If this part of the application is filled out by the individual himself, then all the cells (full name, tax identification number) do not need to be filled out - you only need to put down a date and signature.

The lower part of the first page of the form “Application 2-2-Accounting” (a sample of the filling is presented at the end of the article) is filled out by an employee of the tax authority, and contains information about who carried out the registration (employee position, full name, signature), TIN, date of registration for registration, data of the person who issued the certificate. Next, indicate the details of the certificate, date of issue, full name and signature of the person who received the certificate.

If in the period after 01.09.96 the applicant’s last name, first name, patronymic name changed, then on sheet 2 of the application it is necessary to indicate the data and year when they were changed. Next, you must indicate your gender (number 1 if male and 2 if female) and date of birth. Information about the place of birth must be specified exactly as indicated in the identity document.

Then you need to indicate the type of identification document (code 10 - if it is a passport) and the details of the document (series and number, name of the authority that issued the document, the date it was issued, etc.). Next, the presence of citizenship, the country code according to OKSM and the address of residence or stay in Russia are indicated. The address is indicated in accordance with the entry in the passport. The region code is filled in according to the directory “Subjects of the Russian Federation”.

On page 3 of application 2-2-Accounting, you must indicate information about the document confirming registration at the place of residence or place of stay in the Russian Federation (for foreign citizens or stateless citizens). It is necessary to indicate the type of document, its series and number, indicate the authority that issued the document and the date on which it was received. Next, indicate the date of registration at the place of residence or stay and a detailed address in Russia (zip code, district, city, etc.). After the registration address, you must indicate the address for actual communication with the taxpayer and confirm with your signature the accuracy of the information specified on the page.

A sample of filling out the application “Form 2-2-Accounting” is presented below. Carefully and accurately fill out the form, enter all data in full accordance with the supporting documents in legible handwriting in large block letters.

Application on form 2-2-Accounting

Where and how to apply

There is no need to staple or otherwise secure the document. It is sent by mail with a list of the contents and with a notification, taken personally to the inspectorate or sent electronically.

The recipient is the Federal Tax Service inspection at the citizen’s place of residence (place of stay).

We recommend that you include a cover letter when sending by mail.

| In the Federal Tax Service No. __________ to _____________ Address: ______________________________ From _________________________________ Address: ______________________________ Telephone: ___________________________ Covering letter I am sending documents for tax registration and assignment of a TIN. Please notify me about the readiness of documents by phone __________________________. Additional telephone number _______________________. ___________________ (date, signature). |

Methods for obtaining a TIN

A citizen can obtain a taxpayer identification number in the following ways:

- By personal contact with the tax authority.

From January 1, 2021, you can apply for a TIN and obtain a certificate at any tax authority of the citizen’s choice. Let us remind you that previously it was possible to submit an application and receive a document confirming registration only at the territorial tax authority at the place of residence (registration by passport) or stay of the citizen.

- Through a representative by proxy.

To submit an application and receive a certificate, the representative must have a power of attorney certified by a notary; in the absence of one, the tax authority will refuse to accept (issue) documents.

- By Russian Post by registered mail with a list of the contents.

Please note that if documents are sent by mail, a notarized copy of your passport must be attached to the application.

- Through a specialized service on the Federal Tax Service website.

The fastest and most convenient way to fill out and submit an application for a TIN is to compile it on the website of the Federal Tax Service. Let's take a closer look at this method of preparing a tax registration document.

Registration of individuals

If an individual does not have a place of residence (place of stay), real estate and (or) vehicles belonging to him on the territory of the Russian Federation, registration is carried out by the tax authority, to which, at the choice of the individual, an Application is submitted (form 2-2 Accounting) .

You can submit the Application to any tax authority of your choice in person, through a representative, send it by registered mail, or fill out the Application on the official website of the Federal Tax Service www.nalog.ru using the service “Submission of an Individual's Application for Registration.”

Go to Fill out the Application using the service:

“Submitting an Individual’s Application for Registration”

When submitting the Application in person, a document (documents) identifying the individual and confirming registration at the place of residence (stay) is simultaneously presented to the tax authority.

If there is no place of residence (place of stay) on the territory of the Russian Federation, only a document certifying the identity of the individual is provided.

If an Application is submitted by a representative, a document confirming his authority must be presented.

When sending the Application by registered mail, a duly certified copy of the document (copies of documents) identifying the individual and confirming registration at the place of residence (stay) may be attached to the Application for registration.

The documents required for registration of foreign citizens are submitted to the tax authorities in Russian or in a foreign language with a translation into Russian certified in the prescribed manner.

The tax authority is obliged to register an individual on the basis of an application from this individual within five days from the date of receipt of the said application by the tax authority and, within the same period, issue him a certificate of registration with the tax authority (if the specified certificate was not previously issued).

If an individual’s application is sent by registered mail or transmitted electronically via telecommunication channels to the tax authority, the tax authority shall register the individual on the basis of such an application within five days from the date of receipt from the authorities specified in paragraph 3 and 8 art. 85 of the Tax Code of the Russian Federation, confirms the information contained in this application and, within the same period, issues (sends) to the individual a certificate of registration with the tax authority (if the specified certificate was not previously issued).

If an Application is submitted using the service “Submission of an individual’s application for registration,” the applicant is notified by email of the period of time during which he can contact the tax authority to obtain a Certificate of Registration with the tax authority.

If there is information in the Unified State Register of Taxpayers about the registration with the tax authority of the individual who submitted the Application, registration is not carried out, and the Application serves as the basis for issuing (sending) to this individual a Certificate in the form established by the Federal Tax Service of Russia, in within five working days from the date of receipt of such Application.

Go to The applicant can find out the assigned TIN using the Internet service: “Find out TIN”

Completing an application for a TIN via the Internet

- Go to the Federal Tax Service website to the service “Registration of an individual with a tax authority on the territory of the Russian Federation”

Using this service, you can fill out an application for issuing a TIN, select any tax authority where the certificate will be received, monitor information about the status of the application, and also work with a previously drawn up application or its draft.

- Enter your login (email address) and password.

If you have not registered on the Federal Tax Service website before, you must do so by filling out a special form:

Note: registration on the Federal Tax Service website has no relation to the taxpayer’s Personal Account, which a citizen gains access to by personally visiting the tax authority.

- After entering the login and password, the user will be redirected to the page for filling out the application form

Note: it is better to enter data in order, following the system prompts.

From the stage of preparing a document to sending it, you need to go through 5 steps:

Note: if you plan to receive a certificate from a tax authority other than your place of residence, then in the last block you must select “Other tax authority”: