What is the difference between fixed assets and inventories - in essence and lines in the balance sheet

The assets in question should be distinguished from fixed assets. The latter are represented by the following assets (clause 4 of PBU 6/01):

- intended for use in the production of goods, works, services, for the management needs of the company or for rental by the company;

- intended for use for a period exceeding 12 months;

- not originally intended for subsequent resale;

- capable of bringing economic benefits to the company in the future.

In general, fixed assets are values that are used as means of labor, which are used for the purpose of processing material reserves or using them as a finished surplus product.

Inventory and fixed assets are reflected in different lines of the balance sheet. The asset of the first type is in line 1210, the second is in line 1150.

Important! From 2022, PBU 6/01 will no longer be in force, and accounting for fixed assets will be regulated by two new Federal Accounting Standards: 6/2020 “Fixed Assets” and 26/2020 “Capital Investments”. The main provisions of these standards and their differences from PBU 6/01 are discussed in detail by ConsultantPlus experts. Get free access to K+ and go to Review.

COMPARISON OF FIXED ASSETS AND INTANGIBLE ASSETS IN IFRS

Features of recognition of fixed assets in IFRS

Definition of fixed assets from the perspective of IFRS - a material object used for the production needs of the organization, transportation of goods or rental, the period of use exceeds twelve months.

Also in IFRS there is the concept of historical cost - this is the amount of funds that were paid (money or other objects) for an asset at the time of its purchase.

Book value is the value at the time the asset is recognized in the income statement minus depreciation.

Depreciation is the process of transferring the cost of equipment to products through gradual distribution.

The valuation of a fixed asset as an asset is carried out at cost. The cost includes the entire set of costs that were incurred by the company in bringing the asset into a condition suitable for use.

Fair value is often used for valuation - this is the price that a seller could receive when selling an asset in accordance with today's market selling price.

Table 1 “Differences between the features of recognition of intangible assets and fixed assets”

| № | Name | NMA | OS |

| 1 | Features of recognition | Eligibility criteria intangible asset | Correspondence definition |

| 2 | Control over the asset | Economic benefits from use | |

| 3 | Receiving economic benefit | Cost price is reliable appreciated | |

| 4 | Independent cost assessment asset |

Features of recognition of intangible assets in IFRS

An intangible asset is a company asset that does not have physical properties and is defined as non-monetary.

Monetary asset - cash, shares in other organizations, receivables or loans.

Intangible assets also include experimental developments - as a result of research that has brought a certain value and can be implemented to obtain subsequent benefits.

An intangible asset, like a fixed asset, can be accepted onto the balance sheet of an organization only on the condition that it will necessarily bring economic benefits in the future.

Table 2 “Determination of the initial cost of intangible assets and fixed assets”

| № | Name | NMA | OS |

| 1 | Initial cost | All inclusive purchase price duties and taxes | Object purchase price |

| 2 | Direct costs for bringing the object in a state | Taxes included in cost of the object | |

| 3 | Employee benefit costs | Reward Costs employees | |

| 4 | Site preparation costs for construction | Preparation costs construction sites | |

| 5 | Dismantling costs | Preparation costs and equipment setup |

Intangible assets are recognized in accordance with the total cost of their acquisition. The valuation is based on the fair value that occurs when the asset is purchased; this value is the main value throughout the entire life of the asset.

Once the asset is put into operation, costs are written off as period costs as incurred.

Subsequent valuation of fixed assets

Revaluation is important for the formation of a current balance at the time of preparation. So, if revaluation is carried out rarely, then the relevance of the balance sheet will noticeably decrease and investors’ confidence in the company’s reporting will decrease. It is precisely the fact that assets are reflected at fair value that underscores the relevance of IFRS.

It is important to consider types of depreciation as a way of transferring the cost of an asset to a product. To determine depreciation expenses, first find: salvage value, expected useful life and depreciation method. The useful life is determined on the basis of: volumes of use of the fixed asset, expected physical wear, technological wear and obsolescence. The materiality of different depreciation methods determines how the cost of fixed assets will be transferred to products. IFRS distinguishes three methods of depreciation: straight-line, reducing balance and by volume of production. The organization chooses the depreciation method independently and establishes it in its accounting policies. The depreciation period begins when the asset is ready for use. Liquidation value is defined as the book value minus accrued depreciation for the entire life of the fixed asset.

A fixed asset is written off provided that no more benefits are expected, and if the asset is planned to be sold, then a separate standard, IFRS 5 Non-current assets held for sale, is applied. The formation of profit or loss depends on the net proceeds from the disposal of fixed assets; based on these indicators, other income or expense is formed.

Subsequent valuation of intangible assets

IFRS 16 offers two accounting options:

· At original cost;

· At revalued value;

An asset is accounted for at historical cost, which is its fair value at the date of revaluation less accumulated depreciation and impairment losses. As with property, plant and equipment, the difference between book value and fair value should not be material.

If the revaluation amount is positive, then it is related to equity and is reflected in the accounting for other comprehensive income (impairment reserve). The amount of the markdown is negative, it is reflected in the income statement.

The increase in the value of an intangible asset during subsequent revaluations must be compensated by previously recognized losses, and only then a capital reserve will be formed. On disposal, the reserve is returned to retained earnings.

Bibliography

1. Vakhrushina Maria Aramovna International financial reporting standards. Textbook.Publisher: National Education, 2014.

2. Mikheeva Elena Vyacheslavovna IFRS. Basic provisions. Preparation of international financial statements. In 2 parts (set). Publisher: ANO Institute for the Development of Modern Educational Technologies, 2014.

3. Chaya Georgy Vladimirovich, International Financial Reporting Standards. Textbook and workshop Yurayt, 2021.

4. Ageeva Olga Andreevna ACCOUNTING. Textbook and workshop for open source software. Grif UMO SPO, 2018

5. Accounting Regulations (PBU) Accountant. Regulatory documents Publisher: Normatika, 2021

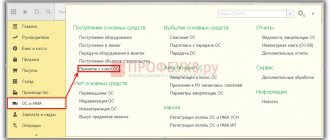

How are inventories accounted for in account 10?

All legal entities are required to keep accounting records of material inventories - this is a mandatory requirement for their business activities (Clause 1, Article 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). In this case, business transactions reflecting the turnover of inventories are recorded on account 10 of the Chart of Accounts. Various sub-accounts are opened for it (for raw materials, fuel, containers, etc.). The corresponding business transactions are registered using supporting documents (invoices, orders, acts, etc.).

Accounting press and publications

"Accounting. Taxes. Law", N 13, 2004

MATERIALS OR FIXED ASSETS?

Accounting for both special clothing purchased due to labor legislation and uniforms purchased at the initiative of the organization can be maintained using a unified system. It needs to be fixed in the accounting policy.

Accounting for workwear has its own nuances. The Ministry of Finance of Russia for this accounting object has issued Guidelines for the accounting of special tools, special devices, special equipment and special clothing (hereinafter referred to as the Guidelines for the accounting of special clothing). They were approved by Order No. 135n dated December 26, 2002.

However, this does not mean that organizations should consider workwear only in accordance with these guidelines. That is, as part of inventories, regardless of service life.

If it exceeds 12 months, then PBU 6/01 “Accounting for fixed assets” can be used to account for uniforms. After all, the Methodological Recommendations for Accounting for Workwear formally relate only to current assets (clause 2).

Therefore, the organization itself must decide how to take into account workwear. The Russian Ministry of Finance explained to us that accountants can account for special clothing both on the basis of PBU 6/01 and on the basis of the Methodological Instructions for Accounting for Special Clothing, regardless of its service life. The choice of methodology remains with the organization, and it must be recorded in the accounting policies.

Each method of accounting for workwear has its pros and cons. Let’s say an organization purchases workwear with a service life of more than 12 months and a cost of no more than 10,000 rubles. Then it is more convenient to account for it as fixed assets. In this case, accounting and tax accounting will coincide and there will be no differences according to PBU 18/01 “Accounting for income tax calculations.”

If workwear costs more than 10,000 rubles, then it is more profitable to take it into account as part of current assets and keep records in accordance with the Guidelines for accounting for workwear. When accounting for such clothing in account 01, the organization will have to pay property tax on its value (clause 1 of Article 374 of the Tax Code of the Russian Federation).

New clothes are coming

If the organization decides to account for workwear as part of current assets, then it is reflected in account 10 “Materials”. To do this, two additional subaccounts are added to account 10:

— 10-10 “Special equipment and special clothing in the warehouse”;

— 10-11 “Special equipment and special clothing in operation.”

Receipt of special clothing to the warehouse is formalized by a receipt order in form N M-4, which is approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a.

If the organization decided to account for work clothes as part of fixed assets, then the received property is reflected in account 08. In this case, primary documents for accounting for fixed assets are drawn up (according to forms OS-1, OS-6, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7).

Who needs special clothing? Get in line!

The issuance of special clothing is reflected in the employee’s personal card. Its form is given in Resolution of the Ministry of Labor of Russia dated December 18, 1998 N 51. In addition, when issuing workwear to an employee for individual use, it is necessary to fill out a record sheet for the issuance of workwear, safety shoes and safety devices in form N MB-7 (approved by Resolution of the State Statistics Committee of Russia dated 30.10. 1997 N 71a). This statement is filled out in two copies. One copy is transferred to the accounting department, and the second remains in the warehouse.

Based on the copy of the statement in Form N MB-7 submitted to the accounting department, the accountant makes the following entry:

Debit 10-11 Credit 10-10

— uniforms were issued to employees.

Or the wiring is done:

Debit 01 Credit 08

— uniforms were issued to employees.

In the case when special clothing issued at the initiative of management is transferred into the ownership of the employee free of charge, the accountant makes the following entries:

Debit 91-2 Credit 10-10 (08)

— the cost of workwear issued for personal permanent use has been written off;

Debit 91-3 Credit 68

— VAT is charged on the value of the property transferred free of charge in accordance with the requirement of clause 1 of Article 146 of the Tax Code of the Russian Federation;

Debit 70 Credit 68

— reflects the amount of personal income tax subject to withholding from the employee.

If an organization accounts for workwear on account 10, then its cost is repaid in a straight-line manner based on its useful life (clause 26 of the Guidelines for accounting for workwear). They are established in the relevant resolutions of the Russian Ministry of Labor. For workwear not specified in them, the service life is determined during the certification of workplaces or in the order of the manager.

————————————————————————————————— The necessary regulations of the Russian Ministry of Labor with the standards for the free issuance of workwear are listed on p. 8 in the material “We’ll dress everyone, but with conditions.”

The period of use begins to count from the date of actual issue of special clothing to employees. At the same time, the period for wearing warm workwear also includes the time of its storage in the warm season (clause 20 of the Rules for providing workers with special clothing, special footwear and other personal protective equipment, approved by Resolution of the Ministry of Labor of Russia dated December 18, 1998 N 51, as amended on 03.02 .2004).

But if the service life of the workwear does not exceed a year, then its cost from the materials account can be attributed directly to expenses (clause 21 of the Methodological Recommendations for Accounting for Workwear). That is, the same as the cost of workwear recorded on account 01, if it does not exceed 10,000 rubles.

According to Article 221 of the Labor Code of the Russian Federation, the employer provides washing, cleaning, repair, disinfection and neutralization of personal protective equipment for employees. Such costs are included in expenses for ordinary activities.

If workwear requires regular cleaning, then the employer can immediately issue two sets of clothing instead of one. Then the period for which special clothing is issued doubles (clause 26).

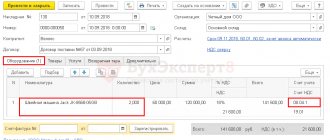

Example. A trade organization purchased two trousers with insulating lining at a price of 590 rubles. for each, including VAT - 90 rubles. According to the Standard Standards for the free issuance of workwear (Resolution of the Ministry of Labor of Russia dated December 30, 1997 N 69), a storekeeper working in unheated premises is required to wear trousers with an insulating lining.

Let's assume the organization is located in the Novosibirsk region (third climate zone). The wearing period for trousers is 24 months. (Resolution of the Ministry of Labor of Russia dated December 31, 1997 N 70). The employee was immediately given two trousers (that is, for 48 months). The organization, according to accounting policies, takes them into account as materials.

The accountant will make the following entries (regarding write-offs):

Debit 10-11 Credit 10-10

— 1000 rub. — trousers were given to the storekeeper;

Debit 44 Credit 10-11

— 20.83 rub. (1000 rubles: 48 months) - part of the cost of the trousers is written off monthly.

As we have already said, if an organization decides to include workwear as part of current assets, accounting and tax accounting will differ. In accounting, the cost of workwear is written off as expenses gradually, but in tax accounting immediately. Because of this, taxable temporary differences are formed in accounting, and, accordingly, deferred tax liabilities.

They reviled and returned

If special clothing is not transferred to the employee’s ownership, then upon dismissal or transfer to another job where the provision of special clothing is not provided, he must return it to the warehouse.

When returning workwear before the expiration date, it is accounted for in accounting at its residual value. In this case, the accountant must make a reverse entry:

Debit 10-10 Credit 10-11

— workwear was returned due to the dismissal of an employee.

From this moment on, repayment of the cost of personal protective equipment will cease. In the future, the employer has the right to re-issue it to employees, with the exception of certain things, the transfer of which is prohibited by the Model Standards.

In the case when work clothes accounted for as part of fixed assets and written off as expenses are returned, no accounting entries are made. This operation is reflected only in analytical accounting.

If an employee quits or moves to another job, but has not returned the protective clothing, then the organization may, on the basis of an order from the head of the organization, withhold from him the residual cost of personal protective equipment.

Discarded clothing

After the wearing period expires, the employee must hand over protective equipment to the organization and receive a new set of special equipment.

What should an organization do with the donated protective clothing?

If the uniform is suitable for further use, it can continue to be issued to your employees (clause 19 of the Rules for providing employees with special clothing, approved by Resolution of the Ministry of Labor of Russia dated December 18, 1998 N 51). Of course, to do this, the discarded clothing must be brought into proper condition.

A permanent or working inventory commission must determine whether special equipment can be used in the future.

Note! The accountant writes off only those personal protective equipment that are actually leaving the organization (clause 31 of the Methodological Guidelines for Accounting for Workwear). Consequently, after the expiration of the wear period, the accountant continues to reflect the workwear suitable for further use in analytical accounting. This applies to both accounting for materials and accounting for fixed assets (clause 18 of PBU 6/01).

When issuing workwear whose wear period has already expired, no accounting entries need to be made.

O.A. Kurbangaleeva

Auditor

L.V.Klimenkova

Expert "UNP"

Signed for seal

05.04.2004

—————————————————————————————————————————————————————————————————— ———————————————————— ——

Other inventories - what applies to them

The term “other inventories” mainly characterizes the accounting of budgetary institutions. In budget accounting - carried out by state and municipal organizations - other inventories include (clause 118 of the order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n):

- special equipment for research,

- young animals of all types of animals and fattening animals, birds, rabbits, fur-bearing animals, bee families, regardless of their cost,

- offspring of young animals in the presence of draft animals in institutions,

- planting materials,

- reagents and chemicals, glass and chemical utensils, metals, electrical materials, radio materials and radio components, photographic equipment, experimental animals and other materials for educational purposes and research work, precious and other metals for prosthetics, as well as disabled equipment and vehicles for disabled people,

- household materials (light bulbs, soap, brushes, etc.), office supplies (paper, pencils, pens, rods, etc.),

- dishes,

- container,

- stern,

- books,

- spare parts for the repair and replacement of worn parts in machinery and equipment, vehicles, industrial and household equipment,

- special purpose materials,

- other similar assets.

Resources classified as other inventory are assets of budgetary institutions, which, as in the case of inventories of commercial organizations, are accounted for in separate accounting accounts. According to the Unified Chart of Accounts (common for all budgetary organizations), account 105 06 is used.

Moreover, in many cases it is supplemented by a 3-digit analytical code of KOSGU. For example, reflecting an increase in the cost of inventories.

In commercial accounting, “other” in the manner determined by local regulations, as a rule, includes inventories with the least degree of significance from the point of view of use in the production process (based on the criteria established by the responsible specialists of the company).

Regulatory framework

According to clause 13 of the Federal Accounting Standard “Fixed Assets” (approved by order of the Ministry of Finance dated December 31, 2016 No. 257n), units of accounting for fixed assets determined when they were accepted for accounting, based on the new conditions for their use by the accounting entity, can be reclassified into another group of fixed assets funds or another category of accounting objects

. In other words, if the conditions for an institution’s use of a fixed asset have changed, then it can be moved to another group of fixed assets or accounted for as another accounting object, for example, as an inventory.

It is the “conversion” of a former fixed asset into a material reserve that is the most likely fate of IT property acquired at the beginning of the 2000s and accounted for as a fixed asset.

However, when reclassifying, two simple conditions must be met:

- first, the disposal of an inventory item from one group of fixed assets and its reflection in another group must occur simultaneously;

- second, the transfer of a fixed asset item to another group of fixed assets or to another category of accounting items does not lead to a change in its value.

The basis document for recording the reclassification of objects in accounting is the Protocol of the Commission on the receipt and disposal of assets.

Increase in the cost of inventory (which is included in account 340 of budget accounting)

The term “increase in the value of inventories” can be considered in several aspects. Thus, in budget accounting, it is understood as the fact that expenses for payment of contracts for the purchase of inventories are allocated to the article code KOSGU 340.

The corresponding code for KOSGU is used by government, budgetary institutions, as well as organizations that have the authority to receive budgetary funds. It records the expenses of a state or municipal organization for the purchase or production of materials and equipment. They can be represented by objects such as:

- medicines and medical equipment,

- Food,

- fuel,

- building materials,

- furniture,

- spare parts,

- special equipment for research,

- stern.

In commercial accounting, an increase in the cost of inventories is understood as the fact of writing off certain expenses associated with the purchase of inventories to increase their value. Each such write-off is recorded as a separate entry.

Order size optimization involves determining inventory requirements

This area of analysis deals with the calculation of the standard indicator of the company’s need for certain material reserves - so as to optimize their purchases in the required volume when ordering from suppliers. In this case, the task of responsible specialists comes down to finding such a quantity of reserves that, on the one hand, is sufficient to maintain the production process, and on the other hand, is not too much in terms of the cost of their acquisition and maintenance.

Thus, in most enterprises, determining the standard for inventory is a necessary part of analyzing the state of inventories, coupled with determining the factors influencing their volume.

Rationing the consumption of inventories of material resources and factors influencing the amount of inventories

In terms of assessing the need for them, inventories can be classified on various grounds. Thus, a common approach is to divide reserves:

- for those that are necessary to ensure an assortment of goods or stable shipment of finished products under contracts (they are, as a rule, the least in volume);

- for those that are necessary to maintain the full production cycle (usually they are second in volume);

- for those needed to maintain production between deliveries of inventory from suppliers (it is assumed that there will be the most of them);

- for insurance - which are applied in the event of a supply interruption or an increase in the need for supplies not provided for by calculations (as a rule, they are about 10% of those that belong to the previous category).

For each of these reserves, the optimal and, as a result, standard indicator of duration or volume is considered based on factors such as:

- dynamics of consumption of inventories (in relation, for example, to the dynamics of demand for manufactured goods);

- frequency of deliveries of materials from the supplier, completeness of deliveries;

- range of products.

It was and became

Information technologies are developing very quickly and what seemed like the pinnacle of technical thought a couple of years ago can today gather dust on the farthest shelves of closets. In the regulatory documents regulating the reflection of scientific and technological progress in accounting, their authors barely have time to make appropriate changes. This is especially true for fixed assets.

So, back in the early 2000s, many institutions purchased, according to KOSGU 310, various boards for computers, keyboards, peripheral devices, etc., which were then classified as fixed assets by regulatory documents. The Federal Treasury also agreed with this expenditure of funds. and even the Russian Ministry of Finance itself, communicating its position in letters. And this is understandable, since representatives of the Ministry of Finance, and the accountants themselves, had neither experience in using nor an understanding of the functionality of many advances in information technology. However, over time, it became clear that much of what was purchased ten to twenty years ago should be accounted for in other accounts.

The opportunity to transfer fixed assets to another group or type of assets became available to accountants in public sector institutions after federal accounting standards came into force.

Results

Material reserves are the resources of an organization on the basis of which a surplus product is created, or used as a surplus product. All organizations, including budget ones, must keep inventory records. Working with inventories, as a rule, involves determining the business entity’s need for them, as well as analyzing the effectiveness of inventory management.

You can learn more about inventory management in an enterprise in the following articles:

- “Other material reserves - what applies to them?”;

- "Inventory of inventories."

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.