Sources of law for organizing accounting in the budgetary sector

The fundamental documents regulating business accounting in the public sector are the unified chart of accounts and instructions for it, approved by order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n. They assume the existence of specialized charts of accounts approved for individual government agencies.

The Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ provides for the classification of existing public sector companies into 3 categories. Each of them has its own chart of accounts.

IMPORTANT! The term “budget accounting” can be applied not to all institutions, but only to those that fall under the classification of Order No. 162n: for example, government bodies, insurance funds, government organizations. All other public sector entities use conventional accounting rules in their work.

Results

Accounting in budgetary structures is subject to the Budget Code of the Russian Federation and is strictly regulated. The country's budget system includes the use of special codes, knowledge of which is also necessary for budget accountants, since the codes are used directly in the preparation of routine entries.

You will also find useful information in the article “Drawing up a chart of accounts for budget accounting - sample 2015” .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Structure of budget accounting accounts

A typical budget accounting account contains 26 characters. An explanation of their purpose is given in the table below.

Signs 1 to 17 identify areas of spending and sources of funds; their content is closely related to the KBK codes. The guidance on the use of accounts is an appendix to Order No. 162 n and explains the procedure for using codes for income, budget expenses, and sources of covering the deficit. At the same time, for these purposes in financial structures positions 1 to 17 are used, and for other institutions - from 4 to 20.

The 18th character is used to indicate the category of financial security. These can be budget resources with code 1 or temporarily available resources - code 3.

The remaining symbols finally characterize the subject of the transaction and are contained directly in the chart of accounts.

Balance sheet structure

At first glance, the balance sheets of commercial and budgetary organizations are similar - both contain an asset and a liability, which are divided into several parts. However, upon closer examination, an experienced accountant will discover significant differences. For example, a budgetary institution is required to separately indicate transactions with target funds, its own income, and funds at temporary disposal. If in the balance sheet of a budgetary institution an accountant reflects data for the reporting year and the previous year, then when working with commercial accounting, you will have to prepare a balance sheet for the reporting year and the two previous ones.

In a commercial structure, the asset is divided into non-current and current assets, the circulation of funds forms the basis of the asset of the commercial balance sheet. State employees have two components: financial and non-financial assets, and funds are divided into those expressed in monetary terms and those that have a tangible form. The balance sheet liability in a commercial structure contains an indication of own and borrowed funds. The latter are divided into long-term and short-term liabilities. For the balance sheet of a budgetary institution, it is important to reflect the types of payments, regardless of their repayment period.

Postings in budget accounting in 2021

The instructions to Order No. 162n contain many typical business situations in connection with the entries that need to be made in accounting. The instructions also contain a separate table with basic postings. If there is no suitable accounting entry in this table, you must make your own entries in accordance with the general requirements of the instructions.

In 2021, there were a number of changes in the budgetary chart of accounts that are significant for the relevant institutions:

- additional correspondence accounts were included;

- separate accounts were removed due to the emergence of a separate chart of accounts for the treasury;

- the concept of accounting for finished products has changed (they began to be accounted for at planned cost);

- The account codes of the section “Authorization of Expenses” have been adjusted; KOSGU, which are no longer used in budgeting expenses, have been excluded from them;

- changes also occurred in the KBK, in particular, codes were removed from them to reflect the classification of government operations (KOSGU).

The described adjustments must be applied when maintaining accounting records. At the same time, it cannot be said that they radically changed his methodology, since in general most of the correspondence accounts remained the same.

Example

The state government educational institution “Lyceum No. 7” carried out the following business transactions in March 2017:

Formation of articles of the FCD Plan for 2021

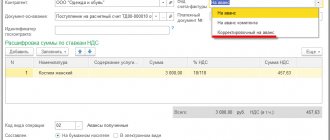

In order to reflect planned assignments for income and expenses, budgetary and autonomous institutions in the program “1C: Accounting of a State Institution 8” enter articles of the FCD plan into the directory “Items of the plan of receipts (disposals)”.

In the elements of the directory “Items of the revenue (disposal) plan” for articles of the KRB type, it is enough to indicate the codes of the section and subsection, type of expenses and KOSGU. If necessary, you can specify a code from an arbitrary classifier “Analytical KPS Code”, which is used to conduct analytics in accordance with the Accounting Policy of the institution.

Requirements for the plan of financial and economic activities of a state (municipal) institution, approved. by order of the Ministry of Finance of Russia dated July 28, 2010 No. 81n, as amended. dated August 29, 2016 No. 142n (hereinafter referred to as the Requirements for the FCD Plan), do not contain the requirement to reflect income and sources in the FCD Plan according to analytical codes of subtypes of income and sources. According to clause 8.1 of the Requirements for the FCD Plan, in column 3 of Table 2, lines 110 - 180, 300 - 420 indicate classification codes for operations of the general government sector, and lines 210 - 280 indicate codes for types of budget expenditures.

To reflect planned indicators on accounting accounts in the elements of the reference book “Items of the revenue (disposal) plan” for articles of the type KDB (CIF), in addition to the code of the section and subsection of the classification of expenses, it is necessary to indicate the codes of the analytical group of the subtype of income (sources) and KOSGU.

Rice. 2

If necessary, you can specify a code from an arbitrary classifier “Analytical KPS Code”, which is used to conduct analytics in accordance with the Accounting Policy of the institution.

Examples of creating KPS and articles of the FHD Plan for different accounts are given in the article “1C: Accounting of a government institution 8”. Formation of a working chart of accounts for budgetary and autonomous institutions in 2021, published in the ITS-BUDGET resources.

***

Currently, fiscal accounts have a rather limited scope of application related to public sector institutions. The main document regulating the accounting procedures in such institutions is Order of the Ministry of Finance No. 152 n. Based on the explanations given in the instructions for it, a specialist from a state company will be able to correctly draw up entries using the appropriate accounting accounts.

Accounting entries in budget accounting must reflect all economic transactions in the institution. We will not repeat the basic principles that guide employees of financial departments, but let us recall one point characteristic of public sector employees. One transaction should not contain accounts with different sources of financing or different BCCs of the same type. For example, there cannot be an entry in which the debit is an account with one classification of expenses, and the credit is with another. Also, the budget source of financing should not be mixed with income-generating activities. In these cases, the accounts belong to different estimates, which is unacceptable in budget accounting. In further examples of postings we will use accounts without the first eighteen characters, only synthetic, analytical accounts and KOSGU. Below are the main examples of entries in budget accounting

which will give an idea about it.

Legal regulation

Treasurers are a separate type of state and municipal organizations created to carry out state tasks and municipal tasks or carry out the functions of government bodies, financed from the corresponding budget on the basis of budget estimates. The rules for organizing and maintaining accounting in government institutions regulate:

- Law No. 402-FZ regarding key issues of accounting organization;

- Instruction No. 157n and Instruction 162n in budget accounting in 2021 for government institutions;

- Instruction No. 132n regarding the formation of budget classification codes to reflect transactions in corporate accounting;

- Instruction No. 191n regarding the composition and procedure for reporting in government organizations;

- Order No. 209n regarding the formation of KOSGU;

- federal accounting standards regulating industry accounting methods;

- methodological recommendations, letters and explanations of the Ministry of Finance of the Russian Federation and individual departments regarding the settlement of issues related to accounting.

The main system of regulatory regulation of accounting includes regional and municipal regulations that establish separate rules for accounting and reporting.

Examples of budget accounting entries

Let's consider working with third-party contractors.

Purchasing services consists of two parts. First, we take into account the invoice (invoice) for the services provided Dt 40120223 - Kt 30223730, then we pay them: 30223830 - 20111610. In this case, payments are made through account 30223, which takes into account accounts payable for payments for utility services. If a budget organization first pays and then receives goods or services, then settlements are carried out through 206 accounts. 20634560 - 20111610 - the organization made an advance payment for materials, 10536340 - 20634660 - material inventories were capitalized and accepted for accounting. Similar entries are used if settlements with accountable persons are affected. 20834560 - 20134610 - money was issued from the cash register to the account, 10533340 - 20834660 - the accountable person purchased fuel or fuels and lubricants for the organization.

Let's continue the review of transactions on material assets. 10531000 - 10531000 - transfer of medicines from one financially responsible person to another (here you can do without KOSGU). 40120340 - 10532440 - writing off food as expenses. Fixed assets (FPE) are most often purchased through account 10610, where overhead expenses that form their cost are collected: 10611310 - 20631560 (or 30231730). Next comes the actual acceptance of fixed assets for accounting: 10134310 - 10611410 (Machinery and equipment - other movable property).

Fixed assets are depreciated - 40120271 - 10434410 and written off: 10434410 - 10134410 - write-off of depreciation amounts, 40110172 - 10134410 - write-off of residual value.

Some payroll entries. 40120211 - 30211730 - calculation of the basic salary, 30213730 - 30302830 - calculation of temporary disability benefits, 30211830 - 30301730 - deduction of personal income tax from salary. 40120213 - 30310830 - contributions to the insurance part of the Pension Fund of the Russian Federation have been accrued, 30211830 - 30403730 - transfer of salaries to bank cards (account for other payroll payments).

For income-generating activities, expenses can be generated not through account 40120, but through accounts 109, which form the cost of production, overhead or general business expenses. Here, for example, is what the depreciation posting looks like: 10960271 - 10434410. At the end of a certain period, the 109th accounts are closed to 40120: 40120211 - 10960211. At the end of the year, expense and income accounts are closed to the financial result account 40130 according to the relevant KOSGU (and at the very 40130 KOSGU no): 40130 - 40110000, 40120000 - 40130.

Sometimes mere pennies are not enough to buy a car and household appliances. And you have already begun to think about a loan. But how do you know whether you will get a loan or not?

Budget accounting entries are compiled based on the rules established by the budget accounting chart of accounts. The correctness of budget accounting entries can be checked by finding suitable business transactions in the instructions for the chart of accounts. We'll talk about this in our article.

What is budget accounting, what regulations govern it?

Public sector organizations keep records based on the provisions of the Unified Chart of Accounts and instructions thereto, approved by Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n. According to clause 21 of instruction No. 157n, private charts of accounts for specific types of organizations also apply.

Clause 2 art. 9.1 of the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ states that state municipal institutions are divided into 3 types. Each type has its own chart of accounts (see Table 1).

Table 1

| Type of government organization | Order approving the corresponding chart of accounts |

| Autonomous institutions | Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n |

| Budget institutions | Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n |

| State institutions | Order of the Ministry of Finance dated December 6, 2010 No. 162n |

The concept of “budget accounting” does not apply to all government agencies. It can be used in relation to certain organizations falling under the jurisdiction of Order No. 162n. Examples of such organizations are government institutions, government agencies, and extra-budgetary funds. The remaining government agencies maintain accounting records (orders No. 174n and No. 183n).

Structure of the budget accounting account

The account number has a complex structure and consists of 26 digits. Table 2 shows the composition of the account indicating the values of the digits.

table 2

| Account digit number | Meaning |

| Classification attribute of receipts and disposals | |

| Financial support | |

| Accounting object | |

| Accounting object group | |

| Type of accounting object | |

| Type of receipts, disposals of an accounting object |

Numbers 1-17 encode the classification attribute of receipts and disposals and are formed from the BCC. Budget accounting instruction No. 162n contains a separate Appendix 2, in which for each account it is specified which BCC must be indicated: the code intended for budget expenditures (KRB), budget revenues (KDB) or sources of financing the budget deficit (CIF). Moreover, for institutions, categories 4-20 of the KBK are taken, and for financial authorities - categories 1-17.

The 18th category is intended to clarify the type of financial support. For budget accounting, according to clause 2 of Order No. 162n, only the value 1 (at the expense of the budget) or 3 (at the expense of funds at temporary disposal) can appear in this place. The remaining digits directly encrypt information related to the accounting object and are indicated in the chart of accounts.

Read about drawing up a chart of accounts for budget accounting.

Reporting of a budget organization

Institutions that receive budget funding, like other taxpayers, are required to report on the results of their financial and economic activities. In addition to basic reporting, such structures submit reports on cash flows and budget execution. Often the information specified in the reporting forms needs to be clarified. The accounting department of the budgetary organization prepares an explanatory note for this purpose. The absence of the latter in the package of reporting documents is the exception rather than the rule.

To clarify certain points, figures, and features of the activities of a budget organization, the controlling structure may request additional documents (balance sheets, declarations, calculations, etc.). The subsidy and the taxpayer are obliged to submit them within the established time frame.

Postings in budget accounting in 2018-2019

Instruction No. 162n contains information about various business transactions and transactions with which these transactions can be processed. In addition, the legislator has developed a separate table with possible correspondence accounts, contained in Appendix No. 1 to Instruction No. 162n. If the required operation is not in the table, then it is possible to independently determine the wiring in accordance with the requirements of Order No. 162n. In 2021, the budget chart of accounts is applied as amended by Order of the Ministry of Finance dated March 31, 2018 No. 65n.

We will consider typical budget accounting entries below using an example.

Example

The municipal government educational institution “School No. 1” in the current month carried out the following business transactions and reflected them in accounting (see Table 3).

Table 3

| Name of business transaction | Amount, rub. | |

| Stationery supplies worth RUB 6,750 were purchased. | KRB 010536340 “Increase in the value of other inventories - other movable property of the institution” | KRB 030234730 “Increase in accounts payable for the acquisition of inventories” |

| Stationery worth RUB 1,750 was donated for use. | KRB 040120272 “Consumption of inventories” | KRB 010536440 “Reduction in the value of other inventories - other movable property of the institution” |

| Staff salaries were accrued for a total amount of RUB 754,000. | KRB 040120211 “Wage expenses” | KRB 030211730 “Increase in payables for wages” |

| Personal income tax withheld from salary | KRB 030301730 “Increase in accounts payable for personal income tax” | |

| Salaries paid to employees' bank cards | KRB 030211830 “Reducing payables on wages” | KIF 020111610 “Retirement of funds of the institution from personal accounts in the treasury body”, as well as an entry in off-balance sheet account 18 “Retirement of funds from the accounts of the institution” |

| Insurance premiums calculated from salary | KRB 040120213 “Expenses for accruals for wage payments” | KRB 030302730, KRB 030306730, KRB 030307730, KRB 030308730, KRB 030310730, KRB 030311730 “Increase in accounts payable for payments to budgets” |

| Personal income tax and salary contributions for September have been transferred | KRB 030301830, KRB 030302830, KRB 030306830, KRB 030308830, KRB 030311830, KRB 030311830 “Reduction of accounts payable for payments to budgets” | KIF 020111610 “Retirement of funds of the institution from personal accounts in the treasury body”, as well as an entry in off-balance sheet account 18 “Retirement of funds from the accounts of the institution” |

| The expenses of this month are written off to the financial result at the end of the year |

Let's determine the important points when calculating salaries:

- The institution must develop and approve a regulation on remuneration, which is formed taking into account the specifics of the organization’s activities and does not contradict current legislation.

- The salaries of the employees of the institution should be calculated in strict accordance with the approved regulations on remuneration and individual local orders of the head of personnel.

- Regardless of the amount of the advance, which is provided for the first half of the worked period, in full. And on the last day of the month.

- , and insurance premiums should be calculated for the entire amount of accruals, without deducting the advance already paid for the first half of the month. The amounts that should be included in the tax base are set out in the Tax Code.

- In 2021, apply the new minimum wage for workers whose salary does not exceed the minimum wage. The minimum wage is regulated by law dated June 19, 2000 No. 82-FZ with the latest amendments.

- Provide in the wage regulations, collective agreement, as well as in labor agreements that salary transfers to the organization are carried out at least twice a month.

- Take into account the regional coefficients established in the region where the organization is located. Take into account the amounts of regional surcharges when calculating the minimum wage.

- When terminating an employment contract, make final payments on the employee’s last working day. Moreover, the amount of mandatory compensation calculation does not depend on the reason for dismissal.

You should follow instructions No. 174n and No. 157n - for public sector institutions, and instructions No. 94n - for non-profit organizations.

Drawing up correspondence accounts (using the example of accounts 106, 205, 209, 302)

Budget accounting uses the standard double entry principle. Let's show typical transactions using the following synthetic accounts as an example:

- 0010600000 “Investments in non-financial assets” (used to reflect actual costs for the purchase, creation, modernization of fixed assets, intangible assets, non-productive assets, inventories);

- 0020500000 “Calculations for income” (used to reflect settlements with debtors);

- 0020900000 “Calculations for damage and other income” (used to reflect the receivables of those responsible for causing damage, prepayments for which services were not provided, and other calculations specified in clause 220 of Order No. 157n);

- 0030200000 “Settlements for accepted obligations” (used to reflect accounts payable).

Depending on the group, type of object and its movement, the account analytics changes, and instead of 0, the corresponding codes are used, which can be found in the budget accounting chart of accounts. A wide list of typical transactions is given in Appendix 1 to the instructions for the budget accounting chart of accounts.

| Table 3 | ||

| Business transaction | Debit | Credit |

| The actual costs of purchasing the OS are reflected | KRB 010611310 “Increasing investments in fixed assets - real estate of the institution” KRB 010631310 “Increasing investments in fixed assets - other movable property of the institution” | KRB 030221730 “Increase in accounts payable for communication services” KRB 030222730 (–//– for transport services) KRB 030225730 (–//– for work, property maintenance services) KRB 030226730 (–//– for other works, services) KRB 030231730 (–//– for the acquisition of fixed assets) KRB 030291730 (–//– for other expenses) |

| Debt for the shortage of fixed assets has been accrued at the expense of the guilty parties | KDB 020971560 “Increase in accounts receivable for damage to fixed assets” | KDB 040110172 “Income from operations with assets” |

| Accrued income from the provision of services | KDB 020531560 “Increase in accounts receivable for income from the provision of paid work and services” | KDB 040110130 “Income from the provision of paid services” |

Accounting for public sector employees

To reflect the amounts of accrued remuneration for the work of employees of public sector institutions, separate accounting instructions should be applied. In other words, the general Chart of Accounts (Order No. 94n) cannot be applied in this case.

Thus, the general instruction for organizations is Order of the Ministry of Finance No. 157n. However, this is not the only document. Additional recommendations and requirements are given in separate orders:

- Instruction No. 174n - for budgetary institutions.

- Instruction No. 183n - for autonomous organizations.

- Instruction No. 162n - for government-type government agencies.

Thus, in accordance with these regulations, public sector employees are required to use account 0 302 10 000 “Calculations for wages and accruals for wage payments” to reflect accruals in favor of their employees.

To organize reliable synthetic accounting, it is necessary to detail the information. To do this, provide the appropriate analytical accounting codes:

- Code “1” or 0 302 11 000 - is intended to reflect operations for directly calculating wages. For example, on this accounting account reflect the accrued salary, incentives, and compensation payments. If a territorial (district) coefficient is applied to earnings, then also reflect these amounts with code “1”. Also include in the group the amounts of accrued vacation pay and sick leave benefits at the expense of the employer.

- Code “2” or 0 302 12 000 - information on other payments in favor of employees is accumulated. For example, this group includes accruals in favor of women receiving benefits for children under three years of age. Currently, the amount of such payment is 50 rubles. If there is a regional coefficient in your region, then also include it in the group with code “2”.

- Code “3” or 0 302 13 000 - this group includes all calculations for calculating benefits for illness, pregnancy and childbirth, one-time payments from the Social Insurance Fund. That is, code “3” is intended to reflect charges for wage payments.

The accrual of labor costs is reflected in the credit of account 0 302 00 000, in correspondence with the accounts:

- 0 109 00 000 - when reflecting payments in favor of employees directly involved in the implementation of municipal tasks;

- 0 401 20 000 - for calculating payments to other personnel.

New accounting standards from 2021

Seven new FSBUs have determined that accounting is being conducted in a new way in 2021. Accounts and instructions for accounting in government institutions have been changed in 2021, and a procedure for accounting for intangible and non-produced assets has been introduced. Read more about these changes in the article “Understanding the New Accounting Standards.”

From 2021, all payments to staff are divided into two groups:

- current - wages;

- deferred - vacation pay.

The procedure for assessing and accounting for employee benefits depends on the group. Current ones are taken into account as part of accepted obligations for wages and accruals on them, and deferred ones are taken into account as part of a reserve, on account 0 401 60 000.

From January 2021, the rights to use intangible assets are reflected in new sub-articles of KOSGU:

- non-exclusive rights with a certain useful life - 352, 452;

- non-exclusive rights with an indefinite useful life - 353, 453.

The requirements for reflecting rights to land plots in the reports of budgetary institutions have been changed. If the “Non-produced assets” standard is applied for the first time, land plots on the balance sheet and included in the Unified State Register of Real Estate should be revalued to cadastral value.

Government organizations need to adjust local documents regulating methods and methods of accounting, that is, update accounting policies. These changes should have been approved in December 2021. Check whether all changes are included in the accounting policies for 2021 in the article “Accounting policies: how to prepare according to new requirements.”

Pay attention to the article on how to properly maintain accounting of bank guarantees.

Accounting in non-profit organizations

Non-profit organizations are required to keep accounting records in accordance with generally accepted standards, in accordance with Order of the Ministry of Finance No. 94n. So, accumulate all accrued remunerations for labor in accounting account 70 “Settlements with personnel for remuneration”.

Regardless of the type of organization (non-profit, budgetary, commercial), keep records of accruals separately for each employee. It is not allowed to enter generalized information on the enterprise as a whole or entries by workshop, section, department, shift.

It is permissible to open corresponding sub-accounts to account 70. For example, to detail information on workshops, departments and other structural divisions of the enterprise.

To reflect the accruals, an entry is made on the credit of account 70 in correspondence with the production cost accounts. For example, to reflect the earnings of core personnel, account 20 “Main production” is used, for support personnel - account 23.

Salary accounting in a budgetary institution

| Note | |

| Salary accrued, posting | Remuneration - KVR 111 Other payments - 112 Benefits and sick leave, as well as insurance premiums - 119 |

| Accrual of sick leave | |

| Accrual of other payments | |

| Wages accrued to employees of main production, posting | 4 109 61 211 (if the salary is included in the cost) 4 109 71 211 (overheads) 4 109 81 211 (general business expenses) |

| Personal income tax withheld | |

| Writ of execution withheld | |

| Transfer to bank cards | |

| Insurance premiums | 4 303 02 730 (FSS - 2.9%) 4 303 06 730 (FSS NS and PZ - 0.2%) 4 303 07 730 (FFOMS - 5.1%) 4,303 10,730 (OPS - 22%) |

Accounting for salaries in a government institution

| Note | |

| Accrued wages to employees, posting | For remuneration of state and municipal employees - KVR 121, for payment of benefits and insurance contributions - 129 |

| Sick leave | |

| Salary transferred from current account | |

| PO issued from the cash register, posting | |

| Insurance premiums | 1 303 02 730 (FSS - 2.9%) 1 303 06 730 (FSS NS and PZ - 0.2%) 1 303 07 730 (FFOMS - 5.1%) 1,303 10,730 (OPS - 22%) |

Legal status of the organization

The Civil Code divides organizations into commercial and non-profit.

The main goal of commercial organizations is to make a profit. Accordingly, non-profit organizations are those for which profit is not an end in itself. These, in particular, include state and municipal institutions (clause 8, part 3, article of the Civil Code of the Russian Federation). Both federal departments and bodies of federal subjects and municipalities can act as founders of such organizations. A state or municipal institution can be a state-owned, budgetary or autonomous institution (Article 123.22 of the Civil Code of the Russian Federation). In addition to the “statutory” type of activity, a public sector organization can conduct other work only if it does not contradict the goals of its creation. The addition must be specified in the statutory documents.

Accounting entries for salary: salary in an autonomous institution

| Notes | |

| Salary accrued, entry for business activities | Similar for budgetary institutions |

| Personal income tax withheld | |

| Union dues withheld | |

| Issuance of wages from the cash register, posting | |

| Salary issued, posting from current account | |

| Insurance premiums | 2 303 02 730 (FSS - 2.9%) 2 303 06 730 (FSS NS and PZ - 0.2%) 2 303 07 730 (FFOMS - 5.1%) 2,303 10,730 (OPS - 22%) |

Accounting entries for wages: examples for non-profit organizations

| Note | ||

| Accrued wages, posting for management personnel | The salary is calculated in full, regardless of the amount of the advance payment transferred | |

| Salary accrued to employees of main production, posting | ||

| Personal income tax: deduction from wages, postings | ||

| Salaries were paid from the current account, the posting for the advance is similar | ||

| Wages have been paid from the cash register, the posting is suitable for reflecting the advance | ||

| Insurance premiums | 20 (for main production) 26 (by management) | 69/3 (FFOMS) |

Changes to the Chart of Accounts for accounting of budgetary institutions and the Instructions for its application introduced (hereinafter referred to as Order No. 227n) have long been expected. Innovations are due to the need to bring the Chart of Accounts and Instructions, approved. (hereinafter referred to as Instruction No. 174n), in accordance with the Unified Chart of Accounts and the provisions of the Instructions for its application, approved. (hereinafter referred to as Instruction No. 157n), new provisions of budget legislation regarding the structure of budget classification, changes in the procedure for preparing financial statements.

Innovations must be applied in order to formulate the accounting policy for 2021 and accounting indicators as of January 1, 2021 (with the exception of the requirements for the formation of 1-4 digits of the account number).

One of the significant changes is that almost all references to the procedure for using primary accounting documents for the purpose of recording business transactions have been removed.

Source documents

You can learn more about the preparation of primary documents in an institution from the material “Encyclopedia of Solutions. Budgetary sphere" Internet version of the GARANT system. Get free access for 3 days!

Budgetary (autonomous) institutions can establish the procedure for generating 5-14 digits of the account number in their accounting policies. In particular, you can use codes for target expense items. If the accounting policy does not regulate the issue of forming 5-14 digits of the account number, then zeros must be indicated in these digits.

The procedure for the formation of opening balances on accounts of non-financial assets has been regulated, with the exception of accounts 0 106 00 000 and 0 107 00 000 - at the beginning of the year, zeros are indicated in digits 5-17.

In addition, special rules are provided for accounts 0 204 00 000, 0 401 30 000, 0 401 20 270. Zeros are always indicated:

- in 1-14 digits account numbers account 0 204 00 000 “Financial investments”;

- in 1-17 digits of account number 0 401 30 000 “Financial result of previous reporting periods”;

- in 5-17 digits of account numbers, account 0 401 20 270 “Expenses on transactions with assets.”

Note.

The use of budget classification by budgetary institutions for accounting purposes can be found in the material in the Encyclopedia of Solutions. Budgetary sphere

Changes to the Chart of Accounts

Mainly related to their alignment with the Unified Chart of Accounts, approved (). The names of many accounts have been adjusted, and corresponding adjustments have been made to the provisions.

The chart of accounts has been supplemented with new analytical accounts, including:

- 0 205 82 000 “Calculations for uncleared receipts” ();

- 0 206 11 000 “Calculations for wages” () - used to reflect the employee’s debt when recalculating wages, associated, for example, with the submission of a corrective report card for the use of working time (in the case of providing certificates of incapacity for work, fulfilling a state duty);

- analytical accounting accounts have been introduced to account 0 209 00 000 “Calculations for damage and other income”, in particular: 0 209 30 000 “Calculations for compensation of costs”, 0 209 40 000 “Calculations for amounts of forced seizure”, 0 209 83 000 “ Calculations for other income" ();

- 0 210 10 000 “Calculations for tax deductions for VAT” ();

- 0 401 40 172 “Deferred income from operations with assets” ();

- Linking accounts 0 401 50 000 “Future expenses” and 0 401 60 000 “Reserves for future expenses” with specific KOSGU codes is not provided for in the new editions; The accounting procedure for these accounts should be determined in the accounting policy based on the economic content of the transactions (,).

The new edition contains Section 5 “Authorization of expenses” (). Accounting for analytical accounts of accounts 0 502 00 000 “Liabilities”, 0 504 00 000 “Estimated (planned) assignments”, 0 506 00 000 “Right to assume obligations”, 0 507 00 000 “Approved amount of financial support”, 0 508 00 000 “Received financial support” is organized according to the corresponding analytical codes of the type of receipts, disposals of the accounting object, corresponding to the KOSGU codes.

Off-balance sheet accounts have also been added:

- 27 “Material assets issued for personal use to employees (employees)”;

- 30 “Calculations for the fulfillment of monetary obligations through third parties”;

- 31 “Shares at par value”.

OUR HELP

Order of the Ministry of Finance of Russia dated March 1, 2016 No. 16n “On amendments to the order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n” (the order is being registered with the Ministry of Justice of Russia) provides for the introduction of a new off-balance sheet account 40 “Assets in managers Assets in managers 4".

Obtaining land plots

on the right of permanent (perpetual) use, including those located under real estate, is reflected in the debit of account 4,103 11,000 “Land - immovable property of the institution” and the credit of account 4,401 10,180 “Other income” (,).

Also added are entries to recognize as expenses of the current financial year capital investments made in fixed assets, intangible assets that were not created (not recognized as assets) in the presence of a decision to terminate the implementation of the investment project within which the capital investments were made ().

- transfer of special equipment from the warehouse to the scientific department to perform R&D under the contract;

- transfer of material reserves to employees (employees) of the institution for personal use for the performance of their official (official) duties;

- transfer of young animals to the main herd;

- recording of material reserves formed as a result of the authorized body making a decision on the sale, gratuitous transfer of movable property that has been put out of service.

The new edition sets out provisions for the formation of costs for the manufacture of finished products, accounting for finished products, and the procedure for accounting for trade margins in the event of identifying shortages or damage to property, including due to natural disasters, has been clarified and supplemented ().

OUR HELP

- debts of customers in accordance with long-term contracts and settlement documents for individual stages of work and services completed and delivered to them;

- debts of buyers under a contract for the sale of property, providing for payment by installments, with the transfer of ownership (rights of operational management) to the object after completion of settlements;

- income in the form of grants, subsidies, including for other purposes, under agreements on the provision of subsidies (grants) in the next financial year (years following the reporting one).

The procedure for writing off receivables (payables) from the balance sheet has been clarified, in particular, those recorded on account 0 205 00 000 “Calculations for income” ().

Additions and adjustments also affected the procedure for recording transactions with funds in temporary disposal, including in foreign currency (,).

In connection with the expansion of analytics for account 0 209 00 000, new correspondence was added (), including (Table 2):

Table 2. New correspondence for account 0 209 000

| Account correspondence | ||

Reflection of the amount of damage:

| ||

| Accrual of debt in the amount of claims for compensation of institution expenses by recipients of advance payments, accountable amounts | ||

Reflection of the amount:

| ||

Postings are provided to reflect in accounting the decrease in settlements with debtors on analytical accounts of account 2,205,00,000, as well as on account 2,209,40,000 in correspondence with the corresponding analytical accounts of account 2,302,00,000 by termination of the counterclaim by offset (

- Accounting for transactions with subsidies for the implementation of government tasks

- Government funds are on the way. Account 201 03

- Accounting for government agency settlements for damage and other income. Account 209 00

- Settlements between a government agency and a financial authority for cash. Account 210 03

- Settlements between a budgetary (autonomous) institution and its founder. Account 210 06

Liabilities

- an accountable person for the return of unused funds (cash documents) in the amount of deductions made from wages (other income) for another type of financial support (activity);

- the person at fault for damage in the amount of deductions made from wages, scholarships and other income, for another type of financial support (activity).

The use of account 0 304 06 000 is provided for the execution of receivables recorded in accounts 0 205 00 000 “Calculations for income”, 0 209 00 000 “Calculations for damage and other income”, 0 206 00 000 “Settlements for advances issued”, 0 207 00 000 “Settlements on credits, borrowings (loans)”, 0 208 00 000 “Settlements with accountable persons”, on income (payments) from another financial source, including offsetting counterclaims (withholdings). Also, account 0 304 06 000 is used for accounting for non-financial, financial assets (except for non-cash funds), settlements of obligations, the financial result of the institution under the transfer act (separation balance sheet) during reorganization through merger, accession, division, separation.

New rules have been established governing the procedure for closing settlements on account 0 304 06 000 at the end of the financial year ().

The main innovation is the establishment of an accounting procedure for the account 0 401 60 000 “Reserves for future expenses” (), newly introduced into the Chart of Accounts for budgetary institutions, as well as the reflection of the corresponding entries in account 0 502 09 000 “Deferred liabilities”.

Previously, an example of detailing the chart of accounts and accounting entries for account 0 401 60 000 were given respectively in Appendix 1

Authorization of expenses

Almost all provisions of this section have undergone more or less significant changes. In connection with the introduction of new accounts and the expansion of analytics on expense authorization accounts, adjustments and additions were made to Section 5 of Instruction No. 174n, which provide for the accounting procedure, in particular, for accounts 0 502 07 000 “Accepted liabilities”, 0 502 09 000 “Deferred liabilities ", 0 504 00 000 "Estimated (planned, forecast) assignments" and 0 507 00 000 "Approved amount of financial support".

You can learn about the procedure for recording expenses in the accounts for authorization in the Encyclopedia of Solutions. Budgetary sphere:

- Authorization of government expenses. Account 500 00

- Accounting for authorization of expenses in a budgetary (autonomous) institution

Olga Monaco

, expert in the “Budget Sphere” direction of the Legal Consulting Service GARANT, auditor

Specifics of sections of the chart of accounts

Non-financial assets of a budget organization include fixed assets, intangible assets, expenses, investments in non-financial assets, depreciation, inventories, finished products, goods, non-produced assets. The last component is new for an accountant familiar only with classical accounting. Non-produced assets are not the results of production. This category includes land, subsoil resources, etc. In accounting, such assets are reflected at historical cost (with the exception of land). Land is valued at cadastral value.

Financial assets of a budgetary organization are accounted for in the same way as in a commercial one. This section of the chart of accounts includes investments in financial assets, advances to counterparties, employees, accounts receivable, financial investments (purchase of securities, contributions to the authorized capital of other organizations, etc.), cash.

In the “Liabilities” section, the accountant of a budget organization should reflect accounts payable. This includes arrears in taxes, social benefits, outstanding financial obligations to other organizations, debts for work performed, services provided, goods supplied, and credit debt.

The “Financial Result” section is almost identical to that in the chart of accounts of an extra-budgetary organization.

“Authorization of expenses” is a specific section relevant for government agencies. It reflects the receipt of subsidies, liability limits and their use, planned income, expenses.

It should also be noted that the accounting department of a budgetary institution uses 30 off-balance sheet accounts. The principle of their conduct is identical to that in a commercial organization. It is allowed to open additional off-balance sheet accounts. They can be used to reflect objects that should not be listed on the balance sheet. Such objects include guarantees, awards, property not under operational management, and much more.