Ekaterina Kuznetsova, a practicing tax consultant for more than 10 years, former deputy head of the field tax audit department, founder (www.pbu.su), speaker at various events on the topic of taxation, spoke about working with marketplaces, taking into account our tax legislation.

Currently, online trading is developing very actively. Online shopping has become such an organic part of our lives that it seems to us as if it has always been this way. More and more entrepreneurs (in the text we will mean both individual entrepreneurs (IP) and limited liability companies (LLC)) are using marketplaces to sell their products. This is really very convenient, because the site already has a stable clientele, an excellent marketing and sales department, accurate analytics and a development strategy. However, the sale of goods through the marketplace has its own characteristics that must be taken into account during such cooperation so as not to violate tax laws.

Each marketplace is ready to cooperate with almost any entrepreneur under the terms of a commission agreement. What is it? Everything related to the commission agreement is regulated by the provisions of Chapter 51 of the Civil Code of the Russian Federation. In this article I will try to simplify the legal language.

Basics

So, first let's understand the terms.

The principal is an entrepreneur, the owner of the goods, who gives them to the commission agent for sale.

A commission agent is an intermediary who accepts goods for sale from the consignor.

At the moment the commission agent accepts the goods for sale, the owner of the goods remains the principal. The ownership of the goods from the consignor will immediately pass to the address of the buyer who purchased this goods from the commission agent under the purchase and sale agreement. If the goods are not sold by the commission agent, then they are returned back to the consignor.

Commission is the cost of the services of a commission agent (intermediary) for the sale of goods. It can be expressed in:

●

a fixed amount specified in the contract;

●

percentage of the transaction amount concluded by the commission agent with a third party (i.e. in pursuance of the contract);

●

in the form of the difference between the price of goods sold and the price specified in the contract.

Simplified tax system and commission agreement: how to pay taxes

Participants in the commission agreement can be organizations using the simplified system. If one party is an enterprise subject to the general taxation regime, and the other is a “simplified” one, then both have many problems related to taxation. Let’s try to resolve them.

According to paragraph 1 of Article 990 of the Civil Code of the Russian Federation, within the framework of a commission agreement, one party (commission agent) undertakes, on behalf of the other party (committent), for a fee, to complete one or more transactions on its own behalf, but at the expense of the principal. Under a transaction made by the commission agent with a third party, he acquires the rights and the commission agent becomes obligated, despite the fact that the principal was named in the transaction or entered into direct relations with a third party for its execution.

The principal is obliged to pay the commission agent a remuneration, and in the case where the commission agent has accepted a guarantee for the execution of the transaction by a third party (del credere), also an additional remuneration. The amount and procedure for payment of additional remuneration must be established in the commission agreement. If the contract does not provide for the amount of remuneration or the procedure for its payment, it is paid after the execution of the contract in the amount in which, under comparable circumstances, payment for similar services is usually charged. This is established by paragraph 1 of Article 991 of the Civil Code of the Russian Federation.

The principal is obliged, in addition to paying the commission, and in appropriate cases, additional remuneration for the del credere in accordance with Article 1001 of the Civil Code of the Russian Federation, to reimburse the commission agent for the amounts spent by him on the execution of the commission order.

If the commission agent made a transaction on more favorable terms than those specified by the principal, then the additional benefit is divided equally between the commission agent and the principal. Unless, of course, the agreement provides for a different procedure for distributing this benefit. This is stated in Article 992 of the Civil Code of the Russian Federation.

Upon execution of the order, the commission agent is obliged, in accordance with Article 999, to submit a report to the commissioner and transfer to him everything received under the commission agreement. If the commissioner has objections to the report, he must notify the commissioner about them within 30 days from the date of receipt of the report, unless a deadline is established by agreement of the parties. Otherwise, the report, in the absence of any other agreement, is considered accepted.

Payment

The commission can be received by the commission agent in several ways:

1

The commission agent himself retains his remuneration at the time of transfer of funds to the principal for the sold goods, namely: the buyer pays the cost of the goods (including commission) to the commission agent;

The commission agent transfers this amount to the principal minus his remuneration. 2

The commission agent receives the amount of commission from the principal, namely: the buyer pays for the goods to the commission agent (including commission);

the commission agent will transfer ALL funds received from buyers to the principal; The principal calculates and transfers the amount of remuneration to the commission agent. In practice, the first method is more popular.

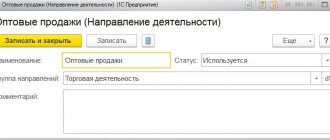

Actions in the program

Follow the “Functionality” link and make the settings for our example, namely:

- on the bank and cash desk tab, check the payment cards box;

- on the trade tab – checkboxes for retail trade and sale of goods or services of principals (principals).

In the accounting system, the receipt of goods is recorded using the corresponding document in the purchases section. Moreover, for your own goods you need to use the “Goods” transaction type, and for commissions - “Goods, services, commission”.

Tax nuances

Often, entrepreneurs who offer their products to individuals tend to use the simplified taxation system (STS), due to the fact that in this case they are not VAT payers. Let me remind you that currently (in 2021) in order for an entrepreneur to apply the simplified tax system, the following criteria must be met:

●

Revenue within 150,000,000 per year;

●

The cost of fixed assets does not exceed 150,000,000 rubles;

●

The average number of employees is no more than 100 people;

●

The share of legal entities in the authorized capital is no more than 25% (for LLC).

Revenue for tax purposes (under the simplified tax system) is recognized as income at the moment of receipt of payment (partial payment) for goods (work, services) to the current account (cash office) in the amount in which they were actually credited. That is, the “cash method” is used (for payment) and until the money arrives in the account (at the cash desk), there is no taxable base.

This is precisely where the most common mistake of simplified entrepreneurs lies, which entails underpayment of taxes to the budget during commission trading.

The whole point is that entrepreneurs, being principals, take into account for tax purposes only those funds that the commission agent transferred to them.

And this will be true if the commission agent transferred to the principal ALL the money received from the sale of the goods, including the amount of his remuneration. However, as I indicated above, in most cases the commission agent transfers funds to the principal after deducting his remuneration.

This is where the confusion arises. The mistake is that entrepreneurs on the simplified tax system reflect revenue for tax purposes in a smaller amount than they should - only the amount of money received into the current account, without taking into account the amount of remuneration remaining with the commission agent. And this is also the income of the principal! And that's why.

Since the ownership of the goods from the principal passes directly to the buyer (bypassing the commission agent), the following structure arises: the goods from the principal are transferred to the buyer at the cost indicated by the commission agent on his website (which includes the amount of the commission) - this entire amount is the principal’s revenue (in including on the simplified tax system). The commission, which is the principal's payment for the commission agent's services related, for example, to finding a buyer, is the principal's costs, which can be taken into account in the expenses of the simplifier if he applies the income-expenditure simplification (15%).

At the principal's

The rules provided for in Chapter 1 apply to relations arising from an agency agreement. 51 “Commission” of the Civil Code of the Russian Federation, if these rules do not contradict the provisions of Chapter. 52 “Agency” or the essence of the agency agreement (Article 1011 of the Civil Code of the Russian Federation).

According to paragraph 1 of Art. 996 of the Civil Code of the Russian Federation, things received by the commission agent from the principal or acquired by the commission agent at the expense of the principal are the property of the latter.

Consequently, the receipt of funds to the settlement account or to the agent’s cash desk from buyers in payment for goods sold on behalf of the principal, which are his property, should be taken into account as revenue from the sale of these goods from the principal (Letter of the Ministry of Finance of Russia dated August 20, 2007 N 03-11- 04/2/204).

The Letter of the Ministry of Finance of Russia dated 05/07/2007 N 03-11-05/95 explains that the date of receipt of income for the principal will be the day of receipt of funds transferred by the intermediary to bank accounts and (or) to the cash desk of the principal.

The principal's income is the entire amount of proceeds from the sale of goods received to the agent's account. Article 251 of the Tax Code of the Russian Federation does not provide for a reduction in the income of principals by the amount of remuneration paid by them to agents. Therefore, the income of principals applying the simplified taxation system should not be reduced by the amount of agency fees withheld by the agent from the proceeds from sales received in his current account when it is transferred to the principal.

Based on this, the income of the individual entrepreneur - the principal is not reduced by the amount of remuneration withheld independently by the agent from the amounts received by him on the basis of the agency agreement. The same position is reflected in Letters of the Ministry of Finance of Russia dated June 25, 2009 N 03-11-06/2/107, dated June 5, 2007 N 03-11-04/2/160, Federal Tax Service of Russia for Moscow dated March 5, 2007 N 18 -11/3/ [email protected]

We suggest you read: MTS office where you can terminate the contract

In this case, the agency fee, paid by the principal to the agent or withheld by the agent independently from the amounts received by him on the basis of the agency agreement, relates to the expenses of the principal on the basis of paragraphs. 24 clause 1 art. 346.16 Tax Code of the Russian Federation.

Consequently, an individual entrepreneur who is a principal and uses the “income minus expenses” taxation system has the right to reduce the income received by the amount of remuneration paid to agents (Letters of the Ministry of Finance of Russia dated April 22, 2009 N 03-11-09/145, dated November 29, 2007 N 03- 11-04/2/290, Letter of the Federal Tax Service of Russia for Moscow dated 03/05/2007 N 18-11/3/ [email protected] ).

For the principal, draw up an agent report on the work done. Attach documents confirming the expenses that the principal will reimburse. The report also indicates the amount of your remuneration. If the agent's report does not indicate the agency fee, approve it in a separate act.

Agent report template

If you are selling goods on your own behalf to a principal who works with VAT, you will have to issue invoices for buyers and report to the tax office. At the same time, you do not need to pay VAT itself.

You issue an invoice for the client on your own behalf. In the seller's data you indicate your details, and in the buyer's data - the client's details. You give one copy of the invoice to the client, the second one you keep for yourself and send a copy of it to the principal. The principal will issue the same invoice on the same date, but in his own name, and give it to you.

If you work on behalf of the principal, you won’t have to bother with VAT. You can, by proxy of the principal, issue an invoice on his behalf. Or the principal will do it himself. In this situation, you do not need to report to the tax office and pay VAT.

Practice

Let's look at how to correctly account for these transactions for tax purposes using the following example.

The principal handed over the goods to the commission agent for sale. Under the terms of the agreement, the commission agent himself withholds the amount of remuneration from the funds received (transfers to the principal the payment received from buyers minus his remuneration). The product presented on the marketplace website will cost 115 rubles. and the buyer will pay 115 rubles. The commission agent's remuneration is 15 rubles. Thus, the principal, in the event of the sale of his goods by a commission agent, must receive 100 rubles for it into his current account without VAT (since he applies the simplified tax system).

Receipt of goods from the consignor

“Receipt (goods, services, commission)” is issued. It is available from the full interface, in “Purchases”.

Fig.3 Receipt (goods, services, commission)

Here, a sales commission agreement is applied; the tabular section contains a list of goods taken on commission. This fact is noted by indicating the off-balance sheet accounting account 004.01 “Goods accepted for commission/Goods in warehouse.” The posting Dt 004.01 will be generated.

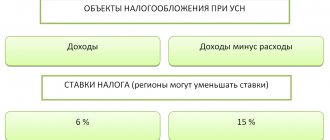

The simplified tax system is subject to income taxation (rate 6% of revenue).

The amount of revenue for tax purposes, taking into account these circumstances, should be determined as follows.

According to the example under consideration, the goods were sold for the amount of 115 rubles, and 100 rubles came to the entrepreneur’s bank account.

In this situation, tax must be paid on the amount of 115 rubles, reflected as revenue in the book of income and expenses and in the tax return under the simplified tax system under the income line.

The tax will be 115 * 6% = 6.90 rubles.

If an entrepreneur incorrectly determines the taxable base as a receipt to an account in the amount of 100 rubles, then the tax will be paid in the amount of 6 rubles (100 * 6% = 6 rubles). The underpayment will be 0.90 rubles. Penalties and fines will be charged in the future.

Income from the sale of consignment goods goes to KUDiR

First of all, it is worth reminding that this product is not yours . And if so, then you are only an intermediary in the sale and, therefore, the revenue received cannot in any way be considered YOUR income. Well, if this is not your income, then:

- In 1C Accounting, revenue from commission trading should not fall into the column “Expenses taken into account when calculating the tax base”;

- You don't have to pay tax on this money!

One day a client came to us for whom everything worked out the other way around. That is, when selling goods belonging to the consignor (the owner of the commission goods), the proceeds from the sale went to KUDiR. But in order not to pay taxes on the amount that would still have to be paid, the person tried to “go the other way,” namely:

What not to do!

If the proceeds from the sale under a commission agreement fall into KUDiR, then there is no need to try to count the amount that you then give to the principal as expenses (for the simplified tax system 15%)!

Remember, there are no costs associated with commission trading. There is only your income (as a commission agent) in the form of a percentage (or other amount) from the sale of non-own goods. This is the amount you need to pay tax on!

If in the book of income and expenses you see the amount of proceeds from the sale of the principal’s goods, then this means that you are simply keeping records incorrectly!

If you want to keep records entirely on your own, then use a special training video course on 1C: Accounting 8.3 for training. Examples of video lessons and curriculum can be found at the link.

Receipt of goods for the consignor

Reflected in the document “Receipt (goods, services, commission)”. A feature of the reflection is the use of account 002 “Inventory assets accepted for safekeeping” to register goods purchased in favor of the principal.

Fig. 12 Receipt of goods for the consignor

The receipt document forms the debt of the principal.

Fig. 13 The receipt document forms the debt of the principal

Retail trade of consignment goods in 1C Accounting

If you need to reflect in 1C a sale to individuals (for cash or by bank card), then the sequence of operations is almost the same. The difference here will be the implementation document.

If you sell retail:

In this case, to reflect the fact of sales, use the “Retail Sales Report” document.

Regardless of whether you sell consignment goods wholesale or retail, do not forget to draw up a report to the consignor, which is an important document! We consider such cases in detail at consulting sessions on retail commission trade, so I do not provide screenshots here. However, if you are well versed in accounting, then you should not have any problems.