On what form should the UTII declaration be submitted? Are there any changes in form compared to the previous quarter and what are they? When must the declaration be submitted? The answers to these questions are given in the article. You can download the new UTII declaration form for the 4th quarter of 2021 (form for KND 1152016) in Excel (Excel) here. The declaration form has a title page barcode 0291 5012 and is a form according to KND 115216.

The main reporting document for the special regime “Single tax on imputed income” is the UTII declaration for the 4th quarter of 2020. You can download the form for free in this article. Due to permanent changes in the legislative framework, the form of the declaration changes periodically.

The new declaration form was approved by order dated June 26, 2018 No. ММВ-7-3/ [email protected] , which came into force on November 26, 2018. This form is “new” conditionally, since it was used to submit reports for the previous quarter, and it must also be used for the Ⅳ quarter. The need to change the form was caused by the fact that starting from 2021, an additional deduction appeared that was applied to the calculated tax amount. This deduction applies to the cost of purchasing online cash registers. It could be used by individual entrepreneurs who, until July 1, 2019, had the right to reduce the tax on the cost of a cash register purchased for work on UTII and previously operating without using a cash register. Starting from the 1st quarter, it is not filled out, since it is no longer possible to use the deduction for cash purchases.

New in 2021 for calculating UTII

Changes in filling out the Calculation arose due to the following innovations:

- The value of the deflator coefficient in 2021 increased to a value of 2.009 (ORDER dated October 21, 2021 N 684 “ON ESTABLISHING DEFLATOR COEFFICIENTS FOR 2021”).

- As of January 1, 2020, changes to the Tax Code of the Russian Federation came into force. Now organizations and individual entrepreneurs that sell retail goods subject to mandatory labeling cannot apply UTII:

- medicines;

shoes;

- clothing and other products made from natural fur.

The Ministry of Finance in letter No. 03-11-09/92662 dated November 28, 2021 clarified that shoe retailers will be able to apply UTII until March 1, 2020.

You can download the “new” form in excel format using the links below.

| New UTII declaration for Ⅳ sq. 2021 (form according to KND 1152016) | |

>>>Download form in PDF | >>>Download form in Excel |

Related articles: Sample of filling out the UTII declaration for the 1st quarter of 2020

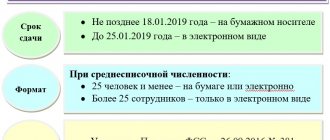

When to report

The UTII declaration must be submitted to the Federal Tax Service no later than the 20th day of the month following the expired quarter. This is provided for in paragraph 3 of Article 346.32 of the Tax Code of the Russian Federation.

If the deadline for submitting the declaration falls on a weekend, it is postponed to the next Monday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). In April 2018, such transfers will not be necessary. After all, the deadline for submitting the UTII declaration for the 1st quarter of 2021 is April 20, 2021 (Friday).

If you fail to submit your UTII declaration for the 1st quarter of 2021 or submit the document late, the company or individual entrepreneur may be fined. The amount of the fine is 5% of the amount of tax that is payable on the basis of the declaration. In this case, the total amount of the fine cannot be more than 30% of the tax amount and less than 1000 rubles. (Article 119 of the Tax Code of the Russian Federation).

Section 2 of the UTII report for the 3rd quarter of 2018

This section of the declaration contains the calculation of UTII for certain types of activities. For each type that falls under the “imputation”, you need to fill out a separate sheet. Activities of the same type in different territories are also taken into account separately (in accordance with the OKTMO code). Section 2 also “transitioned” without changes to the new declaration form.

- Line 010 indicates the code of the type of entrepreneurial activity from Appendix 5 to the Procedure.

- Line 020 contains the address of the activity.

- Line 030 indicates the OKTMO code for this address.

- Line 040 shows the basic profitability by type of activity.

- Line 050 indicates the deflator coefficient K1. Its value for 2021 is 1.868 (order of the Ministry of Economic Development dated October 30, 2017 No. 579).

- Line 060 contains the adjustment factor K2, which takes into account the specifics of conducting business. Its value is approved by local authorities.

- Lines 070-090 determine the tax base by month for July-September 2021.

– column 2 contains the value of the physical indicator for each month;

– in column 4, the monthly tax base is calculated as the product of the basic profitability and adjustment factors (lines 040, 050, 060) by the physical indicator of the month;

– if during any month of the tax period a businessman was registered or deregistered as a UTII payer, then column 3 indicates the actual number of days of business in that month; The UTII base in this case is recalculated based on the specified quantity.

- Line 100 reflects the total tax base for the 3rd quarter, i.e. sum of lines 070 – 090.

- Line 105 contains the tax rate as a percentage.

- Line 110 reflects the amount of UTII for this type of activity, which is determined as the product of the tax base and the rate.

New declaration form

For the first quarter of 2021, organizations and individual entrepreneurs on UTII must submit a declaration according to the “imputation” of the new form. The electronic declaration form required for submitting the UTII declaration electronically has also changed. There is also a new procedure for filling out the declaration.

The amendments are due to the fact that from January 1, 2021, entrepreneurs have the right to reduce UTII by the cost of online cash registers. The maximum amount of such a deduction is 18,000 rubles. for each cash register (Federal Law of November 27, 2021 No. 349-FZ). Accordingly, special lines are provided to reflect this deduction.

Also in the new UTII declaration form, a new section 4 has appeared, “Calculation of the amount of expenses for the acquisition of cash register equipment, which reduces the amount of the single tax on imputed income for the tax period.”

Let us remind you that the costs of purchasing a cash register online include:

- purchasing a device;

- fiscal accumulator;

- software;

- payment for related work and services (for example, setting up a cash register, etc.).

For UTII you do not need to contact the Federal Tax Service for a deduction via the online cash register. It is enough to declare it in the declaration. Due to this possibility, her form has been adjusted. For more information, see “Amendments to UTII from 2021.”

Who should take it?

Contents:

It makes no difference whether it is an organization or an individual entrepreneur. This report is submitted quarterly by those companies that wish to use this method of paying taxes. It is worth noting that many organizations have the right to switch to “imputation” under certain circumstances.

Such companies must fill out a declaration and, within a certain period, submit it to the tax office in the place where the company actually conducts its activities. It happens that an organization does not have a clear place of activity, for example, this may be due to the fact that it is engaged in the transportation of goods, trade, etc. In this case, the company must file a declaration at its legal address. As for an individual entrepreneur, he must contact the tax office at his place of registration.

Despite the fact that many companies have the right to apply UTII, there are certain criteria. For example, an organization that has more than one hundred full-time employees cannot apply imputation. There are also restrictions for companies in the authorized capital of which there are shares of other organizations. Moreover, their size is more than 25 percent. Social, state and municipal organizations cannot apply for UTII.

When to submit your tax return

As already mentioned, this document must be submitted quarterly.

All taxpayers have a single period during which they must file a return. So, when reporting for a quarter, the completed form must be submitted within 20 days of the month following the reporting quarter. For example, we can consider a situation where an organization submits a report for the second quarter (April, May, June). This means that the declaration must be submitted no later than July 20. Do not forget that the law provides for the postponement of the final deadline if it falls on a weekend or non-working holiday.

( Video : “Tax reporting. Deadlines.”)

How to fill out the new section 4

Here's how to fill out the new section 4 as part of the new UTII declaration form in 2021:

- on line 010 – name of the cash register equipment model;

- on line 020 – serial number of cash register equipment;

- on line 030 – registration number of cash register equipment assigned by the tax authority;

- on line 040 – the date of registration of cash register equipment with the tax authority;

- on line 050 - the amount of expenses incurred for the purchase of cash register equipment cannot exceed 18,000 rubles;

- If there are insufficient lines with codes 010, 020, 030, 040, 050, the required number of sheets in Section 4 of the Declaration must be filled out.

New form of UTII declaration for the 3rd quarter of 2018

Currently (September 2021) there is a “transitional” situation regarding reporting on UTII. The Federal Tax Service of the Russian Federation has developed a new declaration form, but the corresponding order dated June 26, 2018 No. ММВ-7-3/ [email protected] has not yet been registered with the Ministry of Justice.

Therefore, tax authorities, in a letter dated July 25, 2018 No. SD-4-3/ [email protected] , recommend using the new form, but at the same time reserve the right for taxpayers to submit reports for the 3rd quarter “in the old way,” i.e. according to the form approved by order of the Federal Tax Service of the Russian Federation dated July 4, 2014 No. ММВ-7-3/ [email protected]

The purpose of changing the declaration form is to reflect in it the so-called. “cash” deduction for UTII. New edition of Art. 346.32 of the Tax Code of the Russian Federation (clause 2.2) makes it possible for impostors to reduce the tax by the amount of costs associated with the acquisition of a cash register.

The main changes made to the report are as follows:

- An additional line 040 has been added to section 3, which reflects the amount of deduction in the form of expenses for the purchase of cash registers

- A new section 4 has been included, which deciphers “cash” expenses.

Therefore, the new form must be used by those payers who want to declare a “CCP deduction”.

But it is also advisable for all other “imputed” persons to submit their UTII declaration for the 3rd quarter of 2021 “in a new way.” After all, the form will most likely be approved by the Ministry of Justice without changes and will still have to be used in the future.

Next, we will consider the procedure for filling out the new form and its differences from the old one.

The Federal Tax Service allows the taxpayer to choose a form for the report and instructs lower tax authorities to correctly select the template for a particular declaration during the reporting campaign. Therefore, if you wish, you can submit it as reporting on UTII for 9 months of 2021.

Methods for submitting a declaration

Of course, it is allowed to submit an electronic report. But many entrepreneurs, given the importance of this report, prefer to fill out paper forms. There are two main options for submitting a report:

- Bring it in person . To do this, you will need to fill out the form in duplicate. This is necessary so that one of them remains with the tax office. A mark is placed on the second copy, after which it is returned to the entrepreneur. This is necessary so that the individual entrepreneur has on hand an official document confirming that the declaration has been submitted.

- Send by registered mail . In this case, the letter must include a description of the attachment. The documents that are sent by letter will be listed here. You also need to fill out two declaration forms. One is inserted into the letter, the second remains in your hands. The advantage of a registered letter is that the sender receives a receipt indicating that the listed documents have been sent. The date of departure is indicated here. This is the date of submission of the report.

If you do not trust postal transfers, and it is not possible to visit the tax office in person, you can transfer the documents by an authorized person. Naturally, you will need to draw up a power of attorney in advance with the help of a notary.

As a rule, the UTII declaration is submitted to the tax authority to which the place where the business activity is carried out belongs. However, there are situations in which it is quite difficult to determine it, for example, if the individual entrepreneur is engaged in transportation or mobile trade. In such situations, the report is submitted to the tax office at the place of registration. If it is a company, then the declaration is submitted at its legal address.

Completing the second section

Here indicate the code by which the business activity is carried out. You also need to enter the postal code and code of the subject of the Russian Federation. The address where the activity is carried out must be indicated in full. The appropriate data is entered in all lines. If some cells are left unfilled, dashes must be placed in them. Surely you noticed that in this form the line “Tax rate” has been added, which has code 105.

Filling rules

All amounts must be integers.

If there are kopecks, they should be rounded to rubles. All pages must be numbered.

When filing a paper declaration, you need to use only blue or black paste.

Each cell is intended exclusively for one character.

Don't fix anything. Do not use concealer or other similar products. If you make a mistake, use a new form.

The text must be written in block capital letters.

Dashes must be placed in cells that are left empty for some reason.

All sheets of the document must be separate. They cannot be stapled or stitched. Information should only appear on one side of each sheet.

Completing the third section

On this page you will need to indicate the appropriate taxpayer attribute. All other lines are also filled in with the necessary information. To avoid any difficulties with this, the form contains recommendations on what data should be entered on each line. It is worth remembering that to fill out the declaration you must use a new form. It is in the third section that some changes are observed. Now the line indicating the tax amount has moved down. This line is assigned the code "050". And its place was taken by line “040”, which indicates the funds spent on the purchase of cash registers.

Title page

On the title page, like on all the others, at the top you will see a place for entering the TIN for individuals, and the checkpoint for organizations. The correction number is indicated below. It indicates whether this is a primary report or a clarifying one. For primary, “0–” is indicated. If you have already submitted this report, but you need to clarify certain data, such a declaration is submitted again. However, the correction number “1–”, “2–” and so on is indicated.

Then the code corresponding to the tax period is written. Each reporting quarter has its own code. Also write down your full name here. In the appropriate fields, indicate the reporting year, activity code, and contact phone number.

At the bottom of the first page there are special fields intended for information about the head of the enterprise if the report is submitted on behalf of the organization. Below, in a specially designated place, you must enter the date the document was completed and your signature.

Read further: