When starting the construction of a fixed asset facility (making capital investments), the investor usually hopes that everything will go as planned. But according to one of Murphy's laws, any work takes much longer and costs much more than planned. And quite often the available money is not enough, the bank does not issue a new loan on conditions that suit the investor, the contractor, as well as suppliers, miss all deadlines, and the official who promised to sign all approvals and permits as soon as possible is fired, or, even worse, declared a defendant in a criminal case.

The pace of construction slows down, then this process stops altogether, and the landscape is decorated with yet another unfinished project. And often the best option is to sell the stopped construction, albeit without much profit, or even at a loss. After all, conservation costs can cause even more damage.

Let's continue the conversation on the topic of accounting in construction and capital investments.

What is assessment of construction in progress

An assessment is the determination of any cost indicators. In relation to an unfinished construction project, this may be:

- assessment of the costs actually invested in the acquisition of the site and construction of the facility;

- determining the market value of the ONS for which it can be sold, pledged, sold in bankruptcy or in enforcement proceedings;

- determining the list of works and the cost of completing construction;

- determination of the book value of the enterprise's assets.

Based on the results of the assessment, a decision may be made about the inexpediency of completing construction, or about mothballing the facility. Also, the assessment results will be used when searching for investors, if, based on the results of construction, the object can be sold or exploited for commercial purposes.

Dear Clients!

The information in this article contains general information, but each case is unique. You can get a free consultation from our engineers using one of our telephone numbers - call:

8 Moscow (our address)

8 St. Petersburg (our address)

All consultations are free.

An assessment may be required to attract investment and restart construction on the site.

Regulatory acts

The main regulatory act in the field of valuation activities is Federal Law No. 135-FZ dated July 29, 1998 (). It specifies the requirements for the qualifications of appraisers and permits for conducting an assessment. Depending on the functional characteristics and type of ONS, the following will be used:

- GOST 31937-2011 Rules for inspection and monitoring of the technical condition of buildings and structures ();

- Town Planning Code of the Russian Federation ();

- standards and sets of rules for certain types of objects (for example, SP 54.13330.2016 will be used if an unfinished apartment building is being assessed).

The Federal Standard FSO No. 7 (Order of the Ministry of Economic Development of the Russian Federation No. 611) was approved specifically for the assessment of real estate, including unfinished objects. It contains rules for preparing assessment tasks, the procedure for selecting and using methods, and requirements for the content of documents.

| No. | Basic concepts you need to know to register an unfinished construction project for cadastral registration | Description |

| 1 | Construction permit | The document will confirm that the facility was built legally, after design and examination. |

| 2 | Technical plan | The main document on the basis of which an unfinished construction project is placed on cadastral registration with information entered into the Unified State Register of Real Estate. The technical plan is prepared by a cadastral engineer after examining the ONS. |

| 3 | Cadastral engineer | A professional specialist who has the right to draw up a boundary or technical plan, an inspection report for objects. A cadastral engineer must have a qualification certificate. Information about all engineers is in the Rosreestr database. |

| 4 | Registration of rights | The procedure during which Rosreestr enters information about the copyright holder of an object into the Unified State Register of Real Estate. Registration can be carried out simultaneously with cadastral registration, or separately from it. |

In simple terms

To evaluate a completed completed property, the market price method is most often used. It allows you to compare the characteristics of the property with similar buildings on the market and determine the real cost at which you can find a buyer. For ONS, this option is practically not applicable. Finding an unfinished property with similar indicators is unrealistic, since such objects can generally be found extremely rarely on the market. Therefore, appraisers use the actual cost method and the profitability method (we will discuss them in more detail below).

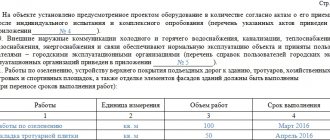

The assessment of unfinished construction includes the following areas:

- study of permits, technical and design documents for the ONS, site;

- determination of the reasons why construction was stopped (for example, cancellation of a construction permit, instructions from supervisory authorities, withdrawal of investors from the project);

- calculation of actual costs that have already been invested in construction (purchase of building materials and land, rental of equipment, wage fund, etc.);

- calculation of future costs that will be required to complete the construction, repurposing or dismantling (demolition) of the facility.

Accounting

In accordance with clause 63 of the Regulations on accounting and financial reporting in the Russian Federation, work in progress (WIP) includes products (work) that have not passed all stages (phases, redistributions) provided for by the technological process, as well as incomplete products that have not passed testing and technical acceptance.

For a contracting organization, the work in progress represents the accumulated amounts of costs associated with the execution of work on the construction of a facility, from the moment construction begins until the delivery of the results of the completed work to the customer.

To reflect WIP in accounting according to the Instructions for using the Chart of Accounts, account 20 “Main production” is intended. Construction companies organize the accounting of work in progress on account 20 in the context of construction projects.

- The debit of account 20 collects costs associated with construction work, and the credit reflects the amount of the actual cost of completed construction work.

- Account balance 20 at the end of the month shows the value of work in progress. The presence of a work in progress is possible when the result of the work performed is not presented to the customer.

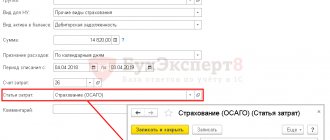

To correctly reflect the work in progress of a construction company, it is necessary to approve in the accounting policy:

- a list of cost items directly related to production;

- method of accounting for production costs (order method or cost accumulation method);

- method of distribution of general production and general economic expenses, services of auxiliary production;

- method of writing off general business expenses (full cost or direct costing);

- method of including expenses in the cost of work (as ready or in the amount of actual costs);

- method of assessing work in progress.

According to clause 8 of PBU 10/99 “Expenses of the organization”, the list of cost items is established by the organization independently.

Instructions for using the Chart of Accounts for accounting establishes a general criterion: direct expenses include expenses directly related to the production of products, performance of work and provision of services. Production costs in construction include costs for:

- materials,

- production works and services (including subcontracting works);

- fuels and lubricants, electricity and other resources;

- inventory and tools;

- special equipment and special clothing;

- machinery and equipment involved in the work (including rental and depreciation);

- workers' compensation and insurance premiums;

- other costs directly related to the construction project.

When accounting for work in progress in construction, to the extent that does not contradict current legislation, one can be guided by the Standard Methodological Recommendations for Planning and Accounting for the Cost of Construction Work, approved by the Ministry of Construction of Russia on December 4, 1995 No. BE-11-260/7 and no longer in force since February 1, 2002.

Cost accounting for construction and installation work, depending on the types of accounting objects, can be organized:

- by order method;

- using the method of accumulating costs over a certain period of time.

(paragraph 1, clause 4.2 of the Methodological Recommendations of the Ministry of Construction of Russia).

The main method of accounting for the costs of construction work is the order-by-order method, in which the object of accounting is a separate order opened for each construction project in accordance with the contract concluded with the customer for the production of work (paragraph 2 of clause 4.2 of the Methodological Recommendations of the Ministry of Construction of Russia).

In addition, paragraph 3 of the Accounting Regulations “Accounting for Construction Contracts” (PBU 2/2008) establishes that accounting of income, expenses and financial results is carried out separately for each executed contract.

The provisions of PBU 2/2008 apply to the accounting of construction contracts, the duration of which is more than one reporting year (long-term in nature) or the start and end dates of which fall on different reporting years.

When performing homogeneous work or constructing similar objects with a short execution time, it is possible to account for work in progress using the method of accumulating costs for a certain period of time by type of work and location of costs. In this case, the cost of work can be determined by calculation based on a percentage calculated as the ratio of the actual costs of producing work in progress to their contract value, and the contract value of the work being delivered, or using other economically sound methods established by the organization when forming accounting records. policy (paragraph 3, clause 4.2 of the Methodological Recommendations of the Ministry of Construction of Russia).

The order-by-order method of cost accounting is that the collection of production costs in accounting accounts is carried out in relation to accounting units - orders. With the order-by-order method in construction, cost analytics on account 20 of accounting is carried out in the context of each object.

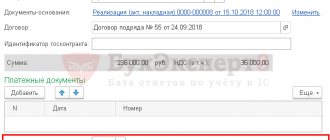

The debit of account 20 includes costs directly related to the construction of a specific facility (credit of accounts 02, 10, 60, 69, 70, 71).

Expenses that relate to several construction projects are recorded on account 25 “General production expenses” (expenses for the maintenance of machinery, equipment, premises; wages for workers involved in servicing several construction projects) at the end of the month are written off to the debit of account 20 or to the debit of account 23 "Auxiliary production".

The distribution of costs for construction projects collected on account 25 is made in accordance with the method approved in the accounting policy, for example, in proportion to direct costs, labor costs, etc.

Account 23 “Auxiliary production” reflects direct expenses related directly to the performance of work and the provision of services to auxiliary units (for example, a motor vehicle fleet). Credit 23 of the account reflects the amount of the actual cost of work performed (services provided) to the main production. In cases where it is not possible to accurately determine for which construction projects work was performed or auxiliary production services were provided, these expenses are distributed in proportion to the amount of direct expenses, employee wages or using other methods established in the accounting policy.

Account 26 “General business expenses” takes into account costs the implementation of which is not directly related to production (administrative costs). In your accounting policy, you must choose one of two methods for writing off expenses from credit account 26:

- to the debit of account 20, distributing them among construction projects;

- directly to the financial result, to the debit of account 90.

The amounts of expenses accumulated in account 20 form the cost of construction work, that is, they are written off to the financial result at the time of recording revenue.

The remaining part of the expenses after write-off is taken into account as WIP balances. For enterprises that apply PBU 2/2008, revenue and expenses under a contract are recognized using the “as ready” method. When determining income and expenses, a company can use one of two ways to determine the degree of completion of work:

- by the share of the volume of work completed as of the reporting date in the total volume of work under the contract;

- by the share of expenses incurred as of the reporting date in the estimated total expenses under the contract.

In the first method, the expenses accumulated on account 20 are written off to the financial result in proportion to the share of work performed on the object.

In the second method, the actual costs of constructing an object are written off from the debit of account 20 in full to the financial result, and income is reflected in accounting in proportion to the share of actually incurred costs to the total amount of costs for the object.

Small businesses have the right not to apply PBU 2/2008. If PBU 2/2008 is not used by construction companies, expenses recorded on account 20 are attributed to the financial result in accordance with PBU 10/99 “Organizational Expenses” at the time of recognition of revenue under a contract in the amount of actual costs incurred.

To avoid differences in accounting and tax accounting in terms of reflecting income and expenses under contracts with a long production cycle, you can recognize in accounting revenue for work with a long production cycle and the corresponding amount of expenses using the “as the work is ready” method (clause 13 PBU 9/99 “Income of the organization” and clause 19 PBU 10/99 “Expenses of the organization”).

Write-off of costs from account 20 in proportion to the calculated share of work performed (other proportion) of PBU 10/99 is not provided. In this regard, in order to avoid an imbalance in the amounts of income and expenses, it is extremely important to debit account 20 with expenses actually incurred in the reporting period and reflect the posting: debit 20 account credit 10 account only when materials are actually used at the construction site.

The construction customer uses the “Construction in Progress” indicator. Unfinished construction means a capital construction project for which work has not been completed. The developer traditionally accounts for the costs of objects under construction on account 08 “Investments in non-current assets” (sub-account “Construction of fixed assets”) in the context of construction projects from the moment of the start of construction until the commissioning of the object.

Objects for which construction work has been completed are accepted for accounting as fixed assets.

Real estate objects put into operation, the documents for which have been submitted for state registration, are recorded on account 01 with their allocation on a separate sub-account.

When is an assessment of unfinished construction required?

While construction work on the site continues, the object cannot be considered unfinished. Based on the analysis of judicial practice, in relation to an unfinished construction project, work should actually be stopped or suspended. In this case, the presence of the minimum required number of structures must be confirmed (usually, already at the stage of foundation construction, an assessment of the ONS can be ordered).

An assessment of unfinished construction may be required in the following cases:

- to make a decision on the need to continue work or to terminate it;

- to change the purpose and functional characteristics of the object, repurposing;

- for pre-sale preparation, if the ONS finds a buyer;

- to make changes to the investment project, search for new sources of investment to continue construction;

- to place ONS on the balance sheet of the enterprise as a property asset;

- for the transfer of an unfinished construction project as collateral for lending, commercial loans;

- to determine the income that can be counted on when completing the construction of the ONS.

Accordingly, the possibility of completing a transaction on favorable terms, attracting investments, and receiving income from the operation of a completed facility depends on the correct choice of methodology and accuracy of assessment.

What services do you need for an unfinished property?

Evaluation of the ONS

0%

Surveys, examination of an unfinished construction project

0%

Preparation of technical plan

0%

Registration of ONS for cadastral registration

0%

Voted:

Basic assessment methods

Most often, the cost is determined using the so-called “cost approach”, which requires:

- preliminary clarification of the methods that will be used to determine the wear and tear of an unfinished object;

- establishing basic parameters in the case of use on a specific ONS;

- establishing the types of wear allowed in each specific case.

In this case, the percentage of readiness of the ONS is calculated according to the cost of the unfinished structure, according to the degree of its physical readiness (established as part of the technical examination performed).

This option is chosen in the case where the optimal use is further construction according to the project (with the possible introduction of partial changes of a non-fundamental nature).

In this case, the main task of the appraiser is to achieve a compromise of interests between the seller and the buyer. Therefore, a price slightly lower than the seller’s actual costs will most likely suit both parties.

But if, according to calculations, the optimal option for the further use of the ONS is not construction, but its complete demolition, then finding a compromise will be much more difficult.

In this case, it is advisable to turn to the income method. It involves calculating the actual cost of the ONS by discounting existing cash flows. This approach is justified by the fact that it is necessary to model the flow in the absence of any retrospective information on profitability and any grounds confirming the stability of possible future income.

The method of discounting cash flows requires the preliminary solution of a number of problems that are of a methodological nature. Taking into account the chosen option for which the object will be used, it is necessary to take into account the risks that may interfere with its implementation during the completion of construction work and the subsequent use of the object.

When choosing any option, the forecasting horizon involves calculating the justification for two main phases:

- investment, including the time of complete completion of construction.

One of two approaches is used. In the first case, the appraiser takes as a basis the standard deadlines for the construction of such objects with their subsequent adjustment, taking into account the degree of actual readiness. In the second, by analogy, the average construction time is taken (statistical analysis), which is adjusted taking into account the percentage of actual readiness of the ONS.

- operational (the required value is taken to be the service life of the facilities before major repairs).

Methods and techniques for assessing unfinished construction

Basic methods for assessing completed and unfinished capital construction projects are specified in Order of the Ministry of Economic Development No. 611 (FSO No. 7). The main options are the market price method (comparative approach), the cost approach, and the income approach. Let us highlight the key features for using each of these techniques:

- with a comparative approach, you need to find objects with similar characteristics and stages of construction, study the supply and demand market (for public health insurance companies this is very difficult to do);

- with the cost approach, the cost of rights to the site, the actual condition and wear and tear of the public infrastructure, incurred and future expenses, calculations and estimates are determined;

- the income method is used for public insurance companies that are capable of generating profit, including after completion of construction.

Appraisers have the right to use other methods, or a combination of the above approaches, if this is necessary for an objective and accurate assessment of the compulsory assets. All methods and methods of assessment, as well as the reasons for their choice, will be indicated in the final report.

The assessment can be carried out not only for commercial properties, but also for unfinished private houses

Features of the ONS assessment

The assessment of an unfinished construction project involves a preliminary justification of the chosen method, or adaptation and partial modification of the methods used in the assessment of finished real estate objects.

For this purpose, the specific features inherent in a particular ONS as an object of evaluation and as a product are clearly defined. Some of them are the same as those used for ready-made objects. For example:

- long-term stage of investment;

- significant costs incurred to prepare for this construction;

- the need to enter the land (plot) market;

- direct dependence on actual investment activity in a given region.

When considering an unfinished construction project as a subject of assessment, you should definitely pay attention to:

- the need to accurately identify the degree of its readiness;

- actual wear and tear (primarily those that have not undergone conservation);

- availability of reliable information about the completion dates of the work;

- lower probability of predicting expected profitability than for a finished object.

A competent appraiser can certainly expand and supplement this list of probable problem points inherent in unfinished construction.

Surveys to evaluate unfinished construction

An object of unfinished construction always has a certain object of erected structures. Moreover, the construction of the facility may be suspended or terminated at the final stages, when most of the floors are ready. Therefore, to assess the ONS, the following examinations need to be carried out:

- studying the features and characteristics of the site, since its market value affects the final assessment of unfinished construction;

- study of the actual state of erected structures (foundation, walls, floors, stairs, etc.), engineering systems;

- determination of wear and tear of structures and communications (the longer the construction of an object is not carried out, the faster the indicator of physical wear and tear will increase).

Surveys may include visual inspection and instrumental diagnostics, partial opening of structures and networks, and testing of installed networks. The greater the percentage of readiness of the object, the greater the volume of surveys will be. During the inspection and diagnostics, acts, protocols, calculations, defective statements, explanations, diagrams, drawings, other documents and graphic materials will be drawn up. This documentation is transferred to an expert organization for evaluation.

Expert commentary. ]Smart Way[/anchor] will not only provide services for assessing unfinished construction, but will also conduct a comprehensive survey of the facility. We specialize in providing design and survey work; we have our own staff of specialists and all the necessary equipment. This will save you time and money and provide other benefits.

Specialists conduct an inspection of unfinished construction before the assessment

Recommendations R-X/20XX-KPT “Accounting for incomplete fixed assets”

document status : materials for the CPT meeting

developer organization: Foundation "NRBU "BMC"

meeting date: 19.12.2014

Revision dated December 16, 2014

Recommendations Р-Х/20ХХ-КпТ

"Accounting for unfinished fixed assets"

Regulations

— Town Planning Code of the Russian Federation dated December 29, 2004 N 190-FZ (in the text – Civil Code of the Russian Federation);

— Accounting Regulations “Accounting for Fixed Assets” PBU 6/01. Approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n (according to the text - PBU 6/01);

— Accounting Regulations “Accounting Statements of an Organization” PBU 4/99. Approved by Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 N 43n (according to the text - PBU 4/99);

— Accounting Regulations “Accounting Policy of the Organization” PBU 1/2008. Approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n (according to the text - PBU 1/08);

— International Financial Reporting Standard IAS 16 “Fixed Assets”. Put into effect on the territory of the Russian Federation by order of the Ministry of Finance of the Russian Federation dated November 25, 2011 No. 160n (according to the text - IAS 16);

— International Financial Reporting Standard (IAS) 2 “Inventories”. Put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated November 25, 2011 N 160n (according to the text - IAS 2).

Description of the problem

In a number of cases, there is a production need to commission a facility before all significant costs stipulated by the project, contract, etc. have been completed. An example of such a situation could be the commissioning of a well from the moment the first ton of oil is produced, despite the fact that reclamation work and other similar activities have been postponed to the next climatic season.

RAS and IFRS standards do not specify the procedure for accepting for accounting and depreciation of operated facilities, the significant costs of construction of which have not been fully completed (hereinafter referred to as incomplete fixed assets). Also, the legislation does not detail the procedure for accounting for costs associated with servicing incomplete fixed assets.

Thus, the accounting treatment of items of fixed assets in progress is a matter of interpretation.

Solution

Unfinished objects that meet the criteria for recognition as part of fixed assets are reflected in the accounting (financial) statements as part of fixed assets.

Depreciation on unfinished fixed assets begins to accrue from the month following the moment the criteria for recognizing the object as part of fixed assets are met.

Obtaining permission to enter does not affect the fulfillment of the criteria for recognizing an object as part of fixed assets.

Costs associated with completing construction, constructing an object and bringing it to a state suitable for use in accordance with the intentions of the economic entity increase the initial cost of fixed assets as completion costs. The list of such costs includes, in particular:

— costs for dismantling construction equipment upon completion of construction;

— costs of bringing the construction area into a state that complies with legal requirements and contractual relations with third parties;

— costs of carrying out work that requires completion in a certain period of time (for example, a climatically favorable period).

The deadline for completing the construction of fixed assets in the situation under consideration is set by the economic entity independently.

Future costs for certain types of work (processing of drill cuttings, land reclamation) may form estimated liabilities if they meet the requirements of PBU 8/2010. This provision is included in the cost of property, plant and equipment at the time of recognition of property, plant and equipment. Subsequently incurred costs for which an provision is created are written off against the previously recognized provision.

Costs associated with the operation of unfinished fixed assets after meeting the criteria for recognizing them as part of fixed assets are expenses of the reporting period.

Basis for conclusions

The norms of PBU 6/01 (clauses 4 and 21) provide that “ an asset is accepted by an organization for accounting as fixed assets if the following conditions are simultaneously met:

a) the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization, or to be provided by the organization for a fee for temporary possession and use or for temporary use;

b) the object is intended to be used for a long time, i.e. a period exceeding 12 months or the normal operating cycle if it exceeds 12 months;

c) the organization does not intend the subsequent resale of this object;

d) the object is capable of bringing economic benefits (income) to the organization in the future.

Accrual of depreciation charges for an object of fixed assets begins on the first day of the month following the month in which this object was accepted for accounting, and is carried out until the cost of this object is fully repaid or this object is written off from accounting

».

IAS 16 contains similar provisions (clauses 15 and 16), namely: “ an item of fixed assets subject to recognition as an asset is measured at cost.

The cost of a fixed asset item includes:

(a) the purchase price, including import duties and non-refundable purchase taxes, less trade discounts and refunds;

(b) any direct costs of getting the asset to the required location and bringing it into a condition necessary to operate in accordance with the intentions of management of the enterprise;

(c) a preliminary estimate of the costs of dismantling and removing an item of property, plant and equipment and restoring the natural resources on the site that it occupies, for which the entity incurs an obligation either when acquiring the item or as a result of its use for a specified period for purposes other than creation of inventories during this period

».

At the same time, paragraph 20 of IAS 16 clarifies that “ the inclusion of costs in the book value of an item of fixed assets ceases when such an item is delivered to the required location and brought into a condition that ensures its functioning in accordance with the intentions of the management of the enterprise

».

In accordance with Russian legislation, in cases provided for by the Civil Code of the Russian Federation, the possibility of putting an object into operation must be confirmed by a permit to put the object into operation. At the same time, the number of documents required to obtain the said permit includes the Acceptance Certificate for the completed construction of the facility[1] (or another similar document).

Since an item of fixed assets was included in the production process, for example, production of products, performance of work or provision of services, etc., depreciation charges on it should participate in the formation of the cost of these products, works, services.

Paragraph 7 of PBU 1/08 states that: “... If on a specific issue the regulatory legal acts do not establish methods of accounting, then when forming an accounting policy, the organization develops an appropriate method, based on this and other accounting provisions, and also International Financial Reporting Standards

…».

In some cases, an object is capable of functioning until all work provided for in the project for the creation of a fixed asset object is completed (for example, design and estimate documentation), but does not meet the requirements of full compliance with management’s intentions. In this case, it is necessary to assess the possibility of starting operation of the facility, as well as the necessity and significance of further costs provided for in the project, contract, etc.

It must be taken into account that “ some operations are carried out in connection with the construction or development of an item of property, plant and equipment, but are not necessary to bring the item to the desired location and bring it into a condition that allows it to operate in accordance with management’s intentions. Because incidental operations are not necessary to bring an asset to its desired location and condition so that it can be operated in accordance with management's intentions, the income and related expenses from such operations are recognized as profit or loss and included in related income and income items. consumption

"(Clause 21 IAS 16).

“The future economic benefits embodied in an asset are consumed by the enterprise primarily through its use. However, the effect of other factors, such as obsolescence or commercial obsolescence and physical wear and tear when the asset is idle, often leads to a decrease in the economic benefits that could be obtained from the asset” (paragraph 56 of IAS 16).

“The cost of inventory shall include all acquisition costs, conversion costs and other costs incurred to maintain the current location and condition of the inventory.

(Clause 10 IAS 2). Thus, since the construction project was included in the production process, for example, in the production of products, performance of work or provision of services, etc., depreciation charges for it should participate in the formation of the cost of these products, works, services.

Paragraph 6 of PBU 4/99 establishes that “accounting statements must give a reliable and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position. Financial statements prepared on the basis of the rules established by regulatory acts on accounting are considered reliable and complete.”

Based on the principle of priority of economic content over form, objects for which work on their creation (construction) has not been completed, but which are used in production, are reflected in the accounting (financial) statements in the line “Fixed assets” and in other aspects should also be considered, as fixed assets.

[1] Used as a document of acceptance of a completed construction of an industrial and housing-civil facility of all forms of ownership (buildings, structures, their queues, start-up complexes, including reconstruction, expansion and technical re-equipment) when they are fully ready in accordance with the approved project, contract agreement (contract).

Stages of assessment of unfinished construction

The assessment of the ONS is carried out on the basis of technical specifications, an agreement with the owner or developer. For assessment activities, design, working and technical documentation, construction permits, and documents for the site are transferred. If the rights to the ONS have already been registered through Rosreestr, an extract from the Unified State Register is requested.

What documents are drawn up based on the results of the assessment of unfinished construction?

The main document after completing the assessment of unfinished construction is a report indicating the cost of the object. The report can be used at the customer’s discretion - for preparing and completing a transaction, for drawing up internal accounting documents, for finalizing design and working documentation, for working with investors. If a decision is made to demolish the PS, design documentation must also be ordered for such work.

How to correctly draw up a technical specification for the assessment of unfinished construction

To draw up a technical assignment for the assessment of unfinished construction, you need to decide on the goals of such a study. The terms of reference indicate the initial data on the object, the scope of application of the assessment report (for example, for the continuation of an investment project or registration of collateral for a bank). Experienced specialists from ]Smart Way[/anchor] will provide assistance in preparing the technical specifications. An example of technical specifications can be found below.

Get an estimate of the cost of this service using our price calculator - here

List of useful documents

Documents for download:

| No. | Links | Description |

| 1 | Sample technical specifications for construction, reconstruction | |

| 2 | Sample application for a permit to construct a new building | |

| 3 | Sample technical plan for registering a building | |

| 4 | Sample application for cadastral registration | |

| 5 | Sample USRN extract | |

| 6 | Sample application for a commissioning permit | |

| 7 | Sample application for project examination | |

| 8 | Recommendations for preparing design documentation for examination |

Problems and difficulties in assessing unfinished construction

In the process of assessment activities on the ONS, the following problems and difficulties may arise:

- discrepancy between technical characteristics and scope of work performed with design and estimate documentation;

- lack of supply and demand market for ONS, which complicates the determination of the real market value;

- the complexity and volume of the object, which entails an increase in cost and a delay in the assessment period;

- lack of permits for the site or object, which will affect the accuracy of the assessment.

By contacting us, you will not have any problems receiving an objective and reliable report on the assessment of unfinished construction. We always guarantee the quality of our work and are responsible for its results!

Reflection in financial statements

Paragraph 64 of the Regulations on Accounting and Financial Reporting in the Russian Federation provides the following methods for assessing work in progress:

- according to actual or standard (planned) production cost;

- by direct cost items;

- at the cost of raw materials, materials and semi-finished products;

- according to actual costs incurred - for a single production of products.

The construction project is a single production, therefore the valuation method is suitable for construction activities - based on actual costs incurred.

The amount of work in progress must be reflected in line 1210 “Inventories” of the balance sheet, in the current assets section. With a long production cycle, the company has the right to reflect the balances of work in progress as part of the indicators of non-current assets.

In Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n, in the notes to the balance sheet form it is stated that indicators on individual assets and liabilities can be given as a total amount with disclosure in the explanations to the balance sheet, if each of these indicators individually is insignificant for the assessment by interested users of the financial the position of the organization or the financial results of its activities.

In this regard, it is necessary to establish in the accounting policy the principle of materiality, which the company will use when preparing financial statements.

The amount of construction in progress at the developer (debit balance of account 08 subaccount “Construction of fixed assets”) can be indicated on line 1150 “Fixed assets” of the non-current assets section of the balance sheet (in the case of construction for one’s own needs), or on line 1170 “Other non-current assets” section of non-current assets of the balance sheet (during construction for the investor). In the “Explanations to the Balance Sheet and the Profit and Loss Statement,” the cost of construction in progress is indicated in lines 5240 and 5250, respectively.

Advantages of our company

]Smart Way[/anchor] has all the necessary specialists for design and assessment activities. We will provide the most favorable conditions for each client, regardless of the complexity of the object or the status of the customer. Our advantages:

- saving time and money, working directly and without intermediaries;

- consulting support at all stages of cooperation;

- involvement of highly specialized specialists in examinations and calculations;

- legal support of transactions with public tax authorities, land plots, assistance in the implementation and management of projects.

For more information about the terms of cooperation, please contact our specialists by calling the numbers listed on the website. The table below shows prices for some types of services and work.

| No. | Service, document | Price |

| 1 | Preparation of documents for an unfinished construction project | from 30,000 rub. (depending on the area and features of the ONS) |

| 2 | Support of the commissioning procedure | from 25,000 rub. (depending on the area and features of the object) |

| 3 | Preparation of a technical plan for the ONS | from 8000 rub. |

| 4 | Support of the cadastral registration procedure in Rosreestr or MFC | from 12,000 rub. |

| 5 | Representation in court to obtain a decision and cadastral registration | from 30,000 rub. |

GLAVBUKH-INFO

In accounting, costs for the construction of facilities are grouped according to the technological structure of costs determined by the estimate documentation. It is recommended to keep records using the following cost structure:— for construction work; — for equipment installation work; — for the purchase of equipment requiring installation; — for the purchase of equipment that does not require installation; tools and equipment; equipment that requires installation, but is intended for permanent supply; - for other capital works. The procedure for accounting for costs for these works depends on the method of their production - contract or business. With the contract method, construction work and equipment installation work completed and formalized in the established manner are reflected in accounting at the contractual cost in accordance with paid or accepted invoices of contractor organizations. When the economic method of performing the specified work is used, the actual costs incurred are reflected in accounting. Actual costs associated with the construction (manufacturing) of objects (in particular, fixed assets) are initially reflected in the debit of account 08 “Investments in non-current assets” (subaccount 08–3 “Construction of fixed assets”) in correspondence with the settlement accounts. Subaccount 08–3 “Construction of fixed assets” takes into account the costs of construction of buildings and structures, installation of equipment, the cost of equipment transferred for installation and other expenses provided for in estimates, financial estimates and title lists for capital construction (regardless of whether it is carried out This is construction by contract or economic method). Until the complete completion of construction work on objects, the costs of their construction (construction) are taken into account as part of construction in progress. Construction in progress is the developer's costs for the construction of facilities from the beginning of construction to their commissioning. Construction in progress is reflected in the balance sheet at actual costs for the developer (investor). After completion of construction, the completed fixed assets are accepted and put into operation. At this point, in subaccount 08–3 “Construction of fixed assets”, the inventory value of completed construction objects is formed. The inventory cost of an object is the developer’s costs for the construction of the object from its inception to its commissioning. The inventory value of completed construction projects is determined in the following order: the inventory value of buildings and structures consists of the costs of construction work and other capital costs attributable to them. Other capital costs are included in the inventory value of objects for their intended purpose. If they relate to several objects, their cost is distributed in proportion to the contractual cost of the objects put into operation; the inventory cost of equipment requiring installation consists of the actual costs of purchasing the equipment, as well as the costs of construction and installation work, and other capital costs attributable to the cost of the equipment put into operation for its intended purpose. If the costs of construction and installation work, as well as other costs, relate to several types of equipment, then their cost is distributed between individual types of equipment in proportion to their cost at supplier prices; the inventory cost of equipment that does not require installation, low-value and wear-out tools and inventory is made up of the purchase price invoiced by suppliers, delivery costs to the warehouse and other costs associated with their acquisition. Upon commissioning, the completed construction facility must be accepted for accounting. When accepted for accounting, the actual costs recorded on account 08 “Investments in non-current assets” (subaccount 08–3 “Construction of fixed assets”) are debited to account 01 “Fixed assets”.

| Next > |

conclusions

An assessment of unfinished construction is needed to determine the objective market value of the object for the transaction, the size of investments and the feasibility of completing the work, and to analyze the prospects for generating income after completion. Organizations that are members of the SRO of appraisers can conduct assessments. Based on the results of the shades of unfinished construction, a report is drawn up.

Get an estimate of the cost of this service using our price calculator - here

You can order an assessment for any unfinished construction project at ]Smart Way[/anchor]. We will provide a favorable commercial offer to each client.

Documents for registration

To register an unfinished construction project, the developer (investor) must submit the following documents to the registration department:

- application for registration of property rights (filled out by a Rosregistration specialist when submitting documents);

- document confirming payment of state duty (for organizations – 15,000 rubles);

- a copy of the identity document of the applicant, a representative of the applicant organization (extract from the Unified State Register of Legal Entities in relation to the applicant organization);

- a document confirming the authority of the representative of the applicant organization;

- a copy of the charter of the applicant organization;

- a copy of the document confirming the ownership of the land plot or the right to use the plot (lease);

- a copy of the construction permit, except in cases where permission is not required (Part 17, Article 51 of the Town Planning Code of the Russian Federation);

- copies of design documentation;

- copies of documents confirming that the object is not the subject of a valid construction contract (for example, a copy of an additional agreement on termination of the construction contract);

- cadastral (technical) passport of an unfinished construction project containing its description.

Along with copies for verification, provide the originals (Article 18 of the Law of July 21, 1997 No. 122-FZ).

The registration department may also require a certificate of sources of construction financing. Such a certificate confirms the absence of rights of third parties to the construction project (Article 218 of the Civil Code of the Russian Federation). There is no unified form for this certificate. Therefore, it can be compiled in any form.

A specialist of the registration authority issues a receipt that confirms the acceptance of documents for state registration (Clause 6, Article 16 of Law No. 122-FZ of July 21, 1997). Registration is carried out no later than one month from the date of submission of documents (clause 3 of article 13 of the Law of July 21, 1997 No. 122-FZ).

The rights to this object arise from the person financing the construction (the investor).