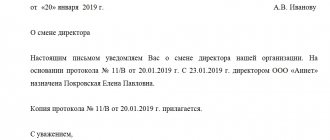

The head of the enterprise can be appointed for an indefinite period or for a certain period. But at any time a company may have a moment when, unplanned or planned, it is necessary to change the director. To do this, you must first hold a meeting of all participants in the enterprise, and then draw up a protocol to confirm the decision made. The document is one of the key ones in the company. It allows you to determine the specifics of the company's work. The appointment and publication of this protocol occurs with the help of a decision to change the manager. It is worth delving into the nuances of these documents in more detail.

What must be indicated in the protocol

In this protocol on the change of general director, it is necessary to specify:

- date and place of the meeting;

- list of those present;

- Full name of the chairman and secretary of the meeting;

- agenda;

- Voting results;

- final decisions (whose powers and when to terminate/who to appoint, from what date, and for what period).

The meeting is chaired by the chairman, and the meeting secretary records the results.

The founders' protocol on the change of director is drawn up in any form. The information contained in it will be checked by a notary when certifying the application on form P14001 to the Federal Tax Service, so it must be complete. It is not necessary to assign a document number.

Extension of powers

The term of office of the general director is determined by the company's charter. After this period, during a scheduled meeting of the authorized body of the LLC, the general director can be re-elected for a new term. This is stated in Article 40 of the Law. Typically, the LLC Articles of Association establish the standard term of office for a director - 5 years. A sample (protocol for extending the powers of the general director) has been prepared for readers of this article. It is compiled in the same way as the previously discussed documents. But in the “Agenda” section it is indicated that the meeting is being held to extend the powers of the manager. A sample fragment of this document is presented below.

Sample protocol on extension of director's powers

Is it necessary to fix deadlines in the decision of the general meeting?

In the future, the minutes of the general meeting on the change of director are the basis for concluding an employment contract with the director and issuing orders for hiring and taking office. If the document does not indicate the term of office of the manager, then the employment contract will be concluded for the period established in the company’s charter. If the term is not fixed either in the charter or in the minutes, then the term of office of the head of the company will be determined for 5 years.

Preparatory stage

At the first stage, it is necessary to make a decision to hold a general meeting of LLC participants, at which the powers of the old general director are terminated and a new one is elected. The procedure for convening and preparing this event is determined by Federal Law No. 14-FZ dated 02/08/1998 “On Limited Liability Companies” (hereinafter referred to as the Law). The decision to convene is made by the executive body of the company. Depending on whether the change of leadership was planned in advance or whether it is unscheduled, preparations are made for a scheduled or unscheduled meeting. The difference in preparation is that the timing of a scheduled meeting is specified in the company’s charter, but an unscheduled meeting is not. Accordingly, society participants must send a demand to the executive body about the need to hold this event.

The following is the graph.

Within 5 days from the date of receipt of the request, the executive body is obliged to consider it and make a decision on approval or refusal to hold a meeting.

Within 45 days after submitting the request for its holding (if approved), the meeting must take place. This is stated in paragraph 3 of Article 35 of the Law.

30 days before the event (no later), those convening the meeting must notify other participants about it. This is done by sending a registered letter with notification to the address indicated in the list of company participants in the company's charter. Notification is also made in any other way specified in the regulatory documents of the organization.

Is a protocol required when changing the director’s last name?

If the personal details of the manager change, there is no need to convene an extraordinary meeting. Employees of the FMS bodies independently transmit data on changes in surnames to the Federal Tax Service (Article 31 of the Federal Law “On Amendments to Certain Legislative Acts of the Russian Federation”). Further changes will be reflected in the Unified State Register of Legal Entities.

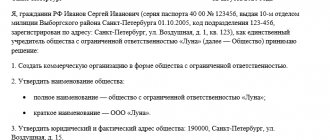

If the company has only one founder, then the document reflecting the fact of the change of the first person of the company is called the decision of the sole participant to appoint a director.

How to change the director of a legal entity?

The director is one of the key figures in the management of a legal entity. It is an executive body and has a wide range of powers; moreover, it can act on behalf of a legal entity without a power of attorney. Therefore, the procedure for changing a director (general director) in an LLC and other organizations is somewhat more complicated compared to replacing an ordinary employee.

In this article we will look at several scenarios for changing the director of an LLC:

a) when this happens by mutual agreement without conflict and it is only necessary to register the change of director in the Unified State Register of Legal Entities.

b) when there is a conflict between the director and the company and the change of director of the company occurs by decision of the company

c) when there is a conflict between the director and the company and the director decides to resign (we will analyze the actions in this case when changing the director on the part of the company and on the part of the director).

In accordance with Art. 33 of the Federal Law “On Limited Liability Companies” the competence of the general meeting of participants includes the formation of the executive bodies of the company and the termination of their powers. Thus, in order to change the director, it is first necessary to hold a general meeting of the company’s participants, at which a new director will be elected and the powers of the previous one will be terminated. However, the charter may assign the authority to appoint a director to the competence of the board of directors. In the constituent documents, in particular in the charter, in most cases, information about the director is not specified, so the charter does not need to be changed. However, if such data is still contained in the charter, it is necessary to make a decision to change the charter at the general meeting of the company’s participants and follow the procedure for amending the constituent documents, and not the Unified State Register of Legal Entities.

It should be noted that the procedure for state registration of a change of general director is generally similar for various organizational and legal forms (the difference in the procedure for changing a director in an LLC and a JSC (formerly a CJSC) lies in the differences in convening a general meeting of participants, shareholders, which we will discuss below, the procedure for changing director in a PJSC (formerly OJSC) is also generally similar, but in a PJSC, as a rule, the decision to change the director is made by the board of directors, and in LLCs and JSCs such a body is less often created). In order to change the director of a commercial organization, you must contact the registration authority of the Federal Tax Service of the Russian Federation. To change the head of an NPO - to the Ministry of Justice, while when registering a change of director in an NPO (an independent non-profit organization, institution, public organization, etc.), additional copies of documents will be required for the Ministry of Justice. Otherwise, you can follow the instructions below for registering a change of director.

We would also like to note that in this article we are considering the procedures for registering a change of director in an LLC (a person acting without a power of attorney); if it is necessary to change the director of a branch, then it is enough to revoke the previously issued power of attorney and issue a power of attorney to the new director (it is also necessary to remember that the director of the branch is an employee of the company who is subject to the general rules of employment and dismissal).

Step-by-step instructions “Making changes to the Unified State Register of Legal Entities when changing the director (general director) in an LLC or joint-stock company”

In order to make changes to the Unified State Register of Legal Entities when changing the director, we recommend following this algorithm.

Step 1. Select a candidate for a new director and check the candidate for the position of director in the register of disqualified persons

A disqualified person cannot hold leadership positions in organizations. Therefore, if a new director is included in this register, the tax office will refuse to make changes in connection with the change of general director.

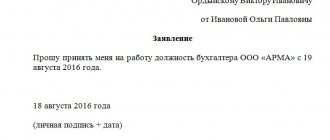

Step 2. Prepare the minutes of the general meeting of participants (decision of the sole founder) on the change of director or the decision of the Board of Directors (depending on the procedure established by the charter)

Usually the decision to change the director is made by the general meeting of participants. The charter may refer this issue to the competence of the board of directors. Therefore, before starting actions to change the director, we recommend that you carefully read the charter. At the general meeting of participants (meeting of the board of directors), decisions are made to terminate the powers of the previous director and to elect a new one. The decision of the board of directors is drawn up and signed in accordance with the requirements of the charter.

The decision to change the director must necessarily contain a decision on two issues:

- on termination of powers of the sole executive body, that is, termination of powers of the current director

- on the election of the sole executive body (new director)

In addition, the agenda in practice includes the issue of choosing a person who will sign an employment contract with the new director of the LLC (for a JSC this issue is included in the absence of a board of directors authorized to sign the employment contract), as well as the issue of choosing the chairman and secretary of the meeting who sign protocol.

If the general meeting of participants is held in compliance with formal procedures established by law (for example, with a large number of participants in the organization, different opinions regarding the candidacy of the director), then the following rules for holding the meeting must be taken into account.

Convening and holding a general meeting of LLC participants:

- The meeting is convened by the director of the company. To do this, he makes a decision independently or on the basis of the request of the company’s participants having in total less than 10% of the votes, the board of directors or other persons and sends a notification to all LLC participants at least 30 days before the meeting. A participant with at least 10% of the votes (or other persons demanding a general meeting) may independently convene a general meeting if the director does not make a decision or refuses to convene it within 5 days after receiving the request.

- members of the company can propose candidates for the position of director by sending proposals to the company to include additional issues on the agenda. This must be done no later than 15 days before the date of the meeting. Next, all candidates must be checked in the register of disqualified persons.

- To change the director, more than 50% of the votes of all LLC participants are required. The charter of the LLC may provide for the need for a larger number of votes to make decisions on changing the director.

Convening and holding a general meeting of participants of a joint-stock company:

- The meeting is convened by the director of the company. To do this, he makes a decision independently or on the basis of the request of the company's participants having in total less than 10% of the votes, the board of directors or other persons and sends a notification to all participants of the joint-stock company at least 50 days before the meeting (in some cases, the meeting must be held within 40 days from the date of sending the request). Please note that a shareholder requesting a meeting cannot independently convene a meeting if his request is refused or not received. To convene a meeting in such a situation, you need to go to court with a request to force the company to hold an extraordinary general meeting of shareholders (as opposed to an LLC).

- shareholders of the company owning at least 2% of the votes may nominate candidates for the position of director by sending appropriate proposals. This must be done so that they enter the society no later than 30 days before the date of the meeting. A later date may be provided for by the charter.

- To change a director, more than 50% of the votes of all shareholders with voting shares are required. The charter of a joint-stock company may provide for the need for a larger number of votes to make decisions on changing directors.

The decision of the general meeting of participants must be documented in minutes. If there is one participant in the company, then the decision of the sole participant of the company is formalized.

Note! Article 67.1 of the Civil Code of the Russian Federation establishes the requirements for the minutes of the general meeting of participants:

- for PJSC: the protocol must be certified by the person maintaining the register of shareholders of such a company and performing the functions of the counting commission

- for NJSC: the protocol must be notarized or certified by the person maintaining the register of shareholders of such a company and performing the functions of the counting commission;

- for an LLC: the minutes must be notarized, unless another method (for example, signing the minutes by all participants or part of the participants - the chairman and secretary of the meeting) is not provided for by the charter of the LLC or by a decision of the general meeting of the company's participants, adopted unanimously by the company's participants. That is, the minutes of the general meeting of an LLC are not certified by a notary if one of the conditions is met: a) a different method of certification is chosen in the charter (for this you can make changes to the charter once) or b) a different method is chosen in the minutes of the general meeting adopted unanimously (signatures this protocol must be notarized).

If the minutes of the general meeting are subject to notarization, then the minutes are signed by the participants of the meeting in front of a notary, and the notary certifies the signatures. The certification of signatures by the registry holder proceeds in a similar manner.

Step 3. Prepare an application for registration of changes in the Unified State Register of Legal Entities in connection with the change of the general director (manager) according to form P13014

By order of the Federal Tax Service of Russia dated August 31, 2020 No. ED-7-14/ [email protected] the Federal Tax Service approved new application forms for registering companies, making changes to the Unified State Register of Legal Entities, constituent documents and other registration actions

. These forms are valid from November 25, 2020. From this moment on, the application forms P13001, P13002, P14001 and P14002 lost their validity. To make changes to the Unified State Register of Legal Entities and constituent documents, a single application form P13014 is used.

In the application on form P13014, fill out the title page, sheets I (information about a person acting without a power of attorney on behalf of a legal entity) and N (information about the applicant). If you are only changing directors, then you do not need to fill out other sheets. Filling out the application in form P13014 must be carried out in strict accordance with the information in the documents (in particular, the passport), otherwise there may be a refusal to register a change of director.

If you need to make several changes to the Unified State Register of Legal Entities at the same time, you can indicate several changes in one application. However, some changes require amendments to the charter, in which case there will be separate sets of documents for registration (for example, changing the general director at the enterprise and the name of the LLC at the same time). Step-by-step instructions on various changes to the Unified State Register of Legal Entities and the charter, as well as on various combinations of simultaneous registration of changes to the charter (for example, on registration of exit and dismissal from the position of a founder who is also the general director of an LLC, on the simultaneous registration of a change of general director and founder), you can use the Unified State Register of Legal Entities Find information in the section “Amendments to the Unified State Register of Legal Entities and the Charter.”

Step 4. Have the applicant’s signature on the prepared application for registration of changes in the Unified State Register of Legal Entities certified by a notary

According to Art. 9 of the Federal Law of 08.08.2001 No. 129-FZ for state registration of a legal entity, applicants can be, including the head of the permanent executive body of the registered legal entity or another person who has the right to act on behalf of this legal entity without a power of attorney, as well as other a person acting on the basis of the authority provided for by federal law, or an act of a specially authorized state body, or an act of a local government body.

During the procedure for registering a change of director general, the question often arises when determining the applicant authorized to sign the application for registration of a change of director and submit documents for registration. Who is the applicant when changing the CEO? Should the new director apply or does his predecessor do so? The answer to this question is contained in the letter of the Federal Tax Service dated March 16, 2021 No. GD-4-14/4301, which states that the application for amendments is submitted by the new director of the organization.

To certify signatures on applications, the notary must provide constituent documents, LLC registration certificates, a decision (protocol) on the appointment of a new manager and a current list of company participants. In addition, when signing applications from a notary, it is necessary to present the applicant’s passport (original) and pay the notary fee (about 3,000 rubles per application).

Step 5. Submit an application on Form P13014 to the registration authority within 3 working days from the date of the decision to change the director

By submitting an application for registration of changes in the Unified State Register of Legal Entities, you notify the tax authority of the change of general director. When submitting an application to register a change of director, you can attach the minutes of the general meeting (decision of the sole participant or decision of the board of directors) to the application, but this is not necessary; the law does not require it. Please note that in order to change the director in an LLC, an application for registration of changes must be submitted to the registration authority, and not to your tax office at the place of registration, if they are different (for example, in Moscow the registration authority is MIFTS No. 46). If a change of director is registered in an NPO. then the documents are submitted to the Ministry of Justice.

The deadline for notifying the tax office about a change in the general director of an LLC or other company is 3 business days from the date the decision on the change is made. In case of failure to notify the tax office or violation of the deadline for notifying the tax office of a change of director, the law provides for administrative liability in the form of a fine in the amount of 5 thousand to 10 thousand rubles.

The state fee for making changes to the Unified State Register of Legal Entities in connection with a change of director is not paid.

The methods for submitting documents to register a change of director of an LLC may be different. Choose one of the options:

- by directly contacting the registration authority

- through the MFC - you should find out about the possibility of applying at a specific MFC

- by postal item with declared value upon forwarding with a list of attachments

- through the Unified Portal of State Services or through the Internet service of the Federal Tax Service of Russia - when submitting documents in electronic form. In this case, the documents must be certified with an enhanced qualified electronic signature

- through a notary only if the applicant personally contacts him for a fee.

When submitting documents, the applicant or his representative is given (sent by mail or e-mail) a receipt indicating, among other things, the date of receipt of the documents based on the results of registration. The progress of registration can also be tracked on the Federal Tax Service website.

Step 6. Receive an extract on amendments to the Unified State Register of Legal Entities

The deadline for registering a change of general director in the Unified State Register of Legal Entities is 5 working days. However, if the procedure for re-registering the general director in an LLC or JSC is carried out taking into account the formal requirements when convening a meeting (in case of disagreements between the founders), then the total period for changing the director may take more than 35 days for an LLC (more than 55 days for a JSC).

This extract confirms the completion of the procedure for registering a change of director of a legal entity.

Step 7. Provide information about the change of director to the bank and notify other counterparties

After registration, you must notify the bank of the change of director. In accordance with clause 7.11 of Bank of Russia Instruction No. 153-I dated May 30, 2014, when notifying the bank, it is necessary to submit documents confirming the powers of the new director (protocol of appointment, extract from the Unified State Register of Legal Entities certifying the introduction of changes) and a document certifying the identity of the new director . The list of documents confirming the powers of the director is not regulated by law. As a rule, this is a protocol or decision to change the director, an extract from the Unified State Register of Legal Entities, or the manager’s passport. If the organization uses Internet banking, it is also necessary to replace the electronic key.

Also, when changing a director (especially if there is a conflictual change of director), we recommend notifying key counterparties.

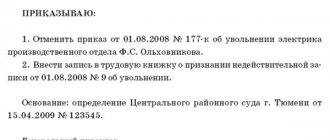

Step 8. Sign an employment contract with the new manager (if required)

An employment contract with the director of an LLC or JSC without a board of directors is signed by a person authorized by the minutes of the general meeting. If there is a board of directors, the agreement is signed by the chairman of the board or another person authorized by the board.

If you need to change the general director of an LLC in Moscow or the Moscow region, you can order the services of our lawyers for registering a change of director of the LLC in the Unified State Register of Legal Entities. We will save your time on completing the necessary documents, queues at notary offices and when submitting (receiving) documents to the tax authority, and will also help you avoid a fine for late entry of information about the change of director in the Unified State Register of Legal Entities. You can find out the price of a lawyer’s services for changing the general director in Moscow and the Moscow region on the page for services for making changes to the Unified State Register of Legal Entities in connection with a change of director by following the link.

Step 1

Select a candidate for a new director and check the candidate for the position of director in the register of disqualified persons

Step 2

Prepare the minutes of the general meeting of participants (decision of the sole founder) on the change of director or the decision of the Board of Directors (depending on the procedure established by the charter)

Step 3

Prepare an application for registration of changes in the Unified State Register of Legal Entities in connection with the change of the general director (manager) using form P13014

Step 4

Have the applicant's signature on the prepared application for registration of changes in the Unified State Register of Legal Entities certified by a notary

Step 5

Submit an application on Form P13014 to the registration authority within 3 working days from the date of the decision to change the director

Step 6

Receive an extract on amendments to the Unified State Register of Legal Entities

Step 7

Provide information about the change of director to the bank and notify other counterparties

Step 8

Sign an employment contract with the new manager (if required)

How to change the general director of an LLC without his consent?

In practice, unfortunately, conflict situations often occur between the director and the founder. In this regard, founders often ask the question: What is needed to formalize a change of CEO without his consent? To begin with, it should be noted that the legislator does not establish a requirement to obtain consent from the director to make changes. The decision to appoint or replace the general director is made exclusively by the founders (or the board of directors, if the powers are vested in it by the charter). Therefore, the procedure for changing a director without his consent and registering changes is no different from the described procedure. However, it must be taken into account that the general director is an important figure in many companies, a lot of business processes are tied to him, he has the right to sign documents without a power of attorney and has other broad powers, therefore, upon dismissal, a dissatisfied director can “put a spoke in the wheels” of the organization, therefore it is important to take measures for the financial and reputational security of the company even before notifying the director of dismissal (take away important documents, keys, change codes, passwords, etc.).

What should the former director do if the founder does not send a notification to the tax office about the change of general director? Is it possible to notify the tax office of a change of director yourself?

In addition, in practice, the opposite situation occurs when the director resigns, but the founder does not make changes to the Unified State Register of Legal Entities. And directors, fearing subsidiary liability for the LLC’s debts, often ask: How to formalize a change of director without the consent of the founders? In this case, it is necessary to take into account that, as mentioned earlier, the appointment and removal of powers from a director is solely the will of the founders (board of directors), therefore, without their consent, making an entry in the Unified State Register of Legal Entities about a change of director is impossible. What should the director do in this case?

Judicial practice in resolving disputes between a former manager and the company is different; there is no uniform position of judges regarding the possibility of excluding information about himself by the director through the court, therefore, before filing a claim in court, it is necessary to study the practice of your region. If the general meeting of LLC participants did not take place or the participants met but did not elect a new director, then this will not prevent the current director from resigning; he only needs to write a letter of resignation one month in advance.

Further, in order to avoid negative consequences, the director can initiate the entry into the Unified State Register of Legal Entities about the unreliability of information about the director (this option has become available to former directors since 2016). And this is fraught with unpleasant consequences for the company. In this case, the tax authorities will make an entry in the state register about the unreliability of information about the head of the company. If an entry “about unreliability” appears in the Unified State Register of Legal Entities, the company will probably have problems. After all, it will cease to be a bona fide taxpayer from the point of view of the tax authorities, which means that other companies will begin to avoid cooperation with it. In addition, tax authorities can exclude a company from the Unified State Register of Legal Entities if reliable information is not provided within 6 months.

In any case, the director should hurry up and submit an application to the registration authority in form No. P34001, because if the tax authorities make an entry in the Unified State Register of Legal Entities about the unreliability of information about the director of the company based on the results of their own audit, for the director this will mean a veto on registration as the head of other legal entities for a period of 3 years.

You also need to save all papers sent to participants (notice of convening a general meeting of participants, resignation letter, postal receipts confirming dispatch, list of attachments, etc.). For example, in order to avoid having to pay administrative fines as a director of a company for failure to provide information to the tax authority.

In addition, there are other measures to influence the company. If for some reason a real operating company has not made changes to the register in a timely manner, this may mislead counterparties. When concluding transactions with a company, they will rely on data from the Unified State Register of Legal Entities. And they are not at all obliged to know that the former director no longer has the right to enter into contracts on behalf of the organization without a power of attorney.

As a general rule, in this case the company cannot refer to the unreliability of state register data as a basis for declaring the transaction invalid. That is, if the former director, whose information remains in the Unified State Register of Legal Entities, enters into an unprofitable deal, the company does not have the right to refuse to execute it or must compensate the counterparty for losses associated with such refusal. And this happens. For example, there is a known case where a former manager signed an additional agreement to a purchase and sale agreement, pledging to return the buyer’s money and pay a penalty for failure to fulfill contractual obligations. The former manager can sign certificates of work performed, acts of reconciliation with the counterparty, which will later form the basis of claims.

Read more about the services of lawyers for LLC registration here. Register an LLC with foreign participation here. Read more about the services of lawyers for registering individual entrepreneurs here. Read more about the services of lawyers for registering a non-profit organization here. Making changes to the Unified State Register of Legal Entities and constituent documents here. Comprehensive services of a corporate lawyer, we work without prepayment, guaranteed results. We also provide services for comprehensive legal support for businesses: no hourly fees, different types of payment (one-time payments or subscription fees), “live” communication with a lawyer, visits by a lawyer to the office. You can view the terms and conditions for providing legal services for business here. Need legal advice? Call us by phone or leave a request on the website, we will contact you as soon as possible and answer all your questions! Legal consultation is free!

"MK-Legal Technologies" - why us?

Our team is made up of people who are passionate about their work. We enjoy our work in all its forms. This is probably why we demonstrate to help our clients. Our advantages:

- Narrow specialization of employees. Each of our lawyers thoroughly knows a certain area of jurisprudence. “Universal” will not be able to solve the problem at a decent level, and we know this.

- Work for results. For example, turnkey registration of companies in the Republic of Belarus presupposes the possibility of officially conducting business based on the results of our work, and not just a set of documents that still need to be sent somewhere. We take care of all the hassle.

- High efficiency. We never delay deadlines. We do not promise that everything will be completed before the deadline allotted by law for the approval of various papers, but we guarantee that your project will be completed as quickly as possible.

- Thoughtful pricing policy. The terms of cooperation are such that they will be attractive both for a beginner in the entrepreneurial field and for an experienced manager.

- Individual approach. We delve into all the features of a particular project. We don't lose sight of anything. We make sure that the result exceeds expectations.

The list of advantages is not limited to this. Let us know when you can receive our employee, and we will come to your office to discuss the details of your application and come to a decision on which direction of interaction to choose! We will do everything that the law allows to ensure that you have the most favorable position. We guarantee that you will not only be satisfied, but also recommend us to others. Let's get started?

084