O.I. Prokhorova author of the article, Ascon consultant on accounting and taxation

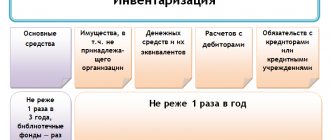

All organizations are required to conduct an inventory before drawing up annual financial statements (Part 2, Article 11 of the Federal Law of December 6, 2011 N 402-FZ, clauses 26, 27 of the Regulations on Accounting and Financial Reporting, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n (hereinafter referred to as Regulation No. 34n), clause 27 of the Guidelines for inventory of property and financial obligations, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 N 49 (hereinafter referred to as Guidelines for Inventory), clause 38 PBU 4/99, Appendix to the Letter of the Ministry of Finance of Russia dated 01/19/2018 N 07-04-09/2694, Appendix to the Letter of the Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01).

The purpose of the annual inventory is to identify the actual availability of property, compare it with accounting data, check the completeness of the reflection of liabilities in accounting, ensure the reliability of accounting data and financial statements (clause 1.4 of the Inventory Guidelines).

Inventory procedure

Mandatory inventory conditions:

- Gathering of the inventory commission in full;

- Counting units in stock;

- Demonstration of reports and all documentation on inventory and materials and receipts of all responsible persons;

- Mandatory recording of the inventory act in the inventory.

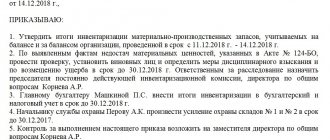

The first stage of the inventory is the creation of an order for the collection of a special commission. It is published by the head of the enterprise in free form in accordance with the INV-22 form. Its content should contain all the information about the company and the product. The commission then draws up an inventory plan, which management must confirm.

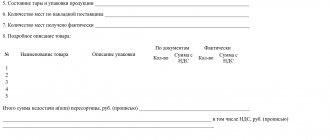

After completing the first stage, the commission conducts a recalculation of materially valuable items in the warehouse, during which an inventory is made in the INV-3 form. It is important to remember that if you make a mistake in the inventory, you should not rewrite everything again, use a proofreader, etc., you just need to cross out the incorrect data with one neat line, after which the correction is written on top. Defective goods are also entered into accounting in accordance with the TORG-16 form. It is advisable that all goods be checked against the accompanying documents to identify differences. All goods that have their own packaging are counted according to the labeling.

Penalty for failure to take inventory

The tax inspectorate or other government agencies cannot fine an organization simply because it did not conduct an annual inventory. There is no such fine in the law.

However, without inventory:

- it is impossible to obtain a positive audit opinion;

- accounting statements may be unreliable, which entails fines both for the organization itself and for its officials (Article 120 of the Tax Code of the Russian Federation; Article 15.11 of the Code of Administrative Offenses of the Russian Federation);

- errors in tax accounting, additional charges of taxes, penalties and fines are possible (Articles 75, 120, 122 of the Tax Code of the Russian Federation).

Final check

Further, based on the results of the audit, the responsible persons confirm their agreement with the results. Then an inventory act is drawn up, during which the remaining valuables in the warehouse are identified. It is worth noting that this document is considered one of the most significant. Inventory acts may differ in their content. To display existing information, the accountant fills out a statement in which all data on product surpluses or shortages is recorded. It is important that the statement be signed by each member of the commission, since on its basis collections are made from financially responsible persons. All results of the inventory are recorded in the monthly reports. The annual report includes reporting results.

Attention

Employees who count goods must disassemble all goods in detail, count them serially, and then enter the data into the statement.

The goods are laid out in serial ascending order. If the goods are stored in additional places, the employee must enter accurate information about the actual location of the goods.

Upon completion of the count, the entire composition of working persons signs on the inventory sheet, which is subsequently copied and given to the operator for entering data into the system. Then the calculations are rechecked. If discrepancies are identified, the senior operator takes the documents to correct them.

Advice

There are unsolved cases of property theft. In addition to everything else, the personnel who work in the warehouse make mistakes when accepting and packaging goods. The human factor, as a result of which shortages, excesses, etc. are formed. By storing goods individually, such shortcomings can be avoided. In addition, do not forget about errors in paperwork and arithmetic inaccuracies in calculations.

To eliminate errors in accounting, an inventory of property is used. The total number of inventories carried out is regulated by the order on the accounting policy of the enterprise, but it must comply with Article 12 of the Law “On Accounting”, according to which, an inventory must be carried out at least once a year before issuing an annual report. But in practice, the majority of warehouses use almost daily inventory of goods. This is done to relieve financial liability. Therefore, during each shift of storekeepers, an inventory of damaged or spoiled materially valuable cargo is made.

Thus, it becomes immediately clear who is to blame for damage to a particular product, and who will bear financial responsibility.

Features of the annual inventory in 2021

When conducting an inventory before preparing reports for 2020, you should take into account the latest changes in accounting legislation.

From 2021, a new accounting standard will be mandatory.

Two standards have been approved, the application of which is mandatory from reporting for 2022, but if you wish, you can switch to the new rules earlier: FSBU 6/2020 “Fixed Assets” and FSBU 26/2020 “Capital Investments” (Order of the Ministry of Finance of Russia dated September 17, 2020 N 204n ).

This may require the organization to take a more thorough approach to checking and reflecting balances in accounting and reporting.

In addition, at the end of 2021, settlements with accountable persons and inventory of balances on account 71 deserve special attention.

This is due to the forced cancellation of business trips due to coronavirus restrictions and the need for many taxpayers to adjust their plans.

Composition of the inventory commission

The inventory commission includes:

- Chairman;

- warehouse manager;

- general accountant;

- employee representatives;

- warehouse attendants;

- security representative.

From time to time, audit service agents are involved in conducting inventory. If at least one of the members of the ratified commission on the day of the inventory did not even hear about it, then the inventory is considered invalid. During this procedure, all reports must be entered into the accounting program systems. All excesses and residues are calculated, and discrepancies in figures are documented.

Important information

Materially responsible persons are obliged to notify the facts of differences and provide the chairman of the inventory commission with a receipt. The accounting department must provide a statement of the results of the inventory. Separate lists for items in safekeeping.

Attention

When goods are received, a separate inventory is created “Inventory assets received during inventory”, form INV-3. When summarizing the inventory, this data will be attached to the warehouse report.

During inventory, goods can be counted manually or using terminals that work on the principle of scanning barcodes.

It is worth noting that barcodes on products are not always correct. Therefore, you should check the product label and code compliance during scanning.

Write-off of bad debts

Bad debts are written off on the basis of an inventory of payments (form INV-17) and an order from the manager (clause 77 of the Accounting Regulations No. 34n, Article 266 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated December 27, 2018 No. 03-03-06/1/ 95709, dated 10/13/2017 N 03-03-06/1/67057, dated 07/11/2017 N 03-03-06/1/43877).

Uncollectible accounts receivable are subject to write-off against the allowance for doubtful debts. If the reserve is not enough, the remaining debt goes to expenses (Article 265 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated January 16, 2018 N 03-03-06/2/1551). In accounting, all organizations are required to create such a reserve; in tax accounting, this is the right of the organization (clause 70 of Regulation No. 34n, Article 266 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated August 31, 2020 No. 03-03-06/2/76195).

The receivable is subject to write-off as expenses along with VAT (Article 266 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated October 21, 2008 N 03-03-06/1/596). According to the Ministry of Finance, when writing off debts on advances issued, the VAT accepted for deduction from this advance payment must be restored (Letter of the Ministry of Finance dated January 28, 2020 N 03-07-11/5018).

After write-off, bad receivables are reflected in off-balance sheet account 007 for five years (clause 77 of Regulation No. 34n).

Under the simplified tax system, written-off receivables are not taken into account either in expenses or in income (Letters of the Ministry of Finance dated 02/20/2016 N 03-11-06/2/9909, dated 07/22/2013 N 03-11-11/28614).

Bad accounts payable are taken into account as income under both the OSNO and the simplified tax system (clause 78 of Regulation No. 34n, clause 2, clause 1, article 248, clause 18, article 250, clause 1, article 346.15 of the Tax Code of the Russian Federation). If an organization uses the simplified tax system to write off the creditor for the advance received from the buyer, then no income will arise, because income is reflected as the advance payment is received (clause 1 of Article 346.17 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated March 14, 2016 N 03-11-06/2/14135).

Writing off accounts payable to the supplier does not oblige the buyer to restore VAT previously accepted for deduction (Letter of the Ministry of Finance dated June 21, 2013 N 03-07-11/23503). When a creditor writes off an advance received, the VAT calculated on it cannot be deducted. There is no need to include it in income or expenses (Article 248 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated December 7, 2012 N 03-03-06/1/635).

Final stage

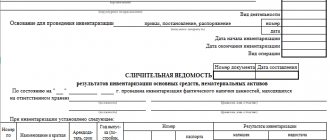

If differences are detected between the actual and accounting quantities of goods, the inventory result is displayed in material form.

This is either savings, which is extremely rare, or shortages. In both the first and second options, further operations are carried out by security services.

Advice

Thanks to the inventory, the culprits are identified and subject to special penalties, including administrative and sometimes criminal liability. The shortfall amounts are compensated from the salaries of financially responsible persons. In special cases, based on the results of the inventory, officials lose their positions.

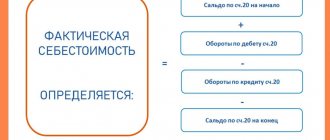

Capitalization of surplus

Assets found to be in surplus are subject to capitalization and credited to the financial results of the organization (clause 5.1 of the Methodological Instructions for Inventory).

In tax accounting, surpluses are included in non-operating income at market value (clause 8, clause 20 of Article 250 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated September 11, 2020 N 03-11-06/2/80113). The market value is determined taking into account the provisions of Art. 105.3 of the Tax Code of the Russian Federation (clause 5 and article 274 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated August 28, 2020 N 03-03-06/1/75787). Depreciation can be calculated on capitalized fixed assets, but bonus depreciation cannot be applied.

Inventory and materials are taken into account as usual. This property may be written off or sold. As for sales, the income received as a result of such transactions is reduced by the amount of the market value of the property being sold (accounted for as non-operating income), at which it was accepted for accounting (clause 2, clause 1, article 268 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated September 23 .2011 N 03-03-06/1/583, dated 02/11/2011 N 03-03-06/1/88, Resolution of the Federal Antimonopoly Service of the Moscow Region dated 02/21/2013 in case N A40-2055/12-20-9).

Perfect Inventory

What does an ideal inventory mean? What advantages and qualities does it have? An ideal inventory should be:

- Short-term - inventory is a slow process, but should take no more than 2 weeks, depending on the size of the warehouse.

- Economically profitable - without a shortage of goods and unnecessary investments.

- Original, with confirmation of quality - after the inventory, the manager must be confident in the reliability of the data.

It is safe to say that it is precisely according to these parameters that the inventory will be called ideal, the one that every company wants to receive.

Inventory the old fashioned way in small warehouses

This method is most popular among small companies. The technology of this inventory method is simple and familiar to everyone. It is carried out using a pen/pencil, paper and a fairly large amount of time. The main idea of this method is manual counting of all units of goods. This inventory method has many disadvantages, which are not difficult to guess:

- The procedure takes a lot of time, at best a week, at worst a month or more;

- To carry out this type of inventory, the warehouse must be closed, which means it entails losses of potential customers and profits.

- Requires certain investments, including paying double the amount to employees, and sometimes hiring staff.

- In most cases, inventory results are not ideal. Defects, surpluses, shortages, etc. are identified. And the most important problem is that the manager cannot be sure of the accuracy of the data, as a result of which a number of other problems arise.

The advantage of this method is saving money, but it is very doubtful. For small warehouses, this inventory method will really help save money, but for large ones it is extremely costly. If we take into account the number of possible errors, and there will be many of them, we can say with confidence that the costs of inventory will be several times less than the losses from such “savings”.

Ordering an inventory from professionals is much more profitable than making mistakes, each of which will cost a pretty penny later. But, before entrusting the preservation of your funds and nerves to specialists, you should make sure that this service is right for you:

- Relevant for large warehouses and enterprises. The cost of one inventory will vary from 30,000 rubles to 50,000 rubles

- You will have to completely trust the professionalism of third-party specialists and in the future always use their services.

- Your employees will not receive new knowledge, and their competence will not grow. Moreover, your employees will no longer have complete control over the warehouse.

Of course, even this method of inventory may entail risks and costs, although, at first glance, it seems the most convenient and profitable.

Inventory results. Discrepancies with accounting registers

[goo_mid] If the inventory commission identifies objects that are not suitable for further use, it must draw up a separate inventory. It indicates basic data about such an object and a general description of the reasons why this object is considered unsuitable.

Subsequently, based on the data from this inventory, management will make a decision on subsequent activities in relation to such a fixed asset.

If it is revealed that a fixed asset has changed its purpose as a result of restoration, reconstruction or re-equipment, then an entry about it is made in the inventory according to its new purpose.

If it turns out that the accounting registers did not take into account the work carried out on fixed assets that was of a capital nature, then the amount of change in the value of the fixed asset is determined based on the totality of data on the cost of such work. Data about such an object is entered into the inventory taking into account the calculated changes.

If objects are discovered that are not registered, or objects for which the accounting does not have complete data or they are indicated incorrectly, all available information on them is included in the inventory list.

Inventory in medium and large warehouses

The second way to inventory warehouses is to count goods using special terminals. These devices are a data collection system that runs on the Goods platform. This method will allow you to avoid a large number of shortcomings and errors by automating the data recording process. How does this happen? Employees receive special terminals and scan barcodes of goods. This helps to significantly save workers time.

It is not surprising that not every company is ready for such changes. Most often, mature and “confidently standing” businesses do this.

Using this type of warehouse inventory you:

Save your money

- You won’t have to overpay your employees or expand your staff;

- You will not need third-party specialists, saving a lot of money;

- You will stop losing money on the mistakes of your employees, profit from closing the warehouse for inventory, and so on.

Save your time and effort

- Thanks to this method, warehouse inventory will take much less time and effort;

- Errors caused by human factors are reduced to zero;

- The resulting free time for employees can be used more rationally.

Gain confidence in the data

- When collecting data using this inventory method, you can be confident in its reliability.

- You gain confidence in your employees, you will see how their experience grows;

- You no longer have to worry about warehouse inventory, because with this method it will become easy.