Travel expenses include employee travel expenses, housing rental costs, daily allowances and other expenses associated with business trips. Business trip expenses are included in other income tax expenses. However, if the business trip was related to the acquisition of a fixed asset or inventory, then it is better to include the costs in the initial cost of the fixed asset (attributed to the cost of the inventory). Difficulties with taking into account travel expenses usually do not arise. The main thing is that these expenses are supported by documents. Travel expenses are not standardized, that is, they are taken into account in full. Typically, these expenses are recognized in the period in which the expense report is approved.

Restrictions on sending certain categories of workers on business trips

A business trip is a trip by an employee by order of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work ( Article 166 of the Labor Code of the Russian Federation ). The specifics of sending employees on business trips are established by Regulations [1], approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 .

It should be remembered that labor legislation establishes a number of restrictions, according to which some employees are prohibited from being sent on business trips, and certain categories of employees can be sent on business trips only with their written consent.

So, it is prohibited to send pregnant women on business trips ( Article 259 of the Labor Code of the Russian Federation ), as well as minors (with the exception of creative workers in the media, cinema organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons participating in the creation and (or) performance (exhibition) of works, in accordance with the lists of works, professions, positions of these workers, approved by Decree of the Government of the Russian Federation of April 28, 2007 No. 252 ).

In addition, employees cannot be sent on business trips during the period of validity of the apprenticeship contract concluded with them, if such trips are not related to apprenticeship ( Article 203 of the Labor Code of the Russian Federation ).

There are certain restrictions regarding sending disabled people on business trips: if the rehabilitation program for a disabled person contains a ban on business trips, sending him on a business trip will be unlawful and may entail administrative liability for the employer (Article 23 of the Federal Law of November 24, 1995 No. 181-FZ “On social protection of disabled people in the Russian Federation" ).

Only with written consent and provided that this is not prohibited by them in accordance with a medical report, can women with children under the age of three years be sent on business trips. The procedure for issuing a medical report is established by Order of the Ministry of Health and Social Development of the Russian Federation dated May 2, 2012 No. 441n .

In accordance with the provisions of Art. 259 , 264 of the Labor Code of the Russian Federation, obtaining written consent for a business trip and checking for medical contraindications is necessary when sending on a business trip:

- a father raising children without a mother;

- guardian (trustee) of minors;

- mother (father) raising children under the age of five without a spouse;

- an employee with a disabled child;

- an employee caring for a sick family member in accordance with a medical report.

Medical reports are issued to citizens based on the results of medical examinations, medical examinations, clinical examinations, in accordance with decisions made by the medical commission, as well as in other cases.

Such a conclusion cannot be replaced by a certificate. The fact is that certificates are issued by doctors (in some cases, paramedics and obstetricians) based on entries in the citizen’s medical records or based on the results of a medical examination. note

It is necessary to obtain written consent for a business trip from employees of these categories, and they must also be informed in writing of the right to refuse the trip. To do this, the employer issues a notice in which the employee is invited to go on a business trip and informed that he has the right to refuse it. The notice is drawn up in two copies.

Preparation of documents when sending an employee on a business trip

According to the changes made to the Regulations by Decree of the Government of the Russian Federation No. 1595 [2], from January 8, 2015, when an employee is sent on a business trip, a job assignment and a travel certificate are not issued.

Let us recall that these documents were used to confirm the employee’s presence at a certain time in a specific place for reimbursement of expenses in connection with a business trip. When sending an employee on a business trip, it is necessary to issue an order either in the unified form T-9 (form T-9a - for sending a group of employees), approved by Resolution of the State Statistics Committee of the Russian Federation No. 1 [3], or in a form developed and approved by the organization itself. In the order for sending on a business trip, the official assignment should be specified in detail (purpose of the trip, deadlines for completing this assignment). As the basis for issuing an order, you can indicate the details of the documents (if any), in accordance with which the employee was required to be sent on a business trip (agreement with a counterparty, an order to conduct an inspection, an invitation to an exhibition, etc.).

The order is signed by the head of the organization (another authorized person), and the employee is introduced to this document upon signature.

Here is an example of issuing an order to send an employee on a business trip.

| Limited Liability Company "Matrix" (Matrix LLC) Order No. 252 about sending an employee on a business trip June 2, 2015 Nizhny Novgorod Send Georgy Aleksandrovich Protasov, a leading equipment adjustment specialist, on a business trip to Energoresurs OJSC, located in Elektrogorsk, Moscow Region, for a period of 4 (four) days from June 8 to 11, 2015 in order to organize equipment adjustment during technological preparation of production. Reasons: equipment supply contract No. 127/5-2 dated 05/25/2015, memo from the head of the production workshop A.S. Obukhov on the need to organize the setup of equipment dated 05/29/2015. Director Sukhonin R.B. Sukhonin I have read the order: Protasov, 06/02/2015 |

In accordance with clause 8 of the Regulations, the employer is obliged to keep records of employees leaving on business trips from the sending organization and arriving at the organization to which they are sent. Records are kept in the appropriate journals, the forms of which are given in the appendices to the Order of the Ministry of Health and Social Development of the Russian Federation dated September 11, 2009 No. 739n .

In this case, the employer or a person authorized by him must, by order (instruction), appoint an employee of the organization responsible for maintaining the departure log and the arrival log. In particular, the logbook of employees leaving on business trips from the sending organization reflects the surnames, first names and patronymics of the seconded workers, the names of the organizations to which they are sent, and their destinations.

For your information

The employer (the person authorized by him) is obliged to ensure the storage of the departure register and the arrival register for five years from the date of their registration.

In addition to reflecting in the appropriate journal information about the employee leaving on a business trip, it is necessary to make an entry about the time the employee was on a business trip in the time sheet. Let us remind you that the employer is obliged to keep records of the time actually worked by each employee ( Part 4 of Article 91 of the Labor Code of the Russian Federation ). To record working hours, the employer can either use the unified form T-13, also approved by Resolution of the State Statistics Committee of the Russian Federation No. 1 , or develop a timesheet form independently. The symbols of worked and unworked time presented on the title page of Form T-12 are also used when filling out the time sheet in Form T-13. Days of absence of an employee from the workplace due to a business trip are indicated by code “K” (or code “06” - “business trip”), while the number of hours worked is not entered.

For your information

The actual length of stay at the place of business trip is determined by travel documents presented by the employee upon returning from a business trip ( clause 8 of the Regulations ). If he travels to the place of business trip and (or) back to the place of work on personal transport (car, motorcycle), the actual period of stay at the place of business trip is indicated in a memo, which is submitted by the employee upon returning from a business trip to the employer along with supporting documents confirming use of the specified transport for travel to the place of business trip and back (waybills, invoices, receipts, cash receipts, etc.).

Next, we will consider individual issues of recognizing travel expenses for tax purposes, taking into account clarifications from regulatory authorities.

What is daily allowance in Russia in 2021

Per diem means payment of expenses of a business traveler during the trip. They are paid taking into account two basic rules:

A fixed amount for each day of a business trip, including daily allowances on weekends and holidays.

When daily allowances are paid, how to count days, not only the accountant, but also the business traveler himself should know. In addition to the immediate days of the business trip, the calculation includes the day of departure and return, including possible delays.

Departure day is the date of departure of the vehicle from the city of the permanent place of work to the locality where the employee is sent. Return day – the date of the employee’s arrival in the city of his permanent place of work.

If transport arrives before 0 o'clock inclusive, the current day is taken into account. If arriving after 0 o'clock, the employee will be paid for one more day.

Payment of daily travel expenses in 2021 is made to the employee the day before sending on a business trip in advance.

Such payments are due to an employee if the business trip takes more than one day. When an employee leaves in the morning and returns in the evening, he is not entitled to a daily allowance.

Recognition of travel expenses when calculating income tax

Based on paragraphs. 12 clause 1 art. 264 of the Tax Code of the Russian Federation, business travel expenses are classified as other expenses associated with production and sales.

What is the procedure for documenting an employee’s travel expenses to the place of business trip and back for income tax purposes? In Letter dated 05/08/2015 No. 03‑03‑06/1/26918, the Ministry of Finance cited the provisions of Art. 252 of the Tax Code of the Russian Federation , on the basis of which expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation , losses) incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented expenses are expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were incurred, and (or) documents indirectly confirming the expenses incurred (in including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract). Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

In accordance with the provisions of Federal Law No. 402-FZ [4], each fact of economic life is subject to registration with a primary accounting document. The forms of primary accounting documents are approved by the head of the economic entity on the recommendation of the official responsible for maintaining accounting records.

Officials of the financial department especially emphasized that in the absence of documents confirming the expenses of an organization employee for travel to the place of business trip and back, the taxpayer does not have the right to recognize these expenses for the purposes of taxing the profits of organizations.

What is the procedure for documenting travel expenses for renting residential premises for income tax purposes? In Letter dated 03/03/2015 No. 03‑03‑07/11015 , the Ministry of Finance clarified that, according to Art. 313 of the Tax Code of the Russian Federation, tax accounting is a system for summarizing information to determine the tax base based on data from primary documents, grouped in accordance with the procedure provided for by the Tax Code. Confirmation of tax accounting data includes primary accounting documents that meet the requirements of Art. 9 of Federal Law No. 402-FZ .

Taking into account the provisions of these articles, as well as the norms of Art. 252 and 264 of the Tax Code of the Russian Federation , the taxpayer has the right to take into account expenses for business trips, in particular for the rental of residential premises, when they are confirmed by primary accounting documents drawn up in the prescribed manner.

How to confirm the duration of a business trip? According to clause 7 of the Regulations, the actual length of stay of the employee at the place of business trip is determined by travel documents presented by the employee upon return from a business trip.

In Letter dated 05/06/2015 No. 03‑03‑06/1/26251 , the Ministry of Finance, having considered the issue of confirming the duration of a business trip when traveling by third-party transport, expressed the following opinion: in the case of an employee traveling to the place of business trip and back to the place of work on third-party transport an organization providing the taxpayer with services for transporting an employee, taking into account that the list of supporting documents is not closed, any primary documents drawn up in accordance with the legislation of the Russian Federation on accounting can be confirmation of the actual length of stay of the employee on a business trip, as well as the use of the specified transport, which indicate the actual location of the employee on the way to the place of business trip and back on the specified transport.

Similar explanations were provided by financiers in letters:

– dated 05/07/2015 No. 03-03-06/1/26489 , dated 04/24/2015 No. 03-03-06/1/23680 , dated 04/20/2015 No. 03-03-06/22368 – when considering the issue of accounting in for income tax purposes, travel expenses for the employee’s travel to the place of business trip and back to the place of work using personal transport;

– dated 04/29/2015 No. 03‑03‑06/1/24840 – when considering the issue of confirming the actual duration of an employee’s stay on a business trip in the case of travel to the place of business trip and back on official transport;

– dated 04/27/2015 No. 03‑03‑06/2/24237 – when considering the issue of documentary confirmation of the actual length of stay of the employee on a business trip.

How are travel expenses made using a bank card of an authorized employee taken into account for income tax purposes? In 03‑03‑06/2/19106 dated 04/06/2015 , officials of the financial department noted that the employer is obliged, in accordance with the established procedure, to reimburse the expenses incurred by the employee related to the business trip.

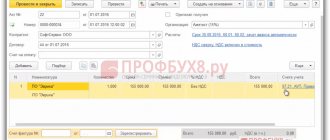

Documentary evidence of travel expenses for profit tax purposes will be the employee's advance report with duly executed supporting documents attached to it, in particular air or train tickets, a hotel bill, etc. In this case, one of the conditions for the employer to reimburse travel expenses to an employee of the organization is the fact of expenses incurred by a business traveler, including using a bank card of an authorized employee. In this case, the advance report must be accompanied by the originals of all documents related to the use of an authorized employee’s bank card, ATM receipts, slips (electronic terminal receipt), etc., in which the surname of the bank card holder must be indicated.

If payment for travel documents (tickets) and hotel reservations for a posted employee are made from a bank card of a person authorized by the bank and this is confirmed by primary documents (tickets and hotel invoice) attached to the advance report, there is no reason to believe that the expenses were not incurred by the posted person.

What is the procedure for accounting for income tax purposes of expenses when sending an employee of an organization (member of an SRO) elected to the governing body of the SRO on a business trip? In Letter dated May 13, 2015 No. 03‑03‑06/1/27392 , the Ministry of Finance, having analyzed the provisions of Art. 252 and paragraphs. 12 clause 1 art. 264 of the Tax Code of the Russian Federation , came to the following conclusion: sending on a business trip an employee of an organization elected to one of the management bodies of the SRO to perform the duties assigned to him is not directly related to the commercial activities of the organization; the taxpayer does not have the right to take into account the expenses incurred with this business trip. purposes of taxation of profits of organizations.

Personal income tax

When calculating personal income tax, the amount of daily allowance is standardized. Thus, daily allowances are not subject to this tax within the following limits:

- 700 rubles per day of being on a business trip in Russia;

- 2500 rubles per day of being on a business trip abroad.

Withhold personal income tax from daily allowances paid in excess of the established norms (700 rubles and (or) 2500 rubles).

This procedure follows from paragraph 10 of paragraph 3 of Article 217 and Article 210 of the Tax Code of the Russian Federation.

Let’s say an organization paid an employee excess daily allowance. Then the employee has income for personal income tax purposes.

Income is recognized on the last day of the month in which the advance report is approved, after the employee returns from a business trip. Withhold personal income tax on the next payment of income to an employee - for example, salary. Transfer personal income tax no later than the first working day after payment of income to the employee (subsection 3, clause 1, article 223, clauses 4 and 6, article 226 of the Tax Code of the Russian Federation).

Let's talk separately about business trips abroad. There are two options.

Option No. 1 Daily allowances are issued in foreign currency

To determine whether the daily allowance is in excess or not, recalculate the amount paid into rubles at the Bank of Russia exchange rate. Do this on the last day of the month when the advance report is approved (clause 5 of Article 210, subclause 6 of clause 1 of Article 223 of the Tax Code of the Russian Federation).

If you have income, withhold personal income tax (letter of the Ministry of Finance of Russia dated January 21, 2016 No. 03-04-06/2002).

Option No. 2 Daily allowances are issued in rubles

To determine whether the daily allowance is excessive or not, the exchange rate at the end of the month is not important. Use the amount actually received by the employee.

If there is income, recognize it on the last day of the month when the advance report is approved. And when you next pay money to an employee, withhold personal income tax (letter of the Ministry of Finance of Russia dated 02/09/2016 No. 03-04-06/6531).

note

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the amount of daily allowance paid does not affect the calculation of the tax base.

Personal income tax

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation are not subject to personal income tax on all types of compensation payments established by the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the limits of the norms provided for by the legislation of the Russian Federation), related, in particular, to the performance by the taxpayer of labor duties (including reimbursement of travel expenses ).

What is the procedure for documenting the employee’s travel expenses to the place of business trip and back for reimbursement by the employer for the purpose of paying personal income tax? Paragraph 10, paragraph 3, art. 217 of the Tax Code of the Russian Federation stipulates that when an employer pays a taxpayer expenses for business trips both within the country and abroad, income subject to taxation does not include actually incurred and documented targeted expenses for travel to the destination and back.

In Letter dated 05/08/2015 No. 03‑03‑06/1/26918 , the Ministry of Finance clarified that taking into account the changes made by Decree of the Government of the Russian Federation No. 1595 to some acts of the Government of the Russian Federation, there is no obligation for the employer to issue a travel certificate for a posted employee. At the same time, department officials recalled that previously a travel certificate with notes from the receiving organization on arrival at the place of business trip and departure from it confirmed the fact that the employee was at the place of business trip, but did not determine the fact of his incurring travel expenses and the amount of such expenses.

The conclusion reached by the Ministry of Finance in the letter is as follows: in the absence of documents confirming the expenses of an employee of the organization for travel to the place of business trip and back, the amounts reimbursed by the employing organization for such expenses are subject to personal income tax in the prescribed manner.

Taxation of personal income tax on salaries and daily allowances for business trips abroad. When an employee is sent on a business trip, including abroad, he is guaranteed the preservation of the average earnings at his place of work, as well as reimbursement of travel and rental expenses associated with the business trip ( Articles 167 , 168 of the Labor Code of the Russian Federation ). In addition, additional expenses associated with living outside the place of permanent residence (per diems) incurred in order to provide food and personal services for a posted worker are subject to reimbursement.

The issue of personal income tax taxation of salaries and daily allowances paid for business trips abroad to the EAEU countries was considered by the Federal Tax Service in Letter No. OA-3-17 dated February 25, 2015/ [email protected] . In their response, the controllers drew attention to the fact that the tax agent - employer must determine the status of an individual on a monthly basis, taking into account the provisions provided for in paragraph 2 of Art. 207 Tax Code of the Russian Federation . That is, the tax agent determines whether an individual was in the territory of the Russian Federation for 183 calendar days during the last 12 months preceding the date of receipt of income.

Thus, the average salary paid monthly to an employee during the performance of his work duties abroad may be taxed in the Russian Federation at a rate of 13 or 30%, depending on the duration of such a business trip.

At the same time, according to the provisions of paragraph 3 of Art. 217 of the Tax Code of the Russian Federation daily allowances in foreign currency within amounts equivalent to 2,500 rubles. for each day of stay on a business trip abroad are not subject to taxation, regardless of the tax status of their recipient.

the Treaty on the Eurasian Economic Union came into force . From the provisions of Art. 73 of this agreement it follows that from this date, income paid by Russian employers to citizens of Belarus, Kazakhstan and Armenia under employment contracts is taxed in the Russian Federation at a rate of 13%, regardless of the tax status of the recipients of this income, if the work is performed by them on the territory of the Russian Federation. However, this article does not affect the taxation procedure for income paid by a Russian employer to a citizen of the Russian Federation.

If, based on the results of a tax period (calendar year), an individual is recognized as a tax resident of the Russian Federation, he has the right to recalculate the amounts of tax withheld by the Russian tax agent at a rate of 30% on income received in such a tax period. The procedure for refunding overpaid tax in such a situation is established by the provisions of clause 1.1 of Art. 231 Tax Code of the Russian Federation .

Contributions from industrial accidents and occupational diseases

Contributions for accidents at work and occupational diseases are calculated on the income of employees. An exception is the payments listed in the List of payments for which insurance contributions to the Social Insurance Fund of the Russian Federation are not calculated, approved by Decree of the Government of the Russian Federation of July 7, 1999 N 765 (hereinafter referred to as the List of Payments).

According to clause 10 of the List of Payments, contributions are not accrued on amounts paid in the form of reimbursement and compensation within the limits established by the legislation of the Russian Federation:

— daily allowances within the limits established by law;

- payment of housing rental costs;

— compensation for the cost of tickets;

— reimbursement of other expenses related to the employee’s performance of work duties.

As is known, from January 1, 2009, the daily allowance norm established by law is 100 rubles. (Resolution of the Government of the Russian Federation dated 02/08/2002 N 93), canceled on the basis of Decree of the Government of the Russian Federation dated 29/12/2008 N 1043.

Therefore, insurance premiums for insurance against industrial accidents and occupational diseases should only be calculated for daily allowance amounts that exceed the daily allowance established by a collective agreement or local regulations. This is stated in the Letter of the FSS of the Russian Federation dated March 18, 2009 N 02-18/07-2165.

If an organization pays daily allowances to posted employees in the amount established by a collective agreement or local regulations, insurance premiums for insurance against industrial accidents and occupational diseases should not be charged.