Policyholders regularly submit reports to the Social Insurance Fund. If the company employs 25 or more people, the policyholder submits reports electronically. You can submit reports through your operator - most often this operation does not require much labor, just generate a report and click the “send” button. There is another way to send reports to the Fund - through a special gateway. In addition, policyholders participating in the Direct Payments pilot project send registers and certificates of incapacity for work to the Social Insurance Fund.

How does the system work?

Cooperation between a medical institution, the Social Insurance Fund, the insurer and the employee was adopted relatively recently.

For this reason, not all employers are members of the Social Insurance Fund network, and not all hospitals issue electronic sick leave. Procedure for obtaining ELN

https://www.youtube.com/watch?v=ytpolicyandsafetyen-GB

It is not difficult to obtain an electronic sick leave certificate from the Social Insurance Fund:

- An employee of an organization goes to a medical institution, where an electronic sick leave is issued for him.

- Next, the specialist approves the virtual document, indicating the deadlines, reasons for incapacity and other necessary information.

- The insured person who applies is assigned a sick leave number, which he passes on to the accountant of his organization.

- Using this code, the accountant finds a virtual certificate of incapacity for work in the personal account of the FSS policyholder. A legal entity or private entrepreneur can register in this section.

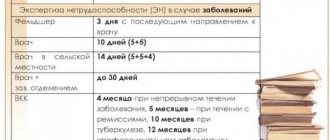

When calculating sick leave, various parameters are taken into account:

- Duration of employee's incapacity for work.

- The rate at which he works.

- Regional coefficient.

- Salary.

- Average income of a citizen and so on.

The calculation is made in the “Benefit Calculation” section.

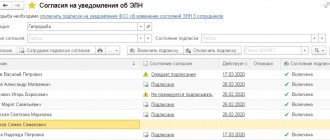

Monitoring of sick leave is carried out through the personal account of legal entities. A complete list of all sick leave is available in the “Electronic Sick Leaves” section.

Also, using the filter, the policyholder can find the required document. The following filters are available to him:

- FULL NAME.

- Pension certificate number.

- Sick leave number.

- Sick leave status.

The employer can supplement or edit the sick leave certificate. To do this, a sick leave request is made in the FSS database using the “Get LN” button. A field will open for entering the sick leave number and SNILS number of the citizen for whom the sick leave is issued. Then you need to click “Get LN” again.

Where is the “Pilot Project for Direct Payments of Social Security Benefits” being implemented?

A pilot project for the payment of disability benefits directly by the territorial bodies of the Social Insurance Fund of the Russian Federation has existed for seven years. The full cycle of its implementation is set from 2012 to 2021. Its rules are established by Decree of the Government of the Russian Federation dated April 21, 2011 No. 294. After the project is recognized as successful, it is planned to switch to direct payments of benefits from the Social Insurance Fund throughout the country.

Every year new subjects of the Federation join the project (clause 2 of Resolution No. 294).

| Date of entry into the project | Subject of the federation |

| 01.01.2012 | Karachay-Cherkessia Nizhny Novgorod Region |

| 01.07.2012 | Khabarovsk region Regions: Astrakhan, Kurgan, Novgorod, Novosibirsk, Tambov |

| 01.01.2015 | Republic of Crimea, Sevastopol |

| 01.07.2015 | Republic of Tatarstan Regions: Belgorod, Rostov, Samara |

| 01.07.2016 | The Republic of Mordovia Regions: Bryansk, Kaliningrad, Kaluga, Lipetsk, Ulyanovsk |

| 01.07.2017 | Republics: Adygea, Altai, Buryatia, Kalmykia Regions: Altai and Primorsky Regions: Amur, Vologda, Magadan, Omsk, Oryol, Tomsk Jewish Autonomous Region |

| Type of subject of the Russian Federation | Name |

| Republic | Adygea, Altai, Buryatia, Kabardino-Balkarian, Kalmykia, Karachay-Cherkess, Karelia, Crimea, Mordovia, North Ossetia - Alania, Tatarstan, Tyva |

| edge | Altai, Primorsky, Khabarovsk |

| Region | Amur, Astrakhan, Belgorod, Bryansk, Vologda, Jewish Autonomous, Kaliningrad, Kaluga, Kostroma, Kurgan, Kursk, Lipetsk, Magadan, Nizhny Novgorod, Novgorod, Novosibirsk, Omsk, Oryol, Rostov, Samara, Tambov, Tomsk, Ulyanovsk |

| Federal city | Sevastopol |

When and how to submit documents to the FSS to the “pilots”?

The employer, having received an application and the original sick leave certificate from his employee, must send them no later than 5 calendar days to his FSS department. The transferred documents are accompanied by an inventory drawn up in the form given in Appendix No. 2 to the FSS Order No. 578 dated November 24, 2017 (clause 3 of the Regulations, approved by Government Decree No. 294 dated April 21, 2011).

How can documents be submitted to the FSS?

You can submit them in paper form by sending them by mail. This can be done by policyholders whose number of individuals in whose favor payments were made over the past year did not exceed 25 people. Other policyholders transfer documents only electronically (clause 4, 4.1 of the Regulations, approved by Government Resolution No. 294 of 04/21/2011).

Electronic transmission is possible in two ways:

- via a web service;

- Through the gateway for receiving documents from electronic signatures.

In both cases, the policyholder must have an electronic signature.

https://www.youtube.com/watch?v=ytadvertiseen-GB

In the first case, documents are transmitted using the policyholder’s information system registered with the Social Insurance Fund. Usually this is a system through which the employer submits its reports electronically, incl. in the FSS.

In the second case, the documents are transferred through the FSS website. At the same time, such an insurer must be registered with the Social Insurance Fund as using electronic document management.

Detailed instructions for sending documents through the FSS document upload gateway can be read here.

The insured person is given the opportunity to choose the form of sick leave. You should find out in advance about the possibility of an accountant creating an electronic document. Often unpleasant situations arise when an employee’s virtual certificate of incapacity for work is not accepted.

In such circumstances, the medical institution resets the electronic version and provides a paper version of the document. It is recommended to clarify in advance whether the policyholder can accept the virtual form of the document. If he is ready for this option, you can do without any difficulties.

Important!

It should be understood that using the FSS personal account and generating sick leave is the right of the policyholder, and not a direct obligation!

When filling out the document, the employee must provide written consent to the processing of personal information and the generation of a certificate of incapacity for work online. As a result, there is no need to confirm the document with the seals of the head physician and the registry.

The sick leave certificate acquires an identification code that allows you to quickly find the form in the FSS LC. After presenting it at your place of work or giving the code number to an accountant over the phone, it will quickly be found in the database.

Document statuses

You can track the fate of the submitted settlement by status. All possible options are in the following table.

Table. Statuses of reports submitted to the FSS

| Status | What does it mean |

| Report uploaded | The reporting file is transferred to the operator’s server through which the sending is carried out |

| Special operator confirmation received | The operator has received the file and is awaiting transfer to the regional office of the FSS |

| Sent | The file has been sent to the Foundation and is awaiting verification |

| Send error | The file has not been transferred to the FSS. If the problem persists after resending, you should contact technical support. |

| Decryption error | The file was not decrypted or the signature was not verified. It is necessary to check the electronic signature certificate, correct violations and resend the calculation. If the problem repeats, you need to contact technical support. |

| Accepted | The calculation has been verified and accepted by the Foundation |

| Not accepted | During the inspection, violations were identified and a protocol was sent to the policyholder. The calculation should be corrected and then resubmitted. |

| FSS found errors | The Foundation detected violations specified in the control protocol. The report was not submitted, it needs to be corrected and sent again |

When the FSS transfers sick leave

For regional organizations participating in the pilot project, there is a special procedure for settlements with the Social Insurance Fund:

- Insurance contributions to the budget are paid in full. The amount of accrued contributions is not reduced by social benefits. insurance.

- Social insurance payments are not reflected in the reporting (4-FSS and calculation of insurance contributions).

- The employer transmits information about sick leave provided by employees to the territorial Social Insurance office.

- The FSS calculates sick leave and pays for it independently. Also, benefits are directly paid at the birth of a child, when registering in the early stages of pregnancy, for caring for a child up to 1.5 years old, and additional payment. leave for treatment.

- The employer pays for the first three days of incapacity at his own expense according to the usual rules (clause 6 of Government Decree No. 294, clause 1, part 1, article 5 255-FZ).

- The organization must also independently pay funeral benefits, pay for additional days off to care for a disabled child, and expenses for preventive measures. These payments also cannot be used to reduce the insurance premiums paid. But their amount is reimbursed by the FSS upon submission of the relevant documents to the territorial body (clauses 10, 11 of Resolution 294) and an application approved by Order of the FSS of the Russian Federation dated November 24, 2017 No. 578.

How to create a calculation

To form 4-FSS you need:

- From the main window of the service, open the “FSS” and click “Create new” :

- In the form that appears, you should select an organization, a period (1 quarter, half a year, 9 months or a year), indicate whether the report is being sent for the first time or is being adjusted:

- If the previous 4-FSS was filled out in the service, then the amounts from it will be transferred to the generated calculation. The values “At the beginning of the reporting period” will be shown taking into account the transferred data. To prevent amounts from the previous period from being transferred, click on the “Do not transfer” .

- After clicking “Create report”, a window for entering information will appear.

- The form contains sections to fill out, marked in the image below. The rules for filling out form 4-FSS are described in detail in a separate article.

- “Title page” – contains information about the organization’s details;

- “Table 1” - it includes payments, taxable and non-taxable, from the beginning of the year and by month of the quarter, as well as the amount of the tariff;

- “Table 1.1” - indicates payments to employees temporarily assigned to work under a contract with another organization or with an individual entrepreneur;

- “Table 2” – indicates debts at the beginning and end of the period, the amount of accrued and paid contributions, the amount of expenses;

- “Table 3” – to be filled in if insurance expenses were incurred;

- “Table 4” – indicates the number of victims in the event of insured events;

- “Table 5” – the results of a special labor assessment and medical examinations are filled in;

- “Section SKE/IF” – is filled out if different types of economic activities are carried out and/or there is partial budget funding.

You can go to the desired section by clicking on the link with its name on the left side of the page. The entered information is saved automatically when moving to a new table. The data is saved by the system to the user's computer, so when working on another PC, the entered data will not be available.

When all the information has been entered into the form, you must click “Save and Close” . The created calculation will be displayed in the list of reports:

If you need to change the data, click on the line with the report.

- When the cursor is placed over the line with the report, the following buttons will appear:

to check the calculation before sending or cancel sending; for generating 4-FSS in PDF format and printing it; to delete a calculation.

Actions of the employer in the FSS account

Finding and processing electronic sick leave certificates in the Social Insurance Fund is not difficult. You need to register in the service and purchase a personal access code for the policyholder to your personal account. This is possible after registering in the Social Insurance system.

Having studied the steps and practiced performing them, the employer will get the hang of it and be able to fully evaluate the comfort and prospects of the service.

- To get started, you should register on the official website of the State Services, where you will be provided with an access password to your personal account - the personal account of the FSS policyholder. Registration is carried out using legal data. person and his details.

- Login to your FSS personal account. To log into the system, you must enter the mobile number used to register on the State Services portal, and a password.

- To work with electronic sick leave in LKFSS, a specially dedicated accountant is required who understands all the intricacies of the service

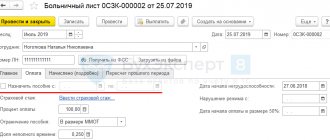

Having gained access to the FSS personal account, the policyholder must notify subordinates about the availability of the service. In order to use it, you need to enter personal data into the electronic sick leave sheet at your medical institution, if such a possibility exists. After receiving a personal document number (personal sick leave code) from the employee, it is transferred to the accountant. Followed by:

- Log in to your personal account and find a sick leave certificate by number.

- Find out from the electronic document the data on the duration of the sick leave for subsequent calculation.

- Fill out information on the electronic sick leave sheet about the organization, the employee’s length of service and the average amount of his income.

- Check for errors.

- Send the completed document from your office to the FSS office using a special key.

Disability benefits are paid directly from the Social Insurance Fund or through the policyholder. In the case of an employer, an accountant makes calculations and accrues money along with the next salary. Next, he performs a reimbursement operation from the Social Insurance Fund. (by submitting an electronic application or visiting a FSS specialist).

Some entities fall under the program that makes payments directly. To pay in this case, the policyholder fills out a request in the FSS LC on behalf of the employee who received the certificate of incapacity for work, and then sends it to the fund.

Delivery Status

To control file delivery, you need to:

- Go to the main page of the service and select the “FSS” , then click “All reports” .

- In the list of reports that appears, select the desired line.

- The page that opens will display file status information, as well as buttons for saving and printing documents.

Procedure for submitting information

The organization, having received the entire package of documents for assigning benefits from the employee, is obliged to transfer information about them to the territorial body of the Social Insurance Fund. Five calendar days are allotted for this.

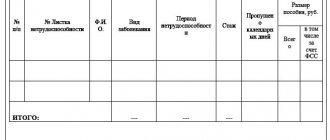

To provide information, a register of sick leave for FSS reimbursement has been developed (sample documents for different types of benefits are presented in the appendices to FSS Order No. 579 dated November 24, 2017).

Next, the territorial body of the Social Insurance Fund checks the sick leave certificate, as well as other documents provided, and makes a decision on the assignment and payment of benefits. If the number of employees of the company does not exceed 25 people, then the package of documents can be provided on paper. If the number is higher, then provision is possible only in electronic form.

How to check your certificate of incapacity for work in Personal Account

The insured person can check the status of the electronic certificate of incapacity for work. To do this, you need to be registered with the State Services. By logging into the FSS Personal Account, you can get acquainted with all the information about:

- Opening, closing or extending sick leave.

- Amount of charges.

- Duration of illness.

- Correct documentation by the employer.

Special options in the user account allow you to receive notifications about changes in sick leave status by email.

You can check the payment of sick leave from the Social Insurance Fund in the “Benefits and Payments” section. This tab contains information about all accruals ever paid.

Finding the right document is greatly simplified by filters based on the following parameters:

- ELN number - certificate of incapacity for work.

- Date of opening and closing of the document.

- Sick leave status.

This will greatly facilitate and speed up the process of finding the required electronic sick leave in your personal account.

You can find out the status of calculations for accruals after entering your registration number or SNILS number in a special form. Next, press the “Search” button.

Data is updated 2 times a week.

Sequence of work with the gateway

https://www.youtube.com/watch?v=ytpressen-GB

The procedure for working with the gateway is simple and accessible. Before starting to send electronic documents, the organization takes a number of sequential actions:

- Registration on the FSS website.

- Applying to the FSS body for an assignment of expanded rights to use the portal and obtaining such rights.

- Download the necessary software on the FSS website.

- Installation of the Foundation certification authority certificate.

- Installing a certificate from the organization's certification authority.

- Preparation of calculations in an accounting program or on the Social Insurance Fund website.

- Using digital signature to sign a file.

- Sending a report through the gateway.

- Receipt of receipts and FSS protocols until the successful acceptance of the report by the Fund. Correcting errors - if necessary.

Let us remind you! The deadline for submitting electronic reports is until the 25th day of the month following the reporting quarter, and on paper – similarly until the 20th day.

Checking and sending

To check and send the file you must:

- Select button "Send". The button is highlighted when the cursor is placed on the line with the report:

- Next you need to check the electronic signature certificate. If you need another certificate, click on the link "Select certificate":

- Then you should select "Check report". A window with the test results will appear:

- if there are no errors, you need to click "Proceed to Send"and send the calculation to the Fund branch:

- If the system detects errors, click “Edit report” , correct the data and save.