Why was the payment lost?

The main reasons for the “loss” of money transferred to the budget:

- The taxpayer incorrectly indicated one of the details in the payment order.

- A bank employee made a mistake when processing a payment order.

Below are the details of the payment order, errors in which will lead to the transferred money being “stuck” in the treasury as unidentified receipts:

- recipient's name;

- TIN and checkpoint inspection;

- UFC account, bank name;

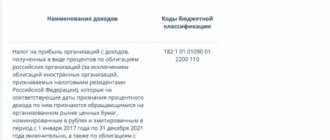

- KBK;

- OKTMO code.

When can you clarify erroneously specified details, and when not?

If there are some errors in the payment order, the transferred money will reach the Federal Tax Service and extra-budgetary funds, but they will not be able to post it to the organization’s settlement card with the budget. Details will need to be clarified. You can check the following information:

- KBK;

- TIN and KPP of the recipient or sender;

- OKTMO;

- purpose of payment;

- taxpayer status;

- basis of payment;

- taxable period;

- number or date of the basis document.

Things are completely different if the taxpayer incorrectly indicated the Federal Treasury account number or the name of the recipient's bank. Errors in these details lead to non-recognition of the obligation to pay tax as fulfilled, since the money does not go to the required account (Clause 4 of Article 45 of the Tax Code of the Russian Federation). The taxpayer’s action algorithm in this case will be as follows:

- transfer the payment again, but with the correct details;

- pay accrued penalties;

- submit an application to the tax service for a refund (or credit) of funds paid using incorrect details.

The form of the Social Insurance Fund's decision to clarify payments has been approved

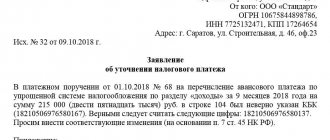

Now let's look at the second option. You have checked all the details on the receipt and found an error. It doesn’t matter whether you or the girl in the bank made this mistake, the money went to the wrong place. There is no point in going to the bank to sort things out and swearing at everyone there. You just need to write a statement to our regulatory authority that a small error has occurred. Let's take a closer look at how to make such a statement.

I prepare applications for my tax office. You will write all your details accordingly. Also indicate yours: name of the organization, full name, name of the inspection, last name of the head of the inspection (you can search on the Internet), your details and dates from receipts. The pension fund and Social Insurance Fund will receive similar applications. Only in the Pension Fund of Russia and the Social Insurance Fund do not write the line: based on clause 7 of Art. 45 of the Tax Code of the Russian Federation, I ask you to make the appropriate changes. Write everything else by analogy.

If the overpayment was due to pension, medical or compulsory social insurance, then the application must be sent to the tax office.

A separate application must be completed for each type of contribution.

The application form may be as follows:

- paper - by personal delivery, mail

- electronic – through TKS, taxpayer’s personal account

If an overpayment of insurance premiums for accidents and injuries at work is established, then the application must be sent to the Social Insurance Fund. For return, form 23-FSS , for offset - 22-FSS .

The Social Insurance Fund has the right to unilaterally offset the overpayment against current debt or future payments.

Since 2021, the administration of contributions is carried out by the Federal Tax Service. To return amounts overpaid in 2021, you must contact the Inspectorate at the place of registration of the organization or registration of the individual entrepreneur. Until 2021, control over the calculation and payment of contributions to pension, health and social insurance was carried out by the Pension Fund and the Social Insurance Fund.

Refunds of contributions overpaid before 2021 are carried out by extra-budgetary funds. The exception is for contributions transferred in excess of accrued contributions to the compulsory pension insurance system. Before transferring the balances to the Federal Tax Service, the Pension Fund distributed the amounts to the personal accounts of the insured persons. Refunds of overpayments of pension insurance contributions are not made.

| Types of contributions | Until 2021 | From January 2021 |

| OPS | Pension Fund | Inspectorate of the Federal Tax Service |

| Compulsory medical insurance | Pension Fund | Inspectorate of the Federal Tax Service |

| FSS | FSS | Inspectorate of the Federal Tax Service |

| FSS for injury insurance | FSS | FSS |

Contributions for insurance from NS and PZ continue to be regulated by the FSS. Receipt of payments, offset of overpayments against arrears, return of overpayments and other settlement operations in 2021 are still carried out by the fund.

What should a taxpayer do if a payment is lost?

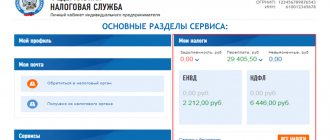

First of all, you need to request a reconciliation of calculations with the budget, for example, in the form of a Certificate of Payment Status. The results of the reconciliation can also be documented in an act signed by the taxpayer and an authorized tax official. Receiving a statement of reconciliation of calculations will allow the taxpayer to quickly respond to the emergence of disagreements with the Federal Tax Service.

Then you need to send a letter to the tax office as soon as possible about the search for payment, a sample of which is given below. Documents must be attached to the letter that confirm that the tax payment has been made. Such documents are:

- payment order for tax payment,

- statement from the bank.

If the payment was issued in paper form, you should attach a copy bearing the bank’s mark (stamp of the institution and signature of the operator who carried out the operation). If the payment order was issued in electronic form, a printout of it and a notification from the bank about acceptance of the payment for execution must be attached to the letter to the Federal Tax Service (the date of acceptance must be indicated).

Payments to the Social Insurance Fund from January 1, 2021 in 1C

You can send a clarification letter in one of several ways:

- Bring it in person to the territorial office of the authority;

- Send with a courier service employee;

- Via the Internet;

- By post with acknowledgment of delivery.

If sending is carried out via the Internet, the company’s digital signature must be affixed to the clarification letter about the purpose of payment.

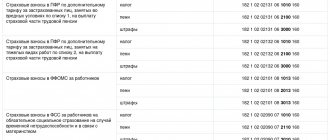

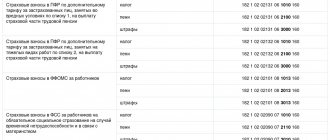

You can clarify any error in the details of the payment order, if it did not result in non-transfer of insurance contributions to the Social Insurance Fund budget to the appropriate account of the Federal Treasury (). That is, you can clarify:

- reporting (calculation) period.

- policyholder status;

- basis, type or attribution of payment;

To clarify, you need to submit a letter to the Social Insurance Fund to clarify the payment, a sample of which will be given below (). A copy of the payment order confirming payment of contributions must be attached to the letter. If necessary, the FSS branch, before making payment clarification, will offer to undergo a reconciliation of calculations ().

After making a decision on clarification, the FSS will notify the policyholder about it within 5 working days ().

To the head of Branch No. 15 of the State Administration of the MRO of the FSS of the Russian Federation, V.I. Kravtsova. —————————— (position of the head (deputy head) of the territorial body of the Social Insurance Fund, full name) 1 Application N - to clarify the basis, type and affiliation of the payment, reporting (settlement) period or status of the insurance payer contributions Municipal budgetary educational institution "Secondary school No. 39" Payer of insurance premiums ———————————————- (full name of the organization (separate unit); full name

individual entrepreneur, an individual not recognized as an individual entrepreneur) —————————————————————————— ¦Registration number in the body ¦7729011234 ¦ ¦control over the payment of insurance premiums ¦ ¦ +————————————-+————————————+ ¦TIN ¦7722645911 ¦ +————————————-+ ————————————+ ¦Gearbox (if equipped) ¦772201001 ¦ +————————————-+————————————+ ¦The location address of the organization is ¦107112, Moscow, st. Tchaikovsky,¦ ¦ (separate division)/address ¦d. 30 ¦ ¦permanent place of residence ¦ ¦ ¦individual entrepreneur, ¦ ¦ ¦individual not recognized ¦ ¦ ¦individual entrepreneur ¦ ¦ —————————————+————————— ——— In accordance with Part.

The law makes absolutely no requirements for both the informational part of the letter and its design, so you can write it on a simple blank sheet or on the organization’s letterhead, and both printed and handwritten versions are acceptable.

The only rule that must be strictly followed: the letter must be signed by the director of the company or a person authorized to endorse such documentation.

It is not necessary to stamp the message, since since 2021 legal entities are legally exempt from the need to do this (provided that this requirement is not specified in the company’s internal regulations).

The letter must be written in at least four copies :

- you should keep one for yourself,

- transfer the second to the counterparty,

- the third to the payer's bank,

- the fourth to the recipient's bank.

All copies must be identical and properly certified.

How to write a letter to the Federal Tax Service

The letter to the tax office about the search for payment does not have a form established by law. Most often it is compiled in any form on letterhead or on a regular A4 sheet. The letter must contain standard details of business documentation.

The structure of the document is as follows:

- "A cap". Here they indicate the name of the tax office, its address, and in the “header” of the document you should write down the name of the organization that sent the letter, its legal address, INN, KPP, OGRN.

- Main part. Here it is necessary to explain in detail the essence of the problem: when exactly the payment order was submitted for execution and in what form. You must also indicate the payment amount and details of the payment order to which the tax was transferred. After this, you need to politely ask to find the missing payment.

- The final part indicates which documents are attached to the letter as confirmation.

The document must be signed by the head of the sending organization. You can also put a seal of a legal entity.

Features of providing a letter

The legislation does not officially regulate exactly how the letter should be submitted to the Federal Tax Service. Taxpayers have the right to provide a document in the following ways:

- bring it in person to the tax office;

- transfer through a representative, having previously issued a power of attorney;

- send by mail in a valuable letter with a list of the contents;

- send via telecommunication channels, certifying the document with an electronic digital signature.

It is best to provide the letter with the attached documents directly to the tax authority, then it will immediately be marked as accepted by the inspectorate.

Tax office employees must review the letter within 30 days and seek payment. If necessary, settlements with the taxpayer will be reconciled. If the tax service makes a positive decision, the payment will be updated on the date of actual payment of the tax, and the accrued penalties will be canceled.

If the Federal Tax Service, after receiving all the necessary documents, recognizes the obligation to pay tax as unfulfilled, the taxpayer can try to appeal this decision first to a higher tax office, and then to an arbitration court.

New details for paying insurance premiums 2021

Tax inspectors must make a decision to clarify the payment within 10 working days. This period begins to count from the date when the inspectors received the application. They must notify you of the decision made.

The inspectorate is obliged to notify the payer of the decision made within five working days (clause 7 of article 45, clause 6 of article 6.1 of the Tax Code). The inspectorate will send a notification of the decision made via telecommunication channels, through a personal account or by mail.

Current as of: January 23, 2021

If you have overpaid any tax to the budget, then you can return the amount of the overpayment or offset it against future payments (clause 5, clause 1, article 21 of the Tax Code of the Russian Federation). In the second case, you need to submit an application to your Federal Tax Service to offset the amount of overpaid tax. It can be submitted to the tax office within 3 years from the day the overpayment was made (clause 2, 7, article 78 of the Tax Code of the Russian Federation).

Overpayment of taxes can be offset against future tax payments, as well as towards repayment of arrears, penalties or fines. But subject to the rules of tax offset (Clause 1, Article 78 of the Tax Code of the Russian Federation).

Let us note that a separate offset procedure has been established for offset of excessively withheld or paid personal income tax from the income of employees.

By the way, if the tax authorities themselves discover an overpayment, they will count it against the arrears of another tax (of the same “level”), or penalties or fines for such a tax themselves (clause 5 of Article 78 of the Tax Code of the Russian Federation).

Drawing up an application for tax offset from one KBK to another is an inevitable part of the procedure for correcting an error in the work of an accountant when transferring a tax or other payment to the state budget. The abbreviation KBK hides the phrase “budget classification code.” Briefly revealing this concept, it can be explained as follows: KBK is a multi-valued, four-step sequence of numbers that indicates all the information about the payment made, the path it takes, including information about who paid the funds and where, as well as for what for the purpose they will be spent. For example, if we are talking about taxes under the simplified tax system, then when paying them to the budget, the taxpayer indicates a certain BCC, thus indirectly “covering” the costs that the state makes for public sector workers: medicine, education, etc. (exactly the same with other fees - they all have a strictly intended purpose). More broadly speaking, the BCC allows you to track the collection of taxes in one direction or another, make the necessary monitoring and, taking them into account, form and plan future budget expenditures for one or another expense items.