Accounting press and publications

“Audit and Taxation”, 2005, N 5

VAT AND EXCHANGE DIFFERENCES

According to paragraph 3 of Art. 153 of the Tax Code of the Russian Federation, when determining the tax base, the taxpayer’s revenue (expenses) in foreign currency is recalculated into rubles at the rate of the Central Bank of the Russian Federation, respectively, on the date of sale of goods (work, services) or on the date of actual expenditure. The date of sale of goods (work, services) is determined depending on the accounting policy adopted by the taxpayer for tax purposes in accordance with Art. 167 Tax Code of the Russian Federation.

For taxpayers who determine the date of occurrence of the obligation to pay tax upon shipment, the tax base for the sale of goods (work, services) for foreign currency is calculated by recalculating the cost of shipped goods (work, services) into rubles at the Bank of Russia exchange rate on the date of shipment.

For taxpayers who determine the date of occurrence of the obligation to pay tax as funds are received, revenue received in foreign currency is recalculated at the Bank of Russia exchange rate on the date of receipt.

Thus, the basis for the tax base for VAT is the ruble expression of revenue or expenses in foreign currency, obtained by recalculating this value at the Central Bank exchange rate, respectively, on the date of sale of goods (work, services) (hereinafter referred to as sales) or on the date of actual expenses. In this case, the specified date will differ from the date of recognition in accounting, since the date of sale of goods (work, services) is determined depending on the accounting policy adopted by the taxpayer for VAT purposes.

When the accounting policy establishes the calculation of tax as funds are received, the tax base includes revenue recalculated at the rate on the date of payment for shipped goods (work, services), and the rate is used:

- on the date of shipment, if the buyer has made an advance payment towards future deliveries;

- on the date of payment, if the receipt of funds occurs after the sale.

When determining the tax liability upon shipment, the tax base is formed on the basis of accounting data, since to obtain the ruble equivalent of the cost of shipped goods (works, services), the exchange rate on the date of shipment is used, regardless of the receipt of funds.

Advance payments for upcoming deliveries of goods, performance of work or provision of services, received in foreign currency, increase the tax base by the amount of the ruble equivalent, recalculated at the rate of the Central Bank of the Russian Federation on the date of its receipt, and subsequently the amount of tax in the same amount is accepted for deduction in implementation period.

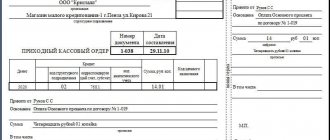

Tax base calculation

to pay tax on import supplies

Let’s assume that goods have been imported, the cost of which according to the contract is $10,000. Ownership of the goods passes at the time of registration of the cargo customs declaration (CCD). The US dollar exchange rate on the date of registration of the customs declaration is 30.00 rubles. per US dollar, on the date of payment of customs duties - 31.00 rubles. per US dollar.

When customs clearance of goods the following are charged:

— import customs duty in the amount of 10% of the customs value of the goods;

— customs duties in rubles (account 76-1) in the amount of 0.1% of the customs value of the goods;

— fee in foreign currency (account 76-2) in the amount of 0.05% of the customs value of the goods;

— value added tax.

———————————T——————————————T———————————————T——————T —————————————————T———————————¬ | Date | Operation |Correspondence| Amount| Exchange rate | Recalculation | | | | accounts | in | or difference | to ruble| | | +———————T———————+currency| in courses (rub.) |equivalent,| | | | Debit | Credit|(USD| | settlement | | | | | | USA) | | difference | +——————————+——————————————+———————+———————+——————+ —————T———————————+———————————+ |11.08 |Paid | 68 | 51 | x |30.00|Rate of the Central Bank of the Russian Federation | 30,000 | | | customs | | | | |on date | | | |duty | | | | |customs| | | |(10,000 x | | | | |registration | | | |30.00 x 10%) | | | | | | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |11.08 |Paid | 76—2 | 52 | 5|31.00|Rate of the Central Bank of the Russian Federation | 155 | | |additional| | | | |on date | | | | customs | | | | |payment | | | |collection (10,000 x| | | | |collection | | | |0.05%) | | | | | | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |11.08 |Paid | 76—1 | 51 | x |30.00|Rate of the Central Bank of the Russian Federation | 300 | | | customs | | | | |on date | | | |collection (10,000 x | | | | |customs | | | |30.00 x 0.1%) | | | | | registration | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |Tax base for calculating VAT (RUB 330,000) includes: | |—customs value of goods, calculated from the contract value in foreign currency | |at the exchange rate on the date of customs clearance: 10,000 US dollars x 30.00 rubles. = | |300,000 rub.; | |—customs duty in the amount of 30,000 rubles. | |The tax amount calculated using a rate of 18% will be 59,400 rubles. | +——————————T——————————————T———————T———————T——————T —————T———————————T———————————+ |11.08 |VAT paid | 68 | 51 | x |30.00|Rate of the Central Bank of the Russian Federation | 59,400 | | | customs | | | | |on date | | | |organ | | | | |customs| | | | | | | | | registration | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |11.08 |Reflected | 41 | 60 |10,000|30.00|Rate of the Central Bank of the Russian Federation | 300,000 | | |transfer of rights | | | | |on date | | | |property | | | | |customs| | | |on imported | | | | | registration | | | |product | | | | | | | | |(10,000 x | | | | | | | | |30.00) | | | | | | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |11.08 |Customs | 41 | 68 | x | x | x | 30,000 | | |duty | | | | | | | | |included in | | | | | | | | |purchased | | | | | | | | |cost | | | | | | | | |imported | | | | | | | | |product | | | | | | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |11.08 |Customs | 41 | 76—1 | x | x | x | 300 | | |fee in rubles | | | | | | | | |included in | | | | | | | | |purchased | | | | | | | | |cost | | | | | | | | |imported | | | | | | | | |product | | | | | | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |11.08 |Customs | 41 | 76—2 | 5|30.00|Rate of the Central Bank of the Russian Federation | 150 | | | fee in foreign currency | | | | |on date | | | |included in | | | | |customs| | | |purchased | | | | | registration | | | |cost | | | | | | | | |imported | | | | | | | | |product | | | | | | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |11.08 |VAT reflected, | 19 | 68 | | | | 59,400 | | |paid | | | | | | | | | customs | | | | | | | | |organ | | | | | | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |11.08 |Accepted to | 68 | 19 | | | | 59,400 | | | VAT deduction, | | | | | | | | |paid | | | | | | | | | customs | | | | | | | | |organ | | | | | | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |31.08 |Coursework | 91—2 | 60 |10,000|30.50|(30.50 - | 5,000 | | |difference at | | | | |30.00) | | | |revaluation | | | | | | | | | obligations | | | | | | | | |before | | | | | | | | |supplier | | | | | | | | |(305,000 - | | | | | | | | |300,000) | | | | | | | +——————————+——————————————+———————+———————+——————+ —————+———————————+———————————+ |01.09 |Produced | 60 | 52 |10,000|30.50|Rate of the Central Bank of the Russian Federation | 305,000 | | |payment | | | | |on date | | | | to the supplier for | | | | |payment | | | |imported | | | | | | | | |product | | | | | | | L——————————+——————————————+———————+———————+——————+ —————+———————————+————————————

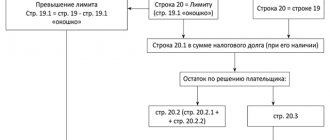

Determining the amount of tax liability

for VAT when reflecting transactions taxed at a rate of 0%

When selling, a tax rate of 0% is applied with documentary evidence of the validity of its application in relation to:

— exported goods, including to the territory of the CIS member states, except for the Republic of Belarus (with the exception of oil, including gas condensate, natural gas, supplied to the territory of the CIS);

— works (services) directly related to their production and sale;

— works (services) related to the transit transportation (transportation) of goods through the customs territory of the Russian Federation;

— transported supplies;

— a number of works (services) given in paragraphs. 4 - 7 p. 1 tbsp. 164 Tax Code of the Russian Federation.

However, the tax base for calculating value added tax includes the amounts of advance payments received towards the future supply of the goods listed above, the performance of work, and the provision of services. An exception to this procedure is the advance in cash of work in outer space and upcoming deliveries of goods, the production of which exceeds six months (according to the List approved by Decree of the Government of the Russian Federation of August 21, 2001 N 602).

Accrued tax amounts are shown in section. II declarations for value added tax at a tax rate of 0%, approved by Order of the Ministry of Taxes of Russia dated November 20, 2003 N BG-3-03/644, on lines 290 - 400 and are subject to payment in the period when advances are received for which the application of zero is expected tax rates.

Please note that the point of view previously expressed by the tax authorities on the issue of including all funds received for export deliveries, including after shipment of goods, should be recognized as advance payments for the purpose of calculating VAT in the absence of documents confirming the application of the 0% rate, was resolved in judicial procedure. And already in the Letter dated September 24, 2003 N OS-6-03/994, the Ministry of Taxes and Taxes of Russia proposes to use in its work the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 19, 2003 N 12359/02.

This document once again confirms that when a taxpayer receives advance or other payments in foreign currency on account of upcoming supplies of goods (performance of work, provision of services), the specified amount is recalculated into rubles at the Bank of Russia exchange rate on the date of receipt of advance or other payments. In this case, the amounts of tax accrued by the taxpayer from the amount of advance and other payments received on account of future deliveries of goods (performance of work, provision of services) subject to taxation are subject to deduction upon subsequent shipment of goods (performance of work, provision of services).

Taking into account the conclusions of the court decision, the funds received by the taxpayer for goods (supplies) after the date of registration by the regional customs authorities of a cargo customs declaration for the export of goods (supplies) in the export mode (movement of supplies), as well as for work performed (services rendered), named in paragraphs. 2 and 3 clauses 1 art. 164 of the Tax Code of the Russian Federation, in the presence of documents confirming the actual performance of the specified works (services), are not included in the tax base for the tax until the tax base is determined, provided for in paragraph 9 of Art. 167 Tax Code of the Russian Federation.

At the same time, funds received by the taxpayer for goods (supplies) after the date of registration by regional customs authorities of a cargo customs declaration for the export of goods (supplies) in the export mode (movement of supplies), as well as for work performed (services rendered), named in paragraphs. 2 and 3 clauses 1 art. 164 of the Tax Code of the Russian Federation, if there are documents confirming the actual performance of the specified work (services), they are not included in the tax base for value added tax only in the amount of funds corresponding to the share of products shipped, work performed (services rendered).

As stated above, such amounts of tax can be claimed for deduction only in the tax period when the validity of applying such a rate is documented, which does not always coincide with the period in which the goods are shipped.

After 180 days, counting from the date of registration of the cargo customs declaration by the regional customs authorities, the period established for the provision of documents, the zero tax rate is considered unconfirmed.

To fulfill the tax obligation arising in such a situation, the tax is calculated on the cost of sold goods (works, services) named above at rates of 10 or 18% and paid to the budget at the expense of one’s own funds. If the full package of the above documents is not collected on the 181st day, counting from the date of placing the goods under the customs export regime, the moment of determining the tax base for VAT and, accordingly, the day of sale of exported goods are determined as the day of shipment of the goods.

This rule for determining the tax base applies to all taxpayers, regardless of what accounting policy for VAT purposes is adopted by the organization.

If it was possible to collect the required package of documents, the tax base is calculated in ruble terms of the contract value at the rate in effect on the last day of the month in which the full package of documents confirming the legality of applying the VAT rate of 0% was collected. The basis is the provision of clause 9 of Art. 167 of the Tax Code of the Russian Federation, which determines the moment for calculating the tax base for VAT when selling goods for export.

As of the specified date, the taxpayer’s revenue (tax base) is formed for transactions taxed at a tax rate of 0%, which is shown on line 010 in section. I Declaration at a tax rate of 0%, approved by Order of the Ministry of Taxes of Russia dated November 20, 2003 N BG-3-03/644.

Accordingly, the last day of the month in which the full package of documents provided for in Art. 165 of the Tax Code of the Russian Federation, is for the taxpayer the date of sale of goods (work, services) for the purposes of applying the 0% tax rate.

According to paragraph 3 of Art. 153 of the Tax Code of the Russian Federation, when determining the tax base, the taxpayer’s revenue (expenses) in foreign currency is recalculated into rubles at the rate of the Central Bank of the Russian Federation, respectively, on the date of sale of goods (work, services) or on the date of actual expenditure.

Let us note once again that the sales date for exported goods (works, services) is the last day of the month in which the full package of documents provided for in Art. 165 Tax Code of the Russian Federation.

A declaration for VAT amounts at an unconfirmed zero rate, subject to payment to the budget, is submitted for the period in which goods (work, services) are shipped, which entails overdue tax payments, starting from the 20th day of the month following the given date. period until the day of actual payment of the tax on which the penalty is calculated. This procedure is regulated by the Tax Code of the Russian Federation.

Upon receipt of the documents specified in Art. 165 of the Tax Code of the Russian Federation, and submitting them to the tax authorities, the paid tax amounts are subject to refund on the basis of the provided declaration at a zero rate, where previously paid tax amounts are taken into account on line 410 section. I.

The corresponding lines of Sec. I and II are filled out in the tax return for value added tax at a tax rate of 0%, the provision of which is provided for:

— for the period in which advance payments were received;

- for the period in which the full package of documents specified in Art. 165 Tax Code of the Russian Federation;

— for the period in which goods (work, services) were shipped, in respect of which the application of a zero rate is unjustified due to the lack of documents after 180 days.

Example. On July 31, 2004, the organization received an advance payment from a foreign buyer for future delivery in the amount of 50% of the cost of goods under the contract, which is $1,180. The goods were shipped for export on August 1, 2004. The remainder of the payment was received in the organization’s transit currency account on August 5, 2004.

The official US dollar exchange rate was:

— July 31, 2004 — 31.00 rub/USD;

— August 1, 2004 — 32.00 rub/USD;

— August 5, 2004 — 31.50 rubles/USD;

— January 28, 2005 — 32.00 rubles/USD.

———————————T—————————————————T———————————————T———— ——T———————————————————T———————————¬ | Date | Operation |Correspondence| Amount| Exchange rate | Recalculation | | | | accounts | in | or difference | to ruble| | | +———————T———————+currency| in courses (rub.) |equivalent,| | | | Debit | Credit|(USD| | settlement | | | | | | USA) | | difference | +——————————+—————————————————+———————+———————+———— ——+—————T—————————————+——————————+ |07.31.2004|Received | 52—2 | 62—2 | 1,180|31.00|Rate of the Central Bank of the Russian Federation | 36,580 | | |prepayment on account| | | | | | | | |future | | | | | | | | |export | | | | | | | | |supplies | | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |31.07.2004|VAT charged on | 76—2 | 68 | |31.00|Rate of the Central Bank of the Russian Federation to| 5,580 | | |advance payment| | | | |date | | | |with a budget for | | | | |receipt | | | |unconfirmed| | | | |advance | | | |export | | | | | | | | |(36,580 x 18 : | | | | | | | | | |118) | | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |01.08.2004|Produced | 62—1 | 90 | 2,360|32.00|Rate of the Central Bank of the Russian Federation to| 75 520 | | |implementation | | | | |transition date| | | |goods on | | | | |rights | | | |export | | | | |property| | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |01.08.2004|Exchange rate difference | 91—2 | 62—2 | | |(32.00 - | 1,180 | | |from revaluation | | | | |31.00) | | | |advance (37,760 - | | | | | | | | |36,580) | | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |08/01/2004|Amount credited | 62—2 | 62—1 | 1,180|32.00|Rate of the Central Bank of the Russian Federation to| 37,760 | | |advance on account | | | | | test date | | | | settlements with | | | | | | | | |buyer | | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |05.08.2004|Produced | 52 | 62—1 | 1,180|31.50|Rate of the Central Bank of the Russian Federation to| 37 170 | | |final | | | | |date | | | |calculation | | | | |receipts | | | | | | | | |monetary | | | | | | | | | means | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |05.08.2004|Exchange rate difference | 91—2 | 62—1 | | |(31.50 - | 590 | | |from revaluation | | | | |32.00) | | | |requirements for | | | | | | | | |buyer | | | | | | | | |(37,170 - 37,760)| | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |20.08.2004|Paid to the budget| 68 | 51 | | | x | 5,580 | | |VAT amount, | | | | | | | | | calculated from | | | | | | | | |advances | | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |Situation 1. In September, the full package of documents required for | |confirmation of the application of the 0% rate on export sales. | +——————————T—————————————————T———————T———————T———— ——T—————T—————————————T——————————+ |30.09.2004|VAT amount to | 68 | 76—2 | | | x | 5,580 | | | standings, | | | | | | | | | calculated from | | | | | | | | |advance | | | | | | | | |payments | | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |12/31/2004|By decision | 68—1 | 68 | | | | 5,580 | | |tax authorities| | | | | | | | |amount credited | | | | | | | | |VAT subject to | | | | | | | | |reimbursement from | | | | | | | | | budget into account | | | | | | | | |current tax| | | | | | | | | obligations | | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |Situation 2. Within 180 days from the date of release of goods by customs authorities in | |export mode, the complete package of documents required for confirmation has not been collected | |applying a 0% rate on export sales. The tax base is calculated from | |contract value, which determines the amount of revenue from sales, at the rate of the Central Bank of the Russian Federation | |on the date of shipment at a rate of 18%, which amounts to a tax amount of 13,593.6 rubles | |($2360 x 18% x 32.00). | |In addition, a penalty amount is charged on overdue debt in the amount of | |8013.6 rub. (13,593.6 - 5580) for the period from September 21 to January 28 (129 days), for | |for calculating penalties, the refinancing rate is 13%. | +——————————T—————————————————T———————T———————T———— ——T—————T—————————————T——————————+ |28.01.2005|VAT accrued to | 76—2 | 68 | x |32.00|Rate of the Central Bank of the Russian Federation on| 13,593.6 | | |payment to the budget | | | | |shipment date| | | |at a rate of 18% of | | | | | | | | | contract | | | | | | | | |cost | | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |28.01.2005|VAT credited, | 68 | 76—2 | | | x | 5,580 | | | counted with | | | | | | | | |advance | | | | | | | | |payments | | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |28.01.2005|VAT paid in | 68 | 51 | | | x | 8,013.6 | | | budget for | | | | | | | | |base | | | | | | | | |updated | | | | | | | | | declarations for | | | | | | | | |August | | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |28.01.2005|Paid penalty for | 99 | 51 | | | | 444.51| | |late payment| | | | | | | +——————————+—————————————————+———————+———————+———— ——+—————+—————————————+——————————+ |02/01/2005|As of the filing date | 68 | 76—2 | | | | 8,013.6 | | |full set| | | | | | | | | documents for | | | | | | | | |confirmation | | | | | | | | |export and | | | | | | | | |zero rate | | | | | | | | | tax amount | | | | | | | | |refundable| | | | | | | L——————————+—————————————————+———————+———————+———— ——+—————+—————————————+————————————

As reported by the Department of Accounting and Reporting Methodology in Letter No. 16-00-14/177 dated May 27, 2003, value added tax when exporting goods is reflected in accounting is carried out as follows.

For the amount of VAT calculated in accordance with clause 9 of Art. 165 of the Tax Code of the Russian Federation, after 180 days, entries are made on the debit of account 68 “Settlements with the budget”, sub-account “VAT for reimbursement”, in correspondence with the credit of account 68 “Settlements with the budget”, sub-account “VAT for accrual”, and accordingly on the debit account 68 “Settlements with the budget”, sub-account “VAT accrued”, with a credit to account 51 “Settlement accounts” when transferring it to the budget.

Amounts of VAT subject to return (reimbursement) to the organization in accordance with Art. 176 of the Tax Code of the Russian Federation, are reflected in accounting as the debit of account 51 “Settlements” (68 “Settlements with the budget”) with the credit of account 68 “Settlements with the budget”, subaccount “VAT for reimbursement”.

If the taxpayer does not confirm the validity of applying a tax rate of 0%, the VAT amounts reflected in the debit of account 68 “Settlements with the budget”, subaccount “VAT for reimbursement”, are written off to the debit of account 91 “Other income and expenses”.

The purchase of goods (works, services) entails the emergence of tax obligations to pay value added tax, which is due to the participation of a foreign organization in transactions, and the Russian organization acts as a tax agent:

— if a foreign person supplies goods (work, services) on the territory of the Russian Federation and is not registered with the tax authorities (clause 1 of Article 161 of the Tax Code of the Russian Federation);

- if the territory of the Russian Federation is a place:

- consumption of consulting, legal, accounting, engineering, advertising services, information processing services, as well as research and development work, as well as the use of an agent to obtain such services;

— provision of personnel;

- transfer of ownership or assignment of patents, licenses, trademarks, copyrights or other similar rights;

— leasing of movable property, with the exception of land vehicles;

— maintenance of aircraft, sea vessels and inland navigation vessels and other works (services) specified in Art. 148 Tax Code of the Russian Federation.

To be included in the tax base, the tax agent determines the currency value of goods (work, services) sold by a foreign person in the amount of expenses converted into rubles at the rate of the Central Bank of the Russian Federation on the date of sale of goods (work, services), that is, on the date of transfer of funds to the tax authorities. agent in payment for goods (work, services). In this case, the expenses of the tax agent are recognized as the actual making of payments, including advance payments, regardless of the adopted accounting policy for tax purposes.

The tax base specified in paragraph 1 of Art. 161 of the Tax Code of the Russian Federation, when selling goods (work, services) for foreign currency, determined by the tax agent, is calculated by recalculating the tax agent’s expenses in foreign currency into rubles at the rate of the Central Bank of the Russian Federation on the date of sale of goods (work, services), that is, on the date transfer of funds by a tax agent in payment for goods (work, services) to a foreign person who is not registered with the tax authorities as a taxpayer.

The tax agent recalculates the tax base when selling goods (work, services) for foreign currency into rubles at the rate of the Central Bank of the Russian Federation on the date of actual expenses (including if these expenses are advance or other payments), regardless of the adopted accounting policy for tax purposes.

The tax agent issues an invoice for the full cost of the purchased goods (work, services), taking into account the tax, the invoice is registered in the sales book, and the tax is included in the declaration in the tax period in which it was withheld.

The tax agent’s right to apply a tax deduction in the amount of tax transferred to the budget, withheld from amounts paid to the seller, arises in the period when the purchased goods (work performed, services rendered) are capitalized (recorded in accounting), paid and there is an invoice issued accordingly. In addition, the need for costs to arise for these goods (works, services) must be determined by the implementation of transactions subject to VAT.

When confirming the legality of the deduction, the invoice is registered in the purchase book in the tax period in which the tax is transferred to the budget.

Failure to comply with the conditions for presenting tax amounts for deduction determines their inclusion in the cost of purchased goods (work, services), including fixed assets and intangible assets.

Specialists

CJSC "BKR-Intercom-Audit"

Signed for seal

27.04.2005

—————————————————————————————————————————————————————————————————— ———————————————————— ——

Exchange rate differences and interest on loans

Liabilities expressed in foreign currency To reduce the risk of depreciation of loan funds, banks (or other credit institutions) often express their amount in foreign currency. This is permitted by law (clause 2 of article 317 of the Civil Code of the Russian Federation). In this case, the ruble equivalent is usually determined at the official exchange rate of the corresponding currency on the day of payment (unless otherwise provided by the agreement). However, due to exchange rate changes, the borrower is unlikely to return to the lender the same amount of money that he originally received. This means that the main condition of the loan agreement, defined in paragraph 1 of Article 807 of the Civil Code of the Russian Federation, is not observed. It says that under a loan agreement, one party transfers into the ownership of the other party money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money or an equal number of other things received by him of the same kind and quality. Meanwhile, the parties are free to conclude an agreement: they have the right to enter into an agreement, both provided for and not provided for by law, and, accordingly, determine its terms. This can be done by the provisions of Article 421 of the Civil Code of the Russian Federation (clauses 2, 4). In addition, the terms of the contract may be determined by business customs. But to the situation with a ruble loan denominated in foreign currency, the analogy of the law is more applicable, which is used in cases where the relationship is not directly regulated by law (Clause 1 of Article 6 of the Civil Code of the Russian Federation). Thus, due to the similarity, such relations are regulated by the rules on loans issued in a fixed amount. Accounting for an investment loanThe general rules for accounting for loans are as follows. Based on paragraphs 3 and 4 of PBU 15/2008 “Accounting for expenses on loans and credits”* interest due to the lender is reflected separately from the principal amount of the debt. Therefore, corresponding subaccounts are opened for accounts 66 “Settlements for short-term loans and borrowings” and 67 “Settlements for long-term loans and borrowings”. * The regulation was approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n. INTEREST ACCOUNTING Loan expenses are reflected in accounting and reporting in the reporting period to which they relate and are recognized as other expenses. But there is one exception here. Suppose a company uses borrowed funds to carry out construction for its own needs. In this case, the building (or other capital construction object) will subsequently be taken into account as a fixed asset. Such a property is called an investment asset and interest on loans is included in its value (clause 7 of PBU 15/2008). Let us remind you: for the purposes of applying PBU 15/2008, an investment asset is understood as an object of property, the preparation of which for its intended use requires a long time and significant costs for acquisition, construction or production. Investment assets include, among other things, objects of unfinished construction, which will subsequently be accepted for accounting by the borrower or customer (investor, buyer) as fixed assets or other non-current assets. ACCOUNTING FOR EXCHANGE DIFFERENCES When accounting for loans in foreign currency, including those payable in rubles, you must also be guided by the rules of PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency.” The rules are as follows. Firstly, in the accounting registers, loan amounts must be reflected not only in rubles, but also in foreign currency (clause 20 of PBU 3/2006). Secondly, for accounts 66 and 67 on the date of each transaction, as well as on the last calendar day of the month, it is necessary to recalculate foreign currency liabilities (clause 7 of PBU 3/2006). Recalculation reveals discrepancies between ruble and currency estimates of liabilities that arose as a result of changes in the foreign currency exchange rate. The amounts of such differences are called exchange differences and are taken into account, according to paragraph 13 of PBU 3/2006, as other income and expenses. Please note: accounting for exchange rate differences on interest obligations does not provide for the same exceptions as for the interest itself. The value of an investment asset does not include exchange rate differences. EXAMPLE 1

Brigantina LLC is building a business center under contract.

To finance the investment project, a loan agreement was concluded to provide an amount equivalent to $1 million at 20 percent per annum. On August 3, 2009, money (rubles) arrived in the organization’s bank account. Interest is calculated by the bank monthly - on the last day of the month at the official rate. For August, their amount was $15,342.47 (USD 1,000,000: 365 days x 28 days x 20%). They were paid on September 8, 2009. In accordance with the agreement, interest is paid at the official exchange rate of the Central Bank of the Russian Federation on the day of payment. The dollar exchange rate as of August 3, 2009 was 31.1533 rubles. per US dollar, as of August 31, 2009 - 31.5687 rubles. per US dollar, as of September 8, 2009 - 31.4298 rubles. per US dollar. The accountant of Brigantina LLC reflected the transactions related to the accounting of the loan received as follows. August 3, 2009: DEBIT 51 CREDIT 67 subaccount “Principal Debt”

- RUB 31,153,300.

(31.1533 rubles x 1,000,000 USD) - a loan was received (reflected in rubles and foreign currency). August 31, 2009: DEBIT 91 subaccount “Other expenses” CREDIT 67 subaccount “Principal debt”

- 415,400 rubles.

((31.5687 rub/USD - 31.1533 rub/USD) x 1,000,000 USD) - reflects the exchange rate difference on the principal debt (increase in debt due to an increase in the exchange rate); DEBIT 08 CREDIT 67 subaccount “Interest”

- 484,341.83 rubles.

(USD 15,342.47 x RUB 31.5687/USD)—interest accrued for August (shown in rubles and foreign currency). September 8, 2009: DEBIT 67 subaccount “Interest” CREDIT 51

- 482,210.76 rubles.

(USD 15,342.47 x RUB 31.4298/USD) — interest paid (shown in rubles and foreign currency); DEBIT 67 subaccount “Interest” CREDIT 91

- 2131.07 rub.

((15,342.47 USD x (31.5687 rub/USD - 31.4298 rub/USD)) - reflects the exchange rate difference on interest obligations. Tax accounting Let's consider how costs associated with the use of borrowed funds are taken into account when taxing profits. " INTEREST" LOSSES First of all, let us recall that in tax accounting expenses on debt obligations are reflected taking into account the restrictions established by Article 269 of the Tax Code of the Russian Federation. At the same time, we note that loans expressed in conventional units are recognized as debt obligations issued in rubles. Therefore, according to the currency criterion they are comparable to loans denominated in rubles (letter of the Ministry of Finance of Russia dated July 30, 2009 No. 03-03-06/1/499). For tax purposes, the borrower recognizes interest as part of non-operating expenses, regardless of the investment nature of the loan. This follows from provisions of subclause 2 of clause 1 of Article 265 of the Tax Code of the Russian Federation. Non-operating expenses must be recognized as expenses of the current period (clause 2 of Article 318 of the Tax Code of the Russian Federation). Moreover, if the duration of the contract falls on more than one reporting period, the expense is recognized as incurred and is included in the corresponding expenses at the end of the reporting period. In the event of termination of the agreement (repayment of the debt obligation) before the expiration of the reporting period, the expense is recognized on the date of termination of the agreement or repayment of the debt obligation. This is provided for in paragraph 8 of Article 272 of the Tax Code of the Russian Federation. Consequently, interest on loans cannot be included in the initial cost of the construction project. Such clarifications are contained in letters of the Ministry of Finance of Russia dated June 18, 2009 No. 03-03-06/1/408 and dated February 3, 2009 No. 03-03-06/1/37. And if the company does not have sufficient income during the construction period, it will have to submit “unprofitable” income tax returns to the tax office. Is it possible to avoid unwanted reflection of these losses in the declaration? Let us turn to paragraph 1 of Article 252 of the Tax Code of the Russian Federation. It states that expenses are recognized as expenses provided that they are incurred to carry out activities aimed at generating income. Meanwhile, during the construction of the facility for their own needs, activities directly aimed at generating income have not yet begun. For the reason that there is no object that allows you to generate income. But the All-Russian Classifier of Types of Economic Activities OK 029-2007* (NACE Rev. 1.1) connects the concept of economic activity with the production process. The activity is characterized by production costs, the production process and the output of products (provision of services). All these signs are absent in the situation under consideration. In addition, during a crisis, construction at any stage may be frozen. * The classifier was approved by order of Rostekhregulirovaniya dated November 22, 2007. No. 329-st. Under such circumstances, the author believes that the recognition of “interest” expenses on loans received can be deferred until the facility is put into operation. This decision must be approved in the accounting policy (Article 313 of the Tax Code of the Russian Federation). One can hope that it will not raise objections from tax inspectors. Another way to avoid losses is to take into account “interest” expenses, but not reflect them in current declarations. Subsequently, if there are sufficient income, the company has the right to submit updated declarations for previous years, in accordance with paragraph 1 of Article 81 of the Tax Code of the Russian Federation, and recognize these expenses in the “mode” of carrying forward losses in accordance with the provisions of Article 283 of the Tax Code of the Russian Federation. NO ACTIVITY - NO LOSS

The objects of classification in OKVED are types of economic activity.

Economic activity occurs when resources (equipment, labor, technology, raw materials, materials, energy, information resources) are combined into a production process for the purpose of producing products (providing services). Economic activity is characterized by production costs, the production process and the release of products or the provision of OK 029-2007 (NACE rev. 11)). THE DIFFERENCES ARE NOT ONLY SUMMARY...Now let’s figure out how changes in the foreign currency exchange rate affect the taxation of profits. To do this, let us turn to the letter of the Ministry of Finance of Russia dated May 15, 2009 No. 03-03-06/1/324. In it, officials explained that an obligation expressed in foreign currency, but payable in Russian rubles, should be considered as an obligation expressed in conventional units. A change in the exchange rate of conventional monetary units generates income and expenses in the form of differences in amounts during transactions of sale (capitalization) of goods, work, services, property rights (clause 11.1 of Article 250, subclause 5.1 of clause 1 of Article 265 of the Tax Code of the Russian Federation). Interest just characterizes the cost of the lender's services. And expenses in the form of interest paid, recognized on an accrual basis, do not correspond to the actual amount of interest paid. Hence the amount differences. However, these considerations are not applicable to the amount of the principal debt expressed in conventional units. The fact is that loan repayment, according to subparagraph 1 of paragraph 3 of Article 39 of the Tax Code of the Russian Federation, is not a sale. For this reason, the discrepancy between the received and returned amounts of the principal debt does not fall under the definition of the amount difference. Nevertheless, a decrease in the exchange rate of a conventional unit creates an economic benefit for the borrower (Article 41 of the Tax Code of the Russian Federation), and an increase in the exchange rate, on the contrary, generates additional costs in accordance with paragraph 1 of Article 252 of the Tax Code of the Russian Federation. In the first case, the borrower has non-operating income that is not directly named in Article 250 of the Tax Code of the Russian Federation, but this does not prevent their recognition, since the list of non-operating income is not closed. If the borrower, due to an increase in the exchange rate, returns a larger amount of money than he received, then the difference should be considered as a fee for using the loan provided for in the agreement. For tax purposes, it must be taken into account in accordance with Article 269 of the Tax Code of the Russian Federation. In this case, the maximum amount of expenses for such a difference is determined taking into account the amount of interest accrued on the loan. Unlike accounting, tax legislation does not provide for the reflection of differences in the composition of income (expenses) at the end of the reporting (tax) period. Therefore, all differences that arise must be taken into account on the date of payment of the relevant debt. WHEN DOES THE AMOUNT DIFFERENCE OCCUR?

According to clause 11.1 of Article 250 of the Tax Code of the Russian Federation, an amount difference is formed if the amount of obligations and claims incurred, calculated at the rate of conventional monetary units established by agreement of the parties on the date of sale (receipt) of goods (work, services), property rights, does not correspond to what was actually received (paid) ) amount in rubles.

Please note: according to officials of the Ministry of Finance of Russia, in the case of making an advance payment (full or partial) for the paid price of the goods, income (expenses) in the form of the amount difference (when payments are made in rubles) does not arise (letter dated September 4, 2008 No. 03 -03-06/1/508). EXAMPLE 2

Under a loan agreement drawn up in conventional monetary units, Mayak CJSC, due to the increase in the currency exchange rate.

e. repaid the debt in an amount exceeding what was received by 100,000 rubles. The amount of interest accrued for the reporting period is RUB 50,000. Due to the growth of the exchange rate i.e. interest paid - 52,000 rubles, that is, 2,000 rubles. more than accrued. Thus, the total cost of borrowing costs for Mayak CJSC amounted to 152,000 rubles. (100,000 + 50,000 + 2000). Of these, 2000 rubles. - the amount difference is recognized as an expense in tax accounting in full. But the amount is 100,000 rubles. For tax purposes, it is not recognized as an independent expense, but is added to the amount of accrued interest. Let’s assume that the maximum amount of interest subject to recognition as a company expense according to the rules of Article 269 of the Tax Code of the Russian Federation is 120,000 rubles. This value must be compared with the cost of the lender’s services, equal to 150,000 rubles. (100,000 + 50,000). Since the cost of services exceeds the allowable amount, it is partially recognized in tax accounting - in the amount of 120,000 rubles. Thus, the total amount of non-operating expenses taken into account when taxing the profits of Mayak CJSC will be 122,000 rubles. (120,000 + 2000). The article was published in the journal “Accounting in Construction” No. 12, December 2009.