You can clarify your tax payments according to the rules prescribed in Art. 45 of the Tax Code of the Russian Federation. Thus, this norm establishes that if a taxpayer discovers an error in the execution of an order for the transfer of tax, which does not entail the non-transfer of this tax to the budget, he has the right to submit to the tax authority at the place of his registration an application about the error with the attachment of documents confirming his payment of the specified tax and its transfer to the appropriate account of the Federal Treasury, with a request to clarify the basis, type and identity of the payment, tax period or payer status.

[email protected] comes into force , which approves the procedure for tax authorities to work with unclear payments (hereinafter referred to as the Procedure).

In this regard, in the article we propose to consider the mechanism of interaction between the Federal Tax Service and the taxpayer in a situation where errors were discovered in the payment order for the transfer of taxes to the budget.

In accordance with paragraph 1 of Art. 45 of the Tax Code of the Russian Federation, the taxpayer (including legal entities and individual entrepreneurs) is obliged to independently fulfill the obligation to pay tax, unless otherwise provided by the Tax Code of the Russian Federation, within the period established by law. Failure to fulfill (improper fulfillment) of the obligation to pay tax is the basis for the tax authority to send a demand for tax payment to him.

What can and cannot be adjusted

There are a number of errors that are considered non-critical in payment orders, i.e. subject to editing (for example, an incorrectly entered BCC - budget classification code, TIN, KPP, name of the organization, etc.) and they are the ones that are corrected by submitting the appropriate application to the tax office.

At the same time, there are inaccuracies that cannot be corrected in the manner described above:

- incorrectly specified name of the receiving bank;

- Invalid federal treasury account number.

In cases where the sender of the payment made errors in such details, the function of paying the contribution or tax will not be considered completed, which means the money will have to be transferred again (including late fees, if any).

Do you want to clarify your payment? Report this to the Federal Tax Service!

Clause 7 of Art. 45 of the Tax Code of the Russian Federation establishes: if a taxpayer an error in the execution of an order for the transfer of tax, which does not entail (!) the non-transfer of this tax to the budget, he has the right to submit a statement about the error to the inspectorate at the place of his registration.

The document submitted to the tax authorities must contain a request to clarify the basis, type and origin of the payment, tax period or payer status. Documents confirming the payment made must be attached to the application.

Features of drawing up an application

An application for clarification of payment to the tax service today does not have a unified uniform form, so employees of organizations and enterprises have the opportunity to write it in any form or, if the company has a developed and approved document template, based on its sample. The main thing is that office work standards are observed in terms of the structure of the document, and some mandatory information is also entered.

In the header you need to indicate:

- addressee: name and number of the tax service department to which the application is sent, its location, position, last name, first name and patronymic of the head of the territorial inspection;

- similarly, information about the applicant company is entered into the form;

- then in the middle of the line the name of the document is written, and just below it is assigned an outgoing number and the date of preparation is indicated.

In the main part of the application you should write:

- what kind of mistake was made, indicating a link to the payment order (its number and date);

- Next, you need to enter the correct information. If we are talking about some amounts, it is better to write them in numbers and words;

- Below it is advisable to provide a link to a provision of law that allows for the inclusion of updated data in previously submitted documents;

- if any additional papers are attached to the application, this must be reflected in the form as a separate item.

How do tax authorities deal with uncleared payments?

Unclarified payments include:

– payments on payment documents in the fields of which information is not indicated (incorrectly indicated) by the taxpayer (or by the bank when generating an electronic payment document);

– payments that cannot be clearly identified for reflection in the information resources of tax authorities.

All information about working with outstanding payments is collected in the statement of outstanding receipts. In it, tax authorities reflect:

– payments attributed by the treasury to the appropriate BCC for accounting for unidentified receipts;

– payments made by taxpayers in violation of Rules No. 107n , which led to the impossibility of reflecting them in cards of settlements with the budget or information resources of tax authorities, which record the corresponding revenues;

– payments that cannot be unambiguously classified to be reflected in the cards of specific taxpayers;

– payments for which taxpayers do not have budget payment cards open.

What to pay attention to when filling out the form

Just like the text of the application, there are no special requirements for its execution, so it can be formed on a simple sheet of any convenient format (usually A4) or on the organization’s letterhead.

You can write the application by hand or type it on a computer.

The main thing is that the document contains a “living” signature of the head of the applicant company or a person authorized to act on his behalf (in this case, the use of facsimile autographs, i.e. printed by any method, is prohibited).

There is no strict need to certify the form with a seal - this should be done only if the use of stamp products is enshrined in the regulatory legal acts of the enterprise.

The application should be made in two copies , one of which is transferred to the tax office, and the second remains in the hands of the representative of the organization, but only after the tax specialist puts a mark on it accepting the document.

What can you do wrong when filling out the payment details?

The composition of the information reflected in the “Purpose of payment” field is shown in the diagram:

An error in any of these points can lead to negative consequences for both the recipient of the money and the payer (legal proceedings and material costs).

Company 1 transferred payment to company 2 in the amount of RUB 661,474. 22 kopecks, designating the purpose of the payment as “Payment of invoice for materials,” although no agreements were concluded between the counterparties for the supply of materials or other goods.

Company 2 considered that the money transferred was rent, since the rental relationship with company 1 actually existed at that moment.

Company 1, through the court, managed to recover from company 2 as unjust enrichment the specified amount plus interest for the use of other people's funds (decision of the Court of Justice of the Tula Region dated 06/09/2016 in case No. A68-10135/2015).

The above example shows how you can suffer serious material losses because of one phrase in the payment instructions.

Find out who and what needs to be done if there is an error in the purpose of the payment.

How to submit an application

The application can be submitted in different ways:

- The simplest, fastest and most accessible way is to come to the tax office in person and hand over the form to the inspector.

- Transfer with the help of a representative is also acceptable, but only if he has a notarized power of attorney.

- It is also possible to send the application via regular mail by registered mail with acknowledgment of receipt.

- In recent years, another method has become widespread: sending various types of documentation to government accounting and control services via electronic means of communication (but in this case, the sender must have an officially registered electronic digital signature).

Incorrect VAT amount

The buyer allocated VAT by transferring payment to the “simplified” supplier. The tax authorities will have a question: why did the supplier fail to submit a VAT return? The supplier should inform them that he did not issue a VAT invoice to the buyer. Therefore, you are not required to transfer VAT to the budget and submit a declaration. You can support your position with a reference to the letter of the Ministry of Finance of Russia dated February 15, 2018 No. 03-07-14/9470. And correspondence with the buyer stating that VAT was allocated by mistake would not be out of place.

In general, it is safer to draw up an additional agreement to the contract. Agree with the buyer whether you will reduce the price by the amount of VAT. Indicate in the additional agreement that the supplier does not pay VAT because it uses a simplified procedure. This way, we will at least eliminate the possibility that the buyer, “waking up”, will suddenly request a VAT invoice or demand a price reduction by the amount of tax.

If the bank puts a spoke in the wheels

The above algorithm requires the participation of the payer and recipient banks. Moreover, it is important that your bank reflects the changed payment purpose in its documents. After all, if third parties ask the bank for a statement of your account, it needs to have the correct information.

So, during audits, the tax office examines the bank statement, which contains the purpose of payment, Appendix 4 to the Order of the Federal Tax Service of Russia dated March 30, 2007 No. MM-3-06 / [email protected] And the tax authorities can insist that the purpose that should be considered reliable should be considered reliable. the bank showed in the extract the Resolution of the Federal Antimonopoly Service of the Central Election Commission dated March 26, 2009 No. A48-3261/08-15; Third AAS dated June 16, 2009 No. A33-16010/2008-03AP-1403/2009.

The courts also request information from banks about the purpose of payment reflected in them; Resolution of the Federal Antimonopoly Service of Ukraine dated April 27, 2010 No. F09-2872/10-C2; AS of the Sverdlovsk region dated March 20, 2009 No. A60-41145/2008-C4. When assessing whether the purpose of the payment has really been changed or not, the court can focus on whether the bank has reflected it. Resolution of the Federal Antimonopoly Service of the Central Election Commission dated June 30, 2010 No. A35-5833/2007-c6.

However, your bank may have a different view of its role. After all, changing the purpose of payment is not regulated by banking legislation. Therefore, different banks act differently. Some reflect changes in their database and in statements for third parties, others do not. Some transmit information about changes in the purpose of payment to the recipient's bank, others do not.

After sending a letter to the bank to clarify the purpose of the payment, you cannot influence its actions. That is why it is important for the payer to receive an acceptance mark on the copy of the letter that remains with him. This will be proof that you have notified the bank. Give a copy of this letter to the payee. If you are the recipient, request a copy from the payer.

You can check whether your bank has corrected the purpose of the payment in its database by requesting from it after a while a statement that includes information about the basis for the payment (if, of course, your bank provides such a statement to clients).

It happens that the bank completely refuses to accept a letter to clarify the purpose of the payment. Then all that remains is to send it by mail in a valuable letter with an inventory of the contents and with a postal stamp on a copy of the inventory.

What happens if you don't submit a letter?

If the payer discovers an error, the tax service must be informed about it.

If the payment is made using incorrect details, it will take a long time to return it through the court.

And you need to pay the tax again until a penalty is charged on the amount owed.

If there is an error in the payment order

If incorrect data is indicated in a payment order, the standard procedure for contacting the tax service is used.

You can only change basic information, for example, change from KBK to KBK, which is correct. But you won’t be able to change your bank account details this way. You must first make the payment again and claim back the previously paid amount.

How and for how long to store a letter

After sending, all letters about clarification of the purpose of payment must be registered in the journal of outgoing documentation, and one copy must be placed in the folder of the current “primary” company. Here it must remain for the period established for such documents by law or internal regulations of the company, but not less than three years . After losing its relevance and expiration of the storage period, the letter can be transferred to the archive of the enterprise or disposed of in the manner prescribed by law.

Results

If the taxpayer made an error in the KBK or other fields of the payment order and the payment was received in the budget system of the Russian Federation, then the payment is considered executed. In this case, you should send an application to the Federal Tax Service to clarify the payment.

If critical errors were made: in the recipient's account number or the name of the recipient bank, the payment does not go to the budget. In this case, you need to re-transfer the tax amount to the correct details, pay penalties and write an application for a refund of the incorrectly paid tax to your current account.

Sources

- https://www.klerk.ru/buh/articles/485877/

- https://nalog-nalog.ru/uplata_nalogov/rekvizity_dlya_uplaty_nalogov_vznosov/obrazec_zayavleniya_ob_utochnenii_nalogovogo_platezha_oshibka_v_kbk/

- https://praktibuh.ru/buhuchet/denezhnye-sredstva/beznalichnye/platezhnoe-poruchenie/pismp-ob-utochnenii-platezha-v-platezhke.html

- https://assistentus.ru/forma/pismo-ob-utochnenii-naznacheniya-platezha/

- https://assistentus.ru/forma/zayavlenie-ob-utochnenii-platezha-v-nalogovuyu/

- https://ppt.ru/forms/nalogi/utochnenie-plateja

- https://buhguru.com/effektivniy-buhgalter/utochnyaem-platezh-v-nalogovuyu-pri-nevernom-kbk.html

- https://buhguru.com/spravka-info/zayavlenie-ob-utochnenii-platezha-po-nalogu-v-2019-godu-tekst-i-obrazets.html

- https://ppt.ru/forms/platejka/pismo-ob-oshibke

- https://pravoznay.ru/zayavlenie-na-utochnenie-platezha-v-nalogovuyu.html

If a dispute does arise

Both the tax office and the counterparty can try to challenge the change in the purpose of the payment, simply by proving that the legislation does not allow such a change. But often their arguments are easy to repel.

ARGUMENT 1. Corrections in the payment order are unacceptable. This is established by the Regulations on Non-Cash Payments. 2.11 Regulations of the Central Bank of the Russian Federation dated October 3, 2002 No. 2-P. However, there we are talking about corrections (such as blots and erasures) in the payment order originally submitted to the bank. Therefore, changing the purpose of the payment after executing the payment order does not interfere with Resolution of the FAS ZSO dated December 23, 2010 No. A75-12877/2009; Fourth AAS dated May 12, 2009 No. A19-16438/08; Third AAS dated April 14, 2011 No. A33-13293/2010.

ARGUMENT 2. It is prohibited to make changes to cash and bank documents. 5 tbsp. 9 of the Accounting Law; clause 1.7.4 sec. I of part III of the appendix to the Regulations of the Central Bank of the Russian Federation dated March 26, 2007 No. 302-P. Only once did the court see this as an obstacle to changing the purpose of payment; Resolution of the Federal Arbitration Court No. A45-10119/2010 dated 02/08/2011, and in other cases the courts decided that the change we are considering does not fall within the scope of this prohibition; Resolution of the Third AAS dated 04/14/2011 No. A33- 13293/2010; Fourth AAS dated May 12, 2009 No. A19-16438/08; Eighth AAS dated May 13, 2011 No. A46-3214/2010; Twentieth AAS dated October 29, 2010 No. A54-267/2010С18; FAS Central Election Commission dated January 12, 2006 No. A62-817/2005.

ARGUMENT 3. Banks do not have the right to determine the direction of use of clients’ money. 845 of the Civil Code of the Russian Federation and interfere with their contractual relations. 1.5 Regulations of the Central Bank of the Russian Federation dated October 3, 2002 No. 2-P. But if the payment purpose is changed, this does not happen. In such cases, the bank does not act on its own initiative, but following the order of its client, who determines the direction of the use of money within the framework of its relations with the counterparty; Resolution of the Federal Antimonopoly Service No. A75-12877/2009 of December 23, 2010; FAS VVO dated April 19, 2011 No. A43-12122/2010; FAS CO dated 03.03.2011 No. A09-5609/2010.

ARGUMENT 4. A terminated obligation cannot be renewed. Proper fulfillment of the obligation terminates it. 1 tbsp. 408 of the Civil Code of the Russian Federation. For example, when you transferred money for goods supplied to you, your obligation to pay for them ceased. You and the seller want to change the purpose of this payment, turning it, for example, into repayment of your debt under another agreement. But then you will again have to consider the obligation to pay for the goods as unfulfilled. However, from the moment the money is transferred, it no longer exists, which means that nothing can be done with it.

This argument is heard rarely in the courts, but it is apt - if one of the parties makes it, the courts consider the change in the purpose of payment to have failed; Resolution of the Federal Antimonopoly Service of the Eastern Military District of 04/05/2010 No. A43-10173/2009-32-160; Second AAS dated December 2, 2010 No. A28-5541/2010-179/22; Twelfth AAS dated April 14, 2010 No. A57-24239/2009; Nineteenth AAS dated October 22, 2009 No. A36-1030/2009. And only once did the court recognize the possibility of renewing by agreement of the parties an obligation that had already been terminated by payment; Resolution of the FAS ZSO dated April 27, 2010 No. A75-6785/2009.

***

If you need to clarify the purpose of the payment, do not put it off until later. The court may recognize the change in the purpose of payment as invalid due to the fact that too much time has passed from the date of transfer of money to the date of clarification. Moreover, how much is too much, the court decides for itself in each specific case. Even a couple of months may seem like too much time to the arbitrators. Resolutions of the Federal Arbitration Court No. A09-5609/2010 dated 03/03/2011, No. A35-5833/2007-c6 dated 06/30/2010.

Other articles from the magazine "MAIN BOOK" on the topic "Errors - correction":

Letter of clarification from the KBK

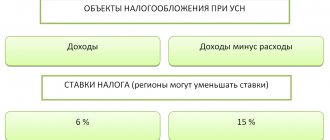

The abbreviation KBK hides the phrase “budget classification code.” Briefly revealing this concept, it can be explained as follows: KBK is a multi-valued, four-step sequence of numbers that indicates all the information about the payment made, the path it takes, including information about who paid the funds and where, as well as for what purpose they will be spent.

For example, if we are talking about taxes under the simplified tax system, then when paying them to the budget, the taxpayer indicates a certain BCC, thus indirectly “covering” the costs that the state makes for public sector workers: medicine, education, etc. (exactly the same with other fees - they all have a strictly intended purpose).

More broadly speaking, BCCs allow you to track the collection of taxes in one direction or another, make the necessary monitoring and, taking them into account, form and plan future budget expenditures for certain expense items.

To correct the BCC, it is enough to write an application to the territorial tax office with a request to clarify the payment and, if necessary, indicate the tax period and information about the taxpayer.

Confirming payment orders must be attached to the application. After reconciling the payments made with the tax office, the supervising inspectors make the necessary decision (the deadline for its adoption is not regulated by law), which is then transferred to the tax payer.

It is allowed to offset the overpaid tax from one BCC to another.

To do this, you will need to draw up an application in a strictly defined form, indicating in it the initial BCC and the one to which you want to transfer funds.

If everything is completed on time and in compliance with the legally established procedure, then there should be no difficulties with transferring money from one KBK to another.

An application for a tax offset from one BCC to another can be written either in free form or according to an established unified template. Regardless of which method is chosen, you need to refer to Article 78 of the Tax Code of the Russian Federation. We will take the standard form as an example, since it contains all the necessary lines, is convenient and easy to fill out.

First of all, let’s say that you can enter information into the form either on the computer or by hand. If the second option is chosen, then you need to ensure that the document does not contain inaccuracies, errors or edits. If they do happen, you should fill out another form.

First fill out the form:

- addressee, i.e. the name and number of the tax authority to which the application will be submitted;

- details of the applicant - his name, TIN, OGRN, address, etc.

Then the main section states:

- number of the article of the Tax Code of the Russian Federation, in accordance with which this application is being drawn up;

- the tax for which the incorrect payment occurred;

- KBK number;

- amount (in numbers and words);

- new payment purpose (if necessary);

- new KBK.

Finally, the document is dated and the applicant signs it.

Current as of: January 23, 2021

Application form for crediting the amount of overpaid tax

If you have overpaid any tax to the budget, then you can return the amount of the overpayment or offset it against future payments (clause 5, clause 1, article 21 of the Tax Code of the Russian Federation). In the second case, you need to submit an application to your Federal Tax Service to offset the amount of overpaid tax. It can be submitted to the tax office within 3 years from the day the overpayment was made (clause 2, 7, article 78 of the Tax Code of the Russian Federation).

Overpayment of taxes can be offset against future tax payments, as well as towards repayment of arrears, penalties or fines. But subject to the rules of tax offset (Clause 1, Article 78 of the Tax Code of the Russian Federation).

Let us note that a separate offset procedure has been established for offset of excessively withheld or paid personal income tax from the income of employees.

By the way, if the tax authorities themselves discover an overpayment, they will count it against the arrears of another tax (of the same “level”), or penalties or fines for such a tax themselves (clause 5 of Article 78 of the Tax Code of the Russian Federation).

The right to correct errors in a payment order is given by the tax code, or more precisely, paragraph 7 of article 45 of the Tax Code of the Russian Federation. However, it should be noted that not all information can be corrected on the basis of this legal norm.

There are a number of errors that are considered non-critical in payment orders, i.e. subject to editing (for example, an incorrectly entered BCC - budget classification code, TIN, KPP, name of the organization, etc.) and they are the ones that are corrected by submitting the appropriate application to the tax office.

At the same time, there are inaccuracies that cannot be corrected in the manner described above:

- incorrectly specified name of the receiving bank;

- Invalid federal treasury account number.

In cases where the sender of the payment made errors in such details, the function of paying the contribution or tax will not be considered completed, which means the money will have to be transferred again (including late fees, if any).

If the taxpayer company’s specialists discover errors in a timely manner, they must immediately try to correct them.

Otherwise, you will again have to transfer the tax or contribution again, and it will be possible to demand a refund of the previously paid amount and the cancellation of accrued penalties only through the courts.

Moreover, administrative sanctions from the tax service (in the form of fairly large fines) cannot be ruled out.

Just like the text of the application, there are no special requirements for its execution, so it can be formed on a simple sheet of any convenient format (usually A4) or on the organization’s letterhead.

You can write the application by hand or type it on a computer.

There is no strict need to certify the form with a seal - this should be done only if the use of stamp products is enshrined in the regulatory legal acts of the enterprise.

The application can be submitted in different ways:

- The simplest, fastest and most accessible way is to come to the tax office in person and hand over the form to the inspector.

- Transfer with the help of a representative is also acceptable, but only if he has a notarized power of attorney.

- It is also possible to send the application via regular mail by registered mail with acknowledgment of receipt.

- In recent years, another method has become widespread: sending various types of documentation to government accounting and control services via electronic means of communication (but in this case, the sender must have an officially registered electronic digital signature).

What to write in an application for clarification of tax payment in 2019-2020? Where to submit it? Let's give an example.

Also see:

Fill out an application for clarification of the BCC or other details in any form and submit it to the Federal Tax Service where the tax was transferred. Attach a copy of the erroneous payment slip to the application (clause 7, article 45 of the Tax Code of the Russian Federation).

What errors occur

Any organization is a payer of taxes, fees, and contributions. At least some tax payment is credited to the state treasury. For the transfer of budget payments, separate rules for filling out payment orders are provided. A mistake will result in penalties and fines. To correct a shortcoming in a payment, send a special application for clarification to the Federal Tax Service with a request to eliminate the inaccuracy.

All payment deficiencies are divided into three categories:

- critical blots in which the defect cannot be corrected;

- non-critical, in which it is enough to contact the Federal Tax Service to clarify the tranche;

- minor defects that do not require correction at all.

IMPORTANT!

Tax authorities have provided separate rules and procedures for clarifying budget transfers. Not all blots can be corrected.

Will there be penalties and offset of overpayments against arrears?

When paying taxes, you should be more careful when indicating the purpose and details of the payment. Otherwise, a penalty will be charged on the amount of the debt. If the payer has provided a letter confirming payment, penalties can be avoided.

The penalty is charged regardless of the payer’s request in the following situations:

- An error was made when specifying the recipient's bank account. Tax authorities do not have the right to change this information, so the date of tax payment will be considered the date of the second transfer of funds. And you will have to pay a penalty for this period, if it was accrued.

- The inspector may change the details, but the original payment was sent late. All accrued fines must still be paid.

If the payer has an overpayment of taxes, it can be counted against the arrears. But this procedure is not carried out automatically, so you need to send the appropriate application.

The Federal Tax Service has 10 days to consider such an application, so it must be sent in advance. At least 10 days before the tax payment deadline. Then the overpayment will be counted.

In what cases is it compiled?

The obligation of current account owners to indicate the purpose of payment when issuing a payment document is regulated by the Regulations of the Bank of Russia.

This procedure is associated with disclosing the essence of transactions, making it more transparent and understandable for regulatory authorities and counterparties.

This field can contain the name of the work, details of the contract, and other primary documents (invoice for payment).

A letter to clarify the purpose of the payment is drawn up after an employee of the enterprise has discovered an error in a previously sent payment document.

The inaccuracy may also be detected by the recipient of the funds. He cannot correct it on his own; to correct the document, he must contact the counterparty.

Sometimes the recipient corrects the error using his own capabilities and then notifies the recipient of his actions. But as a result of such manipulations, controversial issues may arise; the truth will always be on the sender’s side; it is better to exclude this method from practice.

Who has the right to correct an incorrect payment purpose in a payment order?

The recipient of funds does not have the right to change the purpose of the payment at his own discretion; he can only clarify it with the payer. Banks also do not have the right to arbitrarily change the purpose of payment.

As a result, only one party has the right to change the purpose of payment - the payer (the owner of the funds). Such a change must be made in writing and certified by the persons who signed the payment document (Article 209 of the Civil Code of the Russian Federation, paragraph 7 of Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).