We have already considered 6-personal income tax for the six months in one of the previous articles on this topic. Reporting in form 6-NDFL for the 3rd quarter of 2021 is submitted by all employers, regardless of the organizational and legal form: LLC, PJSC, CJSC, individual entrepreneur, etc. The main purpose of introducing this reporting is to increase control over the payment of income tax. However, they decided to get this, alas, not due to more efficient work of the Federal Tax Service, but due to the additional burden on business...

Calculation deadline for 2021

Calculation in form 6-NDFL is submitted to the Federal Tax Service based on the results of each quarter. The deadline for submission is no later than the last day of the month following the quarter. So, for example, 6-personal income tax for 9 months of 2021 was required to be submitted no later than October 31, 2021. However, the deadline for submitting annual personal income tax reports is different. The annual calculation of 6-NDFL based on the results of 2021, as a general rule, must be submitted no later than April 1 of the year following the reporting year. This is stated in paragraph 3 of paragraph 2 of Article 230 of the Tax Code of the Russian Federation.

Tax legislation provides that if the deadline for submitting a 6-NDFL calculation falls on a weekend or non-working holiday, then the reports can be submitted on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). April 1 and 2, 2021 are Saturday and Sunday. Therefore, the annual calculation of 6-NDFL must be submitted to the tax office no later than April 3, 2021 (this is a working Monday). See “Deadline for submitting 6-NDFL for 2021.”

It is worth noting that the annual calculation of 6-NDFL for 2021 is often referred to as “calculation of 6-NDFL for the 4th quarter of 2021.” However, calling it that is not entirely correct. The fact is that no later than April 3, 2021, the inspectorate is required to submit annual reports for the entire 2021, and not just for the 4th quarter of 2021. This is precisely what is emphasized in paragraph 3 of paragraph 2 of Article 230 of the Tax Code of the Russian Federation. Moreover, the indicators in section 1 of the 6-NDFL calculation are filled in on an accrual basis from the beginning of 2021, and not just for the fourth quarter. Therefore, we can say with confidence that it is the annual personal income tax reporting that is submitted, and not the quarterly one.

Advice

We recommend not to delay submitting your annual payment for 2021 until April. In April, the deadline for submitting 6-personal income tax for the first quarter of 2021 will be approaching. It must be submitted no later than May 3. See “Deadlines for submitting 6-NDFL calculations in 2021: table.”

What is 6-NDFL: declaration, certificate or calculation

Form 6-NDFL has been included in the list of mandatory personal income tax reporting since 2016. It had no analogues before. The key features of 6-NDFL are:

- 6-NDFL combines sum and calendar information;

- 6-NDFL has specific features - it combines a system of increasing data from period to period with a quarterly gradation of information on tax payable.

Important! A new form has been introduced for reporting for the 1st quarter of 2021. You can see what has changed in the form in the Review from ConsultantPlus. Trial access to the system is provided free of charge.

Who must submit the annual 6-NDFL

All tax agents must submit an annual calculation in form 6-NDFL for 2021 (clause 2 of Article 230 of the Tax Code of the Russian Federation). Tax agents for personal income tax are, as a rule, employers (organizations and individual entrepreneurs) who pay income under employment contracts. Also, customers who pay remuneration to performers under civil contracts can be considered tax agents. However, it is worth recognizing that the issue of the existence of payments and accruals in 2021 is quite individual and, in practice, there may be various controversial situations. Let's look at three common examples and explain when and who needs to submit 6-NDFL for 2021.

Situation 1. There were no accruals and payments in 2021

If from January 1 to December 31, 2021 inclusive, an organization or individual entrepreneur did not accrue or pay any income to individuals, did not withhold personal income tax and did not transfer tax to the budget, then there is no need to submit the annual 6-NDFL calculation for 2021. In this case, there was no fact upon the occurrence of which the company or individual entrepreneur became tax agents (clause 1 of Article 226 of the Tax Code of the Russian Federation). In this case, you can send a zero 6-NDFL to the Federal Tax Service. The tax office is obliged to accept it. “Zero 6-NDFL: is it necessary to submit it and why.”

It is worth noting that some accountants consider it advisable, instead of “zeros,” to send letters to the tax inspectorate explaining why 6-NDFL was not submitted. With this option, it is better to send such a letter no later than April 3, 2021. See “Letter about zero 6-NDFL: sample.”

Situation 2. Salaries were accrued but not paid

In the context of the economic crisis, there are common cases where there were no real payments to individuals in 2021, but the accountant continued to accrue salaries or remunerations. This, in principle, is possible when a business, for example, does not have money to pay earnings. Should I submit reports then? Let me explain.

If during the period from January to December 2021 inclusive there was at least one accrual, then you need to submit the annual 6-NDFL calculation for 2021. This is explained by the fact that personal income tax must be calculated on accrued income, even if the income has not yet actually been paid (clause 3 of Article 226 of the Tax Code of the Russian Federation). Therefore, the accrued amount of income and accrued personal income tax must be recorded in the annual calculation of 6-personal income tax for 2016. Actually, for these purposes, reporting in Form 6-NDFL was introduced, so that tax authorities could track accrued but not paid amounts of personal income tax.

Situation 3. The money was paid once

Some tax preparers may have paid out earnings only once or twice in 2021. For example, the CEO - the only founder could receive a lump sum payment in the form of dividends. Is it then necessary to fill out and send the annual 6-NDFL to the Federal Tax Service if there are no employees in the organization? Let's assume that the income was paid in February (that is, in the first quarter of 2021). In such a situation, the annual calculation of 6-NDFL for 2021 should be handed over to the tax authorities, since in the tax period from January to December there were accruals and payments. Use a similar approach if the income was paid, for example, only in the fourth quarter of 2021. Then you also need to submit an annual calculation.

If payments took place, for example, only in the first quarter of 2016, then in the calculation of 6-NDFL for the 4th quarter of 2021, you only need to fill out section 1. Section 2 is not required. This follows from the Letter of the Federal Tax Service dated March 23, 2016 No. BS-4-11/4958, which discussed the issue of a one-time payment of dividends. See “Filling out section 1 in 6-NDFL”.

Form 6-NDFL for the 4th quarter of 2021 and general requirements for filling it out

For the annual calculation, use the form of previous periods; no changes have been made to it. 6-NDFL consists of a title page and two sections: section 1 summarizes the indicators for the entire tax period, that is, 2021, on a cumulative basis, and section 2 includes income and withheld tax of the last quarter. Both sections are placed on one page, but there may be more pages if all the indicators do not fit on it.

The general requirements for filling out 6-NDFL for the 4th quarter of 2021 are as follows:

- You cannot correct mistakes made using corrective means, print out the calculation on paper on both sides and fasten the sheets together;

- All pages of the calculation must be numbered, starting with the title page;

- If there is no indicator for a digital field, then “0” is indicated;

- Each page of 6-NDFL is signed by the tax agent (or his representative) and the date of signing is indicated;

- For each territorial OKTMO code, you need to fill out a separate 6-NDFL calculation;

- Only those tax agents whose number of individuals who received income in 2021 did not exceed 25 people can report on paper; the rest submit their calculations electronically.

If there are separate divisions, 6-NDFL for the 4th quarter of 2016 must be submitted separately for each, even if they all belong to the same Federal Tax Service, such clarifications are given by the Federal Tax Service in letter No. BS-4-11/13984 dated August 1, 2016.

The annual 6-NDFL data on the number of individuals who received income from the agent must coincide with the number of 2-NDFL certificates provided (with the sign “1”). Also, the sum of the corresponding indicators of the 2-NDFL certificates must correspond to: the total amount of income, including dividends, calculated by the personal income tax, and the tax not withheld by the agent (letter of the Federal Tax Service dated March 10, 2016 No. BS-4-11/3852).

New form 6-NDFL for 2021: approved or not?

The new form for calculating 6-NDFL for filling out and submitting to the Federal Tax Service for 2016 was not approved. Therefore, prepare the annual report 6-NDFL in the form approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450. Changes to this form have never been made before. You used it throughout 2021. Download the current 6-NDFL calculation form in Excel format and the procedure for filling it out from this link.

The annual 6-NDFL calculation form includes:

- title page;

- section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

Next, we will explain the specifics of filling out each section of 6-NDFL for 2021 and answer the most controversial questions about the reporting of rolling salaries for September and December 2016.

Filling out the title page

When filling out the annual 6-NDFL for 2021, at the top of the title page, mark the INN, KPP and the abbreviated name of the organization (if there is no abbreviated name, the full name). If you need to submit a settlement in relation to individuals who received payments from a separate division, then fill in the “separate” checkpoint. Individual entrepreneurs, lawyers and notaries only need to indicate their TIN.

In the line “Adjustment number” of the annual calculation, if the calculation is submitted for the first time for 2016. If they submit a corrected calculation, then they reflect the corresponding adjustment number (“001”, “002”, etc.).

In the line “Submission period (code)”, enter 34 - this means that you are submitting 6-NDFL for 2021. In the “Tax period (year)” column, mark the year for which the semi-annual calculation is submitted, namely 2021.

Indicate the code of the division of the Federal Tax Service to which the annual reports are sent and the code on the line “At location (accounting).” This code will show why you are submitting 6-NDFL here. Most tax agents reflect the following codes:

- 212 – when submitting a settlement at the place of registration of the organization;

- 213 – when submitting the calculation at the place of registration of the organization as the largest taxpayer;

- 220 – when submitting a settlement at the location of a separate division of a Russian organization;

- 120 – at the place of residence of the individual entrepreneur;

- 320 – at the place of business of the entrepreneur on UTII or the patent taxation system.

If filled out correctly, a sample of filling out the title page of the annual 6-NDFL calculation may look like this:

How to submit 6-NDFL to a merchant combining regimes

An entrepreneur’s combination of OSNO or simplified tax system with PSN is a reason to figure out how to submit 6-NDFL.

Important! UTII has been canceled from 01/01/2021.

The general approach is taken as a basis: 6-NDFL is submitted to the inspectorate at the place of registration. But one nuance must be taken into account: when combining regimes, there may be several places of registration (clause 7 of Article 226 of the Tax Code of the Russian Federation), so the merchant must submit at least 2 reports:

- the first 6-NDFL with data on income paid to employees engaged in activities taxable under OSNO or USN - to the inspectorate where the businessman is registered as an individual entrepreneur (at his place of residence);

- the second report is sent to the inspectorate in whose territory the activities of the individual entrepreneur transferred to the PSN are carried out. It must reflect income paid to employees associated only with these types of activities.

This issue is discussed in more detail here.

Completing section 1

In Section 1 6-NDFL for 2021 “Generalized Indicators”, show the total amount of accrued income, tax deductions and the total amount of accrued and withheld tax for the entire year. The first section is filled out with a cumulative total for the first quarter, half a year, nine months and 2021 (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). Therefore, Section 1 6-NDFL for 2021 should reflect the summary indicators from January 1 to December 31, 2021 inclusive. Take the information to fill out from the personal income tax registers. See “Tax register for 6-NDFL”.

Section 1 looks like this:

Let us explain which lines of generalized values are in section 1:

| Line | What is shown |

| 010 | Personal income tax rate (for each rate, fill out section 1). |

| 020 | The amount of accrued income. |

| 025 | Dividend income from January to December 2021 inclusive. See “Dividends in 6-NDFL: filling out a sample calculation.” |

| 030 | The amount of tax deductions “Tax deductions in 6-NDFL: we reflect the amounts correctly.” |

| 040 | The amount of calculated personal income tax since the beginning of the year. To determine the value of this indicator, add up the personal income tax amounts accrued from the income of all employees. |

| 045 | The amount of calculated personal income tax on dividends on an accrual basis for the entire 2016: from January 1 to December 31, 2021. |

| 050 | The amount of fixed advance payments that are offset against personal income tax on the income of foreigners working under patents. However, this amount should not exceed the total amount of calculated personal income tax (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/3852). |

| 060 | The total number of individuals who received income during the reporting (tax) period. |

| 070 | The amount of personal income tax withheld. |

| 080 | The amount of personal income tax not withheld by the tax agent. This refers to amounts that a company or individual entrepreneur should have withheld until the end of the 4th quarter of 2021, but for some reason did not do so. |

| 090 | The amount of personal income tax returned (under Article 231 of the Tax Code of the Russian Federation). |

Also see “Filling out the lines in the 6-NDFL calculation.”

Completing section 2

Section 2 of the annual report 6-NDFL indicates:

- dates of receipt and withholding of personal income tax;

- deadline established by the Tax Code of the Russian Federation for transferring personal income tax to the budget;

- the amount of income actually received and personal income tax withheld.

When filling out section 2, reflect the transactions performed in chronological order. Let us explain the purpose of the lines in section 2 in the table:

| Line | Filling |

| 100 | Dates of actual receipt of income. For example, for salaries, this is the last day of the month for which salaries are accrued. For some others, payments have different dates (clause 2 of Article 223 of the Tax Code of the Russian Federation). |

| 110 | Personal income tax withholding dates. |

| 120 | Dates no later than which the personal income tax must transfer the budget (clause 6 of article 226, clause 9 of article 226.1 of the Tax Code of the Russian Federation). Typically, this is the day following the day the income is paid. But, let’s say, for sick leave and vacation pay, the deadline for transferring taxes to the budget is different: the last day of the month in which such payments were made. If the tax payment deadline falls on a weekend, line 120 indicates the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). |

| 130 | The amount of income (including personal income tax) that was received on the date indicated on line 100. Also see “Line 130 6-NDFL is not reduced by deductions.” |

| 140 | The amount of tax withheld as of the date on line 110. |

Keep in mind that section 2 of the annual 6-NDFL for 2021 should include only indicators related to the last three months of the reporting period (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). That is, you need to show income and personal income tax - broken down by date - only for transactions made in October, November and December 2021 inclusive. Do not include 2021 transactions in section 2.

Introductory information

The 6-NDFL calculation must contain information summarized by the tax agent on all individuals who received income from him.

The calculation indicates: the amount of paid income, provided tax deductions, calculated and withheld personal income tax and other data (new edition of paragraph 1 of Article 80 of the Tax Code of the Russian Federation). Unlike the 2-NDFL certificate, the new calculation must be submitted not for each employee, but for the organization as a whole. The 6-NDFL calculation is submitted no later than the last day of the month following the first quarter, half-year and nine months of the year, and the annual calculation - no later than April 1 (new edition of clause 2 of Article 230 of the Tax Code of the Russian Federation). Thus, the first time you need to report on Form 6-NDFL is for the first quarter of 2021. Since the period from April 30 to May 3, 2016 falls on weekends, this means that the calculation of 6-NDFL for the first quarter of 2016 will need to be submitted no later than May 4 (clause 7 of article 6 of the Tax Code of the Russian Federation, see “The Government of the Russian Federation approved the transfer weekends in 2016").

Fill out and submit 6‑NDFL and 2‑NDFL for free through “Kontur.Extern”

An example of filling out sections 1 and 2 of the annual calculation

Now we will give an example of filling out the 6-NDFL calculation for 2021, so that the general principle of filling out the sections is clear. Let's assume that in 2021, 27 people received income from the organization. In total, for the period from January to December, the summarized indicators for section 1 are as follows:

- the total amount of accrued income is 8,430,250 rubles (line 020);

- the amount of tax deductions is 126,000 rubles (line 030);

- the amount of calculated personal income tax is 1,079,552 rubles (line 070);

- the amount of tax not withheld by the organization is 116,773 rubles (line 080).

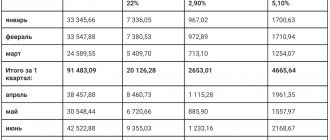

As for the fourth quarter of 2021 itself, income, deductions and personal income tax were distributed as follows:

| Income date | Type of income | Amount of income | Amount of deductions | Personal income tax amount | Personal income tax rate | Personal income tax was withheld | Paid personal income tax |

| 30.09.2016 | Salary for September 2021 | 562 000 | 3000 | 72 670 | 13 | 05.10.2016 | 06.10.2016 |

| 30.10.2016 | Salary for October 2021 | 588 000 | 3000 | 76 050 | 13 | 03.11.2016 | 07.11.2016 |

| 28.11.2016 | Sick leave | 14 200 | — | 1846 | 13 | 28.11.2016 | 30.11.2016 |

| 30.11.2016 | Salary for November 2021 | 588 000 | 3000 | 76 050 | 13 | 05.12.2016 | 06.12.2016 |

| 30.12.2016 | Salary for December 2021 | 654 000 | 3000 | 84 630 | 13 | 31.12.2016 | 09.01.2017 |

| 30.12.2016 | Annual bonus | 250 000 | 3000 | 32 103 | 13 | 30.12.2016 | 09.01.2017 |

Under such conditions, in section 1 you need to show generalized information from the beginning of 2021 on an accrual basis, and in section 2 you need to distribute accruals and payments relating to the 4th quarter of 2021. It will look like this:

Please note that our example conditions include the salary for December and the annual bonus for 2021, which were paid to employees on December 30, 2021. However, we did not reflect these payments in the annual report 6-NDFL. It does not matter when you actually paid your December salary and annual bonus: in 2016 or 2021. They need to be reflected in section 2 of the 6-NDFL calculation for the first quarter of 2021, since these operations will be completed in 2017. According to the latest clarifications from tax authorities, “completion of the operation” should be determined by the latest date when personal income tax should be transferred to the budget. We will consider in more detail the issue of reflecting “carryover” payments in 6-NDFL below.

Calculation of 6-NDFL for the 4th quarter - example of filling

For 2021, Volna LLC accrued RUB 3,630,000. income for 9 individuals. Dividends were paid to one founder in the amount of 46,600 rubles. Tax deductions for the year amounted to 95,650 rubles. Personal income tax (13%) for the year – 465,524 rubles.

Including in the 4th quarter of 2021:

10/05/16 – salary for September was paid – 210,000 rubles. (personal income tax - 27,300 rubles);

03.11.16 - salary for October was paid - 270,000 rubles. (personal income tax - 35,100 rubles) and sick leave - 11,000 rubles. (personal income tax - 1430 rubles);

12/01/16 – vacation pay of 29,000 rubles was paid. (personal income tax - 3,770 rubles);

12/05/16 – wages for November were paid – 265,000 rubles. (Personal income tax – RUB 34,450).

Salary for December 241,000 rubles. (personal income tax - 31,330 rubles) paid in January 2021.

Salary for December was paid in December: how to reflect it in 6-NDFL

The most controversial issues regarding filling out 6-NDFL are payments during transition periods. They are encountered when a salary or bonus is accrued in one reporting period and paid in another. The situation with salaries for December 2021 is especially controversial. The fact is that some employers paid salaries for December before the New Year (in December). Other organizations and individual entrepreneurs paid salaries and annual bonuses in January 2021. See “December 2021 Salary Payment Deadlines.” How to show December accruals in the report so that tax authorities accept 6-NDFL the first time? Let's look at specific examples of filling out 6-NDFD for 2021.

What kind of information will be checked by the Federal Tax Service?

Let's assume that the salary for December 2021 was paid on December 30, 2021. The month has not yet ended on this date, so it is impossible to regard such a payment as a salary for December in the full sense of the word. In fact, money paid before the end of the month is correctly called an advance. As of December 30, the employer is not yet obliged to calculate and withhold personal income tax, since wages become income only on the last day of the month for which they are accrued - December 31 (clause 2 of Article 223 of the Tax Code of the Russian Federation). Despite the fact that December 31 is a Saturday, personal income tax cannot be calculated or withheld before this date (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-3-11/2169).

Example 1

The organization transferred the “salary” to the employees for December on the 30th in the amount of 180,000 rubles. From the payment made on the same day, personal income tax was calculated and withheld in the amount of 23,400 rubles (180,000 x 13%). The accountant transferred this amount on the first working day of 2021 - January 9.

Under such conditions, in section 1 of the 6-NDFL calculation for 2021, the accountant should correctly reflect the salary as follows:

- in line 020 – the amount of the December “salary” (RUB 180,000);

- in lines 040 and 070 - calculated and withheld personal income tax (RUB 23,400).

In section 2 of the 6-NDFL calculation for 2021, the December “salary” paid on December 30 should not appear in any way. You will show it in calculations for the first quarter of 2021. After all, when filling out section 2, you need to focus on the date no later than which personal income tax must be transferred to the budget. That is, paid income and withheld personal income tax must be shown in the reporting period in which the deadline for paying personal income tax falls. Such clarifications are given in the letter of the Federal Tax Service of Russia dated October 24, 2016 No. BS-4-11/20126. In our example, personal income tax must be transferred on the next working day in January – January 9, 2021. Therefore, in section 2 of the calculation for the first quarter of 2021, the December salary will need to be shown as follows:

- line 100 – December 31, 2016 (date of receipt of income);

- line 110 – December 31, 2016 (date of personal income tax withholding);

- line 120 – 01/09/2017 (date of transfer of personal income tax to the budget);

- line 130 – 180,000 (amount of income);

- line 140 – 23,400 (personal income tax amount).

Keep in mind that the tax withholding date on line 110 of section 2 of the 6-NDFL calculation for the 1st quarter of 2021 will be exactly December 31, and not December 30, 2021 (when the payment was made). The fact is that it was on December 31, 2021 that you had to accrue the December salary and offset it against the previously paid advance (which, in fact, was the December salary). The situation is similar with payments until December 30. If, for example, the salary calculation for December was made in the period from December 26 to 29, then the date of personal income tax withholding should still be the date “12/31/2016”.

Withholding personal income tax until the end of the month

Example 2

The organization transferred “salaries” for December to the employees on December 26 in the amount of 380,000 rubles. On the same day, personal income tax was withheld in the amount of 49,400 rubles (380,000 x 13%). The withheld amount was transferred to the budget the next day - December 27, 2021.

In order to fill out 6-NDFL, the accountant turned to the letter of the Federal Tax Service dated March 24. 2021 No. BS-4-11/5106. In this letter, it was recommended to withhold personal income tax on the day of actual payment of salaries (December 26), and transfer the withheld amount to the budget the next day (December 27). In addition, tax authorities advise reflecting these same dates in the 6-NDFL calculation. However, we do not recommend following such recommendations and filling out section 2 of the 6-NDFL calculation for 2021 in this way, for at least two reasons:

- a 6-NDFL calculation filled out in this way will not pass format-logical control and will return with the error “the date of tax withholding must not precede the date of actual payment”;

- withholding personal income tax from wages until the end of the month contradicts later recommendations of the Russian Ministry of Finance in a letter dated June 21. 2016 No. 03-04-06/36092.

Personal income tax was withheld from the January advance

Some accountants withheld personal income tax from the December salary during the next payment of income - from the advance payment for January 2021. How to fill out 6-NDFL in this case? Let's understand it with an example.

Example 3

The organization transferred the salary for December on the 30th in the amount of 120,000. The organization did not calculate and withhold personal income tax from the payment made. The accountant calculated personal income tax on December 31, 2021. The tax amount turned out to be 15,600 rubles (120,000 x 13%). This amount was withheld from the next payment - from the advance payment for January 2021, issued on January 19, 2021.

Under such conditions, the salary for December 2021 will be transferred to line 020 of the 6-NDFL calculation for 2021, and the personal income tax from it to line 040 of section 1 of the 6-NDFL calculation for 2021. Moreover, the tax that was not withheld must be shown on line 080, since the organization should have withheld it, but did not.

In section 2, the operation in the 6-NDFL reporting for the first quarter of 2021 can be shown as follows:

- line 100 – December 31, 2016 (date of receipt of income);

- line 110 – 01/19/2017 (withholding date);

- line 120 – 01/20/2017 (date of payment to the budget);

- line 130 – 120,000 (amount of income);

- line 140 – 15,600 (personal income tax amount).

Such completion and actions of the accountant, in our opinion, cannot be called correct, since the requirement of paragraph 6 of Article 226 of the Tax Code of the Russian Federation has been violated, according to which personal income tax from wages under an employment contract must be transferred no later than the day following the day of payment of income. Accordingly, line 120 must contain a date no later than 01/09/2017. Moreover, it is not entirely clear what prevented the accountant from withholding tax in December and not postponing this operation to the next year. We do not rule out that the above-mentioned filling option may also be returned to the tax agent marked “error.” However, according to our information, some tax inspectorates recommend filling out the 6-NDFL calculation this way. Therefore, in such a situation, we recommend additional consultation with your Federal Tax Service.

Instructions for filling out Form 6 Personal Income Tax

Since the form was introduced recently, filling it out raises a number of questions for employers and accountants. Let's figure out step by step how to fill out the reporting form.

The document consists of a title page and a second page containing 2 sections. If there are not enough lines for reporting, then it is permissible to number additional sheets. Most often, there are not enough lines to fill out the second section, located on the same page as the first. If this happens, then there is no need to duplicate the content of the first section.

The following is an example of filling out 6 personal income taxes for 2021 with step-by-step instructions for each line of the report.

Cover page of form 6 personal income tax

Step 1 - TIN and checkpoint

In the upper fields of the title page the INN and KPP of the company submitting the report are indicated. If the report is submitted by a branch of the company, then the checkpoint of the branch is indicated.

Step 2 - Correction number

The adjustment involves options for filling out submitted reports. If errors or inaccuracies are later discovered in the report data, they can be corrected by sending an updated version of the report. So, if the calculation of 6 personal income tax is submitted for the first time, then zeros are entered in the “adjustment number” field. As the calculation is refined (if necessary), numbers 001, 002, 003 and so on are entered.

Step 3 — Reporting by quarter (period number)

Previously, when submitting a personal income tax report, the year was not divided into reporting periods, therefore the Tax Code of the Russian Federation does not contain the concept of “reporting period” in relation to this particular tax. Now, the wording “submission period” has been added to the 6-NDFL reporting form - that is, the time period for which the employer reports. So if:

- the report is prepared for the 1st quarter, then code 21 is entered

- for half a year - code 31

- for 9 months - code 33

- for the year - code 34.

Step 4 - Tax period

This period is the current calendar year - the corresponding 4 digits are entered in the field.

Step 5 — Tax service code at the place of registration

The line indicates the code of the tax office where the reporting is sent. This is a four-digit code, where the first 2 digits are the region number, and the second two are the inspection code itself (using the example of the Federal Tax Service Inspectorate No. 9 of the Central District of St. Petersburg). It is important to remember that reporting is sent to the inspectorate at the location of the company or division. Individual entrepreneurs submit this report to the tax office at their place of residence.

Step 6 - code at the place of registration of the company

The code “By location (accounting)” helps determine which company submits reports. Such codes are specified in Appendix No. 2 to the Procedure for filling out 6-NDFL.

If the report is provided:

- at the place of registration of the Russian company, you need to enter 212

- at the place of registration of the department (branch) - 220

- The largest taxpayers enter code 213.

Individual entrepreneurs also have separate codes:

- Individual entrepreneur on the general or simplified tax system - code 120

- Individual entrepreneur on the patent system or UTII - code 320

Step 7 - Title

The short (if any) or full name of the company is printed in the “tax agent” field.

Step 6 — OKTMO (municipal entity) code

It is necessary to enter the code of the municipality in whose territory the enterprise or its branch is located and registered (if the report is submitted for a branch). Using the example, the code of the municipal district No. 78 of St. Petersburg, to which the Russian Federal Tax Service inspection No. 9 belongs. Sometimes citizens are paid money (salaries and bonuses) by both the parent company and its division. In this case, two calculations with different OKTMO codes are filled out and submitted to the inspectorate at once.

Section 1

The title page is designed. You can go to a sample of filling out section 1 of form 6 of personal income tax.

The first section of the reporting consists of 2 blocks.

The first block includes summarized data for each tax rate used by the enterprise. One organization can charge personal income tax at several rates - 13%, 15%, 30% or 35%. The basic rate in Russia is 13 percent. Higher rates (15 and 30%) apply to citizens who are not residents of Russia. A 35% rate applies to winnings from sweepstakes, competitions or promotions. If the company uses only the main rate, then the first block of the 1st section is filled out once.

The second block summarizes the results for all personal income tax interest rates if the company applies several.

Block 1 - generalized data for each tax rate separately

Step 1 - Line 010. Tax rate

In field 010 the rate value is entered as a percentage. If necessary (if several different rates are applied), you can number and add sheets. There is no need to duplicate the total data (lines 060 to 090) - the total on the first page is enough; on the following sheets, zeros are placed in these fields.

Step 2 - Line 020. Accrued income

This field sums up all the income of the organization’s employees, calculated incrementally from the beginning of the year. If dividends were paid to anyone, their amount is entered in a separate column 025.

Step 3 - Line 030. Tax deductions

If citizens have been provided with tax deductions since the beginning of the year, then their amount must be recorded in the field with the number 030. Deductions are non-taxable amounts that allow you to reduce the overall financial base when it is withheld. Deductions are available to employees with children (a certain amount for each child). Employees also have the right to apply for social and property tax deductions.

Step 4 - Line 040. Full calculated personal income tax

Line 040 shows the full tax calculated from the total income of an individual in rubles without kopecks. The calculation is made as follows: column 040 minus column 030 multiplied by column 010. That is, subtract the amount of tax deductions from the total amount of income and multiply by the tax rate. Example: (20) * 13 = 329,680. Thus, the amount of personal income tax calculated as an example is equal to 329,680 rubles.

Tax on dividends is calculated separately and recorded in column 045: income in column No. 025 is multiplied by the tax rate in column 010. In our example, this is: 45,500 * 13 = 5,915 rubles.

Step 5 - Line 050. Amount of advances in rubles

This field is filled in only if the company employs foreigners on a patent basis. Then line 050 records the amount of advances in rubles paid to foreigners. In other cases, enter zero.

Block 2 - final indicators 6 personal income tax

Step 6 - Line 060. Number of people who received income during the reporting period

The field indicates the total number of individuals to whom the organization accrued payments for the period. If an employee quit during the reporting year and returned to the company again, then there is no need to change the data in the line.

Step 7 - Line 070. Total amount of tax withheld at all rates

The amount of withheld tax, which should appear in field number 070, in fact does not necessarily coincide with the number in line 040 (the amount of calculated tax). This usually occurs due to the fact that some tax amounts were calculated earlier and withheld from employees later.

Step 8 - Line 080. Unwithheld tax

Column 080 contains amounts of personal income tax that could not be withheld for any reason.

Step 9 - Line 090. Tax refunded

Line 090 records the amount of tax that was withheld incorrectly and returned back to the employee. If no such incidents occurred, a zero is entered.

Section 2

This part of the 6 personal income tax report contains only information for the last quarter, and not for the entire period since the beginning of the year. In the second section of the sample form, we listed the dates of payment of income to employees and their monetary amounts. It is necessary to arrange the specified dates in chronological order.

Step 10 - Line N 100. Date of receipt of income by employees

Column 100 includes the day on which the company’s employees received income. The date and month that must be specified depend on the nature of the payments. The date on which the employee receives income depends on the specific type of payment. Thus, a salary becomes a citizen’s income on the last day of the month for which it is paid. Therefore, it is permissible to indicate in this line the last day of December 2015, if employees received their salaries for December only in January. But vacation pay and sick pay are recognized as citizens’ income on the day they are received.

Step 11 - Line N 110. Day of tax withholding by the company

Column 110 must contain the number (day, month, year) of direct tax withholding by the organization. Personal income tax must be withheld from your salary directly on the day it is paid. So, if the salary for December is paid on January 11, then the tax from it is also withheld on January 11. Personal income tax on vacation and sick pay is also withheld by the company on the day they are paid.

Step 12 - Line N 120. Date of transfer of tax to the budget

Column 120 is a field containing the date of deduction of the tax amount to the budget according to the law. Personal income tax from the salary must be included in the budget no later than the next day after its payment. But the tax on vacation and sick leave paid to employees cannot be paid to the treasury immediately - the main thing is to do it before the end of the month in which they were issued to employees (Article 226 of the Tax Code of the Russian Federation).

Step 13 - Line N 130. Income in rubles without tax deduction

Field 130 indicates the amount of money actually received by employees on a certain date (filled in column 100 on the left), without deducting tax.

Step 14 - Line N 140. Personal income tax that must be withheld from the amount

Column 140 should contain the amount of personal income tax withheld upon payment of income to employees as of the date recorded in column 110 (regardless of the transfer to the budget). It is acceptable to add numbered sheets if there is not enough page to list all income for the quarter by date.

Important note!

When filling out the reporting form, you must ensure that all the cells in it are filled out. Dashes are placed in empty cells as follows:

This rule must also be observed on the title page. Even in the longest line containing the name of the organization, all remaining spaces are filled with dashes.

Salaries for December were paid in January

Many employers paid salaries for December in January 2017. If so, then show the December salary issued in January 2017 in the 6-NDFL reporting for 2021 only in section 1. After all, you recognized income in the form of wages in December and calculated personal income tax on it in the same month. Therefore, when calculating 6-personal income tax for 2016, distribute payments as follows:

- on line 020 – accrued income in the form of December salary;

- on line 040 – calculated personal income tax.

Line 070 of the 6-NDFL calculation for 2021, intended for withheld tax, is not increased in this case, since the withholding took place already in 2021 (letter of the Federal Tax Service of Russia dated December 5, 2016 No. BS-4-11/23138). In section 2 of the annual calculation, do not show the December salary paid in January (letter of the Federal Tax Service of Russia dated November 29, 2021 No. BS-4-11/22677)

Salaries for December were issued after the New Year

On January 9, 2021, the organization issued employees salaries for December 2021 - 250,000 rubles. Personal income tax was withheld from the payment on the same day - 32,500 rubles. (RUB 200,000 × 13%). Add this amount to line 070 of the 6-NDFL calculation for the first quarter of 2021. In section 2 of the same calculation, distribute the dates along lines 100–140:

- line 100 – December 31, 2016 (date of receipt of income);

- line 110 – 01/09/2017 (date of personal income tax withholding);

- line 120 – 01/10/2017 (date of transfer of personal income tax to the budget).

Filling out 6-NDFL (line 130), if the tax base is zero

Let’s say that the employee’s deductions reduce the tax base to zero. In this case, lines 100-140 of section 2 are still filled in. There are no exceptions for such situations.

The accrued salary must be reflected on line 020, deductions on line 030 of section 1.

For wages, the date of actual receipt of income is the last day of the month for which it was accrued. This is line 100 of section 2.

The personal income tax withholding date coincides with the day when the salary was issued or transferred to the employee’s account. This is the date on line 110 of section 2.

According to line 120 of section 2 - the deadline for paying the tax (the next day after the payment of wages). Even if nothing was withheld from the employee, line 120 is filled in.

On line 130 of section 2 - accrued salary, and on line 140 - personal income tax (in this case “0”)

Example

At LLC "Zarya" at 0.5 rates with a salary of 12,000 rubles. Ivanova works as an accountant. Ivanova’s salary for August 2021 was 6,000 rubles, the same amount as a deduction for a disabled child as a single parent. Salaries were issued on September 5, 2021.

In section 2 of form 6-NDFL, line 130 is filled in, as are lines 100-120.

Fragment of 6-NDFL calculation

Salaries for September were paid in October

The deadline for paying personal income tax on salaries for September is October 2021. Therefore, when calculating for nine months, the accountant showed this payment only in section 1. Now these amounts need to be transferred to the reporting for 2021. See “6-NDFL for 9 months of 2021: example of filling out”.

In section 2 of the 6-NDFL calculation for 2021, you need to show the salary for September paid in October. Let's assume that the September salary was paid on October 10. The accountant will fill out section 2 of the annual calculation of 6-NDFL as shown in the example. The validity of this approach is confirmed, for example, by the Letter of the Federal Tax Service of Russia dated 01.08. No. BS-4-11/13984.

How to make it easier to compile 6-NDFL and is it possible not to submit it?

The opportunity not to submit 6-NDFL appears only in one case - if there were no payments in favor of individuals during the reporting period.

This situation is possible if:

- the business is at a preliminary stage of formation (the stage of solving organizational aspects, recruiting staff - in this case, no payments are made to individuals);

- financial condition does not allow making any payments due to lack or absence of financial resources;

- in other similar situations.

In this case, it is advisable to inform the tax office about failure to submit 6-NDFL in a letter, a sample of which you can find here.

Moreover, if in the 1st quarter of 2021 income was paid, and then there were no payments until the end of the year, 6-NDFL for all reporting periods must be submitted, since the calculation must be compiled on an accrual basis from the beginning of the year.

In such situation:

- in section 1 for the periods following the 1st quarter, information is not entered due to its absence - when filling out this section, the payments of the latter in the reporting period of the quarter are taken into account;

- in section 2 of the calculations for all subsequent reporting periods, the indicators of the 1st quarter will be repeated.

You can facilitate the preparation of 6-NDFL in the following ways:

- use special software products;

- minimize the risk of errors (control the verified calculation parameters, including using the control ratios used by tax authorities) - this will avoid submitting adjustments and other clarifications;

- other methods (strengthening control over the reliability of data at the stage of collecting primary information, systemic training of company specialists, allowing them to freely navigate the nuances of tax legislation, etc.).

The mechanism for reducing the risk of errors in 6-NDFL is discussed in the article “Control ratios for checking the 6-NDFL form” .

How the desk audit of the 6-NDFL report is carried out, read here.

How to reflect bonuses in annual calculations

If bonus payment transactions were completed in the fourth quarter of 2016, then they must be shown in the annual calculation of 6-NDFL. However, keep in mind that salary and bonus in section 2 of form 6-NDFL must always be separated from each other. The fact is that the date of receipt of income in the form of wages is the last day of the month for which the employer accrued income (clause 2 of Article 223 of the Tax Code of the Russian Federation). A bonus is a bonus, not a salary, so the date of receipt of income is the day of payment (letter of the Federal Tax Service of Russia dated 06/08/2016 No. BS-4-11/10169). This means that the dates in rows 100 for income will differ. When paying salaries and bonuses, the tax agent needs to fill out two blocks of lines 100–140, even if the salary and bonus were paid on the same day. Let's explain with an example.

How to show bonuses in the annual 6-NDFL

On December 9, 2021, the organization gave employees a salary for November in the amount of 340,000 rubles. and a bonus - 210,000 rubles. Personal income tax from salary – 44,200 rubles. (340,000 rubles × 13%), and from the bonus – 27,300 rubles. (RUB 210,000 × 13%). The date of receipt of salary income is November 30, 2016, and bonuses are December 9, 2016. The accountant will distribute these payments in different lines 100 - 140 of the 6-NDFL calculation for 2021. In this case, the indicators of the 100 rows will differ.

If you paid the annual bonus for 2021 to employees in 2017, then, of course, it will not fall into section 2 of the annual 6-NDFL. You will show the bonus in the calculations for 2017.

Is it necessary to submit a zero calculation?

The answer to this question is clear – there is no need. Entrepreneurs and firms are required to submit Form 6-NDFL only when they are tax agents. And they are recognized as such when they pay wages to their employees. Based on this, we can say that there are three cases when this report does not need to be submitted:

- the organization or entrepreneur operates without hired employees;

- there are employees on staff, but no payments were made during the reporting period;

- the company or entrepreneur is temporarily not operating.

Payments under a civil contract: payment in January

Let's consider another situation when an act for work performed (services rendered) under a civil contract with an individual was approved in December 2021, and payment for it took place in January 2017. In this case, the remuneration under the contract and personal income tax from it should be shown in sections 1 and 2 of the calculation for the first quarter of 2021. Do not show the operation in the 2021 calculations. This follows from the letter of the Federal Tax Service of Russia dated December 5, 2016 No. BS-4-11/23138.

If in December an advance was issued under a civil contract, then it should fall into section 2 of the annual calculation.

Advance under a contract

The organization paid an advance to an individual under a contract on December 19, 2021 in the amount of 20,000 rubles. The tax withheld from this amount amounted to 2600 rubles. (20,000 x 13%). The balance is planned to be issued in January 2021 - after completion and delivery of all work.

In such a situation, reflect the advance to the contractor in the payment period (in December). The date of receipt of income in this case is the day when the company transferred or issued the money to the person. It does not matter whether the company issues money before the end of the month for which the service is provided, or after.

In section 2 of the 6-NDFL calculation for 2021, show the advance by line:

- 100 “Date of actual receipt of income” – 12/19/2016;

- 110 “Tax withholding date” – 12/19/2016;

- 120 “Tax payment deadline” – 12/20/2016;

Method of transferring the annual calculation to the Federal Tax Service

Send calculations in Form 6-NDFL for 2021 to tax authorities electronically via telecommunication channels. “On paper” reporting can be submitted in the only case - if during the reporting or tax period the number of individuals (recipients of income) was less than 25 people. This follows from the provisions of paragraph 7 of paragraph 2 of Article 230 of the Tax Code of the Russian Federation.

Possible fines and account blocking

For late submission of 6-NDFL for 2021, a fine is possible - 1000 rubles for each full or partial month from the date for submitting the calculation (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). But also, if you do not submit the annual calculation within 10 days starting from April 3, 2021, then the Federal Tax Service has the right to block the bank account (clause 3.2 of Article 76 of the Tax Code of the Russian Federation). In addition, if, based on the results of the audit, tax officials find false information in the calculation, the fine for each calculation with such data will be 500 rubles.

Practical conclusions

The procedure for filling out 6-NDFL does not explain the sequence of actions when filling out calculations in various situations that an accountant may encounter on a daily basis. We do not rule out that in the future the Procedure for filling out 6-NDFL will be supplemented or that the official authorities will provide comprehensive explanations that will help you understand how to draw up a new calculation. But it is already clear that the formation of the 6-NDFL calculation will become a process that requires special attention and additional labor costs on the part of the accountant. But for failure to submit or untimely submission of 6-NDFL calculations, not only fines are possible, but also suspension of transactions on the tax agent’s accounts. There are also fines for inaccurate data in calculations (for more details, see “How the reporting of tax agents for personal income tax will change from 2021”).

We also remind you that in addition to the new quarterly 6-NDFL calculations, tax agents will still have to submit “individual” personal income tax reporting for each employee (no later than April 1 of the year following the reporting year). Currently, the order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/ [email protected] , which approved the new form 2-NDFL. It will need to be used when preparing “individual” personal income tax reporting for 2015.

In our opinion, for those who plan to report on personal income tax “on paper” next year, it will be difficult to summarize data for all employees in the calculation of 6-personal income tax, and at the same time separately reflect information on tax rates, dates of receipt of income, dates of withholding and transfer Personal income tax. It is much more reasonable to generate and submit 6-NDFL calculations using a web service, where all the necessary data on employees will be “pulled” into the reporting automatically, without user participation, after which the generated report can be checked for errors and sent to the inspectorate via the Internet. Note that if a tax agent employs 25 people or more, then he does not have a choice of reporting method - he is obliged to submit 6-NDFL calculations electronically via telecommunication channels (new edition of paragraph 2 of Article 230 of the Tax Code of the Russian Federation; see "Federal Tax Service: tax agents who paid income in favor of 25 people or more in 2015 are required to submit 2-NDFL via the Internet").