The legislation provides for the opportunity to submit an application for a refund of state duty. At the same time, in order to return the state duty paid when applying to the court, you must first obtain a ruling and a certificate from the court, and then contact the tax authority.

It should be taken into account that the tax authority will return the state duty only in cases established by the Tax Code of the Russian Federation. If the court refuses the claim or partially satisfies it, the state fee paid when applying to the court is not refundable in full. There are also nuances when concluding a settlement agreement.

Grounds for refund of state duty

An interested person may file an application to the court in cases where:

- the payer generally refused to go to court. It doesn’t matter for what reasons, the fact itself is needed - there is no fact of filing a claim in court

- the court refused to accept the statement of claim (Article 134 of the Code of Civil Procedure of the Russian Federation)

- a ruling was made to return the statement of claim (Article 135 of the Code of Civil Procedure of the Russian Federation)

- the proceedings were terminated (Article 220 of the Code of Civil Procedure of the Russian Federation)

- The court left the application without consideration (Article 222 of the Code of Civil Procedure of the Russian Federation)

- the amount of the state duty was calculated incorrectly (excessive payment of the state duty to the court).

That is, legally significant circumstances must arise that will serve as the basis for a refund of the state duty. They must be indicated in your application and supported by documents.

The grounds and procedure for the return and offset of state duty are regulated by Article 333.40 of the Tax Code of the Russian Federation

An application for the return of an overpaid (collected) amount of state duty is submitted by the payer of the state duty to the body (official) authorized to perform legally significant actions for which the state duty was paid (collected).

The application for the return of an overpaid (collected) amount of state duty must be accompanied by original payment documents (if the state duty is paid in cash) or copies of payment documents (if the state duty is paid in cashless form). An application for the return of an overpaid (collected) amount of state duty may be submitted within three years from the date of payment of the specified amount. Refund of the overpaid (collected) amount of state duty is made within one month from the date of filing the specified application for refund. (clause 3 of article 333.40 of the Tax Code of the Russian Federation).

The procedure for collecting and returning fees for providing information contained in the Unified State Register of Real Estate and other information was approved by Order of the Federal Service for State Registration, Cadastre and Cartography dated May 13, 2021

Clause 11 . The fee received by the rights registration authority is refundable:

in full if the applicant did not submit a request for information from the Unified State Register of Real Estate; if it is paid in a larger amount than provided for in accordance with Part 2 of Article 63 of the Law, funds in an amount exceeding the amount of the established fee are subject to return.

Clause 12 . . The payment is returned on the basis of an application from the payer or his legal successor (hereinafter referred to as the application for a return of payment) or on the basis of a court decision. If an application for a return of payment is submitted electronically, such an application is signed with an enhanced qualified electronic signature of the applicant.

Clause 13 . An application for a refund of payment is submitted to the rights registration authority to which the request for information contained in the Unified State Register was submitted, using one of the methods provided for submitting a request.

If an application for a refund of payment is submitted electronically, such an application is signed with an enhanced qualified electronic signature of the applicant. An application for a refund of payment can be submitted within three years from the date of payment.

Clause 14 . The application for a refund of payment shall indicate: a unique accrual identifier (indicated if available), bank details necessary to return the payment to the person who submitted such an application, as well as last name, first name, patronymic (the latter - if available), SNILS or details of an identity document , - for an individual, name of a legal entity, taxpayer identification number (TIN), registration reason code (KPP), foreign organization code (FCO) (for a foreign organization), main state registration number (OGRN), personal or bank account , name of the recipient's bank, bank identification code (BIC), bank correspondent account - for a legal entity, details of the document confirming the transfer of payment (date, number), amount of the fee paid, information about the payer (for an individual - last name, first name, patronymic ( the latter - if available), SNILS, for a legal entity - name, OGRN, INN or KPP, KIO), as well as the postal address or email address of the applicant.

The application for a refund of payment must be accompanied by original payment documents (if the payment is paid in cash) or copies of payment documents (if the payment is paid in cashless form). If there is information on payment of the fee contained in the State Information System on state and municipal payments, the submission of documents confirming payment of the fee is not required. If an application for a refund of payment is submitted by the payer's legal successor, simultaneously with the application, documents confirming the transfer of the rights of claim to the payer's legal successor are submitted (sent), including those certified by the head of the legal entity that is the payer's legal successor, extracts from transfer deeds, and separation balance sheets.

Clause 15 . If the application for a refund of payment does not contain the information specified in paragraph one of paragraph 14 of this Procedure, or if the documents specified in paragraph four of paragraph 14 of this Procedure are not provided, such an application is considered not received and is not considered by the rights registration authority. In this case, the rights registration authority to which such an application is submitted, no later than five working days from the date of filing the application, sends the applicant to the email address specified in the application (if there is no email address in the application, to the postal address specified in application), a notice specifying the requirements in accordance with which such application must be submitted.

Clause 16 . The rights registration body, which is not the budget revenue administrator, within three working days from the date of receipt of the application for the return of payment and the documents attached to it, sends them to the rights registration body that has the powers of the budget revenue administrator, except for the case provided for in paragraph one of clause 17 of this OK.

The rights registration body, which is not the budget revenue administrator, simultaneously with the application for a refund of the payment sends to the rights registration body, which has the powers of the budget revenue administrator, the information necessary to make a decision on the return (or refusal to return) the payment. The rights registration authority, which is the administrator of budget revenues, within ten working days from the date of receipt of the application for the return of the payment and the documents attached to it, makes a decision on the return (refusal to return) the payment. If a decision is made to return the payment, the rights registration authority, which is the administrator of budget revenues, within five working days from the date of the decision to return the payment sends an application for the return to the Federal Treasury. If a decision is made to refuse to return the payment, the rights registration authority, which is the administrator of budget revenues, within five working days from the date of the decision to refuse to return the payment sends the applicant a notice of the decision made to refuse to return the payment. Clause 17 . If the fee is credited to the account of the rights registration authority that is not the budget revenue administrator, such authority that received the application for the return of the payment, within ten working days from the date of receipt of the application and the documents specified in paragraph 14 of this Procedure, makes a decision on the return (refusal). in return) payment. If a decision is made to return the payment, the rights registration authority, which is not the budget revenue administrator, within two working days from the date of the decision to return the payment sends an application for the return to the Federal Treasury authority. If a decision is made to refuse to return the payment, the rights registration authority, which is not the budget revenue administrator, within two working days from the date of the decision to refuse to return the payment sends the applicant a notice of the decision made to refuse to return the payment.

Refund from the budget of an erroneously (excessively) paid payment amount.

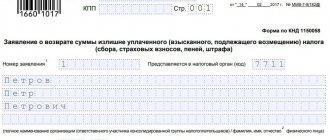

Form and sample application for a refund from the budget of an erroneously (excessively) paid amount for individuals Form and sample application for a refund from the budget of an erroneously (excessively) paid amount for legal entities Form and sample application to clarify the type and nature of the payment

Consideration of an application for refund of state duty

An application for a refund of state duty is submitted to the same court that heard the civil case. If the application is returned by the court or its acceptance is refused, if the citizen changes his mind about filing a claim in court, the application is still submitted to this court.

Documents can be filed with the court within 3 years. The tax authority and the court will count this period either from the moment the funds are transferred to the budget (when the applicant did not go to court). Or from the moment the court makes a decision to return the state duty. For example, the court will make such a decision automatically based on a ruling to terminate proceedings in a civil case. A missed deadline can be restored (Reinstatement of a procedural deadline).

The applicant must attach a genuine payment document to the application for a refund of the state duty. Or indicate that the court added the document to the case materials. In addition to the actual request for consideration of the merits of the issue of return of payment, the applicant must ask the court to issue a certificate. Without a court certificate, the tax authority will not return the money.

An application for a refund of state duty is considered by the judge alone; a court hearing on this matter is not held. The court does not summon the applicant, so the application must describe all the circumstances in as much detail as possible so that the judge understands everything correctly.

After the ruling is issued (usually within 5 days) and it enters into legal force (15 days), the applicant receives a certified copy of the ruling, a certificate and the original document on payment of the state duty (if the issue of refunding the state duty is partially resolved, then a certified copy of the payment document is issued) court office.

The interested party submits these documents (originals), along with the application, to the tax authority at the location of the court. Refund of the state duty to the tax authority occurs within 1 month from the date of application.

Sample application for refund of state duty for a foreign passport to the Federal Migration Service

In order to return the fee paid to the Federal Migration Service, you must submit an application to the authority that controls the return.

Let's consider what features are available when drawing up an application:

- The application is submitted to the head of the migration authority.

- Some questions were transferred to the Main Directorate for Migration Issues of the Ministry of Internal Affairs of the Russian Federation, so an application should be written to the Main Directorate of the Ministry of Internal Affairs of the Russian Federation.

- The application may have a special form, so it is better to contact the migration department directly to resolve the issue.

- On your own behalf, you can fill out an application in any form. It should definitely indicate for what reasons the fee should be returned, in what amount, and also indicate whether you resolved the issue through other authorities.

- Applications and documents should be included at the end of the application.

- The details to which the payment should be made must be in the name of the applicant.

- If a representative applies, the power of attorney number must be indicated and the authority to perform these return actions must be indicated.

- When contacting the department of a legal entity, the signature on the application must only be from the general director. Another person cannot sign the document.

Here is an example of a written application to the migration department of the Main Directorate of the Ministry of Foreign Affairs of the Russian Federation

When contacting the FMS, you can use the following sample application:

A ready-made application form for a refund of state duty to the tax authority is available free of charge.

Sample application to court

In _____________________

(name of court)

Applicant: _____________________

(full name, address)

Application for refund of state duty

The applicant paid the state fee “___”_________ ____ in the amount of ____ rubles. in order to apply to the court with a statement of claim _________ (indicate, if necessary, what application was filed with the court, whether it was accepted, what actions the court took, what court decisions were made, the number of the civil case and the names of the persons participating in the case).

The state duty is refundable because _________ (indicate the circumstances that serve as the basis for the return of the state duty, list the documents that confirm this).

Based on the above, guided by Article 333.40 of the Tax Code of the Russian Federation,

Ask:

- Refund the state duty in the amount of ____ rubles paid by me “___”_________ ____ in accordance with _________ (indicate the details of the document on payment of the state duty).

- Issue a certificate of refund of state duty to the tax authority.

List of documents attached to the application:

- Original document confirming payment of state duty

- A copy of the court ruling (on refusal to accept, on return of application, etc.)

Date of application “___”_________ ____ Signature _______

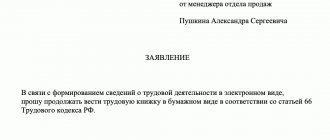

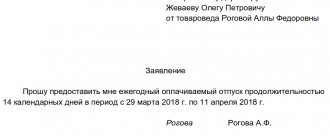

statements:

Application for refund of state duty to court

How to return previously paid state duty from the tax office

To return the state fee, the person who paid it must submit an application for a refund within three years following the payment.

The submitted application must be addressed to the government department that is authorized to provide the services you paid for.

However, before taking the application to the required address, you need to collect additional papers that will confirm your right to carry out the procedure:

- if you want to return the entire amount, then you must attach a copy of the check or receipt received for payment of the duty to your application;

- If you are claiming a refund of only part of the specified amount, then you must also provide a copy of the payment form.

Provided that your request for a refund is satisfied, the refund will be made one month from the date of application and submission of documents.