Accounting for mobile phones in an organization. Part 1

Yulia Latkina, lawyer Tax Law

The mobile phone is a common means of communication. Due to its availability, it is now used by organizational managers as the best means of communication. For an accountant, a mobile phone is just an accounting object. All expenses associated with its acquisition and operation are subject to accounting depending on at whose expense the telephone was purchased, who uses it, for what purposes and who pays the costs of negotiations.

PURCHASING AND CONNECTING TO THE NETWORK OF MOBILE PHONES

When organizations purchase cell phones, accountants face the problem of accounting for them. In accordance with clause 4 of the accounting regulations “Accounting for fixed assets” (PBU 6/01), approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, property used in production or for management needs for a period exceeding 12 months, and capable of bringing economic benefits to the organization is taken into account as fixed assets. A mobile phone purchased by an organization satisfies these criteria, therefore, it should be taken into account as part of the organization's fixed assets. If a mobile telephone device is accepted in accounting as an object of fixed assets, then the organization must draw up an act of acceptance and transfer of fixed assets in the OS-1 form. Form OS-1 is used to record the commissioning of fixed assets, to register the internal movement of fixed assets from one structural unit of the organization to another, to register the transfer of fixed assets from a warehouse (from stock) into operation, as well as to exclude them from fixed assets upon transfer or sale to another organization. When registering the acceptance of fixed assets, an act of form OS-1 is drawn up in one copy for each object by members of the acceptance committee appointed by order (order) of the head of the organization. Drawing up a general act documenting the acceptance of several fixed assets is allowed only when taking into account production and business inventory, tools, equipment, etc., if these objects are of the same type, have the same cost and were accepted in the same calendar month. The act (invoice), after its execution with the attached technical documentation related to this object, is transferred to the accounting department of the organization, signed by the chief accountant and approved by the head of the organization or a person authorized to do so. When registering the internal movement of fixed assets, an act of form OS-1 is written out in two copies by an employee of the structural unit of the donating organization. The first copy with the receipt of the recipient and the deliverer is transferred to the accounting department, the second - to the structural unit of the delivery organization. It is allowed to draw up a general act (invoice) of acceptance and transfer of fixed assets in the OS-1 form, documenting the acceptance of a group of similar fixed assets objects if these objects have the same cost and are accepted in the same calendar.

Landline phone

Before talking about reflecting costs associated with telephony, it is worth understanding what specific expenses the organization makes.

As a rule, the costs associated with the installation of telephones include the costs of purchasing telephone sets and a telephone exchange, laying cable lines, connecting to the local telephone network with the provision of a telephone number. Purchased telephone sets are included in the organization's balance sheet as fixed assets (regardless of their cost).

If the cost of the device is less than 40,000 rubles, then it can be written off as an expense after it is put into operation.

If there are no free subscriber lines in telephone communication cables, construction work on laying the missing communication lines can be carried out by a telephone center at the expense of the company. After completing the work, the telephone center enters into an agreement with the company for the provision of telephone services.

The costs of laying a cable line are reflected in accounting in account 08 “Investments in non-current assets”.

After completion of the work, the amounts spent are written off to the debit of account 01 “Fixed assets”.

Example 1

Vector LLC (tenant) entered into a lease agreement for industrial premises for a period of two years with Alpha LLC (lessor).

Since there were no telephones in the premises, and they were necessary for work, with the consent of the landlord, Vector submitted an application to the local telephone center to conclude an agreement for the provision of telephone services. The tenant entered into a contract with the telephone center for the construction of a new cable line. The contractual cost of the work was 59,000 rubles. (including VAT - 9,000 rubles). The following entries were made in Vector's accounting: DEBIT 08-4 CREDIT 60

- 50,000 rubles.

(59,000 – 9000) – reflects the cost of work on laying a telephone line; DEBIT 19-1 CREDIT 60

– 9000 rub.

– VAT reflected; DEBIT 01 CREDIT 08-4

– 50,000 rub.

– the telephone line has been registered; DEBIT 68, subaccount “Calculations for VAT” CREDIT 19-1

– 9000 rubles. – VAT is accepted for deduction.

If the cable line was laid at the expense of the tenant for telephone installation of the rented premises, then at the end of the lease period it remains in this premises. The cable line in this case is an inseparable improvement of the leased property (resolution of the Federal Antimonopoly Service of the Central District of December 3, 2010 in case No. A62-8422/2009).

Reflection in the lessee's accounting of the transfer of the line to the lessor's balance sheet depends on the terms of the lease agreement.

There is a fairly widespread opinion among tax inspectors that the costs of connecting any new OS are capital ones.

This point of view is justified: the costs of gaining access to the telephone network are indeed long-term. This is due to the fact that the agreement between the subscriber and the operator for the provision of telephone services (with rare exceptions) is unlimited.

An exception may be the case of drawing up an agreement between a telephone exchange and an enterprise renting premises for a certain period. Then a contract will be concluded for the same period.

Summarizing the above, we can propose two ways to reflect the costs of connecting a new phone.

Method 1

If the connection to the local telephone network with the provision of a new telephone number occurred after the signing of the act of putting the new cable line into operation, the costs of connection can be taken into account as part of the costs of constructing the line. This rule is applicable both in accounting and tax accounting (clause 1 of article 257 of the Tax Code of the Russian Federation and clause 8 of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n; further – PBU 6/01).

Method 2

Connecting a telephone may not require installation work, which is paid separately.

Then write off the cost of the service for providing the number at a time - as other expenses associated with production and sales. Example 2

In January, Bereg LLC entered into an agreement with a telephone exchange for the provision of telephone services for a period of one year.

The company paid 59,000 rubles for connecting to the local telephone network. (including VAT – 9000 rubles). The following entries were made in the accounting records of Bereg: DEBIT 26 CREDIT 60

- 50,000 rubles.

(59,000 – 9000) – reflects the cost of connecting to the telephone network; DEBIT 19 CREDIT 60

– 9000 rub.

– VAT reflected; DEBIT 68, subaccount “Calculations for VAT” CREDIT 19

– 9000 rub.

– VAT is accepted for deduction; DEBIT 60 CREDIT 51

– 59,000 rub. – paid for the services of a telephone exchange for connecting to the telephone network. In the tax accounting of Bereg, the costs of telephone services are taken into account in the same amount - 50,000 rubles.

Fixed assets in accounting in 2021

Since the payment was made in parts, the first paid part was RUB 2,000,000. - an entry should have been made in section 2 of the Book of Income and Expenses on February 24, 2021. In section 1, it was supposed to be written off in four stages in equal shares of 500,000 rubles. (RUB 2,000,000: 4 quarters) March 31, June 30, September 30 and December 31, 2021.

Tax accounting of fixed assets under the simplified tax system

The Ministry of Finance in this PBU only provides for the possibility of classifying objects that meet the criteria of fixed assets, but costing less than 40,000 rubles. to inventory accounts. It should be noted that this is a right, not an obligation of the organization. The only strict criterion is objects worth 40,000 rubles. and it can no longer be attributed to the MPZ.

- income from non-exchange transactions (for example, income from taxes, fees, including state duties, customs duties, income from insurance contributions for compulsory social insurance, income from gratuitous revenues from budgets, income from fines, penalties, penalties, compensation for damage);

- income from exchange transactions (income from property, income from sales).

- useful life of fixed assets and intangible assets;

- the amount of estimated reserves;

- the amount of depreciation charges;

- the value of non-financial assets in cases provided for by federal and (or) industry accounting standards for public sector organizations.

Cash flow statement

For accounting purposes, the criterion for recognizing income is the possibility of obtaining economic benefits or useful potential associated with transactions (events), provided that their amount (monetary value) can be reliably determined (clause 7 of the GHS “Income”).

- Any balance sheet consists of assets and liabilities. The difference is that state employees distribute these items, separately reflecting the use of targeted funds and their own profits.

- “Businessmen” reflect in their reports, in addition to the current one, two more previous years, and “public sector employees” – only the previous one.

- Budgetary spheres divide assets into financial and non-financial, and funds into material and monetary; For commercial structures, the division is fundamentally different.

- The budgetary liability reflects all types of obligations, and the commercial one divides them according to terms.

We recommend reading: Lawsuit to increase the pension supplement by 32% for military veterans in 2021

The main principles of accounting remain unchanged, no matter in what organization it is carried out. Everywhere you need to take into account cash, inventories, all kinds of assets and liabilities, reflecting this in the documentation and promptly informing the regulatory authorities.

Differences in reporting

The main difference between commercial and budget accounting is the different accounts on which all business transactions are reflected. For the budgetary sector, a special Chart of Accounts is provided, containing 26 categories.

The last point is especially important because it creates different budget conditions for accepting fixed assets into tax and accounting. The latter needs fixed assets to start in 2021 from an amount of 40 thousand rubles, the tax authorities - from 100 thousand rubles. Only then can it be included in the reporting.

Fixed assets in accounting and tax accounting in 2021

In accounting, the use of increasing factors (not higher than 3) is possible only if the organization calculates depreciation using the reducing balance method. In taxation, special coefficients can be applied to the depreciation rate, calculated both linearly and non-linearly. However, the number of applications of these coefficients is limited. For example, organizations have the right to apply an increased coefficient to the depreciation rate (but not higher than 2) for objects used in an aggressive environment and/or increased shifts (with some restrictions).

Application of coefficients to depreciation rates in accounting and tax accounting

One of the main characteristics of fixed assets in tax and accounting in 2021 is the initial cost. It depends on it whether the object will be used as a primary means or not. Find out what the minimum value of fixed assets is established by the code and PBU in the new year and how to apply the limits.

It makes sense to avoid discrepancies in the formation of the initial cost, since the increased initial cost of fixed assets in accounting does not bring any economic benefits. The only justification for additional inconvenience for an accountant due to differences in accounting is the need to increase assets in order to make the financial statements more attractive to credit institutions or investors, for example.

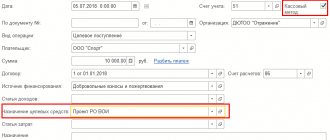

Selecting an account for SIM cards

The provisions of the above-mentioned regulatory legal acts do not define an unambiguous accounting account for SIM cards issued for use by employees of the institution. This means that the procedure for their accounting needs to be developed and consolidated in the accounting policy of the institution (clause 19 of the GHS “Conceptual Framework”, clause 6 of Instruction No. 157n).

Based on the specifics of using SIM cards as information carriers, similar to fuel and refueling cards, the institution may decide to record them in off-balance sheet account 03 “Strict reporting forms” or in an additionally maintained off-balance sheet account (clause 332 of Instruction No. 157n , Letter of the Ministry of Finance of Russia dated October 12, 2012 No. 02-06-10/4243).

The accounting procedure for the additionally introduced off-balance sheet account must be developed and fixed in the accounting policy of the institution. And in order to be able to account for SIM cards in off-balance sheet account 03, they must be included in the list of forms classified as strict reporting forms, established by the institution as part of the formation of its accounting policy (clause 337 of Instruction No. 157n).

Accounting on off-balance sheet account 03 is carried out in the context of persons responsible for storage and (or) issuance of objects, storage locations in a conditional valuation: 1 object, 1 ruble or at the cost of their acquisition - in cases established by the scientific policy of the institution (clause 337 of Instruction No. 157n ).

At the same time, SIM cards, just like mobile phones, are transferred for personal use to employees of the institution. However, it is not possible to take them into account at book value in off-balance sheet account 27. This is explained by the fact that the book value is the value at which the property is recorded in the balance sheet. And SIM cards are not taken into account on balance accounts.

Thus, regulatory legal acts in the field of accounting (budget) accounting do not contain a specific account for accounting for SIM cards. But there are no explanations from the Russian Ministry of Finance on this issue. Therefore, the accounting option for SIM cards must be determined by the institution itself and enshrined in its accounting policy. This can be off-balance sheet account 03 or an additionally entered off-balance sheet account.

Accounting for a telephone purchased by an institution for the personal needs of an employee

When transferring phones for use by employees, additionally reflect them in the balance on account 27 “Material assets issued for personal use to employees (employees).” Keep analytical accounting for account 27 in the quantitative and total accounting card (f. 0504041). This procedure follows from paragraphs 385–386 of the Instructions to the Unified Chart of Accounts No. 157n.

Question

Firstly

, an institution can independently purchase mobile phones and issue them to its employees. In this case, include the telephone in fixed assets and record it in account 101.04 “Machinery and Equipment” (OKOF code 320.26.30.22). This follows from paragraph 38 of the Instructions to the Unified Chart of Accounts No. 157n.

Also, business entities with simplified accounting schemes received the right to immediately depreciate at full price fixed assets related to inventory (they have a low price and a short service life). Such measures allow such entities to reduce the burden when calculating property taxes.

Fixed assets are property owned by the company or attracted by it from the outside, which is used in its production activities for more than one year and has a value above the limit established by regulations.

OS costing up to 40 thousand rubles

Attention! New directories should only be used for objects that began to be used in 2021 and later. There is no need to make corrections to the accounting cards of all previously accepted fixed assets and recalculate their depreciation. This rule is mandatory for both accounting and tax accounting.

In any case, it is important to take into account that fixed assets worth more than 40,000 rubles cannot be reflected in accounting as materials, even if this is provided for in the Accounting Policy. Therefore, fixed assets from 40,000 to 100,000 cannot be accounted for by the organization in account 10 “Materials”. At the same time, when we say “from 40,000,” we mean more than 40,000, since an object with an initial cost of exactly 40,000 rubles can still be taken into account as inventories.

Accounting press and publications

“Modern accounting”, N 10, 2004

SOME QUESTIONS FOR ACCOUNTING MOBILE PHONES

The development of communications in recent years has led to the widespread use of cell phones. The relatively recent formation of the cellular communications market has raised a large number of questions about the accounting of mobile phones.

Options for using phones in an organization

There are four options for using cell phones in an organization, depending on which calculations and payment of taxes are made.

Option 1. The organization uses the employee’s phone through a rental agreement. When renting an employee’s personal phone, the organization pays him the rent established in the contract. In accordance with paragraph 10, paragraph 1, Article 264 of the Tax Code of the Russian Federation, rental payments for leased property reduce the tax base for income tax.

According to paragraph 4, paragraph 1, Article 208 and Article 209 of the Tax Code of the Russian Federation, rent is an employee’s income, subject to personal income tax at a rate of 13%.

Rent is not remuneration for labor, but payment under a civil contract associated with the transfer of property for use, and therefore, according to Article 236 of the Tax Code of the Russian Federation, it is not subject to taxation under the unified social tax.

Note that when renting a phone, its cost is taken into account in off-balance sheet account 001 “Rented fixed assets”.

Option 2. The employee temporarily transfers his phone for free use to the organization under a loan agreement. The employee is not entitled to remuneration under the contract. Therefore, you can pay an employee for using his personal phone by issuing a bonus or financial assistance. The second option is more profitable for both the company and the employee. Although material assistance does not reduce the taxable base for income tax, for the same reason it is not necessary to pay a single social tax (clause 3 of Article 236 of the Tax Code of the Russian Federation). In addition, financial assistance in the amount of up to 2000 rubles. per year is not subject to personal income tax (clause 28, article 217 of the Tax Code of the Russian Federation).

Option 3. The organization pays the employee compensation for using a personal phone. Payment to an employee of compensation for the use of personal property for production purposes is provided for in Article 188 of the Labor Code of the Russian Federation. The amount of compensation is agreed upon with the employee and approved by order of the manager. Note that it can also be specified in the employment contract with the employee. In this case, the costs of paying compensation reduce the tax base for income tax on the basis of Article 255 of the Tax Code of the Russian Federation. If such payments are not provided for in the employment contract, they cannot be taken into account when calculating income tax.

In accordance with paragraph 3 of Article 217 and paragraph 2 of paragraph 1 of Article 238 of the Tax Code of the Russian Federation, compensation within the limits of the norms is not subject to personal income tax and unified social tax. However, compensation standards for the use of personal mobile phones by employees have not been established. Therefore, according to the authors, such compensation is subject to taxation by the specified taxes. You will also have to pay accident insurance premiums from the compensation amount. At the same time, we note that it is necessary to charge a single social tax only if the costs of paying compensation reduce the tax base for income tax.

Option 4. An organization buys a phone for its employee. An organization can buy a phone by bank transfer or through an accountable person. The first method is more profitable, since in this case the company will receive an invoice, which will allow the value added tax paid to be deducted.

When purchasing a phone through an accountable entity, it is much more difficult to obtain an invoice. The fact is that when selling goods for cash to the population, organizations and individual entrepreneurs have the right not to issue an invoice. In such cases, the requirements for issuing invoices established by Article 168 of the Tax Code of the Russian Federation are considered fulfilled if the seller issues a cash receipt or other document of the established form to the buyer (clause 7 of Article 168 of the Tax Code of the Russian Federation).

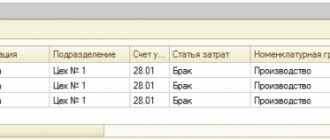

Since the useful life of a telephone is more than one year, it is classified as a fixed asset. Therefore, when purchasing a telephone, the organization must draw up an act of acceptance and transfer of fixed assets in Form N OS-1. If several phones are purchased at once, they can be issued in one act in form N OS-1b. Let us recall that the forms of primary accounting documentation for accounting of fixed assets are approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7.

Accounting for loss or damage to mobile phones

Of the four situations described above, accounting for the loss or damage of a phone by an employee is only necessary in the latter case and will consist of compensation for the damage caused. The loss is assessed during an inventory, which is mandatory after any discovery of theft or damage to property. Shortages may arise due to the fault of the financially responsible person, for unknown reasons in the absence of the perpetrators, as well as as a result of emergency situations. Based on the results of the inventory, an inventory inventory of fixed assets is compiled (Form N INV-1, approved by Resolution of the State Statistics Committee of Russia dated 08/18/1998 N 88) and a statement of records of the results identified by the inventory (form N INV-26, approved by Resolution of the State Statistics Committee of Russia dated 03/27/2000 N 26 ).

As a rule, the cost of a mobile phone does not exceed 10 thousand rubles. Therefore, in accounting and tax accounting, its cost can be immediately written off as expenses (clause 18 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n, and clause 1 of Article 256 of the Tax Code RF). If a phone costs more than 10 thousand rubles, it is included in depreciable property and depreciation is charged on it.

In accordance with the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 N 1, mobile phones belong to the third depreciation group with a useful life from 37 to 60 months. The specific depreciation period is established by order of the head of the organization.

The procedure for accounting for shortages and losses from damage to valuables is established by clause 3 of Article 12 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”.

Based on this provision of the Law, the shortage of property (in our case, a mobile phone) is attributed to the perpetrators. If the perpetrators are not identified or the court refuses to recover damages from them, losses from the shortage of property and its damage are written off to the financial results of the organization.

Accounting for shortages and losses from damage to valuables is carried out on account 94 “Shortages and losses from damage to valuables”.

If a missing or completely damaged mobile phone is listed as part of the organization’s fixed assets, the debit of account 94 reflects its residual value.

In the event of partial damage to the phone, the debit of account 94 reflects the amount of the determined losses.

The write-off of a lost or damaged mobile phone listed as part of fixed assets in account O1 “Fixed Assets” is reflected in accounting as follows:

Debit 01, subaccount “Disposal of fixed assets” Credit 01 - the original cost of the phone was written off;

Debit 02 “Depreciation of fixed assets” Credit 01, subaccount “Disposal of fixed assets” - the amount of accrued depreciation is written off;

Debit 94 Credit 01, subaccount “Disposal of fixed assets” - the residual value of the phone is written off.

If the shortage arose through the fault of the employee, then, in accordance with Article 238 of the Labor Code of the Russian Federation, he is obliged to compensate the employer for the direct actual damage caused to him, which means a real decrease in the employer’s available property or a deterioration in its condition, as well as the need for the employer to make expenses or unnecessary payments for acquisition or restoration of property. The employee bears financial responsibility both for direct actual damage directly caused by him to the employer, and for damage that occurs to the employer as a result of compensation for damage to other persons.

Accounting for settlements for employee compensation for material damage caused to the employer is kept on account 73 “Settlements with personnel for other operations,” subaccount 2 “Settlements for compensation for material damage.”

Example 1. Due to the fault of an employee, a mobile phone belonging to the company was damaged. The cost of repairs carried out by a third party - a workshop - amounted to 1200 rubles. (including VAT). The cost of repairs was collected from the employee’s salary for three months. Transactions are reflected in accounting records:

Debit 94 Credit 60 “Settlements with suppliers and contractors” - reflects the amount paid to the workshop for repairs - 1200 rubles;

Debit 73, subaccount 2 “Calculations for compensation of material damage” Credit 94 - damage is attributed to the account of the guilty employee - 1200 rubles;

Debit 70 “Settlements with personnel for wages” Credit 73, subaccount 2 “Settlements for compensation of material damage” - reflects the deduction from employees’ wages - 400 rubles. (postings are issued monthly for three months).

If the shortage of property is due to the fault of the employee, then the organization loses the right to deduct the amount of value added tax paid upon acquisition of the property. The amount of VAT previously accepted for deduction is subject to restoration and attribution at the expense of the guilty party. In other words, this restored VAT amount is considered as the actual losses of the organization identified during the inventory of property. In accounting, the amount of VAT to be recovered from the value of missing assets is reflected by the entry:

Debit 94 Credit 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT”.

Example 2. During the inventory of fixed assets, a shortage of a mobile phone was identified.

The initial cost of the phone is 12,000 rubles, the amount of accrued depreciation is 2,000 rubles. The amount of VAT paid on this fixed asset item (RUB 2,160) was accepted for deduction.

The financial director of the organization was responsible for the safety of the missing phone. In his explanations regarding the shortage, he stated that the mobile phone was lost through his fault. Therefore, he voluntarily agreed to reimburse the market value of the phone, which amounted to 12,500 rubles.

The following entries are made in accounting:

Debit 01, subaccount “Disposal of fixed assets” Credit 01 - the initial cost of the mobile phone was written off - 12,000 rubles;

Debit 02 Credit 01, subaccount “Disposal of fixed assets” - the amount of accrued depreciation is written off - 2000 rubles;

Debit 94 Credit 01, subaccount “Disposal of fixed assets” - the residual value of a mobile phone is written off - 10,000 rubles;

Debit 94 Credit 68, subaccount “VAT Calculations” - the amount of VAT previously presented for deduction was restored, corresponding to the residual value of the phone - 1800 rubles. (RUB 10,000 x RUB 2,160 / RUB 12,000);

Debit 73, subaccount 2 “Calculations for compensation of material damage” Credit 94 - the amount of the shortfall is attributed to the guilty person - 11,800 rubles;

Debit 73, subaccount 2 “Calculations for compensation of material damage” Credit 98 “Deferred income” - reflects the difference between the market value of the fixed asset and the amount of the shortage - 700 rubles. (RUB 12,500 - RUB 11,800);

Debit 50 “Cash” Credit 73, subaccount 2 “Calculations for compensation of material damage” - the culprit compensated for the damage caused - 12,700 rubles.

As noted earlier, in cases where the perpetrators are not identified or the court refuses to collect, losses from shortages and damage are written off to the financial results of the organization. To formalize the write-off of shortages of valuables and their damage, you must receive:

— a decision of investigative or judicial authorities confirming the absence of perpetrators or refusing to recover damages;

— a conclusion about the fact of damage to valuables from the technical control department or relevant specialized organizations (quality inspections, etc.).

The following entries are made in accounting:

Debit 91 “Other income and expenses”, subaccount 2 “Other expenses” Credit 73, subaccount 2 “Calculations for compensation of material damage” - included in non-operating expenses is the amount of the shortage identified during the inventory, the recovery of which from the guilty parties was refused by the court;

Debit 91, subaccount 2 “Other expenses” Credit 94 - the shortage identified during the inventory is included in non-operating expenses if there are no guilty parties.

When the amounts of shortfalls are included in the financial results, the amount of VAT related to the missing property is subject to restoration, which will also be written off to account 91, subaccount 2 “Other expenses”.

For income tax purposes, expenses in the form of shortages of material assets are equated to non-operating expenses, but only if there are no persons responsible for the shortage or those responsible for losses from theft have not been identified. In this case, the fact of the absence of guilty persons must be documented by an authorized government body (clause 5, clause 2, article 265 of the Tax Code of the Russian Federation).

If, during the inventory, circumstances and events that led to the loss or damage of a mobile phone are revealed, the organization can fully or partially waive financial claims against the guilty employee (Article 240 of the Labor Code of the Russian Federation).

If the mobile phone is broken or lost due to force majeure circumstances, the employee is released from financial liability (Article 239 of the Labor Code of the Russian Federation).

In this case, the following entries are made in accounting:

Debit 94 Credit 01 - the actual cost of property lost as a result of the emergency was written off;

Debit 99 “Profits and losses” Credit 94 - the cost of lost property is included in extraordinary expenses.

Example 3. As a result of the emergency condition of the electrical wiring in the organization, a fire broke out and all the property burned down (became unusable). Based on the results of the inventory, it was established that the cost of the property that had fallen into disrepair was 400,000 rubles, and the accrued depreciation was 100,000 rubles. The amount of VAT paid when purchasing property (72,000 rubles) was reimbursed from the budget. Since the property was insured, the organization received insurance compensation in the amount of 370,000 rubles.

The following entries are made in accounting:

Debit 01, subaccount “Disposal of fixed assets” Credit 01 - the initial (replacement) cost of property, the shortage of which was established during the inventory, was written off - 400,000 rubles;

Debit 02 Credit 01, subaccount “Disposal of fixed assets” - the amount of accrued depreciation is written off - 100,000 rubles;

Debit 94 Credit 01, subaccount “Disposal of fixed assets” - the residual value of the property is written off - 300,000 rubles;

Debit 94 Credit 68, subaccount “Calculations for VAT” - the amount of VAT on damaged property was restored - 54,000 rubles. (RUB 72,000 x RUB 300,000 / RUB 400,000);

Debit 99 Credit 94 - the amount of the shortfall is included in emergency expenses - 354,000 rubles;

Debit 51 Credit 16 “Settlements with various debtors and creditors” - the amount of insurance compensation was credited to the current account - 370,000 rubles;

Debit 76 Credit 99 - the amount of insurance compensation is reflected in emergency income - 370,000 rubles.

Sh.M.Khalilov

K. e. n.

E.E.Leaf fall

Auditor

Signed for seal

24.09.2004

—————————————————————————————————————————————————————————————————— ———————————————————— ——

The purchased iPhone7 (worth about 60 thousand rubles) is a fixed asset and is subject to depreciation. In the documents for the phone, the service life established by the manufacturer is not indicated (only the warranty period is indicated). What OKOF code corresponds to it?

Having considered the issue, we came to the following conclusion:

The “iPhone 7” smartphone corresponds to OKOF code 320.26.30.23 “Other telephone devices, devices and equipment for transmitting and receiving speech, images or other data, including communication equipment for operation in wired or wireless communication networks (for example, local and global networks)” .

For accounting purposes, the organization independently determines the useful life of the purchased smartphone depending on the expected period of its use or expected physical wear and tear.

In tax accounting, an object worth less than 100 thousand rubles. is not recognized as depreciable property and its cost is taken into account as part of material expenses in full as it is put into operation, provided that such expenses meet the criteria established by Art. 252 of the Tax Code of the Russian Federation.

Rationale for the conclusion:

OKOF

From January 1, 2021, a new classifier of fixed assets OK 013-2014 (SNS 2008), adopted and put into effect by order of Rosstandart dated December 12, 2014 N 2018-st, is in effect. The grouping of fixed assets accepted for accounting from January 1, 2017 is carried out in accordance with the grouping provided for by OKOF OK 013-2014.

Unlike the previous OKOF OK 013-94, the new OKOF is less divided by industry. The groups in the new OKOF have been enlarged. In accordance with the Introduction to OKOF, this document adopts the following code structure: ХХХ.ХХ.ХХ.ХХ.ХХХ.

The first three characters correspond to the code of the type of fixed assets given in Table 1. The subsequent characters correspond to codes from the All-Russian Classifier of Products by Type of Economic Activity OKPD2 OK 034-2014 (KPES 2008) and can have a code length from two to nine characters depending on the length of the code in OKPD2.

When positions from OKPD2 are included in OKOF, a classification object should be formed that can be used as fixed assets.

The OKOF code can be searched by the name of the fixed asset or by its purpose.

If you cannot find a fixed asset object by name, you can search by the purpose of the object.

In this situation, a smartphone of the “iPhone 7” model is accepted for accounting as part of fixed assets.

Based on the purpose of the specified object, the telephone can be attributed to the OKOF grouping “Information, computer and telecommunications (ICT) equipment” (code 320), which also includes telephone communication equipment.

As rightly noted in the question, mobile phones can be classified as either 320.26.30.23 or 320.26.30.22. Let's take a closer look.

Code 320.26.30.22 refers to “Telephone devices for cellular communication networks or for other wireless networks.”

Code 320.26.30.23 includes “Other telephone devices, devices and equipment for transmitting and receiving speech, images or other data, including communication equipment for operation in wired or wireless communication networks (for example, local and global networks).”

This grouping includes:

— other telephone sets;

— fax machines, including those with answering machines;

— pagers;

— communication devices using infrared signals (for example, for remote control);

- modems.

Modern mobile phones, including the iPhone 7 smartphone, are designed not only for receiving and transmitting speech, but also for receiving and transmitting images and other data not only using wireless networks, but also the Internet, as well as for photo and video shooting. At the same time, we believe that classifying the “iPhone 7” smartphone as a pocket computer with a mobile phone function (code 320.26.20.11), or as optical and photographic equipment (code 330.26.70) is not entirely correct.

The free encyclopedia - Wikipedia characterizes smartphones this way: “A smartphone (English smartphone - smart phone) is a mobile phone, supplemented with the functionality of a pocket personal computer" * (1).

That is, first of all, a smartphone performs the functions of a phone, and other functions are an addition to it.

Therefore, we believe that in this situation the iPhone 7 smartphone is more appropriate with code 320.26.30.23 “Other telephone devices, devices and equipment for transmitting and receiving speech, images or other data, including communication equipment for working in wired or wireless communication networks ( for example, local and global networks)".

Depreciation

1. Accounting

In accounting, the cost of fixed assets is repaid through depreciation (clause 17 of PBU 6/01 “Accounting for fixed assets”).

Depreciation is calculated using one of the methods specified in clause 18 of PBU 6/01.

In this case, the use of one of the methods of calculating depreciation for a group of homogeneous fixed assets is carried out throughout the entire useful life of the objects included in this group.

In accordance with clause 4 of PBU 6/01, the useful life is the period during which the use of an item of fixed assets brings economic benefits (income) to the organization.

Clause 20 of PBU 6/01 establishes that in accounting, when accepting fixed assets for accounting, their useful life is determined by the organization independently based on:

— the expected period of use of this object in accordance with the expected productivity or capacity;

— expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, and the repair system;

— regulatory and other restrictions on the use of this object (for example, the rental period).

By setting a period, the organization independently chooses the period during which the fixed asset will be used in business activities.

Thus, in this situation, the organization independently determines the useful life of the purchased smartphone depending on the expected period of its use or expected physical wear and tear.

The procedure for determining the useful life when accepting a fixed asset for accounting must be reflected in the accounting policy of the organization for accounting purposes. The selected useful life of a fixed asset for accounting purposes is established by an order of the head of the organization, drawn up in any form.

Note that from January 1, 2021, in the new version of the Government of the Russian Federation Resolution No. 1 dated January 1, 2002 “On the Classification of fixed assets included in depreciation groups” (hereinafter referred to as the Classification), the provision that this classification can be used for accounting purposes is excluded (clause 1 of the Amendments approved by Decree of the Government of the Russian Federation dated July 7, 2016 N 640).

Accrual of depreciation charges for an object of fixed assets begins on the first day of the month following the month in which this object was accepted for accounting, and is carried out until the cost of this object is fully repaid or this object is written off from accounting (clause 21 PBU 6/01, clause 61 Methodical instructions).

2. Tax accounting

In accordance with paragraph 1 of Art. 258 of the Tax Code of the Russian Federation, depreciable property is distributed among depreciation groups in accordance with its useful life.

The useful life is the period during which an item of fixed assets or intangible assets serves to fulfill the goals of the taxpayer's activities. The useful life is determined by the taxpayer independently on the date of commissioning of this depreciable property item, taking into account the Classification.

At the same time, according to paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, depreciable property for the purposes of Chapter 25 of the Tax Code of the Russian Federation includes property with a useful life of more than 12 months and an initial cost of more than 100,000 rubles.

In this situation, the cost of a smartphone is less than 100,000 rubles. Consequently, for tax accounting purposes, such property is not recognized as depreciable and, accordingly, there is no need to determine its membership in a depreciation group in accordance with the Classification.

The cost of such property is included in material costs in full as it is put into operation (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

Please note that from 01/01/2015, the taxpayer has the right to recognize the cost of low-value property as part of material expenses for more than one reporting period, taking into account the period of its use or other economically justified indicators, if he establishes this procedure in the accounting policy for tax purposes (clause 3 p. 1 Article 254 of the Tax Code of the Russian Federation as amended by Federal Law No. 81-FZ of April 20, 2014).

Let us remind you that material costs must meet the criteria established by Art. 252 of the Tax Code of the Russian Federation.

Prepared answer:

Expert of the Legal Consulting Service GARANT

professional accountant Bashkirova Iraida

Information legal support GARANT

https://www.garant.ru

Multiline phone

*(1) See https://ru.wikipedia.org/wiki/%D0%A1%D0%BC%D0%B0%D1%80%D1%82%D1%84%D0% .

Cell phone as a primary means in 2021

For the purposes of this accounting, fixed assets that were registered later than December 31, 2021, and less than this limit, can be immediately transferred to expenses. If its price is more than 100 thousand rubles, then the object will have to be depreciated using one of the two proposed methods.

Write-off of fixed assets worth up to 100,000 rubles

If you purchased an expensive telephone set (more than 10,000 rubles), then you cannot take its cost into account at one time in your expenses. The fact is that in this case the telephone will be classified as a fixed asset for tax accounting purposes. And their cost is written off as expenses through depreciation.

The bonus does not apply if objects are not subject to depreciation (for example, land), are received free of charge, are the subject of leasing, or if they are excluded from depreciable property due to transfer to conservation for a period of more than 3 months, transfer to gratuitous use or reconstruction for a period of more than 12 months (provided that the facilities are not in use during reconstruction).

We recommend reading: For which years can you file a 3rd personal income tax return in 2021