The 2-NDFL certificate is multifunctional and can be used at another place of work, in banks, or the Federal Tax Service to confirm the amount of earnings and taxes paid. Your employee may request it, and it is also intended for mandatory submission to the tax office.

Naturally, in order to generate a 2-personal income tax for an employee, he must be hired in the program, and his salary must also be calculated. We will not dwell on this in detail, since all actions have already been described in our other articles.

In 1C 8.3 ZUP and Enterprise Accounting, there are two types of certificates:

- “2-NDFL for employees”;

- “2-NDFL for transfer to the Federal Tax Service.”

In 1C ZUP they are located in the “Taxes and Contributions” menu, and in Accounting in the “Salaries and Personnel” menu.

The principle of creating and filling in both standard configurations is the same, therefore, as part of our step-by-step instructions, we will consider an example on the ZUP 3.1 demo base.

Preparation and testing

To correctly calculate personal income tax, all necessary data on employees must be entered:

- Salary, vacation and sick leave;

- Standard, personal, social, professional deductions;

- All other income and deductions from them.

Payroll accruals are entered using the “Payroll accruals” documents in the “Salary - All accruals” section. Sick leave and vacations are also introduced here. The documents automatically generate deductions, personal income tax and insurance premiums.

Fig.1 All charges

Other documents on personal income tax are located in the section “Taxes and contributions/All documents on personal income tax”.

Fig. 2 All documents on personal income tax

Here you can generate 2-NDFL certificates. Let's look at some commonly used types of documents.

Application for deductions for personal income tax - the document indicates standard Deductions for children and personal deductions. For standard deductions, the validity period is indicated: in the header of the document the general details are the month the deductions are valid, and in the table – the month the validity of each deduction ends.

Fig. 3 Application for personal income tax deductions

Personal income tax accounting operation - the document takes into account all other income received that is not taken into account in the program, as well as which must be registered manually, accruals, deductions and transfers of personal income tax and some types of deductions. All transactions are recorded on a specific date.

Fig.4 Personal income tax accounting operation

Notification of a non-commercial organization about the right to deductions - the document is used to calculate and accrue property and social deductions. The validity period is specified in the document header.

Fig.5 Notification of the non-commercial organization about the right to deductions

Checking the 1C database for errors with a 50% discount

Remotely in 1 hour 2000 ₽ 4000 ₽ We will provide a written report on errors. We analyze more than 30 parameters

- Incorrect indication of VAT in documents;

- Errors in mutual settlements (“red” and expanded balances according to settlement documents or agreements on accounts 60, 62, 76.);

- Lack of invoices, checking duplicates;

- Incorrect accounting of inventory items (re-grading, incorrect sequence of receipts and expenses);

- Duplication of elements (items, currencies, counterparties, contracts and accounts, etc.);

- Control of filling out details in documents (counterparties, contracts);

- Control (presence, absence) of movements in documents and others;

- Checking the correctness of contracts in transactions.

More details Order

Filling out the 2-NDFL certificate for submission to the Federal Tax Service

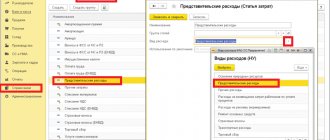

You can create a certificate in the “Taxes and contributions-2-NDFL for transfer to the Federal Tax Service” section or by selecting the appropriate document in the “Taxes and contributions-All documents for personal income tax” section. In the journal that opens, click the “Create” button to generate a new certificate. First you need to fill out the header of the document:

- Year – the year (reporting period) for which the certificate is provided to the Federal Tax Service;

- OKTMO/KPP – territorial reference of the organization at the place of submission of tax reports. Filled out in the “Main – Organizations” section in the card on the “Registrations with tax authorities” tab;

- In the Federal Tax Service (code)/from the checkpoint - details of the tax office;

- Type of certificate – can take the values “Annual reporting” and “On the impossibility of withholding personal income tax”;

- Buttons “Initial”, “Correcting”, “Cancelling” - indicate the status of the certificate.

Fig.6 Filling out the 2-NDFL certificate for submission to the Federal Tax Service

Filling out the 2-NDFL certificate is done by clicking the “Fill” button. The “Number” button is needed when manually entering employees, which in turn is done with the “Selection” button. Before posting the document, you can check the correctness of the entered data using the “Check” button. In this case, the verification algorithm embedded in the program will be used. The accuracy of the calculations provided and the personal information of the employees included in the card will be checked. Before sending, the certificate must be completed by clicking the “Submit” button. Sending to the Federal Tax Service can be done through a universal data exchange file in xml format using the “Upload” button.

With the 1C-Reporting service connected, you can immediately send the prepared document to the tax office. If this service is not connected, contact us: as part of the business support program with 1C specialists, we will advise you on how to quickly set up and connect this service. If you use this service, go to the menu item “Send-Send to regulatory authorities”. Also in this case, it is possible to check the accuracy of the calculation on-line. In the menu there is the item “Send-Check on the Internet”. If an error occurs, you can see the reason (the line will be red when checking, and the reason will be marked). By double-clicking on any line, you can generate a 2-NDFL reference report in 1C for any employee from the list, but you cannot save and print a certificate obtained in this way.

Free expert consultation

Tatiana Panchenko

Consultant-analyst 1C

Thank you for your request!

A 1C specialist will contact you within 15 minutes.

How to create a certificate for employees

Go to the “Taxes and Contributions” menu. (“Salaries and personnel” in 1C: Accounting).

You need to open the list of documents and click “2-NDFL for employees”.

Important! For each individual employee, a certificate is created separately for each year. Click on the “Create” button.

A window will open where you first need to fill out the header. Be sure to indicate the period (the desired year), employee and organization (if you manage several, you will have to select the one you need).

Once you enter these basic data, the rest will come automatically. To update them, click "Fill".

If you are faced with the task of generating a 2-NDFL certificate in the context of OKTMO/KPP codes and tax rates, then be sure to indicate these values in the “Generate” detail.

By clicking on the “question” to the right of the completed field, find out whether income under the selected code is registered for the employee for whom you are preparing the certificate.

If income data is not registered, the program will tell you about it - the corresponding window will not be filled in.

Next, when you have checked all the filled-in data yourself, run the software check and scan the document.

All that remains is to print the certificate for the employee using the required button.

In the header of the finished printed 2-NDFL certificate, you will see a note that this form is not intended for submission to the Federal Tax Service.

Certificate of income and personal income tax for an individual in “1C: Salary and Personnel Management 8” (rev. 3)

To draw up a certificate of income and tax amounts of an individual issued to employees (and other individuals who received income from the organization), in the 1C: Salary and Personnel Management 8 program, edition 3, document 2-NDFL for employees is intended.

In the Year

select the year for which information is generated.

The Organization

field is filled in by default.

If more than one organization is registered in the information base, then you must select the organization on whose behalf the certificate is being generated.

Other Features

As you have already understood, there are two ways to generate certificates and they depend on the final recipient:

- You must issue a document for your subordinate upon his dismissal or upon his personal request upon written application.

- For the tax inspectorate, you, as a tax agent, annually submit information on your people’s taxes to the tax office according to their territorial reference. When you are reporting for people up to 25 people, it will be enough to submit information on paper, but when this number of people exceeds this threshold, you will have to send an electronic report.

Next, I suggest you familiarize yourself with the status of taxpayers:

- Assigned to a resident of the Russian Federation.

- Designed for non-residents of our country.

- Include all highly qualified specialists of your company here.

- Invented for subordinates participating in the state program for the voluntary resettlement of compatriots living abroad;

- This status is assigned to foreign employees with refugee status or those who have received temporary asylum in the Russian Federation;

- If your subordinate is a foreigner and works for you under a patent, then you classify him in this category.

Know that in order to print the certificate, you just need to click on print the income certificate (2-NDFL). Certificates of income of individuals will be generated.

FIREPLACE 2.0. Certificate 2-NDFL 7 years 2 weeks. back #10

The 'Dividends' accrual must have income code #1010 (Dividends). Dividends are accrued using the 'Simple accrual' document with the 'Dividends' assistant. Dividends are paid using the document 'Payment' with the assistant 'Payment of dividends for the year 20xx'. The same document calculates and withholds personal income tax at a rate of 9%.

Important! When calculating and paying dividends, pay attention to the source of income. It must be different from the main source of income, such as 'Dividends'! Check whether the “Paid” attribute is set in the Payment document.

Filling out form 2-NDFL when changing the OKTMO code in 1C: Accounting 8 edition 3.0

The program generates information about the income of individuals in automatic mode. To correctly generate information, it is necessary that the program contains:

- all income received by individuals during the tax period is reflected;

- information on the right to tax deductions (standard, professional, property, social, advance payments for personal income tax) has been entered and the actual deductions provided have been reflected;

- The amounts of calculated, withheld and transferred tax were calculated and taken into account.

Data on tax deductions actually provided to individuals for the year, on the amounts of calculated, withheld and transferred personal income tax can be obtained using the report “Summary” certificate 2-NDFL or Analysis of personal income tax by month (section Salaries and personnel - Salary reports). To analyze the amounts of withheld and transferred tax, it is also convenient to use the Personal Income Tax Payment Analysis report.

Submit your application

Also, before preparing information, you should check:

- the relevance of the program release (you need to make sure that the program is updated with the latest release) and the address classifier (FIAS) or the Russian address classifier (KLADR);

- correctness of filling in the personal data of individuals in respect of whom reporting will be submitted (full name, date of birth, TIN in the Russian Federation, TIN in the country of citizenship (Taxpayer INN (or its equivalent) in the country of citizenship for foreign persons in the case of information about its availability with the tax agent), citizenship, identification document details, registration address (address of residence in the Russian Federation), address outside the Russian Federation (for foreign citizens, the address of the place of residence in the country of permanent residence is indicated). necessary personal data of employees, you can use the Personal Data of Employees report (section Salaries and HR - HR Reports).

There are often cases when an organization changes OKTMO, for example: when changing its legal address. Codes according to OK OK 033-2013 (OKTMO).

In this regard, the main difficulties for accountants arise when submitting 2-NDFL reports. When you have to submit a report to the latest Federal Tax Service, but according to different OKTMO. How can this be implemented in the program? There are different ways to solve the problem. The first is used in the “Salaries and Personnel Management” program, when we show a sign of separation of a department and indicate OKTMO for it before the change.

And we fill out the payroll documents, selecting this unit. Then we generate a 2-NDFL certificate before the month of transition we need, to the new OKTMO, and remove the sign of a separate division, with salary calculation for the remaining months of the year.

We are again generating a certificate, which will already include the new All-Russian Classifier of Municipal Territories

.

But there is another way to solve the problem, perhaps a simpler one. In this case, we edit the uploaded file using a text editor in Word Pad or Notepad. It looks something like this. Let's say we need to download data for September 2016, with the old OKTMO. We cancel payroll documents from September to December 2021, generate a 2-NDFL report and upload it to your desktop. Open the file using Notepad and use the key combination “Ctrl + H”, or in Notepad, on the “Edit” tab, select the “Replace All” command. (Fig.1). If you need to replace an organization's checkpoint, we choose the same algorithm.

Picture 1.

As a result, we will get a full-fledged form, only with the values we need. After this, we make the salary accrual documents not processed, from January to September 2021, and carry out the remaining accruals again, fill out the 2-NDFL report and upload it in the usual manner, the OKTMO details will be entered from the information on the organization. The second solution to the problem can also be used in the accounting department of an enterprise. Let's not forget to restore all salary accruals for 2021.

Dear readers! You can get answers to questions about working with software products on our 1C Consultation Line. We are waiting for your call!

Report 2-NDFL: submission deadlines and general concepts

If you act as a tax agent, know that no later than the end of the first quarter of the year, that is, before April 1, you must report to the tax office on the personal income tax of your subordinates. In a situation where this date falls on a weekend, the reporting day is considered the first working day after the weekend.

Form 2-NDFL must include all income, deductions from amounts subject to taxation, taxes and all other deductions for each individual for the reporting tax period.

Be aware that in addition to the blank form of the certificate, there is a personal form. The employer issues it to the subordinate at his request for personal purposes as a document proving his income, expenses and taxes paid.

I will present further study of the material in the form of separate step-by-step blocks and I hope you will find it convenient.