2-NDFL for 2021 according to the new form

For reports submitted at the end of 2021, information on employee income is prepared on two different 2-NDFL forms:

- the first form is a new form 2-NDFL in 2021 - the tax agent prepares it for submission to the Federal Tax Service;

- the second form - a certificate of income of an individual, used in 2019 - is presented to employees upon their request in accordance with the requirements of Article 230 of the Tax Code.

The peculiarity of the design of the 2-NDFL form in 2021 lies in the change in its structure: the previous report included a title page and five sections, the new 2-NDFL certificate included a title page and three sections. But legislators compensated for the reduction in sections with additional blocks:

- introductory - with information about the tax agent;

- the first section contains the data of the individual to whom the accruals were made;

- the second section - with an addition about the income calculated and paid to the individual, as well as the amount of personal income tax;

- the third section - with information about tax deductions applied by the employer (standard, property and social);

- application - with a monthly breakdown of information about charges and deductions of an individual.

In 2021, fill out form 2-NDFL on separate sheets, not fastened together with staples or in any other way (using glue, etc.). Correcting erroneous information in the form using corrective means is not allowed, only by submitting an adjustment. Form 2-NDFL should not contain empty blocks: if there is no information to fill out the report, put a dash or zero in the cell when the field requires a numeric value. Also, negative values cannot be indicated on the form.

You can 2-NDFL for 2021 on the portal of the Federal Tax Service.

Submit 2-NDFL online

In Kontur.Externe, fill out the current 2-NDFL form and instantly submit it to the tax office.

Send a request

Sample of filling out the 2-NDFL certificate in 2018

Let's consider the 2-NDFL new form 2021 sample form.

Heading

Under the name of the form, the year for which the document was drawn up, its number in the order of execution and the date of creation are indicated.

The next step is the sign of the completed certificate:

- Sign “1” must be entered here if the form is issued in a standard situation, and the tax was withdrawn from the employee.

- Sign “2” is entered if the tax withholding failed.

When sending a correction form, you must enter its serial number in the next field. So, “00” is written here if the certificate is created for the first time. The code from “01” to “98” will indicate the number of the corrective document for this employee. “99” is the cancellation of all previously transmitted data for the specified person.

The last field here is the Federal Tax Service code where the certificate is sent.

Section No. 1 (Information about the tax agent)

This section records information about the employer who is drawing up the document. First, the OKTMO code is entered, then the contact phone number, followed by the TIN and checkpoint codes.

The next column indicates the name of the tax agent.

The following two fields have been introduced on the 2021 form. The reorganization form code can take the following values:

- “0” – liquidation has been carried out;

- “1” – conversion completed;

- “2” – a merger has occurred;

- “3” – separation occurred;

- “5” – connection has been made;

- “6” – division occurred with simultaneous annexation.

The next field contains the TIN and KPP codes of the company that was converted. If none of these actions have been performed, both of these fields remain empty.

Section No. 2 (Data about the individual - recipient of income)

This section contains information about the person for whom the certificate is being created. First, the employee's TIN is indicated. If he is a foreigner and has a TIN of his state, then this code can be written down next to it.

Next, enter your full name. employee. In this case, the patronymic is entered on the form if the person has one. If a situation arises, if an employee changed personal data during the specified period, then the new ones must be indicated in the form and documents must be attached to it to confirm the change.

If the certificate is submitted for a foreign citizen, then it is allowed to enter his data in Latin letters.

You might be interested in:

Reporting in 2021 for LLCs and individual entrepreneurs: deadlines, general table for LLCs, simplified tax system, UTII, unified agricultural tax

At the next stage, the employee's status is indicated. It can take one of the following values:

- 1 - the employee is a resident;

- 2 - is a non-resident;

- 3 – highly qualified specialist;

- 4 - the employee resettled from abroad;

- 5 - a foreigner who has received refugee status;

- 6 – foreigner with a patent.

The following columns record the date of birth and the code of the country in which he has citizenship. For Russians, 643 is entered here.

Next, indicate the details of the document that can be used to confirm your identity.

bukhproffi

Important! If during the reporting year a person’s personal data has changed (for example, a change of surname, first name, etc.), then new information is recorded in the certificate, and supporting documents are attached to it.

The address can be recorded both on the territory of Russia (for residents) and foreign. However, in the latter case, you must also additionally indicate the address in Russia where the foreigner is registered.

Section No. 3 (Income)

Directly in the section heading there is a column where you need to indicate the tax rate at which information is provided in the document. As a rule, the rate for Russians is 13%, and for foreigners - 30%.

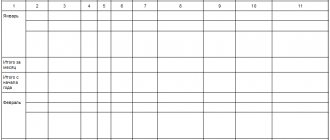

After this, the section contains a table in which you need to record the months, the income accrued in them and their amount line by line. Filling occurs according to the following principle: the month number is entered in the first column, then the code that shows the income received, and in the last column its total expression.

The most common codes used when filling out are:

- 2000 - basic salary;

- 2012 — vacation transfers;

- 2300 - hospital transfers, etc.

(Appendix 1 and 2 to the order of the Ministry of Finance).

Attention! If during the same month an employee received several incomes with different codes, then the same month number is written on each line, but the income code and amount will differ.

The deduction fields in this section are intended to indicate professional benefits. They are assigned codes from 403 and subsequent.

Section No. 4 (Standard, social, investment and property tax deductions)

In this section you need to write down the codes and amounts of tax benefits that the employee used in the specified period. In particular, the standard deduction for children is taken into account here. For example, code 126 for the 1st child, 127 for the 2nd, 128 for the 3rd and all subsequent ones.

If the employee used additional deductions, then he must provide the details of the notification allowing them to be applied. There is such a column for social and property benefits.

This section also shows social and property deductions. For them, it is necessary to enter information about supporting documents in the following columns.

Section No. 5 (Total amounts of income and tax)

This part of the certificate is the result of sections 3 and 4 of the 2NDFL certificates and is a table.

The line “Total amount of income” should reflect the total amount of the employee’s income for the entire year at this enterprise.

In the line “Tax base” you need to reflect the result obtained by subtracting the deductions provided for by the rules from the total income of the employee.

The line “Calculated tax amount” indicates the result of multiplying the amount from the previous line of the certificate by the current tax rate, which was determined in section 3.

The line “Amount of fixed payments” is filled in only by citizens of other countries who work under a patent. In the event that these individuals can reduce the amount of calculated tax by the amount of fixed payments previously made in advance, they should be reflected in this section.

After this, the columns “Amount of tax withheld” and “Amount of tax transferred” are filled in. The accrued and paid tax is reflected here.

Below is information about overpaid tax or any arrears arising from personal income tax.

Under the tabular part, if necessary, the number and date of issue of the notice of the right to reduce advance payments, as well as the code of the Federal Tax Service that issued it, are also indicated.

After this, the code reflects who submits this reporting:

- “1” – The agent himself;

- “2”—His designated representative.

The document is signed by the director.

Latest news on 2-NDFL

The new form 2-NDFL, introduced with reporting for 2021, led to the adoption of accompanying documents, one of which was the Order of the Federal Tax Service dated October 24, 2017 No. ММВ-7-11/ [email protected] This order lists new codes that must be indicated by income and deductions when filling out 2-NDFL in 2021 (see table below).

There have been no changes to the budget classification codes, so employers indicate the codes used in 2021 on their tax payment slips. Actually, there are only four BCCs for legal entities for 2021 for personal income tax for employees:

Despite the detailed procedure for filling out and submitting the report, the use of the new 2-NDFL raises questions among employers. For example, what form should taxpayers use to issue a certificate of accrued income for the past period? So far, the Federal Tax Service has not provided clarification on such issues. But if necessary, to obtain information verbally or in writing, you can contact the tax office or call the hotline. Also, the latest news on 2-NDFL from 2021 can be tracked on the Federal Tax Service website.

How to correctly fill out 2-NDFL and calculate withheld tax

A detailed procedure for filling out the form, approved by the Federal Tax Service, is presented here.

The most problematic tasks when filling out a certificate—those that should be given special attention—are:

Filling out the fields:

- by income (the “Total amount of income” field on the Title Page - on the 1st page of the certificate, as well as the “monthly” fields in the Appendix to the certificate - on the 2nd page);

- “Tax Base” on the Title Page;

- “Tax amount calculated” on the Title Page;

- fields where data on deductions is reflected (they are available both on the Title Page and in the Appendix to the certificate).

They are all connected.

Deductions according to the 2-NDFL certificate - it is appropriate to start the story with them - are classified into 2 categories:

- Those related to standard, social and property. These deductions, in correlation with the codes established by Appendix No. 2 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11 / [email protected] , are shown on the Title Page (and only there).

- Other. They, in correlation with the codes in the same Appendix No. 2 to Order No. MMV-7-11 / [email protected] , are shown in the Appendix to the certificate (and only there).

All amounts of both specified types of deductions are summed up, after which the resulting total is subtracted from the “Total Amount of Income” indicator. The result is recorded in the “Tax base” field.

The “Total amount of income” indicator on the Title Page must be equal to the amount of income “scheduled” monthly in the Appendix to the certificate. Income in the Appendix to the certificate is shown in relation to the codes established by Appendix No. 1 to the same order No. MMV-7-11 / [email protected]

The calculated personal income tax (the “Calculated tax amount” field) is the rate multiplied by the indicator in the “Tax base” field.

And if there were no deductions, then, obviously, the fields “Total amount of income” and “Tax base” will be equal to each other.

The amount of deductions reflected on the Title Page is not equal to the amount of deductions in the Appendix to the certificate. Moreover, both indicators are in no way related to each other, since deductions belong to different categories.

You can download deduction codes for 2-NDFL here.

Filling out the field “Tax amount withheld”

First of all, let’s say a few words about the correlation between “calculated” and “withheld” taxes. Tax is generally considered calculated when taxable income is handed over to an individual or transferred to a bank account. An exclusive rule is established regarding wages. Regardless of when the salary (in terms of the advance or the main amount) is paid out, income is considered received on the last day of the month for which the salary was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Moreover, even if the employer delays wages, it is nevertheless considered the employee’s income, and tax is calculated on it. In the certificate, such income is shown in the Appendix (and affects the amount of income on the Title Page) for the month in which it is payable in accordance with the employment contract.

In general, personal income tax is withheld upon actual payment of income (clause 4 of Article 226 of the Tax Code of the Russian Federation). That is, simultaneously with the calculation of personal income tax. But if the income is a salary, then the situation is special.

As a rule, the salary consists of 2 parts: an advance for the 1st half of the month - paid after the 15th, and the main part (for the 2nd half of the month) - paid on the first days of the next month. Both parts of the salary are considered paid on the last day of the month. This means that personal income tax on both the advance and the main part of the salary:

- calculated on the last day of the month;

- is withheld on the day of payment of the main part of the salary (since it cannot be withheld from the advance payment - due to the fact that at the time of its payment it is not yet recognized as taxable income).

Sample of the new form 2-NDFL

Let's consider an example of filling out 2-NDFL for 2021 for submission to the Federal Tax Service.

Mikhavkiv V.P., a resident of Russia, is officially employed by Pegasus LLC. In 2021, he received a monthly salary and once a quarter a bonus for production success. On June 25, 2021, he resigned, receiving compensation for unused vacation upon final payment.

Mikhavkiv V.P.’s income for the months of 2021 amounted to:

| Worked out by Mikhavkiv V.P. months in 2021 | Type of charges | Amount, rub. |

| January | salary | 15 100,00 |

| February | 15 100,00 | |

| March | 15 100,00 | |

| March | bonus | 10 000,00 |

| April | salary | 15 100,00 |

| May | 15 100,00 | |

| June | 12 080,00 | |

| June | bonus | 8 900,00 |

| June | compensation | 9 505,00 |

| Total | 115 985,00 | |

Mikhavkiv V.P. has one child, for whom he received a standard deduction during the entire period of work at Pegasus LLC - 1,400 rubles.

The amounts of tax accrued and withheld from the income of Mikhavkiv V.P. for 2021 are the same.

in 2021 at Mikhavkiva V.P.

Adjustment 2-NDFL: when and how to submit?

The 2-NDFL correction certificate must be submitted on the “as soon as possible” principle. There will be no fines only if the adjustment is provided before the Federal Tax Service itself discovered the error (Clause 2 of Article 126.1 of the Tax Code of the Russian Federation). But it is impossible to accurately calculate the moment of such detection.

The correction form is submitted not only if errors are detected in the certificate, but also if the data reflected in the original (previous) document changes - for example, in the case of compensation for an overpayment of personal income tax to an employee. For some changes, however, adjustment is not required: for example, if before submitting the certificate to the Federal Tax Service, the recipient of the income had one last name, and then it changed (letter of the Federal Tax Service of Russia dated December 29, 2017 No. GD-4-11 / [email protected] ).

There is a special subtype of adjustment for 2-personal income tax - a cancellation certificate. In it, code 99 is entered in the “adjustment” field. Such a certificate is used if the tax agent recognized that a person received income (and the subsequent calculation and withholding of tax) erroneously, as he subsequently erroneously reflected it in the primary 2-NDFL.

Of course, there will be strict sanctions against the tax agent even if he does not submit the form to the Federal Tax Service in principle or submits it late. Legal consequences are also possible if the document is not provided to the employee.

Deadlines for submitting form 2-NDFL

There have been no changes in the deadlines for submitting 2-NDFL for 2021: as before, tax agents submit 2-NDFL certificates to the Federal Tax Service by April 1. This applies to reports on individuals from whose income tax was fully withheld.

If an employer has not withheld tax from an individual’s payments in full, he must submit a report to the tax service earlier. The deadline for submitting 2-NDFL for these individuals in 2021 is March 1.

The innovations did not affect the procedure for submitting the report: tax agents reporting on 25 or more individuals must submit 2-NDFL according to the TKS, but if there are 24 or fewer certificates, a paper form of the report is allowed.

Reporting Methods

There are several ways to submit a completed report to the Federal Tax Service:

- In paper form in the hands of the tax inspector - this is allowed only to those companies that have a small number of employees (up to 10 people).

- In paper form via postal service - the completed document can be sent to the Federal Tax Service by registered mail with a separately described attachment.

- In electronic form to the tax inspector - the report is filled out in a special program, after which the media with the file is handed over to the inspector. This method can be used if the number of employed workers does not exceed 3,000 people.

- Using electronic document management - for this you need to select a telecom operator and sign an agreement with it, as well as issue a digital signature.

You might be interested in:

LLC reporting on the simplified tax system in 2021: deadlines in the table