What formats can the tax office work with?

The procedure for submitting documents via the Internet is regulated by orders of the Federal Tax Service of the Russian Federation dated 02/17/2011 N ММВ-7-2/ [email protected] and dated 06/29/2012 N ММВ-7-6/ [email protected] There is a simple rule: received an electronic request - submit the documents in electronic form.

In this case, paper originals are scanned and certified before sending, and electronic ones are downloaded from exchange services along with electronic signature files. Before uploading documents to a special operator, you should check the formats.

The tax office can only work with three formats. Scanned copies must be in tiff or jpg, and electronic originals in xml format.

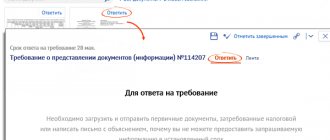

Submit your documents

Click "Submit".

Wait for your acceptance receipt. The status of sent documents can be determined by their status in the file list or in the document.

If you receive a refusal, change the data in the uploaded documents, for example, the serial number. Submit your submission again.

Imperfections of the current legislation

All electronic documents are conventionally divided into formalized and informal.

Formalized are those whose form and format are approved by the norms of the current legislation. These include electronic invoices, consignment notes TORG-12 and a certificate of completion of work. All other documents are considered unformalized. For formalized documents, the xml format is defined. In the case of invoices, this is mandatory; for primary documents, this is a recommendation. If you use an invoice or act not in xml, then such a document automatically becomes unformalized.

Submission of formalized documents does not cause problems. What to do with documents that were created and received, for example, in doc, pdf, xls or others, is a big question today.

File requirements

The unified portal of public services, which today allows companies to resolve many of their issues without leaving the office, accepts scanned documents that meet certain requirements. Thus, paper digitization should include the generation of electronic copies of documents in TIFF and PDF formats. In addition, pages containing black and white and gray illustrations are scanned in 8-bit Grayscale mode (256 shades of gray) at 150 DPI or 300 DPI. Please note that pages containing color illustrations are scanned in RGB (color mode) at 150 DPI or 300 DPI. Brightness and contrast settings are made to achieve the best results in terms of image clarity and color and for optimal typographic text recognition performance. In addition, scans must be opened for viewing using standard tools designed to work with them in the operating system MS Windows 2000/XP/Vista/7/8 without first displaying any warnings or error messages. It is not allowed to set the option to prohibit printing of contents in files, and it is also not allowed to protect them with a password for opening.

note

The letter of the Federal Tax Service dated February 9, 2021 No. ED-4-2 / [email protected] indicates that today the ability to send documents in xml format is established only for certain types of papers. Including for invoices; log of received and issued invoices; purchase books and sales books and additional sheets for them, if any.

Please note that TIFF and PDF should be used as the main formats for presenting digital images of scanned documents. Use of other formats is not recommended. Documents consisting of several pages should be scanned in multi-page mode. That is, after digitization, you should get one file containing images of all pages of the document. If the document consists of one paper page, it is allowed to use the JPEG format. The PDF format is used to fully represent a document in electronic form.

Finding a solution

Unfortunately, the current legislation of Russia does not in any way regulate the process of submitting non-formalized electronic documents upon request. Let's look at an example. They are asking us for an agreement that was created and signed in doc format. We upload it from the exchange service along with electronic signature (ES) files. There will be three files in total: the body of the document, our signature file and the counterparty’s signature file. We cannot send it through a special operator in this form, because our document is not in xml. What to do?

- Convert to the required format. Theoretically, using some converter, you can make jpg, tif or xml from doc. Many questions will immediately arise. What do we get from this transformation? A copy of the electronic contract? Let's say. Can we send it? Order of the Federal Tax Service of the Russian Federation N ММВ-7-6/ [email protected] mentioning tif and jpg, clearly indicates scanned copies of paper originals. There is no approved xml format for the agreement, which means that the tax office simply cannot verify such a document. It is also not clear what to do with the electronic signature files in this case. The option is definitely not suitable.

- Convert to the desired format via scanning. Print the document, certify it with the manager’s handwritten signature and the organization’s seal, then make a scan in the required tif or jpg. Only this time it will be a copy of a copy and it is not clear what to do with the electronic signature files.

Technically, both options are feasible, but have not been tested in practice.

What if it goes to court?

In the practice of litigation on this topic, the prospects are sad. There are few decisions of regional courts, mostly from previous years, that supported taxpayers. But given the existence of a broad rule - “outside the scope of tax control” - and the tax authority’s statement of “justified necessity” - in the issue of requesting documents, the courts mainly take the side of the tax authorities.

- If the verification period has expired, is the claim legal? “It’s legal,” the court says.

- If the request does not indicate specific details of the requested documents, do you need to comply with it? - Definitely, the court decides. – The inspector may not have them.

- Are requests through a chain of counterparties legal? – Lawful, the court answers.

- Is a requirement legal if it is not clear from its content within what tax control procedure it was issued? - The demand is legal. - the court concludes. — This violation when filling out the requirement is of a formal nature and does not interfere with the authority of the tax office to receive documents and information.

The judicial authorities attribute the assessment of circumstances, decisions on the timing and volume of required documents exclusively to the competence of the tax inspectorate conducting the audit . Like this.

It is clear that each company, based on its own situation and analysis of possible risks, makes its own decision on how to respond to the received demand and whether it is worth initiating legal proceedings.

Perhaps, given the wild decisions and millions of fines for failure to submit documents, it is worth going to court and defending your position.

Recommendations from Synerdocs experts

- Work on electronic document formats is carried out for a reason. If there is a format, it is definitely better to use it. There will definitely be no problems with submitting formalized documents.

- Submit unformalized documents on paper. This is what the Ministry of Finance itself recommends in letters dated 01/11/2012 N 03-02-07/1-1 and dated 01/11/2012 N 03-02-07/1-2. That's it for now. Let’s wait and see which option the Federal Tax Service implements.

- Resolve issues together with the operator and inspection. Typically, operator representatives are always ready to answer your questions. And tax authorities are now very loyal to companies that are switching to electronic document exchange. Market innovators, together with representatives of government authorities, could well influence the legislative process and consolidate the best practices of primary exchange at the level of regulations.

Responsibility

Refusal to submit the requested documents or failure to submit them within the established time frame is recognized as a tax offense and entails liability under Article 126 of the Tax Code of the Russian Federation - 200 rubles for each document not submitted and Article 129.1 of the Tax Code of the Russian Federation for failure to provide explanations - a fine of 5,000 rubles, for a repeated violation - 20,000 rubles .

If within 12 months you have already been subject to Article 126 of the Tax Code of the Russian Federation, the fine may be doubled and amount to 400 rubles. (200 rubles x 2) for each unsubmitted (lately submitted) document (clauses 2, 3 of Article 112, clause 4 of Article 114 of the Tax Code). Given the significant document flow, this is a lot.

Selection of documents for the Federal Tax Service by downloading from disk

the Load from disk button

The user has a choice (Fig. 5):

- on command Scanned document -

upload image files (scanned documents);

- on command Documents from another database

– upload an archive with images or xml files downloaded from another database.

Rice. 5. Options for loading files from disk

Uploading scanned documents

Command Load from Disk – Scanned Document

is used if the scanned documents were not attached to the infobase documents in advance. This opens a standard dialog for selecting files from disk (Fig. 6).

Rice. 6. Selecting a file from disk

Selected scanned documents are included in response to a request for the Open

.

This opens the form Preparing a document for sending

, where the selected documents should be pre-processed as follows (Fig. 7):

- add pages of a scanned document if the document is multi-page (button Add

);

- fill in the field Name, details or other characteristics of the source document

. You can manually enter the document details or select a document from the information base using the selection button;

- fill in the field Name, details or other characteristics of the base document (optional)

, if the added document has a basis document (agreement, invoice for payment or other primary document confirming the emergence of contractual relations between the parties to the transaction);

- in field Notary's signature

select a notary’s electronic signature file if the electronic document contains such a signature (for example, a document related to the registration of a legal entity (IP), power of attorney, etc.).

Rice. 7. Preparing a scanned document for sending

After filling out the required document description, click on the Add button in response to the requirement

(Fig. 7).

This opens the Requirement Item

, where you need to indicate the point of the original requirement from the pdf file, in response to which a scanned document is sent (Fig. 8).

Rice. 8. Item requirement

Click OK

The document data will be stored in the request response form.

Loading an archive of documents from another database

If xml documents or scanned documents that need to be sent in response to the request of the Federal Tax Service are located in another information database, then they can be downloaded from this database into a special archive file (exchange file), and then loaded into the information database from which the response is being prepared to the requirement.

To load documents from another database, click the Load from disk

and select

the Documents from another database

(Fig. 9).

Rice. 9. Loading documents from another database

In this case, a form appears where the Load

You can choose one of two download options:

- Loading 1C-EDO or 1C-Taksk xml documents from another database.

- Uploading scanned documents from another database

.

When you select the first option, a form for downloading electronic documents from the exchange package appears and a standard dialog for selecting files from disk opens. The archived file should be highlighted and selected using the Open

.

The electronic document download form displays a list of xml files from the archive file. The required documents should be marked with flags and added in response to the requirement, having previously indicated the item of the original requirement from the pdf file.

In this case, not only the xml documents themselves are loaded, but also the files of electronic signatures for them.

If you select the second option Upload scanned documents from another database

a form for downloading scanned documents from an external source appears and a standard dialog for selecting files from disk opens.

The exchange file should be highlighted and selected using the Open

.

The Upload Scanned Documents from External Source form will display a list of scanned documents from the exchange file that can be included in response to the request.

Details of the scanned document and its image can be viewed in a separate form, which opens by double-clicking.

The required documents should be marked with flags and added in response to the requirement, having previously indicated the item of the original requirement from the pdf file.

To edit details and other features of a document, as well as the base document, just double-click on the document line. This opens a document editing form, as in Figure 7, where you can make the necessary adjustments.

Adviсe

- Keep all correspondence with the tax office: your explanations, cover letters with registers of submitted documents with marks (receipts, protocols) of acceptance, copies of requirements. When dismissing responsible employees, transfer the folder with correspondence with the tax office according to the acceptance certificate as part of the main documents.

- Based on the requested documents, assess the legality of the request, the purpose of the request and calculate the risks.

- Try not to conflict with the tax office and peacefully resolve the issue of submitting documents. Remember that the inspector can also make mistakes.

- When receiving a request and when drawing up a response, look again at the Tax Code. Articles 88,93,93.1 will support you. (and perhaps this article will help)))

- Support all your actions, and especially counteractions, with tax law. Even if you don't go to court.

- Record your statements and objections in writing and send them to the inspectorate.

- Be aware of negative judicial practice on this topic. But if the price is worth it, good luck!

I hope this was helpful.

I wish you calm work, without shocks and without demands!

Preparing to Scan Documents

To scan documents as efficiently as possible, you need to carefully prepare for it.

Before you start scanning directly, you need to unstitch the documentation, remove staples and paper clips, etc. If stitching is fundamentally impossible, you can scan such documents on a special scanner.

At the final stage of preparing documents for scanning, papers are organized by content, structural divisions, chronology, etc.

Editing the response to the Federal Tax Service's request to provide documents

Documents to be submitted is filled out in the response form

.

To edit the tabular part, select the line(s) and use the command bar buttons located above the tabular part (Fig. 16):

- Change

– to edit a document line;

- Remove current item

– to delete a document line from a response to a requirement or the entire requirement item with all document lines;

- Change requirement clause –

to change the number of the claim item;

- Move current element...

– to move a document line up or down within a requirement item group. To move a document to another requirement item, simply drag it while holding down the mouse button.

Rice. 16. Ready answer