Our author Alexey Ivanov talks about the legal reduction of income tax in his Telegram channel.

Some useful information about the possibilities of accounting policies for optimizing taxation. Today we’ll talk about income tax again – it has the most such opportunities.

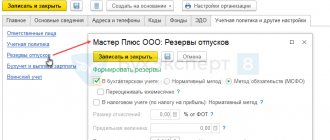

There is something in tax accounting that is pleasant for the taxpayer and unpleasant for the accountant - reserves. If you are not engaged in specific types of activities, then there are 4 of them:

- for doubtful debts (Article 266 of the Tax Code of the Russian Federation)

- for the repair of fixed assets (Article 260 of the Tax Code of the Russian Federation)

- for warranty repairs and warranty service (Article 267 of the Tax Code of the Russian Federation)

- for vacation pay (Article 324.1 of the Tax Code of the Russian Federation)

The taxpayer has the right to create them, securing his decision in the accounting policy.

The purpose of creating reserves is to defer tax payment. Let me remind you: it gives you the opportunity to put the saved money into circulation and have time to earn your own rate of profit on it. How is this delay achieved? By creating a reserve, you recognize an expense before you actually incur it. Sometimes it happens that the expense will not be made at all, but a reserve has been created for it. And it's legal. Such a reserve will then have to be included in income, but by that time the money will have already turned around and brought profit.

For an accountant, this wonderful relief from the state turns into a complication of both tax and accounting. PBU 18/02 and that’s all. Therefore, Aunt Masha tries not to tell her employer about him.

Accounting

The obligation to form a reserve for vacation pay is determined by the norms of the new PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”, approved by Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n.

The effect of PBU 8/01 “Conditional facts of economic activity” is considered invalid with the financial statements for 2011. a) the organization has an obligation that was a consequence of past events in its economic life, the fulfillment of which the organization cannot avoid;

b) a decrease in the economic benefits of the organization necessary to fulfill the estimated liability is likely;

c) the amount of the estimated liability can be reasonably estimated.

So, the organization, in accordance with the Labor Code of the Russian Federation, is obliged to provide its employees with annual leave and pay for them. Such an obligation arises as a result of employees performing labor functions, and the organization cannot avoid it. To fulfill this obligation, the company will incur costs, that is, there will be a reduction in economic benefits.

The reserve for vacation pay is recognized in accounting:

- in the reporting period in which employees perform labor functions, as a result of which they have the right to paid leave - if the leave can be transferred to future reporting periods;

- in the reporting period in which the organization has an obligation to compensate for vacation - if the vacation cannot be transferred to future reporting periods.

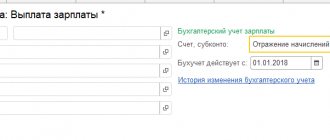

In accounting, the reserve for vacation pay is reflected in the reserve account for future expenses. In accordance with the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, account 96 “Reserves for future expenses” is intended to summarize information on the status and movement of amounts reserved for the purpose of uniform inclusion of expenses into production costs and selling costs.

The reservation of amounts is reflected by the insurance organization on the credit of account 96 “Reserves for future expenses” in correspondence with the debit of account 26 “General business expenses”. Depending on the labor function of employees and the characteristics of the work they performed, expenses associated with deduction to the reserve for vacation pay should be allocated to the appropriate sub-accounts opened under account 26 “General business expenses.”

Actual expenses for which a reserve was previously created are debited to account 96 “Reserves for future expenses” in correspondence with accounts 70 “Settlements with personnel for wages” and 69 “Settlements for social insurance and security”. Account 97 “Deferred expenses” is no longer used to reflect vacation pay.

If the amount of the accrued reserve is insufficient to pay vacation pay, the costs of repaying the obligation are reflected in accounting as current. It should be taken into account that, in accordance with clause 21 of PBU 8/2010, a recognized estimated liability can be written off to reflect the costs of fulfilling only the obligation for which it was created.

If the amount of the accrued reserve is excessive, its balance is applied to the following periods, which directly follows from paragraph. 2 clause 22 PBU 8/2010. For example, if the terms of employment contracts change, leading to the formation of excess reserve amounts, the unused amounts are not written off to the organization’s income, but are transferred when the reserve is formed in the next period.

The correctness of the formation of the reserve is subject to periodic verification at least at the end of the reporting year, as well as upon the occurrence of new events that will affect the amount of obligations to pay vacation pay (for example, a reduction in staffing positions in service departments). Based on the results of the audit, the amount of the reserve can be increased by additional accrual, reduced by adjusting the amount of the reserve in the next reporting period, or written off when the conditions for recognition of the estimated liability are no longer met, or left unchanged.

All organizations, with the exception of organizations that have the right to conduct simplified accounting, are required to create a reserve in accounting for payment of vacations and recognize an estimated liability for payment of upcoming vacations.

The purpose of creating a vacation reserve is to show that at the reporting date the organization has an obligation to employees to pay for vacations.

The vacation reserve is created on the reporting date.

The vacation reserve is created:

- or on the last day of each month (each reporting date);

- or on the last day of each quarter;

- or only on December 31 of each year. This option can only be used by those organizations that submit only annual reports to participants.

The choice of date for calculating the reserve is fixed in the accounting policy.

If the accrued reserve is not enough and the balance on account 96 has become zero, then vacation pay and compensation for unused vacation must be credited to the debit of cost accounting accounts 20 (08, 23, 26, 44).

The procedure for calculating the amount of the reserve for vacation pay is not legally established.

Each organization must develop and consolidate it in its accounting policies.

You can use one of the three most common methods.

Method 1.

The reserve (credit balance of account 96 “Reserves for future expenses”, subaccount “Reserve for vacation pay”) is calculated based on the average daily earnings of employees.

Method 2.

When using this method, you first need to distribute all employees into groups, depending on which of the accounting accounts their salaries are debited to.

For example, the salaries of employees directly involved in the production of products are reflected in the debit of account 20 “Main production”, the salaries of administrative and management personnel (including directors and accountants) are reflected in the debit of account 26 “General expenses”, the salaries of sales managers are reflected in debit account 44 “Sales expenses”.

After this, deductions to the reserve (credit turnover of account 96 “Reserves for future expenses”, subaccount “Reserve for vacation pay”) are calculated based on the share of expenses for vacation pay for employees of each group in the total amount of labor expenses for this group.

Method 3.

The third method of calculating the amount of the reserve involves determining the standard for contributions to the reserve, which is calculated based on the results of the previous year. This standard will be determined as the share of expenses for vacation pay and compensation for employees of each group in the total cost of wages for this group for the year.

The amount of the vacation reserve in the organization’s balance sheet will be reflected in line 1540 “Estimated liabilities” in an amount equal to the credit balance of account 96 “Reserves for future expenses”, subaccount “Reserve for vacation payments”.

Bank reserves, which are mandatory or reserve requirements

Definitions 2

Reserve requirements or obligatory reserves of a bank are bank funds that banks are obliged to keep in bank branches. This is done in order to ensure a guarantee of bank obligations to depositors.

Specifically, they can be called the most effective tool. Their assistance makes it possible to regulate the overall liquidity of the bank system and control the funds of state commercial banks. Bank required reserves can determine the limitations of banks' lending capabilities, the process of regulating the amount of money that is in circulation. Despite the fact that required reserves are highly liquid assets, they cannot be fully used if unforeseen circumstances arise in the bank.

In order to use them, a special limit is introduced. Even by increasing the total volume of required bank reserves, it will not allow the amount of the limit that has been established to be exceeded. Otherwise, all this will lead to additional withdrawal of money from circulation. The process of forming required bank reserves is almost considered an instrument of the monetary policy of the state government.

Reserve for doubtful debts in tax accounting 2021

The procedure for creating and using any reserve must be fixed in the accounting policies of the organization. If an organization creates a reserve for certain types of expenses, then the resulting expenses should be written off precisely from the reserve. And only if the reserve is not enough, then the remaining expenses reduce the tax base.

For some reserves, the amount of the reserve unused as of December 31 can be carried forward to the next year if the organization creates this type of reserve in the next year.

Keep in mind that the creation of reserves in accounting and tax accounting may differ. For example, an organization is required to create a reserve for vacation pay in accounting (PBU 8/2010), but it may not create such a reserve in tax accounting.

A reserve for doubtful debts can be created only for customer debt associated with the sale of goods, performance of work, provision of services, which is not secured by a pledge, guarantee, bank guarantee and is not repaid within the period established by the contract (Article 266 of the Tax Code of the Russian Federation).

Contributions to the reserve are included in non-operating expenses.

We suggest you read: Is it possible to reduce the position of a maternity maid during maternity leave || Reducing the rate of an employee on maternity leave

To determine the amount of contributions to the reserve on the last day of each quarter (month), it is necessary to conduct an inventory.

The total amount of the reserve calculated based on the results of the tax period cannot exceed 10% of the sales proceeds (excluding VAT) for the specified tax period.

The vacation reserve in tax accounting is created in the manner determined by the organization itself (Article 324.1 of the Tax Code of the Russian Federation). That is, you need to set a maximum amount of deductions (the estimated annual amount of expenses for vacations, taking into account insurance premiums) and the monthly percentage of deductions to the reserve.

Deductions to the reserve for vacation pay are taken into account as part of labor costs.

This reserve can be created only by those organizations that have warranty obligations to buyers (Article 267 of the Tax Code of the Russian Federation). The procedure for creating a reserve is clearly stated in Art. 267 of the Tax Code of the Russian Federation and it cannot be changed. Amounts of contributions to the reserve are taken into account as other expenses associated with production and sales.

There have been no changes in tax legislation regarding the calculation of reserves for vacation pay. Creating a reserve in tax accounting remains the right of the company, and not its responsibility. Therefore, companies independently determine for themselves the feasibility of creating such a reserve. In the Tax Code of the Russian Federation, the approach to calculating the reserve is based on the decision made to uniformly account for tax purposes for upcoming expenses for paying for employee vacations, that is, taxation will not be affected by sharp changes in vacation expenses in winter and summer.

Also, the tax legislation clearly defines the mechanism for calculating the reserve. It differs from the requirements of accounting regulations, that is, it is impossible to bring tax and accounting together. Let’s say right away that there will be accounting differences that need to be reflected in accordance with PBU 18/02 “Accounting for income tax calculations”, regardless of whether the organization creates a reserve in tax accounting or not.

If an organization does not create a reserve in tax accounting, expenses for vacation pay, including insurance premiums, for the purposes of calculating income tax are taken into account in expenses at the actual amount.

The organization that decided to create a reserve is guided by the provisions of Art. 324.1 “Procedure for accounting for expenses for the formation of a reserve for upcoming expenses for vacation pay, a reserve for the payment of annual remuneration for long service” of the Tax Code of the Russian Federation and, of course, must reflect the adopted method of reserving in the accounting policy. In addition, the accounting policy specifies the maximum amount of deductions and the monthly percentage of deductions to the specified reserve.

The organization draws up a special calculation, which reflects the procedure for calculating the amount of monthly contributions to the reserve based on information about the estimated annual amount of expenses for vacation pay. There is no unified form of calculation, so each organization develops it independently and enshrines it in its accounting policies.

The percentage of contributions to the reserve for vacation pay is determined as the ratio of the estimated annual amount of related expenses to the expected annual amount of labor costs. Moreover, the annual amount of labor costs includes the estimated annual amount of vacation pay (Letter of the Ministry of Finance of Russia dated 09/08/2008 N 03-03-06/1/511).

Please note that in accordance with Part 1 of Art. 120 of the Labor Code of the Russian Federation, the duration of annual basic and additional paid leaves of employees is calculated in calendar days and is not limited to a maximum limit. Therefore, the estimated annual amount of labor costs can be calculated based on the total number of unused vacation days, regardless of whether this reserve is created for the first time or calculated for the next year (Letter of the Ministry of Finance of Russia dated July 13, 2010 N 03-03-06/2/125) .

The calculation of the maximum amount of contributions to the vacation pay reserve is based on data obtained on the basis of local data and primary documents (remuneration regulations, staffing schedule for the coming year, pay slips for previous periods, vacation schedules, etc.), which are confirmation economic feasibility of expenses.

The maximum amount of contributions to the reserve for upcoming expenses for vacation pay in the next tax period is determined taking into account the amount of the transferred reserve of the previous tax period. By analogy with accounting, the amount of the reserve includes the amount of insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases.

Example 3. An organization decided to create a reserve in tax accounting, which was provided for in its accounting policy. Monthly contributions to the reserve are 10% of actual labor costs, and the maximum annual contribution to the reserve is RUB 1,610,400. The calculation of the percentage of deductions and its maximum value is given in Table 3.

Table 3

A taxpayer who has decided to uniformly account for future expenses for paying employees' vacations for tax purposes is obliged to reflect in the accounting policy for tax purposes:

- the method of reservation adopted by him;

- the maximum amount of contributions and the monthly percentage of contributions to the specified reserve.

For these purposes, the taxpayer is required to draw up a special calculation, which reflects the calculation of the amount of monthly contributions to the reserve, based on information about the estimated annual amount of expenses for vacations, including the amount of insurance premiums for such expenses.

In this case, the percentage of contributions to the reserve is determined as the ratio of the estimated annual amount of expenses for vacation pay to the estimated annual amount of labor costs.

Results

The formation of a reserve for doubtful debts for the purposes of tax accounting is not necessary.

If it is created, then when working with a reserve it is necessary to comply with all the rules established for it by Art. 266 Tax Code of the Russian Federation. Differences in the procedures for creating a reserve in accounting and accounting records determine the presence of discrepancies between the two accounting data, regarded as temporary differences. These differences are taken into account according to the rules of PBU 18/02. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation of the reserve for vacation pay

PBU 8/2010 does not disclose the method for calculating the reserve. It only says that the amount of the estimated liability must reflect the most reliable monetary estimate of the costs necessary for calculations for this liability. The most reliable estimate of expenses is the amount required directly to fulfill (repay) the obligation as of the reporting date.

Each organization determines the methodology for calculating the reserve that meets the requirements of PBU 8/2010 independently and establishes the mechanism for this calculation in its accounting policies. The accounting policy also indicates the frequency of assessment - monthly or quarterly (as of the reporting date - March 31, June 30, September 30, December 31).

The reserve can be calculated separately for each employee, or on average for categories of personnel, for example, for sales departments, management staff and service departments. The most reliable, but at the same time time-consuming method is the calculation for each employee. Each organization determines a method convenient for itself and enshrines it in its accounting policies.

When calculating the reserve separately for each employee, the number of days of paid leave to which the employee is entitled as of the reporting date and his average daily earnings are taken.

When calculating the reserve for a group of employees, the number of days of paid leave to which each employee is entitled as of the reporting date is taken, and the average daily earnings not of an individual employee, but as a whole for the group taken into account. In this case, the basis for determining the average daily earnings will be the average monthly salary for the selected group.

We invite you to read: Cancellation of a court order to collect housing and communal services debt in 2021: How to cancel (challenge) and write an objection. sample debt dispute applications

The calculation of average earnings is carried out in accordance with the provisions of Decree of the Government of the Russian Federation of December 24, 2007 N 922 “On the specifics of the procedure for calculating average wages” (hereinafter referred to as the Regulations). To calculate average earnings, all types of payments provided for by the organization’s remuneration system are taken into account, regardless of the sources of these payments.

Average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months.

Amount of wages actually accrued for the billing period———————————————-: 29.4.12 Amount of wages actually accrued for the billing period—————————————— —-,29.4 x KM Kdngwhere KM is the number of complete calendar months; K is the number of calendar days in incomplete calendar months: dn29.4 Number of calendar days, ————————— x falling on time, Number of calendar days worked in incomplete month.incomplete month

When recognizing the obligation to pay vacation pay to employees, the obligation for the corresponding insurance premiums that will arise upon the actual payment of vacation pay in accordance with the current legislation of the Russian Federation is recognized. In other words, the amount of expenses intended to pay insurance premiums increases the reserve for vacation pay.

The base for calculating insurance premiums is determined in accordance with the provisions of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds” and the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases.”

The rate of insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance is 34%. The rate of insurance contributions for compulsory social insurance against accidents at work and occupational diseases is 0.2%.

At the same time, the maximum value of the base for calculating insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance for each individual must also be taken into account - it amounted to 463 thousand in 2011. rub. {amp}lt;1{amp}gt;

463,000——————————— x 0.34 x 100.Monthly salary x 12

Let's look at examples of calculating reserves for accounting purposes.

Example 1. An organization creates a reserve for vacation pay separately for each employee. The initial data and calculation of the reserve are given in Table 1.

Table 1

| N | FULL NAME. | Number of days of unused vacation | Average daily earnings, rub. | Reserve amount, rub. (gr. 3 x gr. 4) | Amount of insurance premiums, rub. | Total amount of reserve, rub. (group 5, group 6) |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | Aistov V.G. | 25 | 1 300 | 32 500 | 11 115,00 | 43 615,00 |

| 2 | Voronin S.I. | 15 | 1 000 | 15 000 | 5 130,00 | 20 130,00 |

| 3 | Dyatlova M.V. | 38 | 1 200 | 45 600 | 15 595,20 | 61 195,20 |

| 4 | Zhuravlev O.P. | 5 | 2 500 | 12 500 | 2 250,00 | 14 750,00 |

| 5 | Orlova I.V. | 10 | 1 700 | 17 000 | 4 488,00 | 21 488,00 |

| 6 | Sorokina G.N. | 18 | 2 100 | 37 800 | 8 089,20 | 45 889,20 |

For workers numbered 1 - 3, whose annual income does not exceed 463 thousand rubles, the insurance premium rate will be 34.2%, including 0.2% of insurance premiums for compulsory social insurance against industrial accidents and occupational diseases. For example, Aistov V.G. The average daily earnings is 1,300 rubles, that is, the annual income is 458,640 rubles. (RUB 1,300 x 29.4 days x 12 months).

For workers numbered 4 - 6, the annual income will exceed 463 thousand rubles. For example, Zhuravlev O.P. it will be equal to 882 thousand rubles. To calculate the rate of insurance premiums for them, we apply the formula we proposed. So, for Zhuravlev O.P. the insurance premium rate will be 18.0% (17.8 0.2):

- (463 thousand rubles x 0.34 x 100) / (2500 rubles x 29.4 x 12) = 17.8% - the rate of insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory health insurance;

- 0.2% is the rate of insurance contributions for compulsory social insurance against industrial accidents and occupational diseases.

Example 2. An organization creates a reserve for vacation pay by categories of personnel. The initial data for calculating the reserve are given in Table 2.

table 2

| N | Personnel category | Number of people | Monthly salary amount, rub. | Average daily earnings, rub. (gr. 4 : gr. 3 : 29.4) | Number of days of unused vacation | Amount of reserve (excluding insurance premiums), rub. (group 5 x group 6) |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | Directorate | 100 | 6 174 000 | 2 100,00 | 400 | 840 000,00 |

| property insurance (selling division) | ||||||

| 2 | Accounting | 10 | 380 000 | 1 292,52 | 35 | 45 238,10 |

| (service department) | ||||||

| 3 | Administration | 15 | 1 100 000 | 2 494,33 | 70 | 174 603,00 |

| (managerial staff) |

The rate of insurance premiums is determined according to the previously proposed formula. In this case, the average monthly salary for the division is taken as the salary, which is defined as the ratio of the monthly salary for the division as a whole to the number of employees of this division. The insurance premium rate for the selling division will be equal to 21.4% ((463 thousand rubles x 0.34 x 100) / (61,740 x 12) 0.2%). To calculate the total amount of the reserve, indicators for categories of employees are summed up.

The validity of the amount of the reserve for vacation pay taken into account must be documented. Data on the number of days of unused vacation for calculating the reserve is usually provided by the HR department. This document, signed by the responsible person, and the vacation schedule adopted by the organization can serve as supporting documents.

When calculating the reserve, fixed-term employment contracts, as well as employment contracts in which one of the conditions is a probationary period, terminated employment contracts and employment contracts in which changes have been made regarding the conditions for granting vacations and their payment, etc., must be subjected to a separate assessment.

The amount of contributions to the reserve for vacation pay does not include expected payments under civil contracts. The fact is that labor legislation and other acts containing labor law standards do not apply to persons working on the basis of civil contracts, unless the court establishes otherwise (Article 11 of the Labor Code of the Russian Federation). Consequently, such persons are not entitled to leave.

| N | Index | Value, thousand rub. |

| 1 | 2 | 3 |

| 1 | Estimated annual cost of vacation pay | 1 200,0 |

| 2 | Insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance from the estimated amount of vacation pay for the year (page 1 x 34%) {amp}lt;1{amp}gt; | 408,0 |

| 3 | Insurance contributions for compulsory social insurance against accidents at work and occupational diseases from the estimated amount of vacation pay for the year (page 1 x 0.2%) | 2,4 |

| 4 | Limit amount of contributions to the reserve (page 1 page 2 page 3) | 1 610,4 |

| 5 | Estimated amount of labor costs for the year (including estimated annual vacation costs) | 12 000,0 |

| 6 | Insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance from the estimated amount of labor costs for the year (page 5 x 34%) | 4 080,0 |

| 7 | Insurance contributions for compulsory social insurance against accidents at work and occupational diseases from the estimated amount of labor costs for the year (page 5 x 0.2%) | 24 |

| 8 | Estimated annual amount of labor costs, taking into account insurance premiums (page 5 page 6 page 7) | 16 104 |

| 9 | Percentage of monthly contributions to the reserve (page 4: page 8 x 100%) | 10% |

| 10 | The amount of monthly contributions to the reserve (the amount of actual labor costs for the month, taking into account insurance premiums x page 9) | Determined monthly |

| Month | Actual labor costs, rub. | Amount of monthly contributions to the reserve, rub. |

| January | 1 400 000 | 140,000 (1,400,000 x 10%) |

| February | 1 200 000 | 120,000 (1,200,000 x 10%) |

| March | 1 600 000 | 160,000 (1,600,000 x 10%) |

| April | 1 500 000 | 150,000 (1,500,000 x 10%) |

| May | 1 400 000 | 140,000 (1,400,000 x 10%) |

| June | 1 250 000 | 125,000 (1,250,000 x 10%) |

| July | 1 300 000 | 130,000 (1,300,000 x 10%) |

| August | 1 750 000 | 175,000 (1,750,000 x 10%) |

| September | 1 450 000 | 145,000 (1,450,000 x 10%) |

| October | 1 250 000 | 125,000 (1,250,000 x 10%) |

| November | 1 400 000 | 140,000 (1,400,000 x 10%) |

| December | 1 500 000 | 60 400 (1 610 400 — 140 000 — 120 000 -160 000 — 150 000 — 140 000 — 125 000 -130 000 — 175 000 — 145 000 — 125 000 -140 000) |

| Total | 17 000 000 | 1 640 400 |

Monthly amount of contributions to the reserve

Calculate the monthly amount of contributions to the reserve for future payments to employees using the formula:

| Monthly amount of contributions to the reserve for future payments to employees | = | The actual amount of labor costs (excluding future payments), taking into account contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases | × | Monthly percentage of contributions to the reserve |

This procedure follows from the provisions of paragraph 2 of paragraph 1 of Article 324.1 of the Tax Code of the Russian Federation.

In the month when the amount of monthly deductions, calculated on an accrual basis from the beginning of the year, exceeds the maximum amount established in the accounting policy, calculate the amount of deductions to the reserve as follows:

| Monthly amount of contributions to the reserve for future payments to employees | = | Established maximum amount of contributions to the reserve for the year | – | Actual amount of contributions to the reserve since the beginning of the year |

From the next month, do not count on contributions to the reserve. This follows from the provisions of paragraph 1 of Article 324.1 of the Tax Code of the Russian Federation.

Formation of accounting policies regarding the reserve for vacation pay

Here are the formulations that can be used in the accounting policies of an insurance organization.

We invite you to familiarize yourself with: Order for leave of the General Director and assignment of responsibilities: sample 2020

“The estimated liability in the form of a reserve for vacation pay is determined on the last day of each quarter.

The amount of the reserve is calculated as the amount of expenses for upcoming vacations to employees, increased by insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases.

SUM (K x ZP), days from where K is the number of vacation days not used by each employee during the period from the start of work to the end of each quarter; ZP is the employee’s average daily earnings.

The amount of insurance premiums is determined as the product of the amount of expenses for upcoming vacations and the insurance premium rates.

463,000——————————— x 34% x 100Monthly salary x 12

and cannot exceed 34%.

The rate of insurance contributions for compulsory social insurance against accidents at work and occupational diseases is 0.2%.

The accrual of the reserve is reflected in the accounting records by an entry in the debit of account 26 “General business expenses” in correspondence with account 96 “Reserve for vacation pay.”

The use of the reserve is reflected in the accounting records by entries in the debit of account 96 “Reserve for vacation pay” and the credit of accounts 70 “Calculations for wages” and 69 “Calculations for social insurance”.

If the cost of paying vacation pay, including the amount of insurance premiums, exceeds the amount of the reserve, the difference is charged to expenses in the general manner. In case of excess of the amount of the accrued reserve over the amount of vacation expenses, the underused amount of the reserve is included in the reserve formed in the period following the reporting period.”

The procedure for forming reserves

Form all reserves for upcoming payments to employees according to a single scheme (clause 6 of Article 324.1 of the Tax Code of the Russian Federation).

To calculate monthly deductions, draw up a special calculation (estimate), in which you indicate:

- the estimated annual amount of labor costs, taking into account contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases;

- the estimated annual amount of upcoming payments, taking into account contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases;

- percentage of monthly contributions to reserves.

A unified form of such an estimate is not established by law. Therefore, compose it in any form, taking into account the requirements of paragraph 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ on the mandatory details of primary accounting documents.

Temporary differences

During the calendar year, it is obvious that the amount of the reserve calculated by different methods in accounting and tax accounting will not be the same and temporary differences will have to be accrued on the basis of PBU 18/02 “Accounting for calculations of corporate income tax”, approved by the Order of the Ministry of Finance of Russia dated November 19. 2002 N 114n.

If, in the reporting period, labor costs in accounting exceed the same expenses in tax accounting, deductible temporary differences will arise, which will lead to the formation of deferred income tax and reduce the amount of income tax payable to the budget in the period following the reporting period or subsequent ones. reporting periods.

If tax accounting expenses turn out to be greater than in accounting, taxable temporary differences will arise, which will lead to the formation of deferred income tax and increase the amount of income tax payable to the budget in the following or subsequent reporting periods.

Temporary differences accrued throughout the year will be fully repaid only on December 31; only on this reporting date will the amount of the reserve in accounting and tax accounting be equal, since in tax accounting the calculation will be made based on the number of days of unused vacation and the average daily salary. And in the first quarter of next year, temporary differences will again have to be calculated and the current income tax adjusted.

When calculating temporary differences in transactions, the following accounts are used: 09 “Deferred tax assets”, 26 “General business expenses” (type of expense - labor costs), 68 “Calculations for income tax”, 69 “Calculations for social insurance”, 70 “ Payments for wages", 77 "Deferred tax liabilities", 91 "Other income", 96 "Reserve for vacation pay".

Note. When forming a reserve for vacation pay, temporary differences must be reflected in accounting during the calendar year.

Let's look at the example of accounting and tax accounting of the reserve during the year, determine the accounting entries for the accrual of the reserve, accounting for vacation pay and temporary differences. In the example, vacation costs include insurance premiums.

Example 4. An organization decided to create a reserve for vacation pay in accounting and tax accounting since 2011. Previously, the reserve was not accrued. Let us assume that during 2011, on the last day of each quarter, a reserve for accounting and tax accounting was accrued in the amount according to the data in Table 5 (tax accounting data taken from example 3).

Table 5

An example of a methodology for creating a reserve for doubtful debts

A reserve is created for doubtful accounts receivable that are not repaid within the time period established by the agreement, while the period of delay in payment is more than 20 calendar days, provided that such debt is not secured by appropriate guarantees (pledge, deposit, surety, bank guarantee or other guarantees, issued by the counterparty, which, in the subjective opinion of the commission appointed by order of the manager, can be accepted as a guarantee of payment of the debt).

Also, a reserve can be created for accounts receivable, which with a high degree of probability will not be repaid within the time limits established by the contract, on the basis of analytical and financial calculations, which are made by a commission appointed by order of the manager.

Data on accrual of reserve for vacation pay

| Reporting date | Amount of accrued reserve, rub. | Actual vacation expenses, rub. | |

| in accounting | in tax accounting | ||

| 01.01.2011 | 0 | 0 | |

| 31.03.2011 | 450 000 | 420 000 | 300 000 |

| 30.06.2011 | 420 000 | 415 000 | 400 000 |

| 30.09.2011 | 460 000 | 450 000 | 500 000 |

| 31.12.2011 | 250 000 | 325 400 | 200 000 |

| Total for 2011 | 1 580 000 | 1 610 400 | 1 400 000 |

For convenience, we assume that accounting accruals are carried out once a quarter (see Table 6).

Table 6

Bank reserve fund

Definition 3

The bank reserve fund is considered part of the bank's own capital, which can be formed through regular deductions from the profits received every year.

This fund is formed in order to increase the size of the authorized capital, and also serves to compensate and cover losses that sometimes occur due to the functioning of the banking system. The norms for deductions can be determined at a general meeting of bank shareholders. But the size itself cannot be higher than a certain amount. The process of forming reserve funds can occur due to the fact that net assets grow. Deductions from it can only be made when the bank has a profit and can cover losses.

Bank reserve in case of losses from depreciation of securities

This reserve is created in order to compensate for bank losses if securities prices change. The value on the securities market implies the average cost of such a security under concluded transactions that are made during the last trading days of the reporting month of the stock exchanges. There are norms and rules that imply that on the last working day of the month the securities that are in the bank must be revalued at market value. And if the indicator is lower than the balance sheet value, then the bank creates a reserve for the investment, which depreciates.

But the value of the securities balance itself must remain unchanged. And to sum it up, then reserve management will make it possible to control the volume of money in circulation and the money in commercial banks. Also, these measures will help reduce the financial risk for banks and can guarantee that the rights of clients will be protected by the state. All this is extremely important for anyone who decides to invest their money in a bank, trusting its structure.

Vacation Obligations - Reservation Rules

The estimated obligation to pay for upcoming vacations is one of the mandatory reserves in accounting. When forming it, it is important to remember that:

- the creation of an accounting vacation reserve is the responsibility of every company that has employees (except for representatives of small businesses that conduct simplified accounting (clause 3 of PBU 8/2010));

- the formation of a reserve is associated with the need to fulfill the requirements of labor legislation on the need to provide employees with paid leave (Articles 114–115 of the Labor Code of the Russian Federation);

- The amount of the vacation reserve reflected in the reporting allows its users to draw correct conclusions about the existence of vacation obligations at the reporting date.

The scheme for its formation is not regulated by law, however, when developing it, it is important to take into account several fundamental rules:

- periodicity rule - the vacation valuation liability is created for each reporting date;

- rule of rationality - the company has the right to choose a reservation criterion (separately for each employee, for divisions or for the company as a whole) depending on the size of the company and business conditions;

- rule of account identity - the expense items to which vacation reserves are allocated coincide with the expense item, which includes employee salaries.

Methods for calculating vacation obligations

The company creating the vacation reserve is free to choose the methodology for calculating the amount of the vacation obligation. The only requirement is that the algorithm used must provide the most reliable result.

Among the techniques that have become widespread in practice are (for example):

- regulatory method (tax) - calculation of contributions to the reserve is carried out according to the rules of the Tax Code of the Russian Federation (Article 324.1 of the Tax Code of the Russian Federation);

- IFRS method (see example below);

- proportional method - it is based on the following scheme: for the first month worked after vacation or hiring, the company's obligation to the employee is approximately 1/11 of the salary accruals; similarly, at the end of subsequent months worked, the vacation obligation is calculated in proportion to the number of months worked: 2/11 , 3/11, 4/11, etc.;

- average daily (group or individual) method - the amount of vacation obligation is calculated for a group of employees or individually for each of them based on the number of earned unused vacation days for each reporting date and the amount of average daily earnings.

Let's look at an example of how to calculate the vacation liability using the IFRS method.

Example

The structure of Winsor LLC has 3 divisions:

- administrative and economic (AHP);

- production and technical (PTP);

- supply and sales (SSP).

The accounting policy of Winsor LLC establishes:

- the volume of contributions to the reserve for vacation pay is determined based on the salary accruals of each department (including insurance premiums);

- accruals to newly hired and resigned employees during the month are not included in the calculation;

- each month worked in full entitles the employee to 2.33 days of annual paid leave;

- the amount of contributions to the reserve is determined monthly, which allows you to take into account all salary changes (increase or decrease in salary);

- formula for calculating contributions to the reserve for each division (OD):

OR = (payroll + insurance premiums per month) / 28 × 2.33.

For example, as of October 31, 2016, entries were made in the accounting of Winsor LLC related to salary accruals and deductions to the vacation reserve:

| Debit | Credit | Amount, rub. | Decoding the wiring |

| 26 | 70,69 | 478 956 | Salaries accrued to AHP employees |

| 20 | 70,69 | 1 437 237 | Salaries accrued to PTP employees |

| 44 | 70,69 | 321 523 | Salaries accrued to SSP employees |

| 26 | 96 | 39 856 (478 956 / 28 × 2,33) | A reserve has been accrued for vacation pay for AHP employees |

| 20 | 96 | 119 599 (1 437 237 / 28 × 2,33) | A reserve has been accrued for vacation pay for PTP employees |

| 44 | 96 | 26 755 (321 523 / 28 × 2,33) | A reserve has been accrued for vacation pay for SSP employees |