According to tax legislation, every working citizen is obliged to pay a certain amount in the form of taxes to the state treasury. If a taxpayer works in an organization or enterprise, the employer is usually responsible for paying taxes.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Among the documents confirming the conscientious payment of all due contributions is a certificate in form 2-NDFL. In what cases may it be necessary and where can I find a sample filling? More details in this material.

What changed

Since the beginning of 2021, it has become known that employers and companies paying income (for example, dividends) to individuals based on the results of the current year will continue to have to report according to new rules, for which they will need a sample 2-NDFL for 2021.

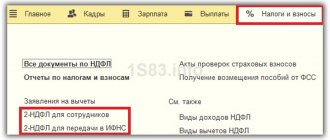

The new registration procedure is significantly different from the previous one. Let's look at how to fill out, where to find and download the current Form 2-NDFL 2019. As of 01/01/2019, changes have been made that will have to be taken into account by all employers, individual entrepreneurs and organizations paying income to individuals. Based on the Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected] , there will be not one form, but two. One of them is used for submitting reports to the Federal Tax Service, and the second is used for issuing to individuals who apply. As representatives of the Tax Service clarify, the sample for filling out the 2-NDFL certificate form in 2021 contains some points that are unnecessary for ordinary citizens. As for the form for the Federal Tax Service, it contains almost everything important and necessary, so the main part of the structure is preserved.

Note that both documents will have the same name - “Certificate of income and tax amounts of an individual.” But so that accountants do not get confused, a small adjustment is made:

- the report, which organizations and individual entrepreneurs must send to the tax authorities, has the abbreviation “form 2 personal income tax” in the title and the official number in the classifier of tax documents - KND 1151078;

- a document that is issued to an individual when he applies on the basis of Art. 230 of the Tax Code of the Russian Federation, has no abbreviations or numbers in the KND.

Since the purpose of the certificates is different, they have a different structure and procedure for filling out. And the Order of the Federal Tax Service directly states this. Minimal changes have been made to the form that employers must issue to employees (Appendix No. 5 of the Order of the Federal Tax Service). In particular, the line about the attribute, the adjustment number and the Federal Tax Service code and the details of the notification of the provision of a deduction were excluded from it. Since the new year, the document looks like this:

As for the report, which is submitted to the Federal Tax Service from 2021, there are slightly more changes in it. The help consists of an introductory part, two sections and one appendix. The previous form 2-NDFL had 5 sections. In addition, tax authorities removed fields for indicating the TIN of individuals and left only one field to clarify the type of notification confirming the right to one of the tax deductions.

Please note that if you fill out reports for tax authorities electronically and transfer them to the Federal Tax Service through operators, you will not notice any special changes. Intermediaries promise that they will promptly update the formats that tax agents use when transmitting data on income and personal income tax amounts. As for certificates for employees, and such requests are not uncommon, it is necessary to use new forms so as not to violate the requirements of the Tax Code of the Russian Federation.

Please note that as of 01/01/2019 the following are no longer valid:

- Order of the Federal Tax Service of the Russian Federation dated October 30, 2015 No. ММВ-7-11/485 and Order of the Federal Tax Service dated January 17, 2018 No. ММВ-7-11/ [email protected] , which now approved the working version of the document and the procedure for filling it out;

- Order of the Federal Tax Service of the Russian Federation dated September 16, 2011 No. ММВ-7-3/576 and Order of the Federal Tax Service dated December 8, 2014 No. ММВ-7-11/ [email protected] , which describe the rules on how to submit information on electronic and paper media and through telecommunications channel operators.

To submit information to the Tax Inspectorate of Moscow, St. Petersburg or another region, use our forms. To access them, registration or other additional steps are not required: all information is free for readers. It's up to you to fill out documents in word, excel or some other format.

Responsibility for late submission

According to Article 226 of the Tax Code of the Russian Federation, tax agents must not only withhold correctly calculated amounts of taxes from employee income, but also promptly transfer the withheld amounts to the state budget, which should be reflected in 2-NDFL certificates.

A tax agent is not required to submit information on individuals if:

- payments were made to employees required to independently pay personal income tax in accordance with Article 227 of the Tax Code of the Russian Federation, i.e. notaries, lawyers, etc.;

- the income received is not taxed. The list of such types of income is contained in Article 217 of the Tax Code of the Russian Federation.

In addition, the so-called zero certificate is not submitted when during the reporting period the company did not carry out activities and did not have employees.

In accordance with Article 126, paragraph 1 of the Tax Code of the Russian Federation, personal income tax reporting not submitted in a timely manner may be grounds for bringing a tax agent to tax or administrative-criminal liability.

To determine the measure of liability that can be applied in a particular case, tax services are guided by the provisions of Article 15.6, paragraph 1 of the Code of Administrative Offenses.

The fine in this case may be:

| 100-300 rubles | For citizens |

| 300-500 rubles | For officials |

| 500-1000 rubles | For officials representing authorities, diplomatic missions, etc. |

| 500-1000 rubles | For lawyers and advocates |

Despite the seriousness and obligatory nature of filing a 2-NDFL certificate, this document cannot be equated to a tax return, the responsibility for failure to provide which is slightly higher.

Thus, a 2-NDFL certificate may be required to be presented to the tax office or to an employee of an enterprise for his personal purposes. Such a certificate is drawn up on a standard form and contains the details of the enterprise, personal data of the employee and information about the amounts withheld.

Marks on the certificate are unacceptable; it is better to make a request for it in writing. Late submission of the 2-NDFL certificate may serve as a basis for the application of penalties.

Sample filling in 2021

Now let's look at a specific example. LLC "Company" must submit a report in 2021 for employee Semenova O.A. according to the new rules. To fill it out you must follow the instructions:

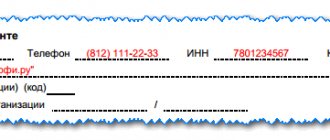

- In general information, everything is quite simple: TIN, KPP, name of the organization or individual entrepreneur, reporting year, Federal Tax Service code, reorganization code and TIN, KPP of the reorganized organization, OKTMO code, telephone.

- The certificate number is the serial number of the form sent in the reporting period.

- Sign (1, 2, 3, 4) - indicated depending on the reasons for submitting the document.

- Correction number: 00 - primary, 99 - canceling. All others from 01 to 98 are corrective reports.

- Data on taxpayers is provided from documents available to the tax agent.

- In the “Tax rate” section, you must indicate the percentage at which personal income tax is withheld. Today there are three rates: 13, 30 and 35%. The most common rate is 13%. It is used for employees with Russian resident status.

- Information on the amounts of income and calculated and withheld tax is taken for the entire reporting period.

- Deduction codes are entered taking into account the Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] In our case, code 126, since the employee has a child.

- Notification type code (provided that a notification is issued):

- number 1 is entered if the taxpayer has been issued a notice of the right to a property deduction;

- number 2, if the taxpayer has been issued a notice of the right to a social deduction;

- number 3, if the tax agent has been issued a notice confirming the right to reduce income tax on fixed advance payments.

- The application is completed for the months in which income was paid or a deduction was provided. There are no differences from the current procedure for filling out this document.

Sample of filling out the 2-NDFL certificate according to the new rules of 2019

Who submits 2-NDFL “Certificate of income and tax amounts of an individual” to the tax office

This form is needed to provide information about the income of employees and the amounts of personal income tax withheld from them to the Federal Tax Service. Additionally, the employer must issue a certificate upon request of the employee. A 2-NDFL certificate is drawn up for each individual who received a salary, income or other payments from an organization or entrepreneur. It is rented out by organizations that pay income to individuals. The employer in this case is the tax agent - withholds and transfers personal income tax to the tax office.

There are three exceptions to this rule:

- You paid the individual only income that is not subject to personal income tax. For example, they gave a gift worth up to 4,000 rubles and did not pay anything else;

- You paid income to individuals without being a tax agent. For example, they bought a car or a garage from citizens, or paid for the work of an individual entrepreneur, self-employed person, private notary, etc.

There is no need to submit a zero certificate for 6-NDFL. For example, they are not represented by organizations that did not operate and did not pay remuneration to employees or paid only non-personal income tax amounts. This is due to the fact that only tax agents submit the certificate, and the above categories do not apply to them.

How do they report on past years now?

Certificates of income for individuals often undergo changes. In 2015-2016, the old form was used, approved by the Order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11 / [email protected] But at the end of 2021, the Federal Tax Service initiated consideration of the next changes to this Order in connection with the approval of the Order of the Federal Tax Service of Russia dated 17.01 .2018 No. ММВ-7-11/ [email protected] (registered with the Ministry of Justice and published on January 30, 2018). If you need to submit information for previous periods, the tax office requires you to use the forms that were in force during that period.

Form valid in 2021

Form valid in 2021

Changes to 2-NDFL in 2021

A new list of medical services and expensive treatments for which you can receive a social tax deduction. From January 1, 2021, services for medical evacuation and palliative care were added to the list, the list of expensive services for reproductive technologies was added, services for orthopedic treatment of congenital and acquired dental defects, etc. were added (Government Decree No. 458 dated 04/08/2020).

Merger of 6-NDFL and 2-NDFL. It is valid from reporting for 2021 (clause “a”, clause 19, article 2 of Law No. 325-FZ dated September 29, 2019). Instead of form 2-NDFL, tax agents will attach to the calculation of 6-NDFL a certificate of income and tax amounts of an individual. The new application will not contain information about the tax agent and the reporting year. Section 3 will be supplemented with several fields for information about notifications from the inspectorate, and instead of the field “Amount of tax not withheld by the tax agent,” a whole new section 4 will appear.

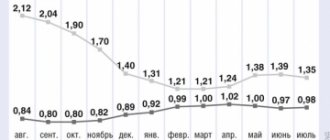

Progressive personal income tax rate . From January 1, 2021, a progressive tax rate was introduced. If the taxpayer’s income for the year did not exceed 5 million rubles, then it is taxed at the old rate of 13%, if it exceeded it, then 650,000 rubles + 15% of the excess amount. In 2021 and 2022, employers will look at each tax base, such as wages and dividends separately. If the limit for each tax base is met, the 15% rate will not be applied to it.

New procedure for calculating personal income tax on interest on deposits . From January 1, interest on deposits is subject to personal income tax of 13% if they exceed the non-taxable minimum (1,000,000 rubles × the Central Bank rate as of January 1 of the corresponding year). Tax base - excess of income over the non-taxable amount

Who is required to submit certificates?

A free sample of the new 2-NDFL certificate for 2021 is required for all tax agents who are required to report to the Federal Tax Service.

They are organizations, individual entrepreneurs, other persons, in accordance with Article 226 of the Tax Code of the Russian Federation, who pay income to an individual who is a taxpayer, employees who are in labor relations with the organization, working under a contract, and other citizens. Such a person is obliged to calculate, withhold tax from the taxpayer and transfer it to the budget. The form for submission to the Federal Tax Service is filled out for each individual.

Each tax agent is obliged to ensure accounting of income paid to individuals, deductions provided to them, and taxes calculated and withheld. For this purpose, a tax register is compiled. It opens immediately upon hiring an employee. The register is developed and approved independently by the tax agent and contains information:

- about an individual, his identification data (full name, date of birth, passport details, TIN);

- types and amounts of income;

- provided deductions;

- amounts of calculated, withheld and transferred taxes;

- dates of tax withholding and its transfer to the budget, details of payment documents.

It is the data from this tax register that will be used to fill out the forms. Please note that if the organization paid the employee only benefits that are not subject to personal income tax (for example, for caring for a child under 1.5 years old), then the certificate does not need to be submitted to the Federal Tax Service.

What is it for?

A 2-NDFL certificate may be required if:

- consideration of court cases related to labor relations;

- resolving controversial situations related to the payment of alimony;

- obtaining visas at foreign embassies;

- registration of a pension;

- establishing guardianship of a child;

- registration with the employment center and calculation of unemployment benefits.

In addition, the following information may be needed:

- parents of a student studying at a university on a paid basis;

- an employee getting a new job;

- for the bank when applying for a loan. In this case, the certificate can serve not only as confirmation of solvency, but also the availability of a job.

Delivery formats

When the company consists of several people, then 2-NFDL can be submitted to the tax office on paper.

If the number of individuals who received income in the company exceeded 25 people, then the report will have to be submitted only in electronic form (clause 2 of Article 230 of the Tax Code of the Russian Federation) via telecommunication channels. To prepare reports, the free software of the Federal Tax Service “Taxpayer Legal Entity” is used. To send an electronic report to the Federal Tax Service in electronic form, you must enter into an agreement with an authorized telecom operator, obtain an electronic digital signature and install software.

How to check a certificate before submitting it to the tax office electronically? To do this, just download the free Tester program from the official website of the Federal Tax Service. By installing it on your computer, you can check the file sent to the Federal Tax Service for compliance with the format for submitting the report in electronic form.

Deadlines and procedure for submitting a certificate to the tax office

In 2021, companies must submit a certificate of income and personal tax amounts to the tax office as part of 6-NDFL, but not every quarter, but once a year. That is, the first certificate must be completed based on the results of 2021 and submitted to the tax office before March 1, 2022.

The 6-NDFL calculation along with the certificate must be sent to the department where the organization or individual entrepreneur is listed as a taxpayer. Those with more than 10 employees submit 6-NDFL calculations and certificates only electronically. Organizations and individual entrepreneurs with 10 employees or less can choose the form of delivery - paper or electronic.

Separate rules apply to organizations with several separate divisions:

- Legal entities whose parent organization is located in one municipality, and separate divisions in another, receive the right to choose one inspection in the municipality to which they will submit reports on all separate divisions.

- Legal entities whose head and separate divisions are located in the same municipality can report to the tax office at the place of registration of the head division.

To use this right, you need to inform about your choice before January 1st to all tax inspectorates with which the organization’s divisions are registered. The decision cannot be changed during the year. A new notification is provided to the tax office only if the number of segregations changes or other changes occur that affect the reporting procedure.

Report submission deadlines

Please note that you must fill out and submit 2-NDFL to the tax office no later than April 1 of the year following the reporting year.

Since this is the last date when tax agents transmit information about an individual’s income, calculated, withheld and transferred taxes to the budget (clause 2 of Article 230 of the Tax Code of the Russian Federation). In this case, the number 1 is indicated in the “Sign” field. In 2021, April 1 fell on a Sunday, so the deadline was postponed to 04/02/2018. As for 2021, no transfers are provided. If the tax agent was unable to withhold tax when paying income and during the entire tax period, then he is obliged to provide the tax report, indicating the number 2 in the “Sign” field. This must be done before March 1 of the next year (clause 5 of Article 226 of the Tax Code RF). Please note that the procedure for providing such information to the tax authorities is now presented in Appendix No. 4 to Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected]

For late submission of the report, a liability of 200 rubles is provided. for each certificate (clause 1 of Article 126 of the Tax Code of the Russian Federation), that is, for a form drawn up for an individual employee. Responsibility has also been introduced for providing certificates with false information. For each such report you will have to pay a fine of 500 rubles. (Article 126.1 of the Tax Code of the Russian Federation), and it can be avoided only if the tax agent identifies and corrects the error before it is discovered by the tax authority.

What it is

The abbreviation personal income tax hides information about taxes on personal income, which is issued in the form of a certificate of the established form. Taxes are transferred to the state budget by the employer, who, if necessary, provides the employee with a 2-NDFL certificate.

Such a certificate can be issued by the accounting department, as a rule, within three days from the date of submission of the request. The document must contain both the details of the enterprise and information about the employee.

Certificate 2-NDFL can be one of the forms of reporting that the employer submits to the tax authorities at the end of the financial year.

In addition, such a certificate may be required by an ordinary employee to be submitted to various authorities: in this case, a written request for its execution will be required.

What changes has the uniform undergone in 2021?

The changes are mainly technical and do not affect the procedure for reflecting income, deductions and taxes:

- Section 1 contains information about the reorganization or liquidation of the company;

- Section 2 excludes information about the taxpayer’s place of residence;

- Section 4 excludes references to investment deductions;

- in section 5, in the lines of the signature and certifying the authority of the signatory of the document, a mention is made of the possibility of signing the certificate by the legal successor.

Thus, filling out the main sections remains the same.

Fines for violations when submitting Certificates of income and tax amounts

Failure to submit certificates as part of 6-NDFL is the basis for prosecution under Art. 126 of the Tax Code of the Russian Federation for failure to provide information necessary for tax control. The fine for each certificate not submitted on time will be 200 rubles per organization or individual entrepreneur. An additional administrative fine in the amount of 300 to 500 rubles can be imposed on the head of the organization, the chief accountant or other official (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

If errors are found in the certificates (for example, an incorrect TIN, amount of income, code, etc.), then the organization or individual entrepreneur will be held liable for taxation and will be fined 500 rubles for each incorrect certificate. A fine can be avoided if you submit an updated certificate before the tax office finds the error.

Form 6-NDFL and fill out income certificates in Kontur.Accounting - a convenient online service for maintaining accounting and sending reports via the Internet.

Easily keep records, pay salaries, submit reports online and benefit from the support of our experts. The first 14 days of work are free. Get to know the service

Sample of filling out a certificate in 2021

Before downloading the 2-NDFL certificate form to fill out in 2021, we recommend that you familiarize yourself with the rules in force in 2021 (until December 31):

- In section 1, you must indicate the name of the tax agent and his basic details: TIN, KPP, OKTMO code.

- Section 2 contains information about the individual: his full name, date of birth and passport details. As mentioned above, you do not need to indicate your residence address.

- Section 3 reflects the taxpayer’s income, graduated by month of payment, income code, and amount.

- Section 4 should provide information about tax deductions provided to individuals.

- The total amounts for the year: income and deductions of an individual, taxes calculated, withheld and transferred to the budget of the Russian Federation are reflected in section 5. The details of the person responsible for filling out are also indicated here.

- Section 3 is completed for each tax rate. For example, if an employee is a non-resident and receives dividends, then two sections 3 and two sections 5 of the certificate must be completed for him. Separately - for wages at a rate of 30% and separately - for dividends at a rate of 15%, indicating the income code.

Sample certificate 2-NDFL according to the 2021 form

Submission rules

If an employee needs a 2-NDFL certificate to resolve some of his private issues, then the submission of such a certificate to the tax office is regulated by law, according to which, in general, the deadline for submitting the document is April 1.

If sign 2 is indicated when issuing the certificate (i.e., the employer was unable to withhold the tax amount), then the document must be submitted by March 1 of the year following the reporting period.

The Tax Service requires 2-NDFL certificates for:

- implementation of tax administration of personal income tax;

- monitoring data received from companies on personnel income to identify violations, such as failure to transfer the required amounts of personal income tax to the budget, errors in calculating withheld amounts, providing incomplete information about withheld tax amounts, etc. Based on the results of monitoring, tax audits of companies that have committed violations can be organized violations.

Dividends in the certificate in 2021

If the company paid dividends to individual founders in 2021, then certificates must also be drawn up for them and submitted to the Federal Tax Service. The dividend income code in the 2021 report is 1010. The tax rate can be:

- 13% if the participant is a resident;

- 15% if the participant is a non-resident of the Russian Federation.

If the founder of the company who received the dividends is a resident of the Russian Federation and at the same time receives wages in the company, then the dividends should be reflected in the same section 3 as other income. In this case, there is no need to fill out a separate section 3.

Procedure for filling out 2-NDFL for 2021

Requirements for filling. The following is not allowed in the Filling Procedure:

- make corrections using a proofreader;

- print on both sides and staple sheets;

- use colored ink other than black, violet and blue;

- enter negative numbers on the certificate.

We recommend filling out the certificate in the following sequence: General part → Section 1 → Appendix on deductions → Section 3 → Section 2 → Section 4.

a common part

— indicate the INN and KPP of the tax agent. Individual entrepreneurs and private practice specialists indicate only the TIN. In the “Certificate number” field, enter its unique number for the reporting period. In the “Correction number” field, enter 00 for the primary certificate, 01 for the first corrective certificate, 02 for the second, and so on. For a cancellation certificate, enter code 99.

Section 1 - enter the taxpayer’s personal data: TIN, full name, status, date of birth, citizenship, series and passport number.

Appendix to the certificate - fill out separately for each personal income tax rate. Please indicate the relevant certificate number and tax rate. In 2021, the standard tax rate for residents is 13% and for non-residents it is 30%. Line by line, indicate the employee’s income with codes and deductions that reduce the tax base.

Income codes in 2-NDFL in 2021

Section 3 - Enter deduction information. Don’t forget to indicate the notification code: “1” for property deductions, “2” for social deductions, “3” for notification of tax reduction on fixed advance payments. Follow the rules:

- Enter each deduction on a separate line;

- amounts for one deduction code can be combined;

- for the same amounts of deductions with different codes, fill in separate cells;

- if there are not enough lines, fill out several sheets, filling out the header of the document and the deductions section.

Section 2 - must be completed separately for each personal income tax rate. Enter your income, tax base, amount of calculated, withheld and paid personal income tax.

- The total amount of income is the amount of income in its pure form, excluding deductions and deductions;

- Tax base - the indicator for the line “total amount of income” excluding deductions;

- Personal income tax accrued - calculated as Tax base × Tax rate;

- The amount of fixed advance payments is only for foreign workers who work under a patent;

- Personal income tax withheld - the amount withheld from the taxpayer’s income;

- Tax transferred - the amount of personal income tax paid to the budget for the year;

- Over-withheld tax is an overpayment of personal income tax or an over-withheld amount that the tax agent did not return to the taxpayer.

Section 4 - completed if the tax was not withheld. Indicate the amount of income from which tax was not withheld and the amount that was not withheld. A separate section is filled out for each personal income tax rate.

New control ratios for 2-NDFL in 2021

Since 2-NDFL became an annex to 6-NDFL, the control ratios have changed significantly. Firstly, most of them have become internal documents, since previously they mainly compared the indicators of 2-NDFL and 6-NDFL. New ratios are given in letter dated March 23, 2021 No. BS-4-11/ [email protected]

If the control ratios are violated, the employer will receive a notification from the tax authorities about the identified inconsistencies with a requirement to provide explanations or make corrections within 5 days.

Maternity benefit in 2-NDFL

Every employer is required to pay temporary disability benefits if the employee has provided sick leave. This payment is subject to income tax.

Are maternity benefits taxed by law? The maternity leave period is 70 days before childbirth and 70 days after it. Payment for temporary disability due to pregnancy is calculated on the basis of a sick leave certificate from the supervising doctor. As for maternity benefits, this type of state payment is not subject to personal income tax.

Important! If an organization's accountant told you that state maternity benefits are subject to income tax, this means that he incorrectly interpreted the Tax Code of the Russian Federation. The company faces a fine for violating labor laws.

Results

Certificate 2-NDFL is a document submitted by a tax agent from 2021 to the Federal Tax Service as part of the calculation of 6-NDFL, as a report on income paid to the employee and the tax withheld (or not withheld) from this income. The certificate may also be required by the employee in respect of whom it was drawn up for submission to the Federal Tax Service, a bank, or another employer. To form in 2021, use the certificate form from the Federal Tax Service order dated October 15, 2020 No. ED-7-11 / [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What are the dangers of falsifying personal income tax certificate 2?

Responsibility for providing false reporting threatens the individual and the tax agent who issued the certificate to the employee.

The production of a fake document is fraught with prosecution under one of the articles of the Criminal Code of the Russian Federation:

- 292 (forgery of false documents);

- 327 (production of counterfeit papers and seals).

Attraction under Art. 327 provides for types of punishments:

- imprisonment (from 6 to 12 months);

- suspended sentence or arrest for up to 4 years;

- correctional work.

Involvement under Article 292 threatens an official:

- correctional labor (from 480 hours to 2 years);

- a fine of 80 rubles;

- arrest from 6 to 24 months.

If a forged certificate reaches the bank, and the financial institution suffers losses based on fraudulent information, then the penalties are toughened against the legal entity that issued the document with false information.

For example, the amount of the fine can be increased to 500 rubles, and the term of imprisonment up to 4 years.