No later than April 1, 2014, tax agents* for personal income tax must report on the income of individuals for the past 2013, as well as the amounts:

- accrued

- withheld

- transferred to the budget system of the Russian Federation

Personal income tax on such income.

*Tax agents for personal income tax purposes are recognized (Article 226 of the Tax Code of the Russian Federation):

- Russian organizations,

- IP,

- notaries engaged in private practice,

- lawyers who have established law offices,

- as well as separate divisions of foreign organizations in the Russian Federation,

from whom or as a result of relations with which the taxpayer** received the income specified in paragraph 2 of Article 226 of the Tax Code of the Russian Federation, are obliged to :

- calculate

- withhold from the taxpayer,

- pay the tax amount,

calculated in accordance with Article 224 of the Tax Code of the Russian Federation, taking into account the features provided for in Article 226 of the Tax Code of the Russian Federation.

Tax on the income of lawyers is calculated, withheld and paid by bar associations, law offices and legal advice centers.

** as taxpayers of personal income tax (NDFL): (Article 207 of the Tax Code of the Russian Federation):

- individuals who are tax residents of the Russian Federation,

- as well as individuals receiving income from sources in the Russian Federation who are not tax residents of the Russian Federation.

The specified information is submitted by tax agents in electronic form:

- via telecommunication channels,

- or on electronic media.

If the number of individuals who received income during the tax period is up to 10 people tax agents can submit such information on paper.

However, in practice, the Federal Tax Service often refuses to accept paper certificates. Such requirements are imposed on tax agents for personal income tax by clause 2 of Article 230 of the Tax Code of the Russian Federation.

The form, formats and procedure for providing the above information are approved by the Order of the Federal Tax Service of Russia dated November 17, 2010. No. ММВ-7-3/ [email protected] “On approval of the form of information on the income of individuals and recommendations for filling it out, the format of information on the income of individuals in electronic form, reference books.”

Paragraph 2 of Order MMV-7-3/ [email protected] establishes that a message about the impossibility of withholding tax and the amount of tax in accordance with paragraph 5 of Article 226 of the Tax Code of the Russian Federation* is also submitted in form 2-NDFL.

*If it is impossible to withhold the calculated amount of tax from the taxpayer, the tax agent is obliged, no later than one month from the end of the tax period** in which the relevant circumstances arose, to notify in writing:

- To the taxpayer,

- Inspectorate of the Federal Tax Service at the place of its registration,

about the impossibility of withholding personal income tax and the amount of tax.

**According to Article 216 of the Tax Code of the Russian Federation, the tax period for personal income tax is a calendar year.

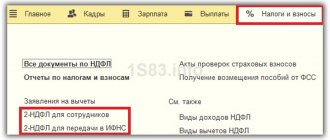

Our article will discuss the procedure for filling out certificates in form 2-NDFL for 2013 with an example of completion.

Sample certificate 2 personal income tax:

Who has the right to provide personal income tax certificate 2?

- Each employer - to its own (permanent and hired) employees (former - or currently working). Individual entrepreneurs, organizations - any registered legal entities can act in this capacity. It is mandatory to have a civil contract.

Employer obligations

- Income tax (13% of the salary of each employee) is paid monthly until the fifteenth day of the next month. If the tax is not paid on time, a fine of two hundred rubles is imposed for each overdue certificate.

Interesting point

When filling out the form, digital indicators are indicated in rubles and kopecks with a decimal point, but the final tax amount is always rounded to the nearest ruble.

What is the difference between 2013 and 2012 income codes?

Both ciphers are used to reflect income received by a full-time employee of the enterprise.

The difference is that 2013 only applies to retiring employees.

Code 2012 is intended to reflect the amounts of average earnings paid for the next labor or additional (including educational) leave. The same code indicates the amount of vacation pay that a person received in the event that he goes on vacation with subsequent dismissal.

Help 2 personal income tax 2012 - the sample is virtually indistinguishable from the 2013 version.

There are differences between earlier forms.

- From now on, income taxed at different rates is filled out within one form (if there is one individual);

- The third, fourth and fifth sections are filled out separately for each existing bet;

- The list of income codes for the securities transactions section has been expanded;

- The list of codes for standard tax deductions and amounts reducing the tax base has been expanded;

- Help may consist of several pages.

The appearance has hardly changed. Nobody forbids making adjustments to old samples - but there is no real need.

How to fill out certificate 2 personal income tax?

- Recommended for 2 personal income taxes (help): download the correct form - this significantly saves time, allowing you to avoid common mistakes. The data is filled out in legible block letters - blue and black are acceptable;

- The title of the certificate indicates the year for which the reporting is prepared (not always the current one). Serial number of reporting in the tax period (assigned by the tax agent). date (current): day, month and year - in Arabic numerals, the year is written in full (four digits);

- Sign - the number “1” (Arabic) is indicated if the certificate is filled out on the basis of Article 230, paragraph 2 of the Tax Code of the Russian Federation. Or the number “2” - if filled in on the basis of Article 226, paragraph 5 of the Tax Code of the Russian Federation;

- Next line: Federal Tax Service code - four Arabic digits, where the first two are the region code, and the second two are the code of the tax authority where the current tax agent is registered;

- Data about the tax agent - in the field “TIN/KPP for an organization or TIN for an individual” - the taxpayer’s identification number is written in numbers and, through the “/” sign, the reason code for the statement. Tax agents who are individuals can only fill out the first field. Organizations fill out both fields. An important point - for branches, the checkpoint must be filled out at the location where the branch is registered;

- The name of the organization, or the last name, first name, patronymic of an individual - organizations indicate the abbreviated registered name, if there is none - the full one. It is necessary to check full compliance with the data provided in the constituent documents. The abbreviation or the most meaningful part of the name is placed at the beginning of the line. The tax agent indicates his full name; if the last name is double, he writes it with a hyphen;

- To eliminate the possibility of error, you can check: there is a certificate 2 personal income tax - sample filling;

- Next item: OKATO code - the code of the administrative-territorial entity is filled in in Arabic numerals - at the location of the address of the legal entity where the employee indicated in the certificate works, or another individual receiving payments. If one individual received income during one calendar year in various branches (separate divisions) of a legal entity located in different administrative-territorial entities, a separate certificate is drawn up for each entity. You can obtain the required OKATO code from the all-Russian classifier of objects of administrative-territorial division, or from the tax authority at the place of registration. Tax agents indicate the code at the place of residence;

- Telephone - indicate the real contact telephone number of the tax agent to obtain reference information (in case of demand and to clarify the accuracy of the data provided). If there is no contact phone number, leaving the field empty is acceptable;

- Information about the individual who is the recipient of the income . The details of the taxable recipient of the income are indicated.

- TIN - taxpayer identification number in Arabic numerals. The number must be in the document on registration of an individual with the tax authority. If there is no TIN, the field may remain empty (compare example of certificate 2 personal income tax);

- Last name, first name, patronymic - the full name of the taxpayer, if the last name is double - it is written with a hyphen. The specified data must match the identity document (some may not have a middle name - in this case, filling it out is not required). It is acceptable to fill in the full name in Latin letters for foreign citizens;

- Taxpayer status is the Arabic numeral “1” if the individual is a resident of the Russian Federation. Number “2” - if not a resident. Number “3” - if he is not, but is recognized as a highly qualified specialist on the basis of Law 115-FZ;

- Date of birth - day, month and year are sequentially filled in with Arabic numerals, the year is indicated in full (four digits);

- Citizenship —indicate the digital code of the taxpayer’s country (citizenship). The code can be clarified in the all-Russian classifier of countries of the world (or download certificate 2 personal income tax 2013, where an example code is already indicated). The Russian Federation has a code of “643”, and Ukraine, for example, has a code of “804”. If the taxpayer is not a citizen, the code of the country that issued the identity document is written; Identity document code is a digital code that can be found in the “document codes” directory.

- Series and document number are digital identifiers of an identity document. The “No” sign does not need to be indicated.

- Address of residence in the Russian Federation - residential address (full version - region code, postal code, district, city, town, street, house, building, apartment). The real address of the actual place of residence is taken into account (see edit 2 of the personal income tax form). If one of the available items is missing (for example, the body), the field is left empty. The address is filled in with block letters and numbers, corner houses can be indicated with a “/” sign, various modifications are added to the “building” field.

- Address in the country of residence - for individuals who are not residents of the Russian Federation and foreign citizens - the permanent address of residence is indicated. The country code is filled in in Arabic numerals, the address in block letters. When filling out this line, it is permissible to leave the address of residence in the Russian Federation blank.

- Income taxed at the rate of % (look: certificate 2 personal income tax 2012 - sample) - data regarding the level of income of an individual is filled in with the calculation of payment for each month. The blank field indicates the interest rate: 9%, 13%, 15%, 30% or 35% - in accordance with the agreement to avoid double taxation. If payments were made at several interest rates during one tax period, for each rate all fields up to section 5 inclusive are filled out separately.

- Month - the months (in Arabic numerals) of making payments for tax periods are indicated in order of priority - upon receipt of income on the basis of Article 223 of the Tax Code.

- Income code - the type of income is determined (based on reconciliation with the “income codes” reference book) - and is written in Arabic numerals. Indicated only if the income level is positive.

- The amount of income is a digital designation of the total level of income without taxation.

The tedious procedure of lengthy filling out the form for each individual employee is laborious and not always advisable.

Sometimes the employer does not have the opportunity to spend his personal time. And sometimes an employee needs a certificate from a previous place of work, where he does not want to appear for various reasons.

In this case, you can bypass the existing principles: buy a certificate 2 personal income tax - ready-made and correctly formulated in full accordance with the requirements.

It is not advisable to rush to enter the request into Yandex or Google: “I will buy a certificate of 2 personal income tax” - the offer should come from a reliable person who will not set you up at the most unexpected moment.

Useful tips

- If the address of the employee/individual who is the recipient of the income is not in the classifier when selected in a special program, it is not advisable to choose a name that is consonant. Firstly, this does not eliminate questions from the Federal Tax Service, and secondly, with available data from other sources, the discrepancy is quickly identified. The best option is to enter the problematic address manually, without the help of a classifier;

- If an amount of personal income tax was erroneously withheld in excess of the required norm, in case of timely detection (before submitting a certificate to the tax authorities) and timely return, additional instructions in the certificate are not required. If discovered after submitting a certificate, a recalculation and provision of an additional updated document is required with the transfer of the refund to the next tax period;

- If the required income code is missing, use the appropriate ones (within the limits of logic), for example, to compensate for unused vacation pay, you can also use the code for compensation for the use of personal property for business purposes, bonuses not related to labor results, excess daily allowances, additional insurance contributions to a savings pension account , increasing the share of the nominal value of parts of the authorized capital.

- If payments were made that were not subject to personal income tax, there is no need to indicate them in the certificate;

- If taxable payments did not occur in every month, you can transfer deductions for non-income months to the next (there is no single position on this matter - some recommend not indicating them at all). A win-win approach has not been developed for this case;

- When filling out, you should carefully check the entered codes in the personal income tax certificate 2 - there are no penalties for making mistakes of this type, but haste can easily add headaches and waste a considerable amount of personal time.

Checking reports

Before submitting the statements, it is imperative to check them to ensure that all amounts are reflected correctly. If errors are found, then corrections must be submitted. For example, in 2021, when an employee is dismissed, the amount of compensation for unused vacation is not reflected. And this is already considered an error and it is necessary to redo the 2-NDFL certificate and send the adjustment to the tax office.

If reporting with errors is sent to the tax office and the taxpayer does not submit an adjustment on time, then penalties in the amount of 500 rubles will be applied to him. What amounts of the fine are provided for incorrect submission of reports can be found in paragraph 1 of Article 126 of the Tax Code of the Russian Federation. If the company independently identified the error and promptly sent the adjustment to the tax office, then in such a situation there is no penalty. The adjustment is filled out according to the general rules.