Unified State Register of Legal Entities: general information

The Unified State Register of Legal Entities (USRLE) is a database containing information about all companies operating in Russia.

Information about individuals is not included in it, but it is quite possible to find the details of non-profit organizations or peasant farms. In accordance with paragraph 1 of Art. 5 of the Federal Law “On State Registration...” dated 08.08.2001 No. 129, information about the company stored in the register includes:

- its name;

- date of state registration;

- location address;

- reorganization and liquidation procedures carried out in relation to the enterprise;

- changes made to the company’s constituent documents and other sources of information;

- data of founders and managers;

- types of economic activities carried out by the enterprise;

- in the event that a company is undergoing bankruptcy proceedings, the stage at which it is located.

During its operation, an enterprise can correct information previously entered into the register. For example, the company may change its director or one of its participants may decide to sell its share to a third party. Such changes must be promptly registered with the tax office, since the relevance of the information contained in the register is important not only for government agencies, but also for counterparties working with the enterprise.

How to change OKVED codes in an LLC

OKVED is an all-Russian classifier of types of economic activity, that is, we are talking about making changes to the Unified State Register of Legal Entities regarding the direction of the company’s work.

Such edits are made as usual. In 2021, a new law came into force, providing for changes to OKVED codes. Thus, companies that continue to engage in their core activities are not required to make changes to the Unified State Register of Legal Entities due to a code change. If a legal entity is registered for the first time, then a new code system will be used for it.

Thus, despite the change in the code system, not every company must contact the tax service to change the classifier.

Is an LLC obliged to enter information about OKVED codes into the Unified State Register of Legal Entities if the register does not contain them?

The law does not provide for the obligation to make such amendments. But it is better to do this as early as possible. Especially when the company’s activities are financed by the state budget.

Urgently enter activities into the Unified State Register of Legal Entities

Until the beginning of 2004, the presence of OKVED codes was optional. This means that there was no uniform classification of the types of economic activities that individual firms could engage in. Since 2004, such codes began to be assigned, but they were not included in the Unified State Register of Legal Entities reports. But starting from 2021, this is a mandatory step, so each company must be assigned its own code.

Changes urgently need to be made if the LLC receives subsidies or budget investments and (or) has personal accounts with financial authorities. In other words, the lack of classification or the use of incorrect figures may become grounds for the cancellation of cash grants and rewards for work done.

An additional change that needs to be taken into account is that receiving state budget money will be available to the population only if the company is included in the register of participants in the budget process. This means that if there is no data on the company’s OKVED in the Unified State Register of Legal Entities, the organization will not be able to receive payment from the state budget.

Information can be entered immediately

If there is no need to distribute budget money, it is also better to enter information into the unified state register of legal entities. But this can be done without haste. Availability of data on the OKVED code will eliminate possible civil disputes with cooperating companies.

This is due to the fact that most of the data in the Unified State Register of Legal Entities is publicly available, and therefore every potential counterparty can familiarize themselves with the information of interest about a legal entity on the Unified State Register of Legal Entities website. In the absence of information about the types of activities carried out, a potential partner may face doubts. Therefore, it is better to display the nature of the work to eliminate doubts on the part of partners.

The second reason for entering the necessary information into the register is to eliminate conflicts with the tax service.

The Federal Tax Service has identified the following reasons why the necessary information should be displayed in the unified state register of legal entities:

- according to the law “On State Registration”, the Federal Tax Service has the authority to delete from the general database data about a company for which there is no information about OKVED codes;

- deliberate evasion of disseminating information about a legal entity (including in matters of the type of activity performed) entails the application of penalties provided for in the articles of the Code of Administrative Offenses (the amount of the penalty is up to 5 thousand rubles).

These are the reasons that are most often mentioned by the Federal Service when terminating the activities of a legal entity, as well as when imposing any sanctions. But such measures contradict the current law. For example, deleting information about a company from the Unified State Register of Legal Entities cannot be carried out on the basis of the absence of an OKVED code. And if you manage to avoid punishment, then there is a risk of facing lengthy (possibly legal) disputes with the tax service.

If the company does not want to separately begin the code registration procedure, then it is possible to send data about the change along with other types of edits.

Types of changes made to the Unified State Register of Legal Entities

Depending on whether the information contained in the company’s statutory documents is corrected or not, the procedure for making changes to the Unified State Register of Legal Entities is somewhat different.

Amendments to the charter that are subject to inclusion in the Unified State Register of Legal Entities include amendments that change:

- Company name;

- organizational structure;

- size of the authorized capital;

- representative offices of the company and its subsidiaries, etc.

The following changes do not require inclusion in the charter, but are subject to registration with the tax service:

- a person holding the position of director;

- composition of participants of the legal entity;

- registration documents previously submitted to the tax office if errors were made in them.

A special procedure for making amendments to the Unified State Register of Legal Entities

When making certain changes to the register of legal entities, a special procedure is applied. These are cases when alienation of property rights to an enterprise occurs. The buyer can be a co-owner or a third party, as well as the enterprise itself.

The procedure itself can occur in one of the following scenarios:

- Notarization of the transaction for the alienation of rights is required;

- notarization is not required; alienation of rights occurs on the basis of an agreement signed by the parties in simple written form.

Depending on which scenario is relevant, the complete set of documents, the order and timing of their submission for registration depend.

Registration of changes in the Unified State Register of Legal Entities: sequence of actions

To make changes to the register of legal entities related to amendments to the charter, you must perform the following steps:

- By a general decision of the company's participants or the sole decision of its sole founder, amend the current charter of the organization.

- Prepare the documents necessary for state registration of changes made to the charter (their list is given below) and submit them to the tax authority. This can be done in the following ways:

- by personally contacting the territorial branch of the Federal Tax Service where the enterprise is registered;

- by sending a postal item to his address with notification of delivery to the recipient;

- by transmitting an electronic transport container encrypted with a digital signature through telecommunications channels.

- Receive a Unified State Register of Legal Entities sheet containing updated information about the company.

Based on the results of consideration of the application, adjustments are made to the register.

List of documents required to make changes to the Unified State Register of Legal Entities

In order to make amendments, the need for which arose as a result of adjusting the information contained in the statutory documents, to the Federal Tax Service, in accordance with clause 1 of Art. 17 Federal Law No. 129, it is necessary to transfer:

- a statement certified by a notary in form P13001;

- 2 copies of the updated version of the charter;

- copies of documents on the basis of which the charter was changed (minutes of the general meeting of founders or the decision of the sole participant);

- minutes of the meeting of the founders of the legal entity or the decision of the sole founder;

- receipt of payment of state duty;

- a power of attorney to perform actions on behalf of a legal entity, if the documents are submitted by a person who does not have the right to perform such actions.

Making changes that are not related to the correction of statutory documents is not subject to a fee. In this case, the Federal Tax Service will need to submit:

- an application drawn up in form P14001;

- copies of documents on the basis of which new information is entered into the Unified State Register of Legal Entities (for example, a copy of a gift agreement, purchase and sale agreement, minutes of the meeting of founders, etc.);

- if necessary, a power of attorney issued in the name of the person submitting information to the registration authority.

The forms of applications submitted by an entrepreneur to the registration authority are established by order of the Federal Tax Service of the Russian Federation dated January 25, 2012 No. ММВ-7-6/ [email protected]

New ways to submit documents to the registration authority

It is worth noting that in 2014, changes were made to the Civil Code regarding the organizational and legal forms of legal entities; according to the law, the organizational and legal forms must be brought into compliance with the new provisions, but the deadline for fulfilling this requirement is not specified. Thus, if it is necessary to make changes, it will also not be superfluous to bring the organizational and legal form of your legal entity into compliance.

Currently, there is no need to submit documents directly to the registration authority. You have the right to send documents by letter with a list of attachments or send them to the Federal Tax Service through the multifunctional center. Documents are considered submitted to the Federal Tax Service on the day the documents are submitted to the post office or MFC, which allows you not to miss the three-day deadline for submitting documents established by law.

Application form for amendments to the Unified State Register of Legal Entities when changing the charter (R13001)

Amendments to the charter entail the need to submit current information to the Federal Tax Service, on the basis of which its employees will independently make adjustments to the Unified State Register of Legal Entities. The document containing such information is an application drawn up in form P13001, given in Appendix No. 4 of Order No. MMV-7-6 / [email protected]

The application must indicate:

- name, INN and OGRN of the legal entity;

- legal address of the company;

- a note that the basis for the changes being made is compliance with the requirements of current legislation;

- details of individuals, organizations, other participants of the legal entity;

- details of the management organization, manager or individual who can represent the interests of the organization without issuing a power of attorney;

- applicant details.

After filling out the document, it will need to be certified by a notary.

Rules for obtaining documents

Based on the results of registration, the tax office will send documents with an enhanced qualified electronic signature to the applicant’s email address. This rule applies to all documents issued by the tax office: charter, changes to the charter, TIN certificate, decision on refusal or suspension.

Upon prior request in paper form, the applicant will only be able to receive confirmation of the contents of electronic documents, and not their originals or copies.

You can receive the documents where you submitted them:

- at the tax office;

- by email;

- through the Internet;

- in the multifunctional center;

- at the notary.

The applicant or his representative has the right to receive documents with a notarized power of attorney. If a representative picks up documents from a notary, you can give the notary a regular power of attorney in advance, if you do not have a notarized one.

What is “house balance” and how to provide it to owners

406041

Application for amendments to the Unified State Register of Legal Entities: form P14001

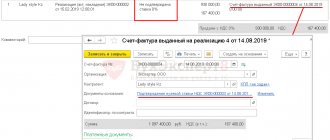

In the event that the changes that must be recorded in the Unified State Register of Legal Entities are not related to the statutory documents, an application drawn up in form P14001 given in Appendix No. 6 to Order No. MMV-7-6/ [email protected] Application is submitted to the tax office is compiled according to the algorithm given above, with the exception that it must indicate the reason for applying to the Federal Tax Service (indicated by entering the number “1” in the corresponding field of the document).

You can fill out the document either manually or using a computer. Federal Tax Service specialists have developed a software product that allows you to automate the process of filling out the documents necessary to make changes to the Unified State Register of Legal Entities. You can download the program, as well as read detailed instructions for filling it out, by following the link https://www.nalog.ru/rn77/program//5961277/.

State duty for making changes to the Unified State Register of Legal Entities in 2018 2019

In accordance with sub.

3 p. 1 art. 333.33 of the Tax Code of the Russian Federation, amendments to the constituent documents are subject to a state duty in the amount of 20% of the amount of the duty charged for registering a legal entity. According to sub. 1 clause 1 of the same article, the amount of the fee paid upon registration in 2021 is 4,000 rubles. This means that you will have to pay 800 rubles to make amendments to the charter. The amount of the mandatory payment collected from legal entities when they make changes to the Unified State Register of Legal Entities that are not related to the statutory documents is not established by law. This means that changes of this kind can be made to the registry absolutely free of charge.

It is worth remembering that you will have to pay to receive a current extract from the Unified State Register of Legal Entities containing updated data. In accordance with clause 1 of the Decree of the Government of the Russian Federation “On the amount of payment...” dated May 19, 2014 No. 462, the payment will be:

- 200 rubles - for issuing information in the form of a paper certificate in compliance with the deadline established by law for the provision of information;

- 400 rubles - for issuing information in the form of a paper certificate on the day of application.

You can obtain an extract for free by using the capabilities of the service provided by the Federal Tax Service, located at https://egrul.nalog.ru/.

Deadline for making changes to the Unified State Register of Legal Entities

It is necessary to make changes to the Unified State Register of Legal Entities in compliance with the deadlines established by the legislator. In accordance with paragraph 5 of Art. 5 Federal Law No. 129, such information must be submitted to the registration authority within 3 days from the date of change in the information to be included in the register. The specified period may not be observed if the information changes:

- about the licenses held by the legal entity;

- Taxpayer's TIN and the date of its registration with the tax office;

- number and date of registration of the person as an insurer in the Pension Fund of the Russian Federation and the Social Insurance Fund.

Violation of the specified deadline for submitting changes to the tax authority entails, in accordance with paragraph 3 of Art.

14.25 of the Code of Administrative Offenses of the Russian Federation, issuing a warning or imposing a fine in the amount of 5,000 rubles on a representative of the organization who committed such a violation. The Tax Service, in turn, is obliged to register the changes made within 5 days from the date of receipt of the application from the representative of the legal entity (clause 16 of Order of the Ministry of Finance of the Russian Federation dated September 30, 2016 No. 169n).

Consequences of refusal and failure to make changes

It is worth noting that in addition to the above fine for failure to make changes to the Unified State Register of Legal Entities within the prescribed period, failure to make changes may entail other consequences. For example, in the event of a change of address, if a government agency, counterparty or other person sent a demand or other information to your address in accordance with the Unified State Register of Legal Entities, then you will be guilty of failure to receive information. Thus, for example, you will not be able to restore the deadline for appealing the decision of the tax authority or the decision to bring to administrative liability, since it is you who are responsible for the information provided to the Unified State Register of Legal Entities.

I would like to make a special note about compliance with the deadlines for submitting documents on state registration of changes to the constituent documents. To submit an application for amendments to the constituent documents, a person is given 3 (three) days from the date of such changes. Otherwise, an official of a legal entity is subject to administrative liability, which provides for a variety of penalties: from fines to disqualification for up to three years. This is one of the reasons to seek qualified help from specialists in your field.

If all the requirements of the law are met with accuracy, then making changes to the Unified State Register of Legal Entities will be successful. After five days from the moment you submitted the documents, the changes will be registered and you will be issued a corresponding certificate.

How to check that the entry of new data into the Unified State Register of Legal Entities has been completed, and to find out whether the data was entered correctly

It is mandatory to check the changes made to the Unified State Register of Legal Entities, and it is better to have documentary evidence of completion of the procedure.

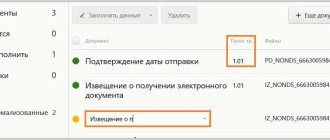

After changes have been made to the register, the applicant is given a current Unified State Register of Legal Entities sheet containing the information included in the database. If for some reason the sheet cannot be obtained directly from the tax authority (for example, if the applicant is in another region and cannot personally visit the territorial office of the Federal Tax Service), information can be obtained in other ways. Whether changes have been made to the Unified State Register of Legal Entities - you can find out by ordering an extract from the register via the Internet. The finished document will reflect all the information in the register at the time of the request. Also, to find out whether changes have been made to the Unified State Register of Legal Entities, you can use the service https://service.nalog.ru/uwsfind.do, which allows you to obtain up-to-date information about the legal entity in respect of which documents have been submitted for registration with the Federal Tax Service.

***

So, in order to make changes to the Unified State Register of Legal Entities, you need to contact the tax service with an application drawn up in the form established by the legislator (P13001 - if changes are made to the charter, P14001 - if only the information contained in the register is subject to adjustment). An application to correct information must be submitted within 3 days from the date of changes in the organization. Failure to comply with this deadline may result in the imposition of a fine on the representative of the organization who committed such a violation. You can find out whether changes have been made to the Unified State Register of Legal Entities by receiving a registration sheet in the register or using a special Internet service.