According to subparagraph 8 of paragraph 1 of Article 23 of the Tax Code of the Russian Federation, documents necessary for the calculation and payment of taxes must be stored for four years. By virtue of paragraph 1 of Article 17 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, the organization must store the “primary”, accounting registers and accounting records for at least five years. Therefore, the safety of the originals must be monitored especially carefully. And if the papers are lost, you will have to take certain actions to restore them. However, if such actions are not successful, documented attempts to return the papers can save the company from fines and additional charges (Resolution of the Federal Antimonopoly Service of the Moscow District dated February 12, 2014 No. F05-2554/2013).

Let's look at what measures can be taken to return documents.

I note that it is better to take such actions before submitting the next reports, so that later, in the event of restoration, you do not have to adjust the declarations and submit clarifications.

The first step towards paper recovery will be an internal investigation, including the study of electronic correspondence with business partners. After this, you must send requests for duplicates (repeated copies of the original) and certified copies of documents. If communication with the counterparty is interrupted, then measures must be taken to find him.

How to issue a duplicate invoice sample

We will prepare and provide duplicates and copies of documents upon your request. In order to use this service, you need to make a request for duplicates and copies of the necessary documents. The request must be made on letterhead with the signature of the manager or chief accountant and the company seal and sent by email. The request must include the following information:

- list of documents you need.

- E-mail address;

- mobile and landline phone numbers;

- TIN of the sender's organization;

- name of the sender's organization;

You or your representative can receive copies or duplicates of documents in the office.

We can also deliver documents to your Moscow office. To do this, you must indicate your address, the name of the nearest metro station and attach a directions. After receiving the application, you will be invoiced for the production of copies and duplicates of documents. Once payment has been received into your bank account, the request will be processed.

Upon provision of the documents specified in the Client’s request, a register of transferred documents is compiled, which is sealed with the signatures of the employee and the client.

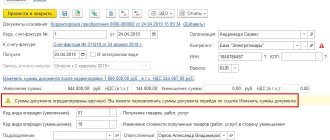

How to indicate on an invoice that it is a duplicate

Typically, invoices are numbered in ascending order for the entire organization within one year or one tax period.

It also provides the service of delivering documents to the client’s Moscow office. If the forwarder does not receive an application from the Client to send documents by mail or delivery by courier, the documents will be located in the office. At the same time, we draw your attention to the fact that not all decisions made by the courts support the taxpayer’s opinion on this issue. It must be filled out by organizations exporting goods outside the Russian Federation to the countries of the EAEU. The product type code will need to be indicated in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the EAEU. Therefore, the duplicate invoice must be completed in the same way, in particular, it must indicate the date of the lost invoice.

The Ministry of Finance of Russia in Letter No. 03-04-11/217 dated December 8, 2004 indicated that the seller does not have the right to issue duplicate invoices (i.e., actually new invoices), and accordingly, deduct VAT amounts based on such invoices - invoices are not allowed to the buyer. At least that’s what the Russian Ministry of Finance thinks (see.

letter dated May 2, 2012 No. 03-07-11/130). Error. A typo even in one letter can be a reason for denial of deduction.

Right. The company name can be written in capital letters instead of lowercase.

Line 6a “Address” should indicate the location of the buyer, exactly as in the constituent documents.

1.1 clause 3 art. 169 of the Tax Code of the Russian Federation, also introduced by Federal Law No. 150-FZ).

If you paid in Moscow, we will send you a copy of the invoice on the next business day by email. The invoice must include the following details (see clause 1. Serial number and date of issue of the invoice.

2. Name, address and TIN of the taxpayer and buyer. If the invoice contains an incorrect name and TIN of the supplier (i.e.

there is no organization with this name and TIN), a deduction on such an invoice will not be possible. When filling out a paper invoice, for example, July 20, 2012, you can enter the date in line 1 in any way convenient for you: The main thing is that the date of the invoice is clear.

Lost invoice

E. Antipova

Once again, tax officials reminded accountants how to make changes to the Purchase Book and Sales Book. Considering that invoices are the most sensitive issue for an accountant, controllers never tire of explaining the complex issues associated with these documents. Letter No. MM-6-03/896 of the Federal Tax Service dated September 6, 2006 was no exception.

The order of entries in the Purchase Book...

If an error is made in the invoice, and it does not matter in which line (TIN of the seller or buyer, address, payment document number), it cannot be registered in the Purchase Book. If you have already done this, then you need to make a corresponding entry in the additional sheet to this book.

All details that an invoice must contain are listed in paragraphs 5 and 6 of Article 169 of the Tax Code. The rules for drawing up these documents stipulate that incorrect completion will result in the impossibility of registration (clause 14).

So, if the accountant has identified an error in the invoice, then it is necessary to make corrections to it in the manner prescribed by paragraph 29 of the rules. This means that the amendments must be certified by the signature of the manager and the seal of the seller. Moreover, there must be a date for making the adjustment.

In the letter, the tax authorities emphasize that until you bring the invoice into compliance with the law, it will not be possible to register it in the Purchase Book. And when the accountant makes all the corrections, the company can easily receive a deduction based on the correct document. The procedure established by paragraph 7 of the rules states that an entry about the cancellation of an invoice “with a defect” must be made in an additional sheet to the Purchase Book in the tax period in which this document was originally registered, that is, before corrections are made to it. Controllers draw the attention of accountants to the fact that these additional sheets are an integral part of the book.

…for incorrect invoices

The additional sheet must be filled out in accordance with Appendix No. 4 to the rules. In the “Total” line of the sheet for the tax period (month or quarter) in which the correct document was registered, it is necessary to summarize the results in columns 7, 8a, 8b, 9a, 9b, 10, 11a, 11b and 12. In this case, it is necessary from the amounts on the “Total” line, subtract the indicators of those invoices for which entries will be cancelled. The amount from the “Total” line must be used when making changes to the VAT return.

Controllers remind that if the tax amount for the previous tax period was underestimated, it is necessary to submit an updated declaration. This procedure is provided for in paragraph 1 of Article 81 of the Tax Code. It must be submitted for the period when the mistake was made and changes were made to the Purchase Book.

In case of erroneous registration of a document in the book, the Federal Tax Service recommends following the same procedure for correcting entries. That is, if the accountant was simply careless in filling out the Purchase Ledger and made an inaccuracy, he must follow the full amendment procedure provided for amended invoices.

If the invoice is not registered

Suppose: the accountant of the purchasing company in the current tax period discovered that he did not make an entry in the Purchase Book for the invoice received in the last quarter. In doing so, he needs to take into account the following. The company has the right to deduct

tax based on the invoice and the corresponding primary document. If in the previous tax period not all amounts to which the company is entitled were declared deductible, the accountant can file an amended return. It will need to reflect the full amount deducted.

In addition, in order for the tax in the corrective return to coincide with the amount indicated in the final columns of the Purchase Book for the corresponding tax period, changes must be made to the book. The Federal Tax Service recommends that they be reflected in an additional sheet to the specified book. Again, for the period in which the accountant adjusts the tax amount. After following this procedure, you need to add the indicators of the registered invoices to the total indicators of the additional sheet.

Adjustment of the Sales Book

According to paragraph 16 of the rules, if changes are made to the Purchase Book, they must be reflected in an additional sheet to this book for the tax period in which the invoice was registered before the changes were made to it. That is, the procedure for adjusting entries does not differ from the Purchase Book. Additional sheets for this book are also an integral part of it, tax officials remind.

Changes are made in accordance with Appendix No. 5 to the rules. In the line of the additional sheet that is subject to cancellation, the data on the invoice is recorded before changes are made to it. The next line records the already corrected document.

In the “Total” line of the additional sheet of the Sales Book of the tax period in which the invoice was originally registered, you need to summarize the results in columns 4, 5a, 5b, 6a, 6b, 7, 8a, 8b and 9. In this case, from the line indicators “Total”, it is necessary to subtract the amounts indicated in the canceled invoices, and add the indicators of newly registered documents with corrections to the received tax. The tax amount from the “Total” line must be used to make changes to the VAT return for the period in which the error was discovered.

If the accountant did not register an invoice in the Sales Book in the last tax period, he needs to reflect it in an additional sheet to this book. In this case, you need to add the tax from this document to the indicators in the “Total” line. If the tax base has changed, then the company is required to submit an adjusting return for the tax period in which changes were made to the Sales Book.

The Federal Tax Service reported that it coordinated its letter with financiers (letter of the Ministry of Finance dated August 18, 2006 No. 03-04-15/159).

Paper will endure anything

It should be noted that shortly before the letter reviewed, the Ministry of Finance had already issued several clarifications regarding the rules for filling out invoices. In particular, document No. 03-04-09/15 dated August 7, 2006 is devoted to the procedure for reflecting the addresses of the buyer and seller. The authors of the letter indicate that the actual address can be included in the invoice, but only if it is specified in the constituent documents of the company.

Letter No. 03-04-11/127 dated July 26, 2006 explains who should sign the invoice. The document must bear the signature of the head of the company and the chief accountant. But the Law “On Accounting” gives the director the right to entrust his signature, for example, to a manager. It is also possible that in a company the manager simultaneously performs the functions of the chief accountant. Then his signature alone is enough.

If the invoice is signed by an individual entrepreneur, he must indicate the details of the state registration certificate. If an accountant keeps records for an entrepreneur, the latter does not have to sign the invoice. An autograph from the businessman himself is enough.

To correctly fill out lines 3 and 4 of the invoice, you can be guided by the letter of the Ministry of Finance dated August 10, 2005 No. 03-04-11/202.

It states that the consignor (consignee) should be understood as the organization (its structural unit) or individual entrepreneur from whose warehouse (to the warehouse) the goods are actually shipped (received). If the procedure for filling out an invoice is violated, this may lead to litigation with the tax authorities. But in disputes about the correctness of filling out lines 3 and 4, the courts, as a rule, side with the firms. For example, the Federal Arbitration Court of the Moscow District, in its resolution dated January 16, 2006 No. KA-A40/13489-05, explained that failure to indicate the address of the consignor or consignee in invoices does not serve as grounds for refusal of VAT refund. This may be due to the following: the shipper is both a seller and the consignee is a buyer. That is, the data in the invoice on lines 3, 4 and lines 2, 2a and 6, 6a duplicate each other.

Duplicate invoice

The instructions establish that if the buyer does not have an invoice, after 10 days from the date of expiration of the invoice, the seller issues a new invoice, filled out in the same way, indicating the inscription: “Duplicate”.

is issued in case of loss of the invoice by the buyer either through his own fault or through the fault of third parties (post office). If there is no duplicate invoice before submitting a tax return for the tax period in which the right to deduct tax is available, VAT is deducted in the tax period in which the duplicate invoice was received.

We recommend reading: How to register ownership of an apartment in a new building 2021

Verifying receipt of a VAT invoice in the prescribed manner You can verify the receipt of the document by the seller in the prescribed manner in two ways: 1) via the Internet on the website https://blank.bisc.by by making a request for the code, number and series of the document form; 2) upon a written application to the tax authority (the response will be given no later than the end of the working day following the day of application).

The Invoice Instructions establish that if the buyer has a VAT invoice filled out in violation of the requirements of the Instructions, VAT will not be deducted from the buyer. This provision is contained in the letter of the Ministry of Taxes and Duties of the Republic of Belarus dated June 24, 2008 No. 2-1-9/528. Thus, even if the details of the VAT invoice are filled out incorrectly, the buyer has the right to deduct the amount of tax presented in this invoice.

Cash receipts

The recovery procedure depends on the payment method. If the payment was made by card through the terminal and you discovered the loss of the document on the same day, then you can print a copy of the receipt through the same terminal.

Please note: the next day this option will no longer be available, since a new business day opens and payments for the previous day are summed up and sent to a report for transmission to the tax authority.

If more than a day has passed, then to restore the receipt you will have to write an application for a copy and contact the retail outlet where the goods were purchased. The copy must be certified according to generally accepted rules - a stamp is placed on it, the full name of the authorized person, date and signature are indicated.

If it is not possible to obtain a copy of the receipt in the store for technical reasons, you can contact the seller’s bank to issue a duplicate. The request must indicate the amount, date of payment and name of the cardholder, preferably the time when the purchase was made.

The entire procedure takes up to seven working days.

Next, we will consider the case of restoring a check if the payment was in cash. Then you need to contact the store with an application to issue a duplicate check, in turn, the seller must “raise” the documents for a certain date and make a copy of the required check, which also needs to be certified.

And finally, the third case is the repeated receipt of an electronic receipt. Issuing a duplicate is possible if the seller has a special application. Typically, you can print a duplicate receipt within 30 days from the date of purchase. Often this service is provided for a fee. This is the most convenient and fastest option, as it allows you to issue a duplicate check that does not need to be certified within 10 minutes. You can ask for a check to be sent by email.

Journal materials - Main book

16 If errors are identified, the seller must issue a new, corrected invoice.

It must indicate in line 1 the date and number of the original invoice in which there were errors. And in line 1a - the serial number and date of the correction. Resolution of the Presidium of the Supreme Arbitration Court of November 9, 2010 N 6961/10; FAS MO dated 02/12/2014 N A40-136320/12-140-970 sub.

7 clause 1 art. 31 Tax Code of the Russian Federation; Resolution of the AS ZSO dated February 12, 2016 N F04-29056/2015; FAS MO dated 12.02.2014 N A40-136320/12-140-970 Resolution of the Presidium of the Supreme Arbitration Court dated 09.11.2010 N 6961/10 Resolution of the FAS MO dated 16.11.2012 N A40-41130/11-91-180 Resolution 9 AAS dated 04.10. 2011 N 09AP-23565/2011-AK (upheld by the Resolution of the Federal Antimonopoly Service of the Moscow Region dated January 19, 2012 N A40-33539/11-99-146) Appeal ruling of the Court of the Khanty-Mansiysk Autonomous Okrug - Ugra dated 22.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Pravo-info » Articles from magazines » DUPLICATE INVOICE: TO BE OR NOT TO BE VAT DEDUCTION (Confirmation of tax deductions in case of loss of the original invoice)

Based on materials from the publication “The Main Book”

Is there a replacement for the original invoice?

Fire, flood, relocation, and sometimes just carelessness of workers can lead to the disappearance of invoices that serve as the basis for deducting input VAT. And if the inspectorate comes with a check, it will regard the deductions as unfounded. As a result, additional VAT, fines and penalties are charged. After all, VAT deductions are confirmed only by invoices <1>. It is impossible to determine VAT deductions by calculation.

Note. If, during an on-site tax audit, the inspectorate reveals that the organization does not have documents confirming “profitable” expenses, then the tax authorities can determine the amount of income tax by calculation <2>. That is, they can calculate not only the amount of income, but also the amount of the company's tax expenses (using data for comparable taxpayers). With regard to VAT, tax authorities can only determine the tax base by calculation - without reducing it by deductions.

Therefore, it is in the interests of the taxpayer to restore the documents that are the basis for the VAT deduction.

If your company contacts a counterparty to recover an invoice, it may receive either a duplicate invoice or a certified copy.

Logically, both documents must confirm the deduction of input VAT. However, right in Ch. 21 of the Tax Code does not say anything about this. Given this circumstance, sometimes inspectors act on the following principle: if there is no original invoice, there is no deduction.

Studying judicial practice

Judges stand on the side of taxpayers (of course, if there is no doubt about their integrity and the authenticity of the restored documents). Let us verify this using the example of real trials.

Certified copies of invoices

(!) The Supreme Arbitration Court clarified back in 2010 that VAT deductions can be confirmed by copies of invoices <3>. Other courts have also indicated the possibility of deductions based on copies of invoices <4>.

Moreover, there are cases when, to confirm VAT deductions, judges consider ordinary copies of invoices and other documents received from counterparties to be sufficient, and not just certified ones <5>. But this is rather an exception: not all courts accept simple photocopies to confirm deductions <6>.

Duplicates of invoices are also legal

(!) Some inspections remove VAT deductions if the organization confirms them with duplicate invoices. They insist that it is possible to restore a lost invoice only by making a copy of the original, and then on it:

— the persons responsible for the preparation of such papers must sign;

- you need to put the seal of the organization that made the copy.

Attention! The amounts on the duplicate invoice and the original invoice must be the same.

However, such a procedure does not follow from the current legislation. Neither civil nor tax legislation contains a ban on the taxpayer's counterparty issuing duplicates in the event of loss of documents <7>. Therefore, deducting VAT on duplicate invoices is legal.

Tax service specialists also agree with this approach.

FROM AUTHENTIC SOURCES

DUMINSKAYA OLGA SERGEEVNA – Advisor to the State Civil Service of the Russian Federation, 2nd class

“Tax deductions are made on the basis of invoices after purchases have been registered and in the presence of primary accounting documents <8>. In this case, the responsibility to confirm the validity of the claimed deductions lies with the taxpayer.

In case of loss of original invoices (for example, as a result of a fire), you can justify the deduction using:

— copies of invoices <9>;

— duplicate invoices <10>.”

Justifiable deficiencies in duplicate invoices

(!) The inspectorate, refusing to deduct VAT on restored invoices, may refer to shortcomings in their design, as well as differences between duplicates and originals.

For example, the signatures of the responsible persons on the duplicate and on the original invoice do not match. When such discrepancies are explainable and caused by objective reasons (for example, the dismissal of employees who signed the original), judges recognize the right to deduct VAT. They indicate that the duplicate invoice must be signed by the current director or other person authorized to sign on invoices as of the date the duplicate is issued <11>.

Moreover, if a duplicate invoice is signed by the former director (or chief accountant), who has already resigned from the counterparty’s organization on the date the duplicate is issued, both tax authorities and judges will consider such a document to be unreal. After all, it will be signed by unauthorized persons, which means that such a duplicate does not confirm the VAT deduction <12>.

Note. For information on how to complete the document restoration procedure, read: Civil Code, 2021, N 20, p. 16

* * *

Sometimes a duplicate invoice is issued to correct an error made on the original invoice. This is wrong: errors cannot be corrected with duplicates <13>. This means that tax amounts cannot be deducted on the basis of invoices, corrections to which were made by issuing duplicates <14>.

If errors are identified, the seller must issue a new, corrected invoice. It must indicate in line 1 the date and number of the original invoice in which there were errors. And in line 1a - the serial number and date of the correction.

———————————

<1> Resolution of the Presidium of the Supreme Arbitration Court of 09.11.2010 N 6961/10; FAS MO dated 02/12/2014 N A40-136320/12-140-970

<2> sub. 7 clause 1 art. 31 Tax Code of the Russian Federation; Resolution of the AS ZSO dated February 12, 2016 N F04-29056/2015; FAS MO dated 02/12/2014 N A40-136320/12-140-970

<3> Resolution of the Presidium of the Supreme Arbitration Court of 09.11.2010 N 6961/10

<4> Resolution of the Federal Antimonopoly Service of the Moscow Region dated November 16, 2012 N A40-41130/11-91-180

<5> Resolution 9 of the AAS dated 04.10.2011 N 09AP-23565/2011-AK (left in force by Resolution of the Federal Antimonopoly Service of the Moscow Region dated 19.01.2012 N A40-33539/11-99-146)

<6> Appeal ruling of the Court of the Khanty-Mansiysk Autonomous Okrug - Ugra dated May 22, 2014 N 33-157-2014

<7> Resolution 3 of the AAS dated 02/26/2016 N A74-7111/2015; 13 AAS dated December 25, 2013 N A21-3211/2013; Appeal ruling of the Court of the Khanty-Mansiysk Autonomous Okrug - Ugra dated May 22, 2014 N 33-157-2014

<8> clause 1 art. 172 Tax Code of the Russian Federation

<9> Resolution of the Presidium of the Supreme Arbitration Court of 09.11.2010 N 6961/10

<10> Resolution 3 of the AAS dated February 26, 2016 N A74-7111/2015; FAS PO dated 05/05/2014 N A12-16582/2013

<11> Resolution 19 of the AAS dated 02/01/2016 N A14-1083/2015 (left in force by the Resolution of the AS TsO dated 05/31/2016 N F10-1389/2016); 3 AAS dated February 26, 2016 N A74-7111/2015; 13 AAS dated December 25, 2013 N A21-3211/2013

<12> Resolution 19 of the AAS dated December 22, 2015 N 19AP-5542/2015 (left in force by the Decree of the AC TsO dated April 25, 2016 N F10-646/2016)

<13> pp. 1, 7 Rules for filling out an invoice, approved. Government Decree No. 1137 dated December 26, 2011

<14> Resolution 3 AAS dated 02/26/2016 N A74-7111/2015

The article was first published in the journal "Glavnaya Ledger" 2021, N 20

How to issue a duplicate invoice sample

And what would be your third question?

— Defendant, why did you retract your confession?

— The lawyer convinced me that I was innocent. A man comes to a legal consultation and asks: “You don’t understand, I wanted to find out if I have the right.” - Yes, you can explain, if I can.

A lawyer on a date with his client: “I’ve studied your case, I just don’t know what to do.” What mitigating circumstances might there be?

- Well. I could have killed five, but I didn’t!

— Defendant, what can you say in your defense? “I ask you to take into account the youth of my lawyer and his inexperience. A woman comes to a gun store and asks: “Do you have a 45 caliber pistol with a laser sight?” - No, I have a lawyer for self-defense. A wife came for a consultation with a lawyer about divorcing her husband: - Why do you want to divorce your husband? - He treats me like a dog!

Advertisement for a law firm: “We will resolve any of your legal cases in no time.

Lost invoice and delivery note

Please advise, we have received a letter requesting lost comrade.

-nak. , and an invoice, how to correctly and legally formalize the provision of repeated documents. Who signed the documents are not working now??

? Tax legislation does not contain definitions of the terms “duplicate” and “copy of a document,” as well as the procedure for their preparation. In accordance with Article 11 of the Tax Code of the Russian Federation, in this case one should be guided by the norms of other branches of legislation.

GOST R51141-98 “Office management and archiving. Terms and definitions" (1) contains the following definitions: -Duplicate document - a repeated copy of the original document that has legal force (clause 2.1.28); -Copy of a document – a document that completely reproduces the information of the original document and all its external features or part of them, and has no legal force (clause 2.1.29); -A certified copy of a document is a copy of a document on which, in accordance with the established procedure, the necessary details are affixed, giving it legal force (clause 2.1.30). The procedure for issuing and certifying copies of documents is regulated by the State Documentation Management System (hereinafter referred to as GSDOU) (3) and GOST R 6.30-2003 (4).

Copy. Since a copy of a document is a document that completely reproduces the information of the original document, the details and text of the copy of the document must fully correspond to the original. On copies of documents in the details “Signature” and “F. I. O. "The signatures and transcripts of the signatures of those officials who endorsed the original document must be indicated.

We recommend reading: Can an employee whose husband is convicted work in a government agency?

Source documents

If an internal primary document is lost (for example, OS-1, OS-6, etc.), then it can be printed from the database and re-signed by the employees who signed the originals.

If the specialist who put his autograph on the original no longer works for the company, you can try to find former colleagues or sign a document with the “Duplicate” stamp for current employees responsible for processing similar transactions.

Since the mechanism for restoring lost documents and requirements for duplicates of such documents are not established by law, the organization has the right to approve them itself. If an accounting document that was received from a business partner is lost, the procedure will be the same as for restoring contracts, we will discuss this below.

How to issue a duplicate invoice sample

In paragraphs

Unlike a duplicate, in this case the invoice must contain an additional detail - a certification inscription indicating that the copy corresponds to the original. This inscription is certified by the seal of the organization.

31, 33 of the Decree of the Government of the Russian Federation “On work books” dated 16.

All companies and individual entrepreneurs need to submit some kind of statistical reporting. And there are so many forms of this reporting that it’s not surprising to get confused in them. To help respondents, Rosstat has developed a special service.

using which you can determine what statistical reporting needs to be submitted to a specific respondent.

However, unfortunately, this service does not always work correctly. The Federal Tax Service has approved a new procedure for obtaining a deferment (installment plan) for payments to the budget. We will prepare and provide duplicates and copies of documents upon your request.

Who signs it? How many copies of the invoice must be issued?

How long should this document be kept? You will learn the answers to these seemingly simple questions from this article. In the summer we moved to a new office and, due to the fault of the movers, we lost a box with invoices for the previous year.

We asked the suppliers to restore the documents. According to Part 3 of Article 24 of the Federal Law of July 7, 2003

No. 126-FZ “On Communications” and clause 5.1.2 of the Regulations on the Federal Service for Supervision in the Field of Communications, Information Technologies and Mass Communications, approved by Decree of the Government of the Russian Federation of March 16, 2009 No. 228.

Tax Code of the Russian Federation vs Ministry of Finance: is an invoice needed to deduct VAT?

Good afternoon, colleagues.

A well-worn topic: your organization or you, as an individual entrepreneur, working for OSN, transferred money to a counterparty including VAT. All your supporting documents are in order, but for one reason or another you did not receive the invoice back. Question: can you deduct VAT?

Tax officials at every step, referring to Articles 171, 172 of the Tax Code of the Russian Federation , in particular, paragraph 2 of Art. 171, paragraph 1, art. 172 and at Art. 169 of the Tax Code of the Russian Federation, they tell us: “No, you can’t, because there is no invoice.” But you have fulfilled your obligation to transfer VAT, however, you cannot deduct it. But you gave the VAT and all supporting documents to the supplier, but you cannot deduct VAT.

Or another example: you issued money for reporting, your employee bought gasoline, fuel and lubricants, and brought you a sales receipt, where VAT is allocated. Or he provided an online check to KKM, where VAT is also highlighted as a separate line. But the tax authorities say: “No, you can’t deduct VAT because there is no invoice.” Fine. Here is a letter from the Ministry of Finance dated November 26, 2021 No. 03-07-11/91521 , which talks about the deduction of VAT when purchasing fuels and lubricants for cash without invoices.

“In the case of the acquisition of these goods (works, services) to carry out transactions subject to VAT, after registration of such goods (works, services) on the basis of invoices issued by sellers, documents confirming the actual payment of VAT amounts, as well as documents confirming the payment of VAT amounts withheld by tax agents”, VAT can be deducted if there are invoices.

What if there are no invoices?

Let's look at the opinion of the Ministry of Finance and decide how much it corresponds to the logic of the Tax Code of the Russian Federation and judicial and arbitration practice. For example, according to paragraph 7 of Art. 171 of the Tax Code of the Russian Federation , VAT can be deducted without having invoices, if you went on a business trip, bought round-trip tickets, etc. In this case, you do not have an invoice, but you can deduct VAT on the basis of strict reporting forms issued to the posted employee, highlighting the VAT amounts on a separate line. And if you buy fuel and lubricants in cash, and you have a sales receipt with a separate line for VAT and a KKM receipt, then the Ministry of Finance still says that without invoices, deducting VAT is impossible.

But the main thing here is that when the Ministry of Finance issues such letters, it acts strictly on a formal basis. And even if you paid VAT and you have all the evidence of this, then you can deduct it, but only if you received an invoice. In this case, the Ministry of Finance always writes the same thing: in accordance with the letter of the Ministry of Finance of Russia dated August 7, 2007 No. 03-02-07/2-138 :

“These letters are of an informational and explanatory nature on the application of the legislation of the Russian Federation on taxes and fees and do not prevent tax authorities, taxpayers, payers of fees and tax agents from being guided by the norms of legislation on taxes and fees in an understanding that differs from the interpretation set out by the Ministry of Finance of Russia.”

Why is there such a link? Yes, very simple. From the point of view of logic, Article 21 of the Tax Code of the Russian Federation and judicial and arbitration practice, if the reality of this transaction is proven, you really paid VAT and there are supporting documents, then you have the right to deduct VAT, even if there is no invoice. That is why the Ministry of Finance says that this is simply their opinion and that it is possible to use legal norms that differ from the interpretation set out in the letters of the Ministry of Finance. For example, a letter saying that nothing can be done without an invoice. This is just a formal approach. But, most likely, you will have to prove your case in court, guys.

Sign up for a tax seminar

Thank you and good luck with your VAT deductions.

Is it possible to issue a duplicate invoice?

In practice, it is generally accepted that a duplicate is recognized as a re-issued copy of an invoice that has the same legal force as the original.

A similar procedure for certifying an invoice with the signature of the manager or chief accountant is maintained when issuing a duplicate invoice. The issued duplicates must correspond to the original invoices. Therefore, the duplicate invoice must be completed in the same way, in particular, it must indicate the date of the lost invoice.

The Ministry of Finance of Russia in Letter No. 03-04-11/217 dated December 8, 2004 indicated that the seller does not have the right to issue duplicate invoices (i.e., actually new invoices), and accordingly, deduct VAT amounts based on such invoices - invoices are not allowed to the buyer.

The position of the Ministry of Finance of Russia is also supported by some arbitration courts (resolutions of the FAS North Caucasus District dated December 19, 2007 No. F08-8364/07-3151A, FAS East Siberian District dated March 11, 2008 No. A19-9152/0744-F02-726/2008, FAS Moscow District dated October 10, 2007 No. KA-A40/10654-07).

It should be noted that in most cases, this approach is applied by the courts when the taxpayer had the opportunity, instead of drawing up a duplicate invoice, to make corrections to the previously issued invoice in the manner prescribed by the Rules. Regarding the number of duplicates (copies) of invoices issued, we note the following. In both cases, it is sufficient to issue one copy of the relevant document.

It should be taken into account that the buyer may have to defend the right to deduct VAT on the basis of a duplicate (copy) of an invoice in court.

Lost invoice. Let's deal with the copy

The organization lost a supplier invoice for 2007 (found out during an internal audit). The supplier has new managers since 2008 (director, chief accountant).

What should they present us with in return for the lost invoice? If the original, then what about the signatures? If it is a copy, then does it need to be certified and by whom? Will I need to fill out additional sheets of the purchase ledger when the error is discovered, or should I just attach the invoice to the invoice journal for the period in which it was originally received?

In accordance with paragraph 1 of Art.

169 of the Tax Code of the Russian Federation, an invoice

is a document that serves as the basis for the buyer to accept goods (works, services) presented by the seller, property rights of VAT amounts for deduction in the manner prescribed by Chapter 21 of the Tax Code of the Russian Federation.

Chapter 21 of the Tax Code of the Russian Federation does not contain provisions regarding the application of tax deductions based on a copy

invoices.

Note that in practice, courts, as a rule, make decisions in favor of taxpayers who have accepted VAT deductions based on copies of invoices, especially since these copies can always be confirmed by originals

invoices held by suppliers (see, for example, resolutions of the Federal Antimonopoly Service of the Volga Region dated March 7, 2006 No. A57-20769/04-28 and the Federal Antimonopoly Service of the West Siberian District dated October 5, 2005 No. F04-6965/2005 (15491-A67-15)).

Moreover, the tax authorities themselves say that in the event of loss or destruction of primary documents, the head of the organization must take measures to restore

those primary documents that are subject to restoration and storage for the period established by law.

For example, copies

statements of cash flows on bank accounts can be requested from the banks in which the organization’s accounts are opened; contracts, acts, invoices can be requested from counterparties, etc.

Such recommendations are given in the letter of the Department of Tax Administration of the Russian Federation for Moscow dated September 13, 2002 No. 26-12/43411.

The Department of Tax Administration of the Russian Federation for Moscow, in a letter dated August 1, 2003 No. 24-11/42672, directly indicated that the buyer is allowed to use a copy

(duplicate) invoice certified in accordance with the established procedure.

How must a copy of an invoice be certified in order for it to be considered “duly certified”?

Let us turn to the ancient, but still valid normative act - Decree of the Presidium of the Supreme Soviet of the USSR dated 08/04/1983 No. 9779-X “On the procedure for issuing and certification by enterprises, institutions and organizations of copies of documents relating to the rights of citizens” (the document is used as amended dated 12/08/2003).

Despite the name, the Decree applies not only to relations related to the certification of copies of documents relating to the rights of citizens.

Current legislation does not regulate the procedure for certification of copies of documents in the interests of organizations.

In such a situation, Art. 6 of the Civil Code of the Russian Federation, according to which it is possible to apply civil legislation by analogy, that is, the application of rules governing similar relations

.

In addition, in practice, arbitration courts apply the norms of the above-mentioned Decree in relation to copies of documents relating to the activities of organizations (see, for example, resolutions of the Federal Antimonopoly Service of the Central District dated July 20, 2004 No. A68-AP-122/Ya-04 and the Federal Antimonopoly Service of the North Caucasus District dated June 25, 2003 No. F08-2194/2003-809A).

According to clause 1 of the Decree, the accuracy of the copy of the document is certified by signature

manager or authorized official and

seal

.

The date of its issue is indicated on the copy and a note is made that the original document is located in the given enterprise, institution, or organization.

For example, the supplier organization may certify a copy of the invoice as follows:

The copy is correct, the original is in the organization.

Director of Romashka LLC _____________ I.I.

Ivanov June 06, 2008

In addition, this copy must be stamped

supplier organization.

If the manager of the supplier organization has changed, then the signature of the manager who certified the copy of the invoice will differ from the signature of the manager on the invoice itself.

To ensure that tax authorities do not have questions about the manager’s signature, you can request a document

, confirming the authority of the new head of the organization.

So, for example, for an LLC such a document will be an extract from the minutes of the general meeting of LLC participants at which this director was elected.

According to paragraph 2 of Decree No. 9779-X, organizations independently certify copies of documents if the law does not provide for the provision of notarized copies of such documents.

Notarization of copies of invoices is not provided for

, but if you wish, you can have a copy of the invoice certified by a notary.

In accordance with paragraph 1 of Art. 252 Tax Code of the Russian Federation

Expenses for the purpose of calculating the tax base for corporate income tax are recognized as justified and documented expenses incurred by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

According to paragraphs 16 clause 1 art. 264 Tax Code of the Russian Federation

other costs associated with production and sales include fees to a state and (or) private notary for notarization.

Moreover, such expenses are accepted within the limits of tariffs approved in the prescribed manner.

However, the tax inspectorate may consider the fee for notarization of a copy of an invoice to be economically unjustified (due to the fact that the law does not provide for mandatory notarization of a copy of this document) and may not agree with the recognition of these costs as expenses for the purpose of calculating corporate income tax.

Unrecognized expenses will “cost” only 10 rubles, this is exactly the fee charged for notarization of one page of a copy of a document (clause 9, clause 1, article 22.1 of the Fundamentals of Russian Legislation on Notaries, approved by the Supreme Council of the Russian Federation on February 11, 1993, No. 4462 -1).

According to clause 7 of the Rules for maintaining logs of received and issued invoices, purchase books and sales books when calculating value added tax, approved by Decree of the Government of the Russian Federation of December 2, 2000 No. 914, if it is necessary to make changes to the purchase book, an entry about Cancellation of an invoice is made in an additional sheet

purchase books for the tax period in which the invoice was registered before corrections were made to it.

The Federal Tax Service of the Russian Federation in a letter dated 09/06/2006 No. MM-6-03/ [email protected] explained that an additional sheet of the purchase book is drawn up if it is necessary to make changes to the purchase book, in particular, if the seller makes corrections

in an already registered invoice, as well as when the taxpayer-buyer discovers in the current tax period that invoices received in expired tax periods have not been registered in the purchase books.

In your case, the invoice was already registered in the purchase book in 2007, no changes were made

.

So you just attach

a certified copy of the invoice to the journal of received invoices for the period in which the original invoice was originally received, and an additional sheet of the purchase ledger is not required.