Modern economic reality is such that counterparties and organizations themselves are not always conscientious payers for purchased goods, works or services. Often, any company has unpaid debts, payment for which will no longer be received, or which the company itself will not pay for one reason or another.

“Stuck” debts cannot appear indefinitely in an organization’s accounting. The law sets the deadlines for when an accountant must write off such debt. In tax accounting, clause 2 of Art. 266 of the Tax Code of the Russian Federation defines bad debts . These are debts for which:

- the statute of limitations has expired,

- the obligation is terminated due to the impossibility of its fulfillment, on the basis of an act of a government body or liquidation of an organization,

- there is a decree of the bailiff on the termination of enforcement proceedings due to the impossibility of collecting the debt, in the event that the writ of execution is returned to the collector, if it is impossible to establish the whereabouts of the debtor, and also if the debtor does not have property that can be foreclosed on,

- the citizen is declared bankrupt and he is released from fulfilling the claims of creditors.

The statute of limitations is three years from the date on which the debt should have been repaid.

Example:

The buyer had to transfer money for goods (work, service) on November 22, 2015. The last day when the seller can go to court to collect the debt from the debtor is November 22, 2021. And if this deadline was missed, then already on November 23, 2021, the debt is considered bad and the seller is obliged to write it off (Letter of the Ministry of Finance of Russia dated May 14, 2018 No. 03-03-06/1/31977, dated June 20, 2018 No. 03 -03-06/1/42047).

On what basis is it legal to write off receivables?

When can accounts receivable be written off? It is legitimate to talk about three main scenarios for its write-off:

- Write-off upon repayment of debt by the debtor. Such a write-off does not imply that the creditor has any additional rights or obligations in terms of taxation - if we are talking about the principal amount of the debt. Exceptions will be observed:

- when receiving income from interest - in this case, tax on it will have to be calculated and paid;

- when the debtor is an individual not registered as an individual entrepreneur, and the interest rate on the loan is less than the refinancing rate of the Central Bank of the Russian Federation: in this case, the creditor as a tax agent will need to calculate and pay tax on the debtor’s material output.

- Write-off upon forgiveness of the debt to the debtor. Similarly, the creditor does not have any tax rights or obligations here, with the exception of the need to calculate and pay tax on material benefits on a forgiven debt to an individual who is not registered as an individual entrepreneur. Debt forgiveness is regarded as a gratuitous transfer of property and therefore cannot be included in expenses (letter of the Ministry of Finance dated April 4, 2012 No. 03-03-06/2/34, clause 4 of Article 270 of the Tax Code of the Russian Federation). However, the Resolution of the Presidium of the Supreme Arbitration Court dated July 15, 2010 No. 2833/10 provides for the possibility of writing off a debt as an expense if the creditor company has a commercial interest in forgiving the debt. But in legal disputes with the Federal Tax Service, it is not always possible to defend such an expense (resolution of the Fifteenth Arbitration Court of Appeal dated November 14, 2013 No. 15AP-13132/13).

- Write-off upon recognition of a debt as bad. Here the situation from the point of view of tax consequences is more interesting: the written-off bad debt can be taken into account in non-operating expenses when forming the tax base for the special income tax (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation). Under the simplified tax system, such a preference is not provided (letter of the Ministry of Finance of Russia dated November 13, 2007 No. 03-11-04/2/274).

A debt can be recognized as bad if (clause 2 of Article 266 of the Tax Code of the Russian Federation):

- the statute of limitations for judicial debt collection has expired;

- the debt is canceled due to the impossibility of repaying it;

- the debt is canceled by a decision of the authority;

- the debtor organization was liquidated;

- bailiffs were unable to collect the debt from the debtor’s property.

Let's consider the grounds for writing off accounts receivable in accounting due to the recognition of the debt as bad - with the prospect of including it in expenses, in more detail.

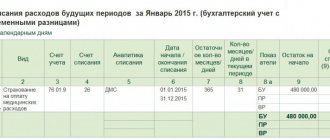

Accounting records for writing off unrealistic (uncollectible) and doubtful debts

Write-off of unrealistic (uncollectible) and doubtful receivables (for income, sources of financing the budget deficit, granted loans, advances) relates to subarticle 173 “Extraordinary income from transactions with assets” of the KOSGU (clause 9.7.3 of the procedure, approved by order of the Ministry of Finance Russia dated November 29, 2017 No. 209n, hereinafter referred to as Procedure No. 209n).

More on the topic: How to determine KVR and KOSGU for transferring subsidies

Unrealistic (unreliable) for collection, doubtful receivables for expenses (for advance payments made, for state and municipal guarantees for which equivalent claims do not arise on the part of the guarantor to the debtor) are written off to subarticle 273 “Extraordinary expenses for transactions with assets” of KOSGU ( clause 10.7.3 of Order No. 209n).

Transactions are reflected in accordance with paragraphs. 78, 80, 82, 84 instructions, approved. by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n (for government institutions), paragraphs. 94, 98, 102, 106, 152 instructions, approved. by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n (for budgetary institutions), paragraphs. 97, 101, 105, 109, 180 instructions, approved. by order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n (for autonomous institutions).

Accounting entries are reflected in correspondence with accounts 040110173 “Extraordinary income from transactions with assets”, 040120273 “Extraordinary expenses on transactions with assets”. In 1 – 17 digits of accounts the same code is indicated as that of the settlement account corresponding to them.

Doubtful debts written off from the balance sheet are accounted for in off-balance sheet account 04 (clause 339 of Instruction No. 157n).

Example 1. A budgetary educational institution provides paid educational services. The accounts include doubtful accounts receivable for the education of children who graduated from school. The institution's commission decided to write off the debt from the balance sheet to the off-balance sheet to monitor the possibility of collection.

Debit KDB 2,401 10,173 Credit KDB 2,205 31,667 – doubtful debts are written off from the balance sheet;

Increase in off-balance sheet account 04 – debt accepted on off-balance sheet.

Example 2. A budgetary educational institution has accounts receivable for advance payment for materials. The counterparty is declared insolvent. The institution's commission decided to write off doubtful debts from the balance sheet to the off-balance sheet to monitor the possibility of collection.

Debit KRB 2,401 20,273 Credit KRB 2,206 34,664 – doubtful debts are written off from the balance sheet;

Increase in off-balance sheet account 04 – debt accepted on off-balance sheet.

When can a debt be written off as bad: the statute of limitations has expired

In general, the statute of limitations for receivables is 3 years (Article 196 of the Civil Code of the Russian Federation). It is counted from the moment the creditor discovers the fact of the debtor’s non-fulfillment of obligations under the loan agreement. That is, delays in relation to the date of fulfillment of obligations established by the contract and documents drawn up as part of its execution - acts, invoices.

The limitation period is counted from zero if (Article 203 of the Civil Code of the Russian Federation):

- the debt has been partially repaid;

- the debtor initiated debt reconciliation, contacted the creditor with a request for restructuring (or took other actions indicating that he intends to repay the debt).

Note! If the debtor has recognized part of the debt, this does not indicate that he recognizes the debt in full, unless otherwise agreed by him (Resolution of the Plenum of the Armed Forces of the Russian Federation dated September 29, 2015 No. 43).

The period is also reset if the creditor files a lawsuit against the debtor (letter of the Ministry of Finance dated September 21, 2007 No. 03-03-06/2/18).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

It should be borne in mind that if the creditor has his own debt to the debtor, then even a bad debtor cannot be written off, since in this case the debt and the debtor must be mutually offset (letter of the Ministry of Finance dated October 4, 2011 No. 03-03-06/1/ 620). Actually, this rule applies, whenever possible, to the following scenarios for recognizing a debt as bad.

Postings and documents

To write off a bad debt, internal inventory and an order from the manager are not enough. Other documents are required to confirm the bad nature of the debt. In addition to the agreement with the counterparty, invoices, acceptance certificates and documents confirming payments, they may be an extract from the debtor’s Unified State Register of Legal Entities, court decisions, decisions of government authorities, etc.

Write-offs are made using one of the following account correspondences:

- Dt 63 Kt 62, 76 - if bad debts can be written off at the expense of the created reserve;

- Dt 91/2 Kt 62, 76 - if the reserved funds are insufficient or the reserve has not been created.

The written-off amount must also be taken into account on the balance sheet on Dt 007. Analytical accounting is carried out in the context of debtors. Documents must be stored for 5 years. Companies operating on the simplified tax system cannot recognize bad debt for tax purposes.

Results

- Bad accounts receivable differ from doubtful accounts receivable in that they are completely impossible to collect.

- If there are several reasons for the occurrence of an uncollectible receivable, the amount is recognized as such based on the first one that arises.

- You can write off a debt by creating a reserve, or you can write it off as a loss.

- When recognizing a “debt” as uncollectible, it is important to rely not only on the company’s internal documents, but also on decisions of government, judicial, and regulatory authorities.

- If there are counterclaims in mutual settlements with the debtor, it is safer to begin to offset them, and then recognize the debt as bad. Otherwise, claims may arise from the Federal Tax Service.

- Bad debt is accounted for on account 63, account 91/2, depending on the source of repayment. Such debt is also taken into account in the balance on account 007.

Debt write-off under circumstances beyond the control of the parties: nuances

A debt can be cancelled, that is, declared uncollectible:

- Due to factual circumstances that interfere with the fulfillment of obligations under the contract, which neither party can influence (clause 1 of Article 416 of the Civil Code of the Russian Federation). As a rule, we are talking about force majeure circumstances - natural disasters, man-made disasters. The occurrence of such circumstances can be confirmed by the official conclusion of the Ministry of Emergency Situations or another government body (letter of the Ministry of Finance dated July 2, 2009 No. 03-02-07/1-336).

- By virtue of the issuance by the authorities of an act, the provisions of which make it impossible for the debtor to fulfill obligations, this is also considered as a circumstance that does not depend on the will of the parties to the contract.

A typical example is the revocation of a banking license from a financial institution that was the guarantor of the debtor under the transaction (while the debtor, for its part, was able to legally justify the impossibility of repaying the debt on its own).

If the relevant normative act is declared invalid, the creditor's obligation again becomes relevant and subject to execution, unless otherwise established by agreement between him and the creditor.

Off-balance sheet accounting

- • strict reporting forms stored in the organization (forms of work books, receipts, forms of certificates, diplomas, etc.);

- • strict reporting forms issued for reporting to employees of the organization (subscriptions, coupons, document forms that serve as the basis for accepting cash from the population, etc.).

We recommend reading: Instruction 157n on budget accounting for penalties for late payment

The intermediary is not involved in the settlements.

If the intermediary is not involved in the settlements, the proceeds from the sale of goods by the intermediary go to the bank account or cash register of their owner. After this, the owner transfers the remuneration due to him to the intermediary.

Debt write-off upon liquidation of the debtor organization

Another criterion for recognizing a debt as bad is the liquidation of the debtor organization without transferring its responsibilities to other persons, for example:

- to another organization due to a merger or acquisition;

- to an individual (former founder, actual owner of the business) due to the onset of subsidiary liability.

The liquidation of an organization is considered completed only if the relevant information is entered into the Unified State Register of Legal Entities. Thus, the supporting document for writing off the debt will be an extract from the state register.

The liquidation rule, even by legal analogy, cannot be applied to debtors in the status of an individual entrepreneur, since the former entrepreneur in any case must fulfill the obligations assumed during the period when he had the status of an individual entrepreneur.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Note that the exclusion of a legal entity from the Unified State Register of Legal Entities as an inactive business entity - as an actual type of liquidation (although it has a different legal nature) can also be a basis for recognizing a debt as bad (letter of the Ministry of Finance dated January 23, 2015 No. 03-01-10/1982).

Which transactions reflect the write-off of accounts receivable in 2021

- arbitration ruling on the end of bankruptcy proceedings and subsequent liquidation of the debtor;

- an extract from the Unified State Register of Legal Entities on the exclusion of the debtor from the register;

- notification of the liquidator (or court decision) about the impossibility of satisfying the claim due to the lack of property of the liquidated legal entity;

- act of the bailiff on the impossibility of collecting the debt, etc.

A debt that is not paid on time is considered overdue. When the probability of repayment is low, there is reason to believe that the counterparty will not be able to fulfill the obligation, then the debt is considered doubtful.

Impossibility of debt collection by bailiffs

Another basis for writing off receivables is the inability to collect the debt through enforcement proceedings. In this case, the Bailiff Service issues an act of completion of debt collection due to the impossibility of its implementation and returns the writ of execution to the creditor. Based on the relevant act and writ of execution, the creditor company has the right to write off the receivable.

It should be borne in mind that before the expiration of the writ of execution - that is, within 3 years after its issuance by the court - the creditor can repeatedly initiate re-collection of the debt by transferring the writ to the bailiff service, however, each time no earlier than 6 months after its return by the bailiffs (clauses 4, 5 of Article 46 of the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ).

Having considered the basis on which accounts receivable can be written off, we will become familiar with the nuances of documenting such a write-off.

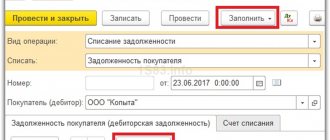

Write-off of receivables in accounting: documentation

To document the creditor's right to recognize the debt, the following will be required:

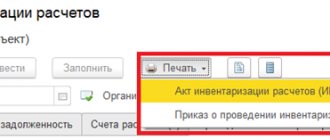

- Carrying out an inventory of debts and drawing up an act on it. The document can be drawn up using the unified INV-17 form or a form developed by the enterprise independently.

- Drawing up an act of writing off accounts receivable. Attachments to it may include documents certifying the grounds for writing off the debt, for example, an act from the Bailiff Service.

- Formation of a certificate of write-off of accounts receivable, which will disclose:

- information about the amount of debt;

- reasons for debt write-off. There is no unified form for such a certificate; an enterprise can use its own.

- Issuance of a manager’s order to write off debt. The order is issued on the basis of the above acts and certificates.

Separately, it may be necessary to draw up an order on the formation of an inventory commission - if it has not been established by the time the procedure in question is carried out.

Is it necessary to put it on off-balance sheet accounting when writing off receivables if there is no property?

You also need to remember about such a point as interrupting the limitation period. If the debtor partially transfers the amount of the debt, or interest on it, or draws up and signs a reconciliation act with the organization, then the calculation of the limitation period is postponed to the next day after one of the listed events.

We recommend reading: How to characterize your mother

The recognition of claims by the debtor is evidenced by any, even penny, payments on existing debt, signed reconciliation reports, written responses, etc. From the moment any of these actions are committed, the limitation period begins to count anew. It is not possible to collect the debt for objective reasons: the debtor company no longer exists, has been declared bankrupt and its assets are not enough to pay creditors during the liquidation process.