The federal accounting standard for public sector organizations “Rent”, applied since 2021, has changed the procedure for reflecting lease accounting items by both the lender and the borrower. In the article, 1C experts consider in what cases the receipt of property for free use is reflected by the borrower, taking into account the application of the provisions of the “Rent” standard, and how such transactions are registered in the program “1C: Accounting of a public institution 8” edition 1 and edition 2. Cases of non-application are also considered "Rent" standard.

Position of the Supreme Arbitration Court of the Russian Federation

This conclusion of the Ministry of Finance of Russia is confirmed by the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98. Paragraph 2 of this document states that, by virtue of paragraph 8 of Article 250 of the Tax Code of the Russian Federation, income in the form of gratuitously received property (work, services) or property rights is recognized in as non-operating income. The application of this rule is not limited only to property rights that represent claims against third parties. This provision also applies when obtaining the right to use a thing free of charge.

Civil law

The fact that for tax purposes when applying the simplified tax system, the receipt of property for gratuitous use should be considered as the gratuitous receipt of property rights follows from the provisions of the Civil Code of the Russian Federation.

Thus, Article 689 of the Civil Code of the Russian Federation provides that under an agreement for gratuitous use (loan agreement), one party (the lender) undertakes to transfer or transfers the thing for gratuitous temporary use to the other party (the borrower). The latter undertakes to return the same thing in the condition in which it received it, taking into account normal wear and tear or in the condition stipulated by the contract.

In this case, the rules on the lease agreement are correspondingly applied to the agreement for gratuitous use.

Reference: for a taxpayer-lender, the provision of property for free use does not lead to the formation of income taken into account when determining the tax base.

EXAMPLEIndividual entrepreneur V.S. Smirnov (borrower) entered into an agreement for the free use of office space with an area of 100 square meters from January 1, 2014. meters on the third floor of the building for a period of five years. Market rental price for 1 sq. meter in this room is 100 rubles. per month. The borrower has a letter from the owner of the building about this (this is the rate at which similar premises located on the same floor in the same building are rented). The amount that the borrower must recognize monthly as income will be 10,000 rubles. (100 sq.m x 100 rubles).Indicated income V.S. Smirnov, in accordance with paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation, will reflect each month in column 4 of the Book of Income and Expenses based on monthly acts of acceptance and transfer of office premises for free use issued by the lender.

It should be borne in mind that premises provided for use as part of the performance of paid contracts for the provision of services are not recognized as received for free use. Therefore, income in the form of a gratuitously received property right to use such premises does not arise in tax accounting.

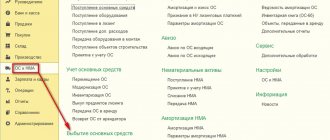

Accounting for preferential rent in “1C: Public Institution Accounting 8”

The receipt, in accordance with the agreement, of non-financial assets related to operating leases on preferential terms for free-term use is reflected by the institution (user) of non-financial assets in the corresponding analytical accounts of account 0 111 40 000 “Rights to use non-financial assets” and the credit of account 0 401 401 82 “Future income from the gratuitous right of use” in the amount of fair (market) value for the period of use of the transferred non-financial assets (clause 41.1 of the Instructions for the use of the Chart of Accounts for Budget Accounting, approved by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n, clause 67.3 of the Instructions on the application of the Chart of Accounts for accounting of budgetary institutions, approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n).

In the program “1C: Public Institution Accounting 8”, edition 1 and edition 2, this operation is reflected in the document Acceptance for accounting of rights to use OS, legal acts.

Depreciation on objects of registration of the right to use property received by an institution for free use related to operating leases is carried out in the amount of monthly lease payments and is reflected in accounting records (clause 19 of Instruction No. 162n, clause 26 of Instruction No. 174n):

Debit 0 401 20 224 “Expenses for depreciation of rights to use an asset” Credit to the corresponding analytical accounting accounts account 0 104 40 000 “Depreciation of rights to use an asset”.

At the same time, in the same amount, the accounting records reflect the assignment to the financial result of the current period of deferred income from obtaining the right to use the asset (under lease agreements on preferential terms):

Debit 0 401 40 182 “Future income from gratuitous right of use” Credit 0 401 10 182 “Income from gratuitous right of use”.

In the program “1C: Public Institution Accounting 8”, these operations are reflected in the document Accrual of depreciation of rights to use OS, legal acts.

Please note that from 01/01/2019, in accordance with the Procedure for applying the classification of operations of the general government sector (approved by order of the Ministry of Finance of Russia dated November 29, 2017 No. 209n, as amended by order of the Ministry of Finance of Russia dated November 30, 2018 No. 246n), the following KOSGU codes are used to reflect income from preferential rent :

- 182 “Income from the gratuitous right to use an asset provided by organizations (except for the public administration sector and public sector organizations)”;

- 185 “Income from the gratuitous right to use an asset provided by public sector organizations”;

- 186 “Income from the gratuitous right to use an asset provided by the general government sector”;

- 187 “Income from the gratuitous right to use an asset provided by other persons.”

Termination of the right to use an asset (subject to full execution of the contract) (disposal of an operating lease accounting object) is reflected in accounting entries in the corresponding analytical accounting accounts (clause 41.1 of Instruction No. 162n, clause 67.3 of Instruction No. 174n):

Debit 0 104 40 000 “Depreciation of rights to use assets” Credit 0 111 40 000 “Right to use non-financial assets”

- in the amount of the book value of the right to use the asset.

In the 1C: Public Institution Accounting 8 program, edition 1 and edition 2, this operation is reflected in the document Termination of rights to use OS, legal acts.

| 1C:ITS Budget For more information about the reflection in “1C: Accounting of a State Institution 8” of operations on preferential lease by the borrower, see the articles published in the methodological support for standard configurations of edition 1 and edition 2 of the BGU1 and BGU2 program. |

If the property is leased

Let’s say an individual entrepreneur using the simplified tax system received non-residential premises under a free use agreement. At the same time, the agreement states that he has the right to transfer this premises for rent. Then income in the form of gratuitously received property (work, services) or property rights and income received in connection with the further transfer of such property for rent (sublease) should be considered as income received in connection with the implementation of various operations (various types of activities).

That is, income from the provision of services for the provision of property for rent (sublease) is taken into account by the taxpayer as part of income when determining the tax base paid in connection with the application of the simplified taxation system, as non-operating income or income from the sale of services. Similar explanations are given in the letter of the Ministry of Finance of Russia dated August 17, 2011 No. 03-11-11/209.

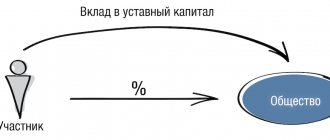

Property of the sole participant of the organization. How to replace rent

If one founder of an enterprise, who is also the director of this enterprise, rents premises and special equipment to his enterprise, do you need to pay yourself rent? Or is there something I can do to avoid paying myself rent? What agreements are needed for this?

There are two ways to provide property for temporary use

:

1.

Rent out;

2.

Give it away for free use.

According to Art. 606 of the Civil Code of the Russian Federation under a lease agreement

(property lease) the lessor (lessor) undertakes to provide the lessee (tenant) with property for a fee for temporary possession and use or for temporary use.

That is, the lease agreement is always paid

.

In accordance with paragraph 1 of Art. 689 of the Civil Code of the Russian Federation under a free use agreement

(

loan agreement

) one party (the lender) undertakes to transfer or transfers the thing for free temporary use to the other party (the borrower), and the latter undertakes

to return the same thing in the condition

in which it received it, taking into account normal wear and tear or in the condition due to agreement.

The rules provided for by certain provisions of the Civil Code of the Russian Federation on rent are accordingly applied to the agreement for gratuitous use.

.

That is, the loan agreement is always free of charge

.

The loan agreement is concluded for the period specified in the agreement

.

If the period of gratuitous use is not specified in the agreement, the loan agreement is considered to be concluded for an indefinite period.

Borrower

is obliged to use the property received for free use in accordance with the terms of the loan agreement, and if such conditions are not defined in the agreement, in accordance with the purpose of the property.

Separable improvements made by the borrower

assets are

his property

, unless otherwise provided by the loan agreement.

According to Art.

690 of the Civil Code of the Russian Federation, a commercial organization does not have the right

to transfer property

for free use to a person who is its founder

, participant, manager, member of its management or control bodies.

Consequently, a participant in a commercial organization has the right to transfer property to the organization for free use

.

The borrower is obliged

maintain the item received for gratuitous use in good condition, including

carrying out current and major repairs, and bear all costs of its maintenance

, unless otherwise provided by the agreement of gratuitous use (

Article 695 of the Civil Code of the Russian Federation

).

Therefore, the borrower's responsibility

(

organization

)

expenses

for the maintenance of property received for free use

is legal and, moreover, mandatory by law

.

The lender is obliged to provide the thing in a condition that complies with the terms of the agreement for gratuitous use and its purpose.

The item is provided for free use

with all its accessories and

related documents

(instructions for use, technical data sheet, etc.), unless otherwise provided by the contract.

If such accessories and documents were not transferred, but without them the thing cannot be used for its intended purpose or its use significantly loses value for the borrower, the borrower has the right to demand the provision of such accessories and documents to him or termination of the contract and compensation for actual damage suffered by him ( Article 691 Civil Code of the Russian Federation

).

In accordance with paragraph 8 of Art.

250 of the Tax Code of the Russian Federation, income in the form of gratuitously received property

(work, services) or property rights (

including the right to use property

), except for the cases specified in

Art.

251 of the Tax Code of the Russian Federation are

recognized as non-operating income

of the taxpayer and, therefore, are taken into account when forming the tax base for corporate income tax.

For the purposes of Chapter 25 of the Tax Code of the Russian Federation, property

(

works, services

)

or property rights are considered received free of charge

if

the receipt of this property

(works, services) or property rights

is not associated with the occurrence of an obligation on the recipient to transfer

property (property rights) to the transferor (

perform

work for the transferor,

provide

services to the transferor ).

The Ministry of Finance of the Russian Federation, in letter dated August 30, 2012 No. 03-03-06/1/444, explained that by receiving property under a free use agreement, an organization receives the right to use this property free of charge

.

Therefore, for profit tax purposes, receiving property for gratuitous use should be considered as gratuitous receipt of property rights

.

When receiving property (work, services) free of charge, income assessment is carried out based on market prices determined

taking into account the provisions

of Art.

105.3 of the Tax Code of the Russian Federation, but not lower than

the residual value

determined in accordance with Chapter 25 of the Tax Code of the Russian Federation -

for depreciable property

and not lower than the costs of production (acquisition) - for other property (work performed, services provided).

Pricing information must be confirmed

by the taxpayer - recipient of property (work, services) documented or through an independent assessment.

Thus, an organization that receives property for free use under an agreement includes in non-operating income income in the form of a freely received right to use property

, determined

based on market prices for the rental of identical property

.

The Presidium of the Supreme Arbitration Court of the Russian Federation made the same conclusion

in paragraph 2 of Information Letter dated December 22, 2005 No. 98.

You did not indicate which taxation system the organization uses.

If the organization is on the general taxation system, then with the gratuitous use of property it generates non-operating income for profit tax purposes

.

If the organization is on the simplified tax system, then since, according to Art. 346.15 Tax Code of the Russian Federation

Taxpayers under the simplified tax system

take into account non-operating income

, determined in accordance with

Art.

250 of the Tax Code of the Russian Federation ,

the organization takes into account non-operating income as part of its income

.

Established in paragraph 8 of Art.

250 of the Tax Code of the Russian Federation,

the principle of determining income when receiving property free of charge, which consists in its

assessment based on market prices

, determined taking into account the provisions

of Art. 105.3 of the Tax Code of the Russian Federation

,

is also subject to application when assessing property rights, including the right to use a thing

.

Thus, a taxpayer who receives property for gratuitous use under an agreement and applies the simplified tax system includes in income income in the form of a gratuitously received right to use property

, determined based on market prices for the rental of identical property (letter of the Ministry of Finance of the Russian Federation dated August 25, 2014 No. 03-11-11/42295).

The Ministry of Finance of the Russian Federation also indicates that when carrying out entrepreneurial activities subject to UTII, income in the form of gratuitously received property rights

for the use of retail space transferred

by the sole founder

of the organization (individual),

participation share

in the authorized capital of the organization is

more than 50%, is subject to corporate income tax

(letter dated January 31, 2013 No. 03-11-06/3/1935 , dated September 20, 2012 No. 03-11-06/3/66).

Based on pp.

11 clause 1 art. 251 of the Tax Code of the Russian Federation , when determining the tax base

, income in the form of property received by a Russian organization free of charge, in particular,

from an individual

, if the authorized (joint) capital (fund) of the receiving party

consists of more than 50% of the contribution

(

share

)

of this individual faces

_

In pp. 11 clause 1 art. 251 Tax Code of the Russian Federation

We are talking about the gratuitous receipt

of property

, not

the right to use

property.

Based on this rule, the organization would not have taxable income, for example, if a participant transferred ownership of the premises to his organization, the authorized capital of which consists of more than 50% of the contribution (share) of this participant

.

But if this participant has granted his organization the right to use free of charge

premises (special equipment), then

p.p.

11 clause 1 art. 251 of the Tax Code of the Russian Federation can no longer be applied, which means that the LLC will have taxable income.

Application of paragraph 8 of Art.

250 of the Tax Code of the Russian Federation is not limited only to property rights that represent claims against third parties

.

By virtue of this norm, income in the form of gratuitously received

property (work, services) or

property rights is recognized as non-operating income

.

Therefore, the Ministry of Finance points out, the taxpayer-borrower has income

in the form of property rights received free of charge, in particular, from an individual,

is subject to inclusion in non-operating income

on the basis of

clause 8 of Art.

250 Tax Code of the Russian Federation .

An organization, when concluding an agreement for the gratuitous use of property, will be able, in the same way as when concluding a lease agreement, to include expenses associated with the use and maintenance of such property as expenses for tax purposes.

, provided that such expenses meet the criteria established

by Art.

252 of the Tax Code of the Russian Federation (letters of the Ministry of Finance of the Russian Federation dated April 4, 2007 No. 03-03-06/4/37, dated July 24, 2008 No. 03-03-06/2/91).

At the same time , expenses associated with the repair of fixed assets received for free use

, are taken into account as part of

other expenses

associated with production and sales (letter of the Ministry of Finance of the Russian Federation dated March 22, 2010 No. 03-03-06/1/159).

In letter dated December 5, 2012 No. 03-03-10/128, the Ministry of Finance of the Russian Federation explained that in accounting and balance sheet

An organization

can only reflect property that, according to the law, is recognized as the property of this organization

.

When receiving property under a gratuitous use agreement,

the ownership

of this property

does not pass

.

Property received under a gratuitous use agreement is accounted for by the borrower on an off-balance sheet account in the valuation adopted in the agreement

.

Therefore, upon receipt

for temporary gratuitous use of property,

such property does not increase the net assets

of the borrower company, determined according to the balance sheet, since it is not reflected in the organization’s balance sheet, but

is listed on an off-balance sheet account

.

Receipt of property for free use is reflected in off-balance sheet account 001

.

Repair and maintenance costs

premises received for free use are reflected in the

debit of accounts 20

(

26, 44, 91

) and

the credit of account 60

.

According to Art. 105.1 Tax Code of the Russian Federation

if the peculiarities of relations between persons may influence the conditions and (or) results of transactions made by these persons, and (or) the economic results of the activities of these persons or the activities of the persons they represent, these persons are recognized as

interdependent

for tax purposes.

To recognize the mutual dependence of persons, the influence that may be exerted due to the participation of one person in the capital of other persons is taken into account, in accordance with an agreement concluded between them, or if there is another opportunity for one person to determine the decisions made by other persons.

Interdependent persons are recognized as

an individual and an organization if such an individual

directly and (or) indirectly

participates

in such an organization and

the share of such participation is more than 25%

, and the organization and the person exercising the powers of its executive body (

clause 2 p. 2 Article 105.1 of the Tax Code of the Russian Federation

).

Therefore, in your situation, the parties to the contract will be recognized as interdependent persons

.

In letter dated October 18, 2012 No. 03-01-18/8-145, the Ministry of Finance of the Russian Federation explained that transactions between related parties can be divided into two groups

: controlled, recognized as such subject to the provisions

of Art.

105.14 of the Tax Code of the Russian Federation , and other transactions between related parties.

Regarding controlled transactions

Taxpayers are obliged to notify the tax authorities about the completion of such transactions and submit the relevant documentation when the Federal Tax Service of the Russian Federation conducts an audit of the completeness of calculation and payment of taxes in connection with transactions between related parties.

In turn, according to paragraph 1 of Art.

105.17 of the Tax Code of the Russian Federation,

verification of the completeness of calculation and payment of taxes in connection with transactions between related parties is carried out by the Federal Tax Service of the Russian Federation.

At the same time, monitoring the compliance of prices applied in controlled transactions

, market prices

cannot be the subject of on-site and desk inspections

.

In cases of transactions between related parties that do not meet the criteria of controlled

, in which the calculation of the tax base is carried out on the basis of the provisions of individual articles of part two of the Tax Code of the Russian Federation based on prices determined in accordance with

Art. 105.3 of the Tax Code of the Russian Federation

,

monitoring the compliance of prices

applied in such transactions with market prices

may be the subject of on-site and desk audits

.

At the same time, according to paragraph 4 of Art. 105.3 of the Tax Code of the Russian Federation, tax authorities can check the completeness of calculation and payment only of the following taxes

:

1) income tax

organizations;

2)

personal income tax

, paid in accordance with

Art.

227 of the Tax Code of the Russian Federation (entrepreneurs, notaries, lawyers);

3) mineral extraction tax

(if one of the parties to the transaction is a taxpayer of the specified tax and the subject of the transaction is an extracted mineral resource, which is recognized for the taxpayer as an object of taxation by the tax on the extraction of mineral resources, the extraction of which is taxed at a tax rate established as a percentage);

4)

VAT

(if one of the parties to the transaction is an organization (individual entrepreneur) that is not (is not) a VAT payer or is exempt (exempt) from fulfilling the duties of a taxpayer for VAT).

If the property was received by the company on UTII

As for a company that applies the taxation system in the form of UTII, when it carries out business activities subject to such tax, income in the form of premises received free of charge for use, transferred by the sole founder (individual), is subject to corporate income tax (see letter from the Ministry of Finance Russia dated January 31, 2013 No. 03-11-06/3/1935).

Commented document: Letter of the Ministry of Finance of the Russian Federation No. 03-11-11/4042 dated 02/03/2014 “STS: accounting for property received free of charge”

Tax consultant P.R. Sidorov

, for the magazine “Normative Acts”

Guide for the simplified tax system

With this e-book, you will easily understand all the intricacies of the simplified taxation system, competently draw up a balance sheet and financial statements. You will receive the electronic edition immediately after payment to your email. Find out more about the publication >>