A debt owed by a borrower to a lender that is not repaid within the prescribed period is called overdue debt. Return periods are established by the parties in the agreement. It is worth knowing which debt is considered overdue before signing the contract in order to control the timing of payments and fulfill your obligations.

What debt is considered overdue?

Any commercial transaction is accompanied by the conclusion of an agreement between the parties, which stipulates the terms of the transaction: deadlines for fulfilling agreements and penalties for failure to fulfill obligations. These types of transactions include:

- contract of sale,

- service agreement,

- lease contract,

- credit and mortgage agreements.

Types of overdue debts:

- Creditor is the debt of an individual or legal entity to a creditor. The subject is obliged to repay the debt specified in the contract. This type of debt occurs when money does not arrive to the creditor on time or arrives late.

- Accounts receivable - when services provided by the company or goods sold are not paid by the consumer on time.

It is necessary to have an understanding of the basis for the debt in order to determine which accounts payable are considered overdue. By definition, this is an agreement between individuals or legal entities when one of the parties receives funds under certain conditions, but does not return them within the period established in the agreement.

As soon as a debt arises, the lender receives rights that relate to the repayment of the debt:

- Interest accrual for using funds beyond the due date.

- Penalty for late payment.

For a creditor, debt has a dual meaning:

- Brings losses because funds are loaned for a certain period, but are not returned on time.

- The delay will become income for taxation; for this, the lender needs to write it off.

Competent debt write-off means that you need to withstand the period of delay established by law. Further actions are carried out in accordance with the law.

Methods of debt collection from legal entities

There are several ways to collect debt from a legal entity. Let's evaluate each in more detail; to choose the most suitable one, it is better to consult with our lawyer who has experience in working with debtors and knows how to apply in practice each of the presented individually or collectively.

Peaceful settlement of the dispute

The fastest way to repay a debt is undoubtedly a peaceful resolution of the issue. This option is beneficial for both sides of the dispute, since it significantly saves time and reduces the costs of resolving the problem.

The percentage of pre-trial dispute resolution is quite high, so before contacting government agencies, it will be effective to try this method. Moreover, an attempt to resolve the issue through negotiations is a prerequisite for judicial protection.

It is noteworthy that debt can arise not only from the bad faith of the counterparty, but also from various types of errors in documents or in the work of the organization’s employees.

In this regard, resolving a dispute over debt obligations is not only an effective way to collect a debt, but also one of the key points when filing a claim. Options for a peaceful settlement may also include:

- concluding an additional agreement with the debtor on drawing up a payment schedule, on deferment or installment plan of the debt, fixing the amount of the debt without charging fines or applying sanctions.

- it makes sense to conclude a compensation agreement if the debtor is unable to repay the entire amount of the debt at once or by a certain date, if no improvement in the debtor’s financial condition is expected. Its essence lies in the fact that the debtor transfers part of the debt amount, movable or immovable property and other things to pay off his debt. This path is suitable for those situations where it seems more expensive and difficult to collect the debt in full.

Assignment of the right of claim

One of the fastest ways of collection is also the transfer of rights to receive debts to another person. This person can be a company specializing in debt collection or well-known collection agencies.

If you agree to part with 30%, 50% of the debt amount to pay for the services of such companies, then this type of collection will help you get part of the debt and save your time.

Retention of the debtor's property

In cases where the creditor is in charge of the debtor’s property due to the existence of contractual relations between them, then such property can also become a guarantee for debt collection.

Actions to retain property will help motivate the debtor to repay the debt, because in addition to the risk of losing the property itself, there is a danger of owing for safekeeping, for example, in a relationship under a lease agreement, read about retaining the property of the debtor-tenant at the link.

Statement of claim to court

The classic and most commonly used method of debt collection is filing a claim with an arbitration court.

When applying for this type of protection of rights, you must have supporting documents for the occurrence of the debt, have knowledge of substantive and procedural law, and be prepared to pay a state fee, the amount of which is determined as a percentage of the amount of the claim.

In addition, you need to have enough time both to prepare documents and to take personal participation in the trial itself and beyond at the stage of enforcement proceedings.

A positive court decision is not a guarantee of debt repayment. It will be especially problematic to repay the debt if the debtor does not intend to pay off the debts and will evade his obligations in various ways.

Arbitration court

An alternative to turning to the Russian judicial system is the opportunity to submit an application for debt collection to an arbitration court.

The advantage of arbitration is the time frame for consideration of cases. By turning to an arbitrator, the process can be significantly shortened from several months to several weeks.

Acts of this judicial body have the same legal force and can be transferred for execution to the federal bailiff service.

What debt is considered overdue in accounting?

The creditor's accounting must record the amount of debt on the company's balance sheet before the statute of limitations expires. Fixing overdue amounts is a prerequisite, since the actual property and funds that are issued in the form of a loan belong to the lender. Information about delays is excluded from the accounting documentation only by a court decision or upon expiration of the debt collection period.

These actions are recorded without fail in current accounting documents and in current reporting. Uncollectible debts are accounted for using a special form.

Untimely control of financial expenses, including insufficient accounting of overdue debts, can lead to bankruptcy. The status of debts is monitored over a period of 5 years. This is the maximum period when a debt is considered overdue in accounting.

If funds are credited to the account in a certain amount, they are transferred from the category of debts to the company’s balance sheet. The amount of debt is written off by order of the manager if the company suffers real losses due to the debt.

In order to avoid the situation of formation of receivables, the company needs a preliminary market analysis and verification of the partner before the contract is concluded, if we are talking about a legal entity. As for individuals, it is necessary to have information about their credit history and current solvency in order to minimize the risk of debt formation on the part of the borrower in the future.

Results

Long-term accounts receivable include all debts to the enterprise that are expected to be repaid within a period of time exceeding 12 months from the reporting date. When filling out financial statements, indicators of current and long-term debt are indicated together in line 1230 - with subsequent separate division into debt classified as current and non-current, in the form of an explanation to the balance sheet.

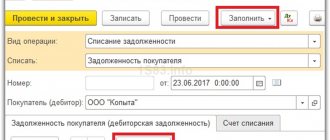

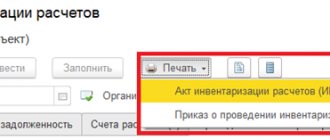

Currently, a widely used accounting software product is 1C.

With the help of which reports from this program can you assess the status of accounts receivable at an enterprise, see the material “How to view accounts receivable in 1C correctly?” You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

About debt write-off

Debts are written off by the lender after 3 years from the date of the delay, taking into account the individual conditions for the occurrence of delays and the behavior of the borrower after the start of the period of non-payment. In order for the write-off to be carried out legally, the creditor must complete the necessary documents:

- Order from the manager to carry out the write-off procedure.

- An inventory act is necessary for a clear picture of the state of the company’s assets at the time of debt write-off.

- Write-off is carried out as soon as the statute of limitations expires, as well as if it is impossible to fulfill debt obligations for objective reasons. The law establishes the following actions for objective reasons:

- The presence of an act of a government authority stating that enforcement proceedings are terminated. The act must indicate the reasons why it is not possible to collect the debt from the borrower.

- The creditor's own assessment of the debt as unrealistic for reimbursement. The document must be drawn up in writing explaining the reasons for the impossibility of collecting the debt, signed by the manager and affixed with the company seal.

The creditor's assessment alone is not enough to carry out the write-off procedure. The lender's written assessment must be confirmed by official authorities.

Vicarious liability of the director or founder of the debtor company

In order not to pay debts, unscrupulous market participants often resort to liquidating the organization, removing assets from the balance sheet of the enterprise and other tricks to avoid retribution. Sometimes the creation of companies is the sole purpose of obtaining benefits to the detriment of law-abiding economic entities.

IMPORTANT : but creditors also have a mechanism to protect themselves from such actions of debtors.

In cases where a legal entity has ceased to exist or is approaching bankruptcy, it is possible to bring to subsidiary liability the managers and founders of the enterprise controlled by them.

An important point in bringing a person to subsidiary liability is, firstly, the presence of administrative powers affecting the activities of the legal entity, and secondly, the commission by the subsidiary defendant of actions that resulted in non-repayment of the debt to the creditor.

To attract a sub-defendant to participate in the case of debt repayment, the presence of mandatory conditions must be present, including his proven guilty behavior, the presence of losses and a causal connection between the occurrence of the debt and the actions of the manager himself.

ATTENTION: watch video arbitration disputes and subscribe to our YouTube right now to be able to receive free legal advice in the video comments:

About the types of delays

The current legislation describes in detail the types of debts and the procedure for their gradation:

- Doubtful - all types of debt obligations for which entries were not made in the accounting documentation of the enterprise within the period specified in the loan agreement. When registering these types of debt obligations, there is no guarantee or collateral, that is, there is no property security. Thus, any debt that can be written off without problems can be classified as doubtful. The exception is when the creditor suspends write-off until all the circumstances surrounding the formation of the debt are clarified.

- Hopeless. Grounds for classifying a debt as bad:

- The debt is not closed for 3 years.

- The debtor is a bankrupt or liquidated company.

- Debt obligations in relation to which enforcement proceedings have already been initiated and were terminated due to the determination of the impossibility of collection.