Organizations offering insurance services are required to maintain accounting records. Their activities are controlled by the insurance market department that exists under the Central Bank.

Question: How are the costs of insuring property (including leasing and rented property) reflected in accounting and tax accounting? The organization entered into a property insurance contract for a period of 12 months (365 days) and paid a lump sum insurance premium in the amount of 146,000 rubles. The insurance contract is valid from March 1 of the current year (the date of payment of the insurance premium) to February 28 of the next year inclusive. For tax purposes, income and expenses are accounted for on an accrual basis. Reporting periods for income tax are the first quarter, half a year, and nine months of the calendar year. Interim financial statements are prepared on the last day of each quarter. View answer

Primary documents

Primary documentation is the papers on the basis of which accounting is carried out. Primary information for an insurance organization:

- Founding papers: charter, license.

- Insurance contracts.

- Papers confirming the occurrence of the event (application, insurance certificate).

- Papers confirming coverage of losses.

- Tax accounting registers.

The insurance company needs to approve the document flow schedule and document forms that are necessary for accounting needs.

the insurance premium reflected in accounting when terminating a compulsory motor liability insurance contract ?

Payment of insurance premium

Payment of the premium

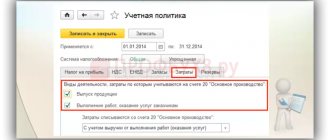

In order for insurance costs to be automatically evenly taken into account as expenses, it is necessary, at the stage of paying the insurance premium, to correctly fill out the document Write-off from the current account transaction type Other write-off in the Bank and cash desk - Bank - Bank statements - Write-off section.

The document states:

- Recipient - the counterparty to whose account the insurance premium is paid;

- Amount - the paid amount of the insurance premium according to the bank statement;

- Debit account - account 76.01.9 “Payments (contributions) for other types of insurance”: this is a special account in 1C, provided for paid insurance premiums;

- Counterparties - insurance company;

- Deferred expenses are parameters for automatic uniform recognition of compulsory motor liability insurance costs.

Postings according to the document

The document generates the posting:

- Dt 76.01.9 Kt - payment of insurance premium.

Insurance policy accounting

It is recommended to reflect the received MTPL policy on the balance sheet, since the organization must generate complete and reliable information about its activities and its property status (Article 13 of the Federal Law of December 6, 2011 N 402-FZ, clause 4, clause 32 of the Accounting Regulations and financial statements, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n).

In 1C there is no special off-balance sheet account for accounting for policies. Therefore, you need to create it yourself , for example, 013 “OSAGO, DSAGO, CASCO policies.” PDF

BukhExpert8 advises keeping records both according to the elements of the directory Deferred Expenses and according to Fixed Assets . With this set of analytics, you can, for example, analyze which vehicle your insurance is running out of.

Acceptance of an incoming MTPL policy for off-balance sheet accounting is formalized by the document Transaction entered manually, type of operation Transaction in the section Operations – Accounting – Transactions entered manually.

Accounting for payments under basic agreements with policyholders

The organization makes insurance payments when insured events occur. They may relate to various areas:

- Property (payments are made in cases of theft, flooding and other damage).

- Medicine (payments in case of illness).

- Auto (payments in case of car theft).

How is accounting carried out when insuring the leased asset by the lessee (sublessee)?

Insurance payments are formed from the totality of all proceeds from people who have entered into an insurance agreement with the organization. Payments are recorded on account 22. Information about them is collected in registers. Analytical accounting is carried out in the context of agreement forms and policyholders. Information is recorded in accounting on the date of occurrence of insurance rights.

Accounting for bonuses

Insurance premiums are payments made by a person to an organization. The insurance agreement comes into force either from the date specified in it or from the date of payment of the first premium.

How is accounting carried out when insuring cargo by the shipper ?

Compensation in the event of an insurance event is paid only when the person has no arrears on premiums. All amounts for the past period must be paid.

The compensation paid to the insured may be counted towards the following insurance premiums.

Let's look at an example. The insured person was awarded compensation in the amount of 50,000 rubles. Additional expenses associated with the insured event were also confirmed. The person decided to use half of this amount towards future insurance payments. In this case, these postings are used:

- DT22/1 KT51. Payment of insurance compensation.

- DT22/1 KT51. Payment of additional expenses.

- DT22/1 KT77/1. Crediting part of the indemnity amount against the following insurance premiums.

The legality of all payments is confirmed by the primary source.

Step-by-step instruction

On April 2, a Ford Mondeo was purchased.

On April 3, the car was insured by PJSC IC Rosgosstrakh: an insurance premium of MTPL was paid in the amount of 14,820 rubles. for the period from April 4 of the current year to April 3 of the next year

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Payment of insurance premium | |||||||

| April 03 | 76.01.9 | 51 | 14 820 | 14 820 | Payment of MTPL insurance premium | Write-off from current account - Other write-off | |

| 013 | 14 820 | Accounting for MTPL insurance policy | Manual entry - Operation | ||||

| Reflection in accounting for insurance premium costs for April | |||||||

| April 30 | 26 | 76.01.9 | 1 096,27 | 1 096,27 | 1 096,27 | Accounting for compulsory motor liability insurance costs | Closing the month - Write-off of deferred expenses |

| Reflection in accounting for insurance premium costs for May | |||||||

| May 31 | 26 | 76.01.9 | 1 258,69 | 1 258,69 | 1 258,69 | Accounting for compulsory motor liability insurance costs | Closing the month - Write-off of deferred expenses |

For the beginning of the example, see the publication:

- Purchasing OS (auto)

Accounting for reinsurance

Reinsurance is the transfer of obligations to protect against risks. It is assumed that these obligations are transferred from one organization to another. That is, a person enters into an agreement with one organization. She will be considered the primary insured. It is she who is responsible to clients. She also accepts various insurance claims.

If reinsurance is carried out, these transactions become relevant:

- DT92/4 KT77/4. Premium aimed at reinsurance.

- DT77/4 KT91/1. Money received from the reinsurer.

- DT77/4 KT77/6. Money deposited under agreements submitted to reinsurance.

The reinsurance agreement is a separate contract. The reinsurer makes payments only in the amounts established by the contract. Amounts above the limit are paid by the primary insurer.

They are obligated to insure, they have the right to take into account expenses.

The Tax Code distinguishes between such concepts as compulsory and voluntary property insurance: compulsory insurance can be taken into account in taxable expenses within the limits of insurance tariffs approved in accordance with the legislation of the Russian Federation and the requirements of international conventions, if any. Voluntary property insurance is taken into account in the amount of actual costs, but a number of other conditions apply for the recognition of such costs. In the above case, we are seeing two types of insurance - compulsory (MTPL) - for a car owned by the company, and voluntary (insurance of a rented car in case of damage).

It is known that compulsory insurance is carried out in accordance with the letter of the law and regardless of the wishes of the property owner. Taking into account the costs of compulsory insurance, an accountant comes across quite often: as a rule, these are payments under compulsory motor liability insurance.

The obligation to insure the liability of motor vehicle owners (MTPL) is established by Decree of the Government of the Russian Federation of May 7, 2003 N 263, approving the Rules for compulsory civil liability insurance of motor vehicle owners. Tariffs for compulsory insurance of this liability were approved by Decree of the Government of the Russian Federation of December 8, 2005 N 739. Thus, an enterprise can include in other expenses the amount of insurance already calculated for it at the established tariff.

Nota bene. Expenses for compulsory types of insurance are included in other expenses within the limits of insurance tariffs approved in accordance with the legislation of the Russian Federation and the requirements of international conventions. If these tariffs are not approved, compulsory insurance costs are included in other expenses in the amount of actual costs (clause 2 of Article 263 of the Tax Code of the Russian Federation).

For profit tax purposes, Accent uses the accrual method. In addition, the company pays advance payments for income tax based on the profit actually received, so the reporting period for it is a month (clause 2 of Article 285 of the Tax Code of the Russian Federation). The duration of the contract (one year) exceeds the duration of the reporting period (one month). Therefore, the amount that can be taken into account for profit tax purposes for February is determined in proportion to the number of calendar days of the agreement (365 days) and the number of calendar days falling within the agreement in the reporting period (18 days) (clause 6 of Article 272 of the Tax Code of the Russian Federation) . Therefore, in February, the accountant will take into account the amount calculated in the table below.

Table. Calculation of the amount for compulsory motor liability insurance taken into account in February 2010

| Amount of annual MTPL insurance | Duration of the contract under compulsory motor liability insurance | Calculation of the amount recorded in February 2010 | Amount taken into account in February for profit tax purposes |

| 10,000 rub. | 365 days | 10,000 rub. : 365 days x 18 days | RUB 493.15 |

When applying the cash method, the insurance premium under the MTPL agreement is fully recognized as an expense after actual payment to the insurer (clause 3 of Article 273 of the Tax Code of the Russian Federation). Of course, the insured vehicle must be used for business or management purposes. Thus, if Accent LLC used the cash method rather than the accrual method, then in February the entire amount - 10,000 rubles - would have been expensed. (provided that payment under the MTPL agreement was made in February).

Accounting for payments under coinsurance agreements

A person may enter into insurance agreements with several organizations. In this case, the companies will be jointly and severally liable to the person in the event of an insured event. That is, each organization contributes a certain share. There are 2 options for drawing up an agreement:

- The person enters into separate agreements with each company. Calculations are carried out by each organization separately.

- All operations are carried out by one organization, which acts on behalf of others.

If agreements are concluded with each organization separately, these postings are used:

- DT77/1 KT92/1. Calculation of insurance premium.

- DT51 KT77/1. Payment of the premium.

- DT22/1 KT77/1. Calculation of payment upon the occurrence of an insured event.

- DT77/1 KT51. Transfer of payment.

If settlements are carried out by one organization, accounting is carried out by each insurance company. Accounting reflects amounts proportional to the organization's share.

What if?..

Let's say the car gets into an accident. Let's consider two cases.

Option 1. If damage is caused to the company car.

If the car is involved in an accident, the damage is compensated by the insurance company of the person responsible for the accident.

The insurance amount, within the limits of which the insurer, upon the occurrence of each insured event (regardless of their number during the validity period of the compulsory insurance contract) undertakes to compensate the victims for the harm caused, is:

- in terms of compensation for harm caused to the life or health of each victim, but not more than 160 thousand rubles;

- in terms of compensation for damage caused to the property of several victims, but not more than 160 thousand rubles;

- in terms of compensation for damage caused to the property of one victim, but not more than 120 thousand rubles.

These norms are established by Article 7 of the Law.

When the insured amount is credited to the organization’s account, it must be reflected in the accounting records as other income, and the amount spent on car repairs must be included as expenses from ordinary activities.

Let's go back to the previous example. Let's assume that in May 2010 the car was involved in an accident, the culprit of which was a driver from another organization. The cost of repairing the car amounted to 160,000 rubles, and the insurance compensation received amounted to 120,000 rubles.

The accountant of Luch LLC will make the following entries in accounting: 05.25.10:

Debit 26 Credit 60 - car repair expenses have been taken into account, according to documents from the car service - 135,593 rubles. 05/25/10: Debit 19-3 Credit 60 – VAT allocated based on the invoice – RUB 24,407. 05/25/10: Debit 91-2 Credit 19-3 – VAT is reflected as part of other expenses – RUB 24,407. 05/31/10: Debit 51 Credit 76.1 – insurance compensation received from the insurance company in the amount of 120,000 rubles. 05/28/10: Debit 76.1 Credit 91 - the amount of insurance compensation is taken into account as other income based on the insurance company’s document recognizing the amount of damage - 120,000 rubles.

In tax accounting, recognition of a loss in the amount of 40,000 rubles can be challenged by the tax authorities. And there are grounds for such a dispute.

According to Articles 1064, 1079 of the Civil Code of the Russian Federation, harm caused to the person or property of a citizen, as well as harm caused to the property of a legal entity, is subject to compensation in full by the person who caused it.

Legal entities and citizens whose activities involve an increased danger to others (and this includes the use of vehicles) are obliged to compensate for damage caused by a source of increased danger, unless they prove that the damage arose as a result of force majeure or the intent of the victim. The obligation to compensate for damage is assigned to a legal entity or citizen who owns a source of increased danger on the right of ownership, the right of economic management or the right of operational management or on another legal basis (by lease, by power of attorney for the right to drive a vehicle, by virtue of an order of the relevant body on transferring to him a source of increased danger, etc.).

Most often, the decision on compensation for harm is the subject of litigation, so many organizations refuse this procedure and prefer to suffer losses.

The Tax Code considers expenses provided that they were incurred to carry out activities aimed at generating income. If an organization deliberately refuses to receive income, then it should not recognize the corresponding expenses.

Tax officials have repeatedly expressed the view that the cost of restoring a car after a traffic accident cannot exceed the amount of compensation received from the insurance company. (letter from the Federal Tax Service of Russia for Moscow dated March 21, 2007 No. 19-11/25344). The illegality of the value added tax deduction is explained by the fact that insurance compensation is not subject to VAT taxation. Only those amounts of VAT that are purchased to carry out transactions recognized as objects of taxation are subject to deductions (clause 2 of Article 171 of the Tax Code of the Russian Federation).

Therefore, an organization that has reflected the full amount of repairs in expenses and applied a VAT tax deduction must be prepared to defend its position in court.

There is positive judicial practice on this issue (Resolution of the Federal Antimonopoly Service of the Ural District dated July 7, 2008 No. F09-4771/08-S3 in case No. A76-23428/07, Resolution of the Federal Antimonopoly Service of the Moscow District dated July 8, 2009 No. KA-A40/ 5895-09, etc.).

The insurance company often pays for repairs of damaged vehicles directly to the car service center, bypassing the car owner’s account. In such cases, the organization may not recognize in tax and accounting either income in the form of insurance compensation or expenses in the form of the cost of repairs paid by the insurer. As a rule, this applies to voluntary CASCO insurance contracts.

Option 2. When damage is caused to third parties

If an organization’s car is involved in an accident and damage is caused to a third party, and the payment received from the insurer does not cover the cost of repairs, then the organization faces the question of compensation for material damage.

The organization has the right to recover this amount from the employee, or may not do this and pay compensation at the expense of the organization’s funds.

Full financial liability of an employee arises in connection with damage caused as a result of an administrative violation, if established by the relevant government body. The driver’s guilt is determined in the protocol, which is drawn up by the internal affairs bodies when an accident occurs. Therefore, the organization has the right to demand compensation for material damage from the employee.

Article 238 of the Labor Code obliges an employee who causes damage to the organization’s property to compensate the amount. In order to correctly reflect this operation in accounting, it is necessary to have documentary evidence. They can be either a court decision or an employee’s statement recognizing the amount of material damage (10.2 PBU 9/99).

In accounting, funds received from an employee are recognized as other income of the organization.

Money received from an employee to compensate for damages is not subject to value added tax.

Deduction of damage is possible on a monthly basis from the employee’s salary, but in the amount of no more than 20 percent of the amount due for payment (Article 138 of the Labor Code of the Russian Federation).

Let’s assume that in May 2010, a Luch LLC car was involved in an accident, which resulted in material damage to a third party. The driver of the organization was found to be at fault for the accident. According to the court decision, material damage in the amount of 40,000 rubles is recovered from him. The driver's monthly salary is 25,000 rubles.

When reflecting transactions to pay off damage from an accident, the accountant makes the following entries: 05/23/10:

Debit 91.2 Credit 76 – the organization recognized material damage to a third party in the amount of 40,000 rubles. 05.25.10: Debit 73 Credit 91 – the driver of the organization recognized material damage to the organization’s property in the amount of 40,000 rubles. 05.25.10: Debit 76 Credit 51 – the amount of material damage to the injured party was transferred 40,000 rubles. 05/31/10: Debit 70 Credit 73 – the amount of material damage was withheld from the employee’s salary of 5,000 rubles. 05/31/10: Debit 50 Credit 73 – contributed to the organization’s cash desk by an employee to cover material damage of 10,000 rubles.

In tax accounting, amounts received from an employee are included in non-operating income on the basis of paragraph 3 of Article 250 of the Tax Code. Money received from an employee to compensate for damages is not subject to value added tax.

If an organization decides not to recover material damage from an employee (and the Labor Code allows this to be done), then in tax accounting the loss from repayment of material damage at the expense of the organization’s funds will not be recognized. As in the case of recognition of expenses in excess of the amounts of insurance compensation, in this situation the requirements established by Article 252 of the Tax Code of the Russian Federation will not be met.

This opinion was expressed in the letter of the Ministry of Finance dated April 9, 2007 No. 03-03-06/2/66, according to which, in the event of refusal to recover damages from the employee, the amount of the organization’s costs for restoring the vehicle after an accident and the amount paid to another participant in the accident , cannot be attributed to non-operating expenses for the purposes of accounting for income tax, since these expenses will not be economically justified and, therefore, the requirements established by Article 252 of the Tax Code of the Russian Federation will not be met.

Accounting for liability insurance

Liability insurance involves compensation for damage caused by the insurer to a third party. For example, a person received insurance in case of apartment flooding. And then he flooded his neighbor's apartment. In this case, the insurance company compensates for the damage caused to this neighbor. Let's look at other common cases of liability insurance:

- Damage caused to someone else's vehicle during its operation.

- Damage caused to the environment or people due to potentially hazardous activities.

- Damage caused to third parties in connection with the performance of legal or medical activities.

Let's look at the entries made for liability insurance (example):

- DT22/1 KT51. Payment of damages to a person injured in a car accident.

- DT91/2 KT22/1. The payment is included in the spending structure.

- DT50 KT91/1. Receipt of money from a person found guilty of an accident.

FOR YOUR INFORMATION! You can insure business risks. In this case, the insurance agreement ends early upon termination of business activity.

How to account for property insurance costs

The Ministry of Finance recalled in a letter dated October 8, 2021 No. 03-03-06/1/88006 in what order to take into account the costs of property insurance.

The procedure for accounting for costs of compulsory and voluntary property insurance is defined in Article 263 of the Tax Code of the Russian Federation.

When taxing profits, an organization has the right to take into account insurance premiums:

- for all types of compulsory property insurance - within the limits of insurance tariffs;

- for types of voluntary insurance in accordance with the list given in paragraph 1 of this article - in the actual amount.

Voluntary property insurance includes, for example, the following types of insurance:

- means of transport;

- cargo;

- fixed assets for production purposes, intangible assets, unfinished capital construction projects;

- risks associated with construction and installation work;

- inventory;

- harvest of agricultural crops and animals;

- other property that is used by the taxpayer for activities aimed at generating income;

- liability for harm to third parties;

- liability for causing harm to the environment as a result of an emergency at a hazardous facility.

Contributions for types of voluntary property insurance that are not listed in paragraph 1 of Article 263 of the Tax Code of the Russian Federation can be taken into account only when insurance is a prerequisite for the activities of the company (subclause 10, paragraph 1 of Article 263 of the Tax Code of the Russian Federation).

In tax accounting, the costs of compulsory insurance are included in other expenses within the limits of insurance tariffs approved in accordance with Russian legislation. Costs for voluntary insurance are included in the amount of actual expenses.

Features of VHI accounting

VHI is one of the types of personal insurance. As a rule, it is included in the “social package” provided by the employer. Contributions for voluntary health insurance are included in expenses if there are circumstances specified in subparagraph 16 of article 255 of the Tax Code of the Russian Federation. Consider these circumstances:

- The VHI agreement is signed for a period of more than a year.

- The insurance company has a license to conduct insurance activities.

- Expenses are fixed at no more than 6% of total labor costs.

In accounting, expenses for voluntary health insurance relate to the period in which they arose. Insurance payments are recorded on the DT of expense accounts (for example, account 20, 26, 44). The company may make insurance payments for persons with whom labor relations have not been formalized. Related expenses will be recorded on DT 91. A subaccount 02 will be opened for it.

Reflection in accounting for insurance premium costs

To automatically account for the costs of the MTPL insurance premium on a monthly basis, you need to run the procedure Closing the month, a routine operation Write-off of deferred expenses in the section Operations - Closing the period - Closing the month.

Postings according to the document

Accounting for MTPL costs for April

The document generates the posting:

- Dt Kt 76.01.9 - accounting for the costs of compulsory motor liability insurance as part of general business expenses for April.

Accounting for MTPL costs for May

The document generates the posting:

- Dt Kt 76.01.9 - accounting for the costs of compulsory motor liability insurance as part of general business expenses for May.

Similarly, the costs of compulsory motor liability insurance are recorded for the following months before the end of the insurance contract.

Control

The calculation of the amount of costs for compulsory motor liability insurance can be viewed in the report Help - calculation of write-off of expenses for future periods using the Help-calculation in the Month Closing .

We will check the correctness of the calculation of the amount of costs for compulsory motor liability insurance with the program:

Test yourself! Take a test on this topic using the link >>

For the continuation of the example, see the publication:

- Acceptance for accounting of fixed assets with bonus depreciation

See also:

- Cost accounting under CASCO

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Features of creating insurance reserves

The formation of insurance reserves is an event considered mandatory for an insurance company. The mandatory creation of such reserves is stipulated in Article 26 of Federal Law No. 4015-1 “On the Insurance Business” of November 27, 1992. The sequence of formation of reserves is specified in the order of the Ministry of Finance No. 51 n dated June 11, 2002.

Let's consider the sequence of formation of reserves:

- Establishing the required type of reserve. Orders of the Ministry of Finance 32n and 51n will help with this. You also need to focus on the local regulations of the company.

- Establishing a method for determining the reserve.

- Determination of the reserve for each insurance agreement.

The reserve is needed to ensure that the organization always has the amount of funds that is needed in the event of an insured event.

Accounting

According to clause 3 of PBU 9/99 “Income of the organization”, receipts from legal entities and individuals under commission agreements, agency and other similar agreements in favor of the principal, principal, etc. are not recognized as income of the organization.

Based on clause 3 of PBU 10/99 “Expenses of the organization,” the disposal of assets under commission agreements, agency and other similar agreements in favor of the principal, principal, etc. is not recognized as expenses of the organization.

In accordance with the Chart of Accounts for accounting financial and economic activities of organizations and instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, it is advisable to keep accounting of intermediary transactions with an agent using account 76 “Settlements with various debtors and creditors”, by allocating separate subaccounts to this account for specific calculations:

76-1 “Settlements with insurance Settlements with the principal”;

76-3 “Settlements with the principal for agency fees.”

The wiring in this situation will be as follows:

Debit 76-1, Credit 51

- the insurance premium of the insurance company was transferred from the current account;

Debit 76-2 Credit 76-1

- expenses for payment of the insurance premium are presented to the principal;

Debit 51 Credit 76-2

- funds were received from the principal to the current account to reimburse expenses for cargo insurance;

Debit 76-3 Credit 90-1

- agency fee accrued;

Debit 90-3 Credit 68

- VAT charged on agency fees;

Debit 90-2 Credit 20 (26)

- the agent’s own expenses are reflected.