The concept of an authorized representative of a taxpayer

The tax payment procedure is quite lengthy and consists of several stages. First of all, you need to collect reports, fill out a declaration and visit the tax office.

Managers of large companies cannot always afford to spend time visiting tax authorities. Today, an authorized representative of the taxpayer can pay fees for any legal entity.

An authorized representative of a taxpayer is a person (individual or legal entity) who can represent the interests of the taxpayer in transactions with tax authorities, as well as with other participants in relations regarding taxes and fees.

The authorized person carries out his actions on the basis of a power of attorney, which is issued in accordance with the procedure established by the Civil Code of the Russian Federation.

Law, theory and concept of law

1. As a general rule, the subjects of any legal relations participate in such legal relations personally, but there are exceptions. The Tax Code of the Russian Federation, taking into account the norms of civil legislation of the Russian Federation, provides for the institution of representation . In accordance with Art. 26 of the Tax Code of the Russian Federation, a taxpayer, that is, a person charged with paying taxes, has the right to participate in relations regulated by legislation on taxes and fees through a legal or authorized representative , unless otherwise provided by the Tax Code of the Russian Federation. The personal participation of a taxpayer (payer of fees) in tax legal relations does not deprive him of the right to have a representative and, conversely, the participation of a representative does not deprive the taxpayer of the right to personal participation in these legal relations. The legal representatives a taxpayer organization are persons authorized to represent the said organization on the basis of the law or its constituent documents. As a rule, the head of the organization and his deputies act as the legal representative of the organization. Accordingly, the taxpayer-organization in tax legal relations is represented by persons authorized to do so by law or by the constituent documents of the organization. As a rule, the legal representative of an organization authorized to act on its behalf without a power of attorney is the executive management body of the relevant organization. Legal representatives of a taxpayer - an individual are recognized as persons acting as his representatives in accordance with the civil legislation of the Russian Federation. Therefore, in tax legal relations the following may act as legal representatives of individuals: parents - for minors, including adopted children; guardians - for those under guardianship; trustees are for the wards. A legal representative of an individual acts on his behalf without a power of attorney.

Any taxpayer (payer of fees) has the right to authorize an individual or legal entity to represent his interests in the tax authorities and before other participants in tax relations. Such a representative is called an authorized representative . An authorized representative a taxpayer organization exercises his It should be noted that the action or inaction of an authorized representative of a taxpayer-organization is not automatically recognized as an action or inaction of the taxpayer himself, as is the case for a legal representative. An authorized representative of a taxpayer — an individual — exercises his powers on the basis of a notarized power of attorney or a power of attorney equivalent to a notarized one in accordance with the civil legislation of the Russian Federation. Persons who, due to their official position, can influence the taxpayer’s performance of his duties are not given the right to be his representatives by appointment. These persons include: officials of tax and customs authorities; bodies of state extra-budgetary funds; internal affairs bodies; judges; investigators; prosecutors.

Who cannot be an authorized representative of a taxpayer

The legislation prohibits the following categories from being authorized representatives:

- employees of tax and customs authorities;

- specialists of internal affairs law enforcement agencies;

- judges, investigators and prosecutors;

- specialists of state extra-budgetary funds.

This rule is enshrined in Article 29 of the Tax Code of the Russian Federation. This legislative norm was established for the reason that these persons represent the interests of the state and cannot simultaneously be representatives of the taxpayer and the party exercising control over the payment of taxes and fees.

Responsibility of the taxpayer's authorized representative

Authorized representatives of the taxpayer are responsible to the participants in tax legal relations. They are responsible for representing interests in the following cases:

- related to company registration with tax authorities;

- related to filing a declaration;

- related to the collection of tax arrears from taxpayers;

- related to holding a company accountable for violations in the field of payment of taxes and fees, as well as in other cases if the action or inaction of the tax authorities affects the rights of the organization.

The authorized person is responsible for meeting deadlines, filing tax reports, correctly filling out the tax return, as well as for the correct calculation of the final amounts.

For this reason, the taxpayer's authorized representative must have a very good understanding of modern tax laws.

Legal representative of a legal entity

The term “legal representative of a legal entity” is very closely related to the concept of “head of an organization.”

It is at the same time one and the same, and yet different. As we said, when examining the term head of an organization, for the purposes of the Fire Regulations in the Russian Federation, any authorized person or even an individual entrepreneur can be considered the head of an organization.

But if fire safety requirements are violated, relations arise between the person and government authorities, regulated by the Code of the Russian Federation on Administrative Offences.

And in accordance with Part 4 of Article 25.4 of the Code of Administrative Offenses, the interests of a legal entity when considering a case of an administrative offense, in certain cases, an official or judge who is considering a case related to violation of fire safety requirements or failure to comply with an order of state fire supervision authorities may recognize the presence of a legal representative of a legal entity as mandatory. faces.

And the same article (only part two) defines:

The legal representatives of a legal entity in accordance with this Code are its director, as well as another person recognized in accordance with the law or constituent documents as a body of the legal entity. The powers of the legal representative of a legal entity are confirmed by documents certifying his official position.

That is, let's imagine a hypothetical situation. In the Sberbank branch, for example in Petropavlovsk-Kamchatsky, fire safety requirements were violated. The supervisory authority discovered this and opened an administrative case. A “representative” of Sberbank came - for example, their chief fireman. With power of attorney. And they tell him: no, we need German Oskarovich Gref personally to consider the case. Since Sberbank is a PJSC. Since it is he, Gref, who is the legal representative of the legal entity, in accordance with Part 1.2 of Article 69 of Federal Law No. 208 of December 26, 1995. Disputes and persuasion begin. Well, indeed, Gref will not go to Petropavlovsk-Kamchatsky to see Major Pipkin of the internal service to consider a case about some violations, some requirements, some kind of fire safety. A representative of Sberbank thinks so. And he is wrong. Because Major Pipkin has the right, including with the police, to bring in a legal representative of a legal entity. If it deems necessary.

Unfortunately, such brave majors have not yet been found. Let's hope that they will appear again, because in theory, after the arrest of Sergei Genin, every inspector considering the accident case should have called (strictly according to the law) legal representatives of VTB, and even (scary to say) Gazprom. So that they can see for themselves what is happening at their facilities.

The legal system “Consultant” presents a very good table that clearly shows who is the legal representative for certain legal entities.

For now, it is possible to conclude: the legal representative of a legal entity, when considering a case of an administrative offense, is always the head of the legal entity, but not always the head of the legal entity in the concept defined by the Fire Regulations is its legal representative. Moreover, he is not a legal representative - a lawyer by proxy.

| Represented legal entity | Legal representative | Grounds for the establishment of a representative office / example of documents confirming the powers of a specific legal representative |

| Limited liability company Sole executive body of the company (CEO, president and others) | Sole executive body of the company (CEO, president and others) | Article 40 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”/Charter |

| Joint-Stock Company | Sole executive body of the company (director, general director) | Article 69 of the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” |

| General partnership | A participant in a general partnership, unless the constituent agreement stipulates that all its participants conduct business jointly, or the conduct of business is entrusted to individual participants | Article 72 of the Civil Code of the Russian Federation (part one) |

| Partnership of Faith | Participants who carry out entrepreneurial activities on behalf of the partnership and are liable for the obligations of the partnership with their property (full partners), unless the founding agreement establishes that all its participants conduct business jointly, or the conduct of business is entrusted to individual participants | Article 84 of the Civil Code of the Russian Federation (part one) |

| Business partnership | Sole executive body of the partnership (CEO, president and others) | Article 19 of the Federal Law of December 3, 2011 N 380-FZ “On Business Partnerships” |

| Production cooperative (artel) | Chairman of the cooperative | Article 17 of the Federal Law of 05/08/1996 N 41-FZ “On Production Cooperatives” |

| State unitary enterprise and municipal unitary enterprise | Head of a unitary enterprise (director, general director) | Article 21 of the Federal Law of November 14, 2002 N 161-FZ “On State and Municipal Unitary Enterprises” |

| The owner of copyright and related rights (legal entity) with whom no agreement has been concluded on the transfer of powers to manage rights | Accredited collective rights management organization | Article 1244 of the Civil Code of the Russian Federation (part four) |

| Shipowner and cargo owner | Ship captain | Article 71 of the Merchant Shipping Code of the Russian Federation, Article 30 of the Inland Water Transport Code of the Russian Federation |

| Consumer society | Chairman of the Council of the Consumer Society, Chairman of the Board of the Consumer Society | Article 19 of the Law of the Russian Federation of June 19, 1992 N 3085-1 “On consumer cooperation (consumer societies, their unions) in the Russian Federation” |

| Union of Consumer Societies | Chairman of the Council of the Union of Consumer Societies, Board of the Union of Consumer Societies | Article 37 of the Law of the Russian Federation of June 19, 1992 N 3085-1 “On consumer cooperation (consumer societies, their unions) in the Russian Federation” |

| Credit consumer cooperative | Sole executive body of the credit cooperative (chairman of the credit cooperative (chairman of the board of the credit cooperative)), director (executive director) | Article 22 of the Federal Law of July 18, 2009 N 190-FZ “On Credit Cooperation” |

| Housing savings cooperative | Sole executive body of the cooperative (director) | Article 44 of the Federal Law of December 30, 2004 N 215-FZ “On Housing Savings Cooperatives” |

| Housing or housing construction cooperative | Chairman of the Board of a Housing Cooperative | Article 119 of the Housing Code of the Russian Federation |

| Agricultural cooperative | Chairman of the cooperative | Article 26 of the Federal Law of December 8, 1995 N 193-FZ “On Agricultural Cooperation” |

| Gardening, vegetable gardening or dacha non-profit association of citizens (gardening, vegetable gardening or dacha non-profit partnership, horticultural, vegetable gardening or dacha consumer cooperative, horticultural, vegetable gardening or dacha non-profit partnership) | Chairman of the board of a horticultural, gardening or dacha non-profit association | Article 23 of the Federal Law of April 15, 1998 N 66-FZ “On gardening, market gardening and dacha non-profit associations of citizens” |

| Mutual Insurance Society | Director of the company | Article 15 of the Federal Law of November 29, 2007 N 286-FZ “On Mutual Insurance” |

| Homeowners Association | Chairman of the Board of Homeowners Association | Article 149 of the Housing Code of the Russian Federation |

| Bar Association of a constituent entity of the Russian Federation | President of the Bar Association | Article 29 of the Federal Law of May 31, 2002 N 63-FZ “On advocacy and the legal profession in the Russian Federation” |

| Federal Chamber of Lawyers of the Russian Federation | President of the Federal Chamber of Lawyers | Article 29 of the Federal Law of May 31, 2002 N 63-FZ “On advocacy and the legal profession in the Russian Federation” |

| Federal Fund for Assistance to Housing Development | General Director of the Foundation | Article 8 of the Federal Law of July 24, 2008 N 161-FZ “On promoting the development of housing construction” |

| Autonomous institution | Head of an autonomous institution (director, general director, rector, chief physician, artistic director, manager and others) | Article 13 of the Federal Law of November 3, 2006 N 174-FZ “On Autonomous Institutions” |

| Management company of an international medical cluster | General Director of the management company | Article 7 of the Federal Law of June 29, 2015 N 160-FZ “On the international medical cluster and amendments to certain legislative acts of the Russian Federation” |

| Deposit Insurance Agency | General Director of the Agency | Article 23 of the Federal Law of December 23, 2003 N 177-FZ “On insurance of deposits of individuals in banks of the Russian Federation” |

| State Corporation "Bank for Development and Foreign Economic Affairs (Vnesheconombank)" | Chairman of Vnesheconombank | Article 16 of the Federal Law of May 17, 2007 N 82-FZ “On the Development Bank” |

| Fund for Assistance to Reform of Housing and Communal Services | General Director of the Foundation | Article 11 of the Federal Law of July 21, 2007 N 185-FZ “On the Fund for Assistance to the Reform of Housing and Communal Services” |

| State Corporation for Promoting the Development, Production and Export of High-Tech Industrial Products "Rostec" | General Director of the Corporation, First Deputy or other Deputy General Director of the Corporation | Article 16 of the Federal Law of November 23, 2007 N 270-FZ “On the State Corporation for Promoting the Development, Production and Export of High-Tech Industrial Products “Rostec” |

| State Atomic Energy Corporation "Rosatom" | General Director of the Corporation | Article 27 of the Federal Law of December 1, 2007 N 317-FZ “On the State Atomic Energy Corporation Rosatom” |

| State Corporation for Space Activities "Roscosmos" | General Director of the Corporation | Article 26 of the Federal Law of July 13, 2015 N 215-FZ “On the State Corporation for Space Activities “Roscosmos” |

| State | Chairman of the Board of the State Company | Article 13 of the Federal Law of July 17, 2009 N 145-FZ “On State Law and on Amendments to Certain Legislative Acts of the Russian Federation” |

| Central Bank of the Russian Federation | Chairman of the Bank of Russia | Article 20 of the Federal Law of July 10, 2002 N 86-FZ “On the Central Bank of the Russian Federation (Bank of Russia)” |

| Russian Science Foundation | CEO | Article 13 of the Federal Law of November 2, 2013 N 291-FZ “On the Russian Science Foundation and Amendments to Certain Legislative Acts of the Russian Federation” |

| Foundation for Advanced Study | CEO | Article 13 of the Federal Law of October 16, 2012 N 174-FZ “On the Foundation for Advanced Research” |

article prepared by:

fire safety engineer

P.Yu. Knyazev

Posted: January 21, 2021

All rights to the text of the article belong to the author. Copying, distribution, use and other actions, except for viewing on this page of the ptm01.ru website, are prohibited.

Allowed: copy the link (url) to this page and send the copied link to an unlimited number of people.

When in doubt, follow the rule: everything that is not permitted is prohibited.

Power of attorney for an authorized representative of the taxpayer

An authorized representative of a taxpayer carries out his activities on the basis of a power of attorney. A power of attorney is a written agreement between a taxpayer and a third party regarding the transfer and division of rights. According to Article 185.1 of the Civil Code of the Russian Federation, the validity period of a power of attorney is no more than 3 years.

If the agreement does not contain information about the terms, then the power of attorney is considered to be valid for exactly one year. Moreover, if the date of opening of the power of attorney is not indicated, then it is considered invalid.

The authorized representative has the right to perform all actions specified in the power of attorney personally.

He can delegate his powers to third parties, but only if this is really necessary.

In this case, the authorized person is obliged to notify his principal and issue a power of attorney to a third party. Such a power of attorney must be notarized.

Representation in tax legal relations

Please print a standard form of power of attorney to the tax authorities with links to articles of the Tax and Civil Code of the Russian Federation to obtain, for example, acts of reconciliation of tax calculations and submission of reports.

According to paragraphs 6 clause 1 art. 21 Tax Code of the Russian Federation

Taxpayers have the right to represent their interests in tax legal relations personally or

through their representative

.

At the same time, in accordance with Art. 31 Tax Code of the Russian Federation

tax authorities have the right to demand not only from taxpayers, tax agents, but also from their representatives to eliminate identified violations of the legislation on taxes and fees and monitor their compliance with these requirements.

Subject of representation

in relations regulated by the legislation on taxes and fees,

Chapter 4 of Part 1 of the Tax Code of the Russian Federation

.

Art. 26 Tax Code of the Russian Federation

It has been established that a taxpayer can participate in relations regulated by the legislation on taxes and fees

through a legal or authorized representative

, unless otherwise provided by the Tax Code of the Russian Federation.

The personal participation of a taxpayer in relations regulated by the legislation on taxes and fees does not deprive him of the right to have a representative, just as the participation of a representative does not deprive the taxpayer of the right to personal participation in these legal relations.

Representative powers

must be

documented

in accordance with the Tax Code of the Russian Federation and other federal laws.

These rules also apply to fee payers and tax agents.

The Tax Code of the Russian Federation divides taxpayer representatives into legal and authorized

.

Legal

Representatives

of a taxpayer-organization

are persons authorized to represent the specified organization on the basis of the law or its constituent documents.

So, for example, according to Art. 40 of the Federal Law of the Russian Federation dated 02/08/1998 No. 14-FZ “On Limited Liability Companies”

The sole executive body of the company (general director, president and others)

acts on behalf of the company without a power of attorney

, including representing its interests and making transactions.

Actions (inaction) of legal representatives of an organization committed in connection with the participation of this organization in relations regulated by legislation on taxes and fees are recognized as actions (inaction) of this organization.

Legal

Representatives

of a taxpayer - an individual

are recognized as persons acting as his representatives in accordance with the civil legislation of the Russian Federation.

So, for example, Art. 26 of the Civil Code of the Russian Federation

It has been established that parents, adoptive parents or trustees are recognized as the legal representatives

of minors

aged fourteen to eighteen years.

Authorized

A taxpayer's representative is an individual or legal entity authorized by the taxpayer to represent his interests in relations with tax authorities (customs authorities, bodies of state extra-budgetary funds), other participants in relations regulated by the legislation on taxes and fees.

Cannot be authorized representatives

taxpayers, officials of tax authorities, customs authorities, bodies of state extra-budgetary funds, internal affairs bodies, judges, investigators and prosecutors.

Authorized representative of the taxpayer- organization

exercises its powers

on the basis of a power of attorney

issued

in the manner established by the civil legislation

of the Russian Federation.

An authorized representative of a taxpayer - an individual exercises his powers on the basis of a notarized power of attorney or a power of attorney equivalent to a notarized one

in accordance with the civil legislation of the Russian Federation (

Article 29 of the Tax Code of the Russian Federation

).

Chapter 10 of the Civil Code of the Russian Federation is devoted to issues of representation and power of attorney.

.

In accordance with Art. 182 Civil Code of the Russian Federation

a transaction made by one person (

representative

) on behalf of another person (

represented

) by virtue of authority based

on a power of attorney

, an indication of the law or an act of an authorized state body or local government body directly creates, changes and terminates the civil rights and obligations

of the represented

.

Limits set

to the powers of a representative.

The representative cannot

make transactions on behalf of the represented person in relation to himself personally.

He also cannot enter into such transactions in relation to another person whose representative he is also at the same time, except in cases of commercial representation.

Not allowed

making a transaction through a representative, which by its nature can

only be completed in person

, as well as other transactions specified by law.

For representation before third parties, written authority, called a power of attorney

.

A written authorization to carry out a transaction by a representative may be presented by the represented directly to the relevant third party.

Notarization of the power of attorney is required in two cases

:

– to carry out transactions requiring notarial

forms;

- for a power of attorney issued by way of subpoenaing

.

A power of attorney on behalf of a legal entity is issued signed by its head

or another person authorized to do so by its constituent documents,

with the seal of this organization attached

.

A power of attorney on behalf of a legal entity based on state or municipal property to receive or issue money and other property assets must also be signed by the chief (senior) accountant

this organization.

Let us remind you that for representation in tax legal relations, a power of attorney on behalf of a legal entity

notarization

is not required

, and a power of attorney issued by

an individual entrepreneur

is subject to mandatory

notarization

.

The validity period of the power of attorney cannot exceed three years. If the term is not specified in the power of attorney, it remains valid for a year

from the date of its commission.

Power of attorney that does not indicate the date

its commission is insignificant.

The unified form of power of attorney was approved by Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a only for receiving inventory items

(Form M-2), issued by the supplier according to the order, invoice, order, agreement.

Consequently, a power of attorney for representation in tax legal relations is drawn up by an organization or an individual entrepreneur in any form

in compliance with the requirements of the Civil Code of the Russian Federation and the Tax Code of the Russian Federation.

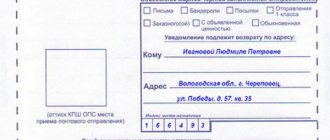

Example of a power of attorney:

| Power of attorney Sixteenth of October, Ekaterinburg two thousand and six By this power of attorney, the limited liability company “Vostok”, represented by director Ivanov Ivan Ivanovich, acting on the basis of the Charter, trusts Petrov Petrovich, who is on staff as the head of the financial and economic department, to represent the interests of LLC “Vostok” in the Federal Tax Service for the Leninsky district of the city. Yekaterinburg, namely: to sign on behalf of Vostok LLC acts of reconciliation of calculations for taxes and fees, to submit accounting and tax reporting. This power of attorney was issued for a period until January 1, 2008, without the right of substitution. I certify the signature of the representative Petrov Petrovich _______________. Director of Vostok LLC ________ Ivanov I.I. M.P. |

If a power of attorney is issued to a person who is not on the staff of the organization, the passport details of this person should be indicated.

The procedure for issuing a power of attorney for an authorized representative of a taxpayer

A power of attorney has a certain procedure for issuance, which is established by Article 185.1 of the Civil Code of the Russian Federation. At the same time, on the basis of this document, the authorized person has the right to perform all legal actions to the same extent as the principal.

According to the law, the contract must have a unified form. The powers of the trustee are confirmed by a notary.

The power of attorney must be issued with the signature of the head or the person replacing him. The organization's seal is not required. This rule is enshrined in paragraph 4 of Article 185.1 of the Civil Code of the Russian Federation. Also, if the commissioner files tax returns, he may provide written notarization.

Grounds for termination of the power of attorney

Article 187 of the Civil Code of the Russian Federation contains grounds for termination of a power of attorney:

- if the power of attorney has expired;

- if the power of attorney is canceled by the principal;

- if the trustee himself renounced his authority;

- if the legal entity has ceased its activities as a result of liquidation or reorganization;

- if the principal and the trustee are declared incompetent or missing;

- upon the death of the principal or trustee;

- if a bankruptcy procedure has been introduced in relation to the organization, in which the principal loses the right to issue powers of attorney.

There are no deadlines for revocation of a power of attorney for either the principal or the authorized person. If the principal changes or cancels the power of attorney, he is obliged to notify the authorized person and the tax authorities about this.

The taxpayer's legal successors retain their rights and obligations that arose as a result of their actions after it became known about the termination of the power of attorney. However, the rule is not valid if the tax authorities were aware of the termination of the document.

After the power of attorney has expired, the authorized person or legal successor is obliged to return the document to the taxpayer immediately.

This obligation is two-sided.

If this does not happen, and the organization is unable to return the document form, then it must submit an announcement within the established time frame that the power of attorney is considered invalid. This is necessary to prevent fraudulent activities, namely to ensure that no one else can use the company’s power of attorney.

After publication of the announcement, all actions under the power of attorney carried out within the period following publication are considered invalid.

Representation in relations with tax authorities

Sorry, this entry is only available in Russian. For the sake of viewer convenience, the content is shown below in the alternative language. You may click the link to switch the active language.

Magazine "Russian Tax Courier", No. 24, 2006

Chapter 4 of the Tax Code is devoted to representation in relations regulated by legislation on taxes and fees. The provisions of the Code provide for the right of the taxpayer to participate in these relations not only personally, but also through a representative. The only exceptions are cases when the taxpayer must fulfill the obligation to comply with tax laws personally, without involving third parties. So, he must pay the tax himself. No one else can do this for him, even at his expense (Article 45 of the Tax Code of the Russian Federation).

In any case, the subject of the tax legal relationship is the taxpayer. It does not matter whether he personally participates in this legal relationship or through his representative. Such clarifications are contained in paragraph 7 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated February 28, 2001 No. 5 “On some issues of application of part one of the Tax Code of the Russian Federation.”

Which persons can be representatives of a taxpayer?

The Tax Code divides taxpayer representatives into legal and authorized ones. Let us first consider which persons are considered legal representatives.

Legal representatives of the taxpayer

According to Article 27 of the Tax Code of the Russian Federation, legal representatives of a legal entity are persons authorized to represent this organization on the basis of the law or its constituent documents.

Constituent documents are considered as a source of confirmation of legal representation. After all, they determine the procedure for managing a legal entity, as well as the procedure for creating management bodies.

As is known, the most common organizational and legal forms of legal entities are joint stock companies and limited liability companies. The powers of the legal representatives of such an organization are vested in the person who exercises the functions of its sole executive body. For example, a director, general director, etc. This person, without a power of attorney, acts on behalf of the company, including representing its interests and making transactions. The relevant provisions are enshrined in Article 40 of the Federal Law dated 02/08/98 No. 14-FZ “On Limited Liability Companies” and Article 69 of the Federal Law dated 12/26/95 No. 208-FZ “On Joint-Stock Companies”.

Based on Article 28 of the Tax Code of the Russian Federation, actions (inaction) of legal representatives of an organization are recognized as actions (inaction) of the organization itself.

EXAMPLE 1

The General Director of Sirius LLC did not submit a tax return to the tax authority within the prescribed period.

In this case, the organization itself (legal entity) will be brought to tax liability under Article 119 of the Tax Code of the Russian Federation.

Legal representatives of an individual are persons vested with this status in accordance with the civil legislation of the Russian Federation (clause 2 of Article 27 of the Tax Code of the Russian Federation).

The Civil Code specifies parents, adoptive parents, guardians, and trustees as legal representatives who, on the basis of the law (that is, without a power of attorney), represent the interests of:

– minors;

– persons recognized by the court as incompetent due to a mental disorder;

– persons whose legal capacity has been limited by a court as a result of alcohol or drug abuse.

In addition, when parents exercise powers to manage the child’s property, they are subject to the rules established by civil law regarding the disposal of the ward’s property. This is stated in paragraph 3 of Article 60 of the Family Code.

Thus, parents, being the legal representatives of minor children who own property that is subject to taxation, exercise powers to manage common property, including fulfilling the obligations to pay taxes.

Authorized representatives of the taxpayer

The powers of an authorized representative of a taxpayer, whether a legal entity or an individual, are confirmed by a power of attorney, specially issued for carrying out actions aimed at relations with the tax authorities.

No agreements between the taxpayer and the representative will serve as the basis for representation in relations with the tax authorities. In particular, this applies to a property trust management agreement. In paragraph 8 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated 02.28.2001 No. 5 “On some issues of application of part one of the Tax Code of the Russian Federation” it is explained that the specified agreement cannot serve as a sufficient legal basis for the trustee to represent the interests of the founder of the management in the field of taxation.

If the founder of the management and the trustee have reached an agreement regarding representation in the tax field, then the corresponding powers of the manager are also formalized by a power of attorney. This condition is contained in Article 185 of the Civil Code of the Russian Federation.

The powers of a representative - an individual require confirmation by a notarized power of attorney or a power of attorney equivalent to it. The latter includes powers of attorney listed in paragraph 3 of Article 185 of the Civil Code of the Russian Federation.

In turn, the representative of the taxpayer-organization exercises his powers by power of attorney, certified by the signature of the head of this legal entity (another person authorized to do so by the constituent documents). In addition, the power of attorney must have the seal of this organization.

The heads of representative offices and branches of an organization are its authorized representatives, and not legal representatives. The fact is that they act on the basis of a power of attorney from the organization. This rule is contained in paragraph 3 of Article 55 of the Civil Code of the Russian Federation.

Please note : authorized representation of these persons is also permissible if separate divisions pay tax at their location. In such a situation, there is no contradiction with the norm of Article 45 of the Tax Code of the Russian Federation, according to which the taxpayer must independently fulfill the obligation to pay tax. Indeed, according to Article 19 of the Tax Code of the Russian Federation, separate divisions of organizations fulfill the latter’s responsibilities for paying taxes and fees at their location.

How to issue a power of attorney

The requirements for issuing a power of attorney are contained in the Civil Code. In paragraph 1 of Article 185 of the Civil Code of the Russian Federation, a power of attorney is defined as a written authority issued by one person to another person for representation before third parties. There are two main requirements for a power of attorney. Firstly, it must be drawn up in writing, certified by the signature of the head and the seal of the organization (if the taxpayer is a legal entity). And, secondly, the power of attorney must bear the date of issue, otherwise it will be considered void.

Table . List of persons recognized as representatives of the taxpayer

| Legal representative | Authorised representative | ||

| organizations | individual | organizations | individual |

| - a person authorized to represent this organization on the basis of law or its constituent documents | – a person acting as a legal representative of this individual in accordance with the civil legislation of the Russian Federation | – an individual or legal entity authorized by the taxpayer to represent his interests in relations with tax authorities (customs authorities, bodies of state extra-budgetary funds), other participants in relations regulated by the legislation on taxes and fees. Power of attorney issued in the manner established by the civil legislation of the Russian Federation | |

Please note that the legislation does not contain a requirement to issue a power of attorney on the organization’s letterhead or indicate its number.

The maximum validity period of a power of attorney cannot exceed three years. The taxpayer has the right not to indicate the validity period of the power of attorney. In this case, it is valid for one calendar year from the date of its issue.

The scope of the representative's powers is determined by the taxpayer. He can issue a one-time power of attorney to perform one legal action. For example, to receive notification about the possibility of applying a simplified taxation system. It is also possible to issue a special power of attorney to perform a number of similar actions. In particular, in the case of submitting tax reports during the calendar year.

Finally, the taxpayer has the right to issue a general power of attorney to carry out various transactions or legal actions for a certain period of time. At the same time, from the meaning of the power of attorney it should be clear what exactly is being trusted and to whom. Therefore, when registering the details of an authorized person, it is advisable to indicate his address, passport number, TIN, etc.

Some taxpayers reflect the powers of the representative in as much detail as possible in the power of attorney. For example, they separately list the right to receive acts and decisions based on the results of a tax audit, demands for payment of taxes, fines, penalties, etc. But even if the content of the powers is stated in general terms, this is not a significant violation. Thus, the following wording can be given in the power of attorney: “To represent the interests of the taxpayer in relations with tax authorities in accordance with the legislation of the Russian Federation on taxes and fees.”

EXAMPLE 2

Romashka LLC decided to switch to a simplified taxation system. Having considered the corresponding application from the company, the tax office made a positive decision. To receive notification of the possibility of applying the simplified tax system, Romashka LLC issued a one-time power of attorney to its accountant Ivan Ivanovich Ivanov.

Sample power of attorney:

| POWER OF ATTORNEY Moscow "04" December 2006 Limited Liability Company "Romashka" represented by General Director Alexander Alexandrovich Vasilkov, acting on the basis of the Charter, hereinafter referred to as the "Principal": trusts Ivan Ivanovich Ivanov (passport series 45 07 number 159258, issued by the Department of Internal Affairs of the Maryino district of Moscow on November 15, 2002), residing at the address: Moscow, Shokalsky proezd, 2, apt. 126, receive from the Federal Tax Service of Russia Inspectorate No. 5 for the Central Administrative District of Moscow a notification about the possibility of applying the simplified taxation system to Romashka LLC. This power of attorney was issued before December 8, 2007. I certify the signature of Ivanov Ivan Ivanovich Ivanov. CEO LLC "Romashka" Vasilkov A.A. Vasilkov M.P. |

Civil legislation imposes on the principal who has revoked the power of attorney the obligation to notify of this fact both the person to whom the power of attorney was issued and third parties for whose representation it was issued. This is stated in Article 189 of the Civil Code of the Russian Federation.

In addition to the cancellation of the power of attorney, its validity is terminated in a number of other cases. Let's list them:

– expiration of the power of attorney;

– refusal of the person to whom the power of attorney was issued;

– termination of the legal entity on whose behalf the power of attorney was issued;

– termination of the legal entity to which the power of attorney was issued.

Powers of attorney equivalent to notarized ones

A power of attorney for the authorized person must be notarized, but there are certain circumstances when notarization is not possible. Article 185.1 of the Civil Code of the Russian Federation establishes a list of powers of attorney that are equivalent to notarized ones:

- documents issued to military personnel undergoing treatment in hospitals. Must be certified by the head of the medical institution or senior physician;

- documents issued to military personnel located in places of military headquarters where there are no notary offices;

- powers of attorney of convicts in places of deprivation of liberty, which are certified by the management of the correctional institution;

- powers of attorney of adults located in social protection organizations, certified by the management of such organizations.

Commentary on Article 29 of the Tax Code of the Russian Federation

This article defines an authorized representative of a taxpayer.

An authorized representative of a taxpayer is an individual or legal entity authorized by the taxpayer (individual and (or) organization) to represent his interests in relations with tax authorities (customs authorities, bodies of state extra-budgetary funds), other participants in relations regulated by the legislation on taxes and fees.

By virtue of the said representation, one person (representative), having the appropriate powers (power of attorney), performs actions (in tax legal relations, that is, for tax purposes) on behalf of another person (represented), as a result of which the latter acquires, changes and terminates rights and responsibilities.

A representative can be any legally capable person, that is, an individual (who does not have the status of an individual entrepreneur - from the moment he acquires civil legal capacity, who has the status of an individual entrepreneur - from the moment of registration in this capacity) and a legal entity - from the moment of its emergence in the prescribed manner.

The following cannot be authorized representatives of a taxpayer:

— officials of tax authorities (heads (their deputies) of tax inspectorates;

— customs officials;

— officials of state extra-budgetary funds;

— officials of internal affairs bodies;

- judges;

— investigators;

- prosecutors.

The provisions of this article do not allow the above persons to participate in tax legal relations as authorized representatives of the taxpayer by virtue of their position and regardless of the fact that they perform their official duties in another relevant body or region.

An authorized representative of a taxpayer-organization exercises his powers on the basis of a power of attorney issued in the manner established by the civil legislation of the Russian Federation.

A power of attorney is a written authority issued by one person to another person for representation before third parties.

The power of attorney must contain the data necessary to recognize it as a power of attorney, that is, the date of preparation, details of the representative and the represented, the essence of the authority, the right of subrogation (or lack thereof).

The person to whom the power of attorney is issued must personally perform the actions for which he is authorized. It can entrust their execution to another person if it is authorized to do so by a power of attorney or is forced to do so by force of circumstances to protect the interests of the person who issued the power of attorney. In this case, the person who transferred the powers to another person must notify the person who issued the power of attorney about this and provide him with the necessary information about the person to whom the powers were transferred. Failure to fulfill this obligation makes the person who delegated the authority responsible for the actions of the person to whom he delegated the authority as if it were his own. A power of attorney issued by way of delegation must be notarized, except in cases provided for by law (Clause 4 of Article 185 of the Civil Code of the Russian Federation).

The validity period of the power of attorney cannot exceed three years. If the term is not specified in the power of attorney, it remains valid for a year from the date of its execution. The validity period of a power of attorney issued by way of subpoenaing cannot exceed the validity period of the power of attorney on the basis of which it was issued.

A power of attorney that does not indicate the date of its execution is void.

A power of attorney on behalf of a legal entity (organization) is issued signed by its head or another person authorized to do so by its constituent documents, with the seal of this organization attached. A power of attorney on behalf of a legal entity based on state or municipal property to receive or issue money and other property assets must also be signed by the chief (senior) accountant of this organization.

An authorized representative of a taxpayer - an individual exercises his powers on the basis of a notarized power of attorney or a power of attorney equivalent to a notarized one in accordance with the civil legislation of the Russian Federation.

The power of attorney can be certified either by a state notary office or by a private notary.

The following are equivalent to notarized powers of attorney:

1) powers of attorney of military personnel and other persons undergoing treatment in hospitals, sanatoriums and other military medical institutions, certified by the head of such an institution, his deputy for medical affairs, a senior or duty doctor;

2) powers of attorney of military personnel, and at points of deployment of military units, formations, institutions and military educational institutions, where there are no notary offices and other bodies performing notarial acts, also powers of attorney of workers and employees, members of their families and family members of military personnel, certified by the commander ( the chief) of this unit, formation, institution or institution;

3) powers of attorney of persons in places of deprivation of liberty, certified by the head of the corresponding place of deprivation of liberty;

4) powers of attorney of adult capable citizens located in institutions for social protection of the population, certified by the administration of this institution or the head (his deputy) of the relevant body of social protection of the population.